Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Volatility has fallen following the recent spot sell-off, during which implied vol at short-dated tenors had spiked above longer-dated tenors and inverted the term structure. ETH continues to trade between 5-10 vols higher than BTC. In addition, the sell-off in spot saw a strong skew towards puts in both majors as investors became concerned with buying OTM puts for downside protection. This has since recovered – due to the selling of OTM puts – although ETH’s skew trades slightly lower than BTC at short-dated tenors, indicating more bearish positioning. Leverage as indicated by perpetual swap funding rates and futures- implied yields has increased slightly, but still remains far below the extremes observed in March.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

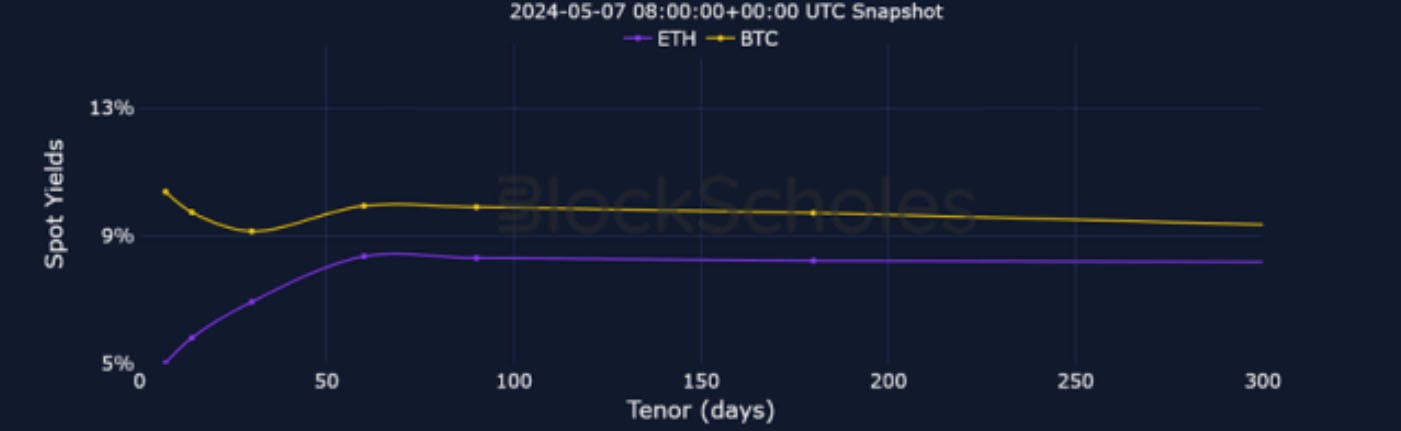

Futures

BTC ANNUALISED YIELDS – yields at tenors 1M and below rose sharply above longer-dated tenors, indicating demand for leveraged long exposure.

ETH ANNUALISED YIELDS – similar behaviour can be observed in ETH, although it trades slightly lower than BTC at short-dated tenors.

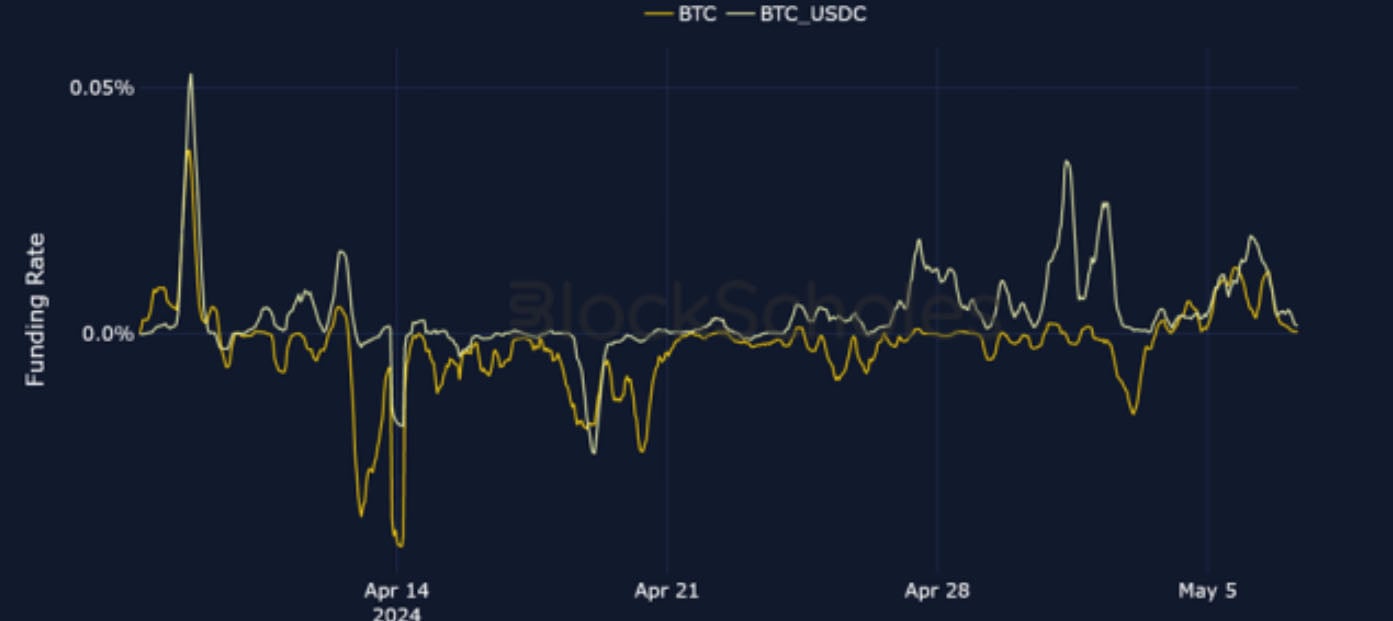

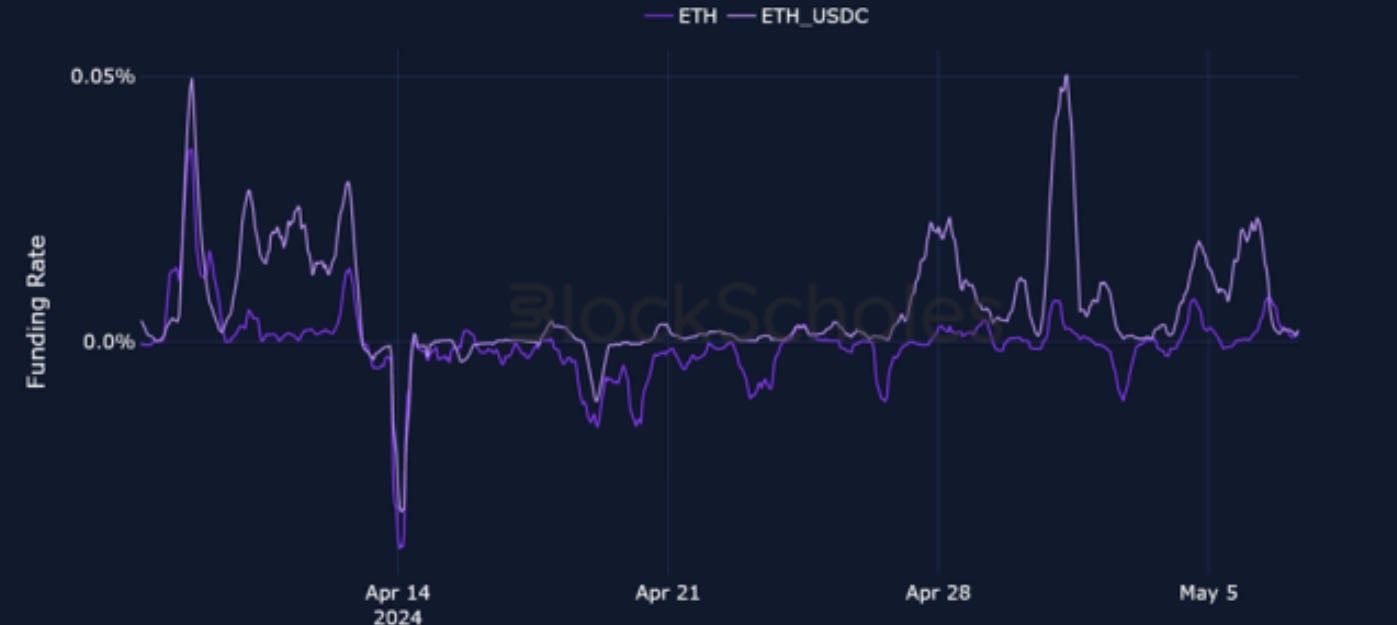

Perpetual Swap Funding Rate

BTC FUNDING RATE – currently close to zero, but has traded positively over the past week as demand for leveraged long exposure increases.

ETH FUNDING RATE – has traded positively over the past week, with the more illiquid USDC-margined token trading higher than the token-settled rate, although both currently trade near zero.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – the term structure became inverted briefly as vol at short-dated tenors spiked, followed by a continuance of the downward trend observed before BTC sold off.

BTC 25-Delta Risk Reversal – short-dated smiles skewed heavily towards puts during the sell off, before recovering.

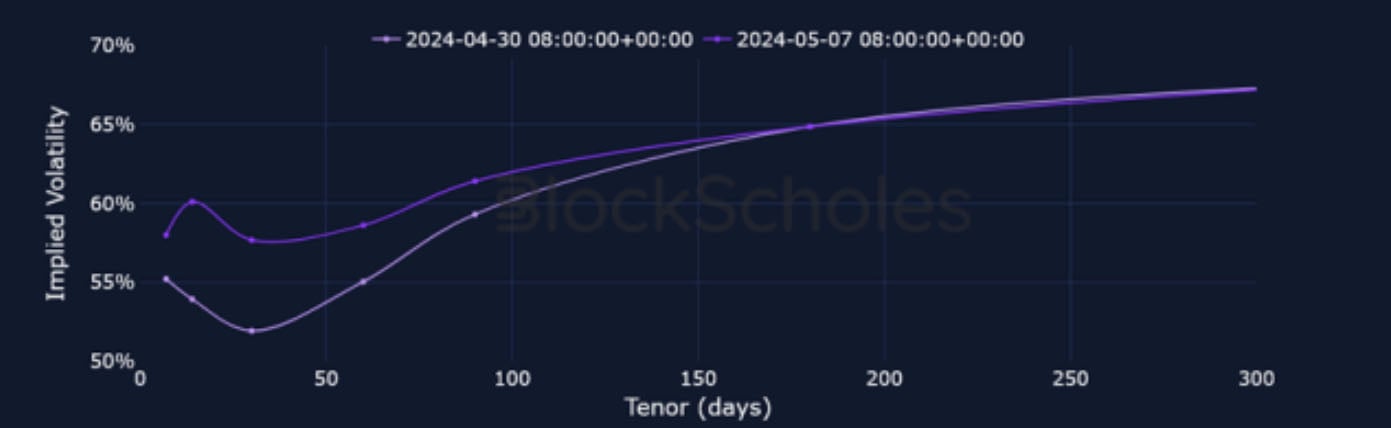

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – despite spiking in a similar fashion to BTC, ETH vols trade 5-10 vols higher than BTC, across the term structure.

ETH 25-Delta Risk Reversal – skew has recovered following the increased demand for downside protection during the spot price sell off.

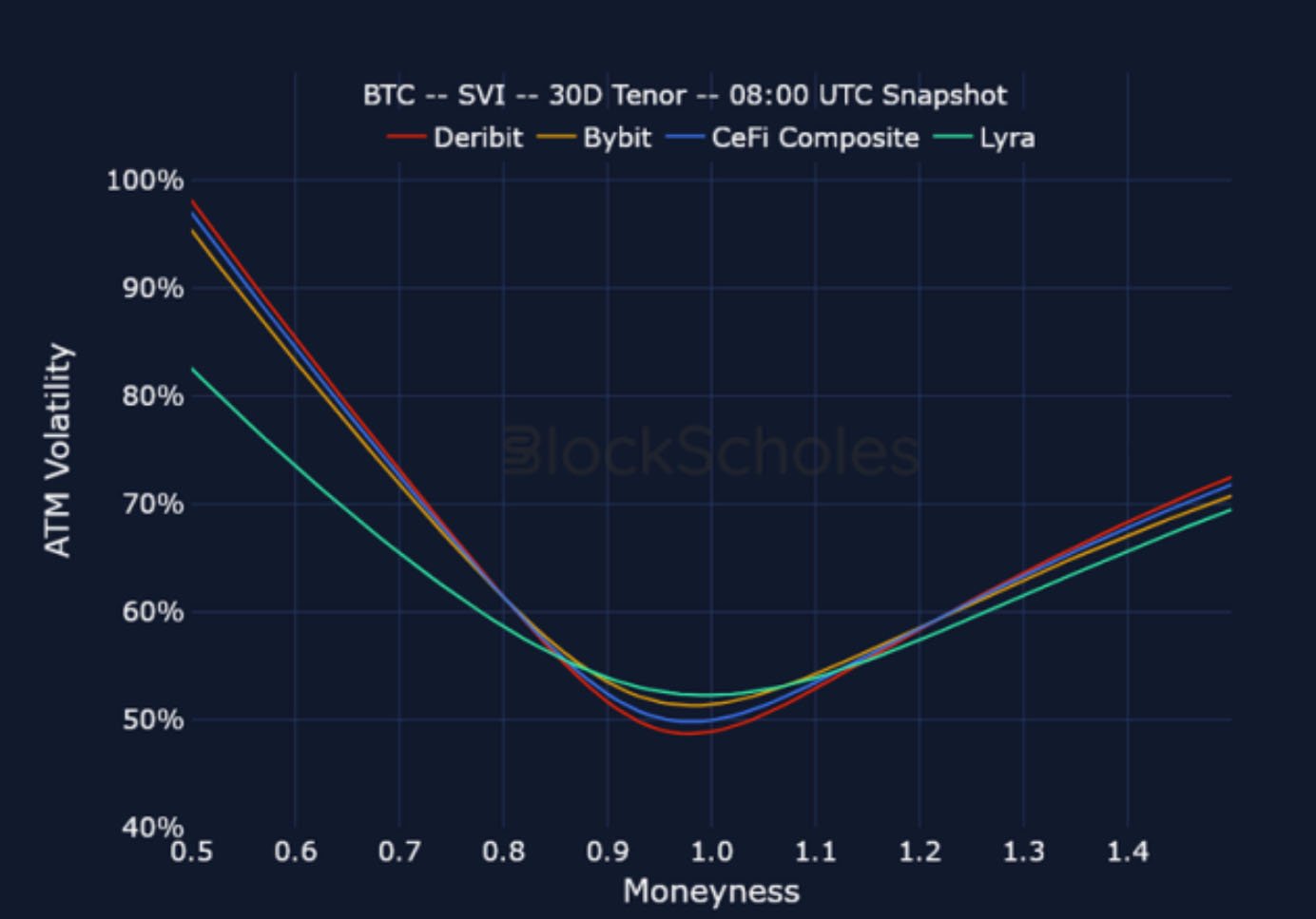

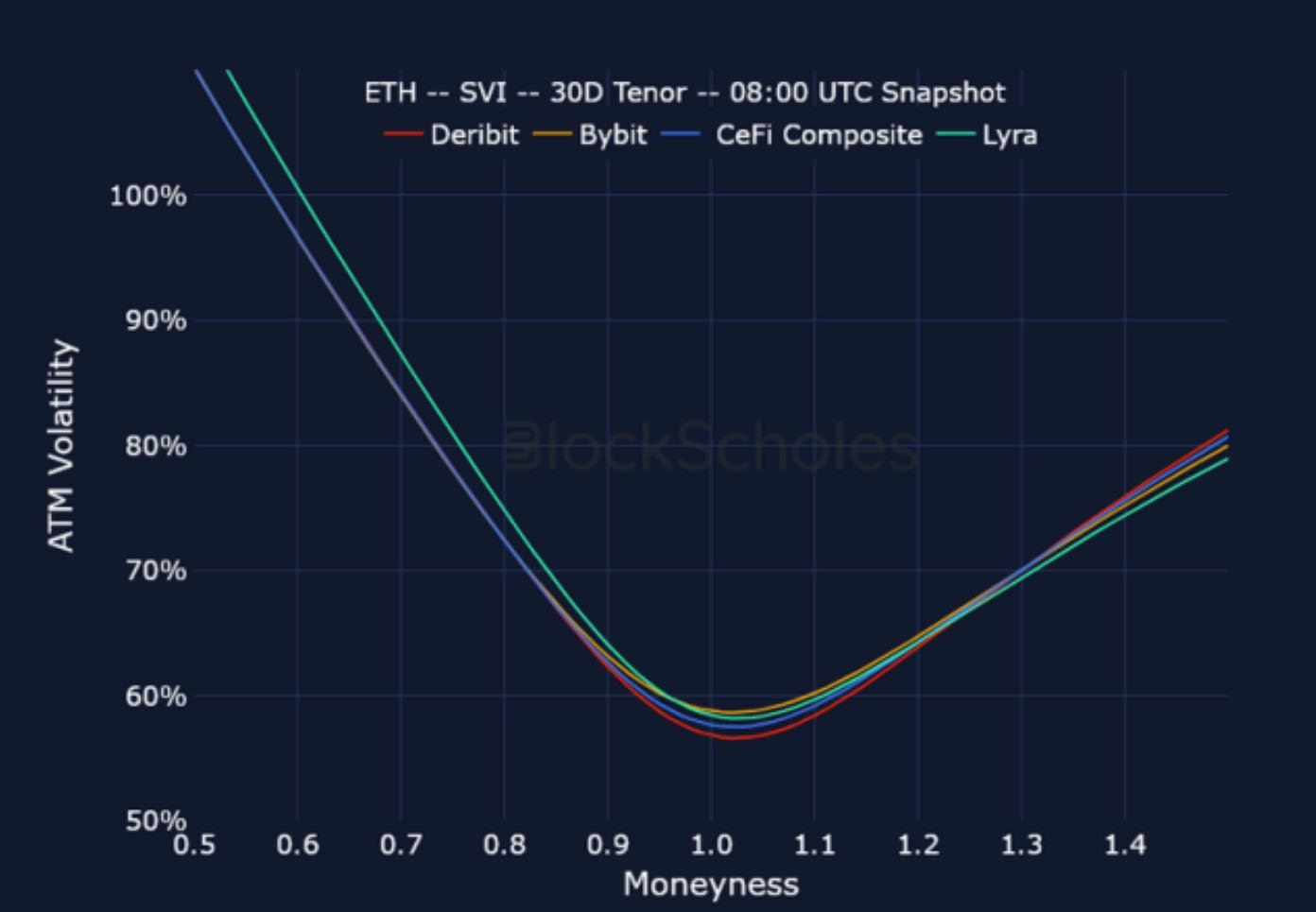

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 8:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 8:00 UTC Snapshot.

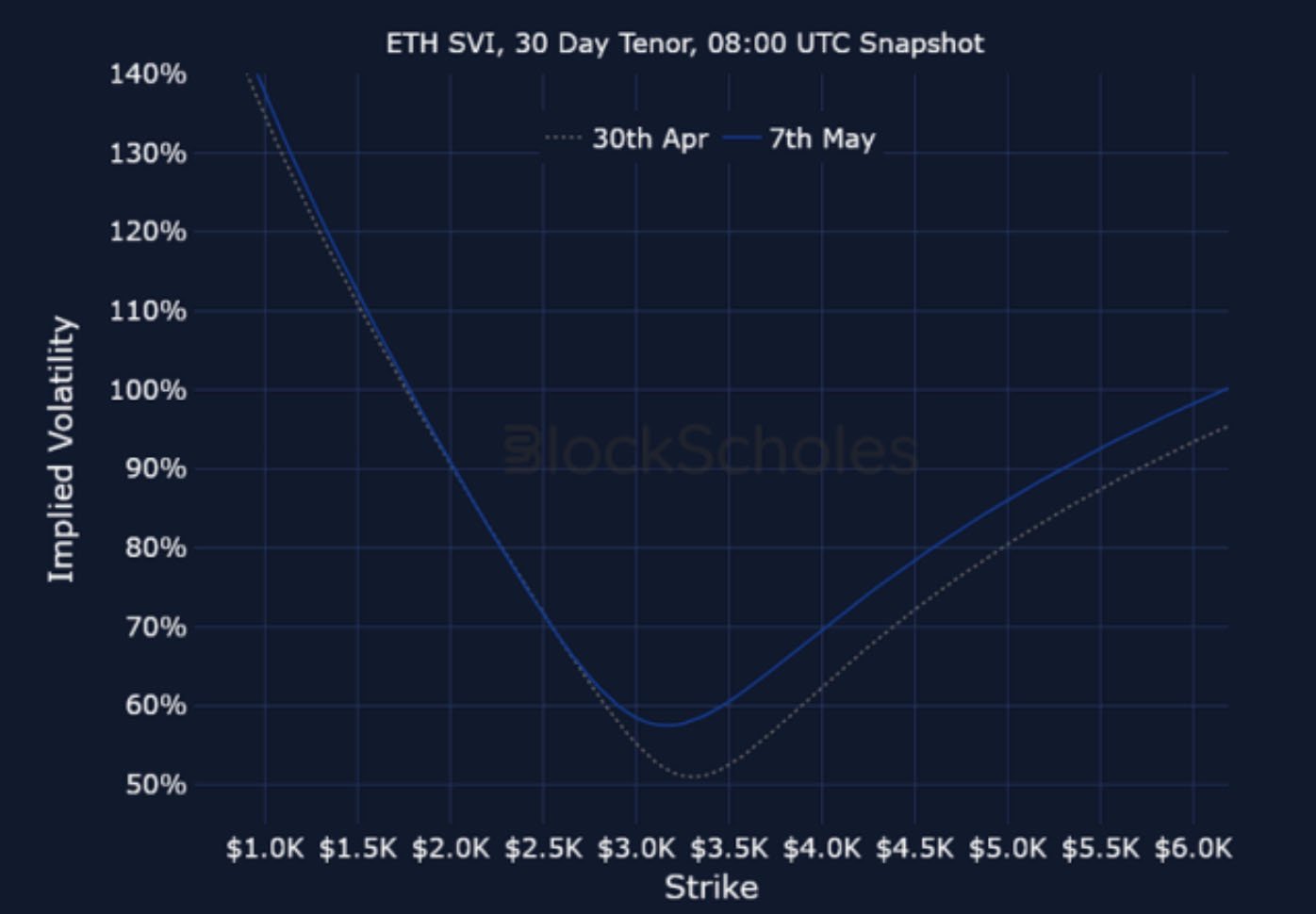

Listed Expiry Volatility Smiles

BTC 31-MAY EXPIRY– 8:00 UTC Snapshot.

ETH 31-MAY EXPIRY – 8:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

AUTHOR(S)