Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

ETH lead another attempt by spot prices to cross above the year-long highs recorded in March. With it, we saw a return to high levels of leverage in derivatives markets: high yields implied by futures prices, high perpetual swap funding rates, and a rally in short dated at-the-money implied volatility that briefly inverted the term structure. However, the rally was shorter lived and smaller in size than that which took BTC prices to all-time highs. Furthermore, while volatility continues to trade flat across the term structure at its higher, 70-80% range, futures markets report a collapse in funding back to their longer-held trend.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

*All data in tables recorded at a 10:00 UTC snapshot unless otherwise stated.

Futures

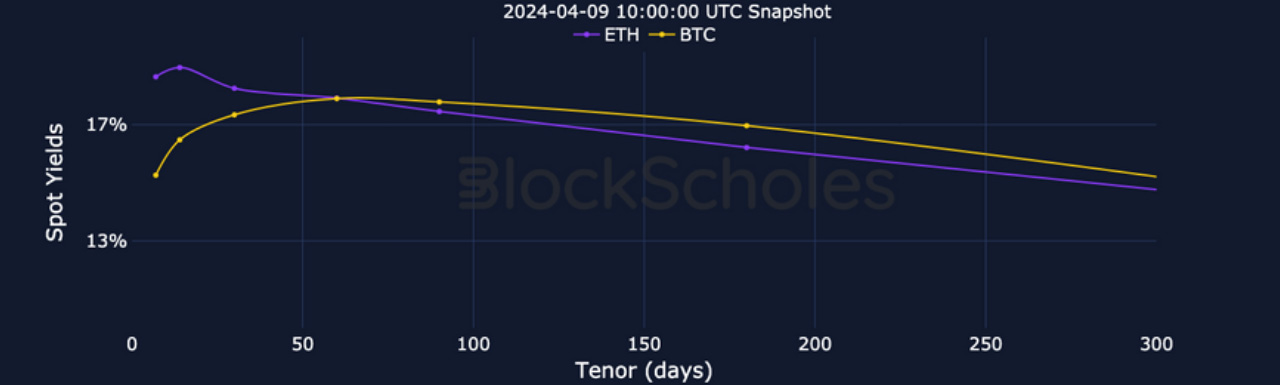

BTC ANNUALISED YIELDS – yields spiked and returned to their trend near 15%, recording a lower top than in previous rallies to all-time highs.

ETH ANNUALISED YIELDS – followed a similar trajectory to BTC’s during the rally, despite ETH out-performing in spot.

Perpetual Swap Funding Rate

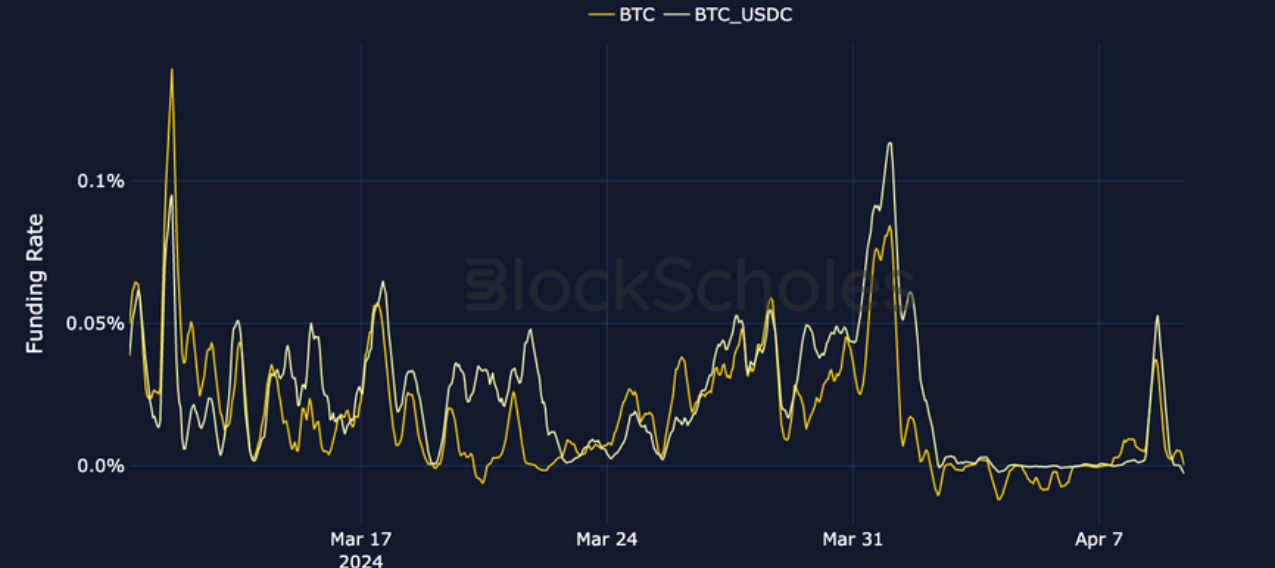

BTC FUNDING RATE – like futures yields, did not record as strong a spike as in previous rallies, funding is now trading near zero after the round trip in spot.

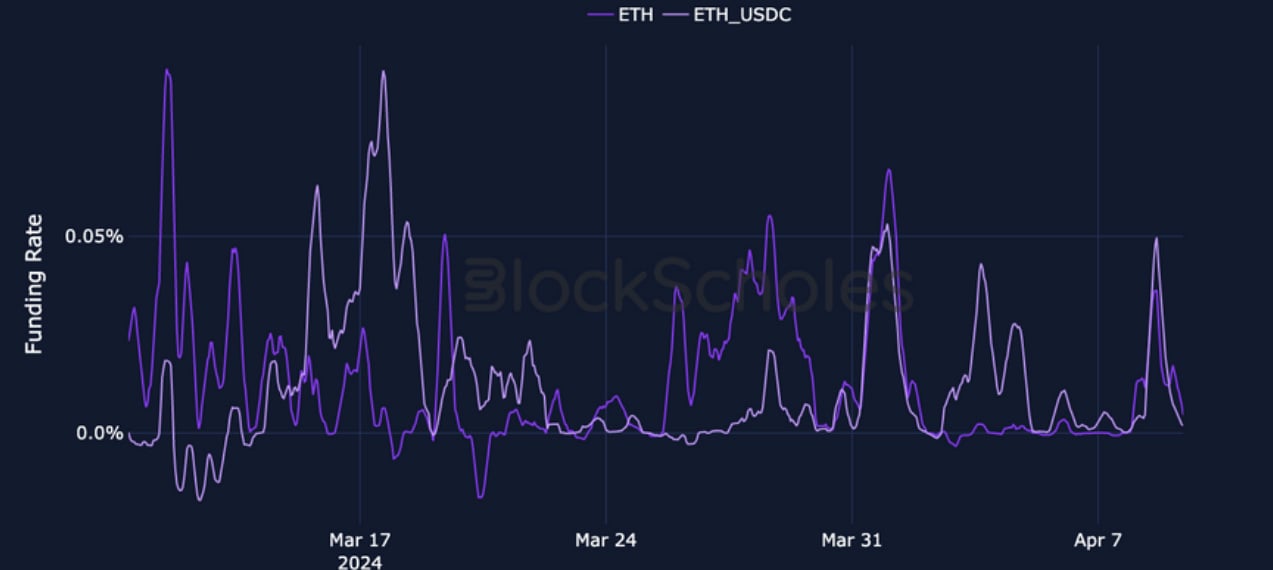

ETH FUNDING RATE – has followed BTC’s rate down to zero as spot has halted its rally, but held on to its higher level tighter than BTC spot has.

BTC Options

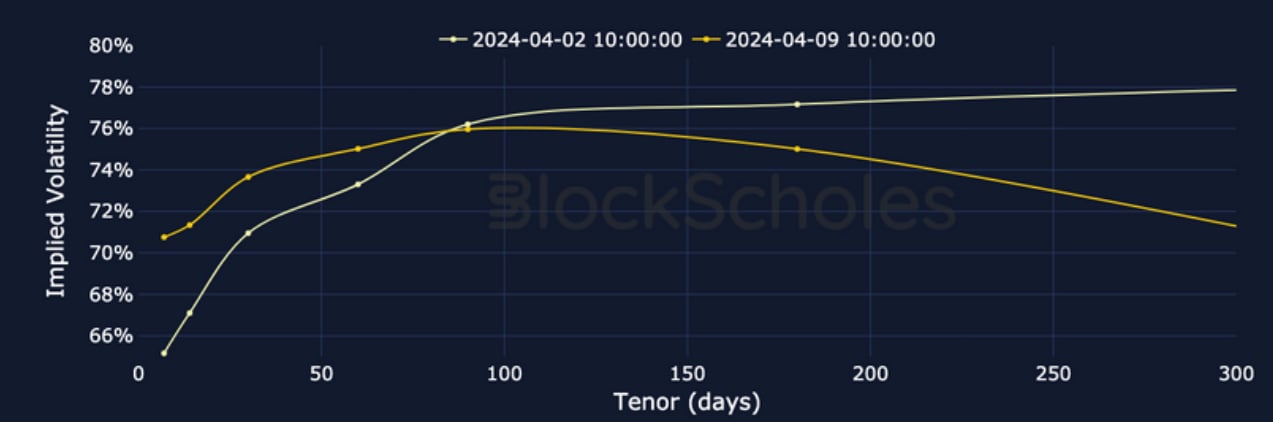

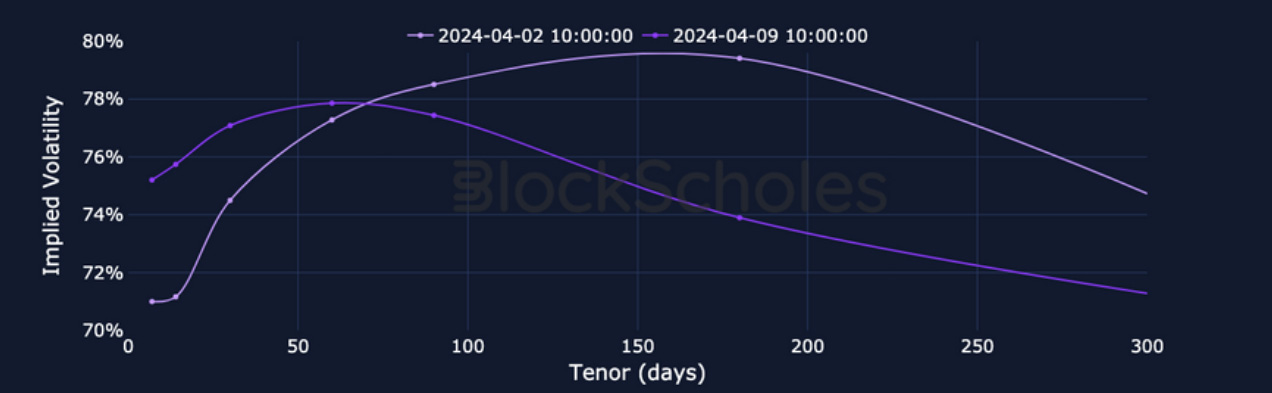

BTC SABR ATM IMPLIED VOLATILITY – the term structure has flattened significantly as volatility has risen in short-dated tenors over the last 24H.

BTC 25-Delta Risk Reversal – the rise in short-dated volatility corresponds with a recovery from the strong skew towards puts as upside is in demand.

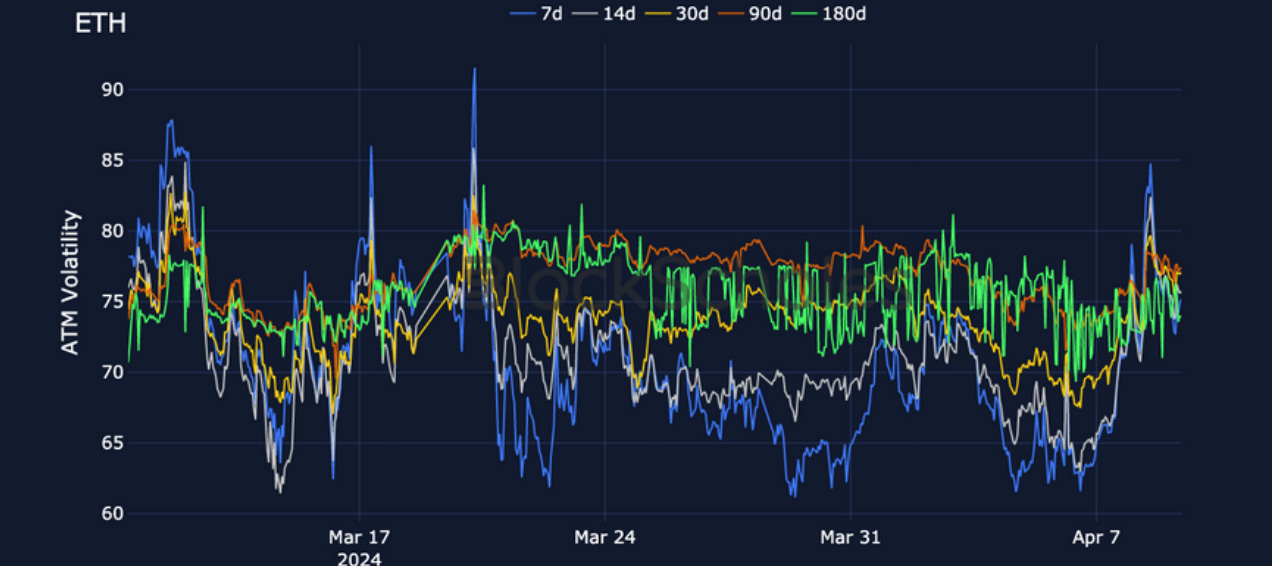

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – saw a similarly strong rally at short dated tenors that saw the term structure invert temporarily at its peak.

ETH 25-Delta Risk Reversal – posted a recovery from an even stronger skew towards calls earlier in the month during the spot rally.

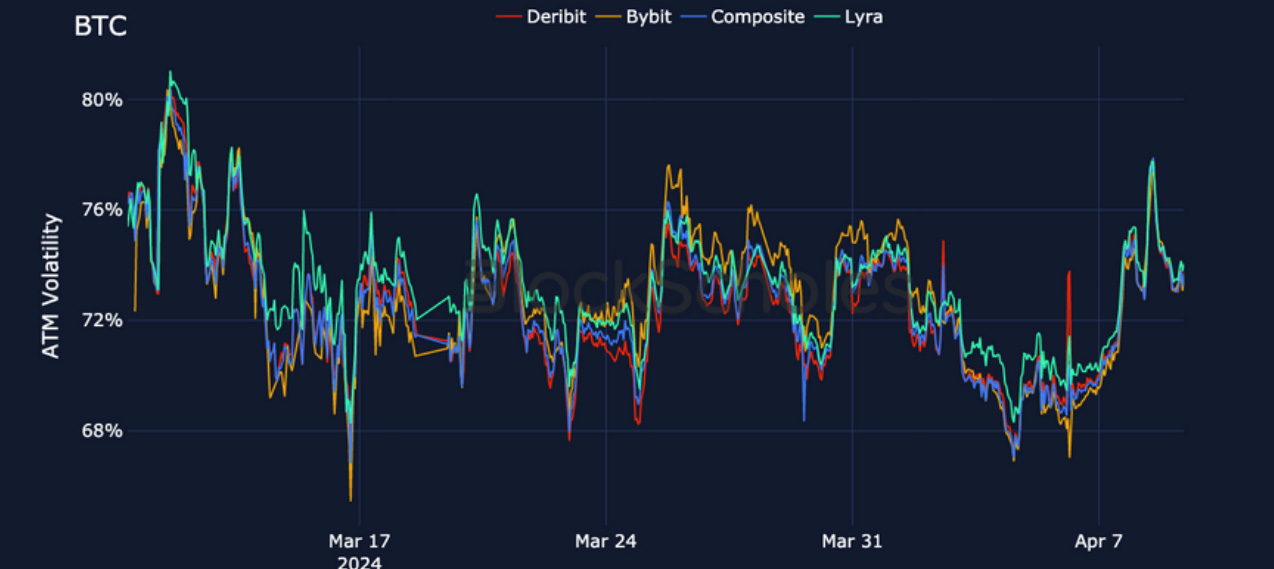

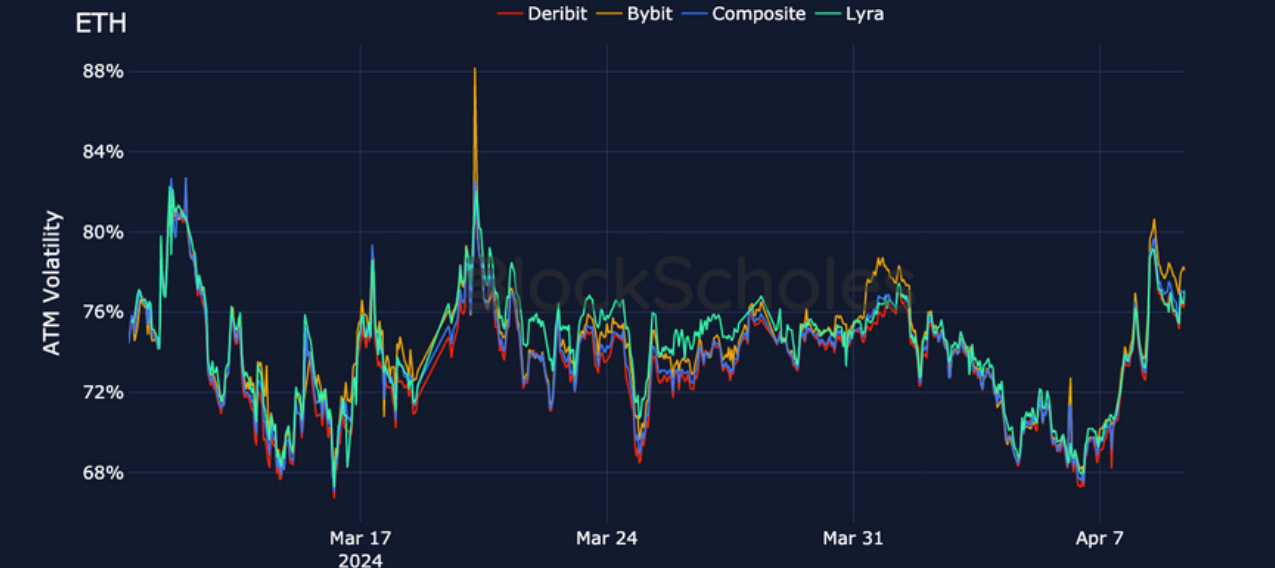

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

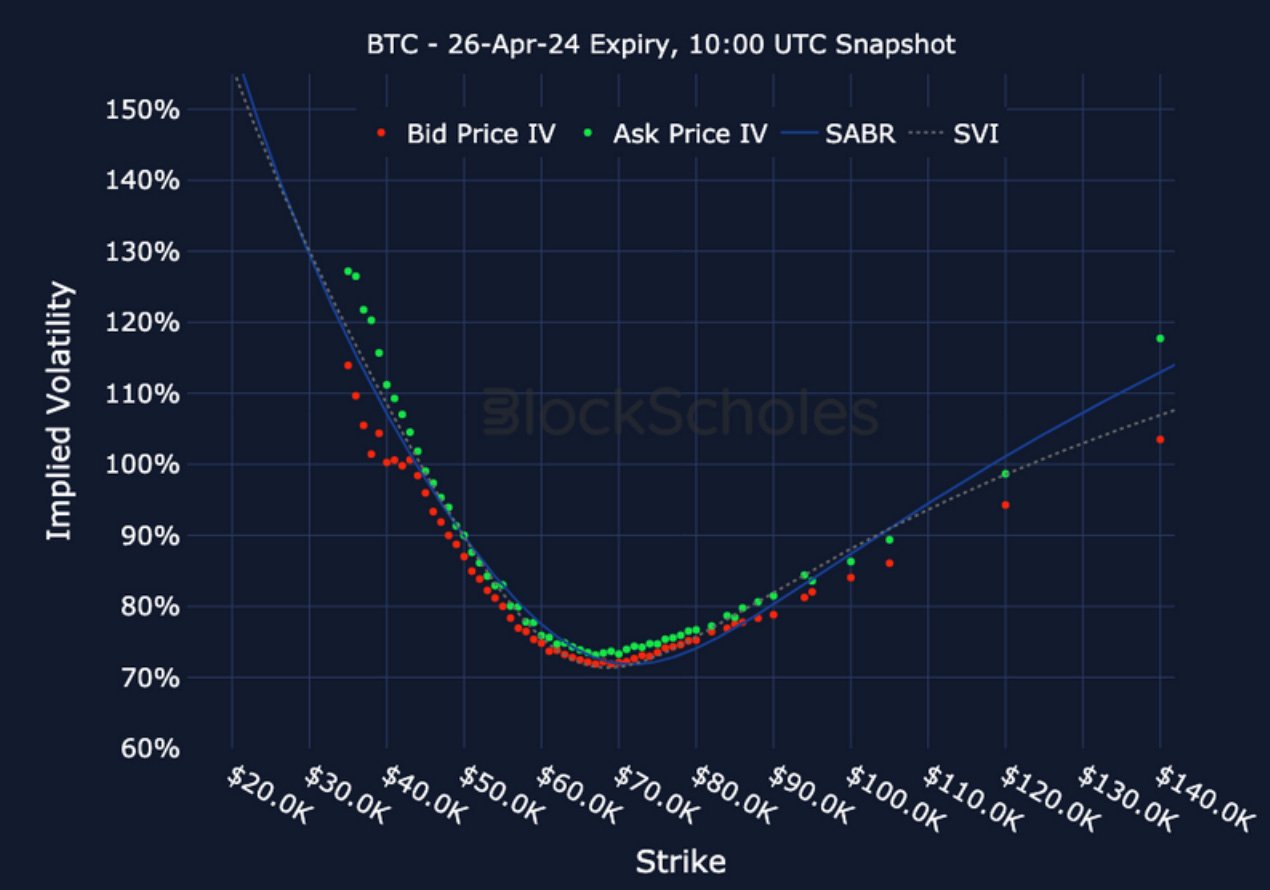

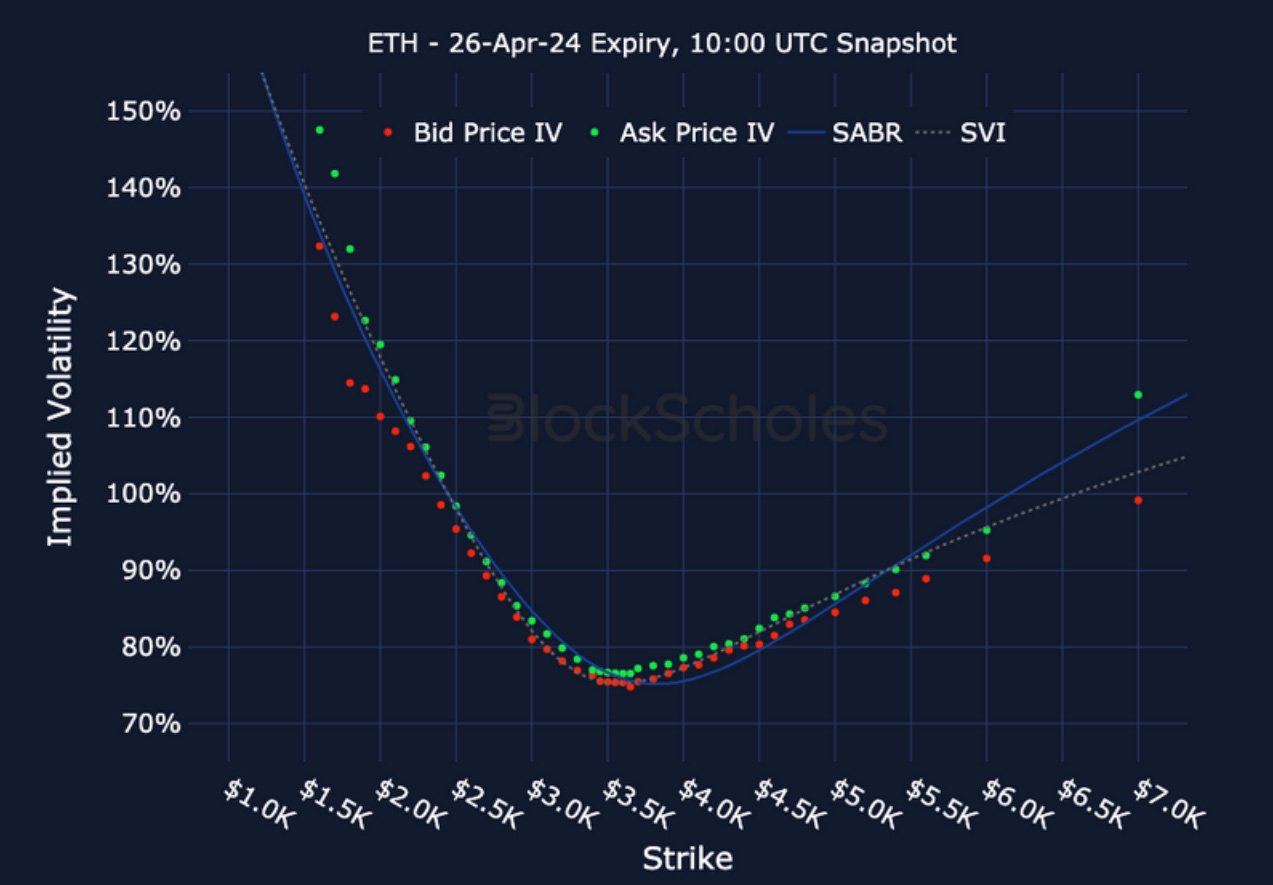

Volatility Smiles

BTC-26-APR-24 Expiry, 10:00 UTC.

ETH-26-APR-24 Expiry, 10:00 UTC.

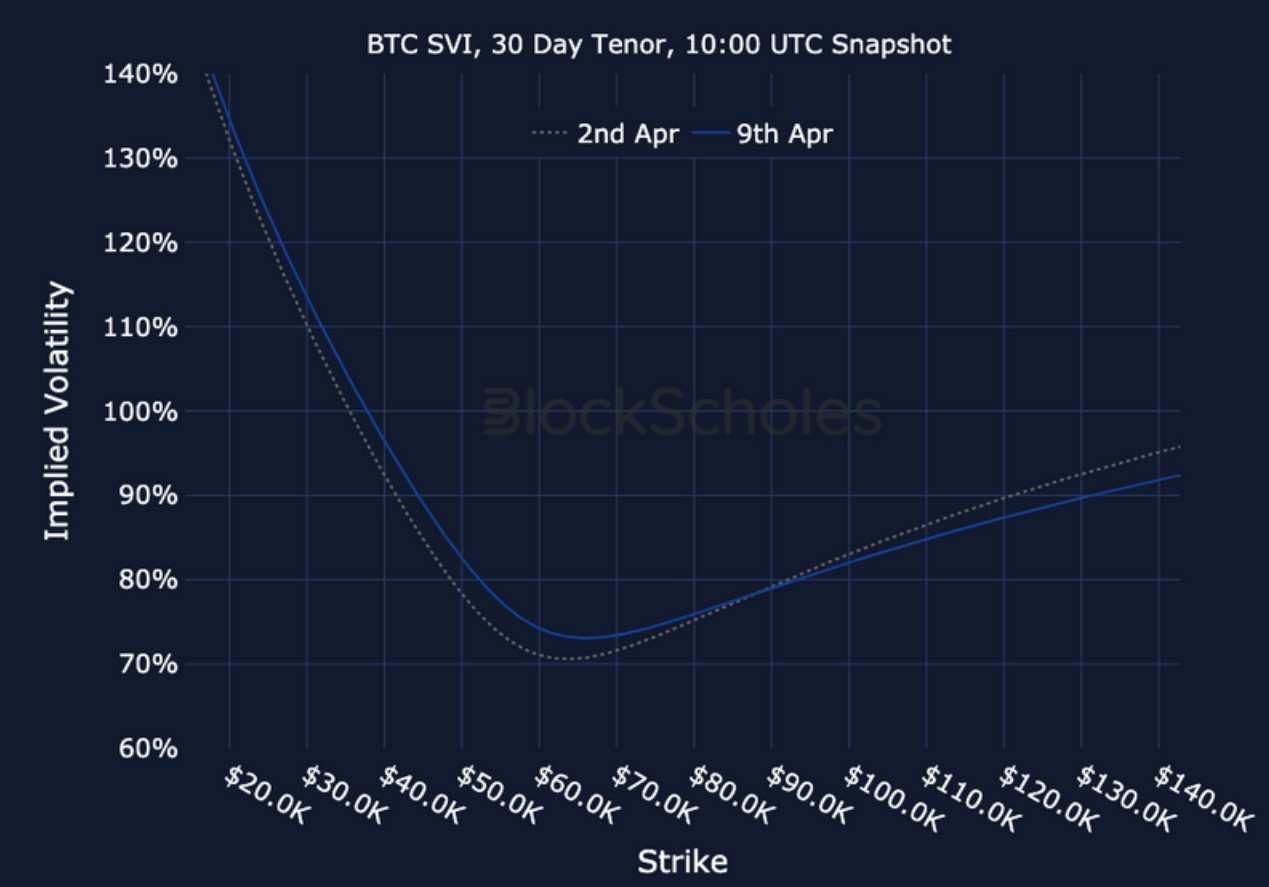

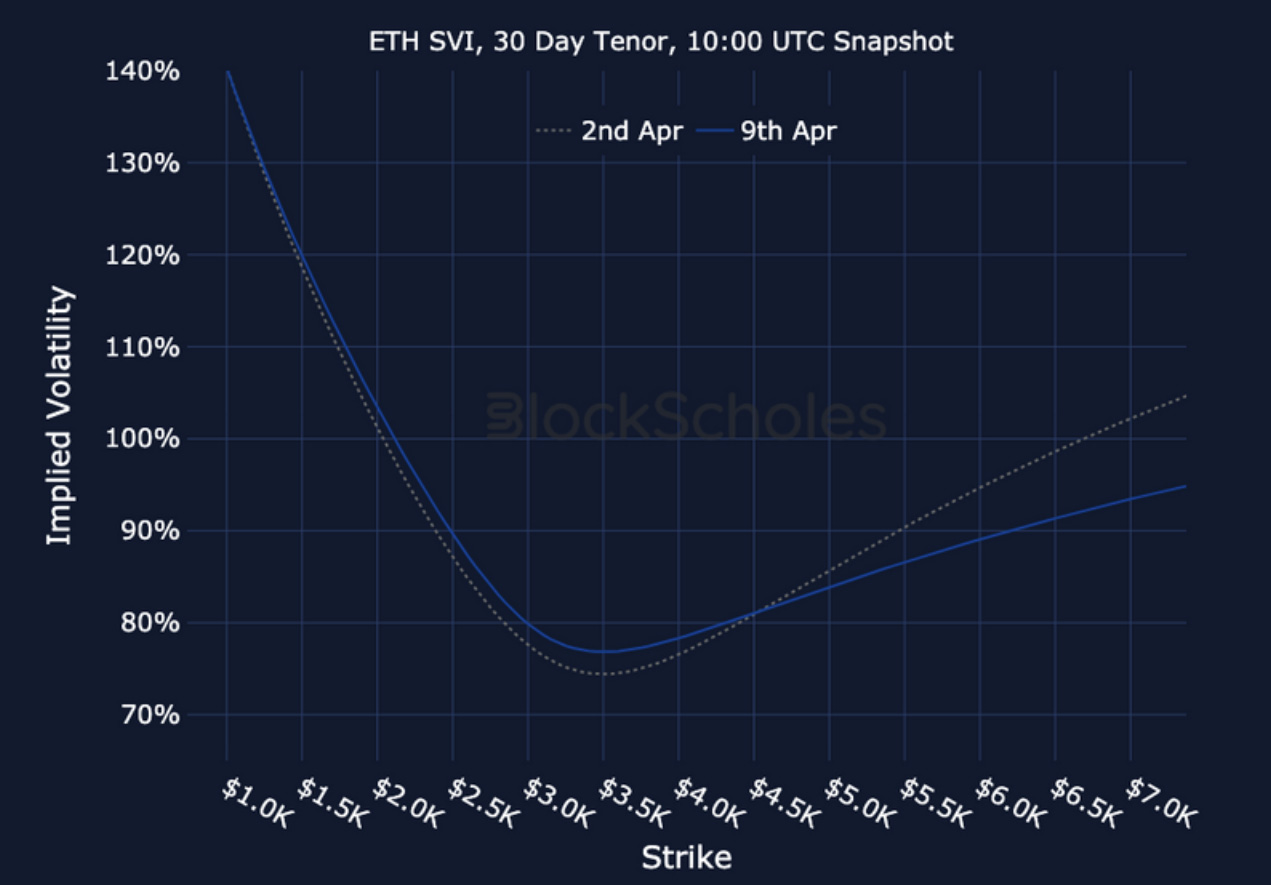

Historical SVI Volatility Smiles

BTC SVI – 30 Day Tenor, 10:00 UTC.

ETH SVI – 30 Day Tenor, 10:00 UTC.

AUTHOR(S)