Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The recent turmoil in financial markets amounted to a relief rally as President Trump showed a willingness to negotiate a trade deal with China. That ignited a further spark in BTC’s spot price that had already been rallying even before that, pushing it past $90K. Derivatives markets have not supported the rally, however. BTC funding rates have changed wind, registering two negative spikes after positive readings for most of the month. BTC’s term structure of volatility did not invert either. ETH, which rallied harder, saw stronger support in derivative markets with short-tenor volatility smile skews spiking dramatically higher before paring back slightly.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

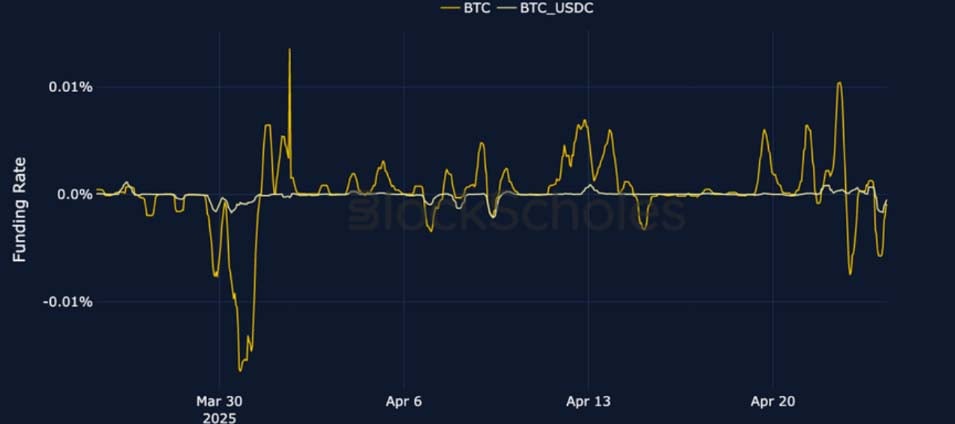

Perpetual Swap Funding Rate

BTC FUNDING RATE – Having not reported the same bearish sentiment this month, BTC now contrasts ETH’s funding rates with two negative spikes.

ETH FUNDING RATE – A deep and persistent period of negative funding rates appears to have tailed off during the most recent spot price rally.

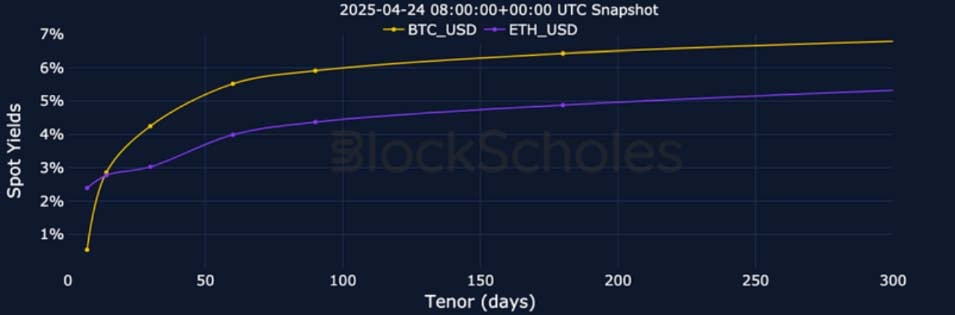

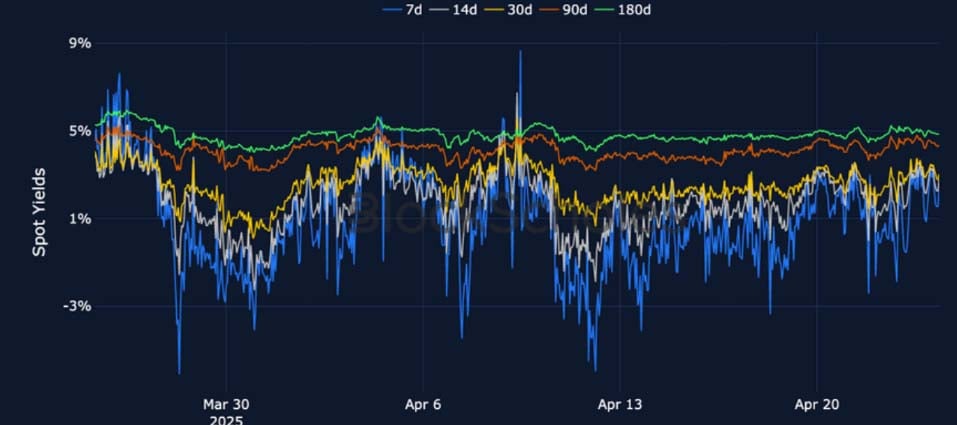

Futures Implied Yields

BTC Futures Implied Yields – Recent recovery rallies in BTC spot price have not been enough to stop the term structure of yields re-steepening.

ETH Futures Implied Yields – ETH spot yields remain noticeably below BTC’s having fallen without recovery on Apr 8, 2025.

BTC Options

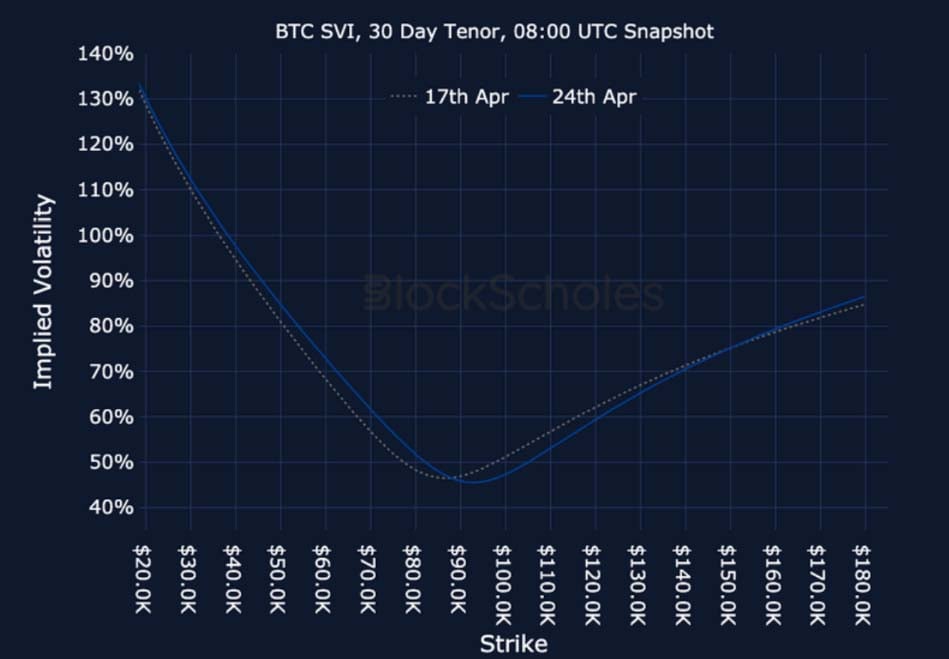

BTC SVI ATM IMPLIED VOLATILITY – BTC’s term structure did not invert, and now trades far steeper than ETH’s.

BTC 25-Delta Risk Reversal – Short-tenor calls see a sharp recovery in demand despite smiles across the term structure since reverting to netural.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – A far smaller inversion of the term structure has resolved with a fall in short-tenor volatility.

ETH 25-Delta Risk Reversal – Short-tenor volatility smile skews have spiked dramatically higher during the rally in spot prices.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

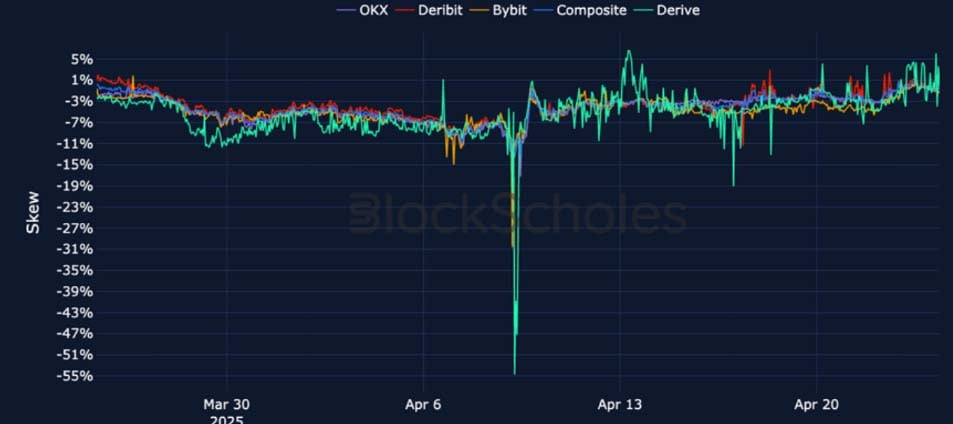

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

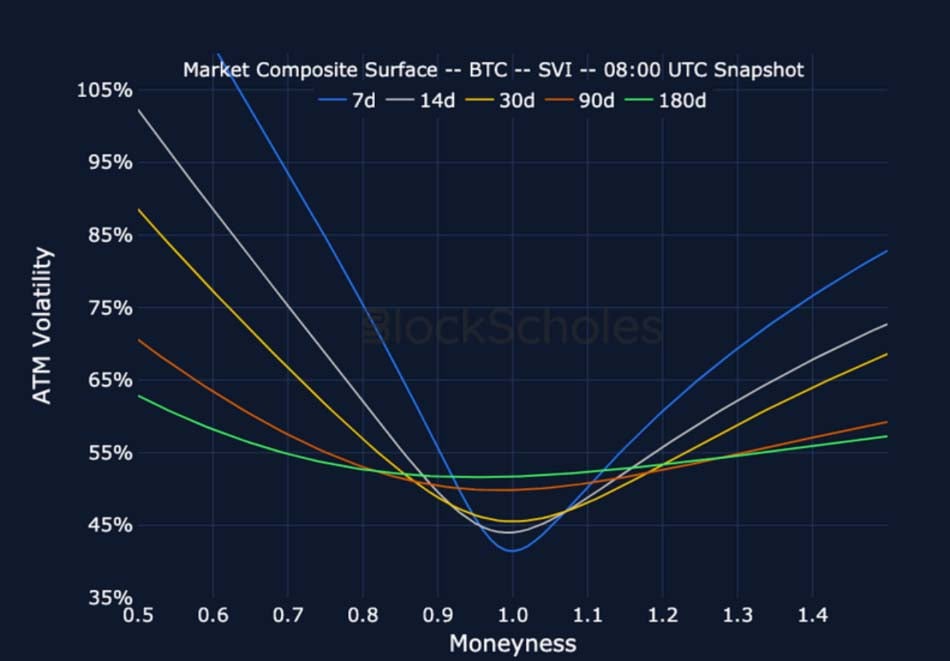

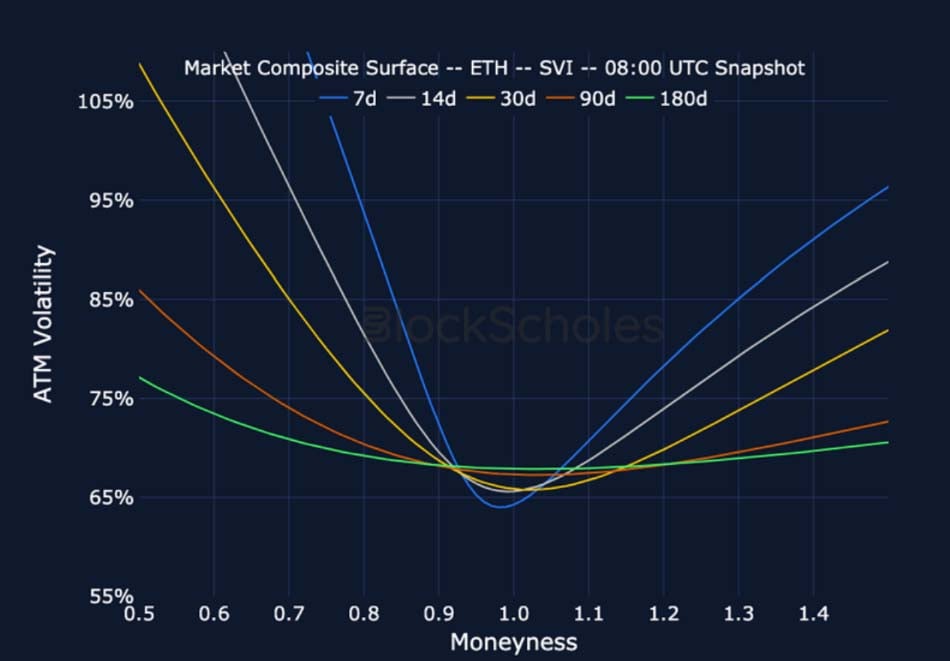

Market Composite Volatility Surface

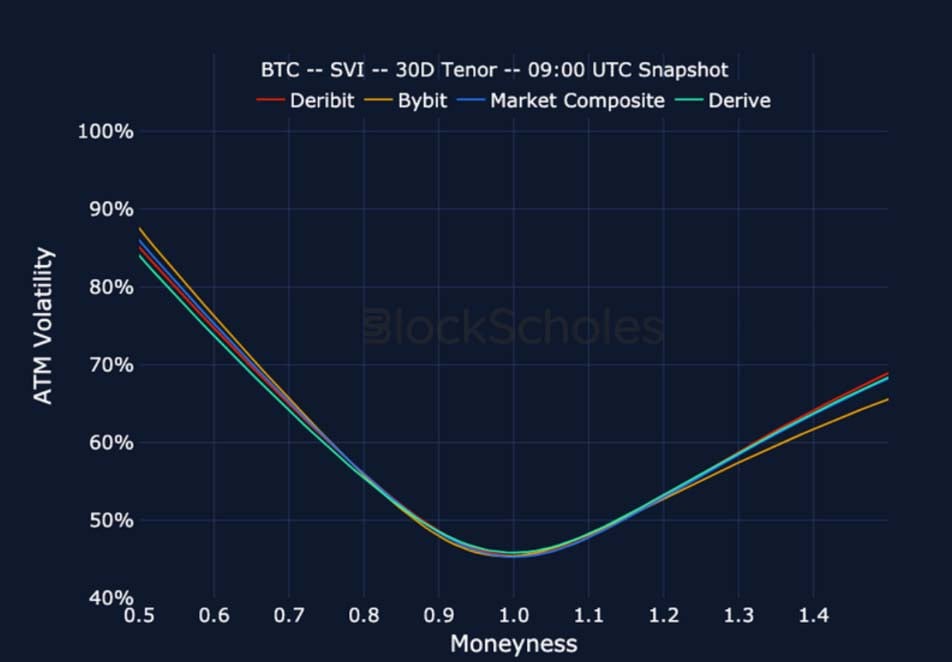

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

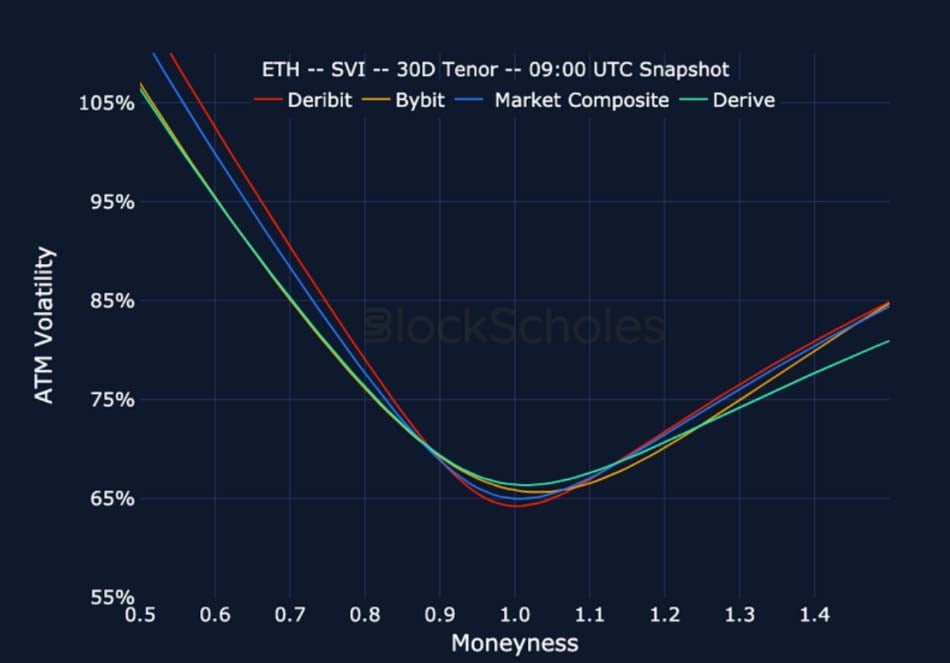

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

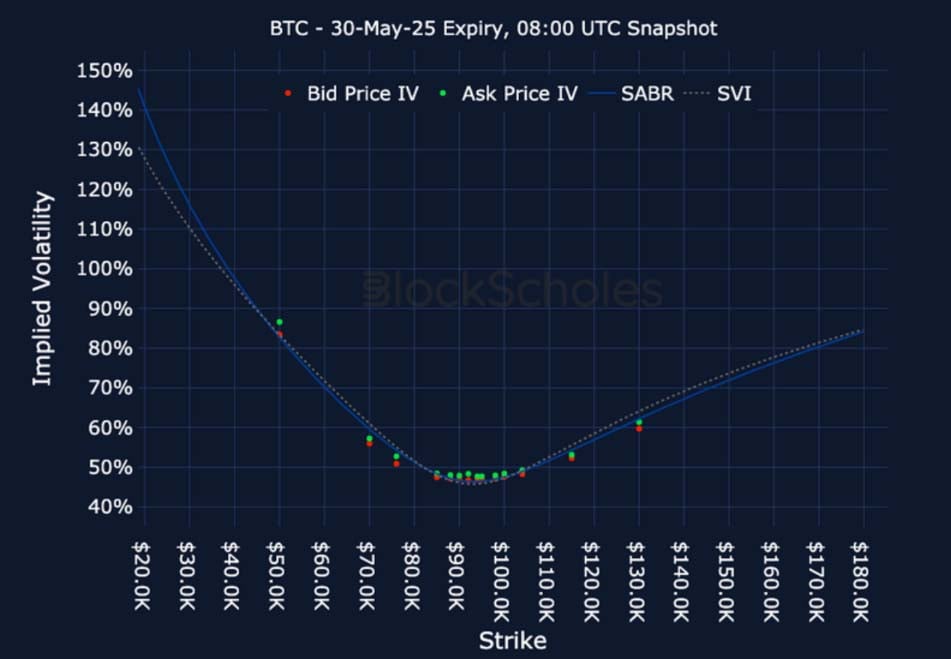

Listed Expiry Volatility Smiles

BTC 30-MAY EXPIRY – 9:00 UTC Snapshot.

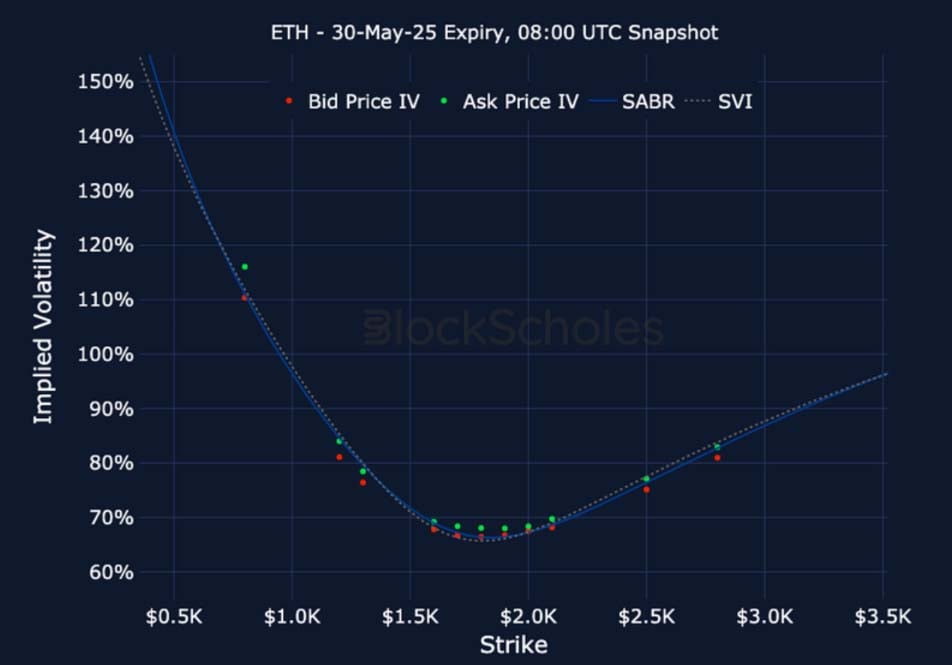

ETH 30-MAY EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)