View on market

Six applicants for spot Ethereum ETFs have updated their S-1 forms, hinting at potential SEC approval. U.S. spot Bitcoin ETFs saw $294.8 M in net inflows, and Ethereum’s price may rally to $3,400, presenting a call ratio strategy opportunity for traders.

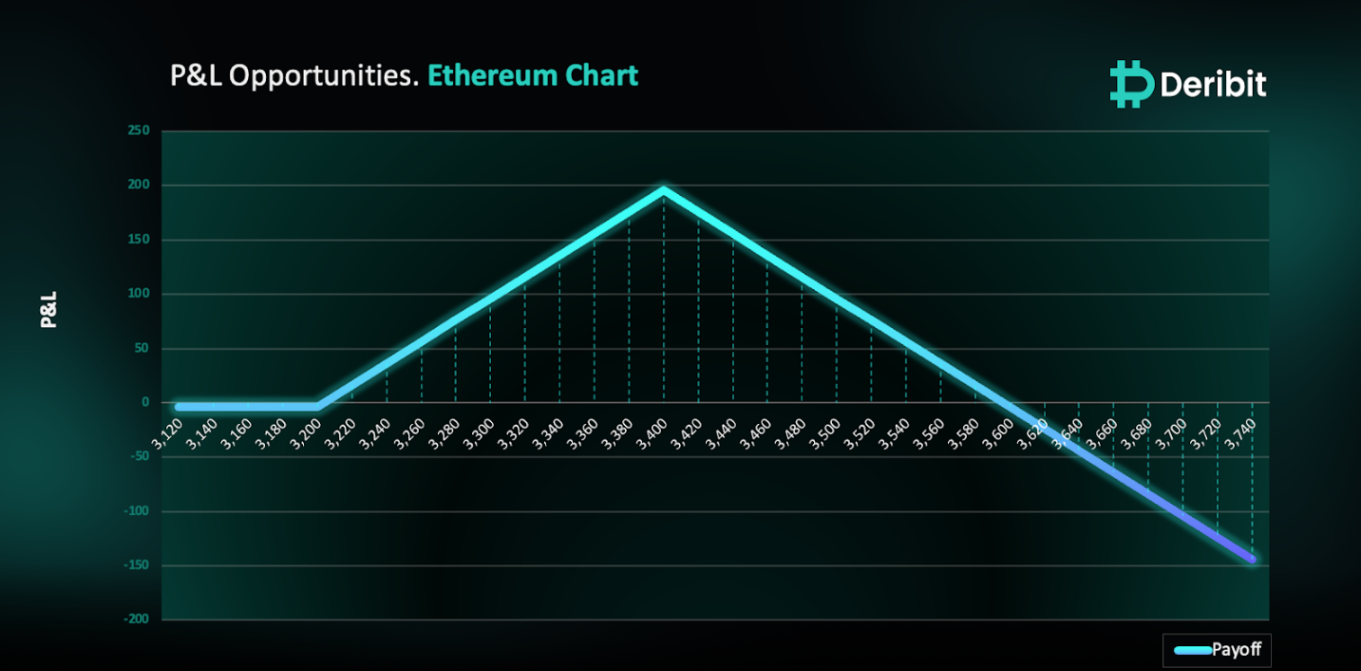

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You may consider taking this trade if you are eyeing upward momentum from here and anticipating resistance at the $3,400 levels in ETH.

Trade Structure

(OTM Call) Buy 1x ETH-19JUL24-$3,200-C @ $87

(OTM Call) Sell 2x ETH-19JUL24-$3,400-C @ $41.5

Target: Spot level < $3,400

Payouts

Maximum Profit: $196/ETH

Net Debit of Strategy: $4/ETH

Why are we taking this trade?

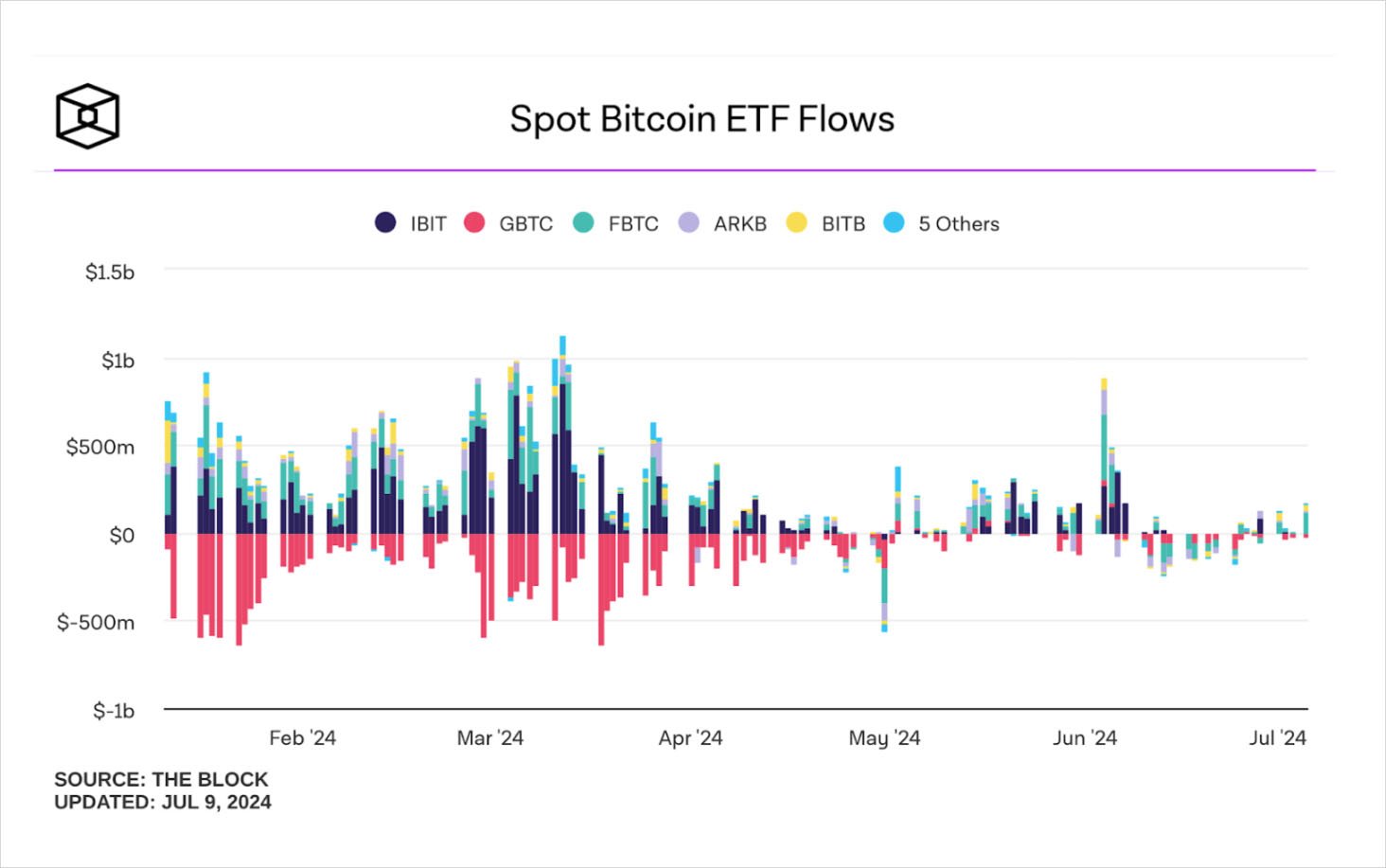

All six applicants for spot Ethereum ETFs have filed updated S-1 forms, suggesting that SEC approval might be on the horizon. Meanwhile, U.S. spot Bitcoin ETFs experienced net inflows of $294.8 million on Monday. (Source: Farside Investors)

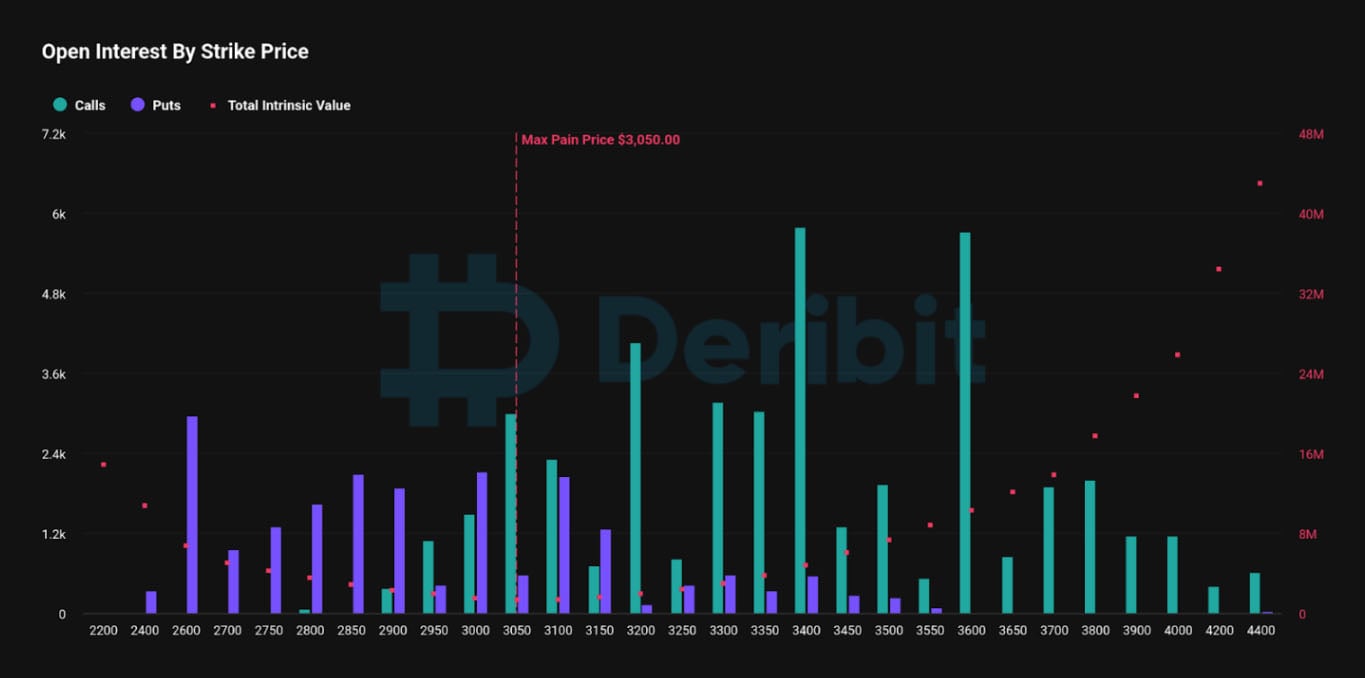

Technically, as shown in the attached Ethereum chart, the $2,840 level has provided solid support, leading to price bounces. We can anticipate the rally to continue upwards to the next resistance level, around $3,400. Adding to our odds, upon looking at the options data, high OI is sitting at the $3,400 strike of ETH options for 19th July(Source: Deribit). Therefore, traders might consider deploying a call ratio strategy in ETH for 19th July expiry.

To implement this strategy, traders can buy a higher strike Call option (e.g., $3,200) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $3,400).

If the price of ETH is at $3,400 when the options expire on July 19th, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy is at a debit of $4, significant losses are possible due to the position’s net short Call exposure.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)