This BTC Rally Feels Different: Institutions In, Hype Out

Bitcoin is trading near $110,000 after setting new all-time highs, but this rally stands out from past cycles.

What’s driving it? Institutional demand. BlackRock’s IBIT has seen 30 straight days of inflows, helping BTC stay strong despite macro volatility. In just two sessions, U.S. Bitcoin ETFs pulled in over $1.5 billion – marking their biggest inflow streak since inception.

Political headlines seem to matter less now. When Trump proposed a 50% tariff on EU goods, traditional markets wobbled – but BTC barely moved, bouncing back quickly. Bitcoin is no longer just a speculative asset. It’s acting like a macro hedge in an environment filled with policy risk, inflation, and trade uncertainty.

The regulatory landscape is also evolving. The Genius Act is gaining momentum, hinting at clearer rules for stablecoins and crypto. Rumors of a strategic Bitcoin reserve under Trump – and TMTG’s plan to raise $3B for crypto – suggest Bitcoin is becoming part of U.S. financial and geopolitical strategy.

This isn’t hype. It’s leadership. Bitcoin isn’t just weathering the noise – it’s rising above it.

Volatility Convergence: BTC Steady Climb, ETH Pullback

Bitcoin’s realized volatility rose by 8 points to 45%, while Ethereum’s dropped to 72%;

- Front-end BTC implied volatility climbed about 4 points; ETH lagged, rising only 1–2 points.

- Carry is neutral for both BTC and ETH, with implied and realized vols in line.

- Implied daily ranges have mostly held, except on Friday when Trump’s EU tariff news hit the market.

- Crypto is breaking higher – slowly – but the move is backed by strong ETF inflows and rising institutional interest.

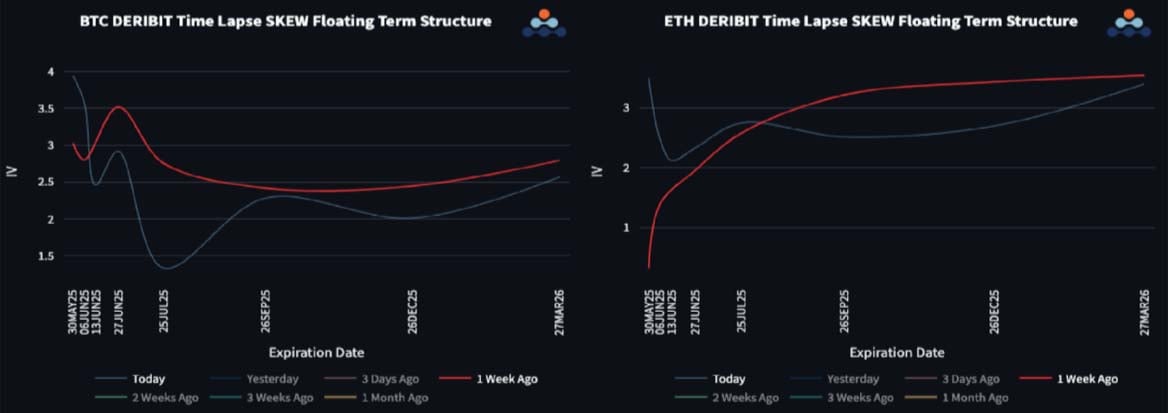

Skew Dynamics: Call Premiums Dominate Again

Front-end skew briefly favoured puts last week but has since reversed with spot prices and now shows call premium across the curve;

- BTC call skew ranges from 1.5 to 4 vols, with July showing the lowest point.

- ETH’s skew curve is flattening. Front-end calls are bid up with a 3-vol premium, while the back- end is softening slightly.

- There’s still room for skew to expand if the upside gains momentum. For now, call spread buying is keeping it contained.

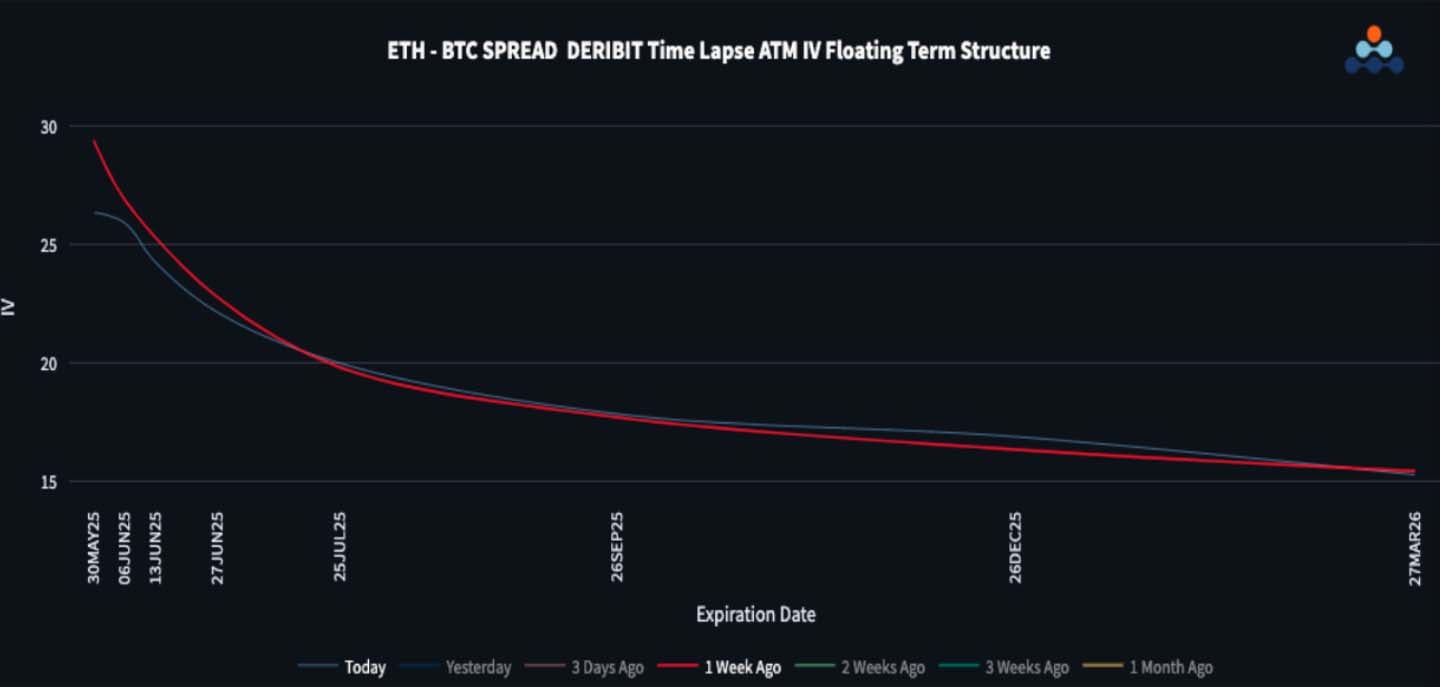

ETH/BTC Spread: Relative Value in Volatility

ETH/BTC held steady for most of the week before bouncing back above 0.024 today;

- Front-end vol spread narrowed slightly as BTC vols caught a bid.

- Back-end vol spread looks rich and may offer good relative value.

- ETH/BTC front-end skew spread is now close to neutral, with calls trading at a 1-vol premium for the July 25 expiry.

- Realized vol spread between ETH and BTC has been over 30 vols. If you expect both to move more in sync this summer, selling that vol spread could be a smart play.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)