Spot BTC ETF Deadline Set for this Wednesday

Just when we thought we had seen it all, here comes the SEC’s X account posting:

“Today the SEC grants approval for #Bitcoin ETFs for listing on all registered national securities exchanges. The approved Bitcoin ETFs will be subject to ongoing surveillance and co.”

Only to witness a few minutes SEC’s Chair himself, Gary Gensler, denying the announcement:

“The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products” said SEC Chair Gary Gensler.

So, someone posted this fake announcement that spot bitcoin ETFs had been approved. Despite this, approval is still expected to happen tomorrow.

What’s most comical is that based on X team investigation, the compromise was, in their words, “not due to any breach of X’s systems, but rather due to an unidentified individual obtaining control over a phone number associated with the @SECGov account through a third party,” the X team said.

The most laughable? The account “did not have two-factor authentication enabled” the X team added. And this is the entity trying to set financial cybersecurity standards?

Nonetheless, the hack of the SEC’s account has brought to life an event we had long anticipated, that is, the news, while believed to be true, turned out to be a “sell the news” event.

Credited to @therationalroot

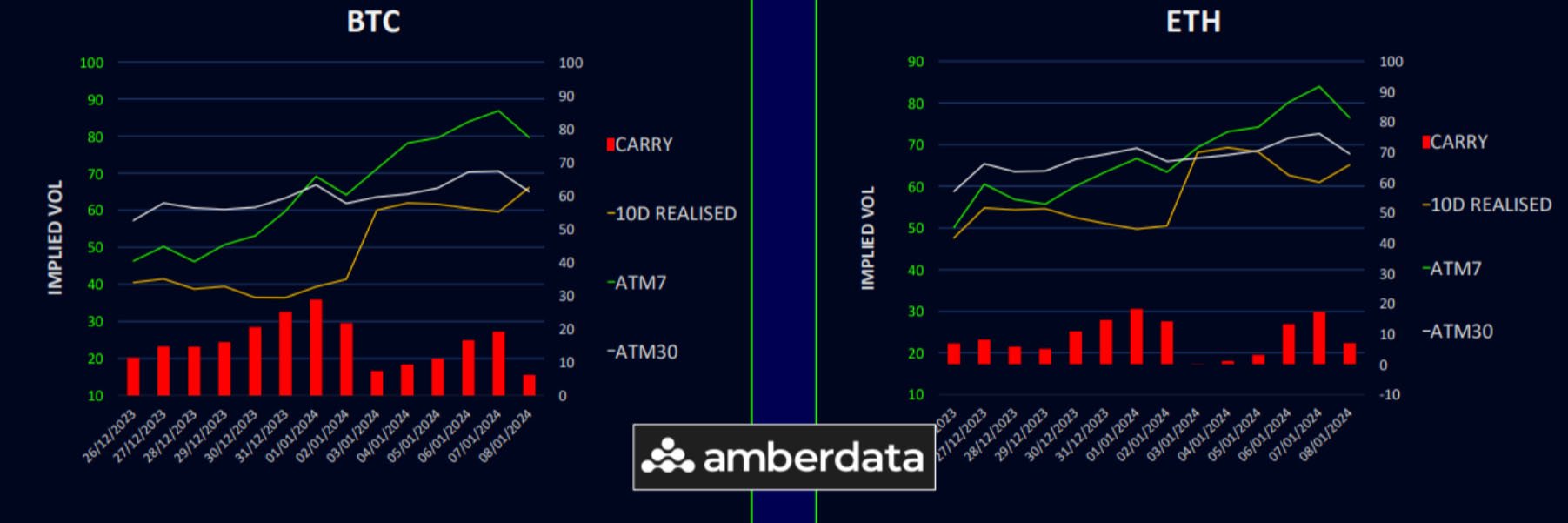

Vol Carry Still Positive

Over the past week, there’s been a significant increase in crypto volatility, especially as we near the ETF approval deadline this Wednesday. Last week, a sudden market drop occurred due to rumours of SEC rejection, leading to the liquidation of leveraged long positions. However, the market has since recovered, with Bitcoin reaching new local highs near $48,000 after the fake ETF approval news.

Implied volatilities have risen, particularly in the short term, to counteract the impact of option price decay or theta. This rise in implied volatilities, typical before major volatility events, keeps the volatility carry positive. But once the ETF news is released, we expect a sharp decrease in these implied volatilities. The Bitcoin rally before the official news and the continued high Ethereum volatility indicate a favourable environment for long gamma traders. Let’s see if it lasts!

BTC’s Term Structure in Expected Backwardation

Bitcoin’s term structure remains in backwardation ahead of the ETF deadline this Wednesday. Weekly options are resisting value decay until after the event. The rest of the term structure is experiencing slight pressure as traders anticipate a volatility reset. For February/March 2024 expiries, we foresee a significant impact, especially since they don’t include the ‘halving’ event.

Ethereum’s term structure has also moved into backwardation, albeit less drastically than Bitcoin’s. The early part of 2024 is down by about 2 volatilities, but long-term Ethereum volatility remains robust, indicating stronger confidence in Ethereum for the rest of 2024. This prediction has been further reinforced after the fake ETF approval where BTC was sold while ETH held steady.

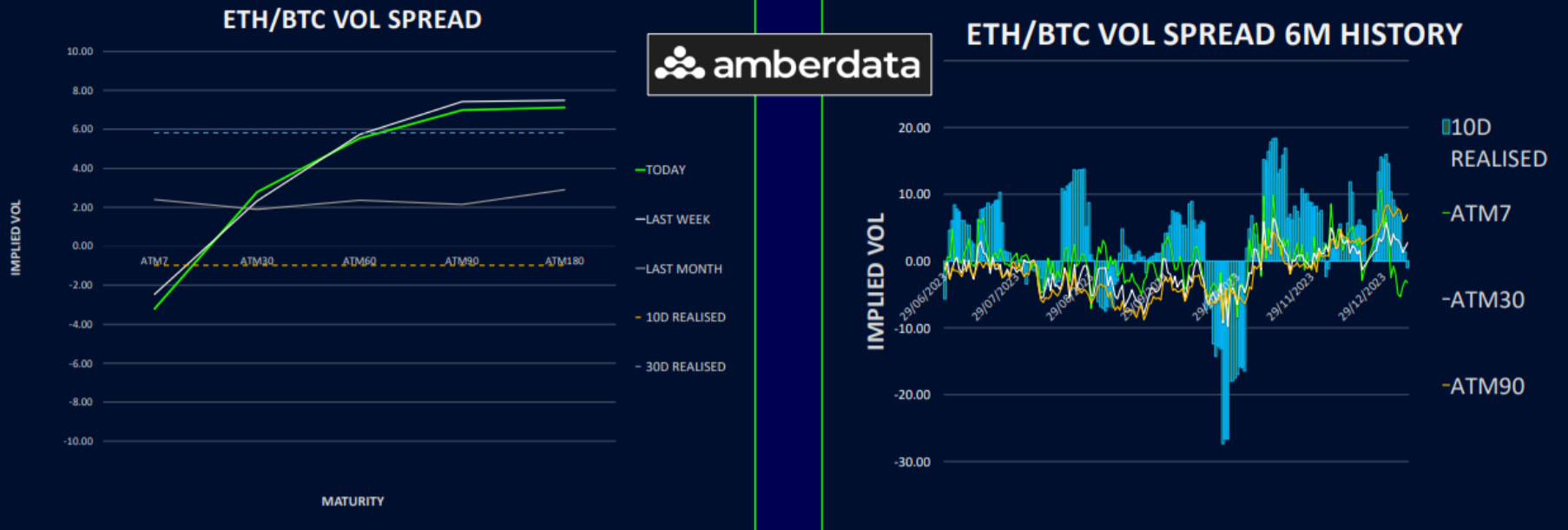

ETH/BTC Vol Spread Favors ETH Premium Out the Curve

In the current market, the Ethereum/Bitcoin volatility spread favors Bitcoin in the weekly expiry by approximately 4 vols. However, as we look further along the curve, the premium shifts to Ethereum, with longer-term expiries showing about a 7 vol premium for Ethereum – a relatively high figure in recent times. The Ethereum/Bitcoin spot spread recently fell below the 0.050 support level due to a sudden move in Bitcoin, making it a good entry point for the spread. It has since recovered though.

The rise in back-end Ethereum vol makes call switches less attractive, but bullish risk reversals for Ethereum, coupled with selling out-of-the-money BTC calls, appear to be a viable strategy. If Bitcoin falls below key support levels like $40,000, adding BTC puts or put spreads could enhance the trade.

Interesting Moves in BTC Skew

This week, the Bitcoin skew term structure showed notable changes. Weekly skew shifted to put premium due to increased hedging demand, but outright put protection was less favored compared to put spreads.

The rest of the term structure still shows call premium, with the highest at the back end near 5 volatilities. Ethereum’s skew reflected a similar pattern, with weekly puts gaining more premium, possibly indicating higher beta for Ethereum in a general crypto downturn.

Short-term overwriting flows in Ethereum have reduced call premium. For long-term Ethereum bulls, call spreads are becoming a more efficient strategy. In case of a market sell-off, low-cost bullish risk reversals are worth considering, as call premium could rise further.

Option Flows And Dealer Gamma Positioning

Bitcoin trading volumes surged by 45% as prices fluctuated between $41,000 and $48,000 over the week. Traders primarily focused on short-term expiries (12-19 January) for protective buying against event risk, with notable activity in call spreads and calendar call spreads for March 2024.

Conversely, Ethereum volumes fell by 35%, with the spotlight on Bitcoin. The $2,500 strike was the most active, through either direct call buying for January expiries or through call calendar buys for February/March 2024 and March/June 2024.

Bitcoin dealer gamma positioning was more balanced this week, with a significant long position at the $50,000 strike balancing smaller positions at lower strikes. Dealers are likely to prevent Bitcoin from breaching $50,000 as they manage their long gamma exposure.

Ethereum dealer gamma remains relatively flat, with short positions above $2,500 indicating potential for upward momentum. However, a short-term Ethereum rally is doubtful without Bitcoin also rising, given the prevailing focus on the ETF narrative.

Strategy Compass: Where Does The Opportunity Lie?

Monetising short-dated calls and/or rolling them into longer term call spreads seems like a no brainer at this point. Look past the ETF noise and lean on the “halving” being a supportive longer-term narrative. Also selling some calls against long positions to earn premium works if you agree with us that 50k should act as a resistance into 26Jan.

We have been hedging a lot of our crypto exposure, and will be looking to add risk back again on any dips over the next few weeks. ETH remains our preferred long here, given where the spread has got to, and we like June 2024 call spreads and bullish risk reversals.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)