View on market

If you hold a positive outlook on BTC, here’s a tailored trading suggestion suited to the present market conditions.

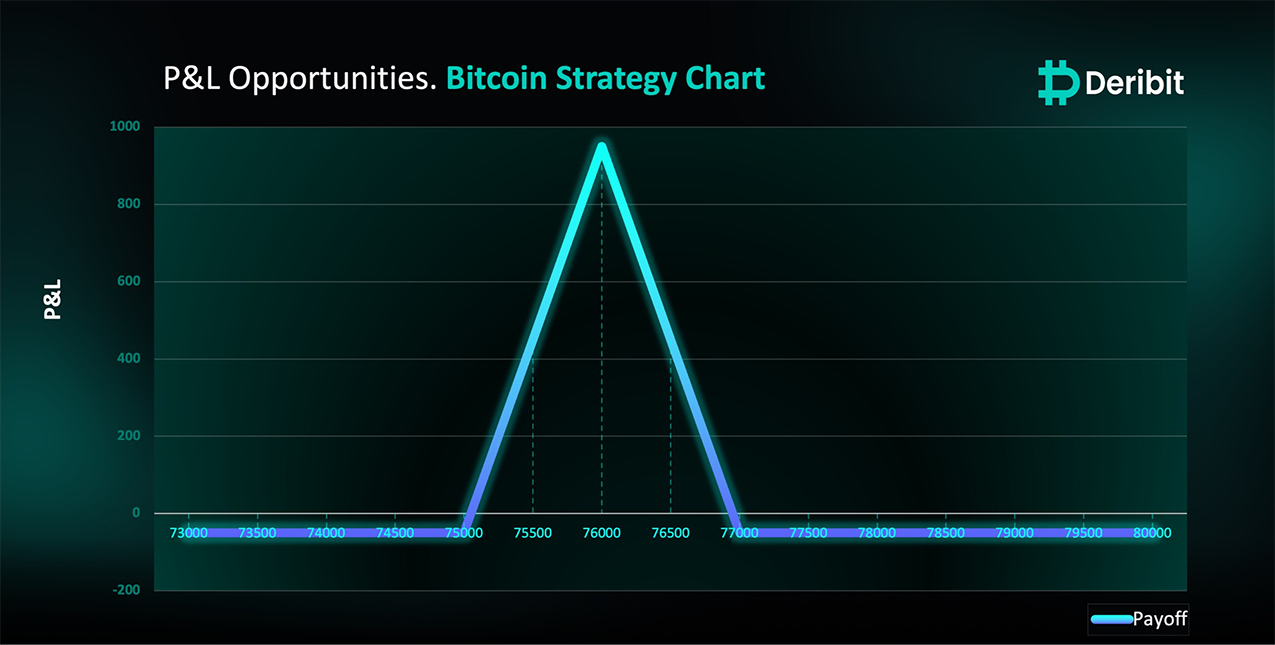

Call Butterfly

The proposed strategy is a Call Butterfly Strategy. A Butterfly spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with an even higher strike price.

Feel free to execute this trade if you believe BTC has short-term upward potential.

Trade Structure

(OTM Call) Buy 1x BTC-5APR24-$75,000-C @ $940

(OTM Call) Sell 2x BTC-5APR24-$76,000-C @ $720

(OTM Call) Buy 1x BTC-5APR24-$77,000-C @ $550

Target: Spot level < $76,000

Payouts

Maximum Profit: $950/BTC

Debit of Strategy: $50/BTC

Why are we taking this trade?

BTC hasn’t experienced significant pullbacks, and prominent demand zones are evident on the 4-hour chart. Its proximity to the all-time high indicates a bullish outlook in the short term. Traders expecting this bullish trend over the next few days might opt for a call butterfly strategy to capitalize on short-term gains.

To implement this strategy, traders can buy a higher strike call option (e.g., $75,000) and simultaneously sell calls in double quantity (2x) with a higher strike price (e.g., $76,000) and buy call with an even higher strike price (e.g., $77,000)

If Bitcoin is at $76,000 when the options expire on April 5, traders will be at maximum profit from the strategy.

Should there be a market downturn, the downside risk is confined to the initial debit of $50.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)