Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

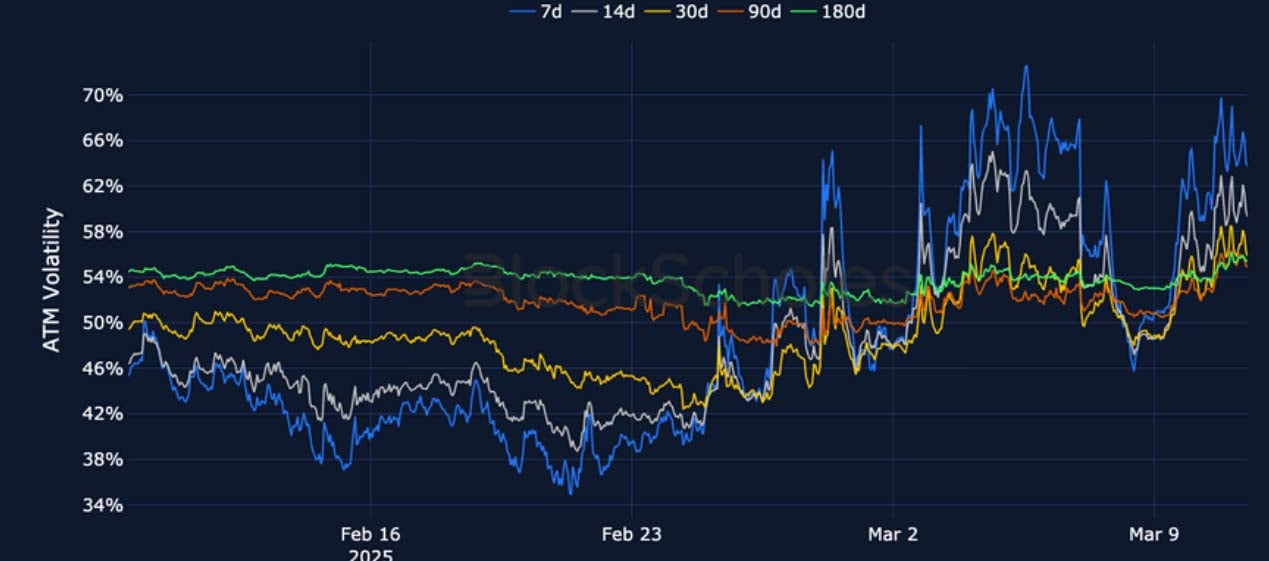

A deepening correction in spot prices has seen BTC trade more than 25% below the all-time high that it recorded in late January. ETH has suffered more, trading 53% below its December high of $4K. The derivatives markets of both assets paint a strong, bearish picture: short-tenor futures prices traded below spot prices, perpetual swap funding rates turned sharply and persistently negative, and options markets priced out much of their skew towards calls at longer tenors. The inversion of the term structure of volatility offered a brief reprieve at the end of last week, but returned in full force as US markets opened on Monday, as short-tenor volatility rallied once again and smiles skewed strongly towards puts.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

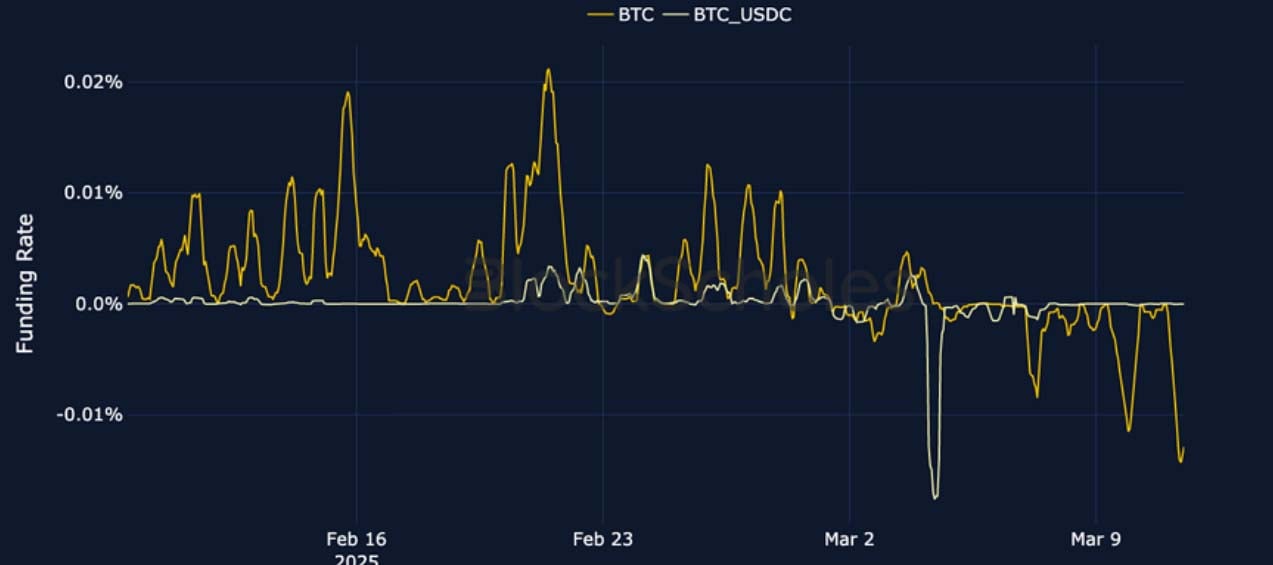

Perpetual Swap Funding Rate

BTC FUNDING RATE – Recorded persistently negative funding rates alongside a dip negative in futures implied yields.

ETH FUNDING RATE – Funding rates trade at their most bearishly negative since the election, reflecting ETH spot’s underperformance to BTC.

Futures Implied Yields

BTC Futures Implied Yields – BTC’s short-tenor futures prices now trade below that of spot for the first time since the US election in November.

ETH Futures Implied Yields – Short-tenor futures now trade below spot prices in an extreme expression of bearishness.

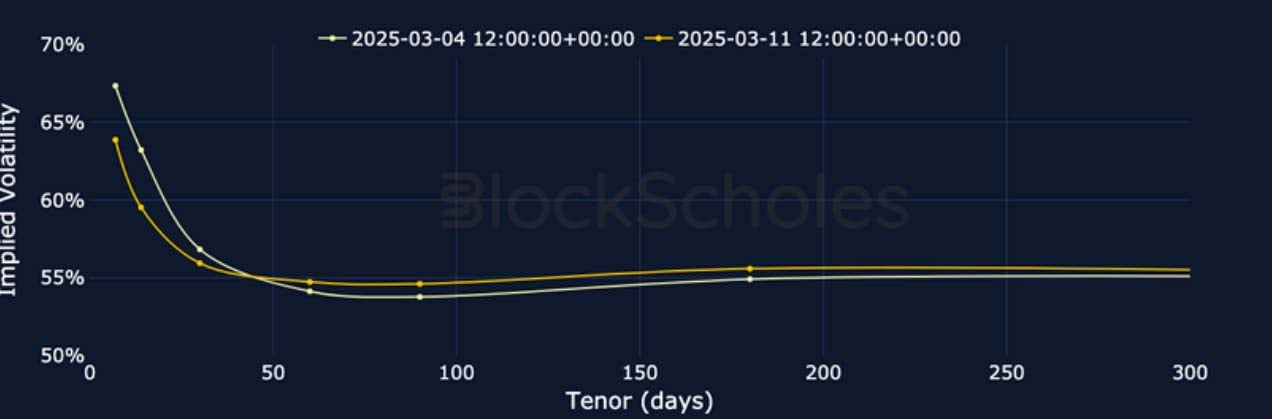

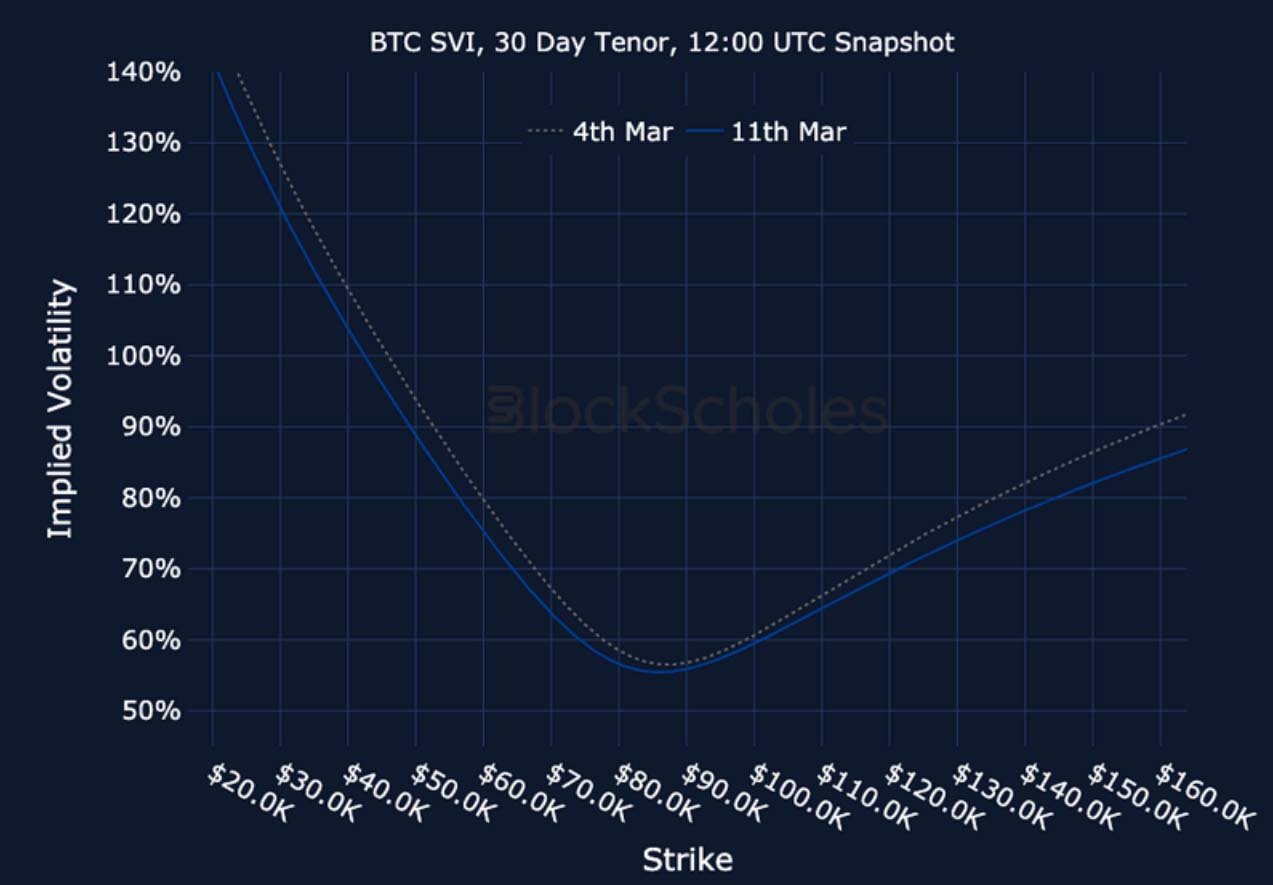

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – The term structure of volatility has

BTC 25-Delta Risk Reversal – While not as bearish as ETH’s, BTC’s volatility smiles have also skewed towards puts at all tenors shorter than 3 months.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – A short-lived flattening in the term structure has turned into an even stronger inversion as the selloff deepened.

ETH 25-Delta Risk Reversal – The skew towards OTM puts has deepened significantly as short-tenor smiles assign a 21 point premium to the downside.

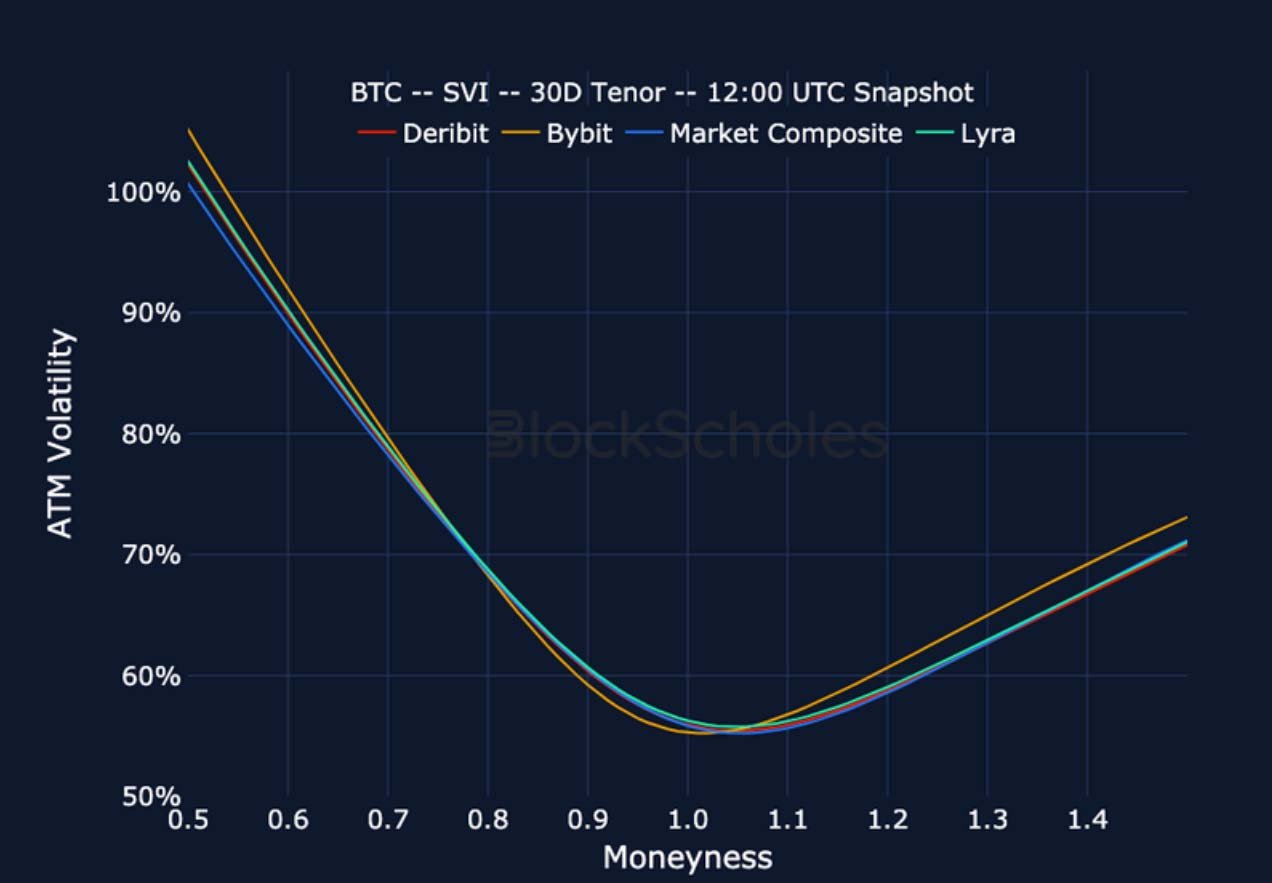

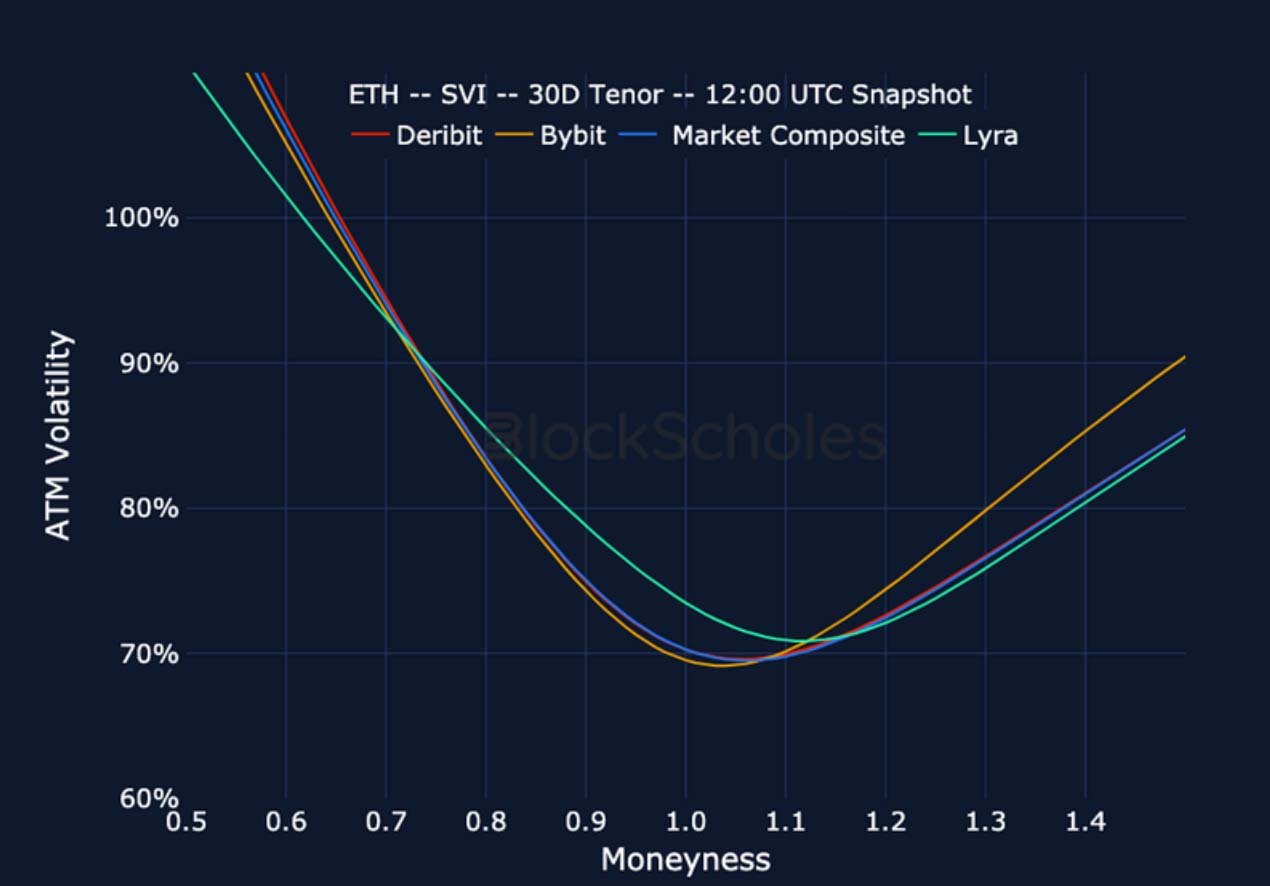

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

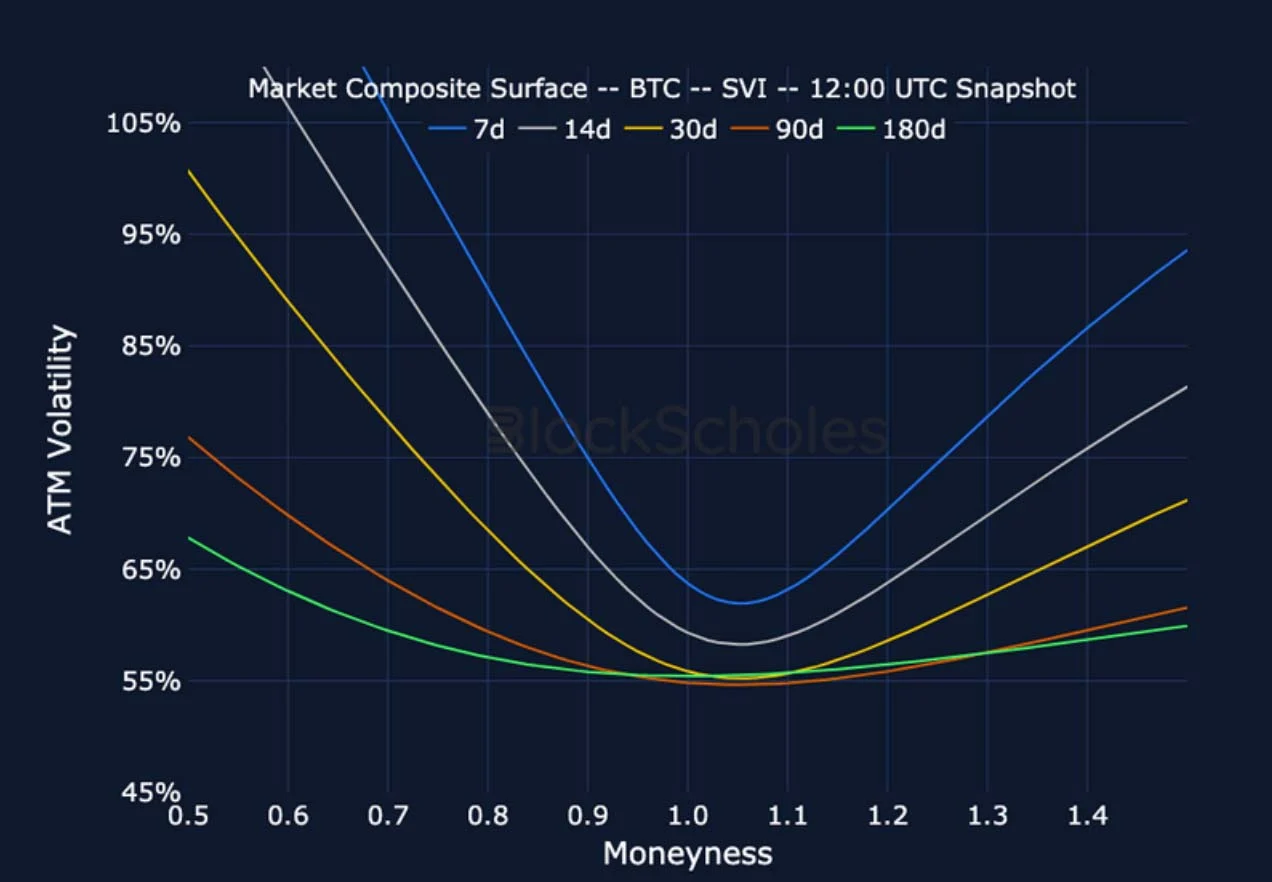

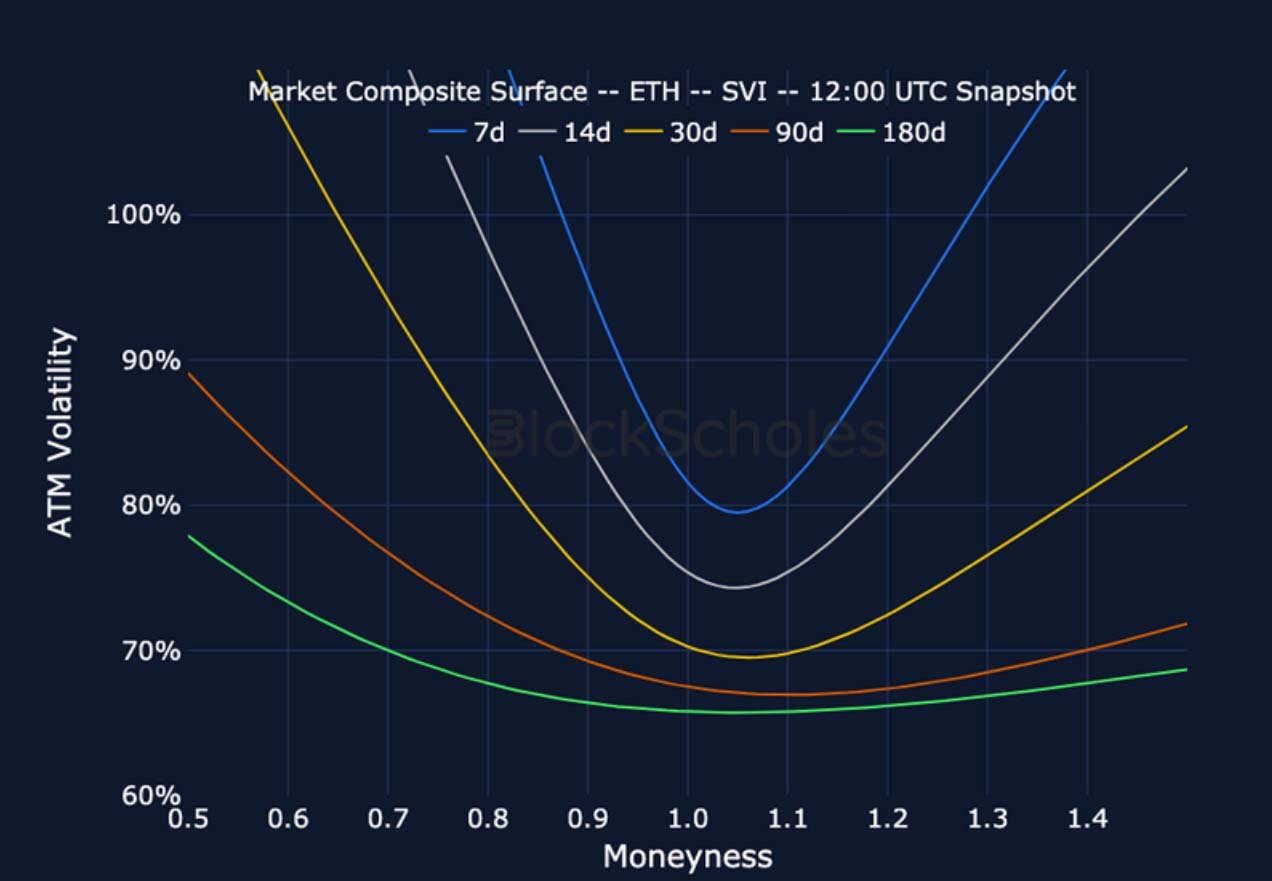

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

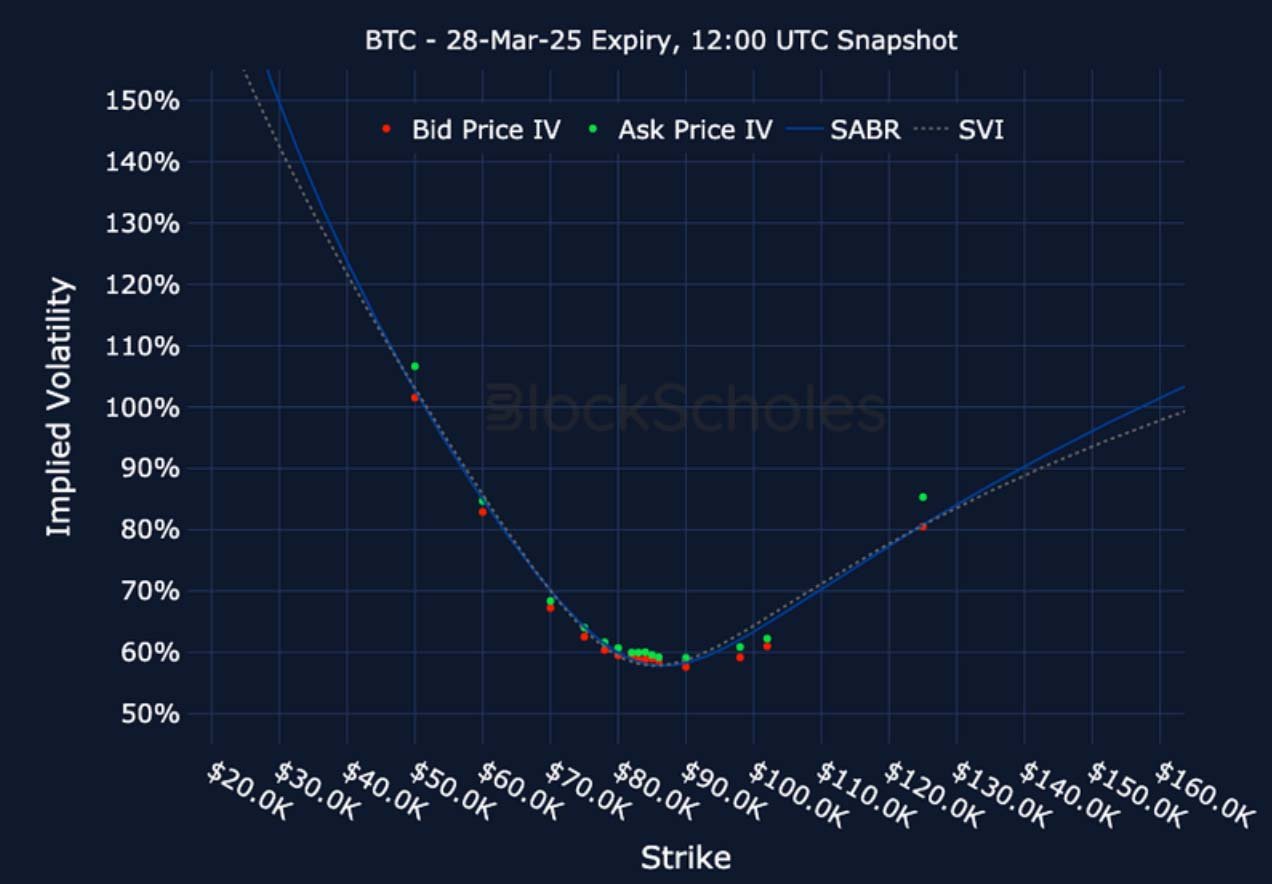

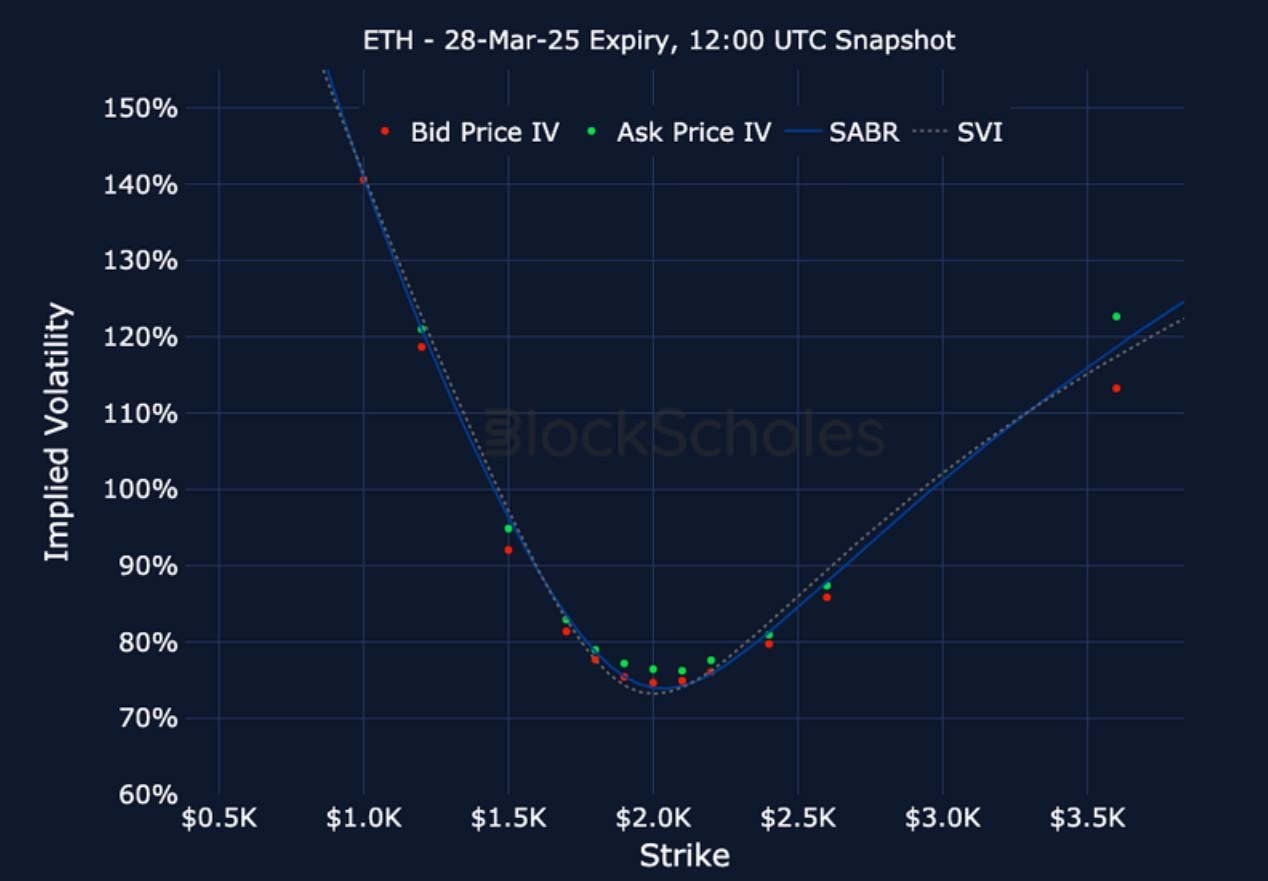

Listed Expiry Volatility Smiles

BTC 28-MAR EXPIRY – 9:00 UTC Snapshot.

ETH 28-MAR EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)