View on market

Bitcoin dropped amid strong U.S. employment data, yet technical support and high investor interest hint at a potential rally while global central banks cut rates. Technical analysis indicates potential for a Bitcoin rally, with traders eyeing a bullish trend and considering Call Butterfly Spread strategies.

Call Butterfly Spread

The proposed strategy is a Call Butterfly Spread strategy. A Butterfly Spread with Calls is a three-part strategy that is created by buying one Call at a lower strike price, selling two Calls with a higher strike price and buying one Call with an even higher strike price.

You can consider executing this strategy if you are eyeing upward movement in BTC prices.

Trade Structure

(OTM Call) Buy 1x BTC-14JUN24-$73,000-C @ $327

(OTM Call) Sell 2x BTC-14JUN24-$74,000-C @ $223

(OTM Call) Buy 1x BTC-14JUN24-$75,000-C @ $145

Target: Spot level < $74,000

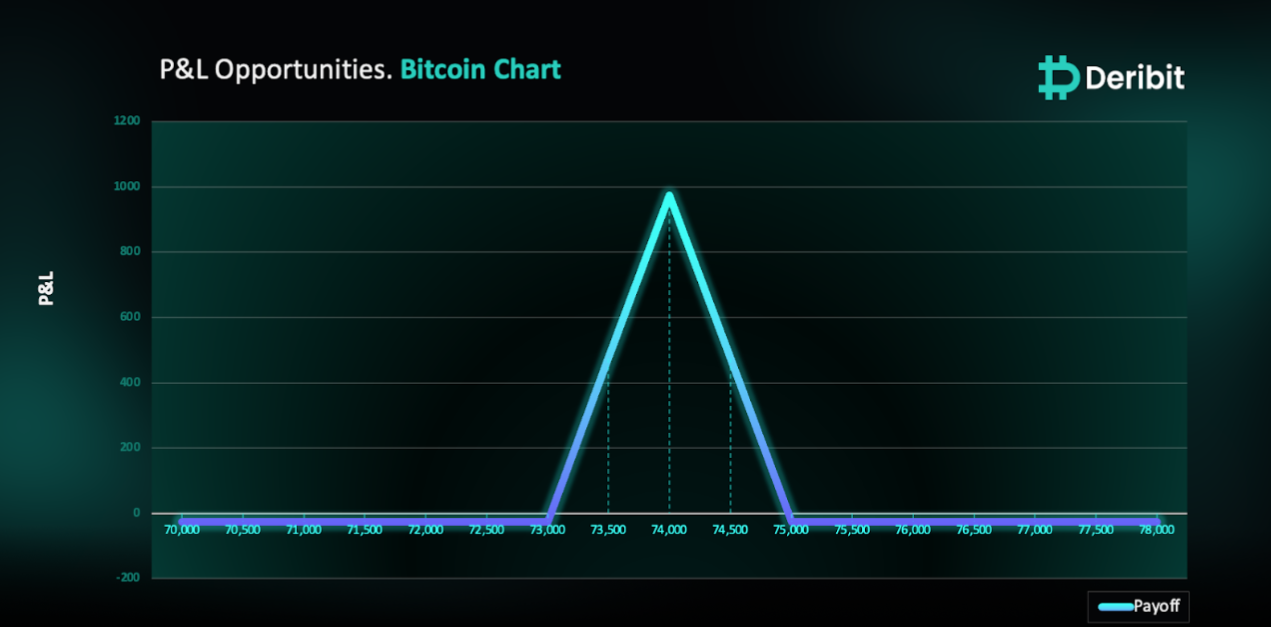

Payouts

Maximum Profit: $974/BTC

Debit of Strategy: $26/BTC

Why are we taking this trade?

Market Overview: Bitcoin and Global Economic Trends

Bitcoin faced downward pressure on Friday as equity markets reacted to unexpectedly strong U.S. employment data. The labor market indicators suggest ongoing inflationary pressures, prompting caution from the U.S. Federal Reserve regarding its higher-for-longer interest rate policy. The U.S. Labor Department reported a rise in the unemployment rate to 4.0% in May, the first increase since January 2022. Non-farm payrolls (NFPs) surged by 272,000 jobs, surpassing economists’ expectations.

Global Interest Rate Movements

On the other side, several central banks globally are cutting interest rates. The European Central Bank (ECB) reduced its key rate to 3.75%, down from 4% set in September 2023, marking the first cut since 2019 despite persistent inflation in the eurozone. The Bank of Canada also lowered its overnight rate by 25 basis points to 4.75%, becoming the first G7 nation to reduce rates in the current cycle. Sweden and Switzerland have followed suit with their own rate reductions.

Bitcoin’s Performance and Technical Analysis

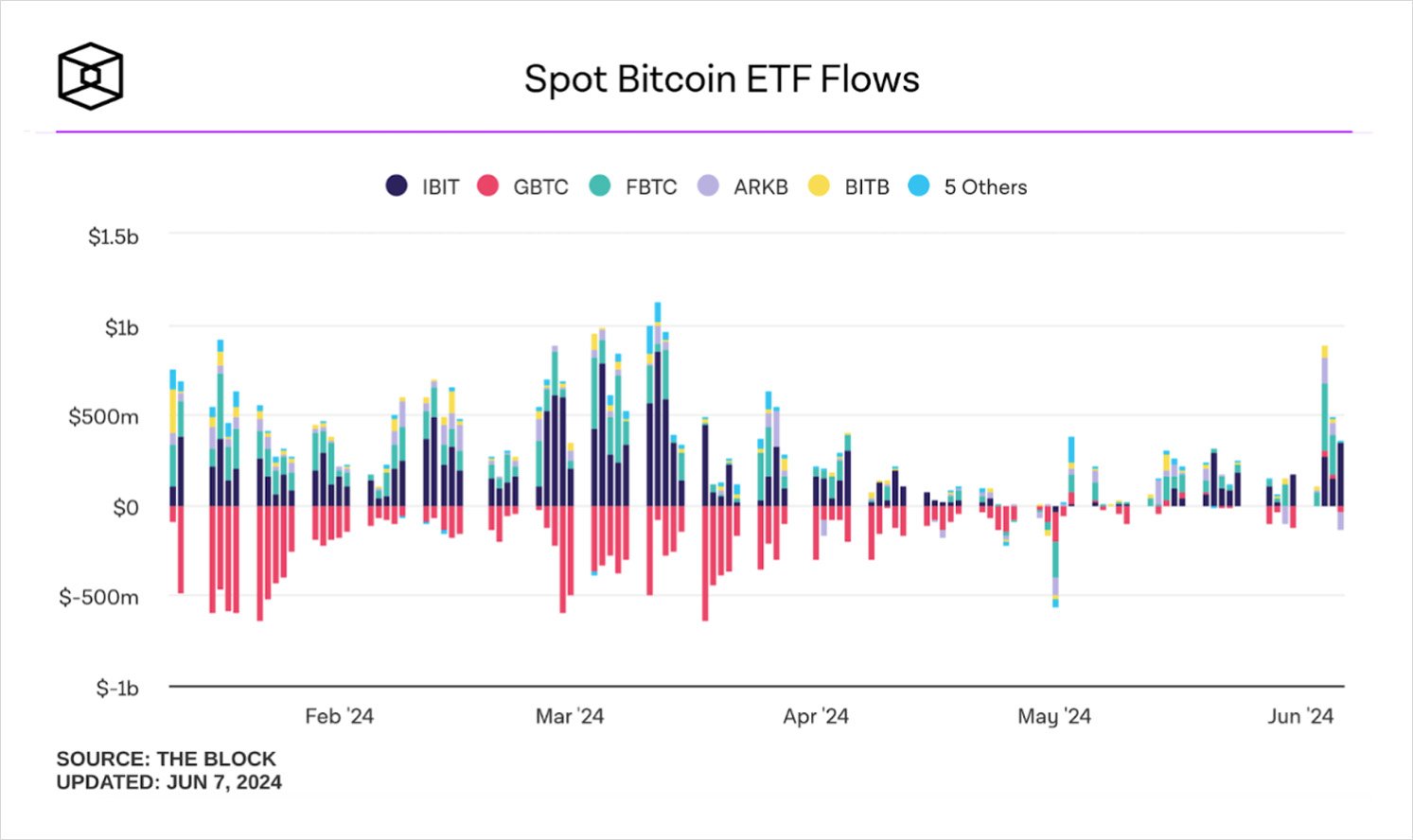

Despite the broader market pressures, U.S. Spot Bitcoin ETFs saw a net inflow of $131 million on June 7, continuing a 19-day streak of net inflows. This indicates sustained investor interest in Bitcoin even amidst market volatility (Source: Farside Investors).

From a technical perspective, Bitcoin’s 4-hour price chart shows an active supply zone that has shown its impact. Following the release of the employment data, Bitcoin’s price dropped to around $68,450, aligning with two critical data points:

- Breakout Confirmation: This price level is where Bitcoin previously broke out of a triangular pattern, (marked by the Yellow line), signifying a significant demand zone.

- Pivot Point Revisited: Traders who shorted Bitcoin at the marked resistance/supply zone have seen their 2RR trades materialize as prices fell to this pivotal level, as marked in the chart.

Given these factors, there is a potential for Bitcoin’s price to rally from this support zone. Traders can expect a bullish environment, especially with high open interest in the $73,000 and $74,000 strikes for the June 14 expiry.

Trading Strategy: Call Butterfly Spread

For those looking to capitalize on the anticipated bullish momentum in Bitcoin, implementing a Call Butterfly Spread strategy could be advantageous.This setup allows traders to benefit from a moderate rise in Bitcoin’s price while limiting potential losses.

To execute this approach, traders can purchase a Call option with a higher strike price (e.g., $73,000) while simultaneously selling double the quantity of Calls at a higher strike price (e.g., $74,000) and buying a Call at an even higher strike price (e.g., $75,000).

If the Bitcoin price is at $74,000 when the options expire on June 14th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $26.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)