Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

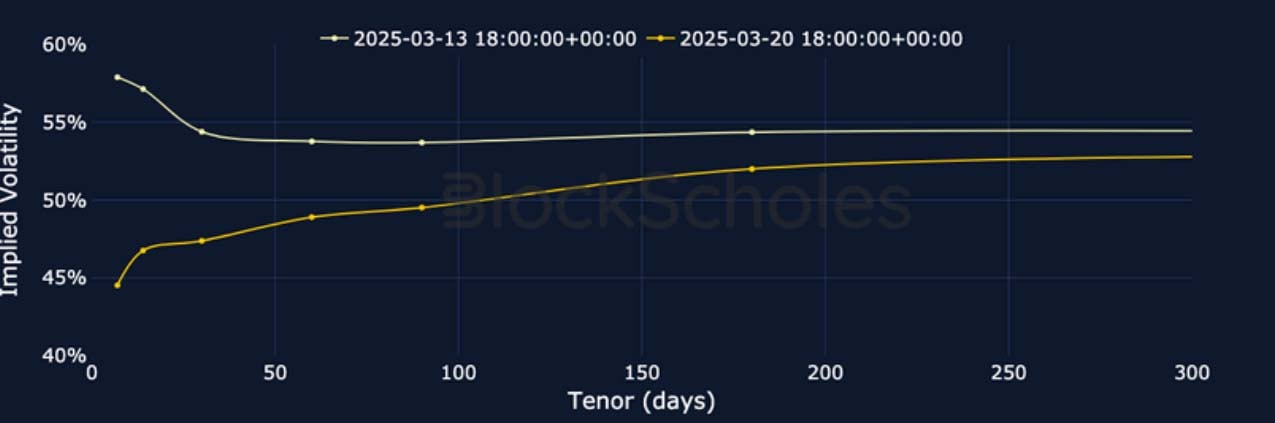

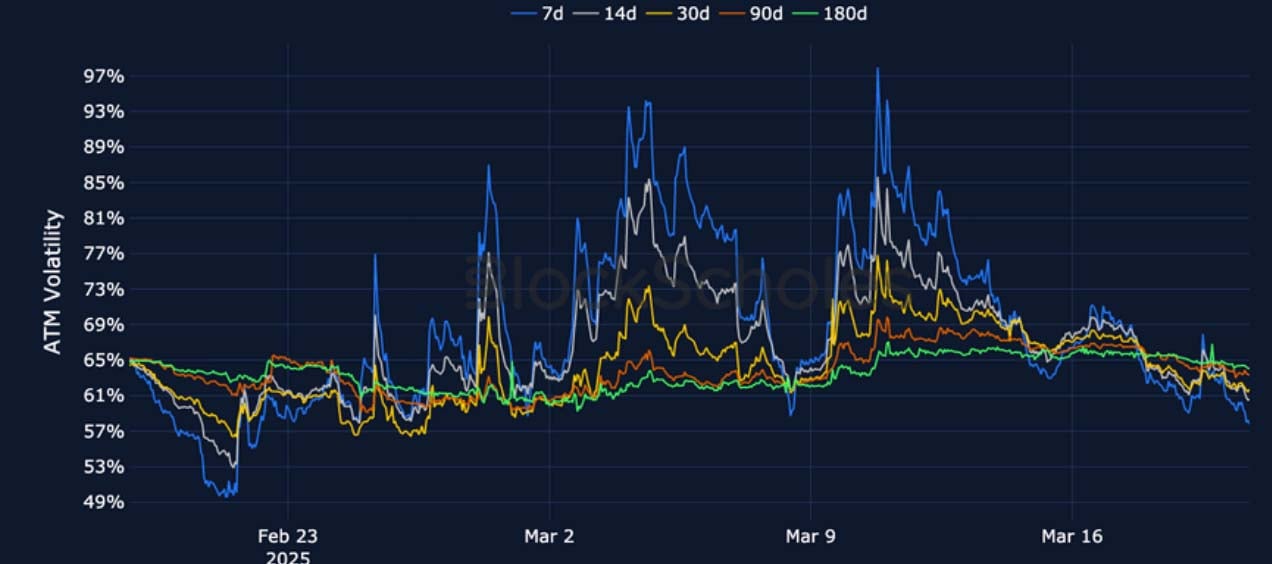

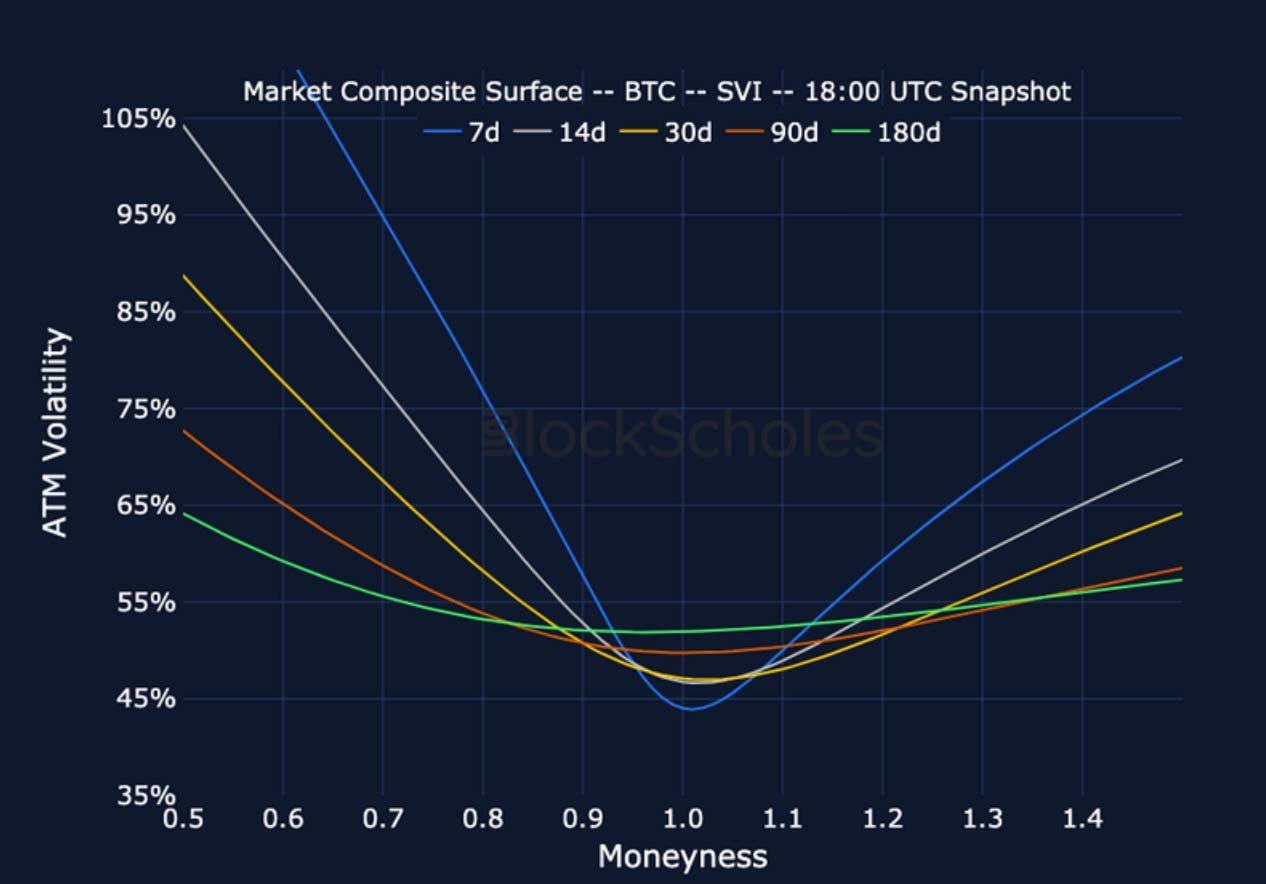

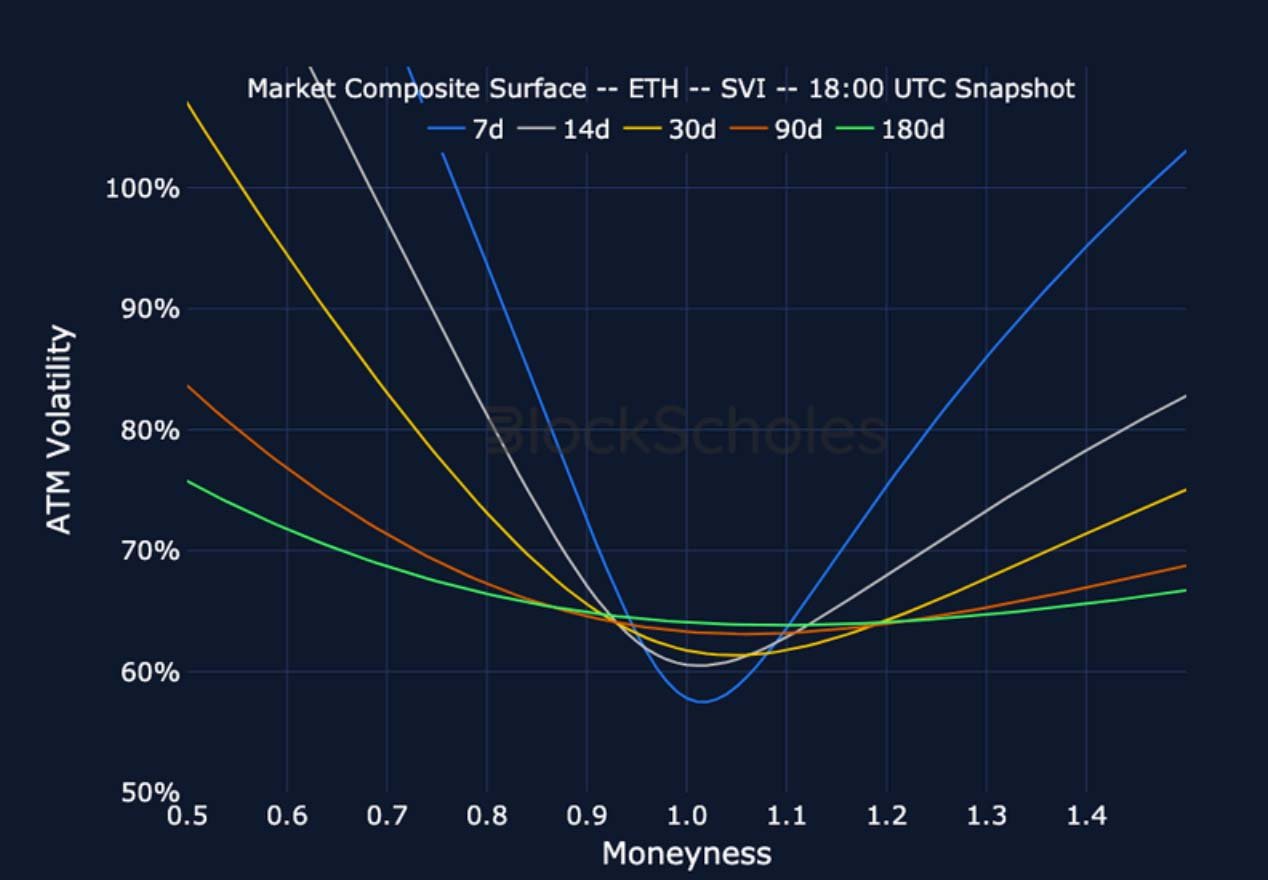

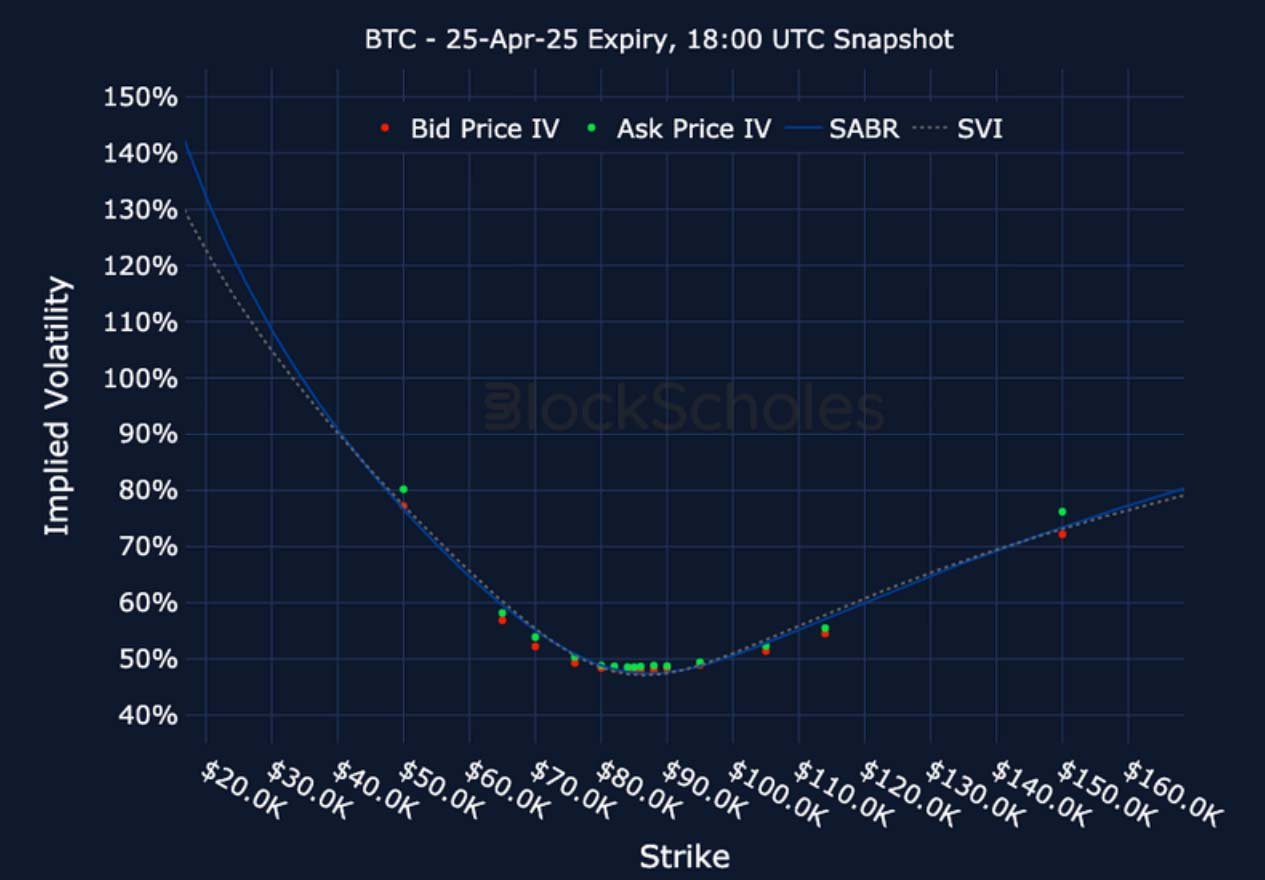

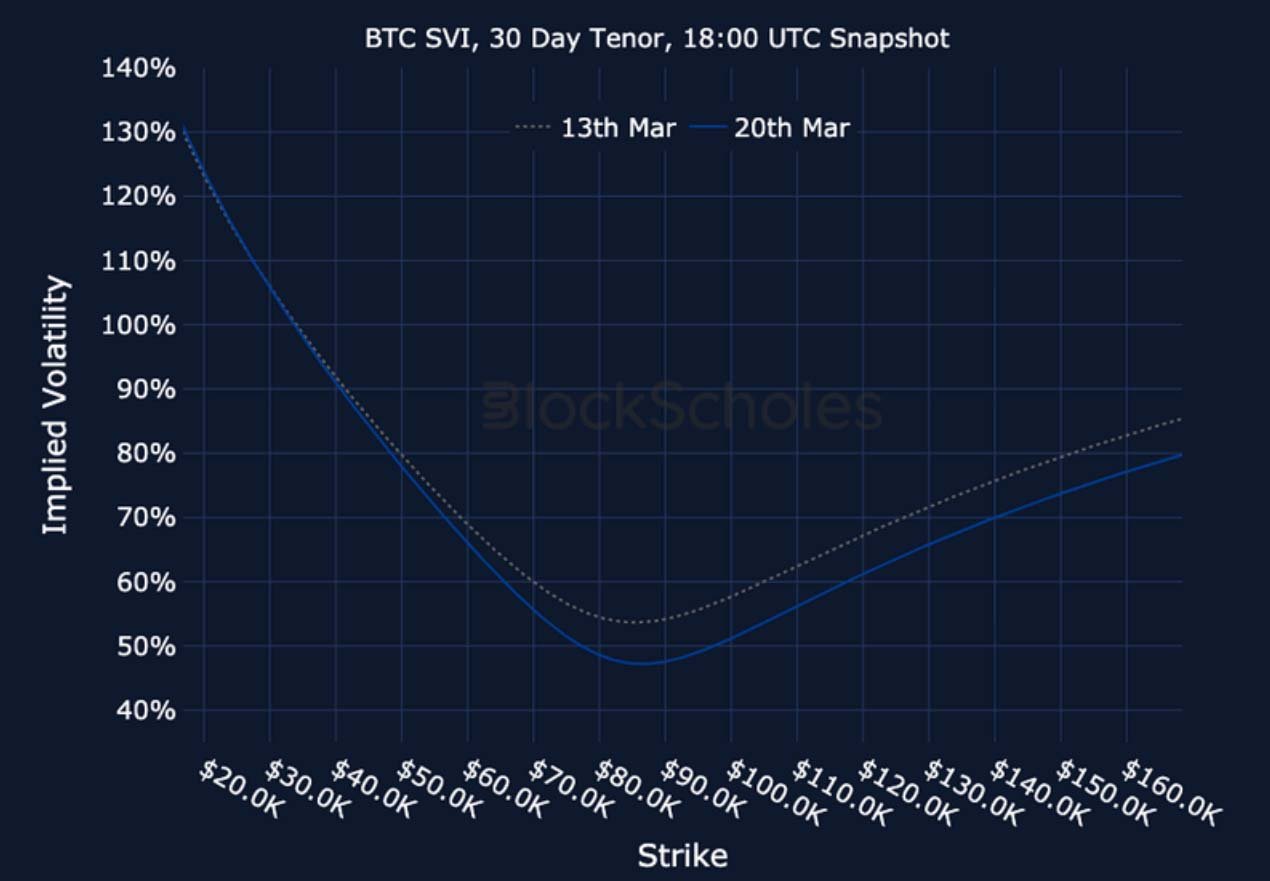

While not delivering a complete recovery rally back to January’s all-time high, this week has at least seen a pause in the intense and persistent collapse in risk appetite. Futures yields continue to fall and funding rates trade negative. However, the skew towards OTM puts priced- in by volatility smiles across the term structure was briefly erased as the lower level of delivered volatility has caused a dis-inversion in the term structure of at-the-money implied volatility. Front-end volatility levels for BTC and ETH trade below 45% and 60% respectively — the bottom of their respective ranges in March.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

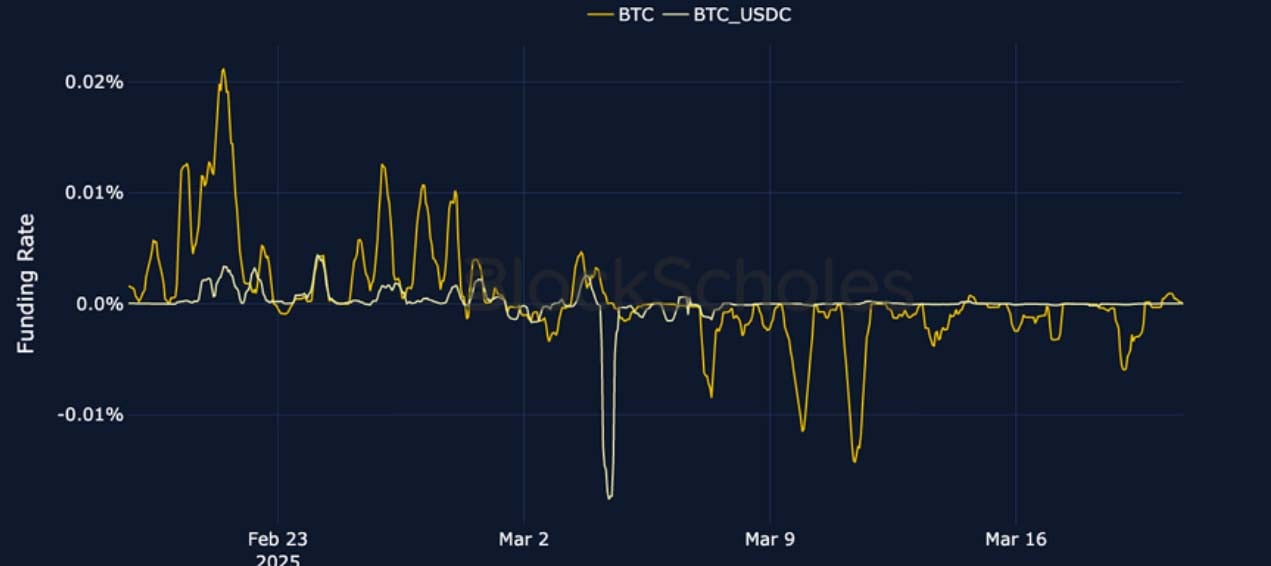

Perpetual Swap Funding Rate

BTC FUNDING RATE – Are reacting asymmetrically to moves in spot: selloffs see a negative rate, but recoveries do not result in a positive rate.

ETH FUNDING RATE – The past week has delivered a far less bearishly negative funding rate than did the selloff in spot prices in the week before.

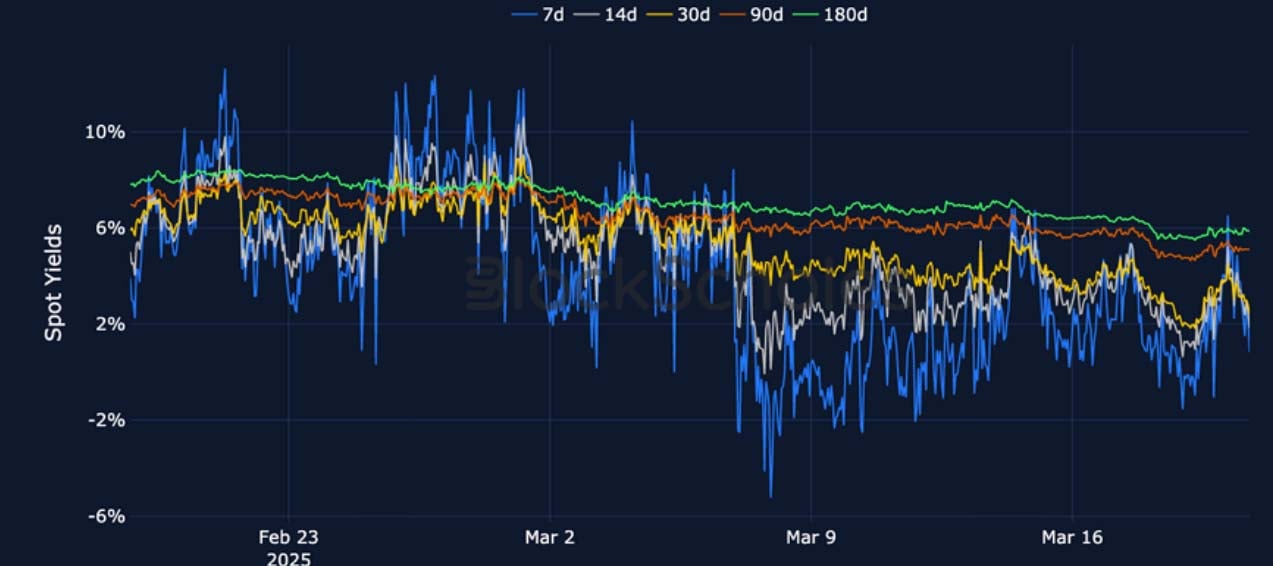

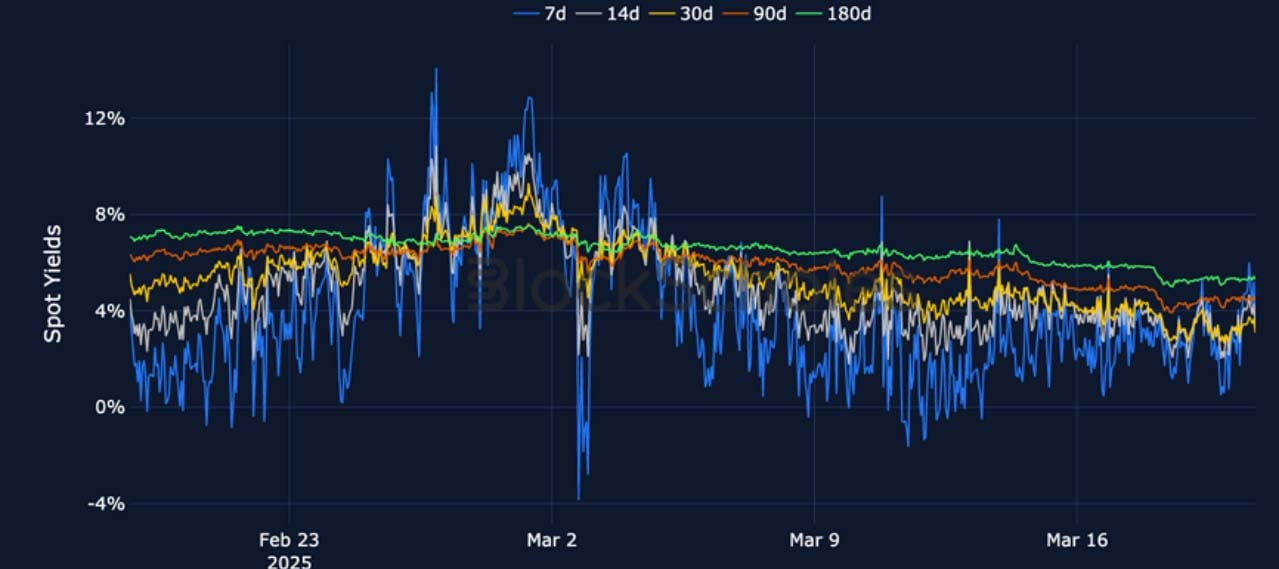

Futures Implied Yields

BTC Futures Implied Yields – The term structure of futures yields is steepening once again after March’s volatility erased much of the premium.

ETH Futures Implied Yields – Futures with later expirations trade at a similar premium over spot as BTC’s, while the front-end of the curve is 2.5% higher.

BTC Options

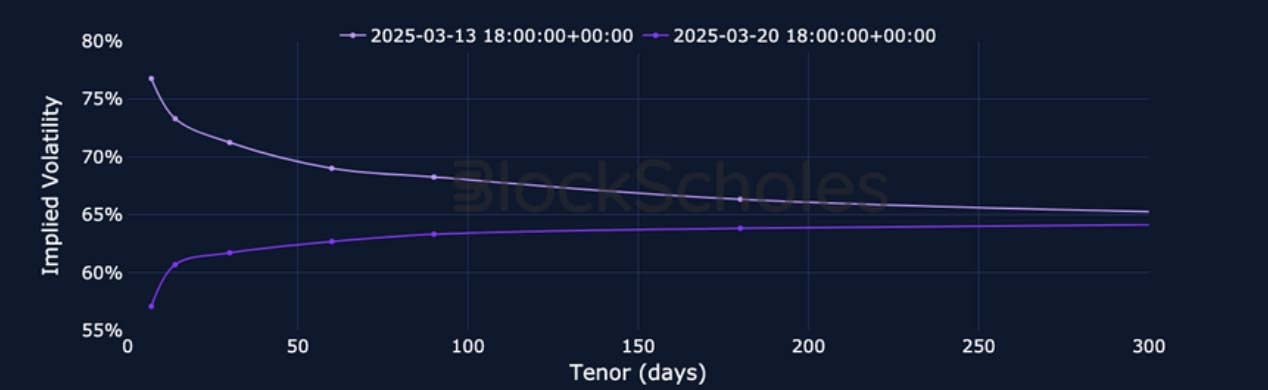

BTC SVI ATM IMPLIED VOLATILITY – Short dated volatility levels fall to 45%, their lowest levels since the period of repeated inversion began in March.

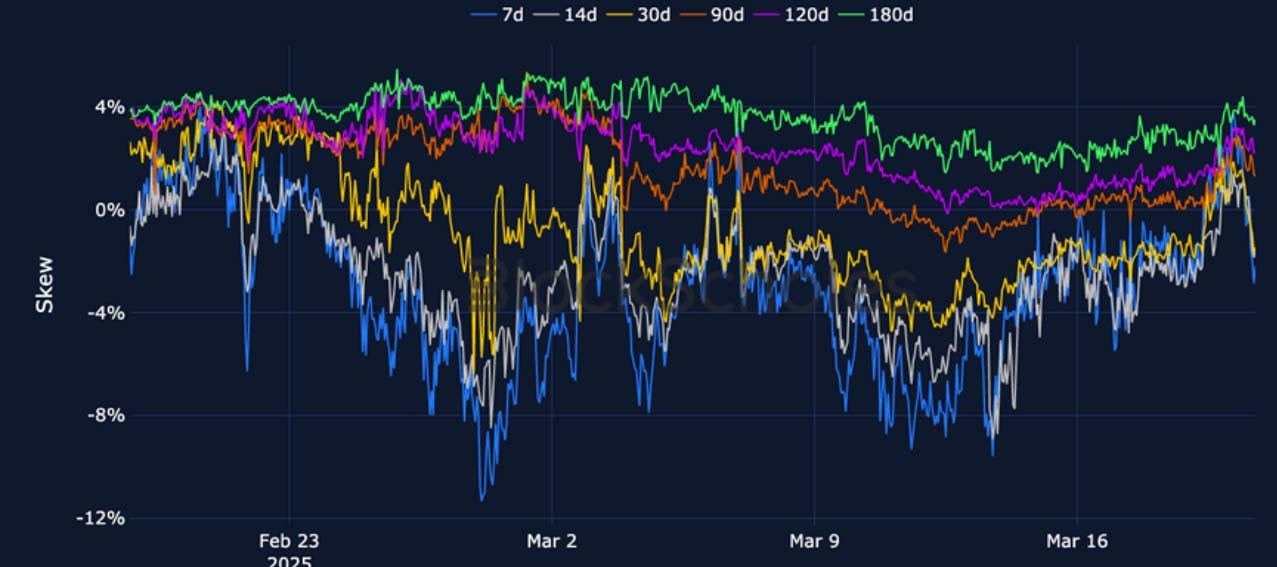

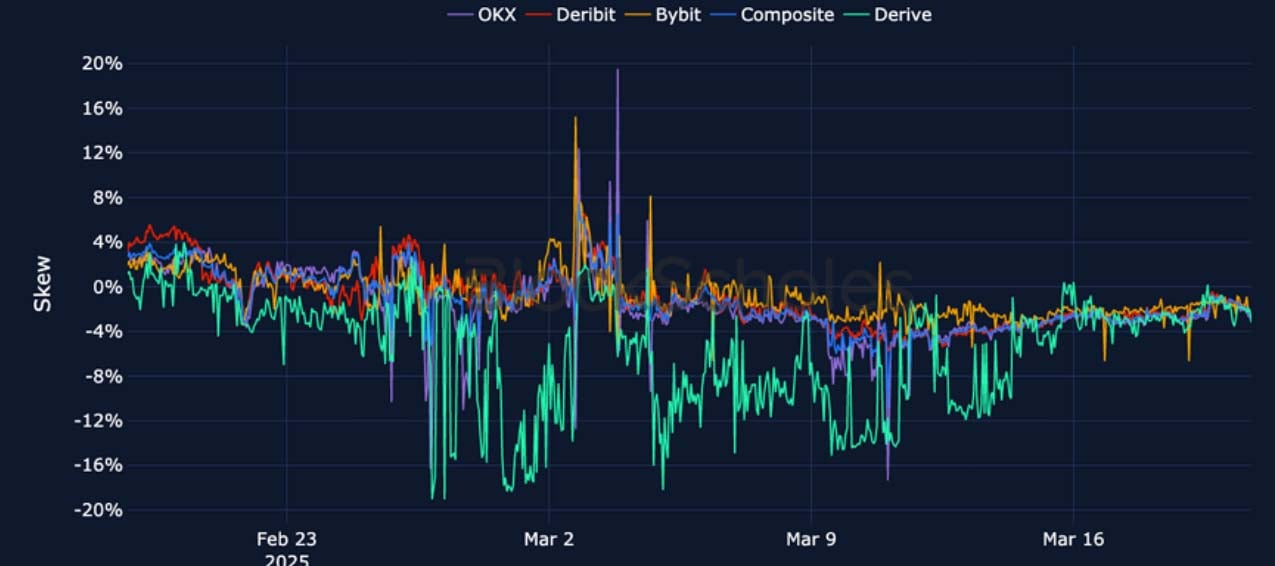

BTC 25-Delta Risk Reversal – BTC’s skew briefly traded positive, in favour of OTM calls, before reversing direction after spot slips back below $85K.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – The dis-inversion of the term structure continues as 7d tenor volatility falls below 60%.

ETH 25-Delta Risk Reversal – Skew recovers from its steeper skew towards OTM puts, but remains tilted towards downside protection.

Volatility by Exchange

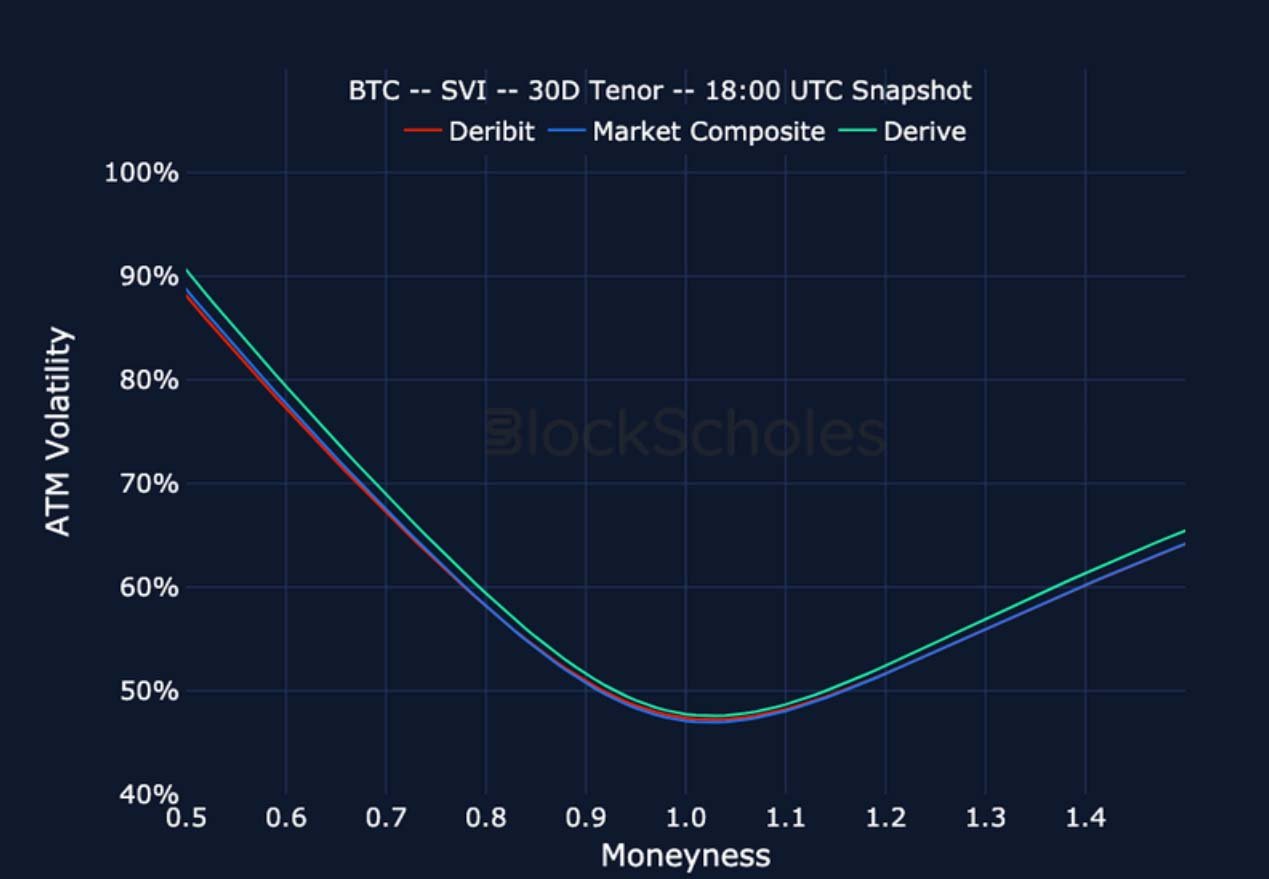

BTC, 1-MONTH TENOR, SVI CALIBRATION

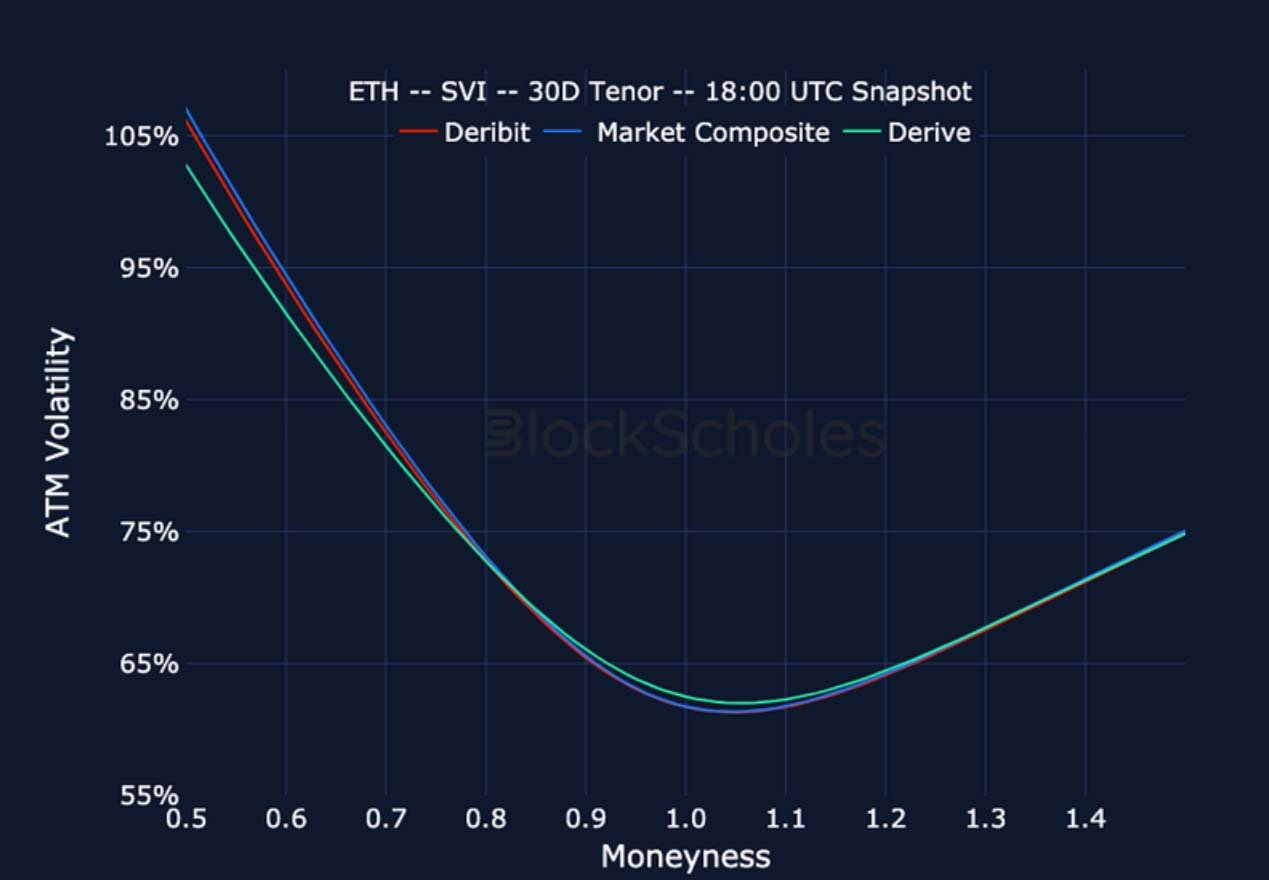

ETH, 1-MONTH TENOR, SVI CALIBRATION

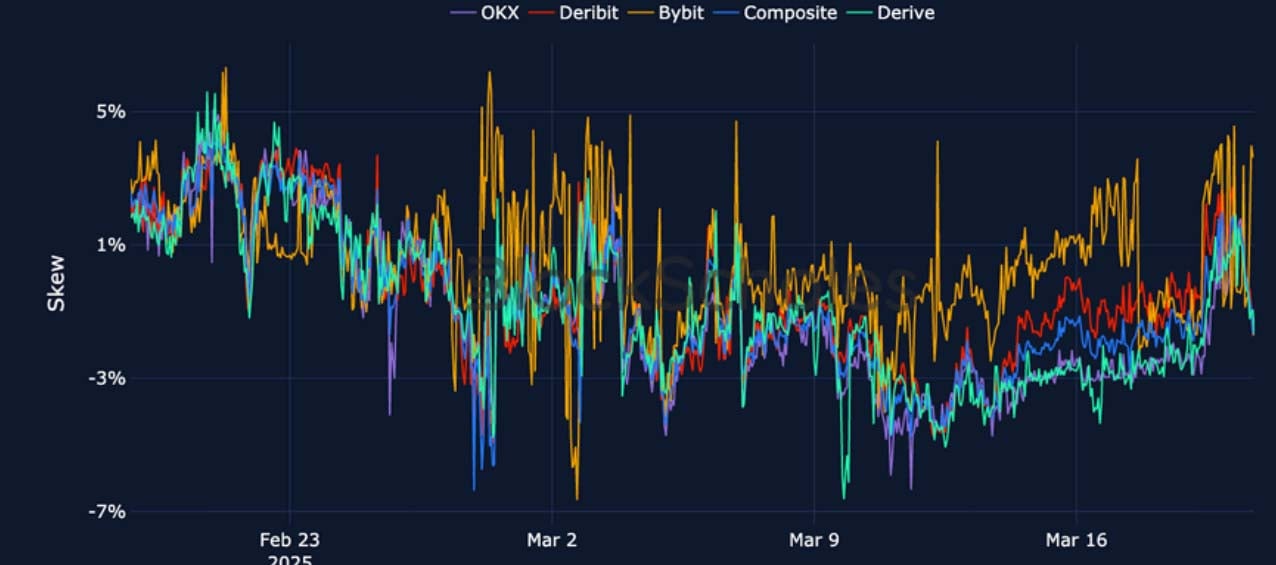

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

Listed Expiry Volatility Smiles

BTC 25-APR EXPIRY – 9:00 UTC Snapshot.

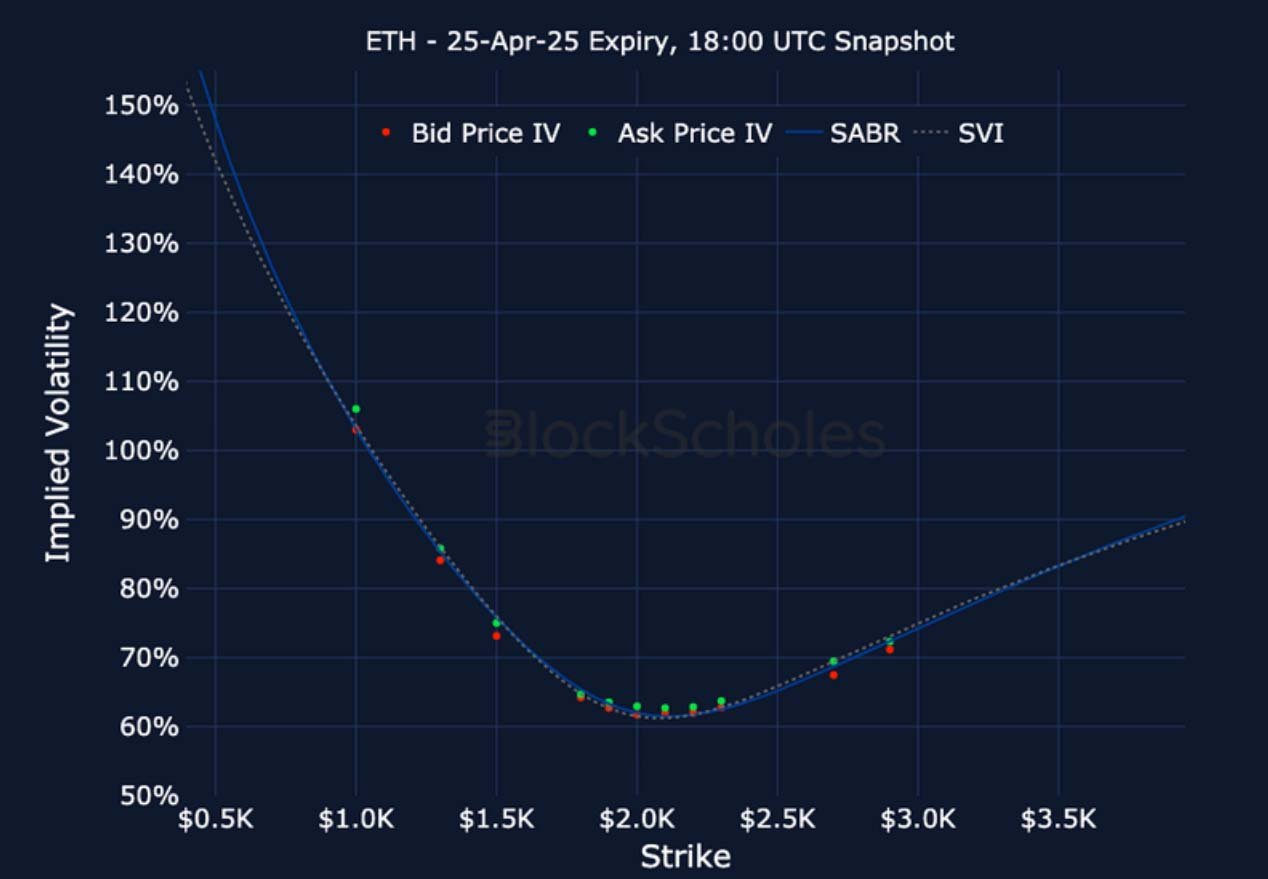

ETH 25-APR EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)