View on market

Ethereum is sideways, with strong support at $2,860, which has been tested multiple times and previously led to a high of $4,080. The recent approval of Ethereum ETFs and overall bullish sentiment in the crypto industry suggest a promising outlook for ETH.

Bull Call Spread

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying price rises.

You may consider taking this trade if you expect ETH price to rise.

Trade Structure

(OTM Call) Buy 1x ETH-08NOV24-$4,000-C @ $187

(OTM Call) Sell 1x ETH-08NOV24-$4,500-C @ $112

Target: Spot level > $4,500

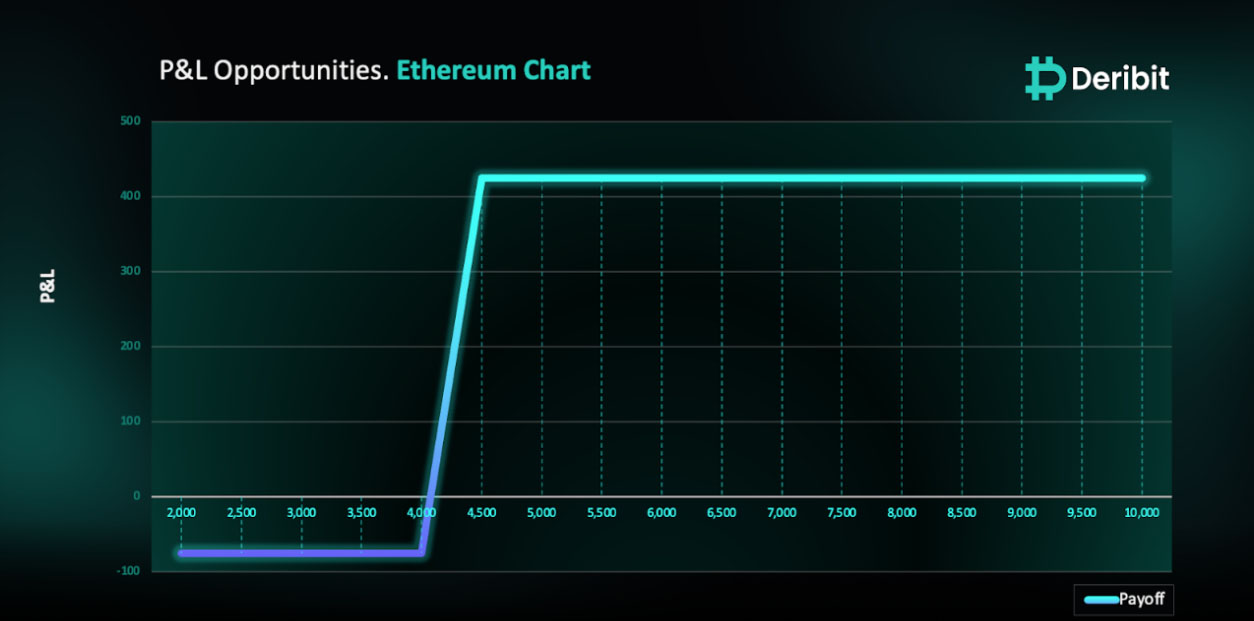

Payouts

Maximum Profit: $425/ETH

Debit of Strategy: $75/ETH

Why are we taking this trade?

Examining Ethereum’s (ETH) price chart from a high-time-frame perspective reveals that the cryptocurrency is currently in a sideways trend on the daily chart. This trend is characterized by price consolidation within a defined range without a clear upward or downward trajectory. A crucial support level has formed around the $2,860 mark, which has been tested seven times. This repeated testing indicates robust demand, as buyers consistently enter the market at this level to prevent further price declines. This support zone was also instrumental in driving ETH to a previous swing high of $4,080, suggesting that a sustained hold at this level could lead to another upward move.

The broader crypto market sentiment remains bullish, particularly with the recent approval of Ethereum ETFs. This development is likely to boost institutional interest and investment in ETH, potentially propelling its price higher.

Given the strong support at $2,860, the recent approval of ETH ETFs, and the positive sentiment in the crypto market, the future outlook for Ethereum appears promising.

Therefore, traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis. US elections are to be held on 5th Nov 2024, therefore the 8th Nov expiry is the election expiry.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $4,000) and simultaneously sell a Call option at a higher strike price (e.g., $4,500).

If the price of ETH is at or above $4,500, when the options expire on Nov 8th, traders will achieve maximum profit from this strategy.

If the price fails to increase sufficiently, the potential loss is limited to the initial debit of $75.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (ETH), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)