Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The most recent period of short lived realised volatility has caused a pick-up and cool-off in the ATM levels of implied volatility of both assets. ETH retains it’s implied volatility premium to BTC’s across the term structure, as well as its volatility smile’s sharper skew towards OTM puts at longer tenors. The future-implied yields of both assets are flat, between 0-2% (annualised) across the term structure.

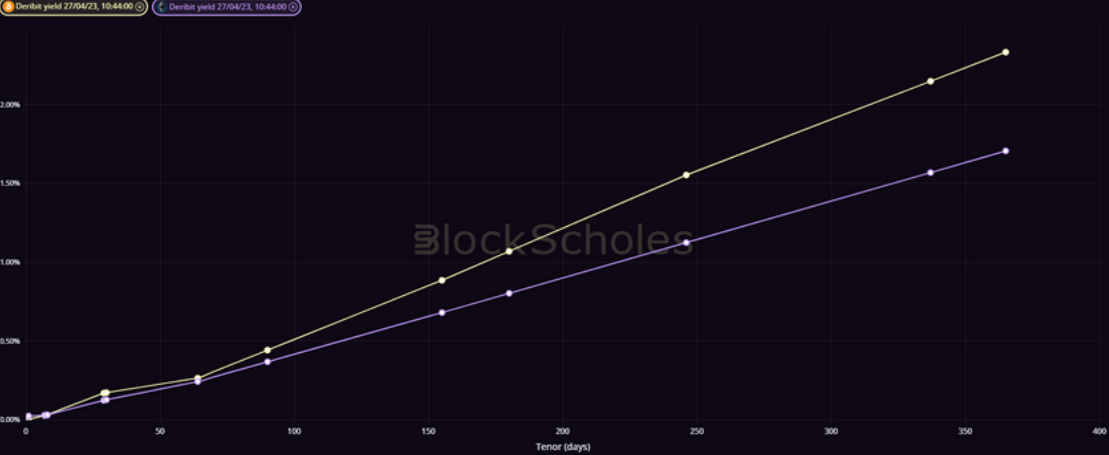

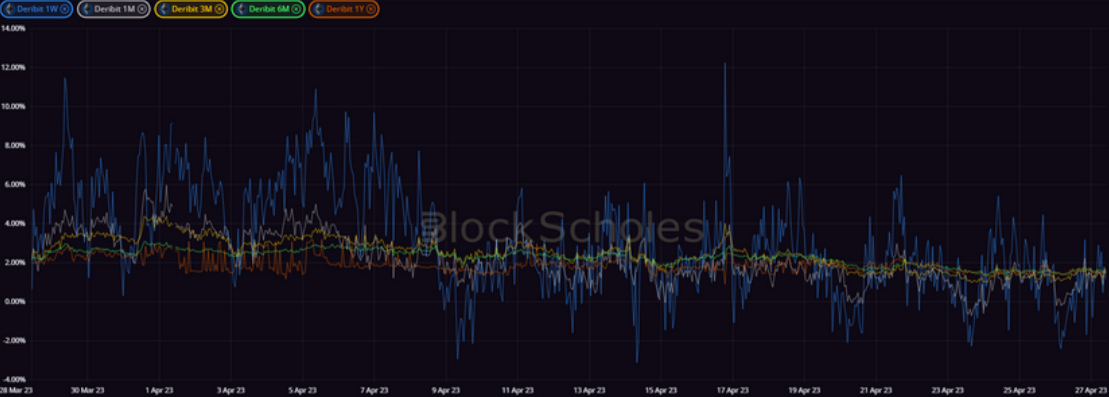

FUTURES IMPLIED YIELD TERM STRUCTURE.

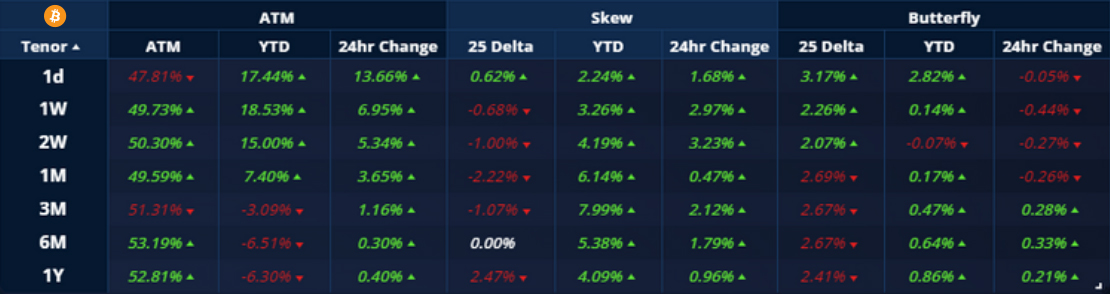

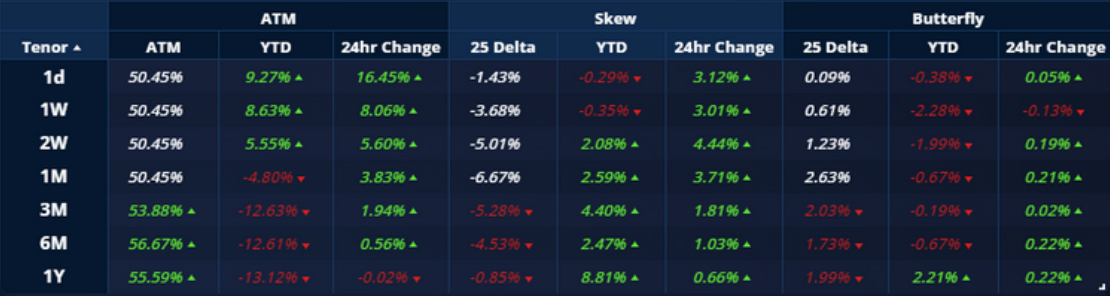

VOLATILITY SURFACE METRICS.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

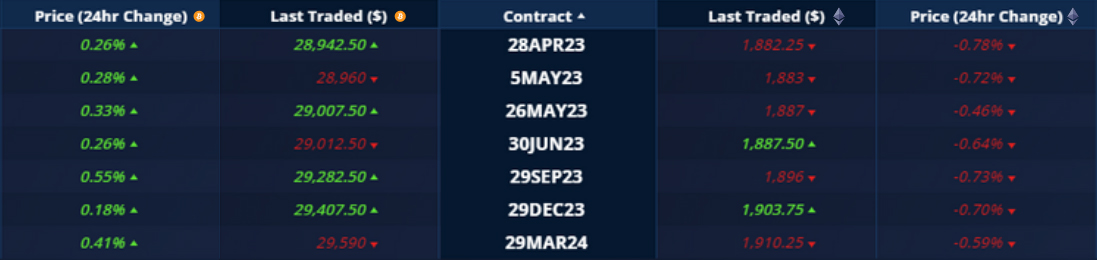

Futures

BTC ANNUALISED YIELDS – fall closer to 0 at shorter tenors during the volatility price action.

ETH ANNUALISED YIELDS – are volatile near to zero, having already traded in its range for most of the past month.

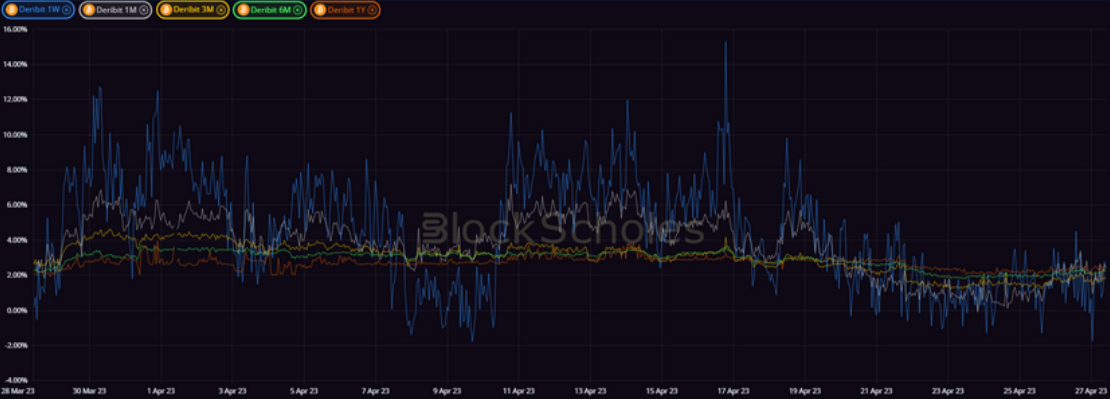

Perpetual Swap Funding Rate

BTC FUNDING RATE – reports muted excess long or short interest in the perpetual swap contract over the past weekend.

ETH FUNDING RATE – spiked positively in the early part of this week as long positions paid shorts for exposure to ETH’s spot rally.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – remains flat relative to historical levels, but rose in the last 24 hours due to high realised volatility.

BTC 25-Delta Risk Reversal – recovered from its skew towards OTM slightly in the last couple of days, with shorter tenors remaining neutral.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – still trades in a tight range across the term structure and remains at a premium to BTC volatility.

ETH 25-DELTA RISK REVERSAL – like BTC saw a recovery to a more neutral vol smile at all tenors that remains through to today.

Volatility Surface

BTC IMPLIED VOL SURFACE – reports lower implied volatility then its recent history across the surface.

ETH IMPLIED VOL SURFACE – like BTC’s, shows that implied volatility is lower than its average value over the previous 30 days.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

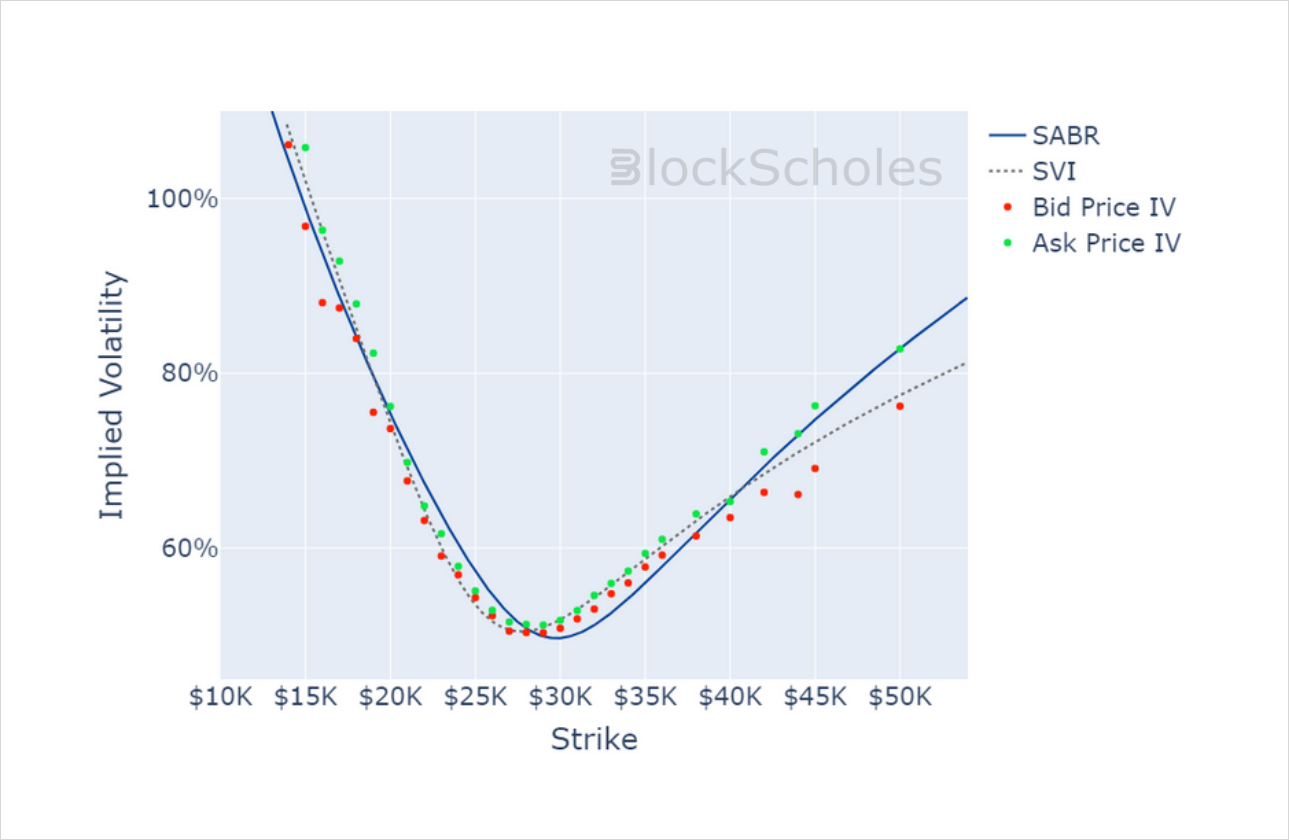

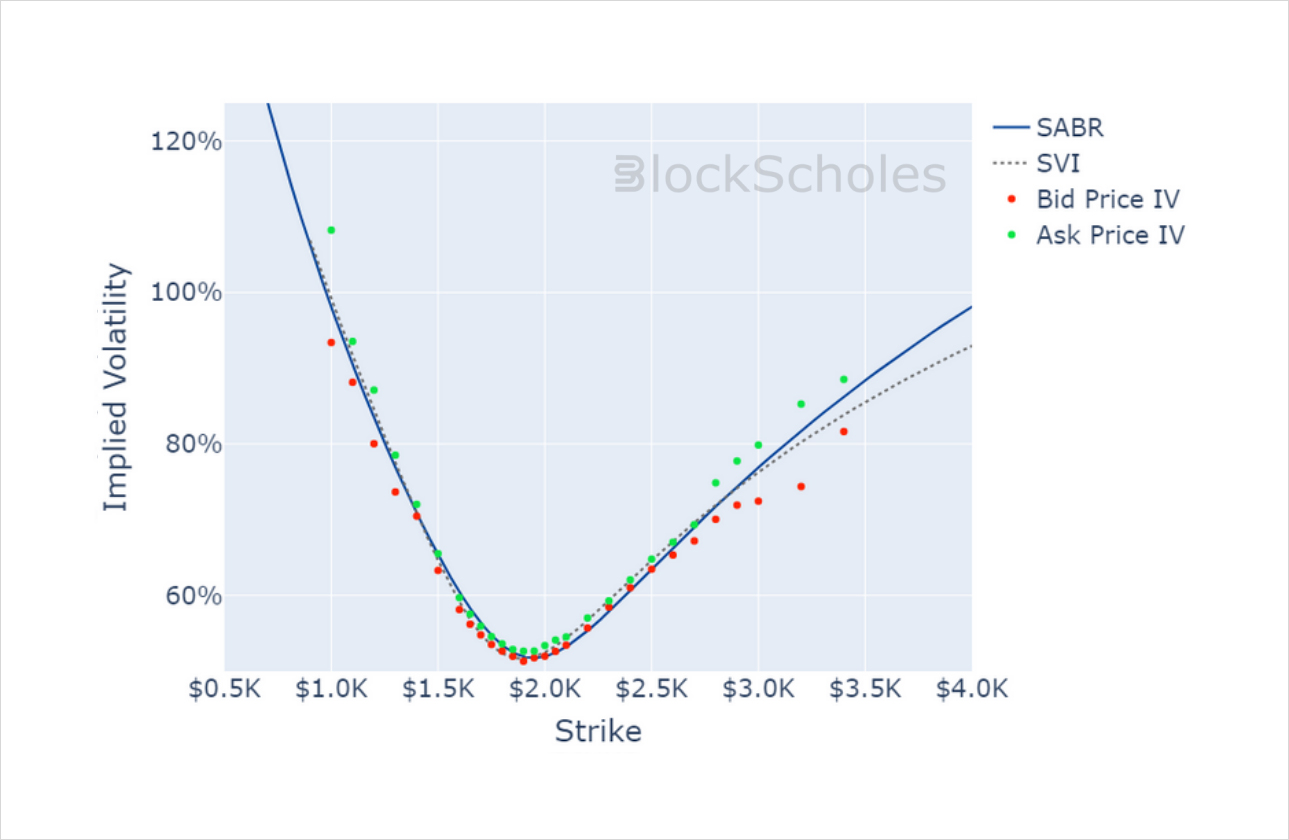

Volatility Smiles

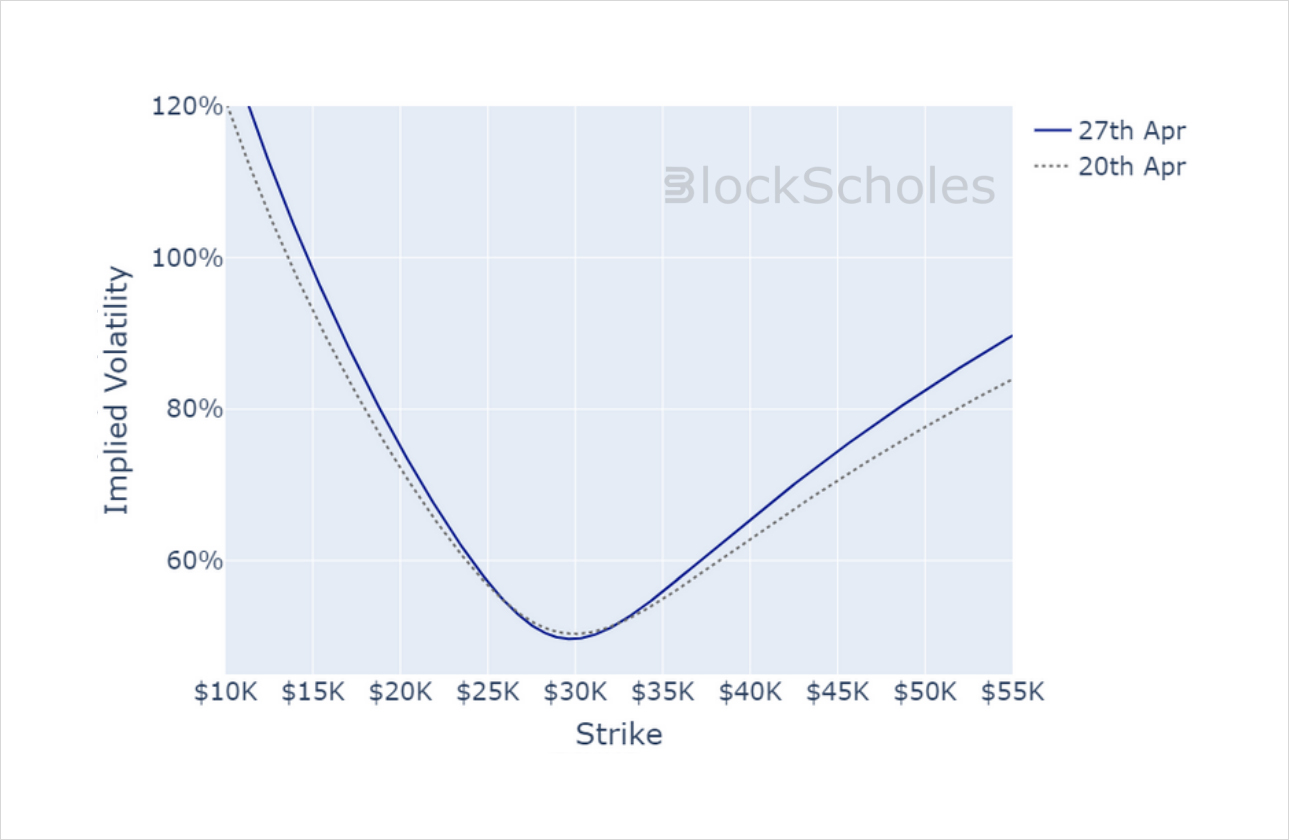

BTC SMILE CALIBRATIONS – 26-May-2023 Expiry, 10:00 UTC Snapshot.

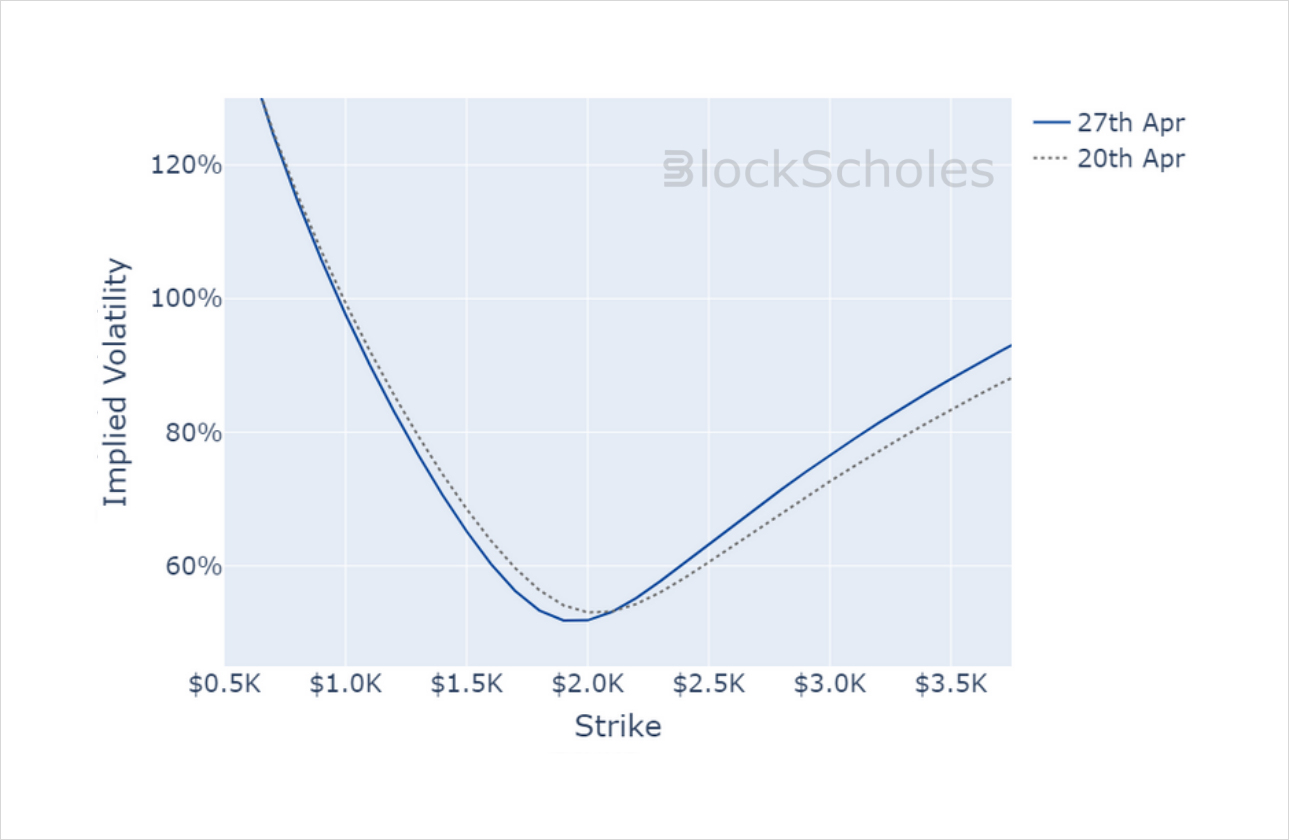

ETH SMILE CALIBRATIONS – 26-May-2023 Expiry, 10:00 UTC Snapshot.

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)