View on market

Bitcoin forms lower highs and miners facing shrinking revenues and fees, are pressured to sell their holdings. For traders looking to navigate this market, the Bear Call Spread strategy can be a suitable approach to consider.

Bear Call Spread

The proposed strategy is a Bear Call Spread. A Bear Call Spread is achieved by simultaneously selling a call option and buying a call option at a higher strike price but with the same expiration date.

You might consider initiating this trade if you believe that BTC to see more bearish to sideways time.

Trade Structure

(OTM Call) Sell 1x BTC-17MAY24-$65,000-C @ $340

(OTM Call) Buy 1x BTC-17MAY24-$66,000-C @ $200

Target: Spot level < $65,000

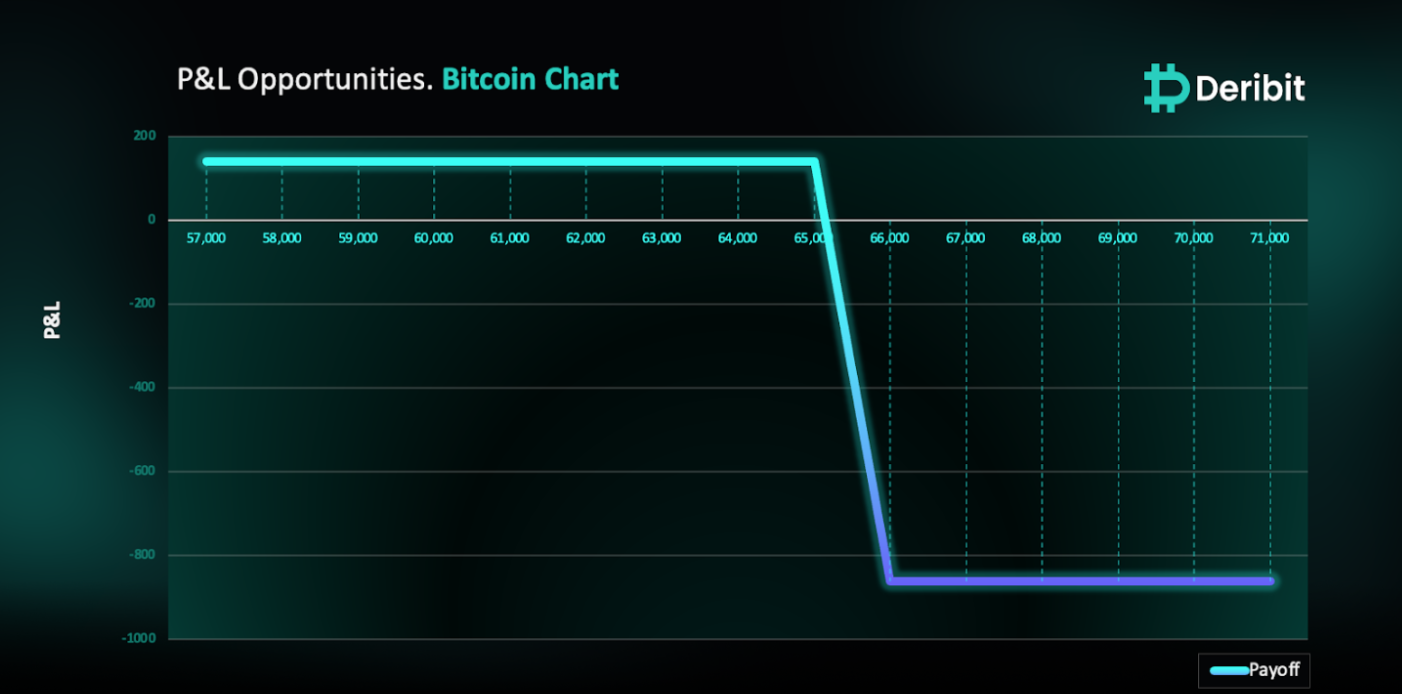

Payouts

Maximum Profit: $140/BTC

Why are we taking this trade?

As mentioned in my previous analysis, both the BTC halving event and the US BTC ETF flows have failed to generate significant market excitement. Similarly, the approval of spot Bitcoin and Ether ETFs by Hong Kong regulators has been met with a tepid response. Observing the current market trends, Bitcoin is forming lower highs once again, and the supposed breakout in the flip zone turned out to be a mere fakeout, as shown in the attached 4-hour BTC price chart.

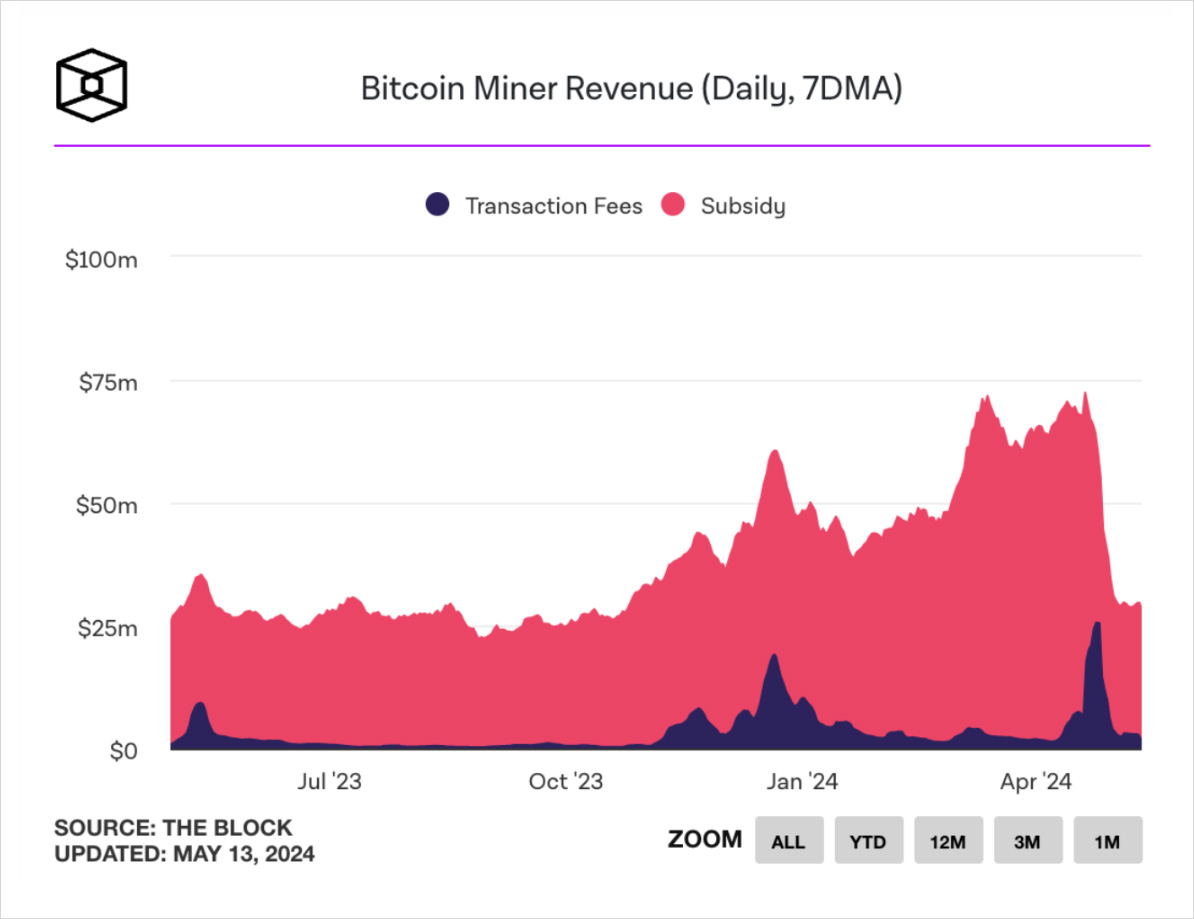

Bitcoin miners are under pressure to sell their holdings due to declining revenues following the latest BTC halving. The transaction fees they earn from processing trades are also drying up.

As a result, I anticipate that BTC will remain bearish for a few more weeks. Traders can capitalize on this bearish outlook on BTC using a Bear Call Spread strategy.

To execute this strategy, traders can sell a call option of a higher strike price, eg. $65,000 while simultaneously purchasing a call option at an even higher strike price, like $66,000.

In case of market upturn, the maximum loss is limited to $860. Maximum loss of Bear Call Spread = Difference between strike prices of calls ($66,000 – $65,000) – Net credit ($140).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)