View on market

The anticipated launch of multiple Ether ETFs by major asset managers signals strong institutional interest, and can potentially drive Ethereum prices higher. Ethereum’s significant fee income advantage and versatile applications further support a bullish outlook.

Bull Call Spread

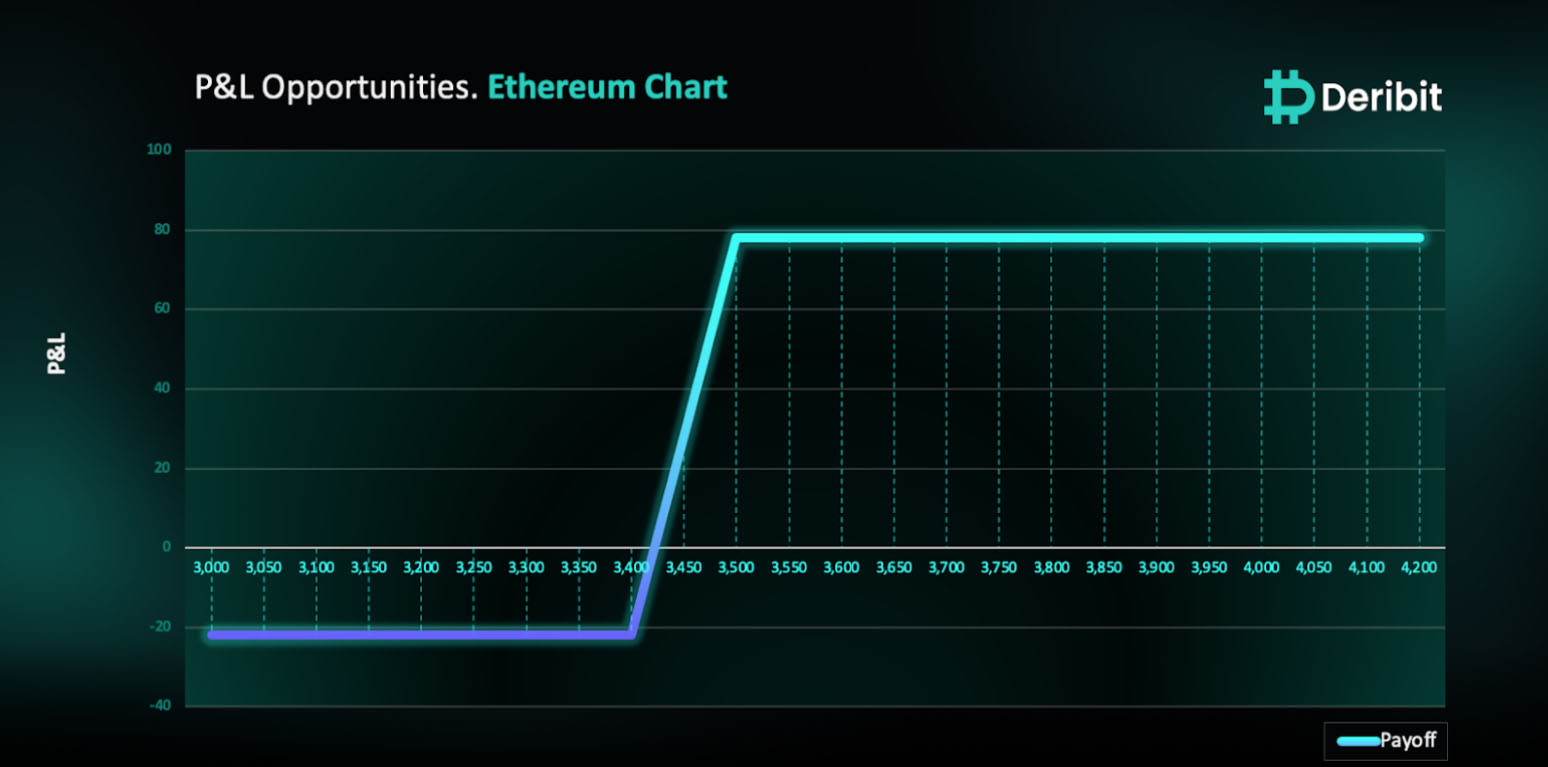

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying rises in price.

You may consider taking this trade if you expect ETH to rise in prices as the Spot ETFs might start trading anytime during the month.

Trade Structure

(OTM Call) Buy 1x ETH-26JUL24-$3,400-C @ $100

(OTM Call) Sell 1x ETH-26JUL24-$3,500-C @ $78

Target: Spot level > $3,500

Payouts

Maximum Profit: $78/ETH

Debit of Strategy: $22/ETH

Why are we taking this trade?

Asset manager Bitwise has refiled its S-1 application for an Ethereum exchange-traded fund (ETF) just days before the July 8 deadline, signaling that the products could hit the market soon, also it included a waiver of the sponsor fee for the first $500 million in assets.

Eight bidders, including BlackRock, Fidelity, 21Shares, Grayscale, Franklin Templeton, VanEck, iShares, and Galaxy/Invesco, have already received approval to list their shares on their respective exchanges. They now await the effective status of their S-1 filings to begin trading the Ether ETFs.

Ethereum has outpaced Bitcoin in fee income by an impressive 100%. Ethereum’s network recorded $2.73 billion in fee income, the highest in the industry, while Bitcoin generated $1.3 billion. This significant lead is due to Ethereum’s diverse range of applications and services, including decentralized finance platforms and NFTs, which drive higher usage and transaction fees. This positions Ethereum as a more versatile and widely utilized network compared to Bitcoin. (Source: Investing)

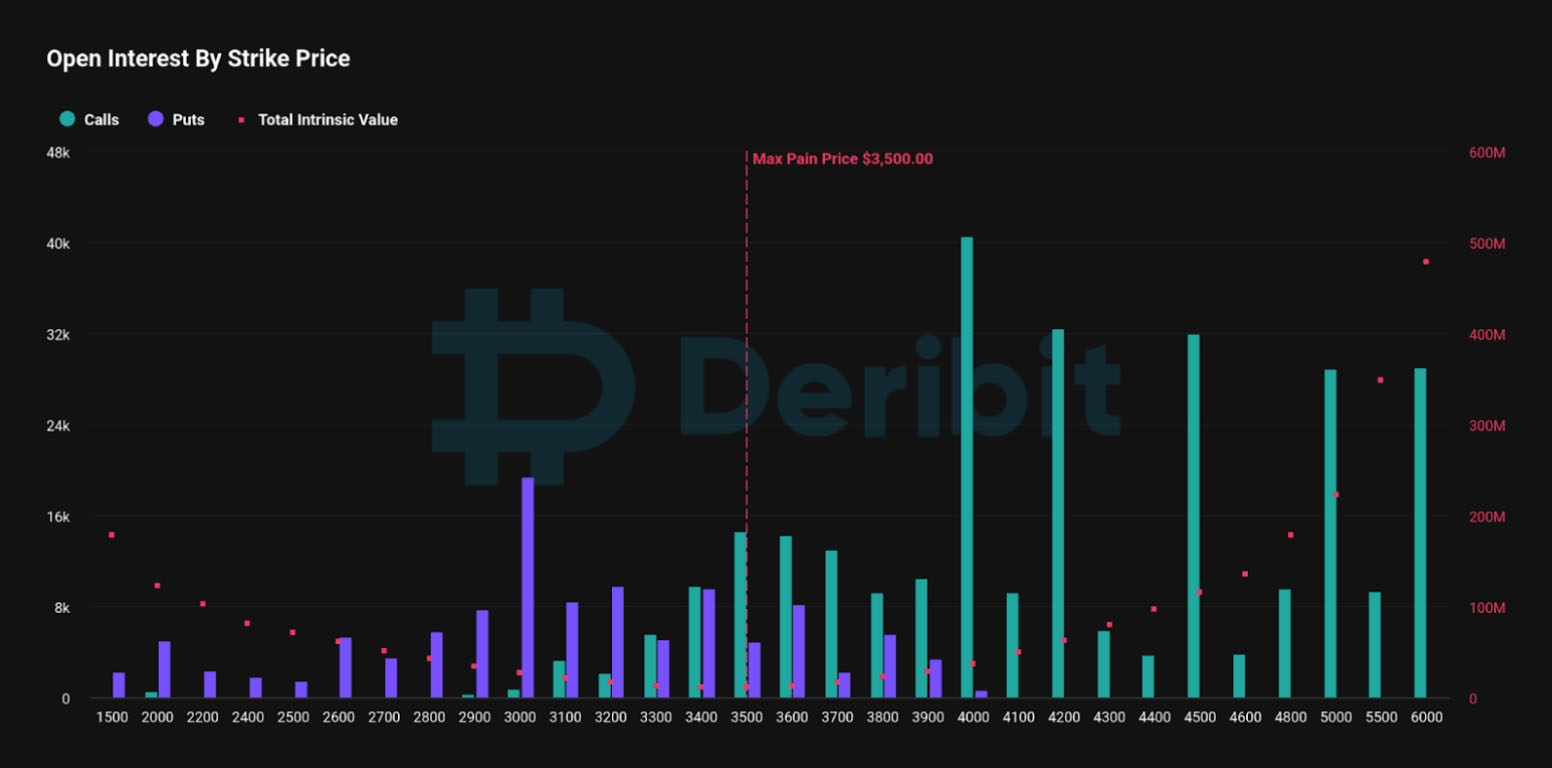

From a technical analysis perspective, the attached daily Ethereum price chart shows a rally-base-rally structure, indicating potential support at these levels due to the explosive rally from the mentioned base. Additionally, the Maximum Pain for Ethereum options expiring on July 26th is at the $3,500 strike price, suggesting that the price may trade closer to this level.

Source: Deribit Options Metrics

Therefore, traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $3,400) and simultaneously sell a Call option at a higher strike price (e.g., $3,500).

If ETH prices reach $3,500 when the options expire on July 26th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $22.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)