Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

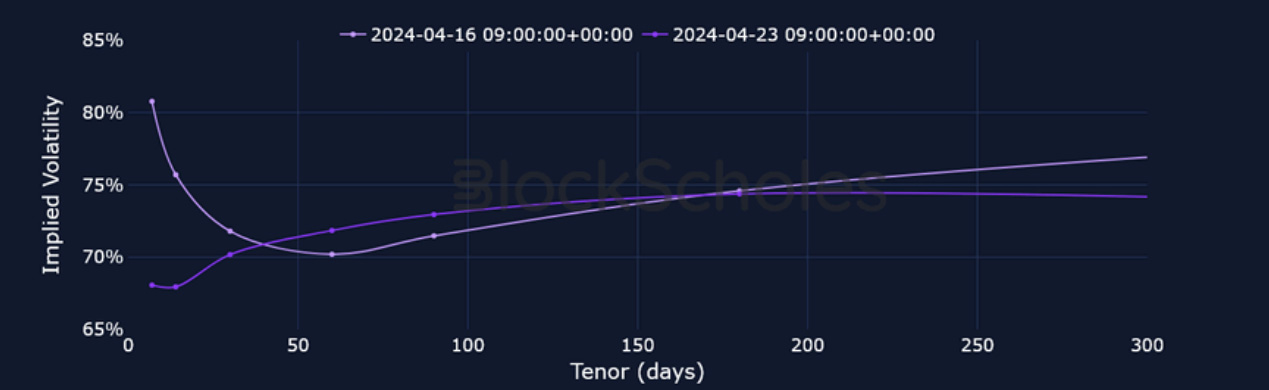

Following a bounce in spot price at range lows, BTC and ETH currently trade at $66K and $3.2K respectively. Funding rates remain close to zero for both majors, and future-implied yields are near their lowest levels in more than a month as BTC trades in the middle of its sideways trending range. In the past week, volatility at short-dated tenor options has fallen, correcting the front-end of BTC and ETH’s previously inverted term structures. The fall in volatility was matched by a recovery in skew from OTM puts to more neutral levels at all tenors less than 3-months, indicating that investors are less concerned with buying OTM puts for downside protection.

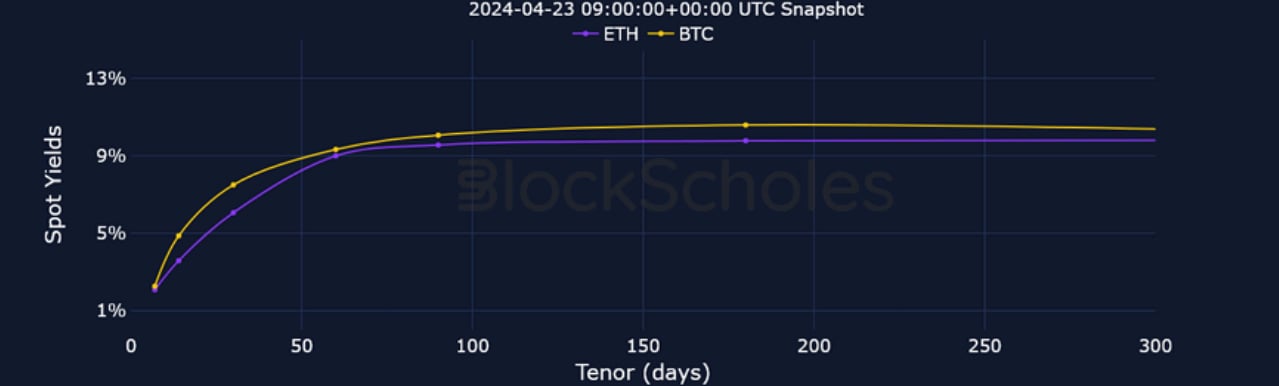

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Futures

BTC ANNUALISED YIELDS – yields trade near their lowest levels in over a month as spot continues to trade within the $60-70K range.

ETH ANNUALISED YIELDS – a similar conclusion can be drawn for ETH futures, although yields remain compressed at short-dated tenors.

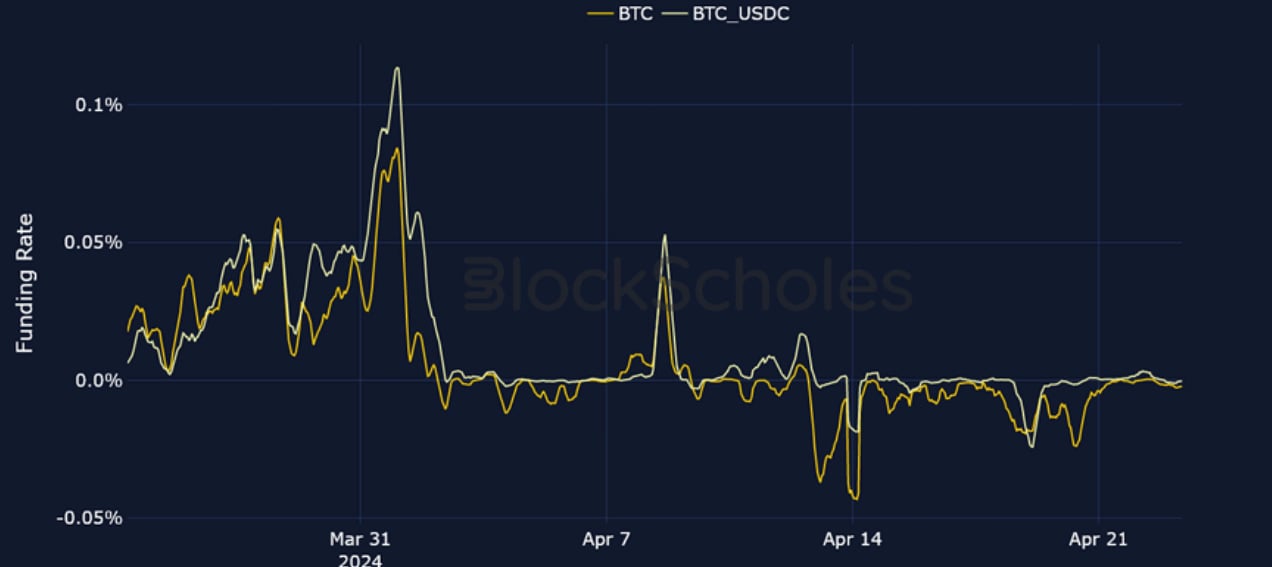

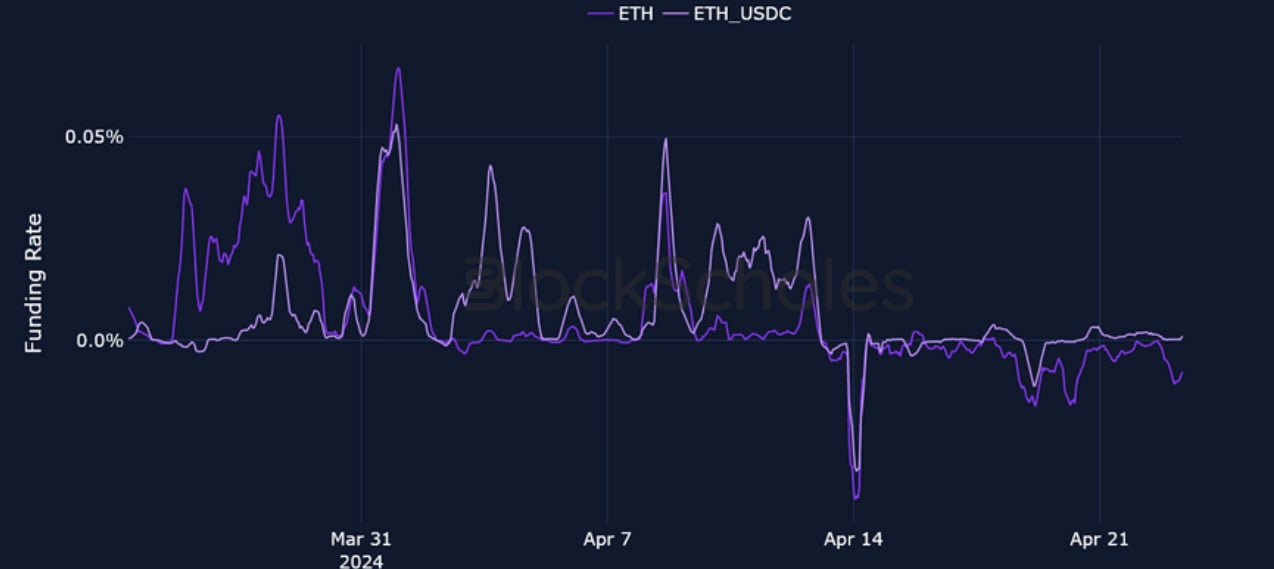

Perpetual Swap Funding Rate

BTC FUNDING RATE – has continued to trade intermittently negative over the last week as spot reaches the middle of its monthly range at $66K.

ETH FUNDING RATE – dipped strongly negative during the selloff on the evening of the 13th, but has remained close to zero in the days since, occasionally becoming negative.

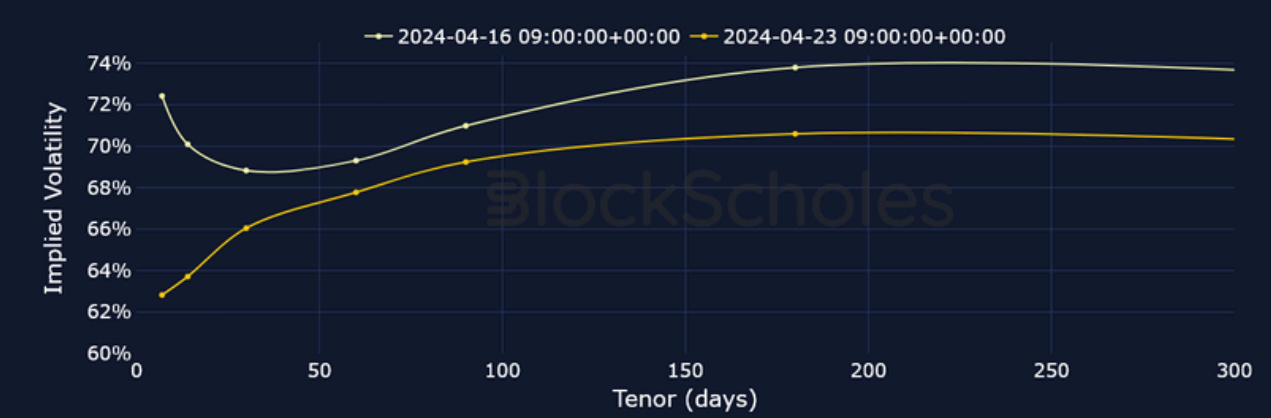

BTC Options

BTC SVI ATM IMPLIED VOLATILITY– short-tenor volatility has fallen in the past week, correcting the previously inverted term structure.

BTC 25-Delta Risk Reversal – the fall in short-tenor volatility corresponds with a reduction in skew towards OTM puts at tenors less than 3M.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – as with BTC, implied vol has fallen at the front end, correcting the inverted term structure seen last week.

ETH 25-Delta Risk Reversal – skew has recovered at tenors less than 3M, indicating that investors are less concerned with buying downside put protection following a fall in implied vol.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

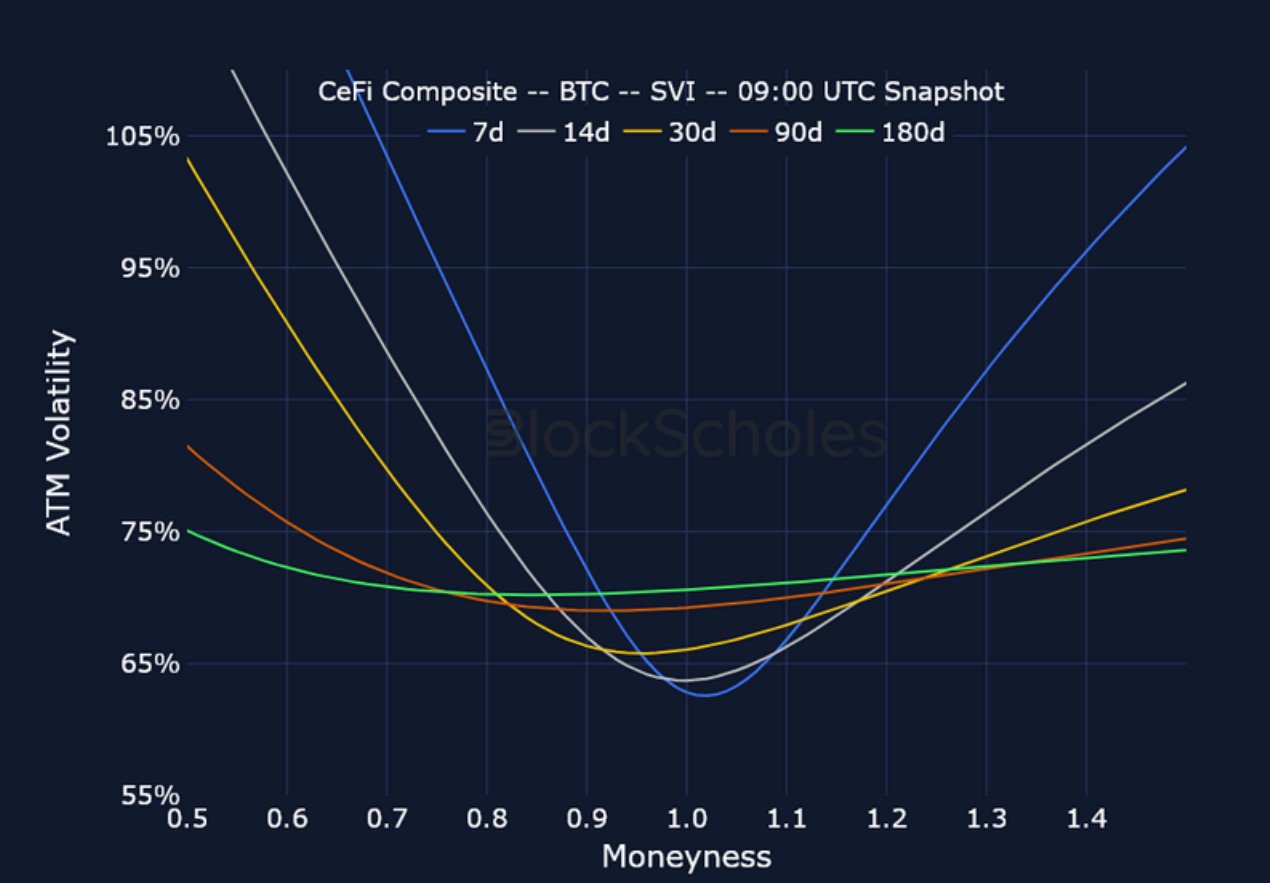

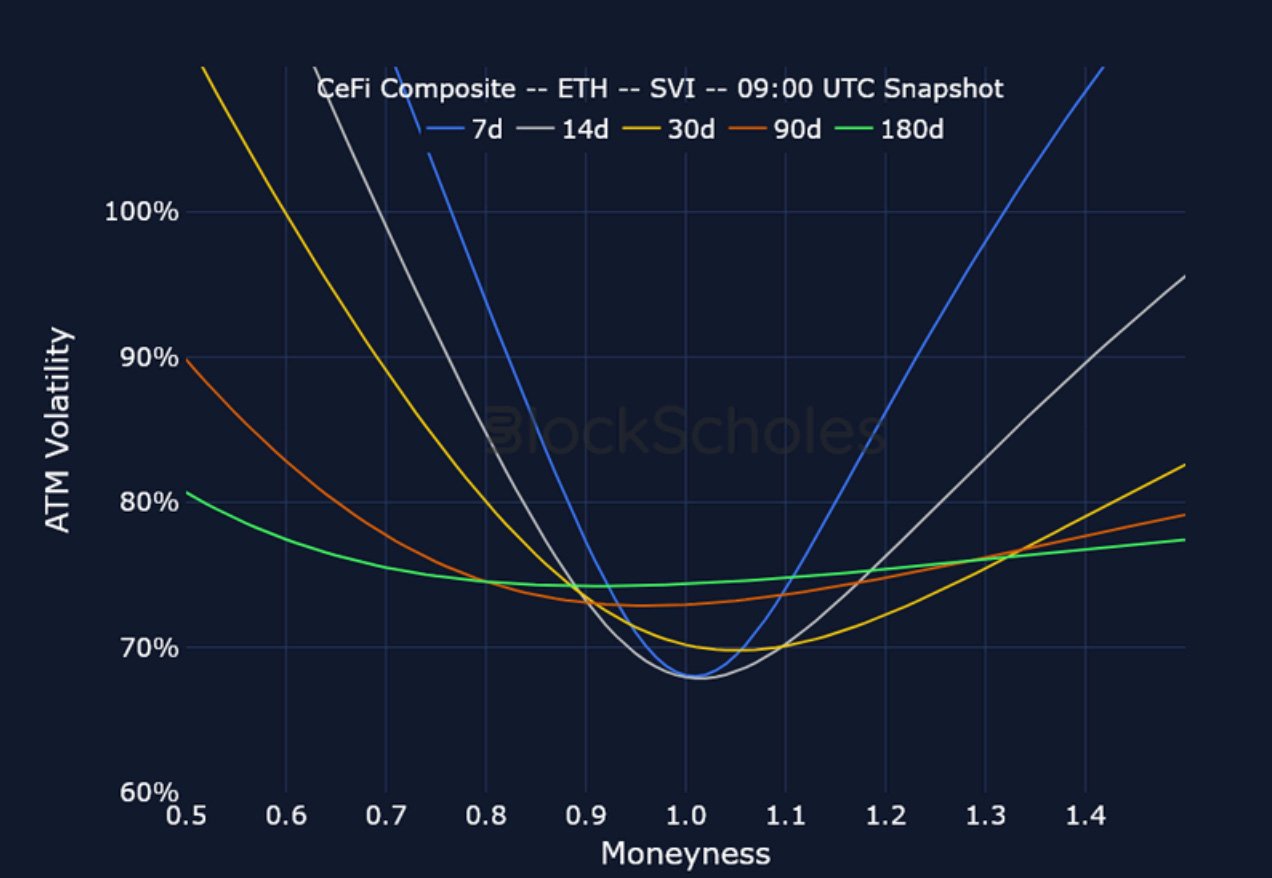

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

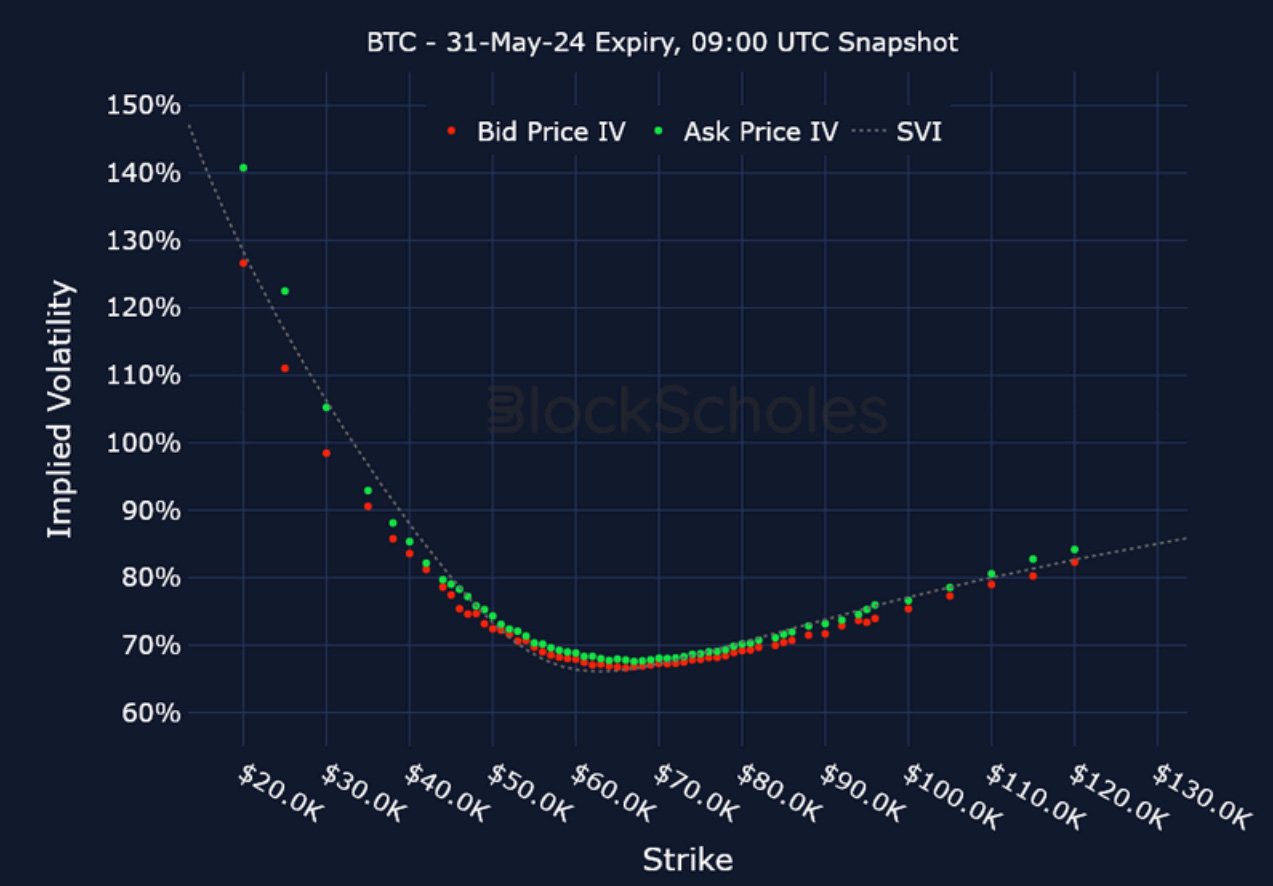

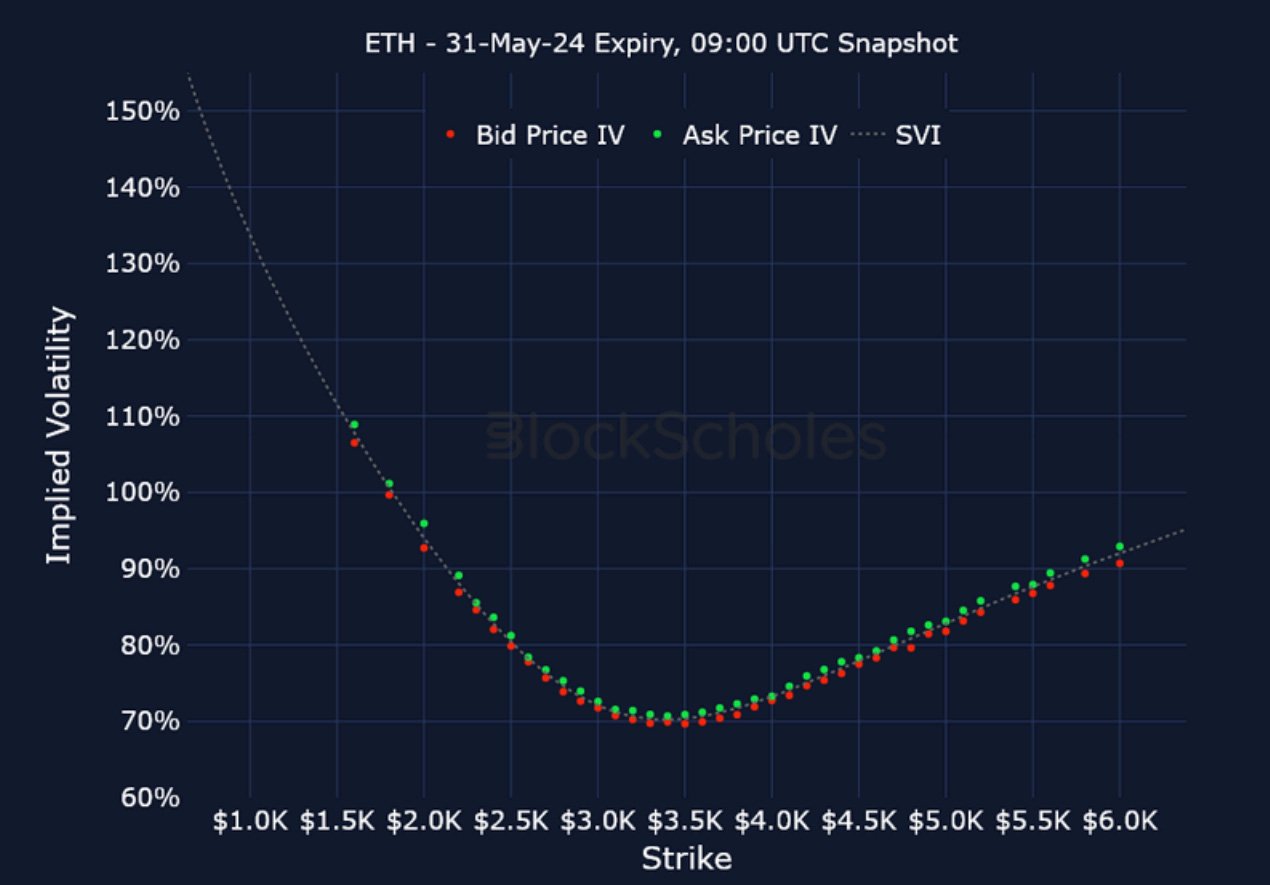

Listed Expiry Volatility Smiles

BTC-31-MAY-24 – 9:00 UTC Snapshot.

BTC-31-MAY-24 – 9:00 UTC Snapshot.

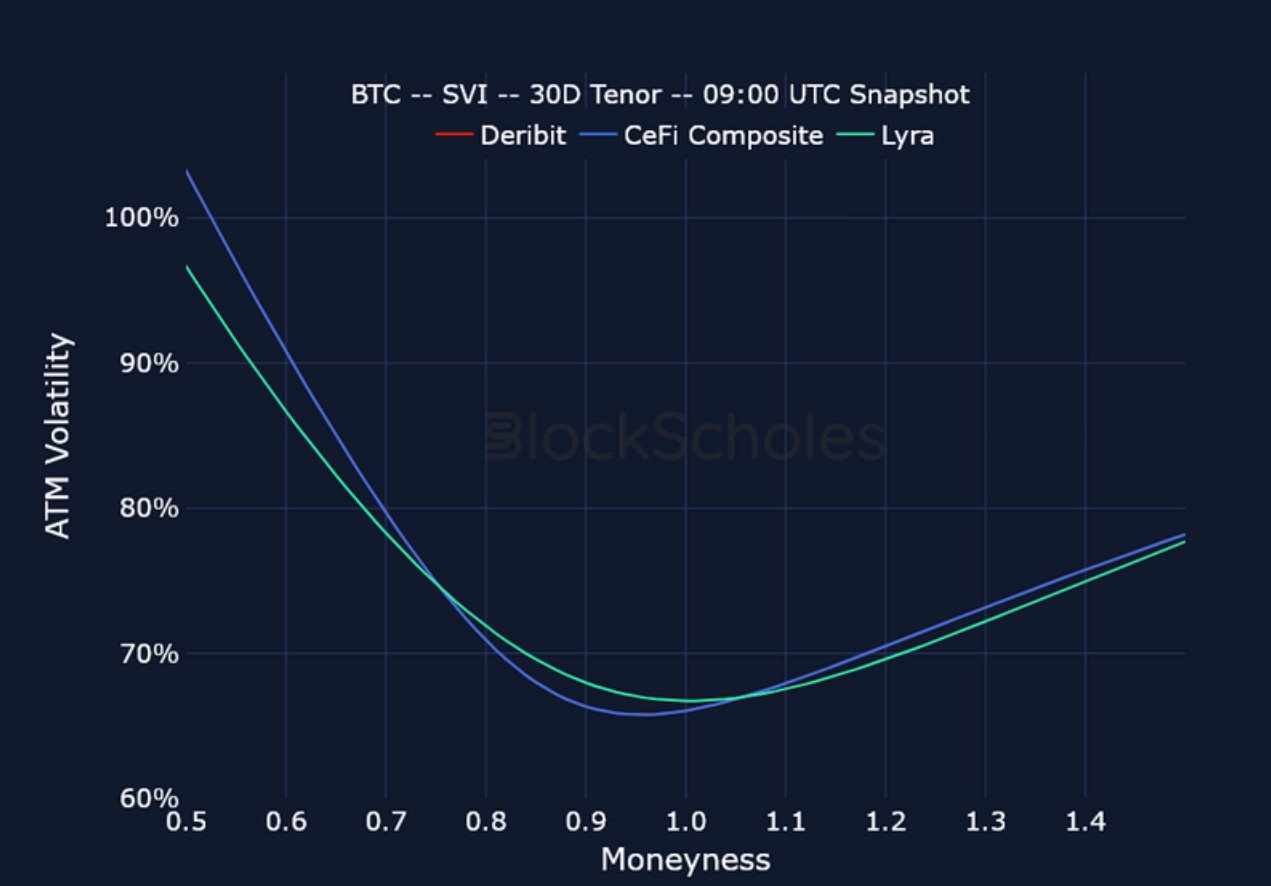

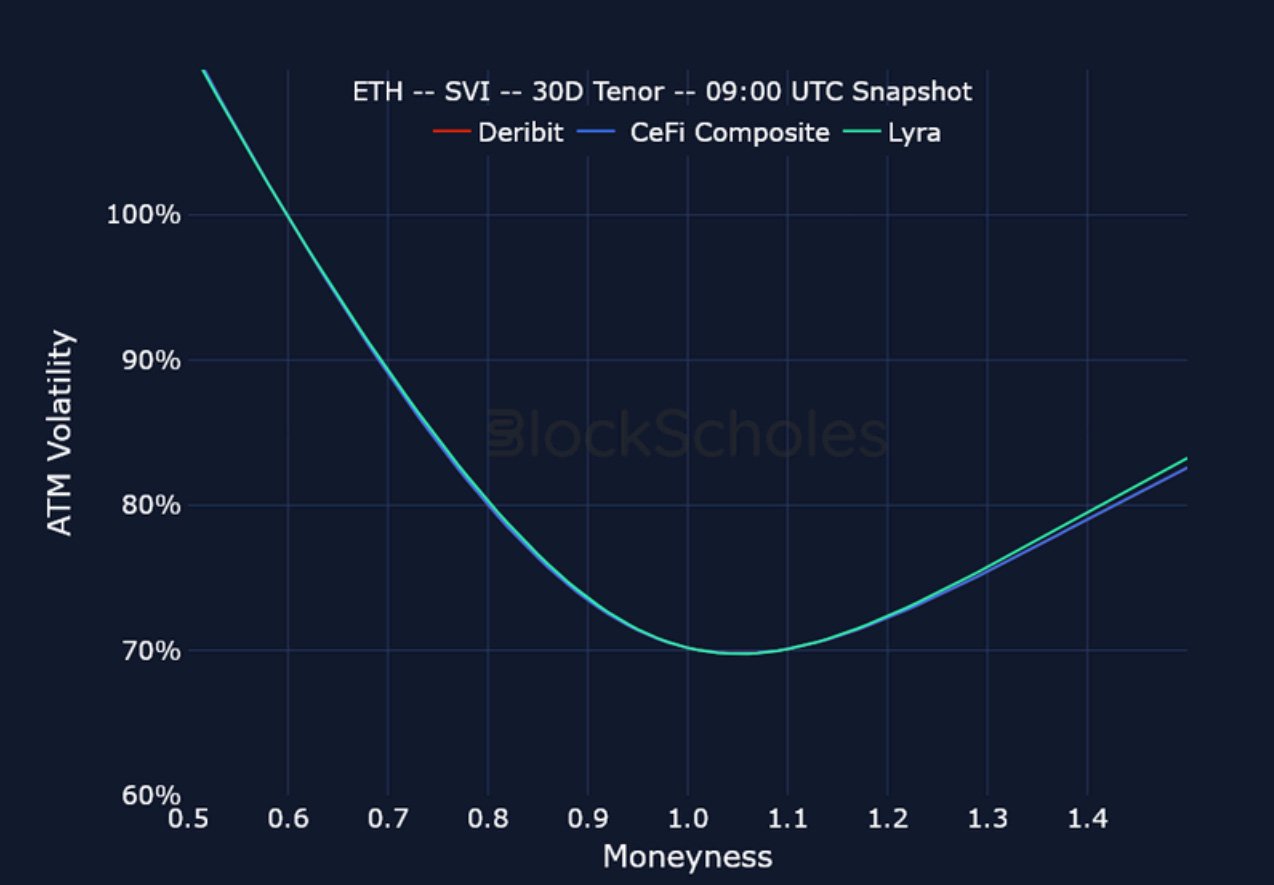

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

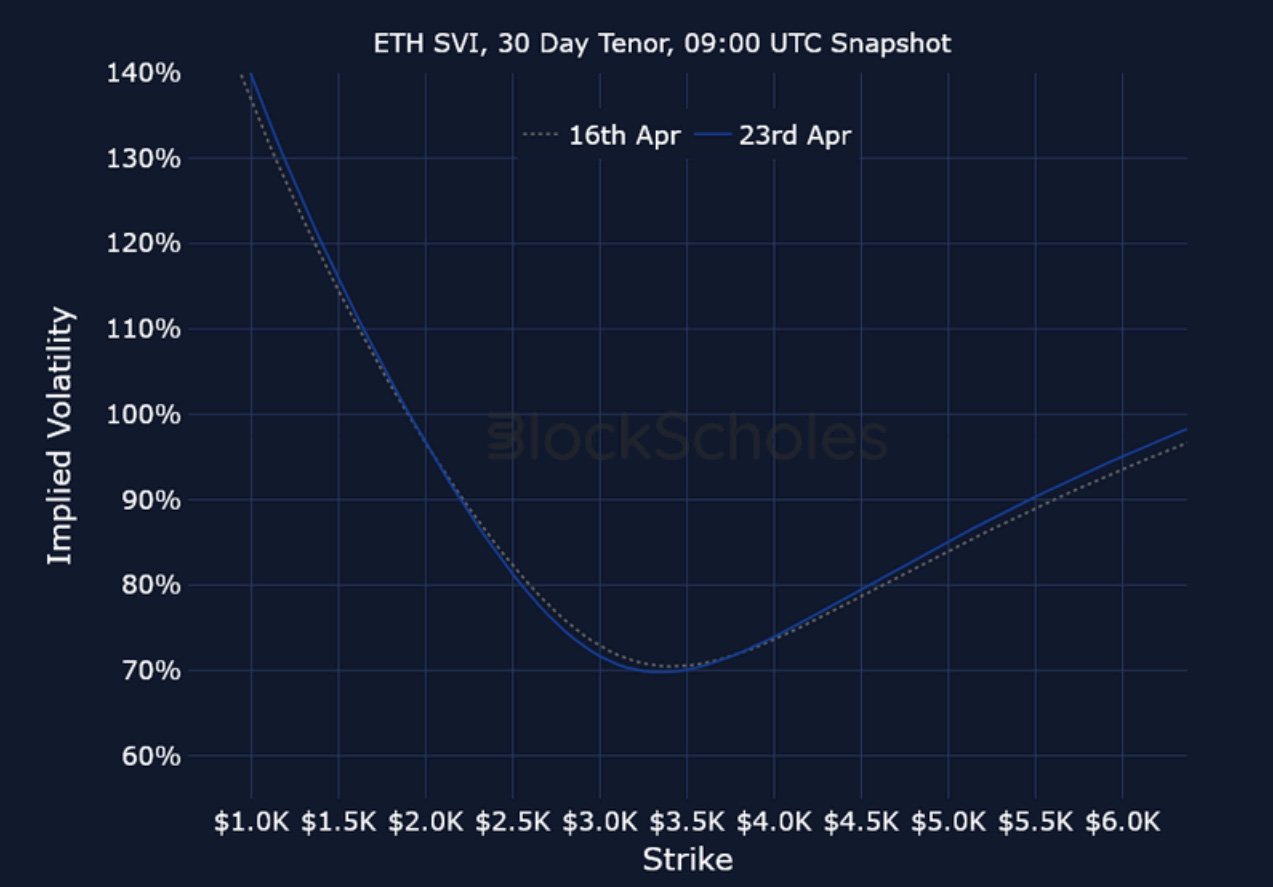

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

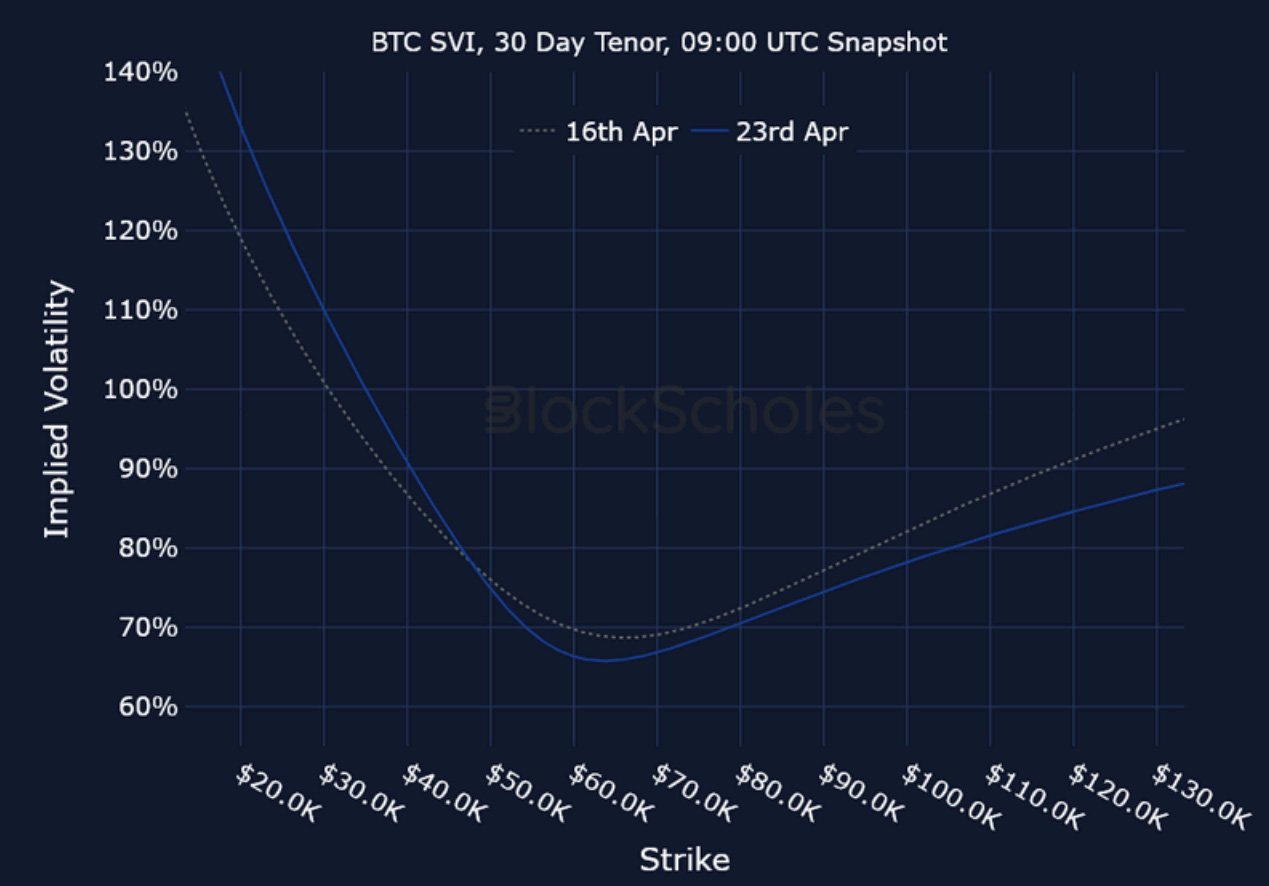

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)