Macro Backdrop

The Fed looks set to trim rates by 25 bps rather than 50, striking a balance that avoids spooking markets. Institutional demand remains the anchor, with BTC spot ETFs recording consistent inflows and ETH attracting steady interest despite regulatory hurdles. Even assets like XRP and SOL rallied after ETF delays, reinforcing the view that postponements are steps toward approval. Altcoins are driving momentum, drawing capital out of BTC’s consolidation and into higher-beta names. Overall, crypto feels steady, range-bound, and awaiting its next macro catalyst.

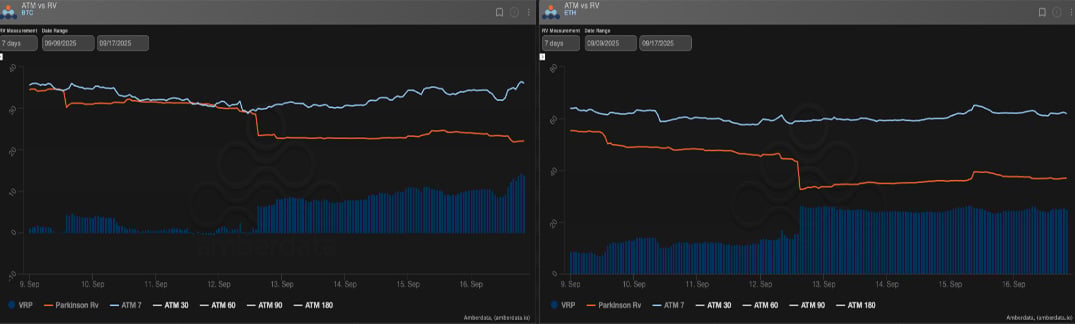

Implied vs. Realized Volatility – Low and Orderly

Realized vol collapsed last week, with BTC dropping into the low 20s and ETH below 40. While front- end vols remain sticky ahead of the FOMC, the rest of the curve drifted 2–3 vols lower. Carry has turned decisively positive, especially in ETH, as realized has rolled over but implied remains supported. Price action has been orderly, reinforcing the low-volatility regime.

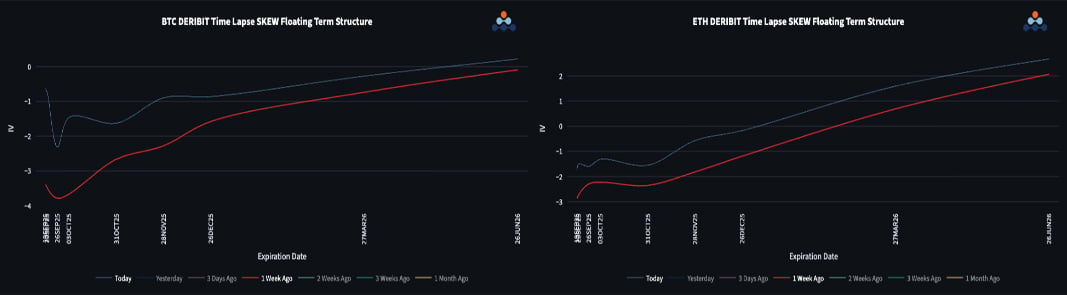

Skew – Puts Fading, Calls Emerging

Skew curves bounced alongside the market, trimming put premiums. BTC front-end skew narrowed from -4 to -2, though puts still dominate. ETH’s skew shifted more evenly, with short-dated expiries holding slight put bias while long-dated structures lean toward calls – a sign of medium-term bullish positioning. Sentiment is tilting constructive as a rate cut is already priced in.

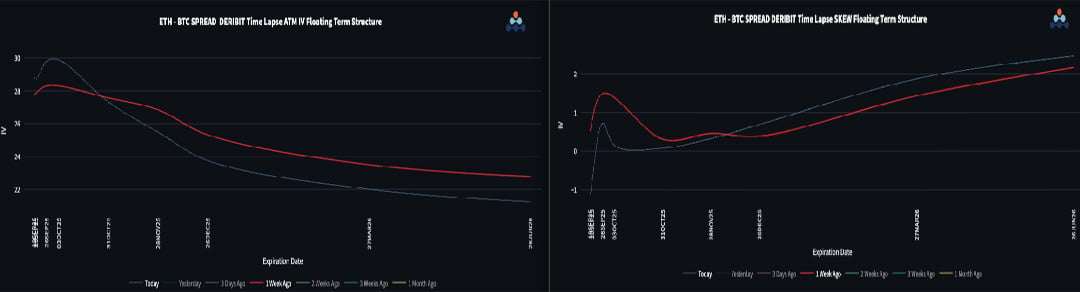

ETHBTC Pair – Spreads Signal ETH’s Long-Term Premium

The ETH/BTC vol spread is inflecting around October expiries, with front-end spreads touching 30 as BTC vols softened more sharply. Long-dated structures still show call premium for ETH, reflecting lower institutional hedging pressure and the asset’s less mature adoption profile.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)