View on market

Bitcoin is likely to trade sideways despite today’s CPI data release, with implied volatility suggesting no major moves. Traders might consider a Short Strangle strategy due to Bitcoin’s current range-bound technical setup.

Short Strangle

The proposed strategy is a Short Strangle. A short strangle consists of one short call with a higher strike price and one short put with a lower strike. Both options have the same underlying and the same expiration date, but they have different strike prices.

You may take this trade if you think BTC will play in the range of $65,000 and $59,000.

Trade Structure

(OTM Call) Sell 1x BTC-17MAY24-$65,000-C @ $227

(OTM Put) Sell 1x BTC-17MAY24-$59,000-P @ $201

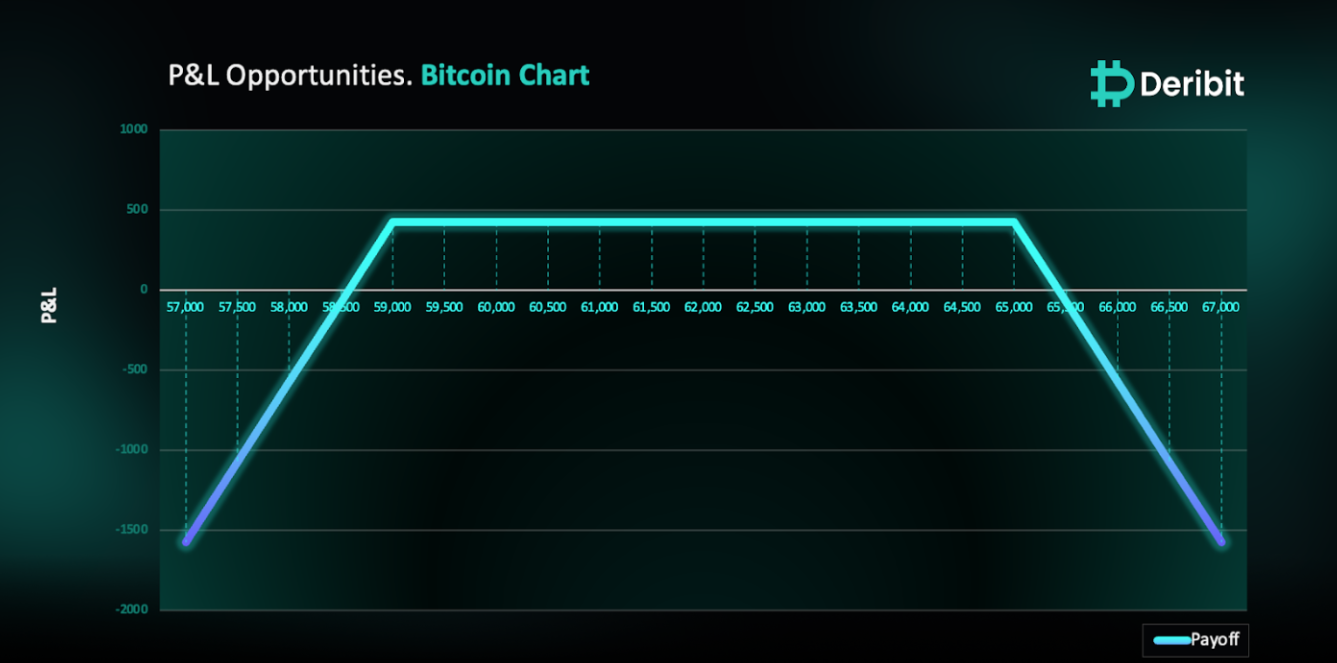

Payouts

Maximum Profit: $428/BTC

Why are we taking this trade?

I expect Bitcoin to keep trading sideways despite today’s CPI US inflation data release. The implied volatility is priced at 56.8% for the 17th May maturity vs.51.8% for other maturities, indicating that a significant move in Bitcoin due to the inflation data is unlikely. From a technical perspective, Bitcoin is currently stuck between a demand zone and a supply zone, as shown in the attached 4-hour price chart.

In the short term, the market structure looks like a roadblock for any sharp moves in Bitcoin, and next week’s SEC decision regarding the ETH ETF could bring in some momentum.

Given this situation, traders may find a Short Strangle strategy beneficial to manage the anticipated choppy price action.

To implement this strategy, traders can sell a higher strike call option (e.g., $65,000) and simultaneously sell puts in the same quantity of a lower strike price (e.g., $59,000).

If the Bitcoin price is greater than $59,000 and less then $65,000 when the options expire on May 17th, traders will achieve maximum profit from this strategy.

It’s important to note that a large price move in either direction could cause significant losses due to being short both a call and a put.

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)