View on market

I anticipate that SOL may experience a sideways to bearish trend in the coming days, influenced by the ongoing offloading of Locked SOL tokens and freshly formed Supply zones in control. For traders looking to navigate this market, the bear call spread strategy could be a suitable approach to consider.

Bear Call Spread

The proposed strategy is a Bear Call Spread. A bear call spread is achieved by simultaneously selling a call option and buying a call option at a higher strike price but with the same expiration date.

You might consider initiating this trade if you believe that SOL can see more sideways to bearish days of the week.

Trade Structure

(OTM Call) Sell 1x SOL_USDC-10MAY24-$135-C @ $5.8

(OTM Call) Buy 1x SOL_USDC-10MAY24-$140-C @ $4

Target: Spot level < $135

Payouts

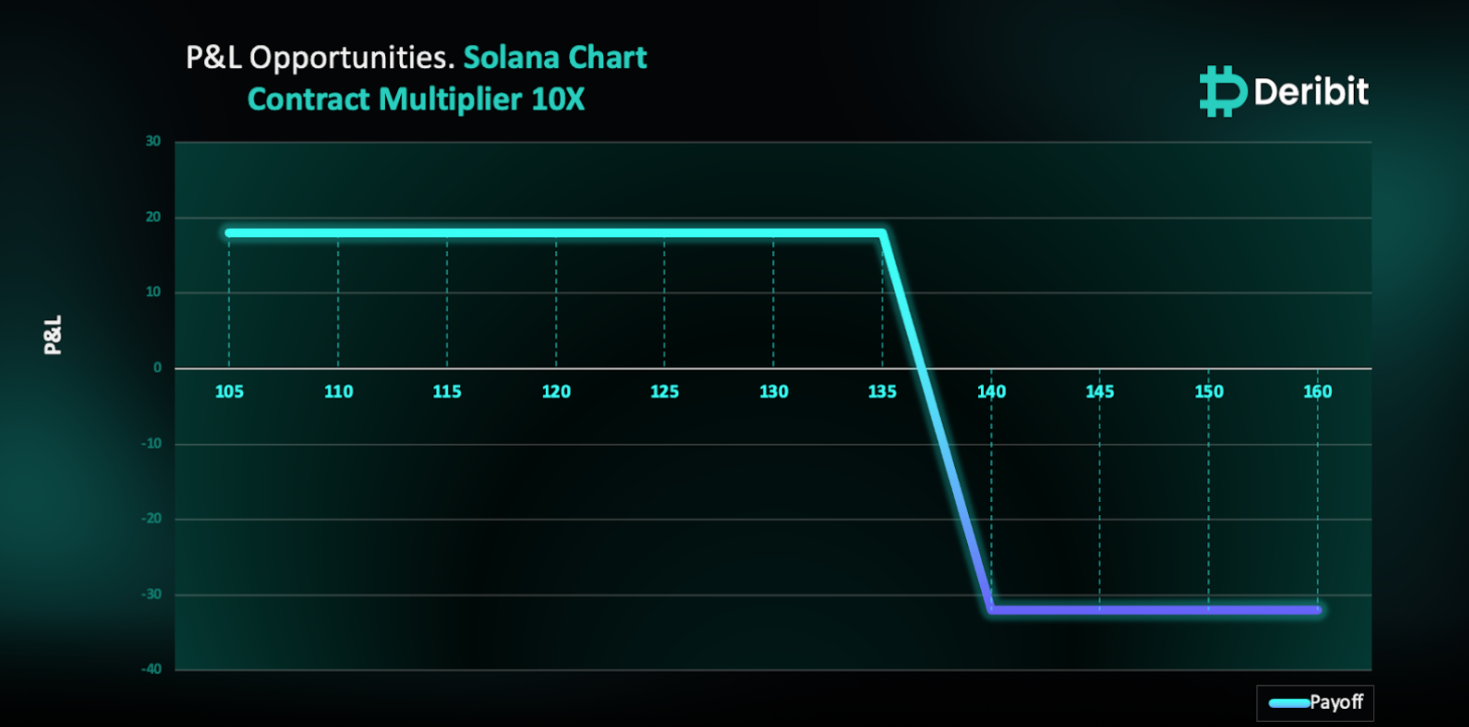

Maximum Profit: $18 per contract

Why are we taking this trade?

As the process of offloading of 1.8 million locked SOL tokens continues at around $100, we can observe the impact of traders’ sentiments on the SOL prices, as it’s making lower highs as highlighted in the attached 4 Hr SOL Price chart. The ongoing downtrend and the evident respect for newly formed supply zones suggest a downward trajectory, especially with the anticipation of further tranches of locked Solana being offloaded in the days ahead. Consequently, traders may consider leveraging a bear call spread strategy to capitalize on the sideways to downside outlook for SOL.

To execute this strategy, traders can sell a call option of a higher strike price, eg. $135, while simultaneously purchasing a call option at an even higher strike price, like $140.

In case of market upturn, the maxim loss is limited to $32 , Maximum loss of Bear Call spread = Difference between strike prices of calls ($135 – $140) – Net Credit ($1.8).

Note: Solana Contract Multiplier is 10.

How to take this trade on Deribit?

Step 1: Go to Options books under SOL_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)