Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

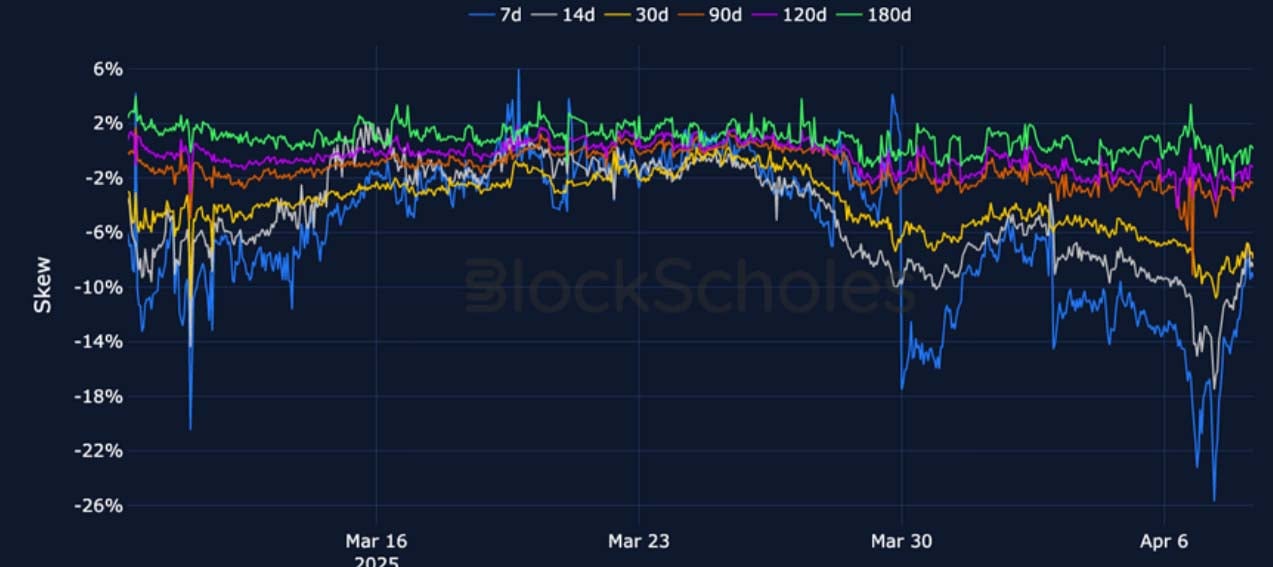

Crypto-assets seemingly held up on Friday, amidst a wider market rout which saw US equities experience their worst two-days since 2020. However, that changed by the second half of the weekend as BTC joined the selloff. At that point, BTC’s term structure had once again inverted, and ETH’s structure steepened further from an already inverted state. Those inversions have slightly abated since. The bearish spot moves which saw the ETH/BTC pair drop to its lowest in 5 years resulted in a strong spike down in futures-implied yields and an even stronger skew towards OTM puts at short tenors since the US Banking Crisis turmoil in Q1 2023.

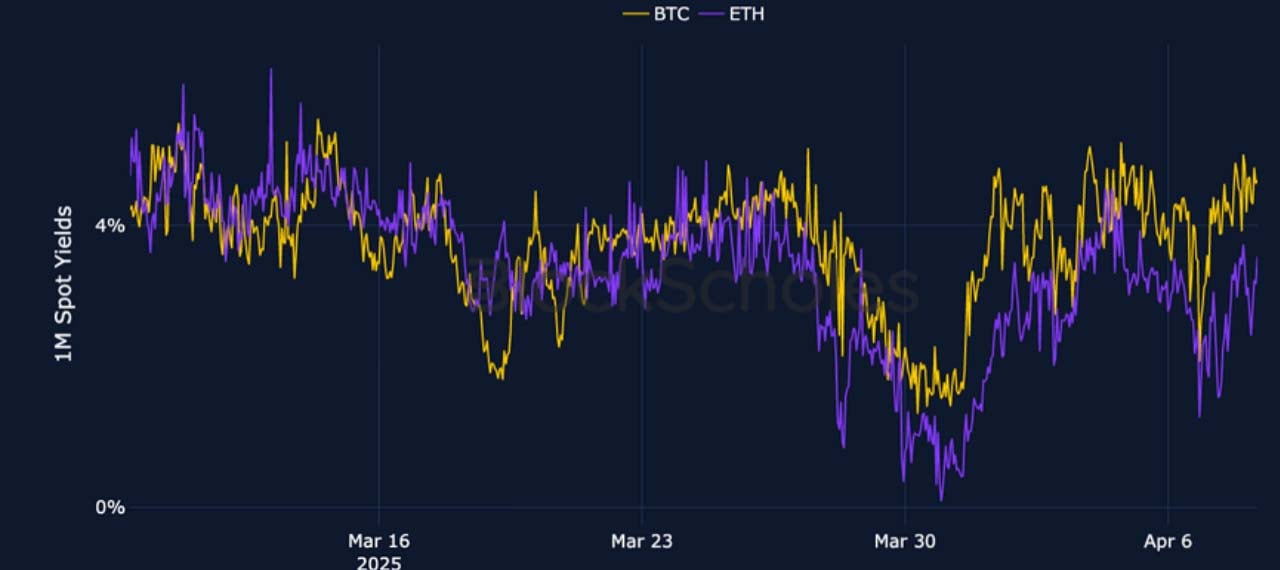

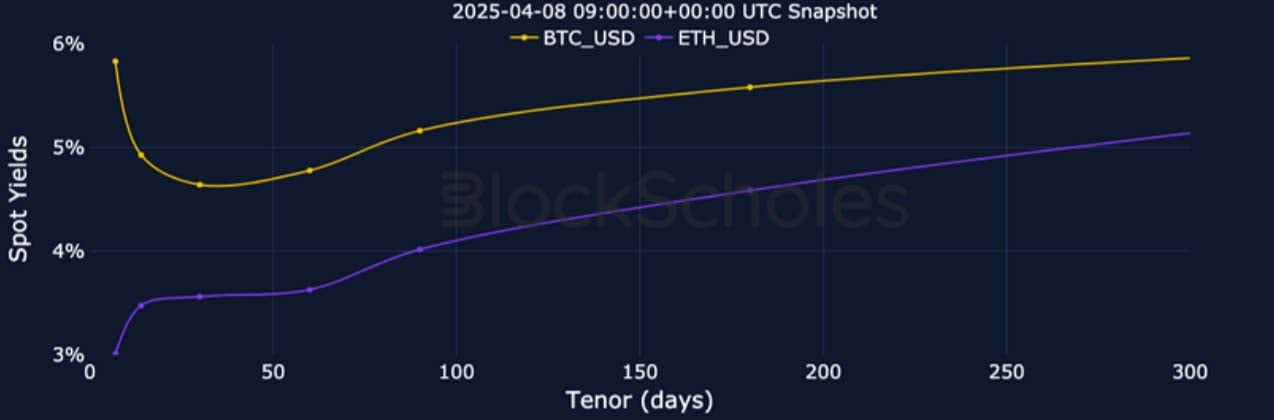

Futures Implied Yields

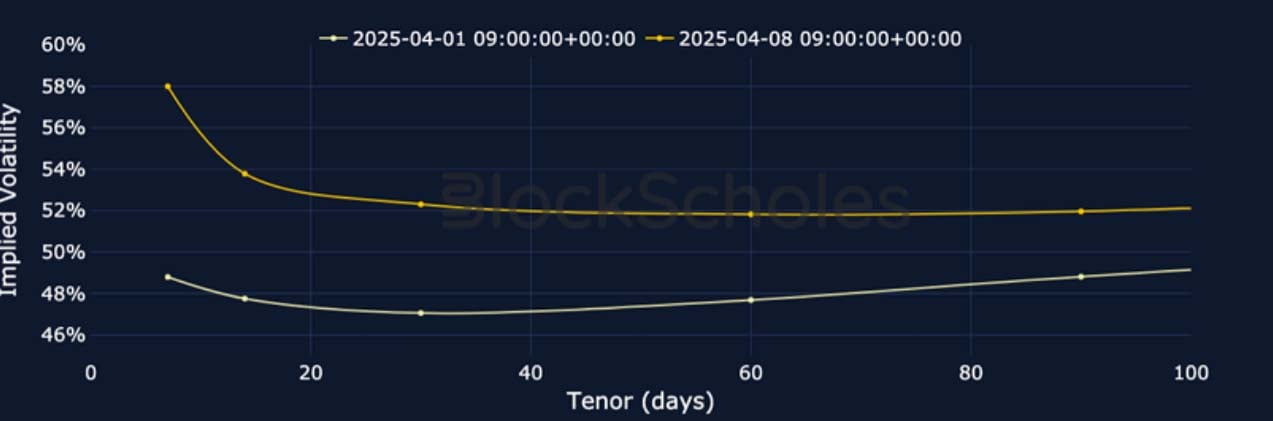

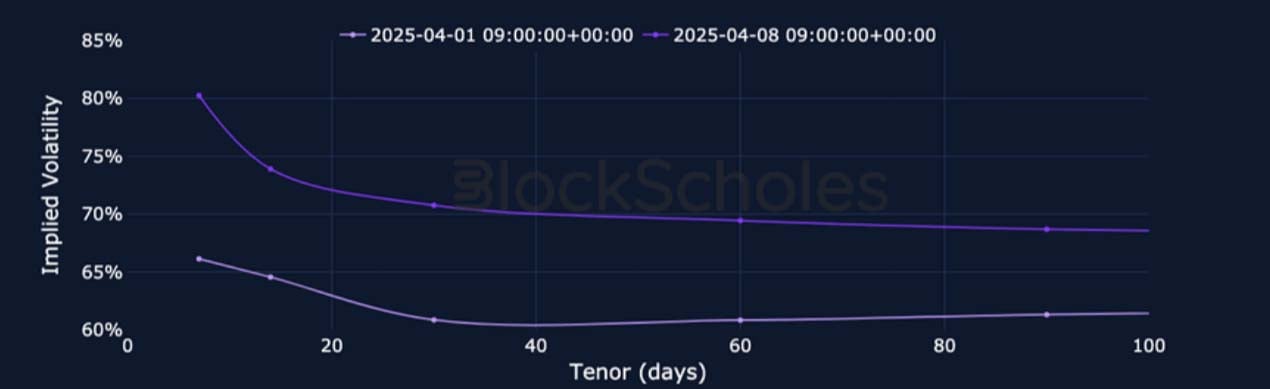

1-Month Tenor ATM Implied Volatility

Perpetual Swap Funding Rate

BTC FUNDING RATE – After a strong spike up last week, BTC’s funding rate remains close to neutral, briefly dropping below 0 amidst macro headwinds.

ETH FUNDING RATE – ETH Perpetuals recorded another major demand for downside exposure as ETH spot price sold off over 15%.

Futures Implied Yields

BTC Futures Implied Yields – The spot selloff on April 6 saw BTC yield’s strongly turn negative, before recovering amidst today’s relief rally.

ETH Futures Implied Yields – ETH spot yields fell to less strongly negative levels, and have subsequently recovered to a less bullish stance than BTC.

BTC Options

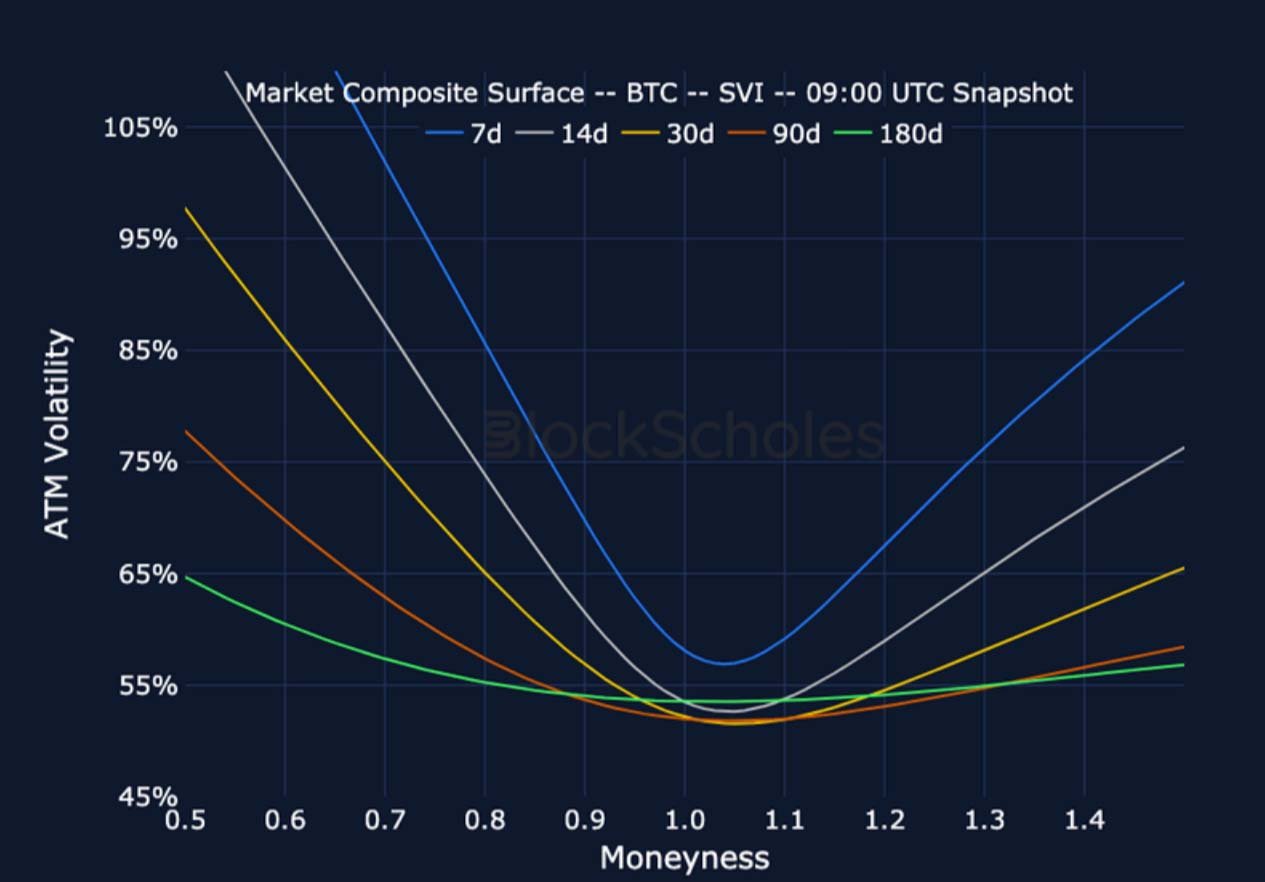

BTC SVI ATM IMPLIED VOLATILITY – BTC’s term structure exhibited a significant inversion which has since relented somewhat.

BTC 25-Delta Risk Reversal – Vol smiles skewed even further towards OTM puts than they did during the 2023 US Banking Crisis in this week’s selloff.

ETH Options

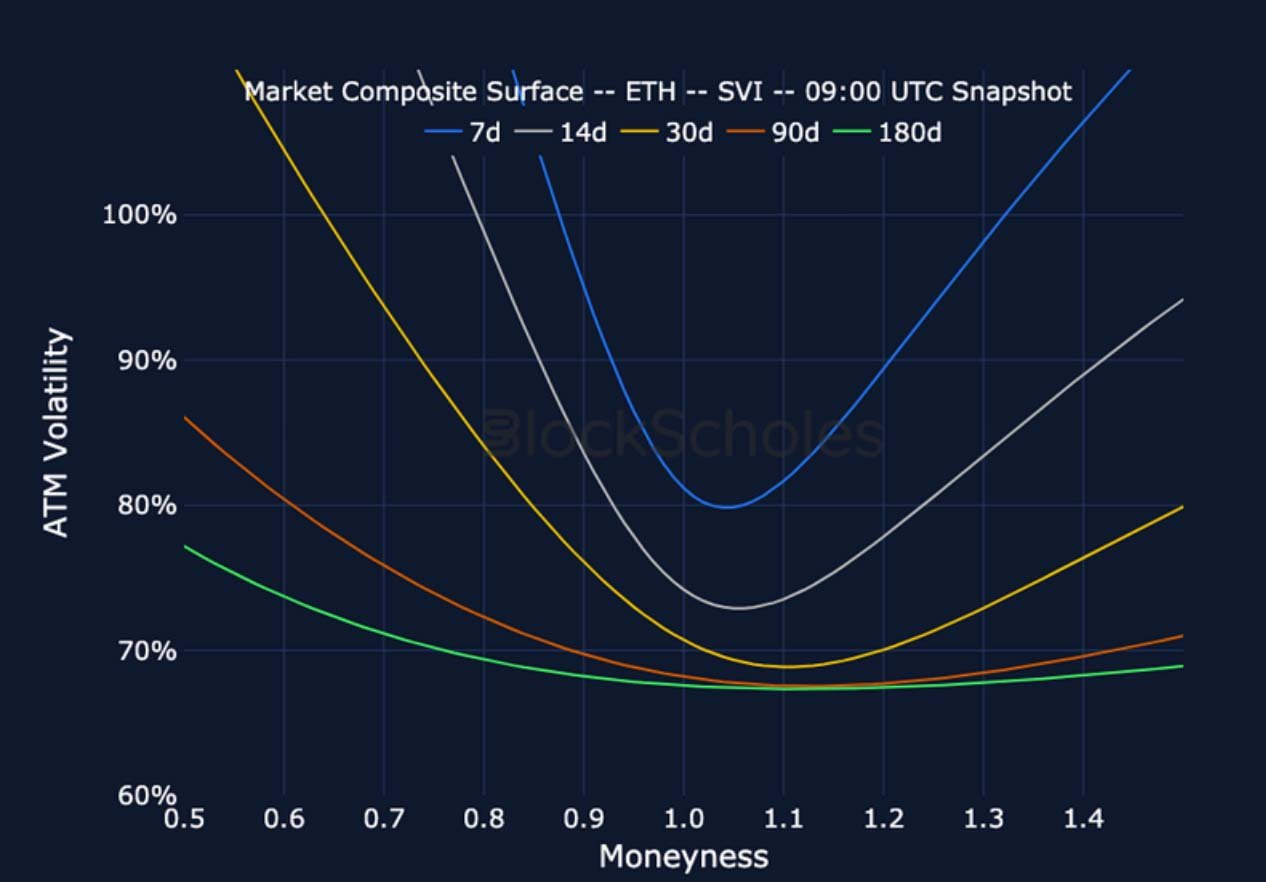

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure remains inverted ,with front-end volatility more than 20 points higher than 7-day BTC tenors.

ETH 25-Delta Risk Reversal – Short-tenor volatility smile skews are still firmly showing put demand, though have abated from their strong April 6 lows.

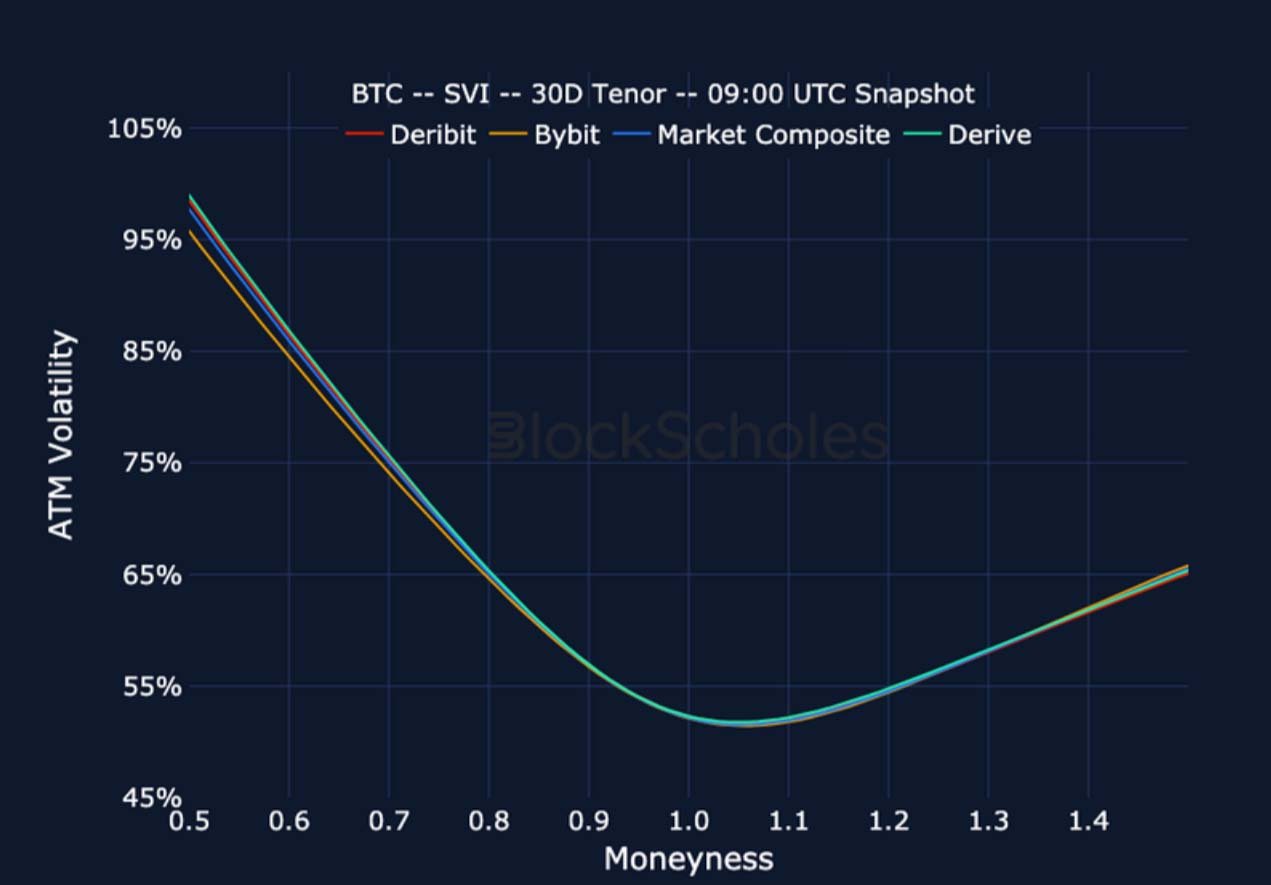

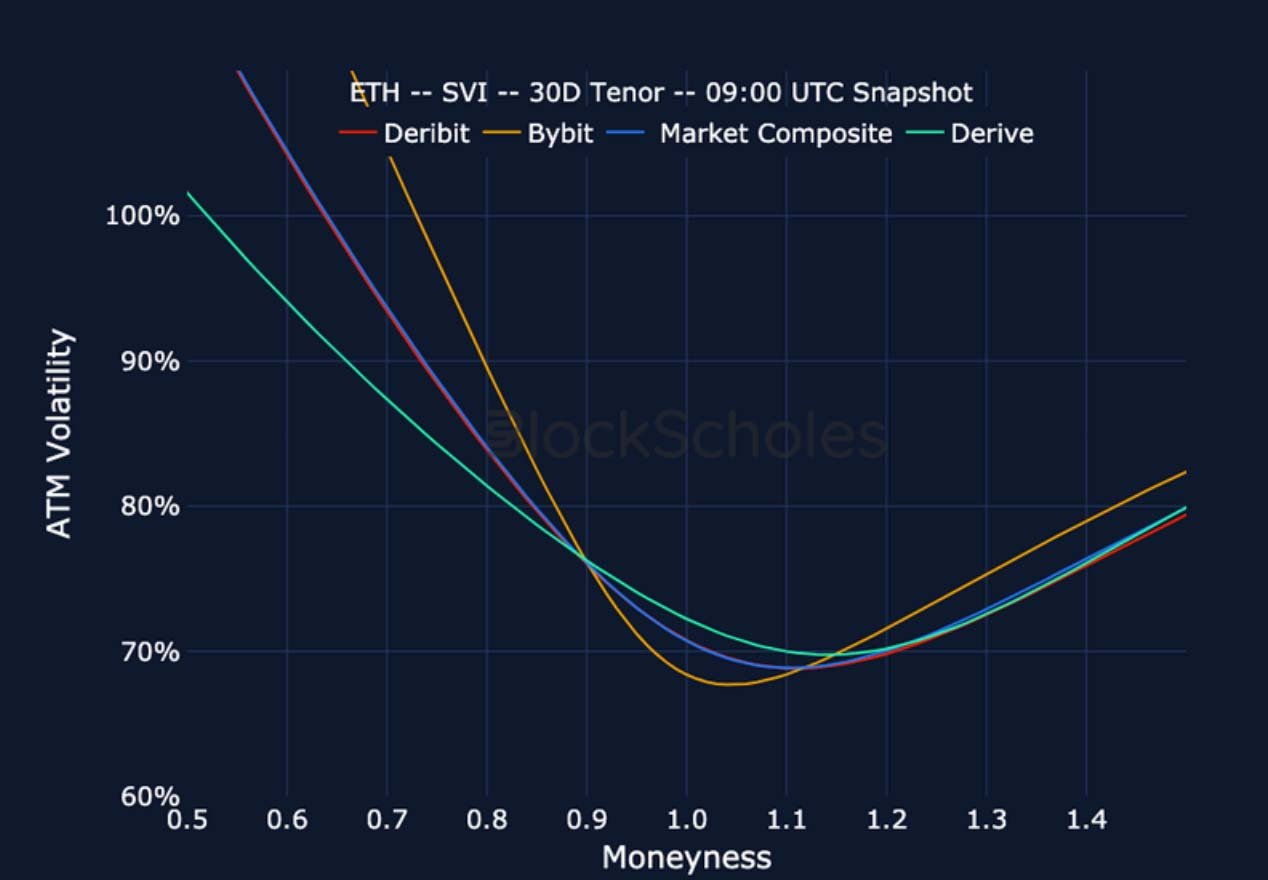

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

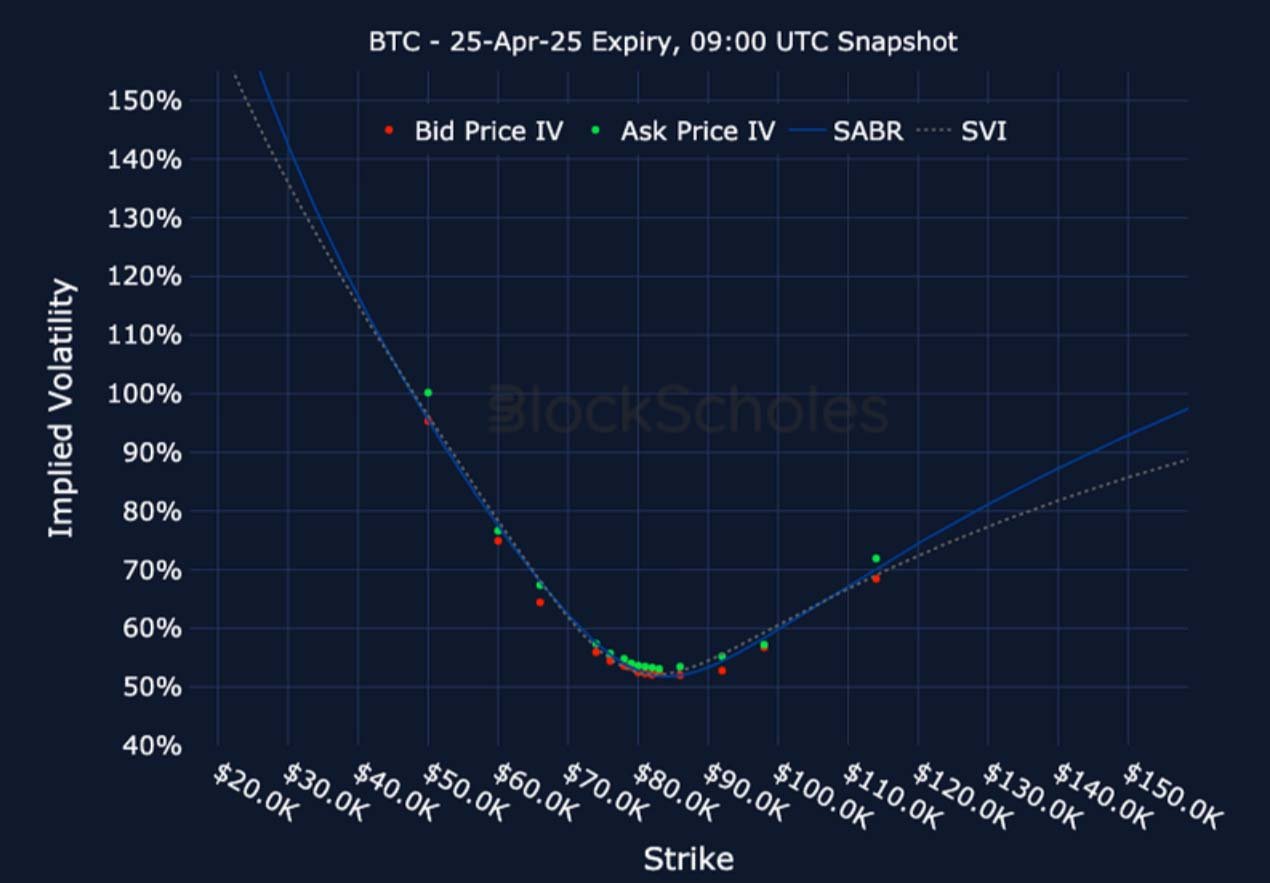

Listed Expiry Volatility Smiles

BTC 25-APR EXPIRY – 9:00 UTC Snapshot.

ETH 25-APR EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

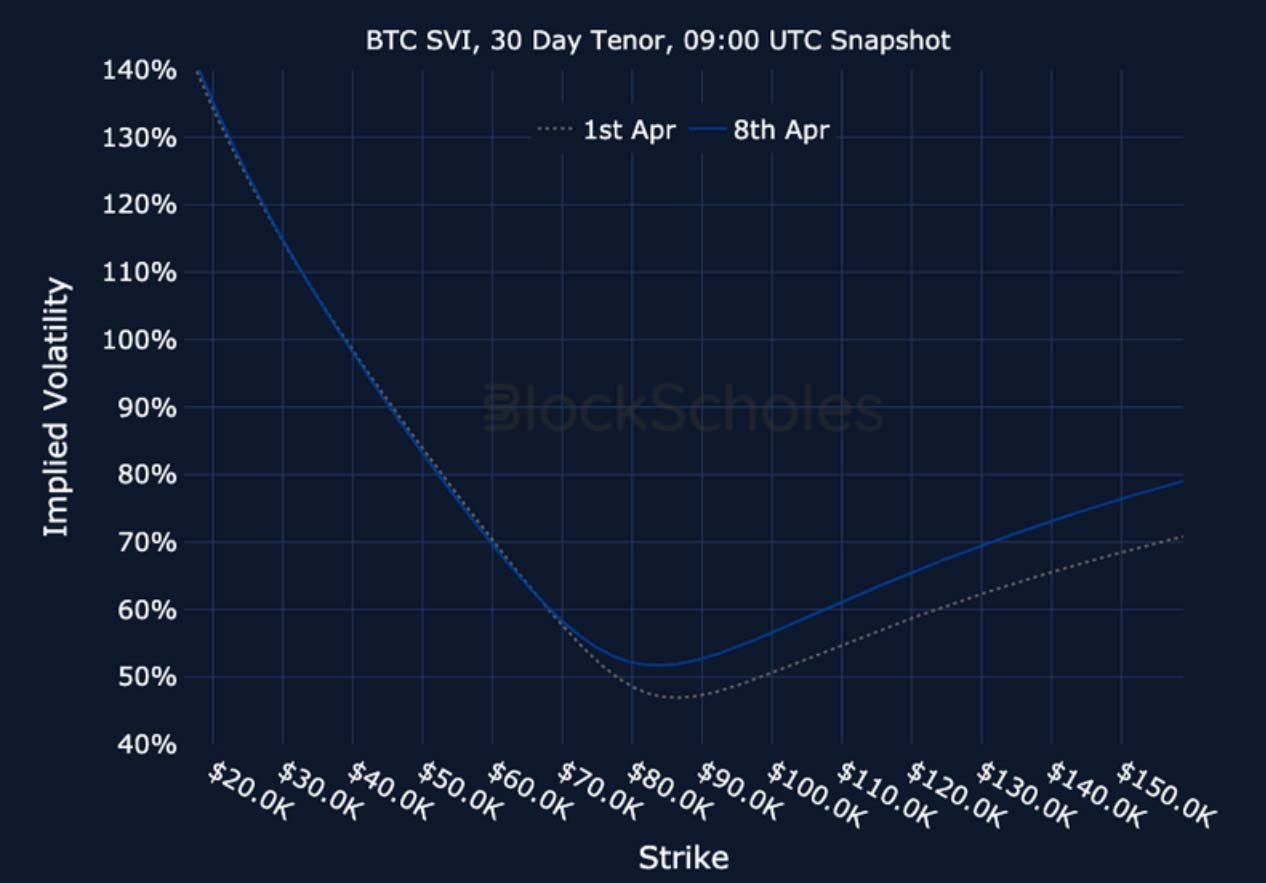

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)