View on market

BTC has broken the $57,700 support, forming lower highs, signaling a downtrend. Expect a slower decline due to the support area at $55,500 levels.

Bear Put Spread

The proposed strategy is a Bear Put Spread. A Bear Put Spread is achieved by simultaneously buying a Put option and selling a Put option at a lower strike price but with the same expiration date.

You might consider initiating this trade if you feel BTC can fall further as the support area of $57,700 has been taken out and lower highs are formed in the 4hr time frame.

Trade Structure

(OTM Put) Buy 1x BTC-04SEP24-$57,000-P @ $519

(OTM Put) Sell 1x BTC-04SEP24-$56,500-P @ $375

Target: Spot level < $56,500

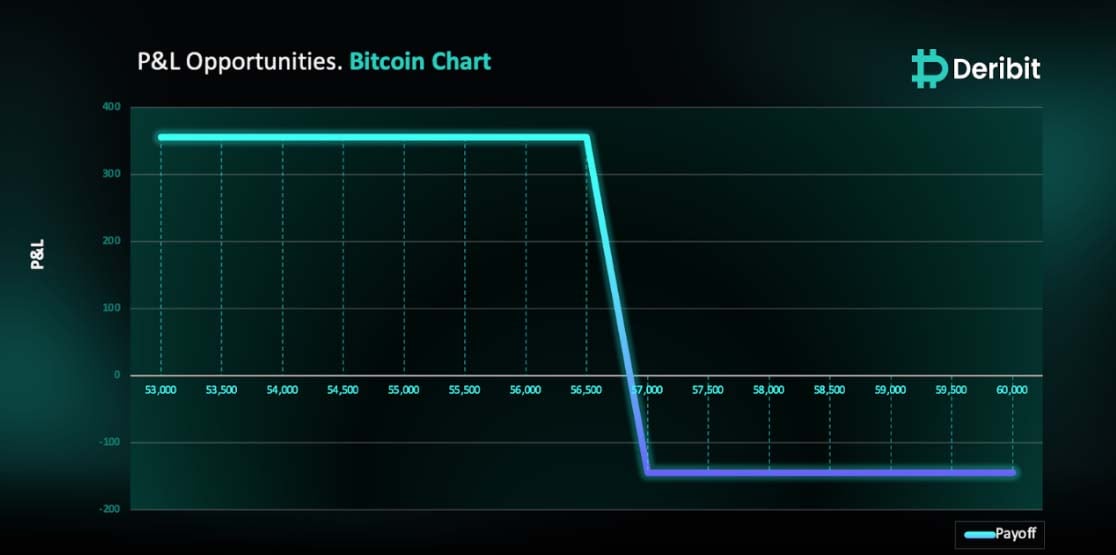

Payouts

Maximum Profit: $356/BTC

Debit of Strategy : $144/BTC

Why are we taking this trade?

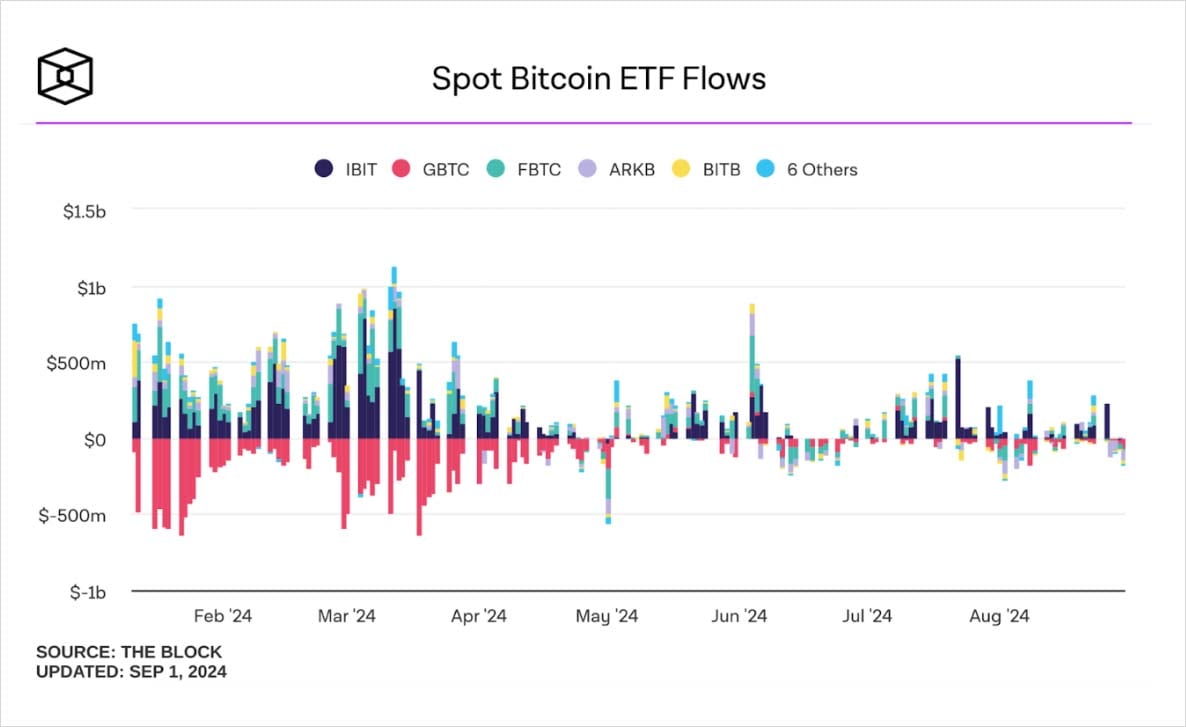

As shown in the attached 4-hour BTC price chart, BTC had been respecting the support pivot at $57,700. However, this level has been breached, with the price closing below it on the 4-hour candle. Additionally, the price is forming lower highs, signaling a downtrend. I anticipate the price to continue declining, albeit at a slower pace, due to the presence of support areas highlighted in the chart. Furthermore, spot BTC ETFs have experienced outflows for the past four days. (Source: Farside).

Hence, traders might consider deploying a Bear Put Spread strategy to capitalize on the anticipated price movement.

To execute this strategy, traders can buy a Put option of a lower strike price, eg. $57,000 while simultaneously selling a Put option of an even lower strike price, like $56,500.

If BTC prices are at or below $56,500, when the options expire on September 4th, traders will achieve maximum profit from this strategy.

In case of market upturn, the maximum loss is limited to the initial debit of $144.

How to take this trade on Deribit?

Step 1: Go to the “Combo Books” page, which can be found in the top menu under “Strategy”.

Step 2: Go to the “Create Combo” tab, and enter the details for the desired combo. At this stage you’re just creating the order book for the combo, so you don’t need to worry about the direction.

Step 3: Click “Create and RFQ”, and then click “Confirm”, to create an order book for the combo.

Step 4: Go to the “Combo List (BTC)” tab, click on the desired combo to open the order book.

Step 5: Enter your order details and execute. Depending on the direction of the trade, you may need to either buy or sell the combo. The direction of each leg is displayed under the Buy and Sell buttons.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)