Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Leverage as indicated by perpetual swap funding rates and futures-implied yields remains much lower than the extremes we saw ahead of the flush-out at the end of March. Implied volatility levels have crashed lower for both tokens and across their term structures, led by a significant under-performance in shorter-dated tenors. Vol smiles remain intermittently skewed towards OTM puts at short tenors as the market appears to brace for further downside in the short term. ETH vols trade some 5 vols higher than BTC’s across the term structure, with both future-implied yields and vol smile skews indicating more bearish positioning than in BTC’s markets, particularly in the short term.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

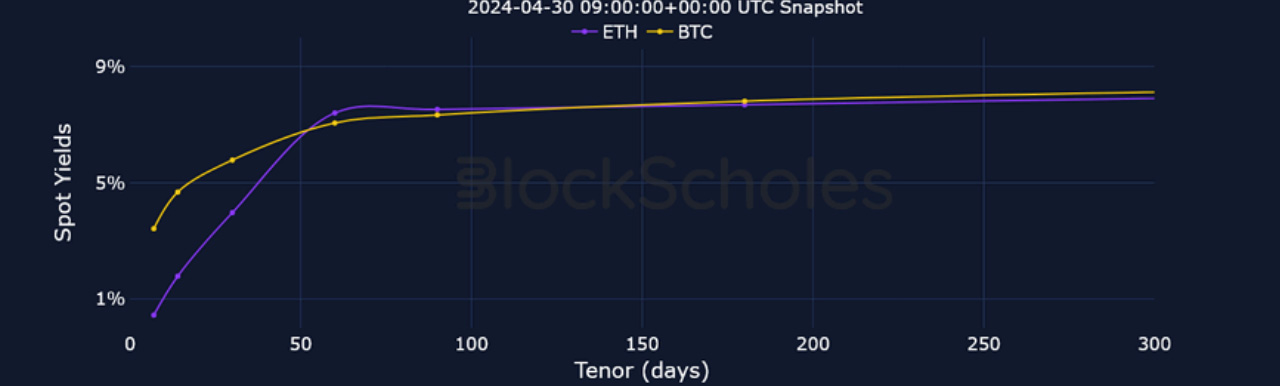

Futures

BTC ANNUALISED YIELDS – yields trade near their month-long lows as spot continues to trade in its $60-70K range.

ETH ANNUALISED YIELDS – trade in a similarly tight range, but at much lower levels for shorter-dated tenors.

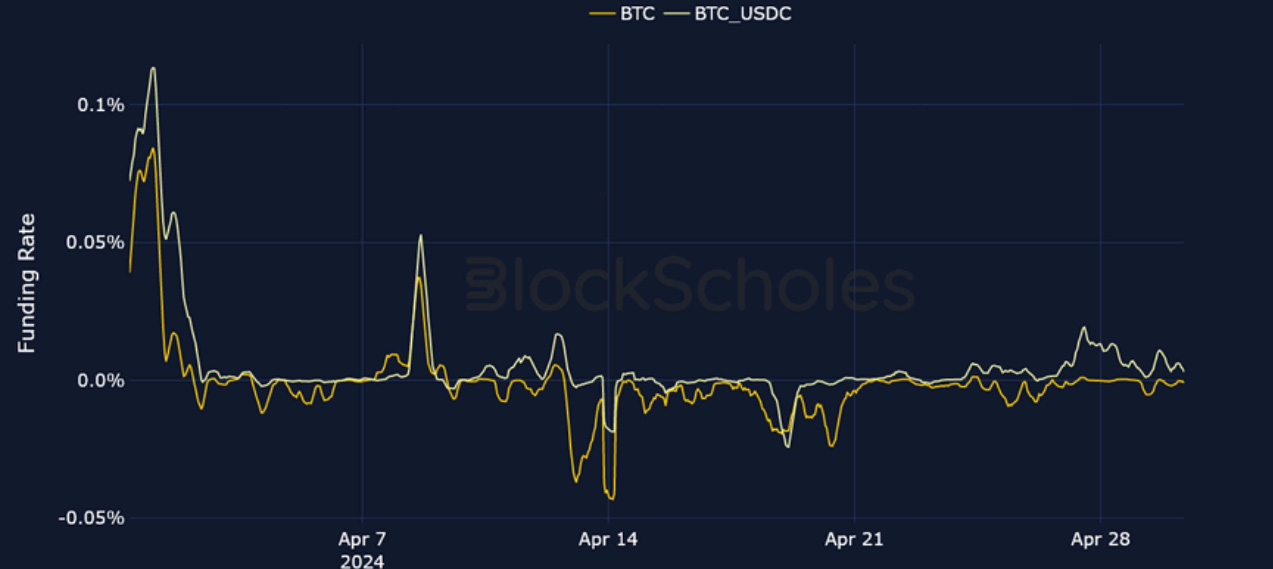

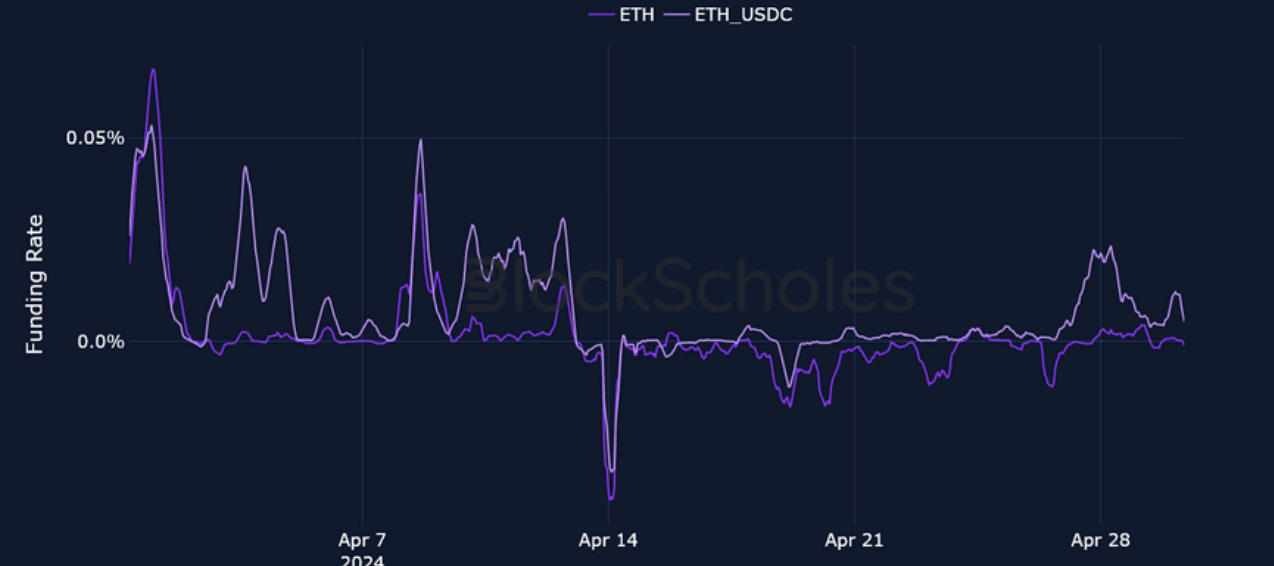

Perpetual Swap Funding Rate

BTC FUNDING RATE – remains close to zero as demand for leveraged exposure remains low following the flush-out one month ago.

ETH FUNDING RATE – indicates slightly higher rates in the more illiquid USDC-margined token, with the token-settled rate remaining close to zero.

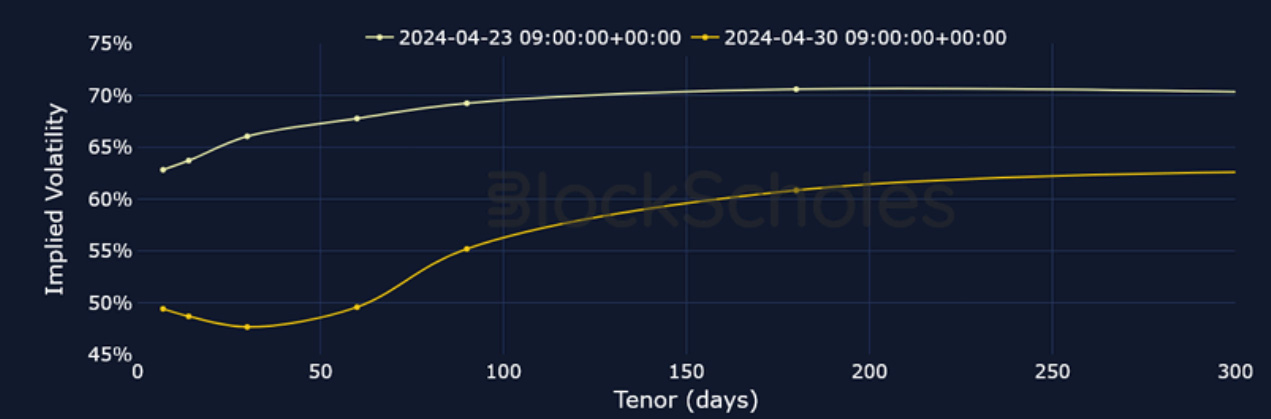

BTC Options

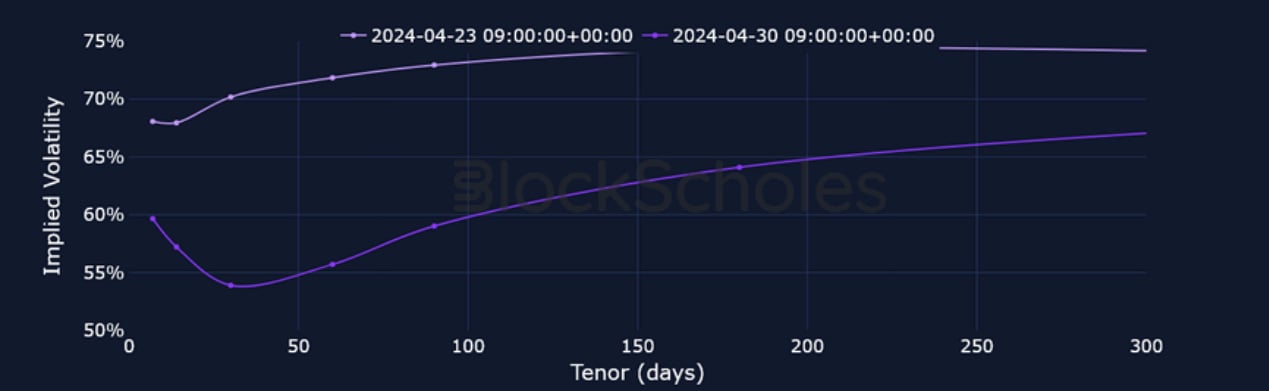

BTC SVI ATM IMPLIED VOLATILITY– volatility levels have collapsed over the last week, lead by under-performing vol at shorter-dated tenors.

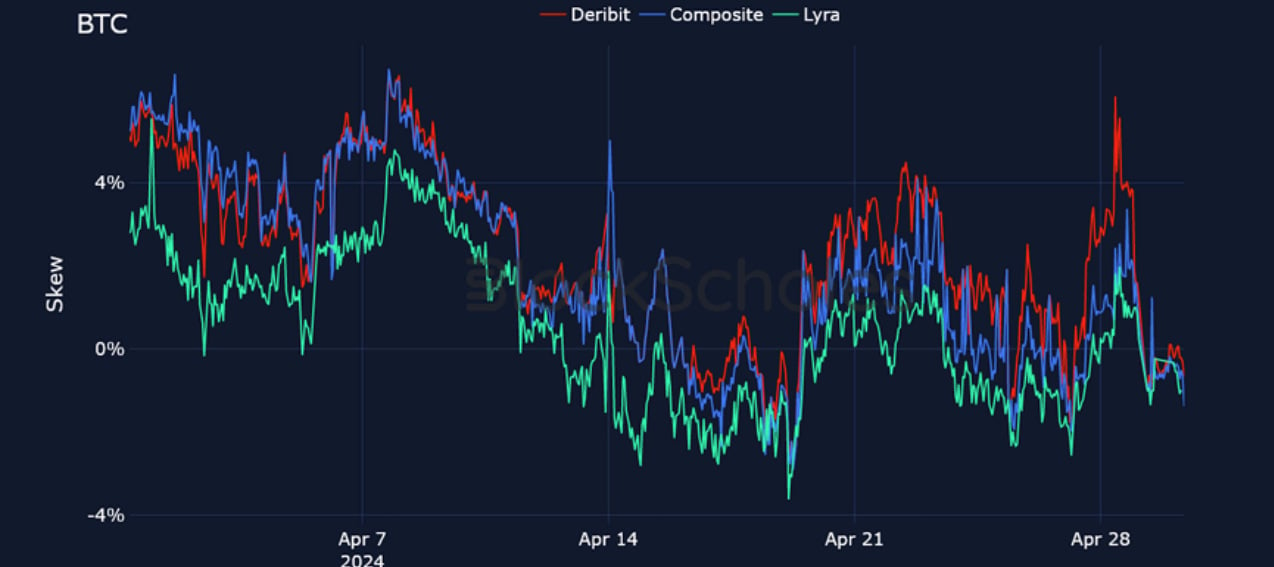

BTC 25-Delta Risk Reversal – short-dated smiles have skewed towards puts intermittently over the last month.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – despite falling at a similar clip to BTCs ETH vols remain elevated by around 5 vols across the term structure.

ETH 25-Delta Risk Reversal – reports a persistent tilt towards OTM puts at shorter-dated tenors over the last month.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

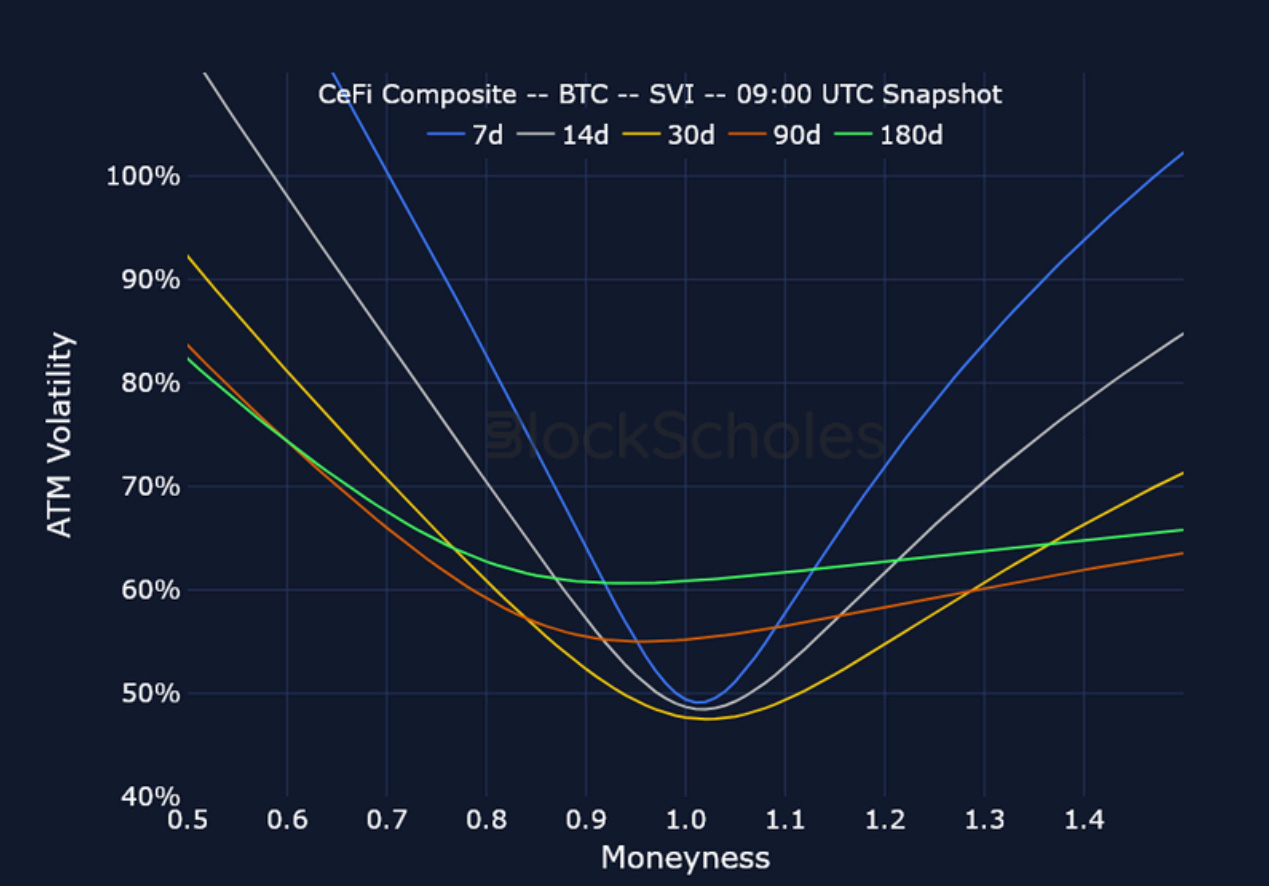

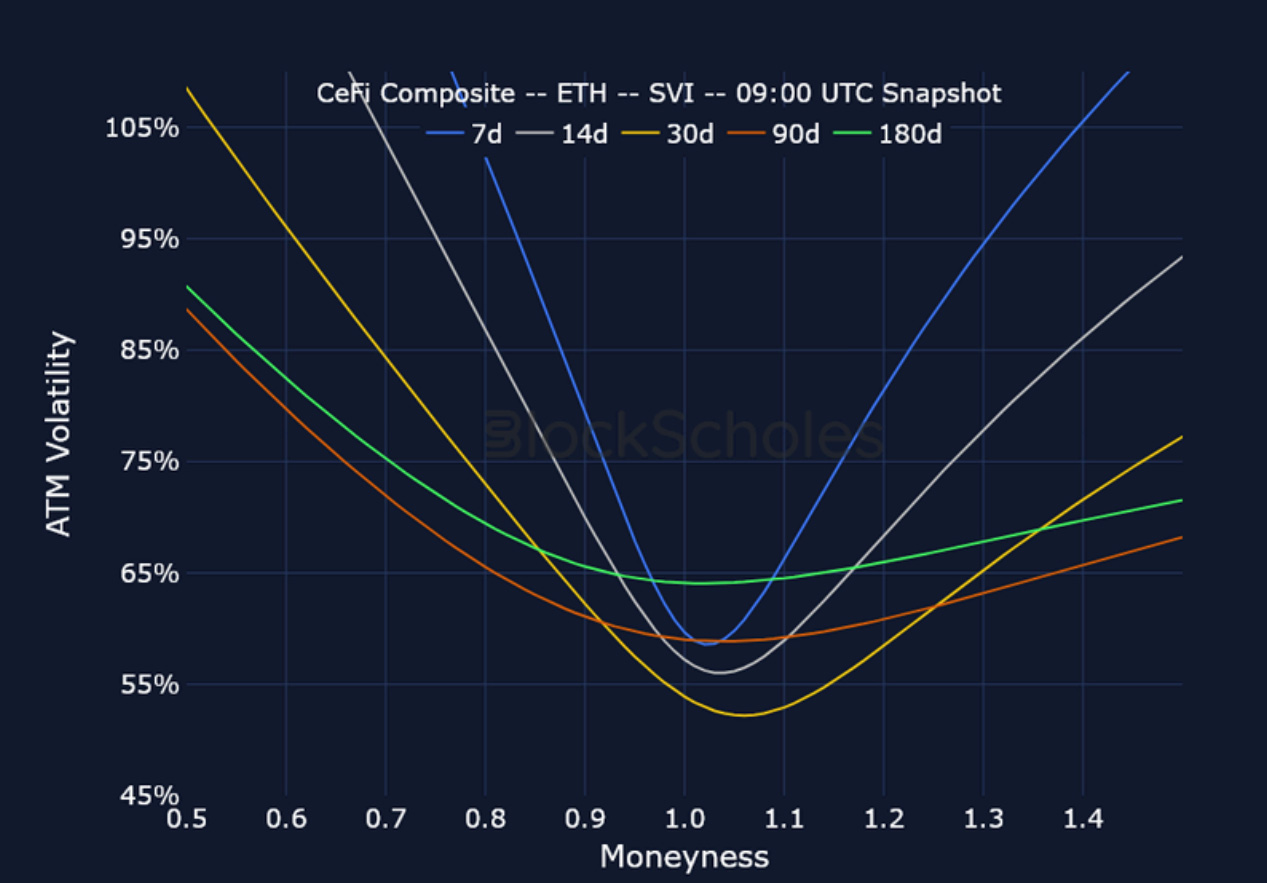

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

Listed Expiry Volatility Smiles

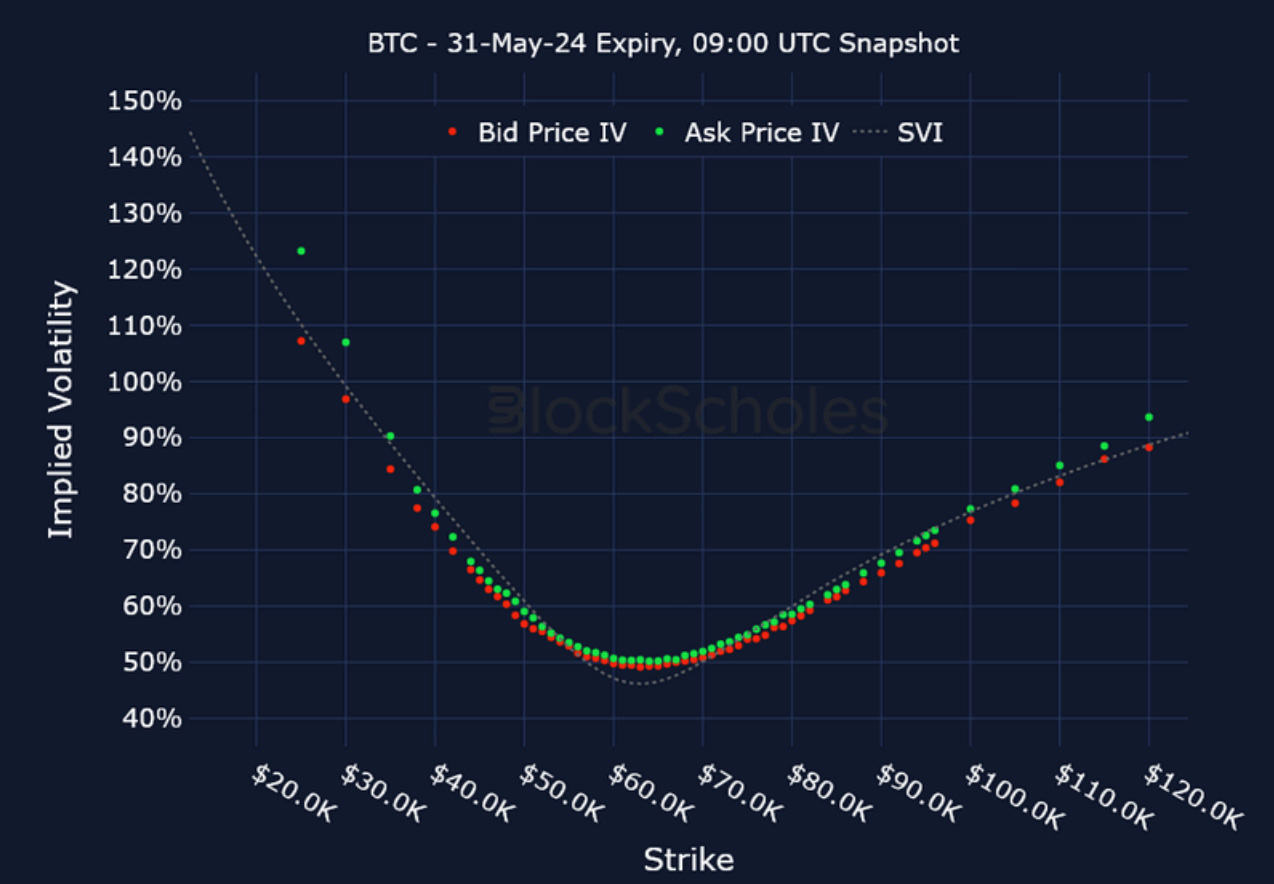

BTC 31-MAY EXPIRY– 9:00 UTC Snapshot.

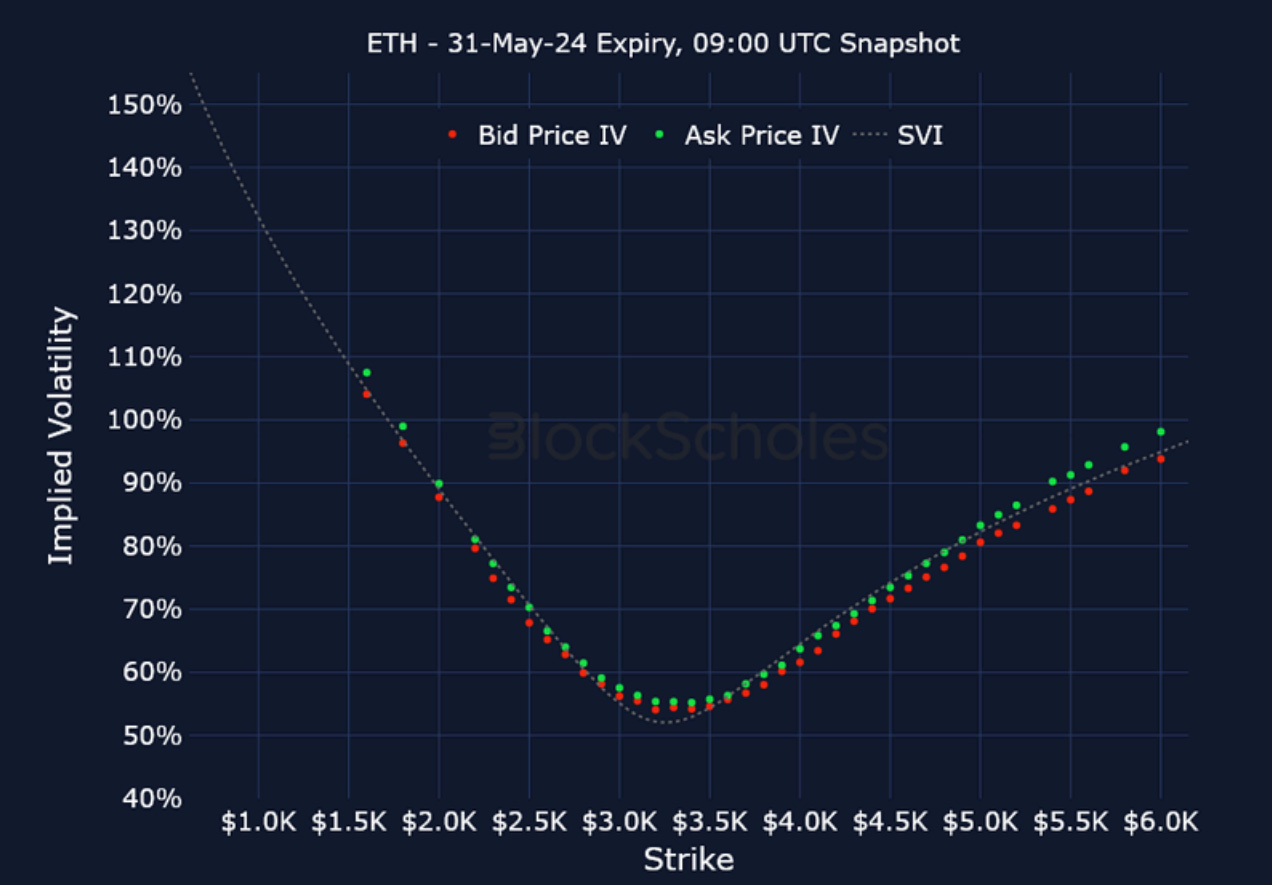

ETH 31-MAY EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

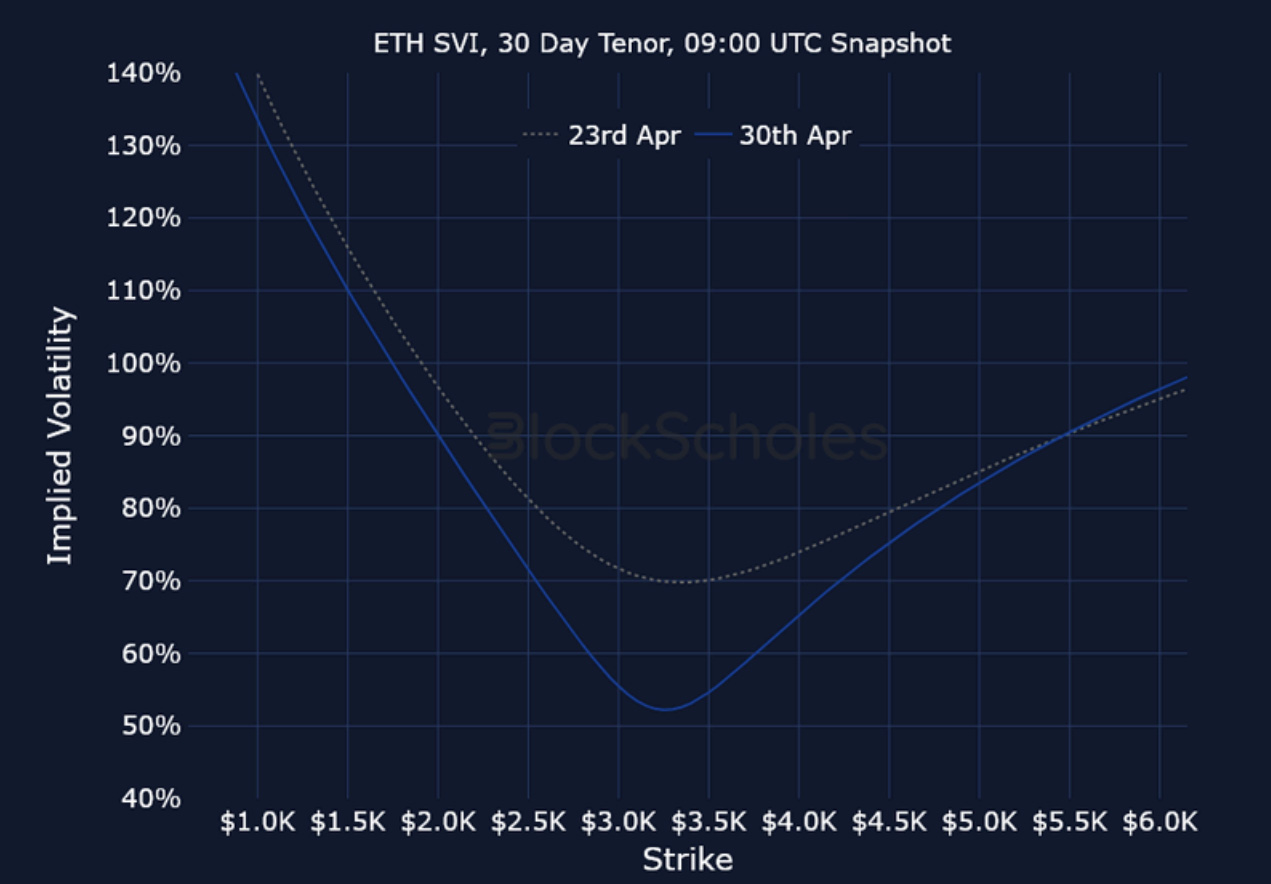

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)