Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Cryptocurrencies were engulfed by a wave of risk-on momentum over the past week, as President Trump announced the US’s first trade deal with a major partner, and later a 90-day tariff pause with China. ETH fared as the largest beneficiary of the subsequent rally, up 40% in a week. Implied volatility soared at the front-end of the term structure, before a pause in the rally sent volatility expectations plunging down again. BTC finally regained the $100K mark, for the first since early February, however short-tenor volatility was largely compressed through the move, and has dropped off since. Short-tenor smiles are still skewed positively towards calls.

Futures Implied Yields

1-Month Tenor ATM Implied Volatility

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC funding rates shot up past 0.02% as BTC recaptured $100K for the first time since February.

ETH FUNDING RATE – Funding rates for ETH briefly spiked up amidst a 40% rally in spot this week, after being mostly negative through April.

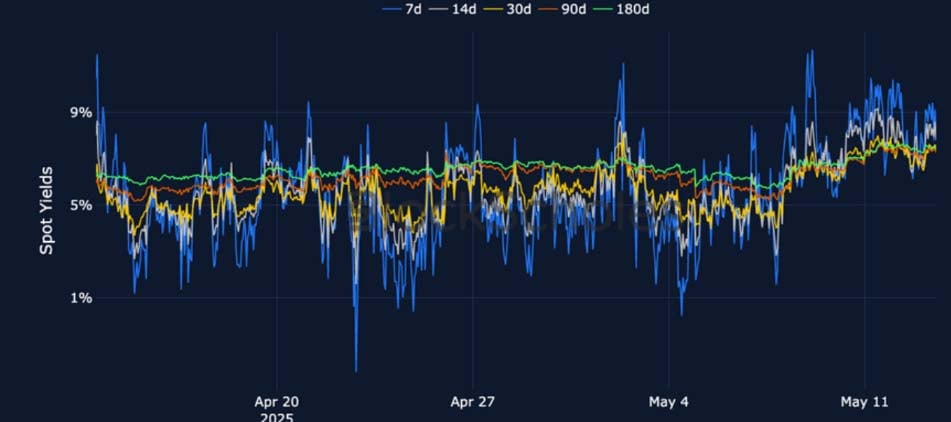

Futures Implied Yields

BTC Futures Implied Yields – The futures term structure has trended upwards after bottoming on May 4, though remains inverted.

ETH Futures Implied Yields – ETH futures yields temporarily rose to 10% during ETH’s spot outperformance, now at a modest 2% at a one week tenor.

BTC Options

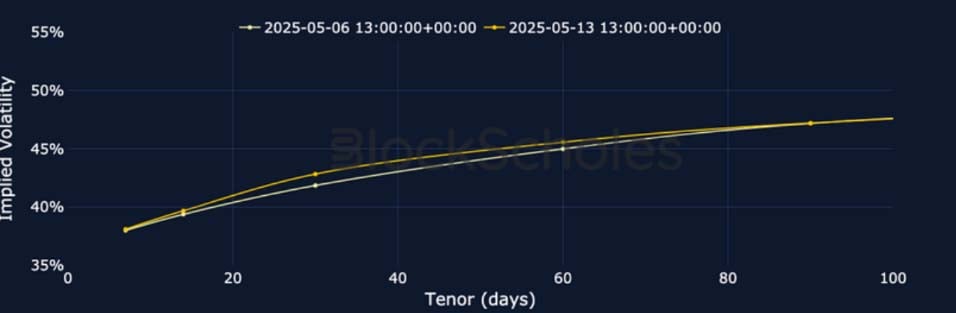

BTC SVI ATM IMPLIED VOLATILITY – Despite blowing past $100K, front-end volatility did not rise enough to invert the term structure, in contrast to ETH.

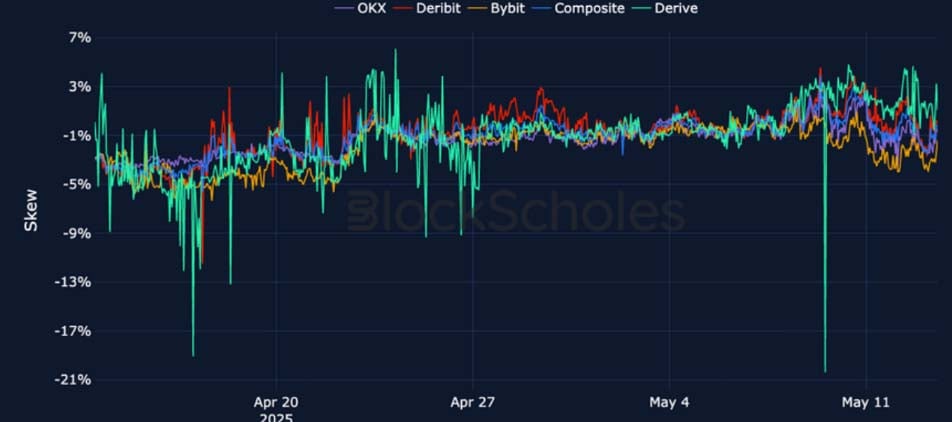

BTC 25-Delta Risk Reversal – Short-tenor smiles skewed towards OTM calls during the spot rally, briefly touching 5.56% before dropping off to 3%.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – After the largest single-day increase in spot price since 2021, front-end volatility lifted 20 points overnight on May 9.

ETH 25-Delta Risk Reversal – ETH’s 25-day risk reversal soared during the peak of its rally, however the 7D tenor now holds less of a bullish skew than BTC 7D tenors.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

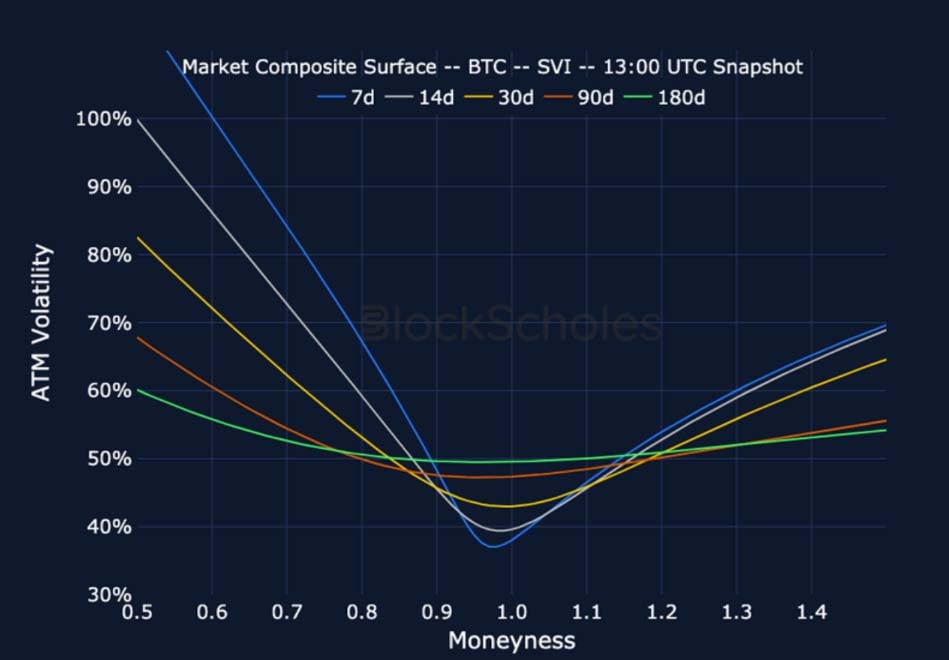

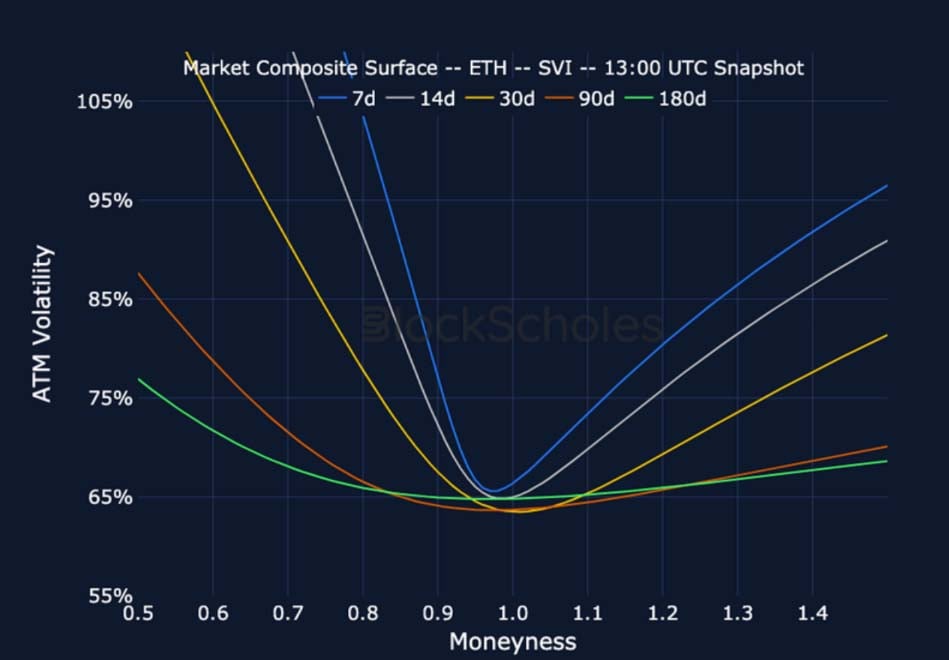

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

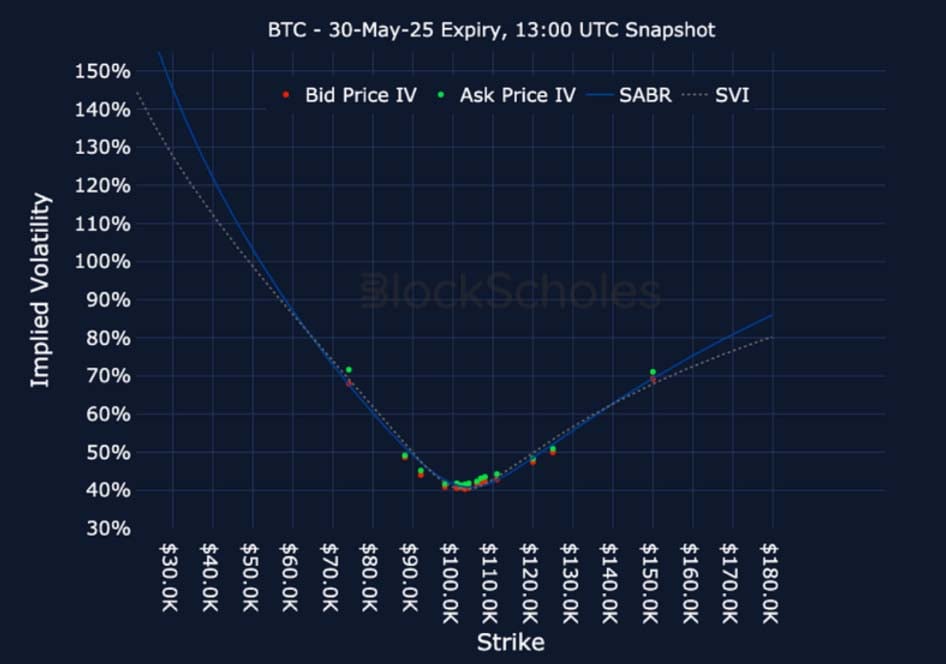

Listed Expiry Volatility Smiles

BTC 30-MAY EXPIRY – 9:00 UTC Snapshot.

ETH 30-MAY EXPIRY – 9:00 UTC Snapshot.

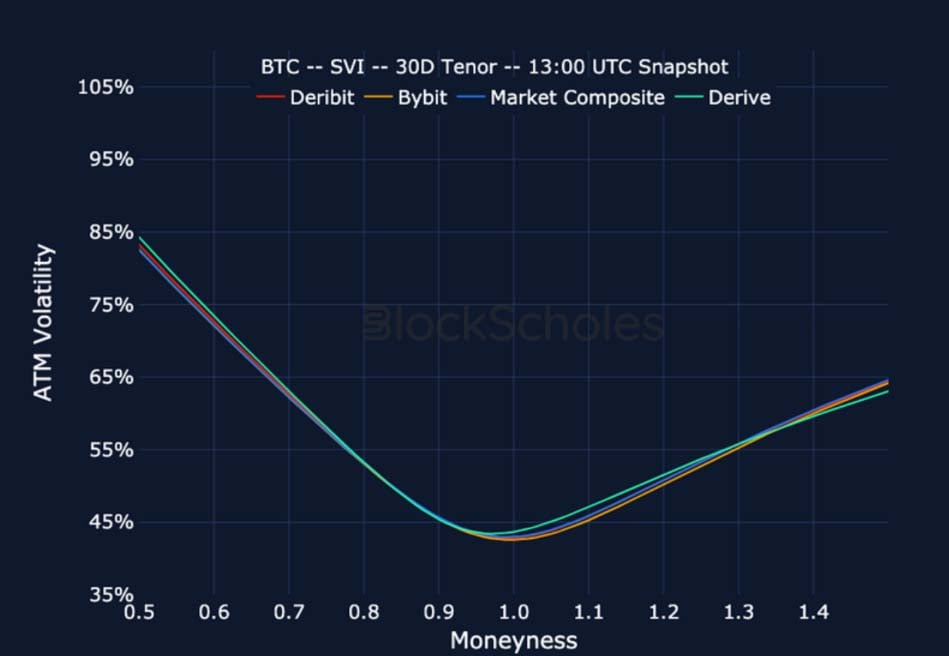

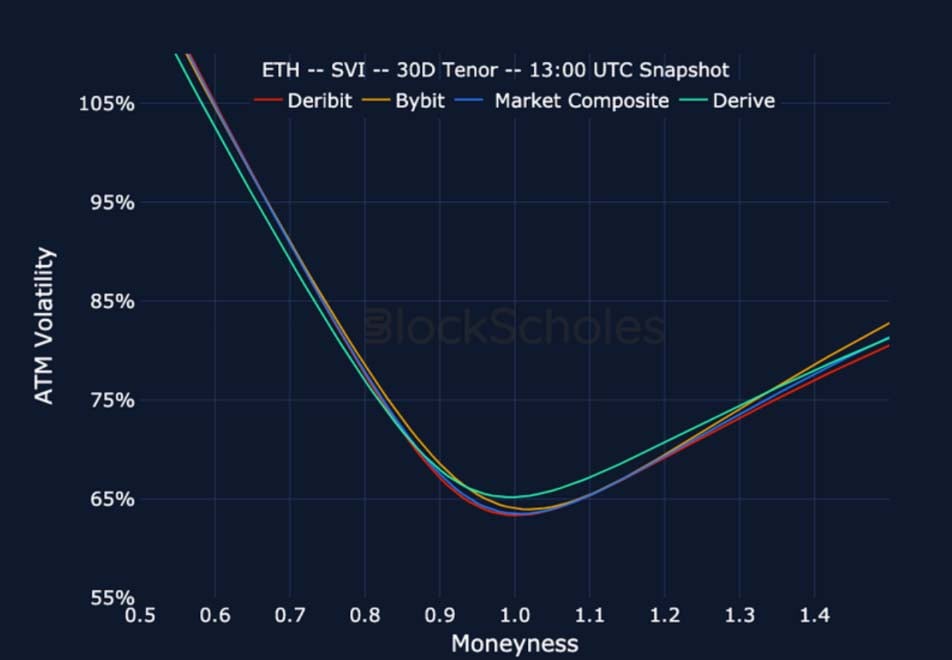

Cross-Exchange Volatility Smiles

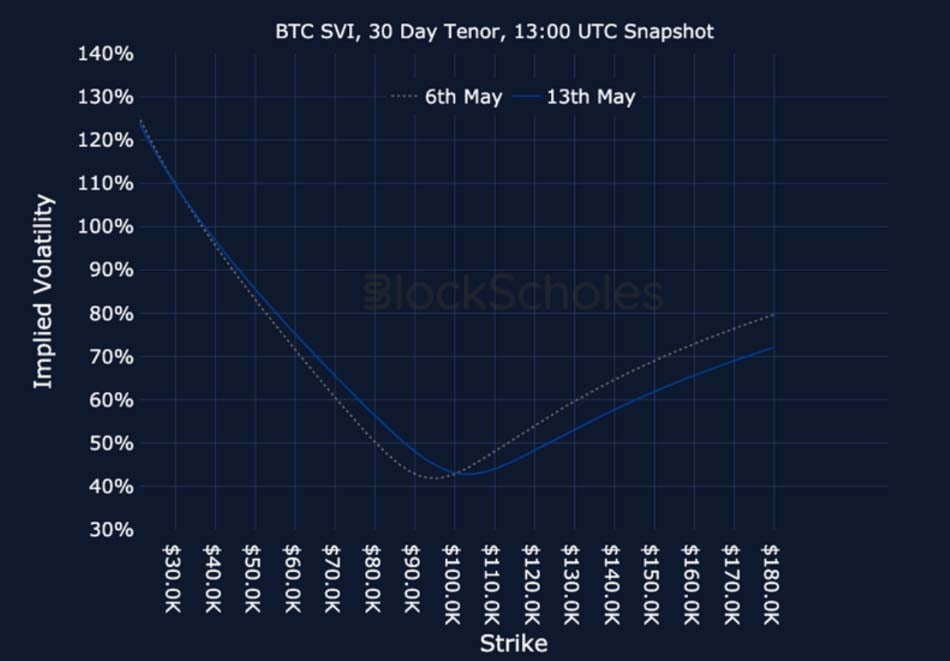

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)