Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

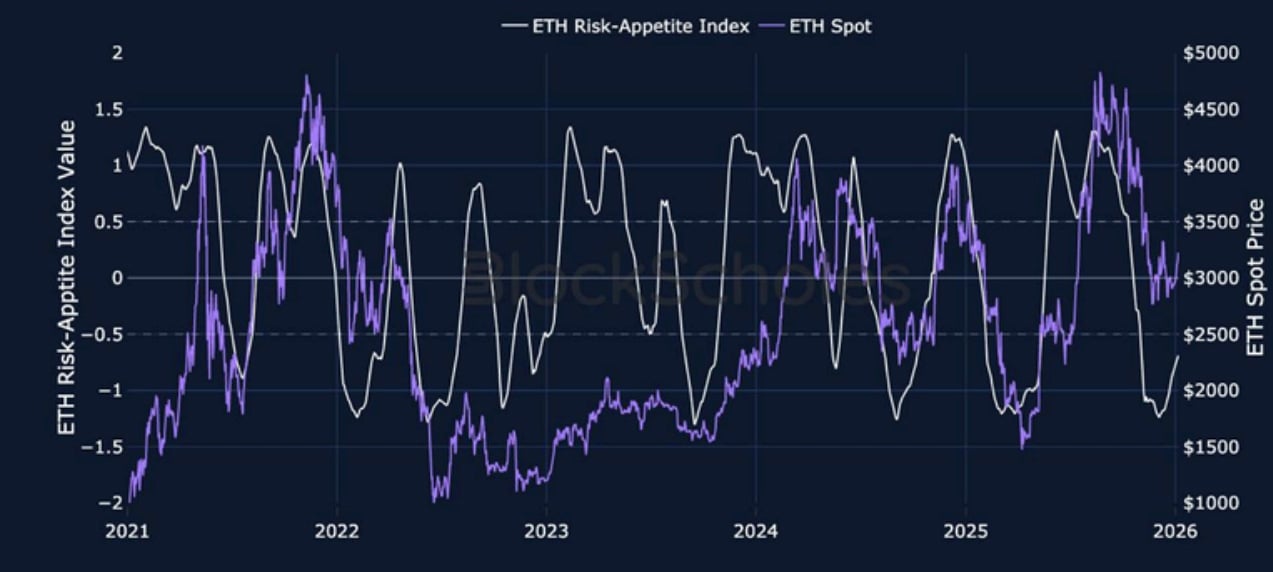

The volatility lull over the Christmas holiday period was slightly disrupted by a wave of weekend airstrikes and the capture of Venezuelan President Nicolás Maduro by the US. That resulted in 7-day ATM IV levels for BTC and ETH jumping 10 and 13 vol points respectively over the weekend. Despite the increased volatility, risk-assets rallied alongside precious metals. BTC is up 7.7% over the past week, while ETH is up more than 10%. The rebound in crypto spot prices has also coincided with early signs of recovering sentiment in Spot Bitcoin and Ethereum ETF inflows. On Monday, Spot BTC ETFs made their largest single-day purchase of BTC since October 7, 2025 ($697.2M). Perpetual funding rates have also been firmly positive over the past week, while the futures curve for BTC has inverted, as traders show a willingness to pay a premium over spot price for leveraged long exposure in the short- term. Our in-house Risk Appetite Index has also continued to tick higher, after forming a local bottom in the tail- end of last year.

Block Scholes BTC Risk Appetite Index

Block Scholes ETH Risk Appetite Index

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

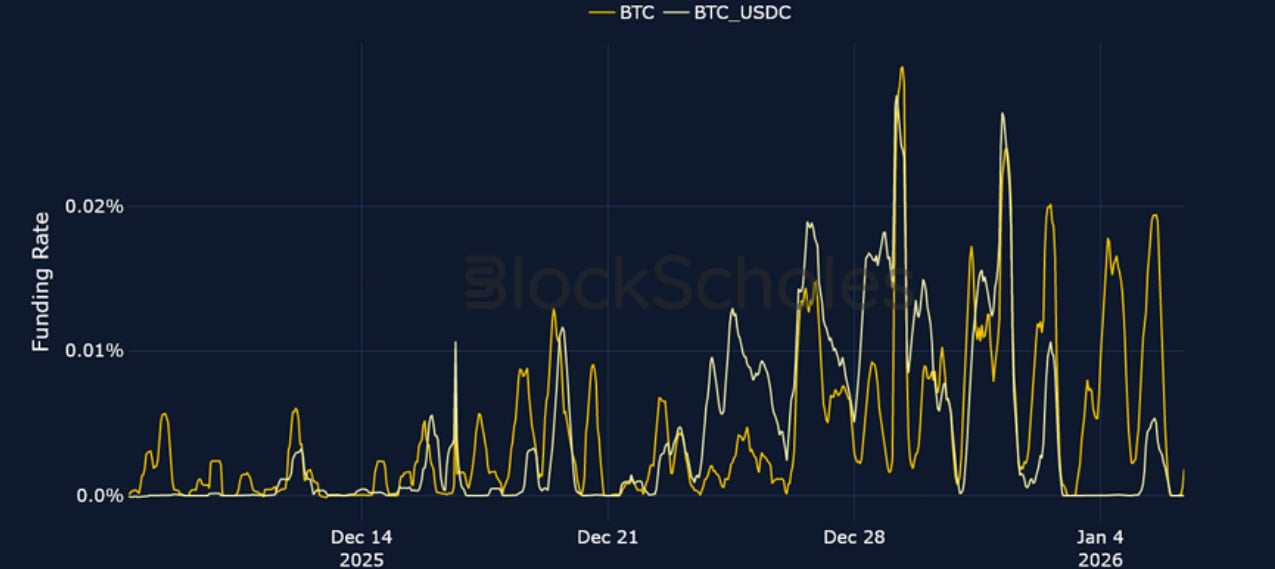

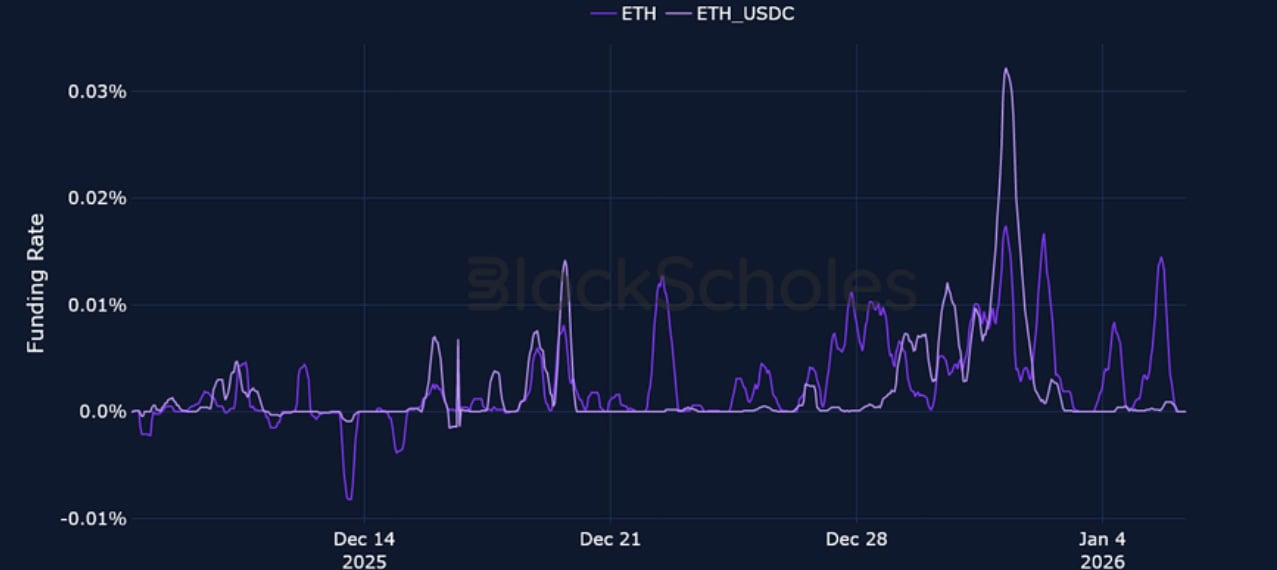

Perpetual Swap Funding Rate

BTC FUNDING RATE – The past week has seen traders show appetite for leveraged long exposure as BTC rallied to a three-week high on Monday, firmly breaking the psychological resistance level of $90K.

ETH FUNDING RATE – ETH funding rates have been positive in the first week of the new year, coinciding with ETH spot price firmly reclaiming $3K.

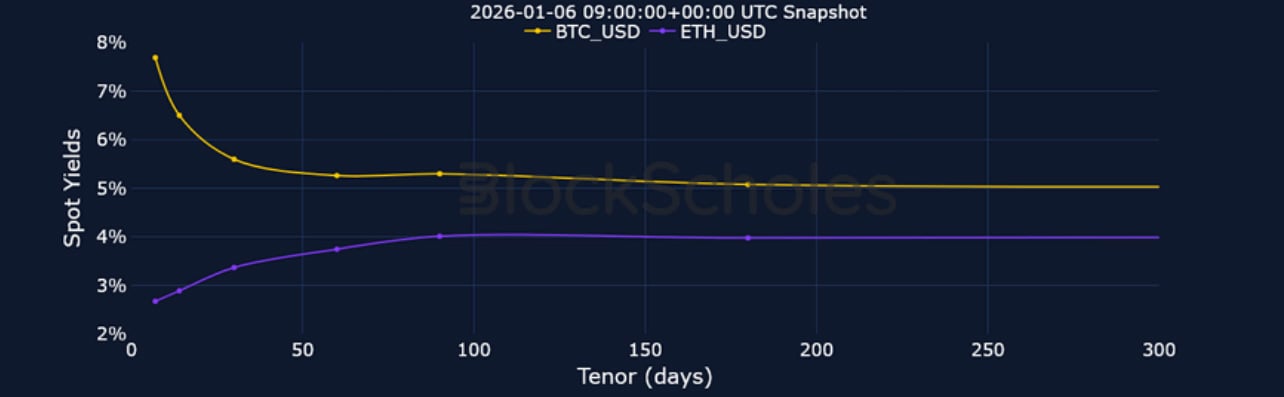

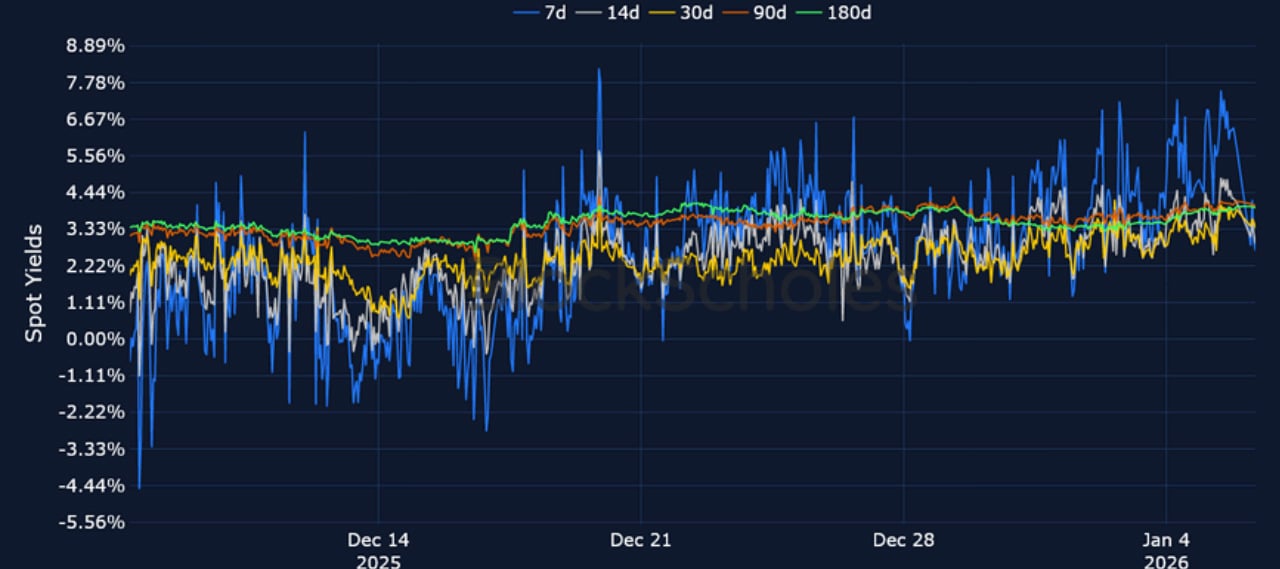

Futures Implied Yields

BTC Futures Implied Yields – The term structure of annualised futures yields has inverted for BTC, as short-tenors trade with a higher yield than longer tenors, a sign of short-term bullish positioning.

ETH Futures Implied Yields – Futures yields for ETH are positive at all tenors, though at lower outright levels compared to BTC.

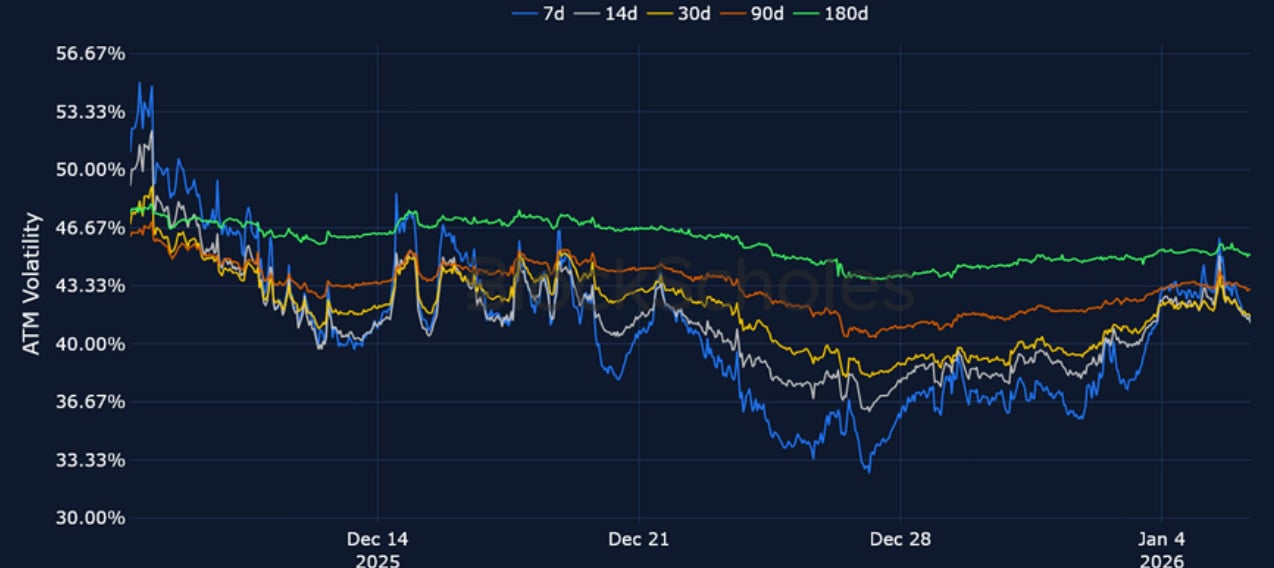

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – The US’s military operation in Venezuela and a return back from the festive period saw ATM IV levels rise last week.

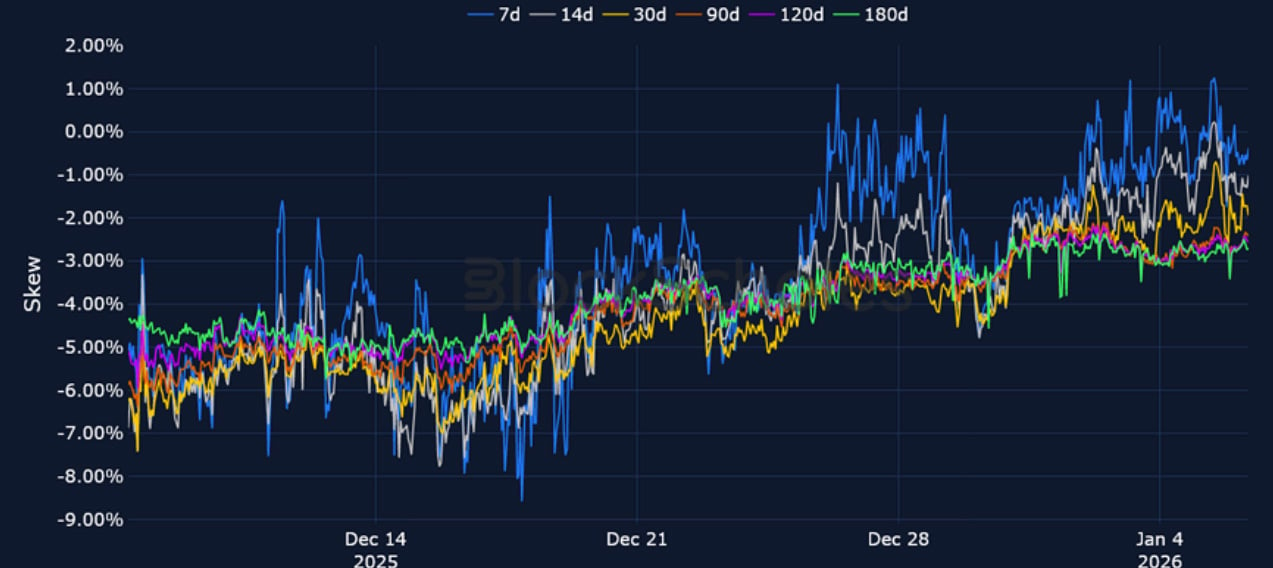

BTC 25-Delta Risk Reversal – While most of the volatility curve still shows a put premium, the peak of December’s bearishness has mostly been priced out at all tenors, coinciding with Spot ETF inflows and the current spot rally.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – The capture of Venezuelan President Nicolás Maduro added to the break from the Christmas period volatility lull.

ETH 25-Delta Risk Reversal – 7-day volatility smiles show a very modest premium towards OTM call options, a sign of a tentative rebound in sentiment in ETH options markets.

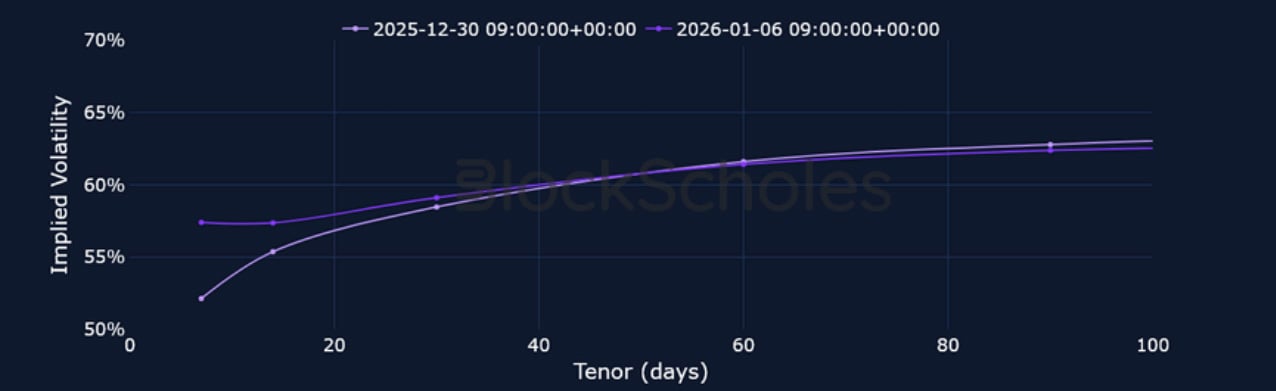

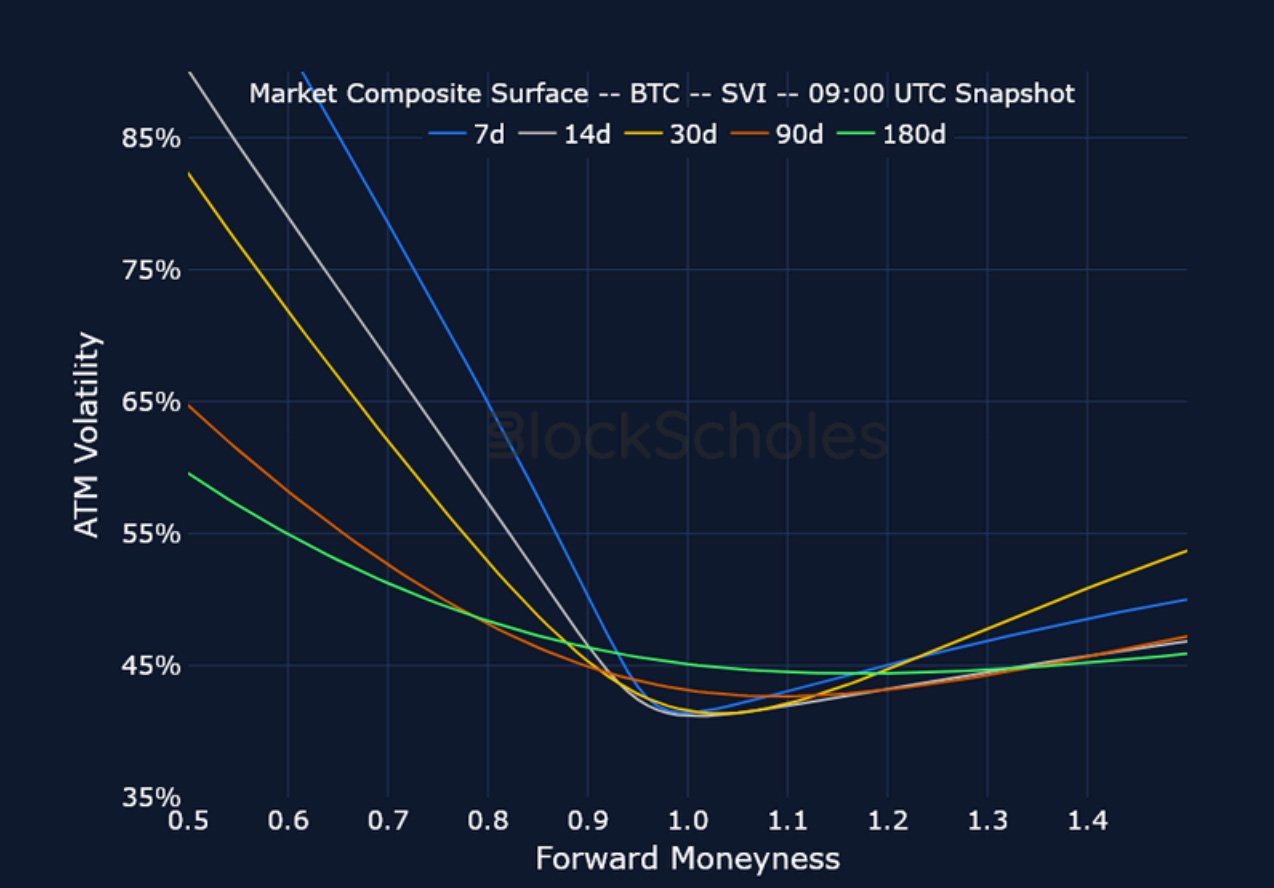

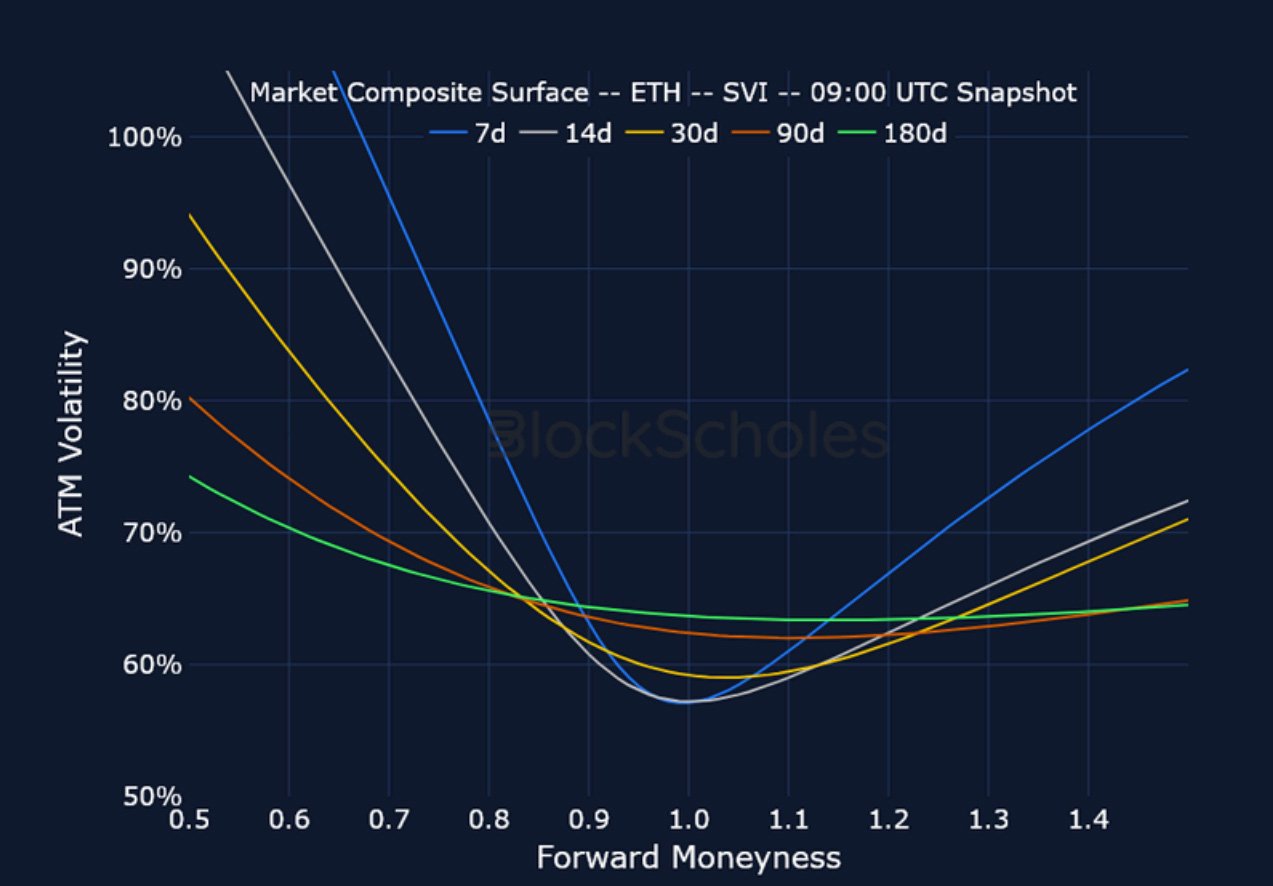

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

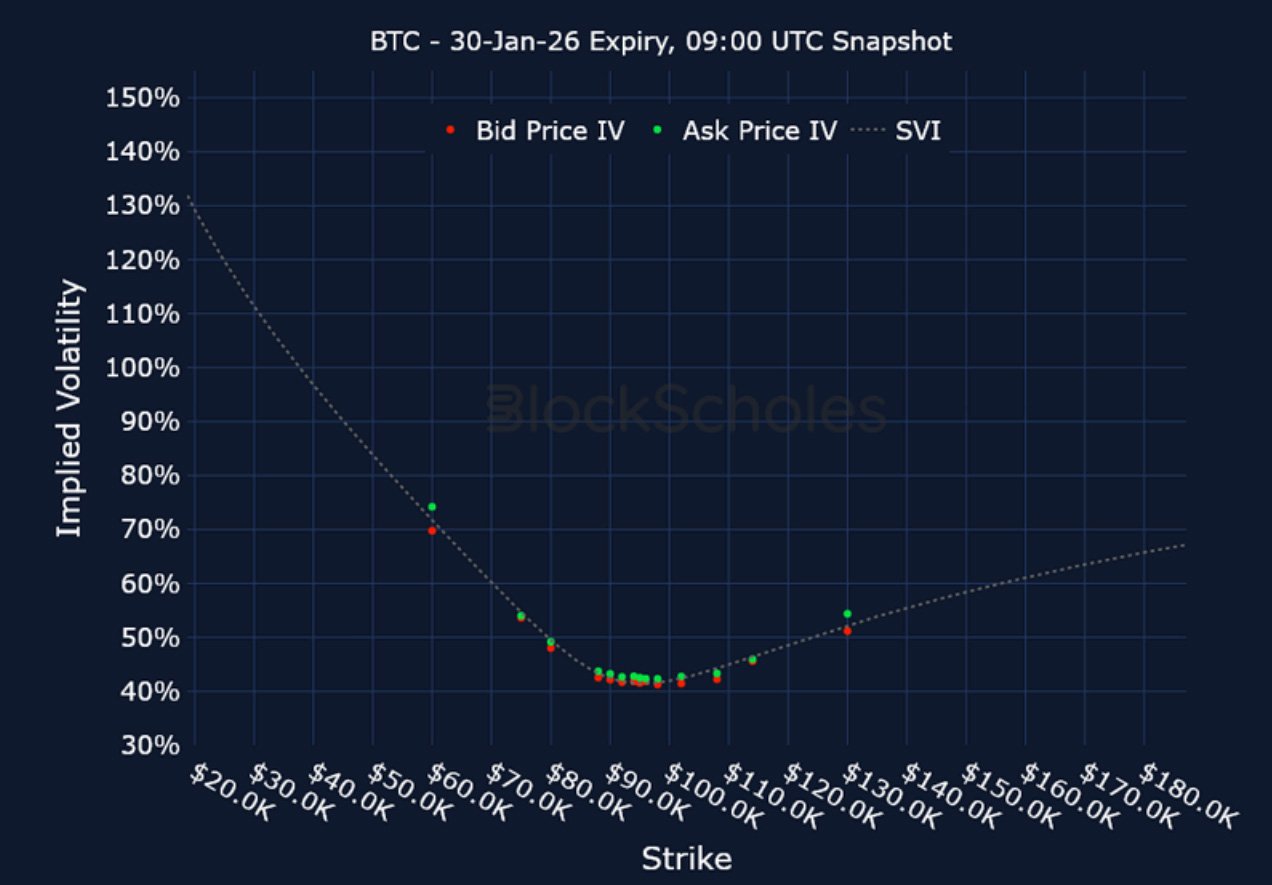

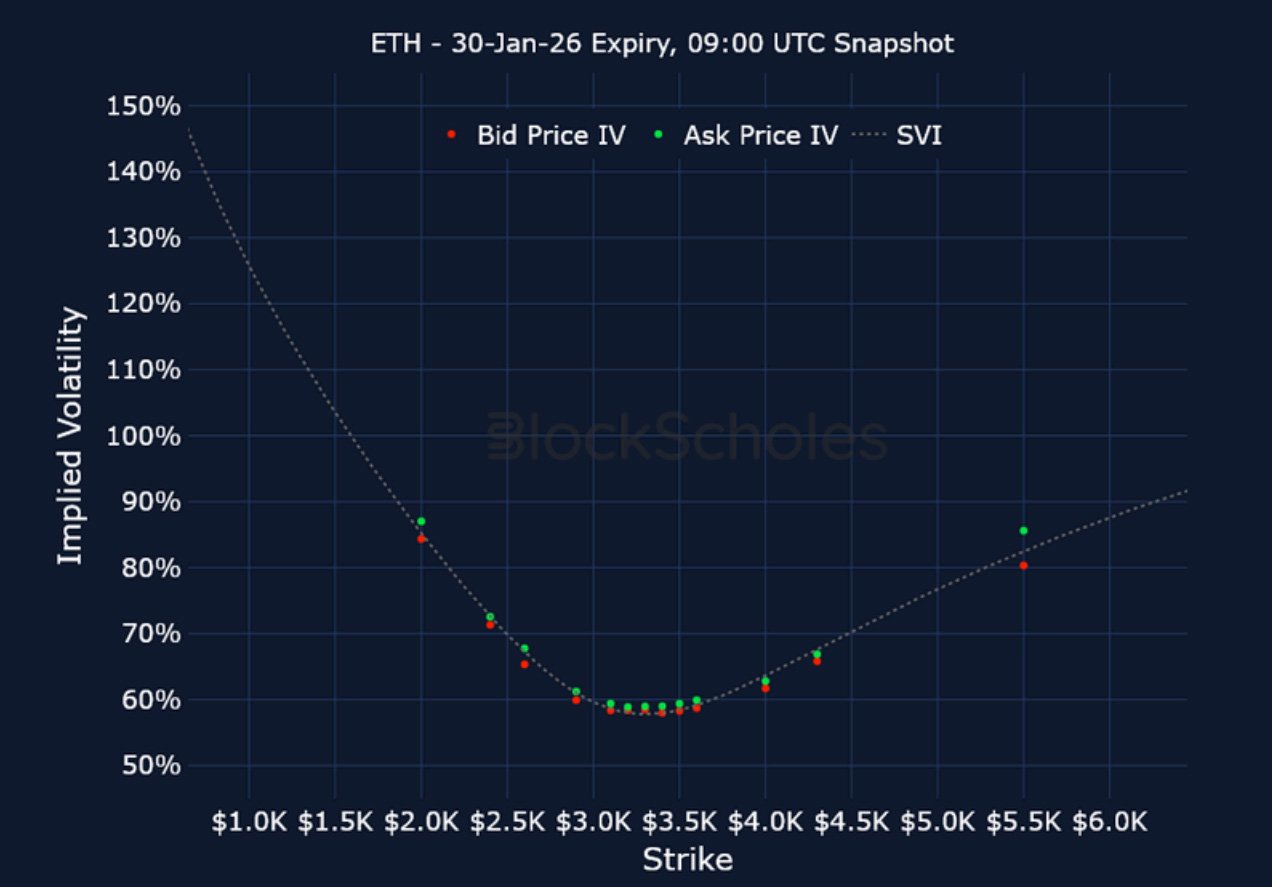

Listed Expiry Volatility Smiles

BTC 30-JAN EXPIRY – 9:00 UTC Snapshot.

ETH 30-JAN EXPIRY – 9:00 UTC Snapshot.

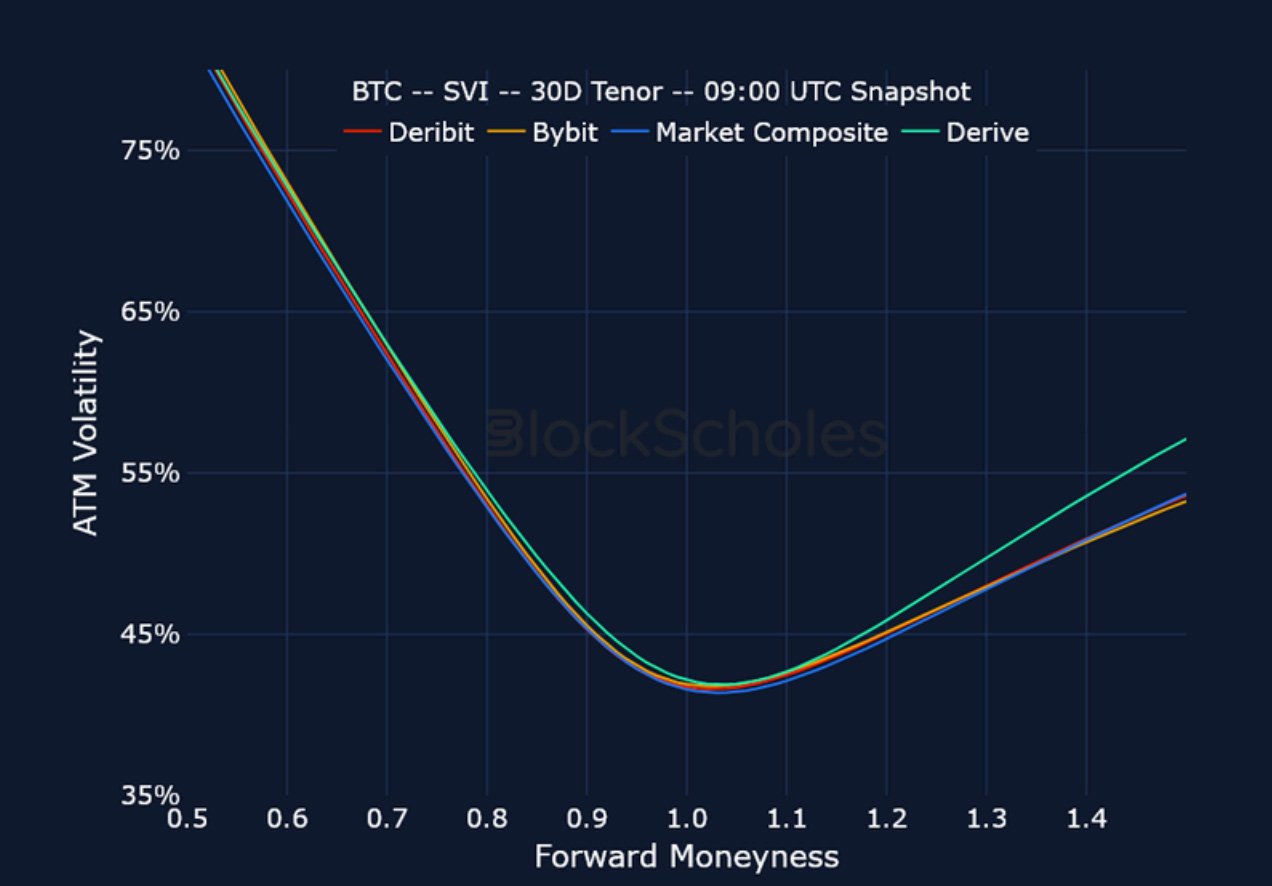

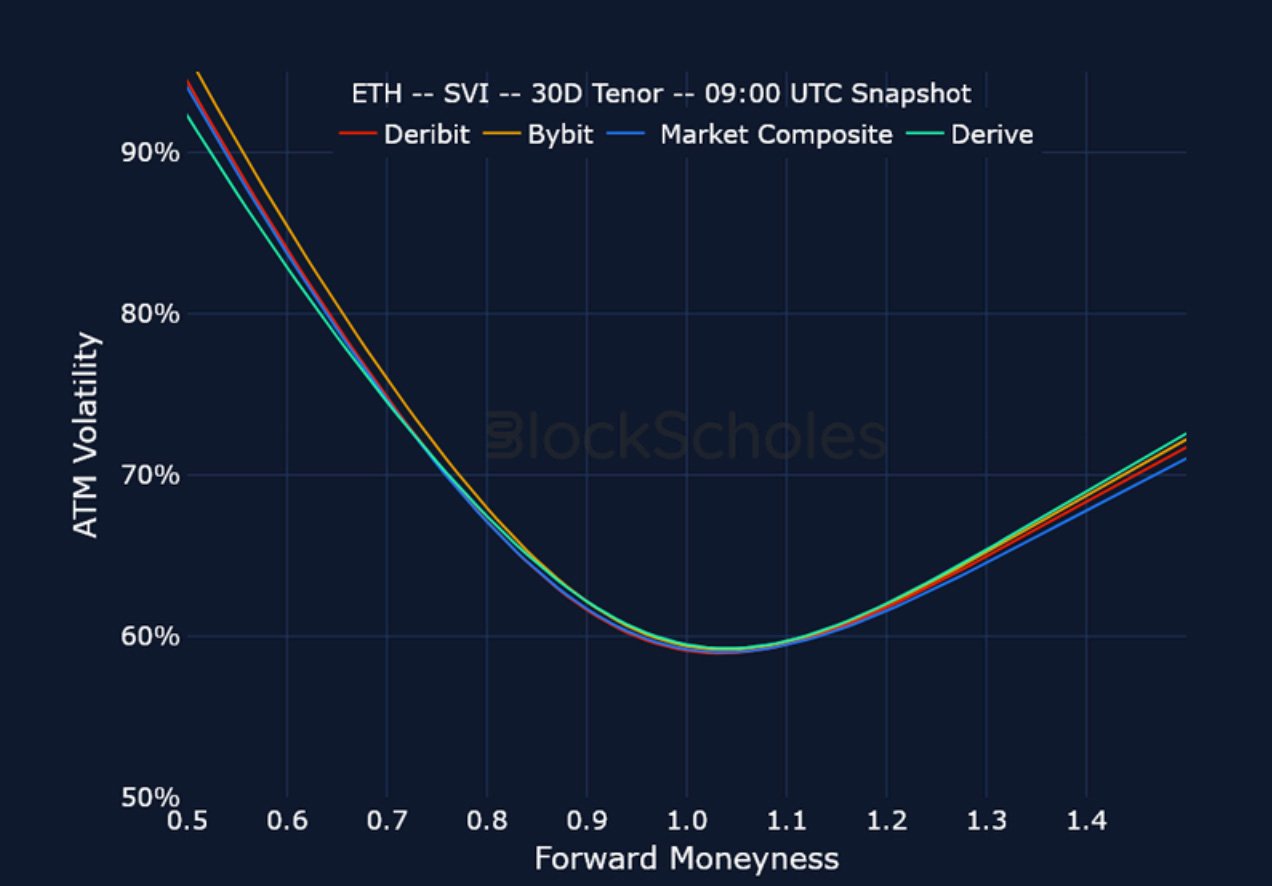

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

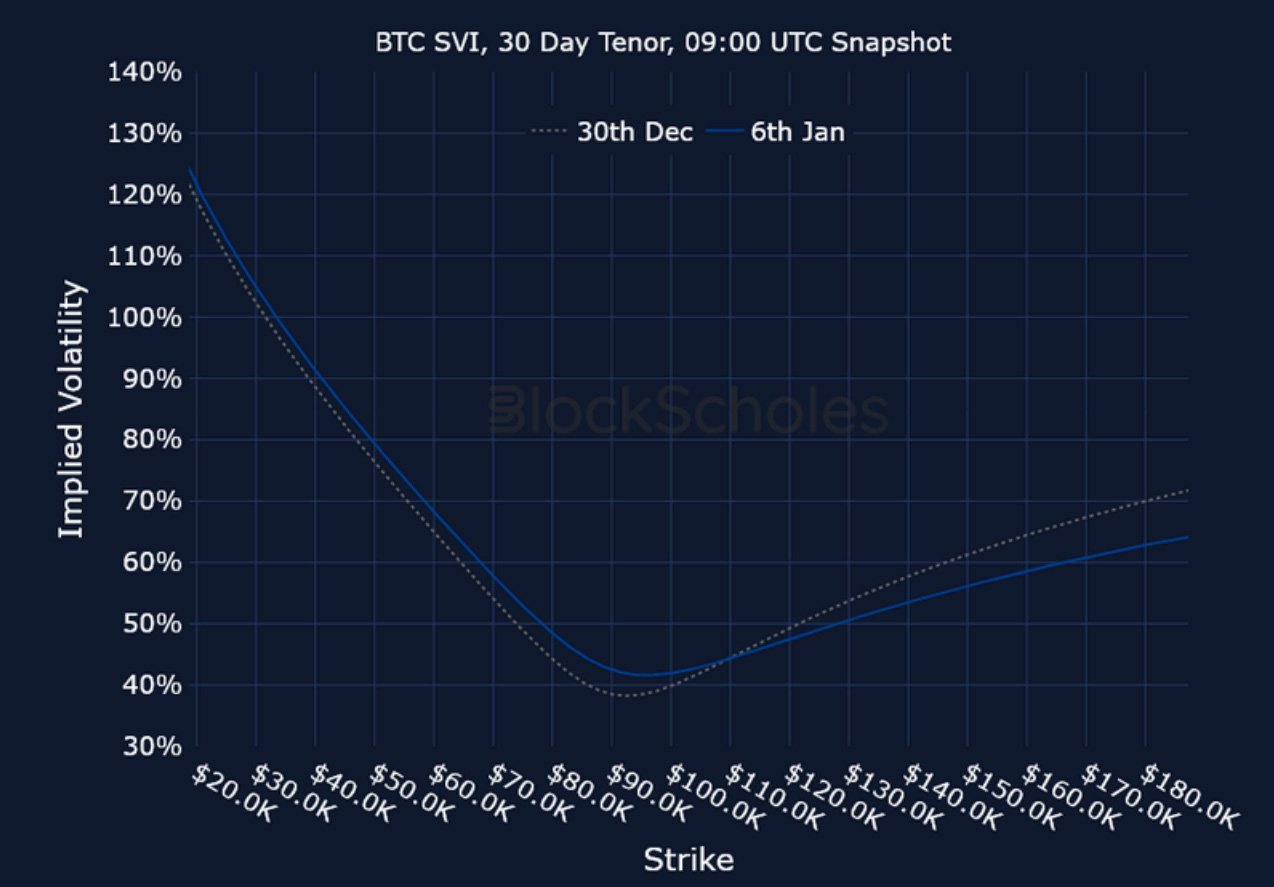

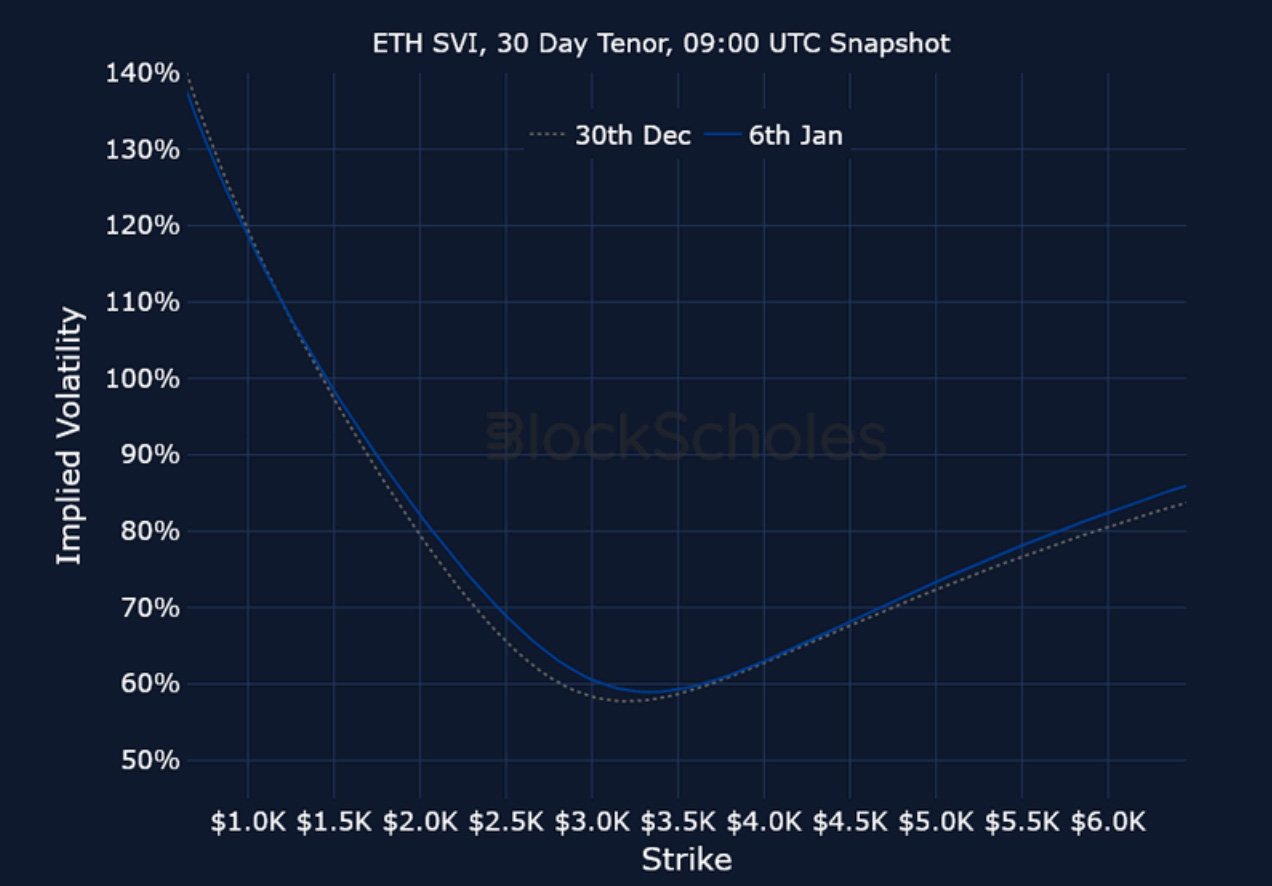

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)