View on market

BTC faces resistance around $61,700, and a false breakout led to significant retracements, indicating further declines due to breached demand zones.

Put Butterfly Strategy

The proposed strategy is a Put Butterfly strategy. A Butterfly Spread with Puts is a three-part strategy that is created by buying one Put at a higher strike price, selling two Puts with a lower strike price and buying one Put with an even lower strike price.

You can consider executing this strategy if you are eyeing downward movement in BTC prices.

Trade Structure

(OTM Put) Buy 1x BTC-16AUG24-$55,000-P @ $495

(OTM Put) Sell 2x BTC-16AUG24-$54,000-P @ $349

(OTM Put) Buy 1x BTC-16AUG24-$53,000-P @ $241

Target: Spot level = $54,000

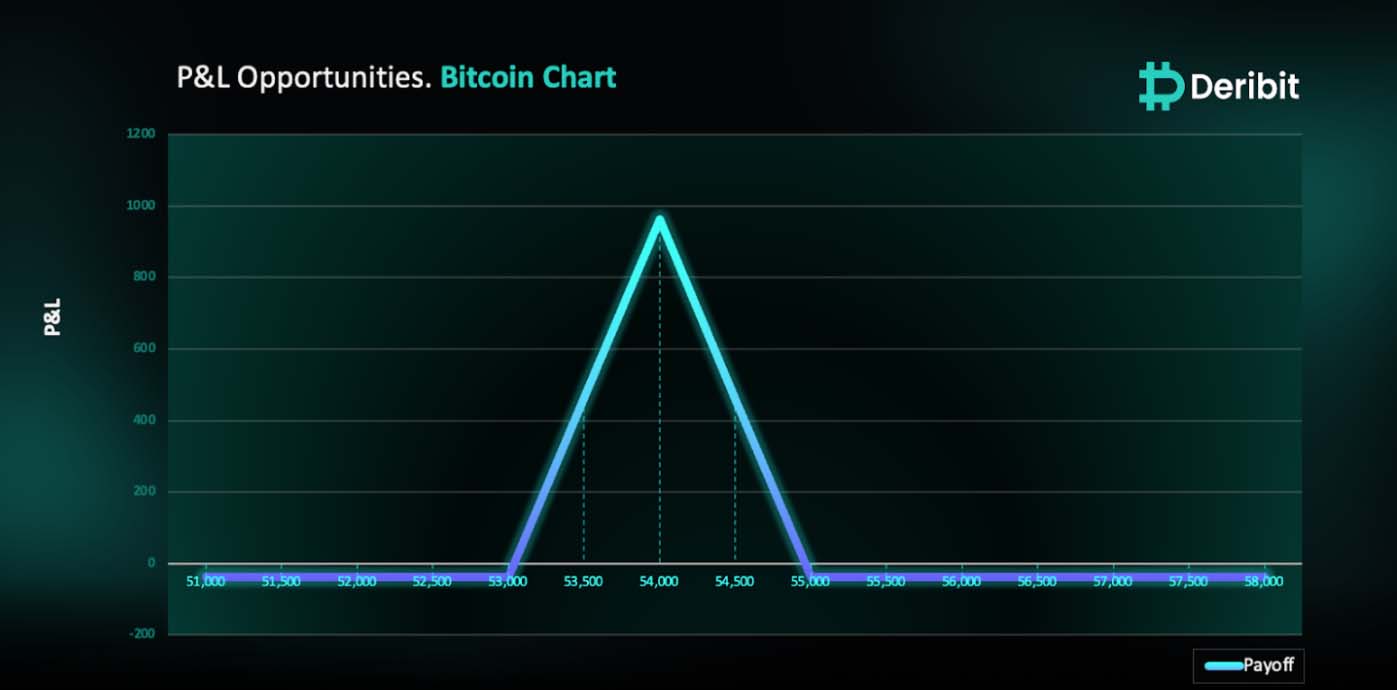

Payouts

Maximum Profit: $962/BTC

Debit of Strategy: $38/BTC

Why are we taking this trade?

As shown in the attached 4-hour price chart, Bitcoin (BTC) is facing resistance around the $61,700 mark. While the price initially appeared to break through this level, it turned out to be a false breakout. This is evident as the price was rejected by the distal line of the supply zone, and the 4-hour candle failed to close above it. Following this rejection, we observed significant downward retracements.

I expect these retracements to continue, potentially leading to lower price levels in the near future, as the demand zones have been breached, as highlighted in the attached chart.

Therefore, traders can consider deploying a Put Butterfly strategy to capitalize on the anticipated price movements.

To execute this approach, traders can purchase a Put option with a higher strike price (e.g., $55,000) while simultaneously selling double the quantity of Puts at a lower strike price (e.g., $54,000) and buying a Put at an even lower strike price (e.g., $53,000).

If the BTC price is at $54,000 when the options expire on August 16th, traders will achieve maximum profit from this strategy.

In case of a market upturn, the potential loss is limited to the initial debit of $38.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)