Weekly recap of the crypto derivatives markets by BlockScholes.

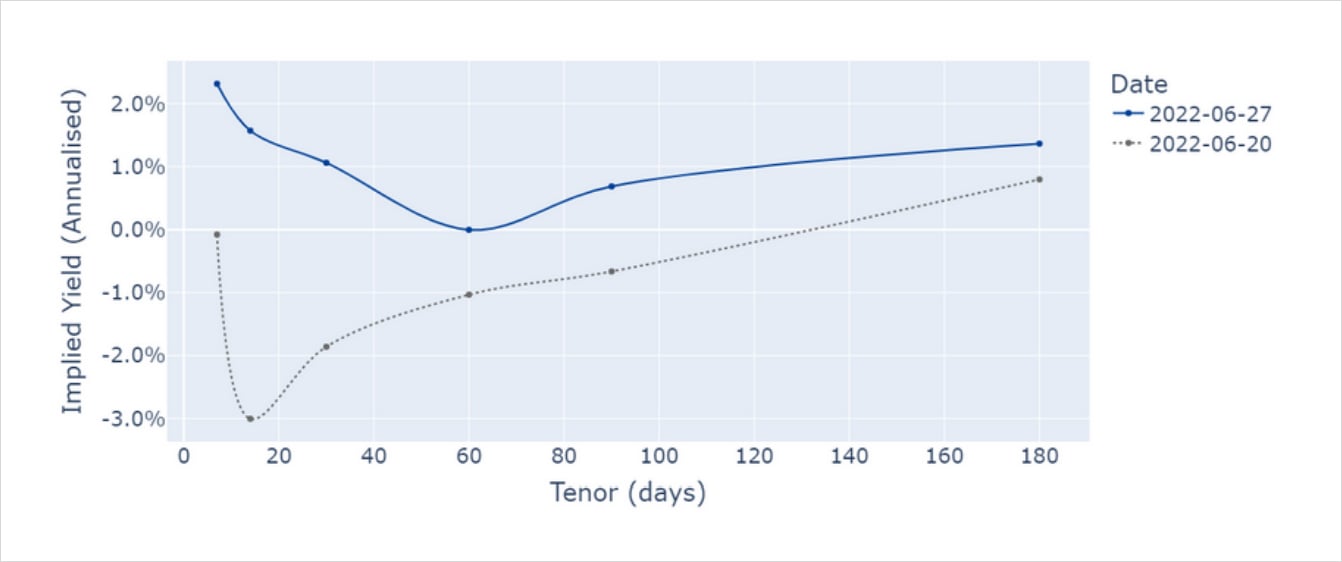

BTC’s Implied yield curve flattens, with prices near to spot for short dated tenors

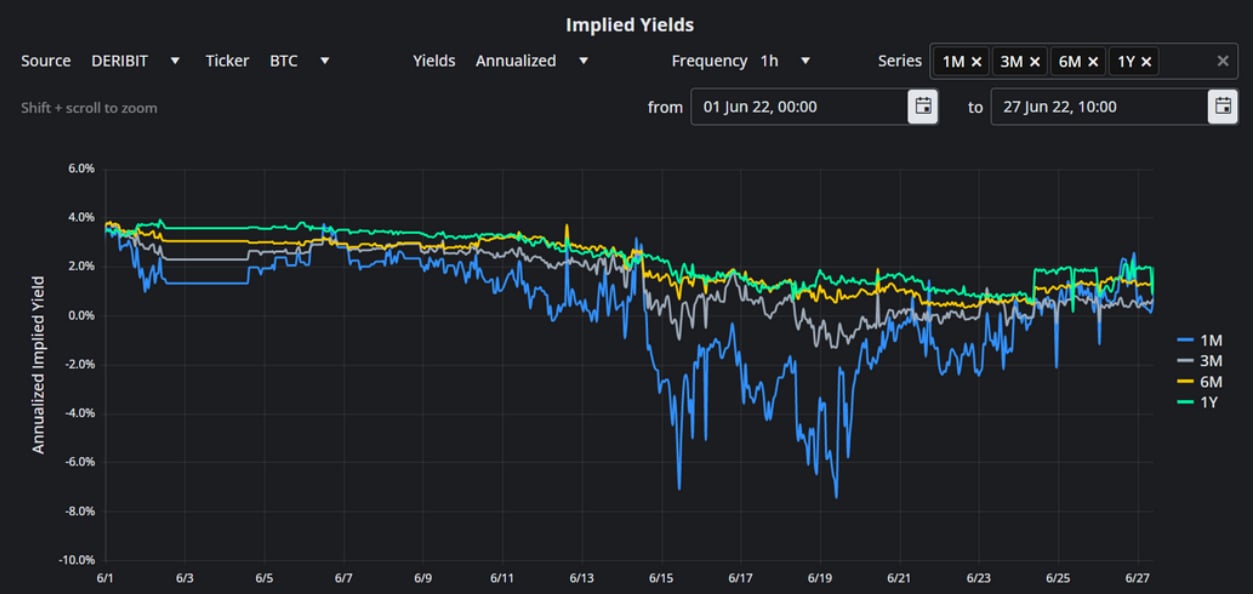

Annualised Yields recover from the deep drop in the second week of June to trade in a more compressed range

BTC Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

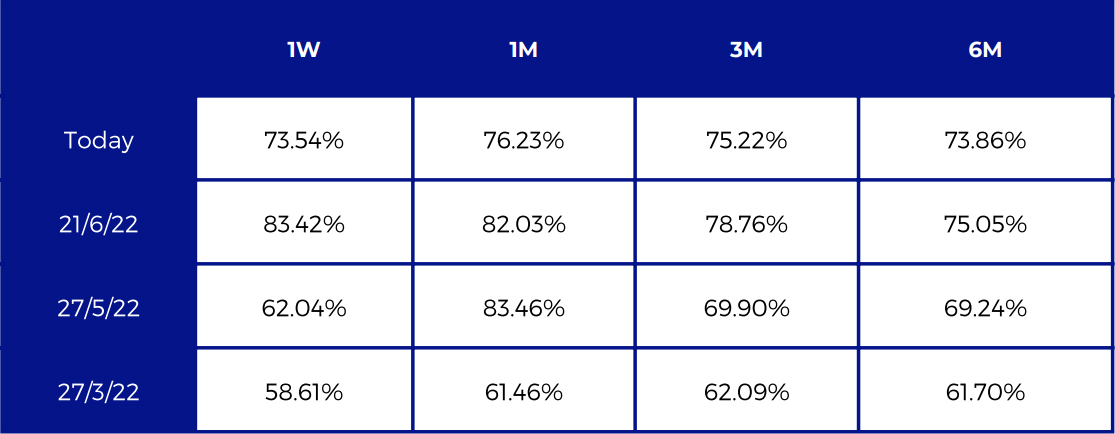

ATM Volatility remains settled in mid-70s

Put-call skew is still reflecting the attractiveness of protection against further downwards movements

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

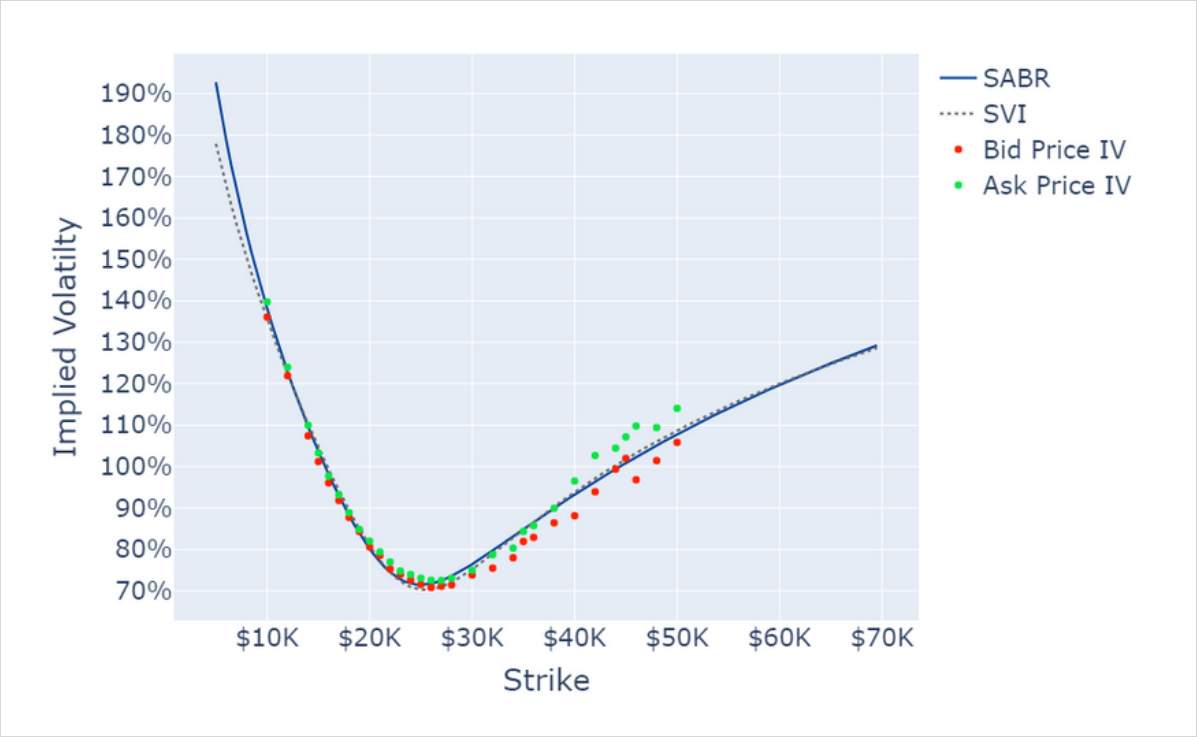

BTC 29th July Expiry smiles

SABR and SVI Smile Calibrations.

The smile remains steep as ATM vol lowers to mid-70s

BTC 1 Month SABR Implied Vol Smile.

ETH Derivatives Analytics

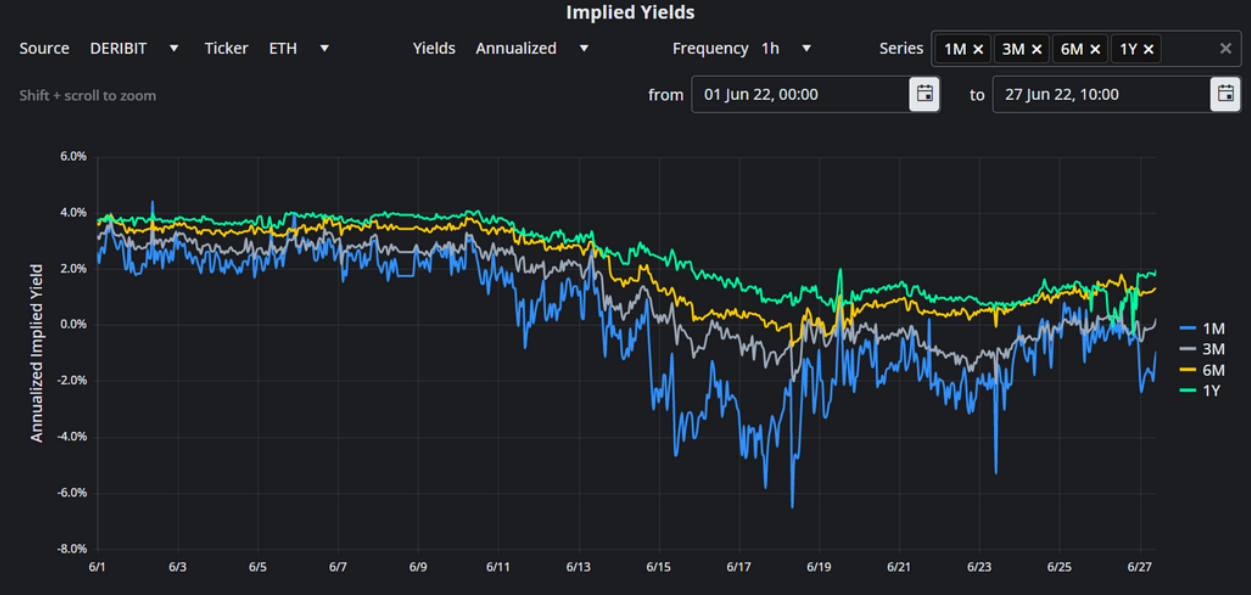

ETH’s annualised yields hover near zero with short dated tenors still negative

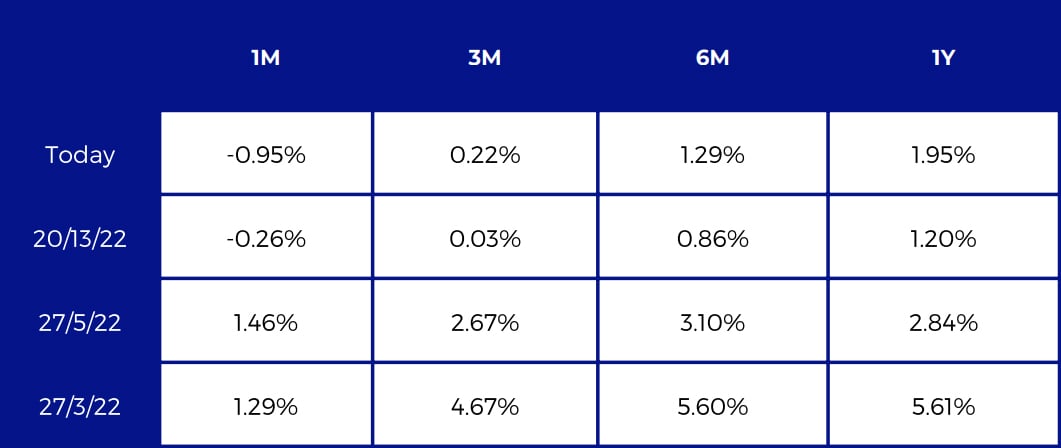

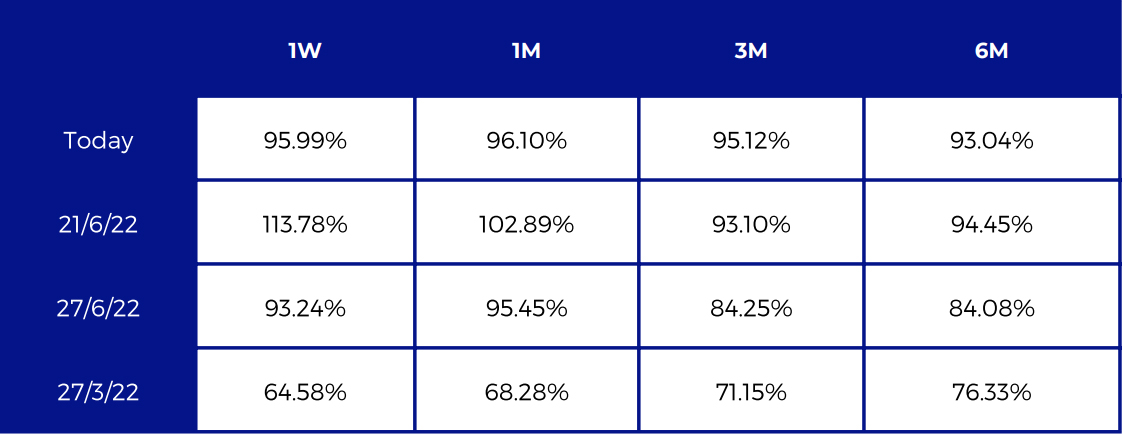

Annualised Futures Implied Yields Table

All timestamps 10:00 UTC, SVI Smile Calibration

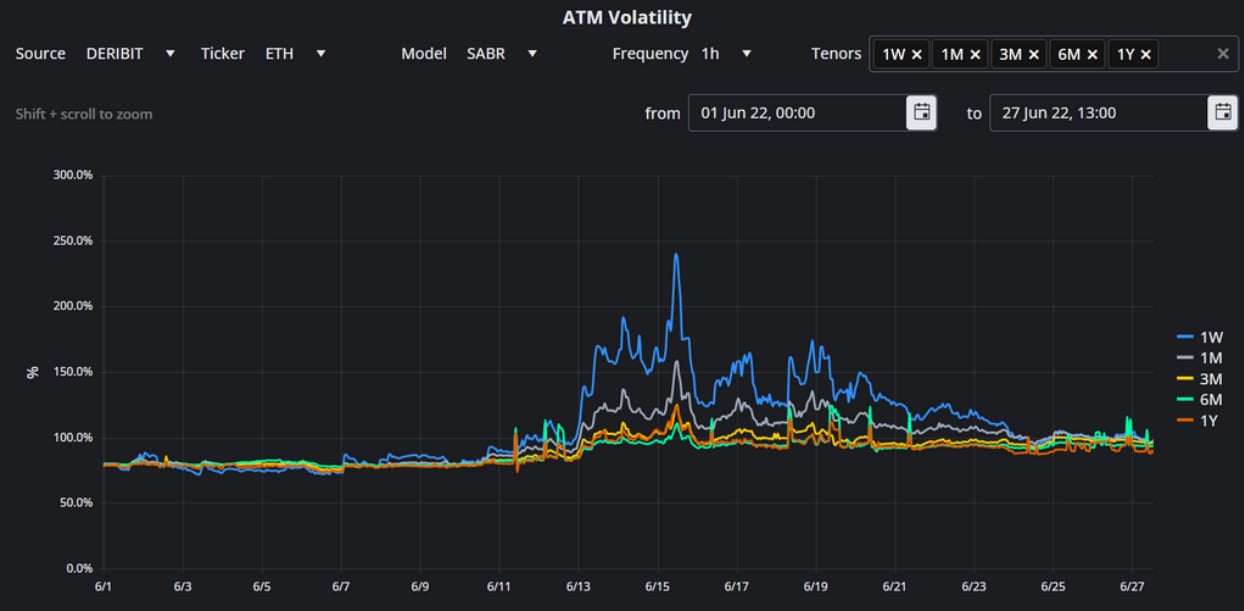

ATM implied vols trend sideways around 100%, with shorter tenors at the highest implied vol

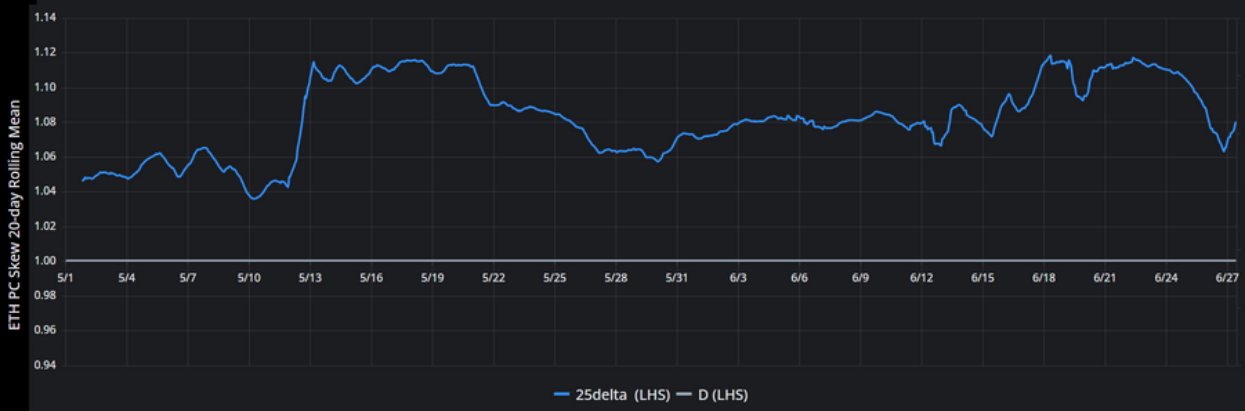

ETH’s put-call skew lessens in contrast to BTC’s, showing a weakening relative richness in downside protection

ETH ATM Implied Volatility Table

All timestamps 10:00 UTC, SABR Smile Calibration

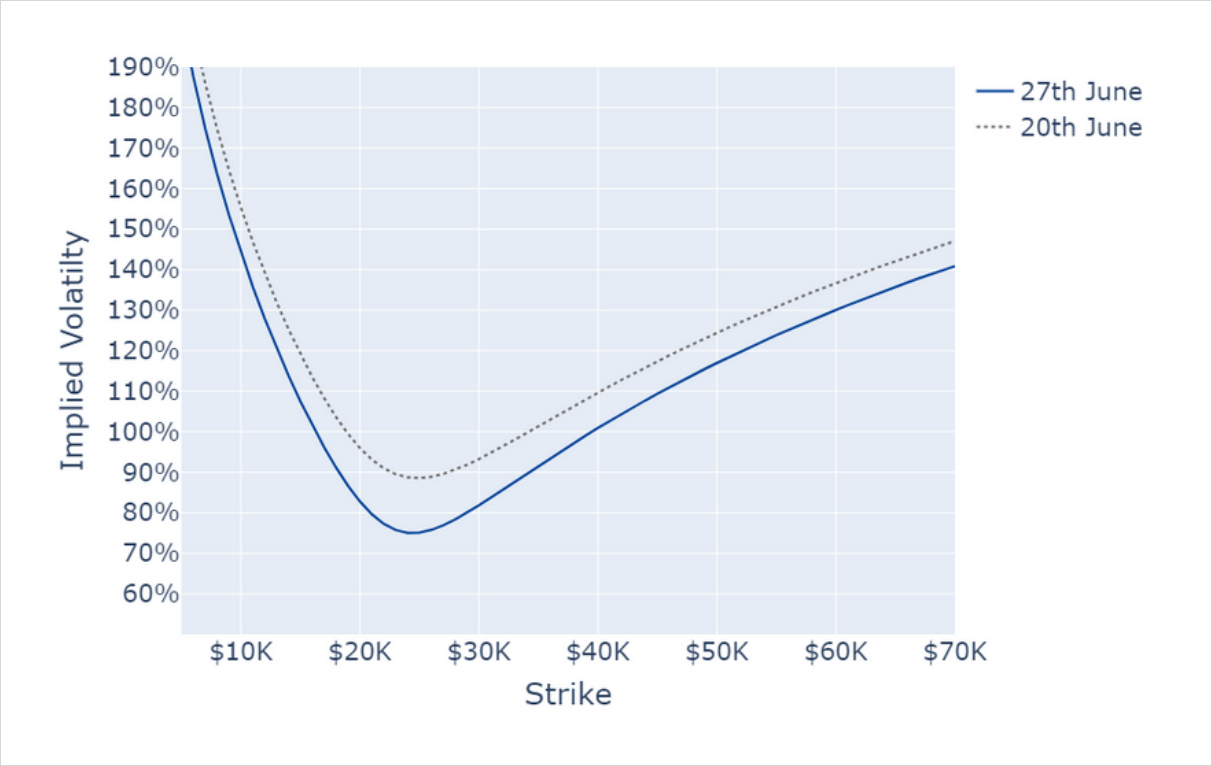

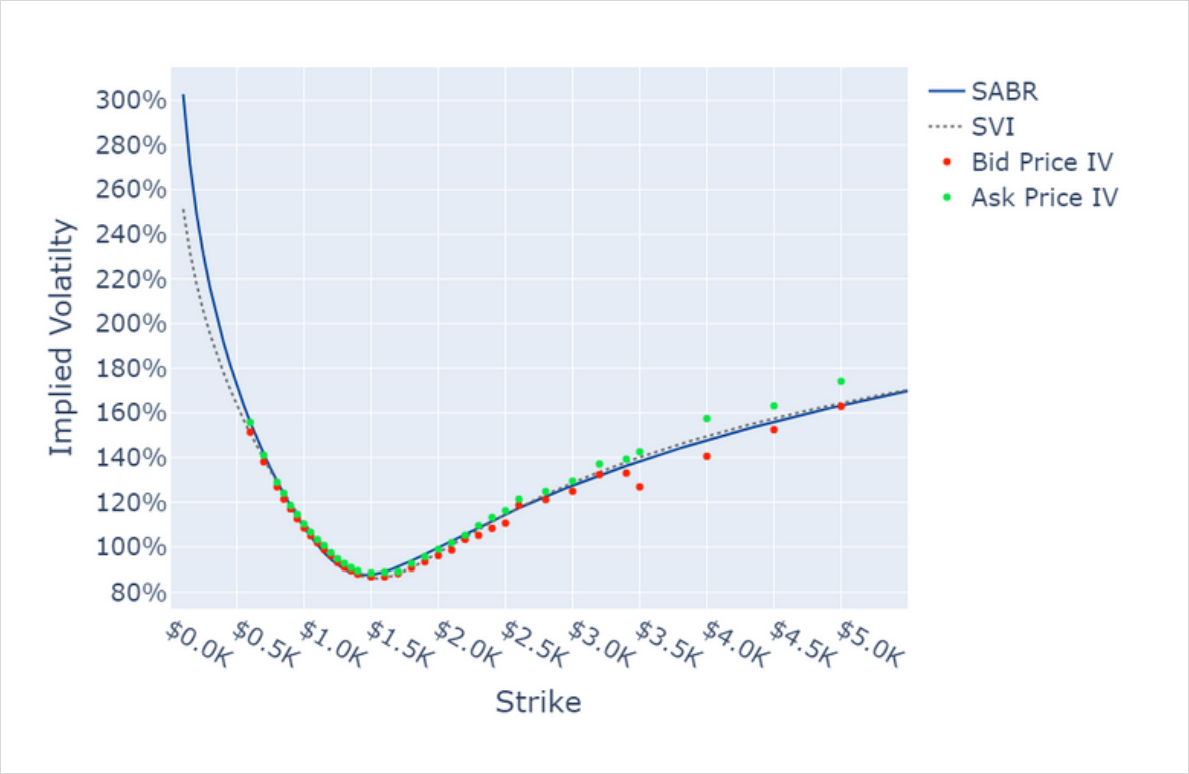

ETH 29th July Expiry smiles

SABR and SVI Smile Calibrations.

ETH’s implied volatility is higher than BTC’s across the vol smile, reflecting it’s sharper drops in price

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)