Implied Ranges Respected

Crypto markets have stabilized after recent turbulence and are gearing up for a pivotal week.

There has been plenty of fundamental news to take in. Powell’s testimony before the Senate reinforced the Fed’s ‘wait-and-see’ approach to rate cuts. Meanwhile, a hotter US CPI print keeps the USD strong despite BTC is defying this with a bounce recovering the $98k handle. Also, developments towards a Russia/Ukraine ceasefire and Trump reciprocal tariffs are at play this week.

On a more crypto-centric note, new regulatory shifts—such as a revamped SEC approach and revised FDIC guidelines—promise a bright outlook this year. Plus, MicroStrategy is reinforcing its bullish stance with continuous major Bitcoin acquisitions.

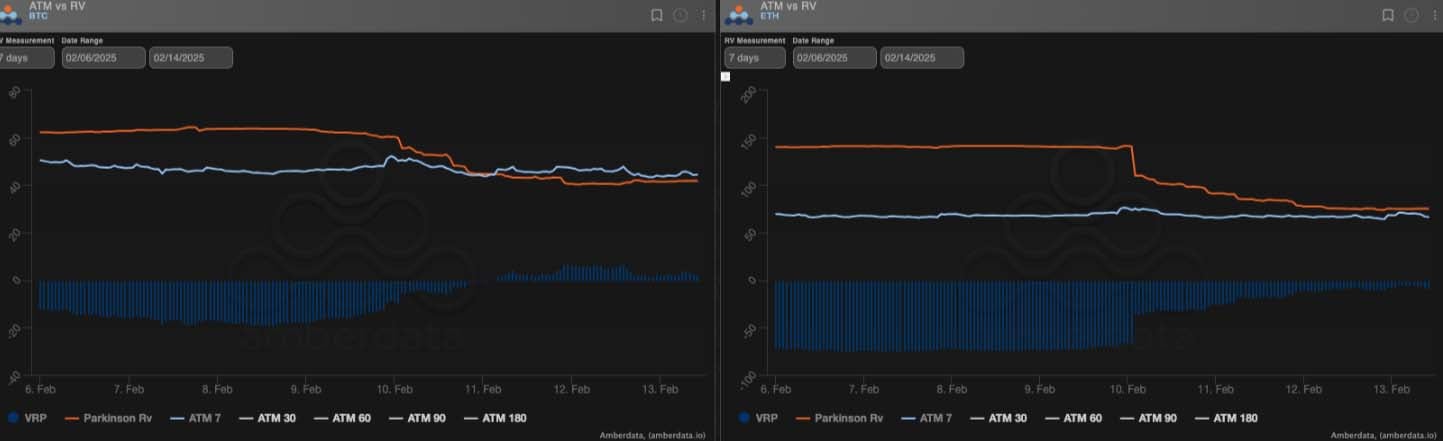

Volatility Is Cooling Off

Bitcoin’s realized volatility has eased into the 40s, while Ethereum remains elevated near 80. A significant drop in front-end implied volatility has reintroduced a steep contango for Bitcoin, with its carry turning slightly positive—though Ethereum still has negative carry and flat term structure. Markets are stabilizing as they consolidate near the lower end of the range.

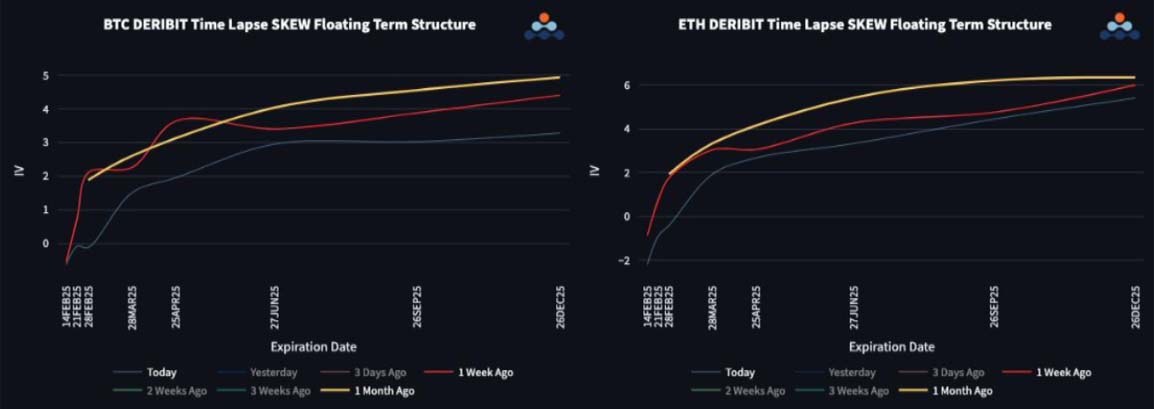

Skew Term Structure Stays In Contango

Options skew remains in contango but is trending lower overall. Bitcoin shows a flat front-end skew, while Ethereum carries a modest 2-vol put premium. Post-March, both assets flip to a call premium, with Ethereum leading at 5–6 vols. This steeper skew in Ethereum hints at a higher beta and the potential for a significant rally later in the year.

ETH/BTC Stabilizes

The ETH/BTC spot rate has stabilized after dipping below 0.03, halting its free fall despite a continuing downtrend. Ethereum’s front-end volatility remains roughly 20 points above Bitcoin’s, in line with a 40-point realized spread, while the back-end spread holds steady around 10 vols—a likely floor for now. Meanwhile, the skew curve is steepening, with ETH puts and long-end calls trading at a premium. Stay tuned for more on these trends.

To get full access to Options Insight Research including our proprietary crypto volatility dashboards, options flows, gamma positioning analysis, crypto stocks screener and much more, Visit Options Insights here.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)