View on market

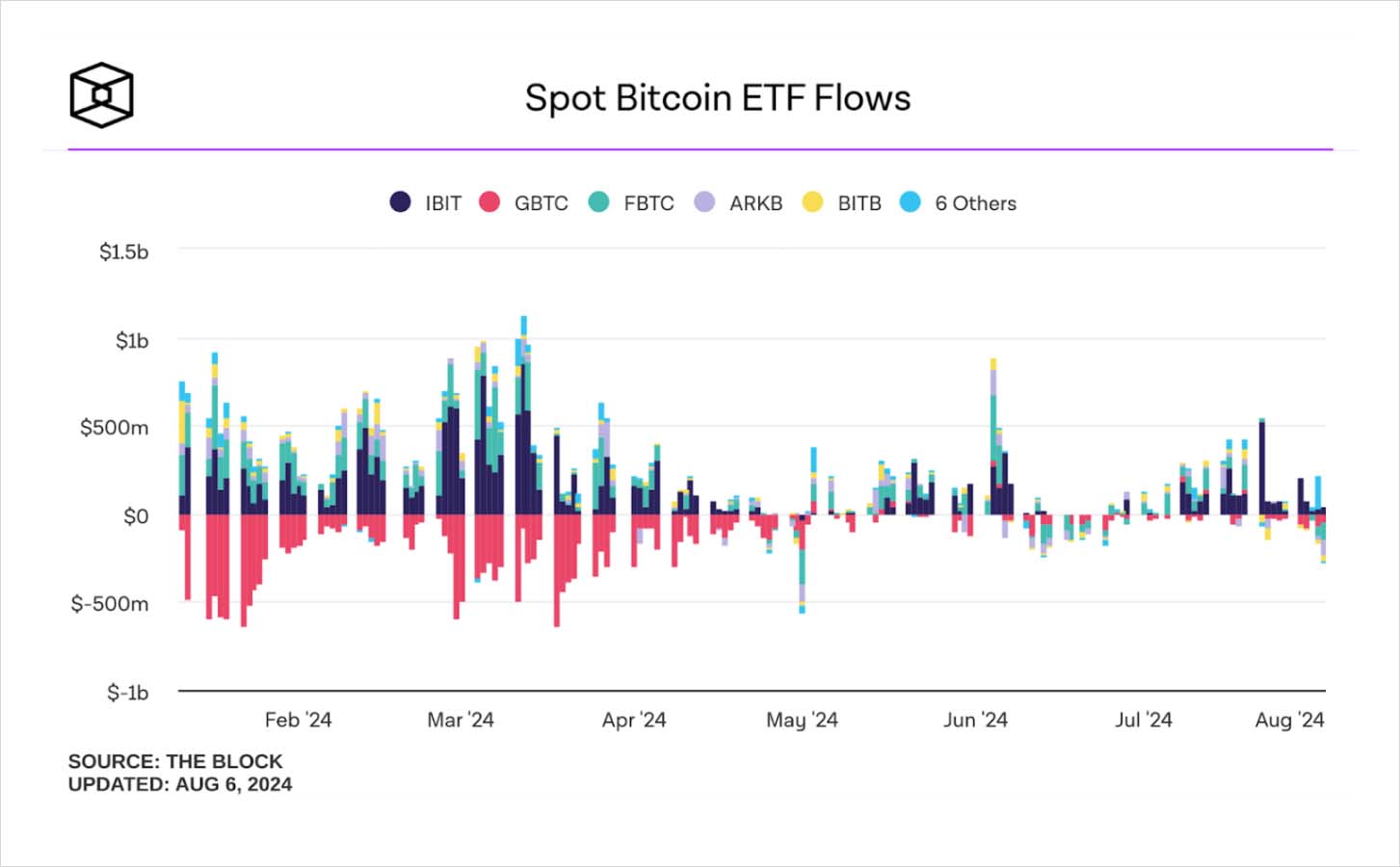

Spot Bitcoin ETFs in the U.S. saw $168.4 million in outflows due to macroeconomic factors and crypto-specific issues, causing a market downturn. Technically, Bitcoin is trending downward, and further declines are likely.

Bear Put Spread

The proposed strategy is a Bear Put Spread. A Bear Put Spread is achieved by simultaneously buying a Put option and selling a Put option at a lower strike price but with the same expiration date.

You might consider initiating this trade if you feel BTC will face resistances and may trade lower.

Trade Structure

(OTM Put) Sell 1x BTC-16AUG24-$52,000-P @ $1,075

(OTM Put) Buy 1x BTC-16AUG24-$53,000-P @ $1,375

Target: Spot level < $52,000

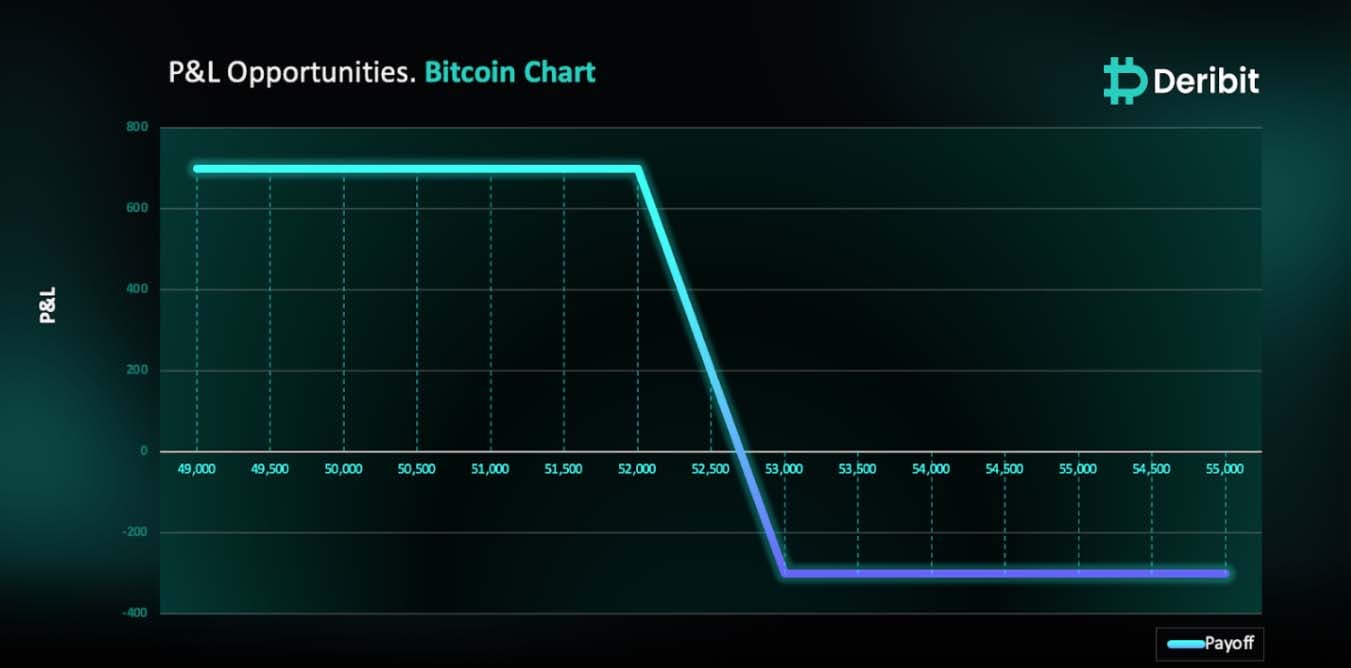

Payouts

Maximum Profit: $700/BTC

Debit of Strategy: $300/BTC

Why are we taking this trade?

Yesterday, spot Bitcoin exchange-traded funds in the U.S. saw a significant outflow of $168.4 million (Source: Farside Investors).

This movement coincided with a major downturn in both the global cryptocurrency and stock markets, driven by various financial and macroeconomic factors. Among the macro issues affecting global equities were rising tensions in the Middle East and disappointing U.S. economic data. In the crypto realm, factors like Jump Crypto’s asset maneuvers and uncertainties surrounding the upcoming U.S. election further fueled a selloff in the market.

On the technical side, as I mentioned in yesterday’s analysis, Bitcoin has broken below the lower trend line of its current channel as highlighted in the attached chart, suggesting a downward trajectory. I anticipate that the price may struggle to climb higher and could potentially face further declines from this point.

Hence, traders might consider deploying a Bear Put Spread strategy to capitalize on the anticipated price movement.

To execute this strategy, traders can buy a Put option of a lower strike price, eg. $53,000 while simultaneously selling a Put option of an even lower strike price, like $52,000.

If BTC prices are at or below $52,000, when the options expire on August 16th, traders will achieve maximum profit from this strategy.

In case of market upturn, the maximum loss is limited to the initial debit of $300.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)