View on market

A significant rally in altcoins like MATIC is underway due to a bullish crypto market and the potential approval of a Spot Ether ETF, which could rapidly boost sentiment. Traders might use a Call Ratio strategy to capitalize on this, while some volatility is expected with the imminent US ETH ETF approval.

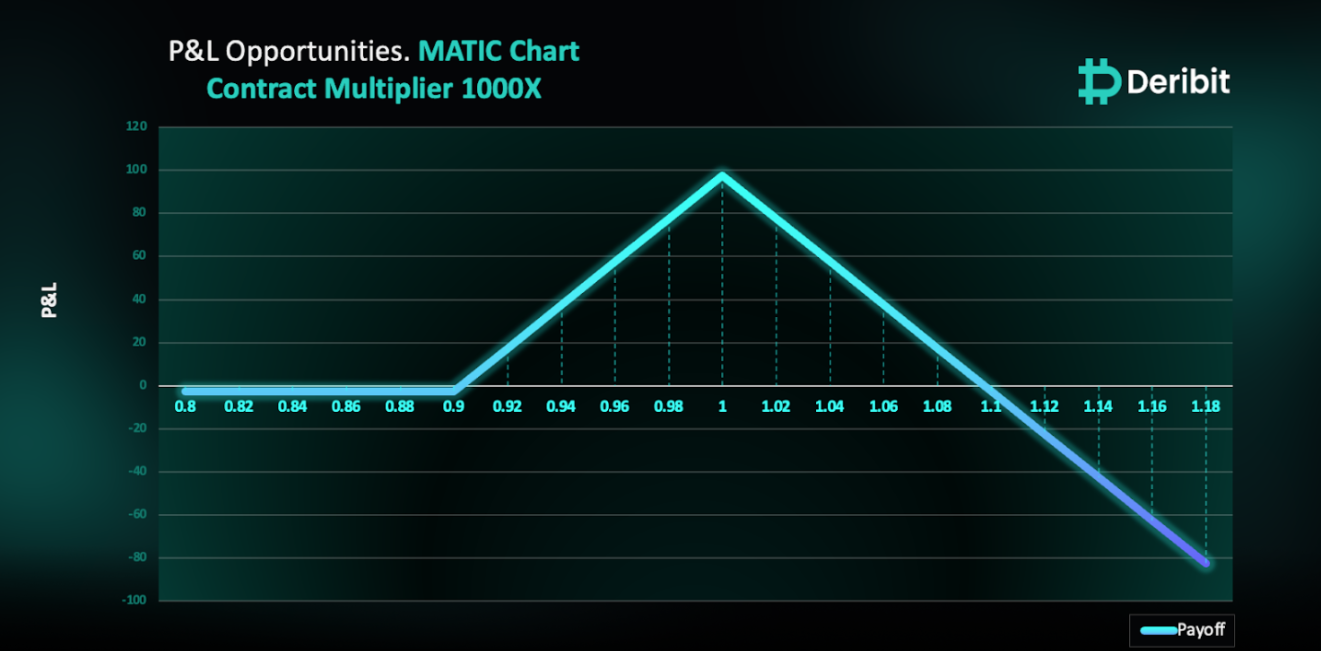

Call Ratio Spread

The proposed strategy is a Call Ratio spread. A Call Ratio spread involves buying a Call option that is OTM, and then selling two (or more) of the same option type (Call) of the same expiry, further OTM.

You may consider taking this trade if your perspective aligns with a bullish outlook on Polygon.

Trade Structure

(OTM Call) Buy 1x MATIC_USDC-28JUN24-$0.90-C @ $0.0225

(OTM Call) Sell 2x MATIC_USDC-28JUN24-$1-C @ $0.0100

Target: Spot level < $1

Payouts

Maximum Profit: $97.5/contract

Net Debit of Strategy: $2.5/contract

Why are we taking this trade?

As mentioned in my recent Insights, we’re witnessing a significant rally in altcoins, including MATIC, driven by a bullish sentiment throughout the entire crypto ecosystem. This trend was highlighted in yesterday’s Insight, which mentioned the impending approval of a Spot Ether ETF. Such a development could rapidly accelerate bullish market sentiment. From a technical standpoint, Polygon (MATIC) is demonstrating strength, with no signs of weakness or rejection, as shown in the attached price chart of MATIC. Additionally, altcoins may experience some volatility today as the approval of the US ETC ETF could happen at any moment. Traders might consider capitalizing on this opportunity using a Call Ratio strategy.

To implement this strategy, traders can buy a higher strike call option (e.g., $0.9) and simultaneously sell calls in double quantity (2x) of a higher strike price (e.g., $1).

If Polygon price is at $1 when the options expire on June 28, traders will be at maximum profit from the strategy.

It’s important to note that while the initial debit of this strategy is $2.5, losses beyond the initial debit are possible due to the position’s net short call exposure.

Note: MATIC Contract Multiplier is 1,000.

How to take this trade on Deribit?

Step 1: Go to Options books under MATIC_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)