View on market

Solana is emerging as a major player in the crypto space with strong market demand, high-performance blockchain, and recent bullish momentum. Cypherpunk Holdings’ significant increase in Solana holdings and Solana’s market outperformance highlight its growing appeal.

Call Ratio Spread

The proposed strategy is a Call Ratio Spread. A Call Ratio Spread involves buying a Call option that is OTM, and then selling two Calls of the same expiry, further OTM.

You might consider initiating this trade if you believe that SOL can follow a bullish trend as $160 resistance pivot is breached.

Trade Structure

(OTM Call) Buy 1x SOL_USDC-26JUL24-$160-C @ $7.32

(OTM Call) Sell 2x SOL_USDC-26JUL24-$170-C @ $3.96

Target: Spot level < $170

Payouts

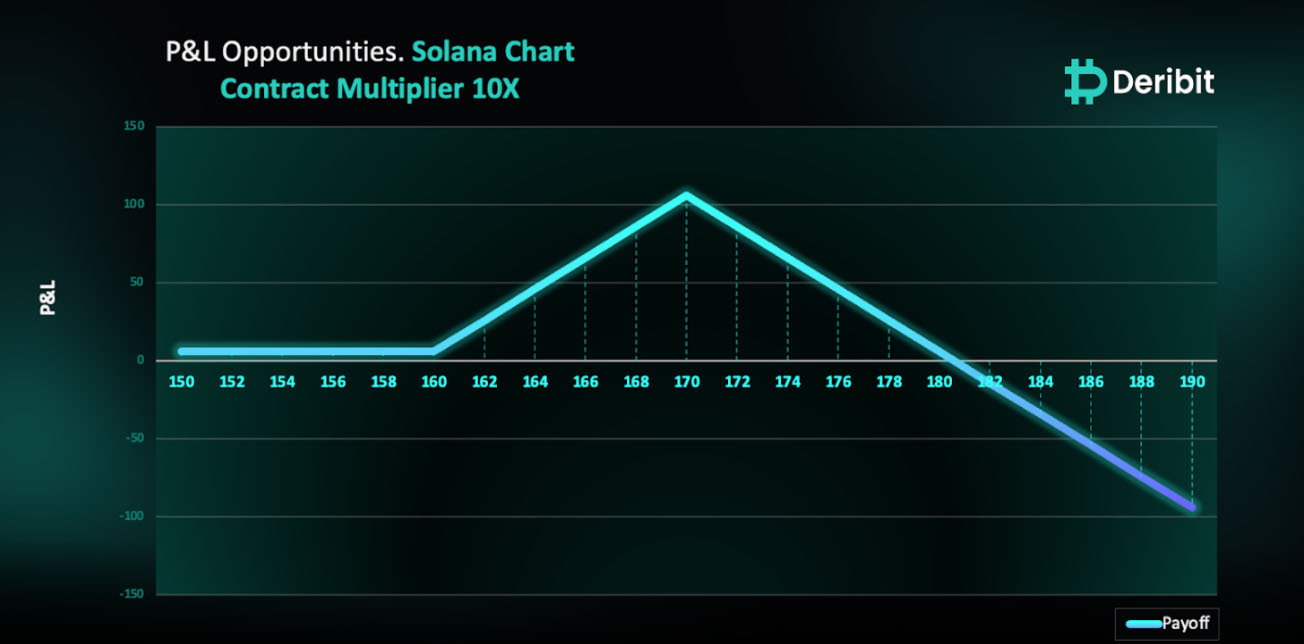

Maximum Profit: $106 per contract

Net Credit of Strategy: $6 per contract

Why are we taking this trade?

This year, one of the main crypto narratives has been the approval and trading of U.S. spot Exchange Traded Funds (ETFs), which have been a resounding success. The success of these ETFs is so apparent that even BlackRock’s CEO, Larry Fink, has expressed his approval, stating he likes Bitcoin now. Following this, an Ether spot ETF is expected to begin trading next week, which is also anticipated to be successful, albeit on a smaller scale compared to the Bitcoin ETF. Adding to the excitement, VanEck has submitted the first-ever application for a Solana exchange-traded fund (ETF) to the SEC.

Solana stands out among a few crypto assets with strong market demand and a highly decentralized network. Renowned for its high-performance blockchain platform, Solana is known for its scalability and low transaction fees. It has demonstrated strong bullish momentum recently, rising steadily and breaking through multiple important resistance levels.

Investment and Market Performance

Cypherpunk Holdings, a Toronto-based publicly traded investment firm, has significantly boosted its Solana (SOL) holdings. On July 16, the firm announced that it now possesses over 63,000 SOL tokens, valued at nearly $14 million. This marks a substantial increase from last month when Cypherpunk held only 6,131 SOL tokens. At the end of the first quarter of 2024, the firm reported holding no Solana tokens at all.

Strong inflows into spot Bitcoin ETFs suggest that sentiment has turned positive, and traders are buying aggressively. The monthly performance of Solana, market cap-wise, suggests it is outperforming other coins in the space, including Bitcoin (BTC) and Ethereum (ETH).

On the technical front, if we look at the 4-hour chart of Solana, the price managed to successfully breach the resistance pivot of $160 on the upside. Following this, no significant retracements were observed. On the other hand, there is a resistance zone at $170, which could challenge Solana’s price movement upwards.

Therefore, traders can consider deploying a Call Ratio strategy in Solana options to capitalize on the above analysis and the bullish atmosphere in the underlying.

To implement this strategy, traders can buy a Call option (e.g., $160) and simultaneously sell Calls in double the quantity (2x) of a higher strike price (e.g., $170).

If the price of Sol is at $170 when the options expire on July 26th, traders will be at maximum profit from the strategy.

It’s important to note that while this strategy collects an initial credit of $6 per contract, significant losses are possible due to the position’s net short Call exposure.

Note: Solana Contract Multiplier is 10.

How to take this trade on Deribit?

Step 1: Go to Options books under SOL_USDC & Select expiry.

Step 2: Choose Strike and execute your trade.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)