View on market

Bitcoin dropped to its lowest level since February, and Ethereum fell below $2,200 amid a broad crypto selloff, influenced by macroeconomic news and Jump Crypto’s asset movements amid an investigation, signaling a downward trend with global tensions.

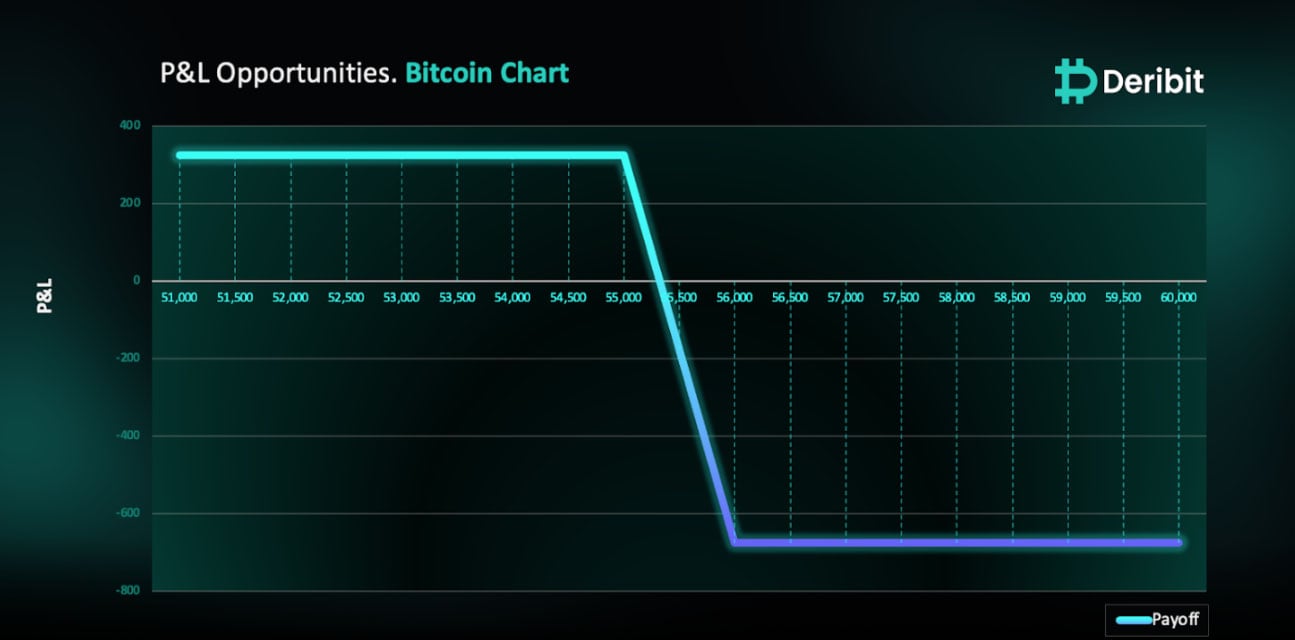

Bear Call Spread

The proposed strategy is a Bear Call Spread. A Bear Call Spread is achieved by simultaneously selling a call option and buying a call option at a higher strike price but with the same expiration date.

You might consider initiating this trade if you believe that BTC can fail to move higher.

Trade Structure

(OTM Call) Sell 1x BTC-16AUG24-$55,000-C @ $1,665

(OTM Call) Buy 1x BTC-16AUG24-$56,000-C @ $1,340

Target: Spot level < $55,000

Payouts

Maximum Profit: $325/BTC

Why are we taking this trade?

Bitcoin saw a significant drop on early Monday morning EST. This decline occurred amid a widespread selloff in the crypto market, driven by several factors, including macroeconomic developments, asset movements by Jump Crypto, and the increasing likelihood of Kamala Harris winning the upcoming U.S. election against pro-crypto candidate Donald Trump.

Over the weekend, Jump Crypto, part of Jump Trading, began transferring hundreds of millions of dollars in crypto assets, including Ethereum and USDT. This activity sparked speculation that the firm might be liquidating its crypto holdings due to an investigation by the U.S. Commodity Futures Trading Commission.

As highlighted in the insights from July 30th, Bitcoin was trading within a channel. The attached 4-hour chart shows that the lower trend line of this channel has been breached, indicating a downward trend for Bitcoin.

As a result, I anticipate that BTC shall continue trading below $55,000 which was a key support for BTC which has been broken now. Traders can capitalize on this outlook on BTC using a Bear Call Spread strategy.

To execute this strategy, traders can sell a call option of a higher strike price, eg. $55,000 while simultaneously purchasing a call option at an even higher strike price, like $56,000.

In case of market upturn, the maximum loss is limited to $675. Maximum loss of Bear Call Spread = Difference between strike prices of calls ($56,000 – $55,000) – Net credit ($325).

How to take this trade on Deribit?

Step 1: Go to Combo books under the Strategy tab & Create combo.

Step 2: Click RFQ and send your order to the Combo List.

Step 3: Go to Combo list (BTC), click on your Strategy and execute.

Disclaimer

This report must not be used as a singular basis of any trading decision. The document includes analysis and views of our research team. The document is purely for information purposes and does not constitute trading recommendation/advice or an offer or solicitation of an offer to buy/sell any contract.

AUTHOR(S)