Deribit is introducing an automated system for applying fee discounts. This is a tiered system of progressively lower fees that is open to all traders on Deribit. When the requirements for the next fee level are met, the next day the new discount will automatically be applied to the account.

By introducing automated volume discounts for fees, Deribit is making fee discounts more transparent, and open to everyone.

On the 1st of November 2025, each account will be assigned a fee level based on the volumes of the account during October. After that date, upgrades will be processed daily, and downgrades will be processed monthly.

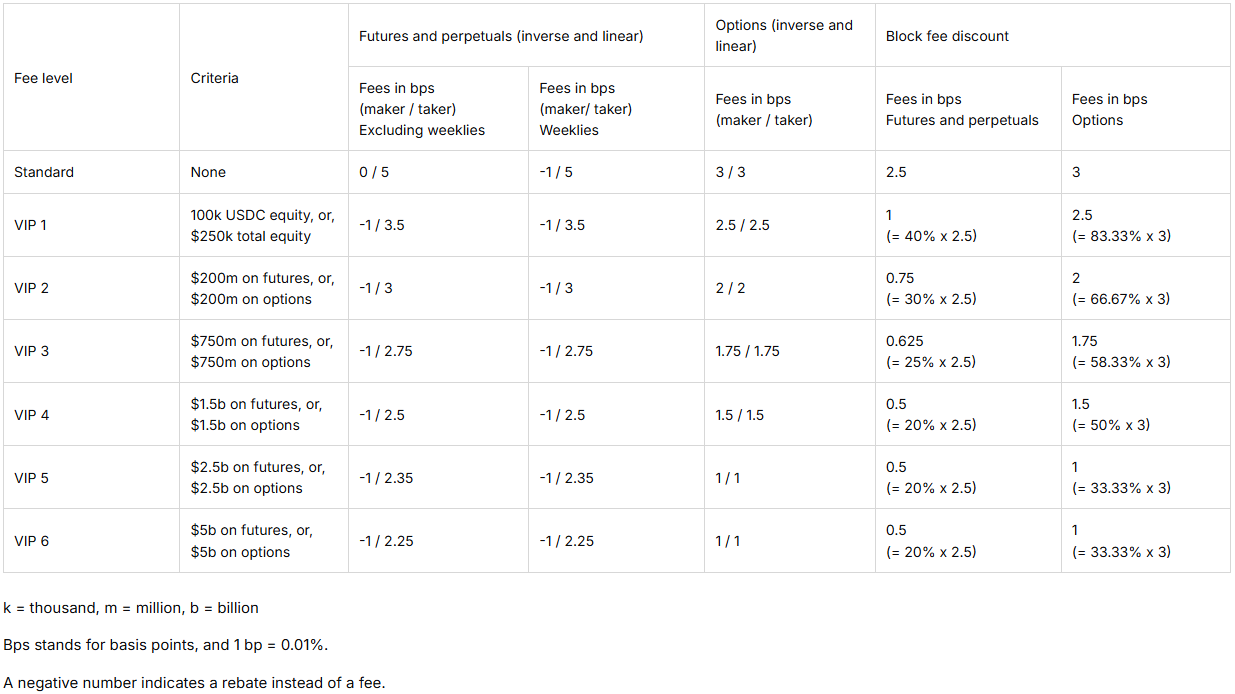

The following table details the upcoming fee levels and their corresponding fee rates.

Note that while this table is accurate at the time of publication, for up to date fee levels, the best resource is the knowledgebase fees page.

Satisfying the criteria

For level VIP 1, eligibility requires either 100k USDC equity or total equity worth at least $250k. The 100k USDC equity threshold must be satisfied specifically with USDC and cannot be met using the equivalent value of other currencies.

For fee levels with a volume requirement (VIP 2 to VIP 6), the volume threshold for options is separate from the volume threshold for futures. However, the discounts of the highest VIP level a trader reaches for either instrument type are then applied to both product types.

For example, a trader with $750 million in options volume, but only $100 million in futures volume, will be assigned to level VIP 3, and they will still benefit from the reduced futures fees of VIP 3 as well.

Similarly, a trader with $150 million in option volume, and $600 million in futures volume, has not satisfied the option volume criteria for any level, but they have exceeded the futures volume criteria for VIP 2. They will therefore be assigned to VIP 2, and they will benefit from the reduced fees of VIP 2 for both options and futures.

Trades from all subaccounts in an account will be included in fee level calculations. However, trades in spot instruments do not count towards volume requirements.

Upgrades and downgrades – moving between levels

Upgrades happen once per day at 12:00 UTC, and are based on a rolling period of the previous 30 days. It is possible to be upgraded more than one level at a time if the criteria has been met.

Downgrades are only processed on the 1st day of each month, and are based on the previous calendar month (rather than 30 days). Downgrades will also only happen one level at a time, so if on the 1st day of the month a trader is below the threshold for their current fee level, they will only be moved down a single level on that day.

The mechanism for moving up/down the fee levels means that upgrades happen quickly, and downgrades happen slowly.

Once an account is upgraded to VIP 1, the monthly average of daily equity over a calendar month is used to determine eligibility for maintaining VIP 1 status. If an account fails to meet the criteria for a full calendar month, meaning an average of USDC equity is less than 100k and average of total equity less than $250k, it will be downgraded to the standard fee level. After a downgrade, the account cannot be re-upgraded to VIP 1 for one month. This rule is designed to prevent abuse and is the only exception to the principle of fast upgrades.

More information

For more information on all fees, including these automated fee levels, visit the Deribit knowledge base.

AUTHOR(S)