Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

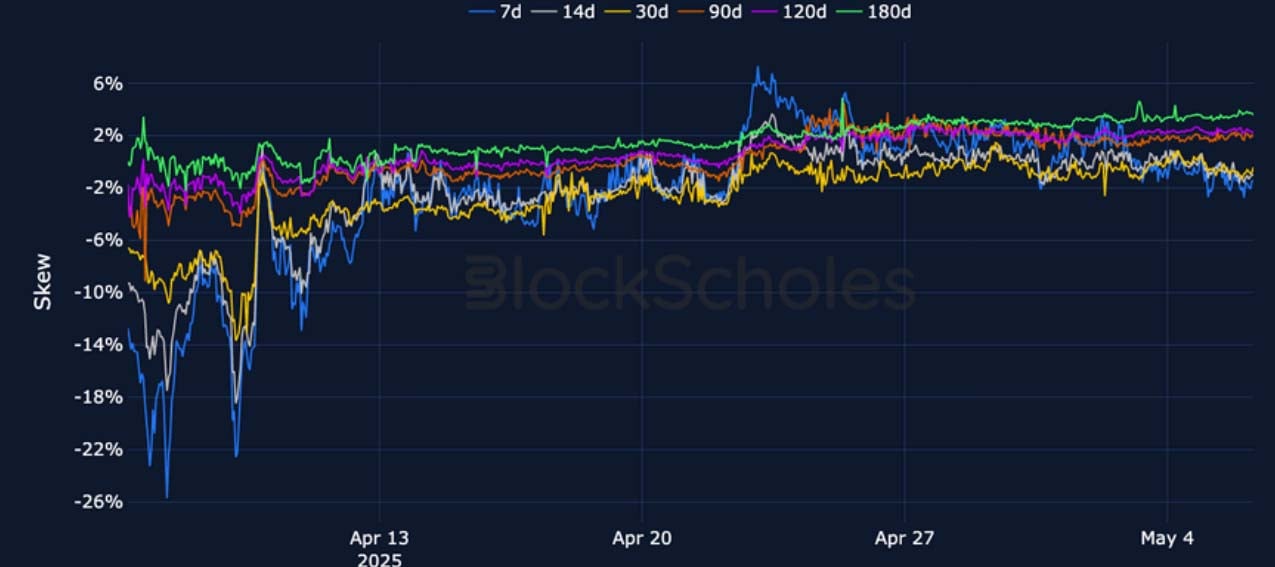

Implied volatility has dropped off from its April levels despite the potential for continued erratic trade policy in the US: the newest development involves a 100% tariff on all foreign- made films. BTC has stabilised above $90K, while risk US equities ended a nine-day consecutive win streak. BTC’s derivatives markets show some evidence of downward momentum: futures yields, while at a healthy 4%, have dropped off from 8% at the start of the month, 7-day implied volatility is approaching its 18-month floor of 35%, and short-dated volatility smiles are skewed less strongly towards OTM calls then they were at the end of April.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

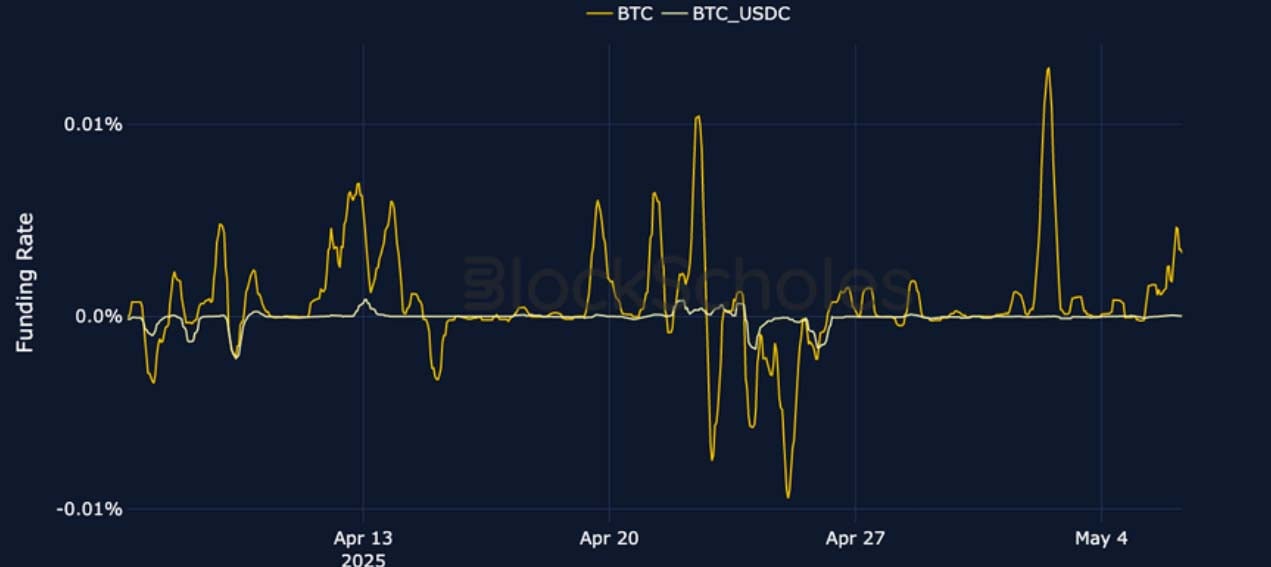

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC funding rates have recovered into positive territory having ended April with strong negative spikes.

ETH FUNDING RATE – Funding rates for ETH remain flat and close to neutral despite volatility smile skews tilting towards puts at shorter tenors.

Futures Implied Yields

BTC Futures Implied Yields – The futures yield term structure remains positively sloped for BTC, though has a far flatter slope compared to ETH.

ETH Futures Implied Yields – ETH futures yields have risen from their end of April lows however still trade lower and steeper compared to BTC.

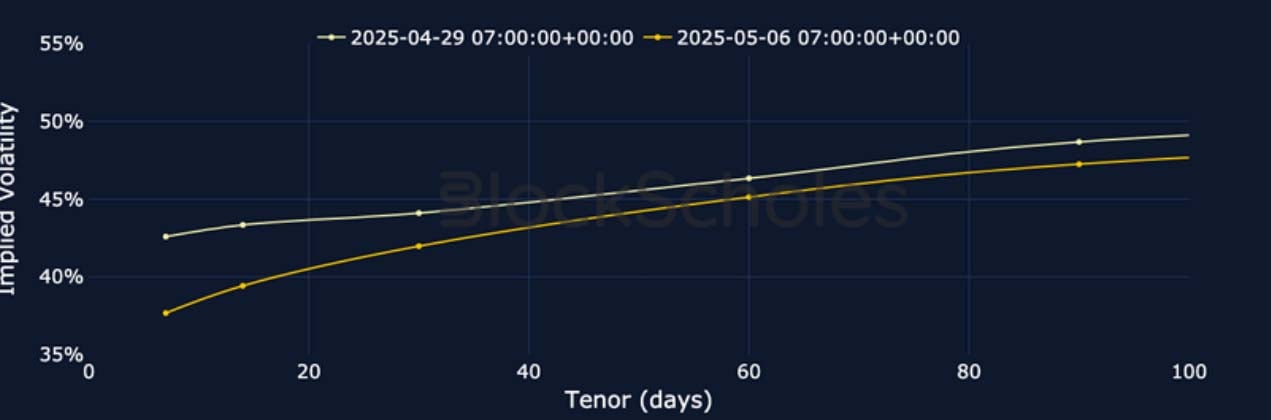

BTC Options

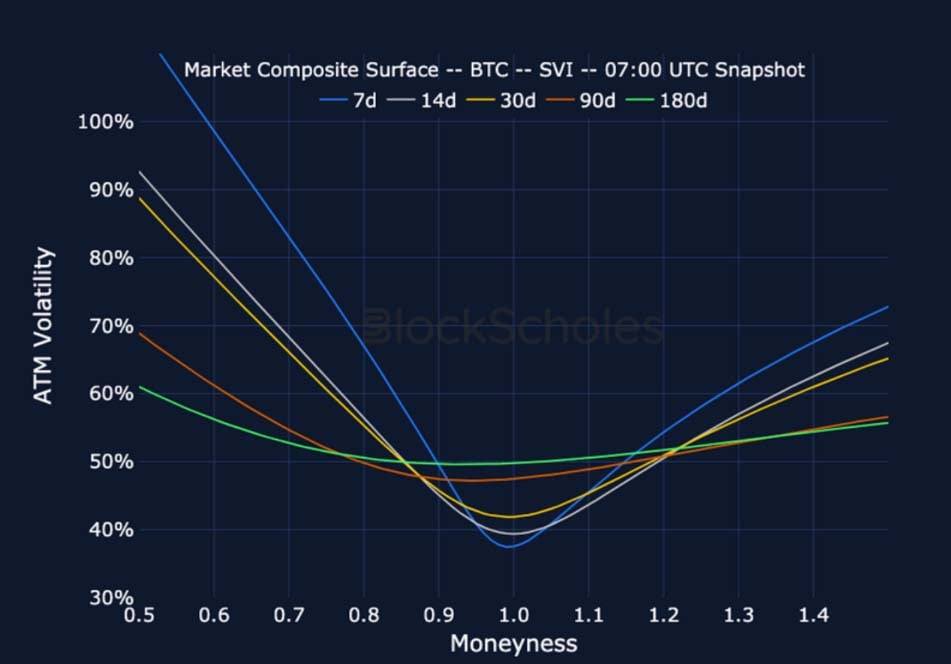

BTC SVI ATM IMPLIED VOLATILITY – BTC’s volatility term structure has lost some of its steepness from last week, as front-end volatility has dropped off.

BTC 25-Delta Risk Reversal – The premium previously assigned to out-the- money BTC calls has now dropped to neutral for short-tenors.

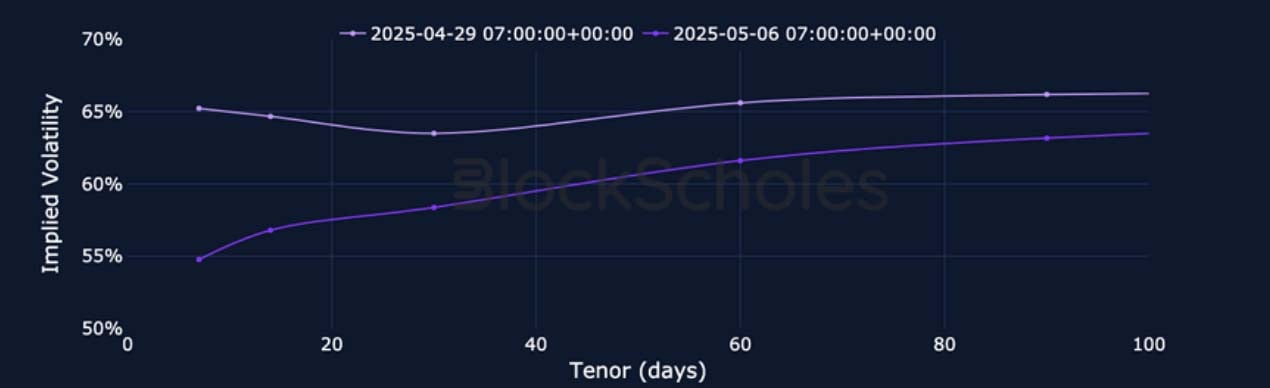

ETH Options

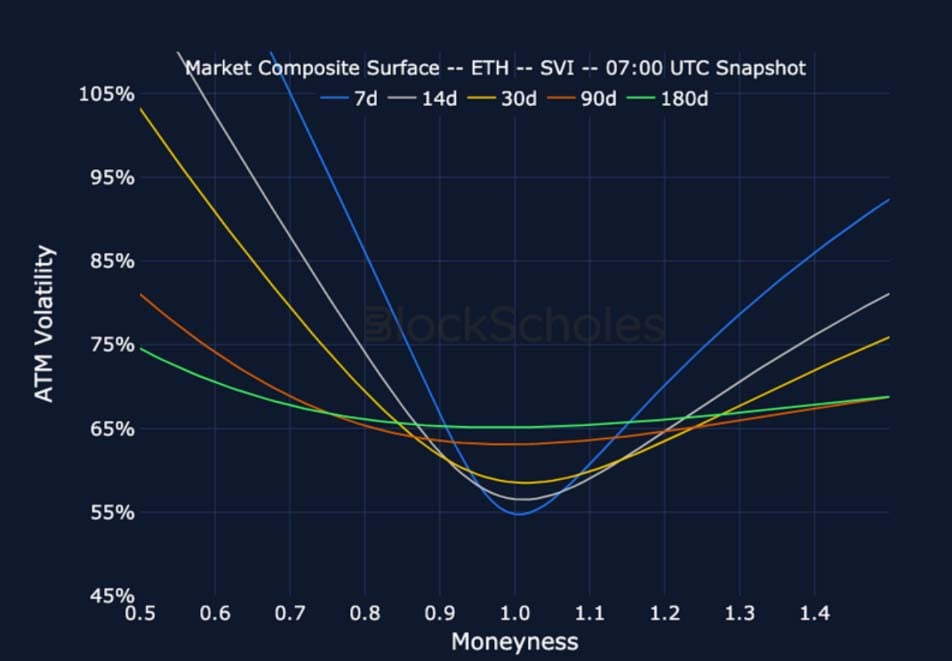

ETH SVI ATM IMPLIED VOLATILITY – Volatility across ETH’s term structure continues to leak downwards, as with BTC.

ETH 25-Delta Risk Reversal – While short-tenor BTC skews have moved towards neutral, front-end skew for ETH is now tilted towards OTM puts.

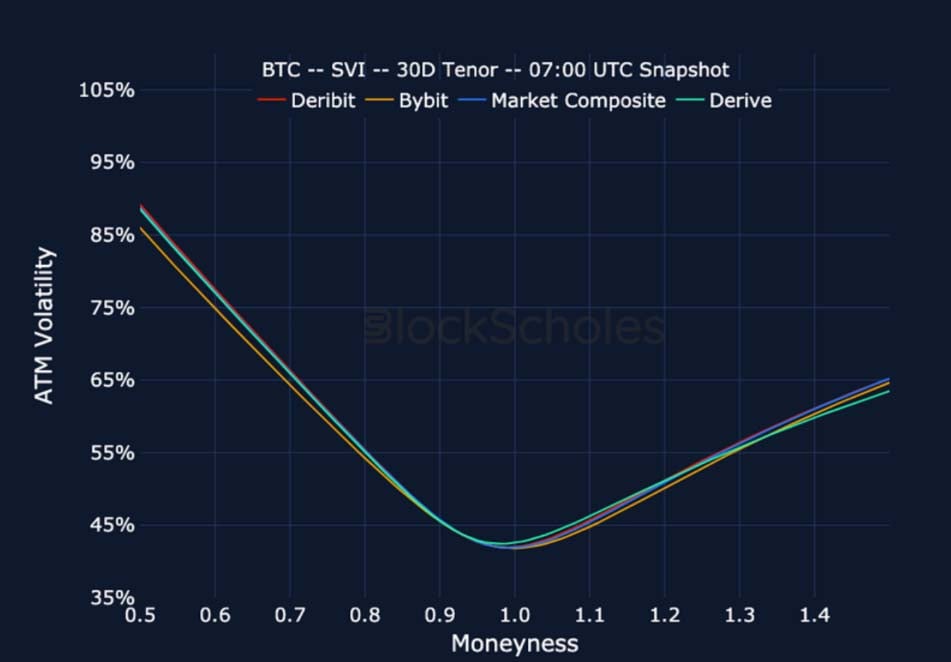

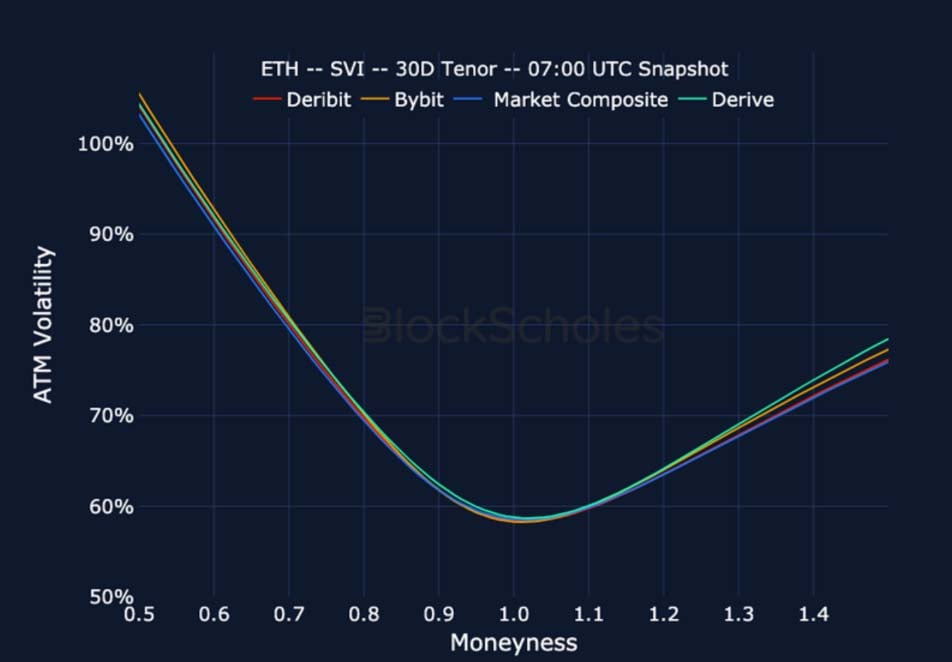

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

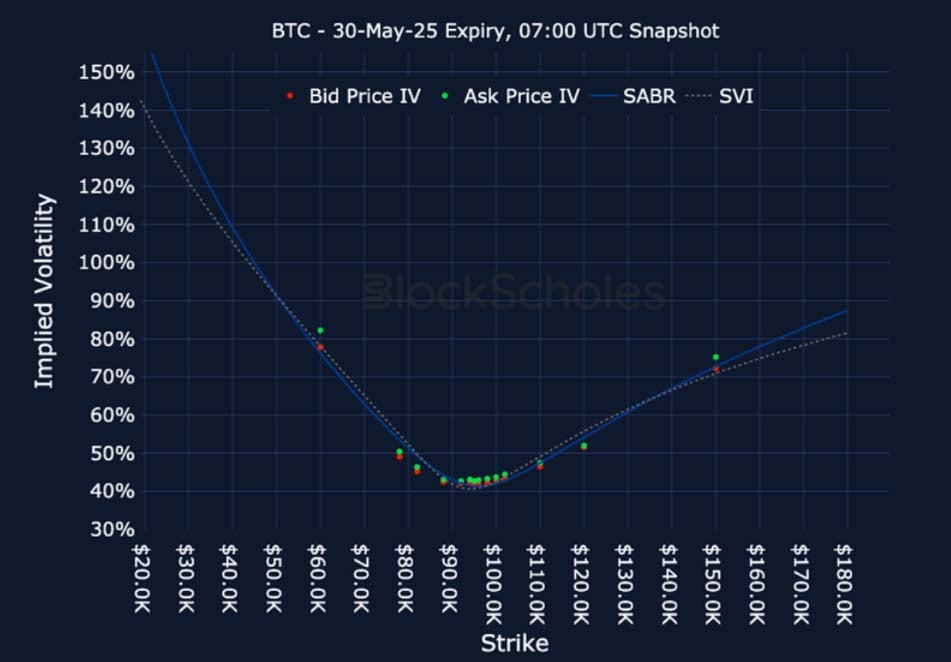

Listed Expiry Volatility Smiles

BTC 30-MAY EXPIRY – 9:00 UTC Snapshot.

ETH 30-MAY EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

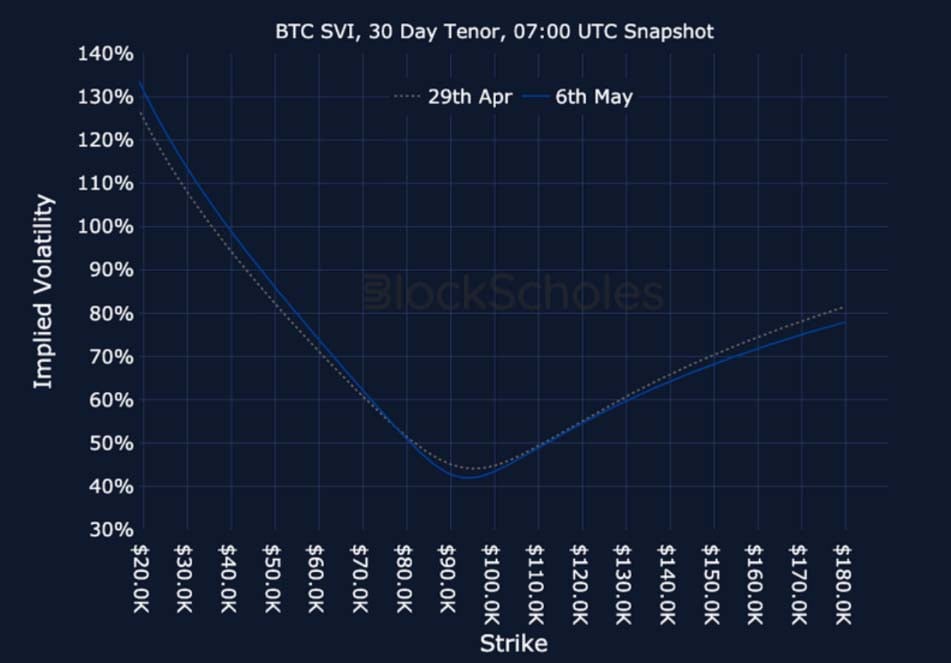

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)