View on market

Inflation in the U.S. is slowing, but the Federal Reserve needs more evidence before cutting interest rates, with a focus on reaching a 2% inflation target. Meanwhile, Bitcoin shows a potential short-term low and positive trends for July, suggesting a Bull Call Spread strategy might be advantageous for traders.

Bull Call Spread

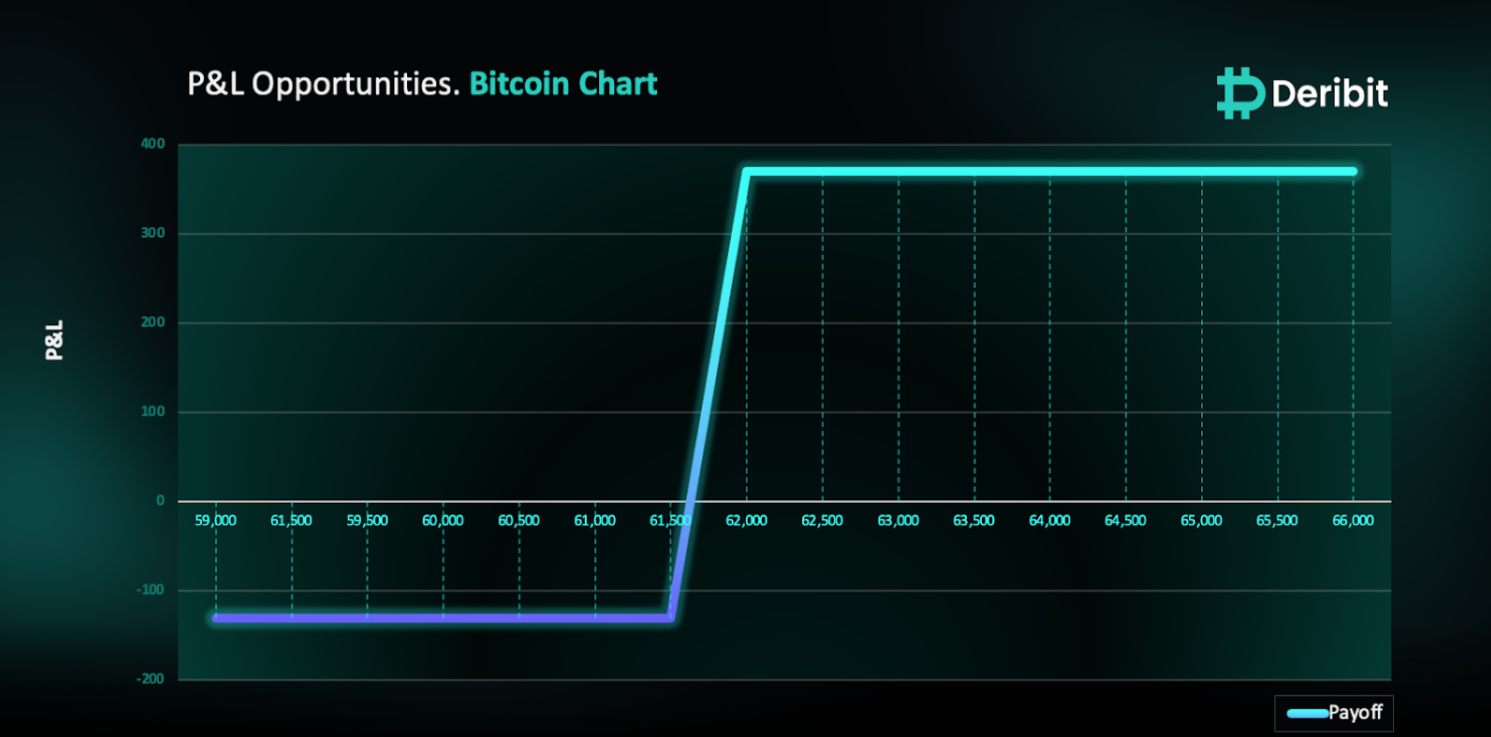

The proposed strategy is a Bull Call Spread. A Bull Call Spread consists of one long Call with a lower strike price and one short Call with a higher strike price. Both Calls have the same underlying and the same expiration date. It is established for a net debit (or net cost) and profits as the underlying rises in price.

You may consider taking this trade if you expect BTC to rise in prices and respect the trendline breakout.

Trade Structure

(OTM Call) Buy 1x BTC-5JUL24-$61,500-C @ $400

(OTM Call) Sell 1x BTC-5JUL24-$62,000-C @ $270

Target: Spot level > $62,000

Payouts

Maximum Profit: $370/BTC

Debit of Strategy: $130/BTC

Why are we taking this trade?

Inflation in the United States is slowing again after higher readings earlier this year, Federal Reserve Chair Jerome Powell said, but more evidence is needed before the Fed will cut interest rates. After persistently high inflation reports at the start of 2024, Powell noted that the data for April and May suggest a return to a disinflationary path. However, Fed officials want to see annual price growth slow further toward their 2% target before they can confidently say high inflation has been fully addressed.

In his Tuesday appearance, Powell stated that the U.S. economy and job market remain fundamentally healthy, allowing the Fed to take its time in deciding when rate cuts are appropriate. Attention now shifts to Friday’s non-farm payrolls report, which will be crucial in assessing whether the U.S. labor market remains resilient amid decades-high interest rates.

As mentioned in yesterday’s insight, July’s positive seasonality could be significant for crypto investors, as Bitcoin has historically performed stronger during this month. From a technical standpoint, as shown in the attached 4-hour BTC price chart, Bitcoin has broken out of a trend line (indicated by the white line) with some minor retracements observed exactly to the demand pivot as marked by the yellow line. This suggests the possibility of a short-term low forming in BTC, with the trend likely to continue at a slower pace.

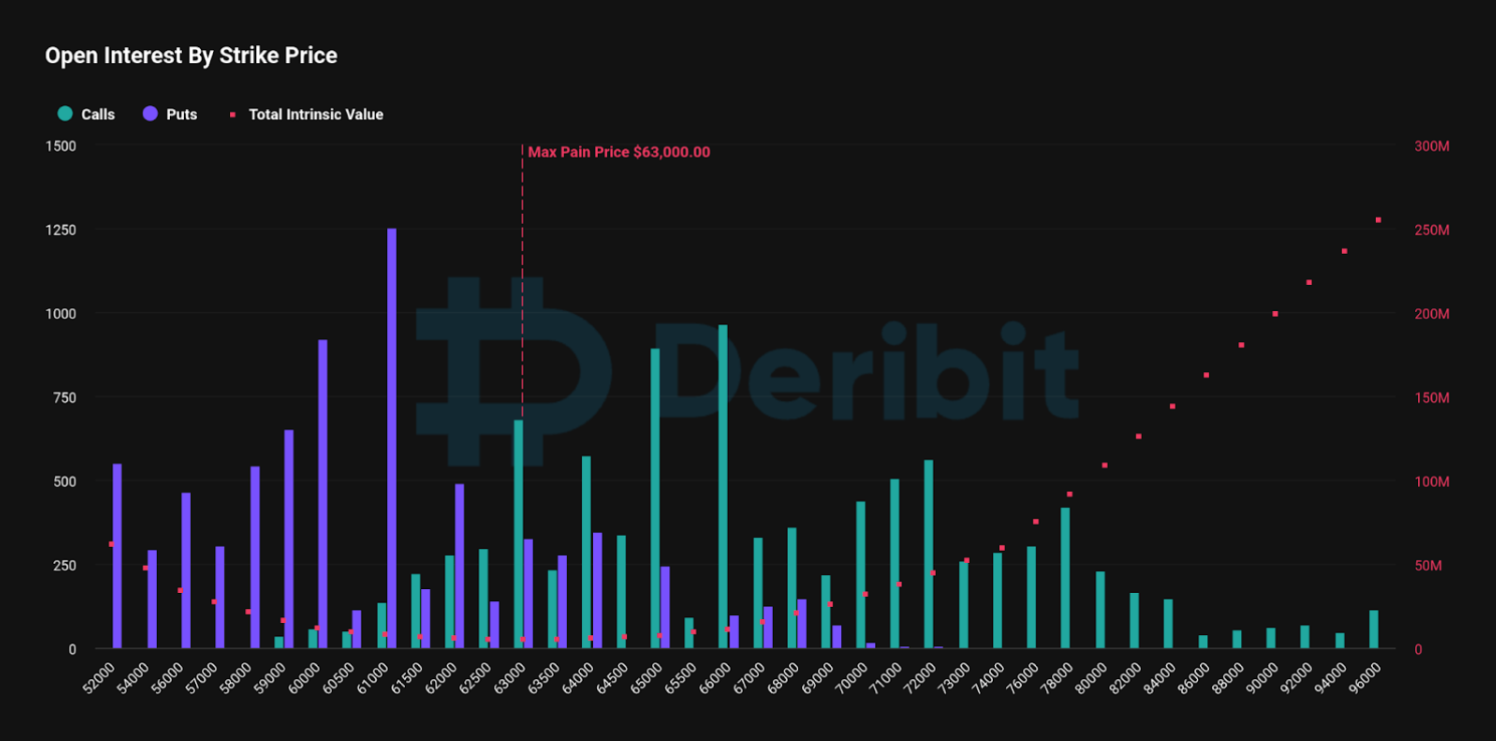

Additionally, the Maximum Pain for BTC options on July 5th stands at the $63,000 strike, indicating that the price may try to remain close to $63,000 by expiry.

Source: Deribit Options Metrics

Therefore, traders might consider deploying a Bull Call Spread strategy to capitalize on this anticipated price movement based on the above analysis.

To implement this strategy, traders can buy a Call option at a lower strike price (e.g., $61,500) and simultaneously sell a Call option at a higher strike price (e.g., $62,000).

If BTC reaches $62,000 when the options expire on July 5th, traders will achieve maximum profit from this strategy.

In case of a market downturn, the potential loss is limited to the initial debit of $130.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)