View on market

ETH is currently in a downtrend approaching $2850 support, with low chances of SEC ETF approval. Traders can utilize a bear call spread strategy to capitalize on the anticipated sideways to downside movement.

Bear Call Spread

The proposed strategy is a Bear Call Spread. A bear call spread is achieved by simultaneously selling a call option and buying a call option at a higher strike price but with the same expiration date.

You might consider initiating this trade if you believe that ETH can remain sideways to bearish till 24th May.

Trade Structure

(OTM Call) Sell 1x ETH-24MAY24-$3050-C @ $77

(OTM Call) Buy 1x ETH-24MAY24-$3100-C @ $60

Target: Spot level < $3,050

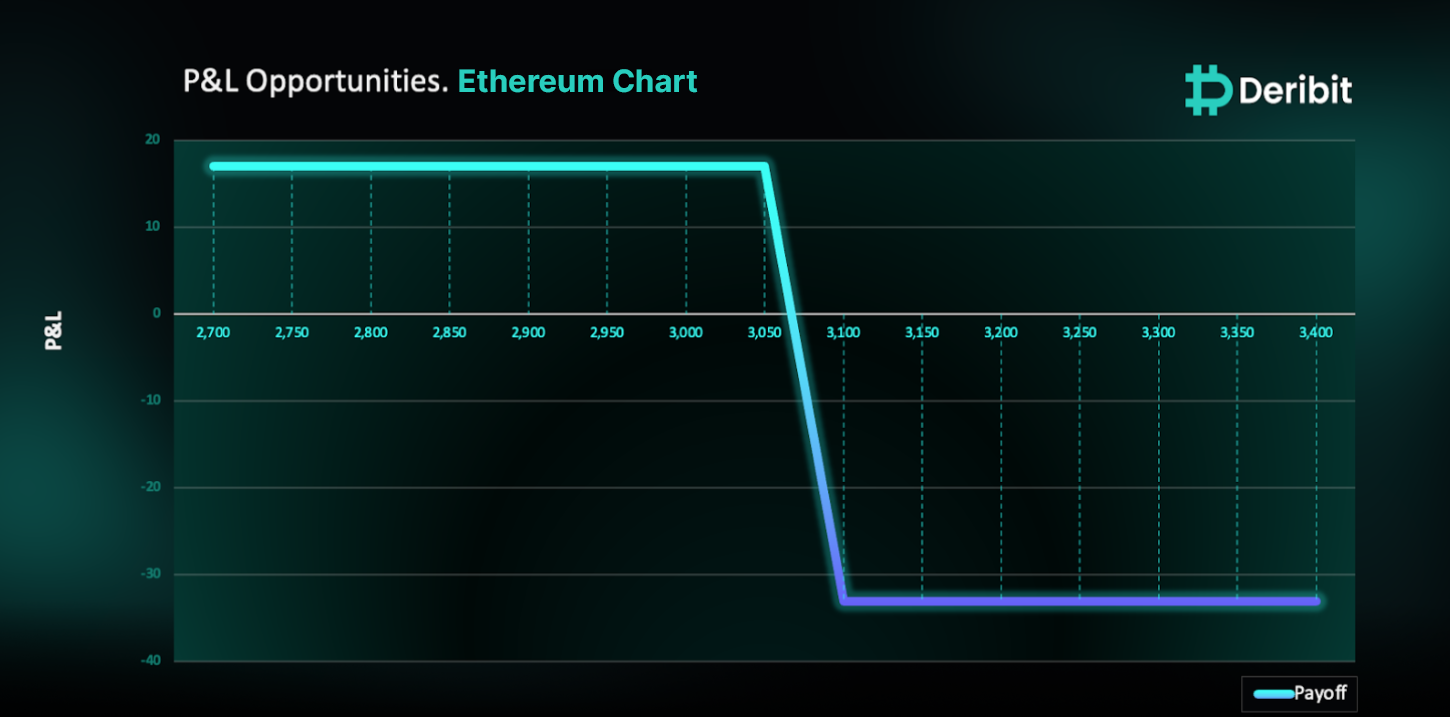

Payouts

Maximum Profit: $17/ETH

Why are we taking this trade?

As illustrated in the attached 4-hour Ethereum price chart, ETH is currently experiencing a downtrend, characterized by lower highs in its formations, and is trading close to its support level of $2850. The likelihood of the SEC approving an ETH ETF on May 23 is very slim, and the possibility of an ETF approval in 2024 seems uncertain. Additionally, the launch of ETH ETFs in Hong Kong has only attracted around 10% of the inflows compared to BTC, indicating cautious investor sentiment. Therefore, traders can look to consider deploying a bear call spread strategy to take advantage of the sideways to downside trend anticipated for ETH.

To execute this strategy, traders can sell a call option of a higher strike price, eg. $3050, while simultaneously purchasing a call option at an even higher strike price, like $3100.

In case of market upturn, the maxim loss is limited to $33, Maximum loss of Bear Call spread = Difference between strike prices of calls ($3100 – $3050) – Net Credit ($17).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)