Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Volatility has continued to gradually rise across the term structure, with ETH spiking at all tenors over the last day following an upgrade in the probability of an Ethereum spot ETF being approved. With implied volatility spiking particularly at the front-end, the term structure has become inverted. Implied volatility for ETH options now sits at levels not seen since April. The vol smile skew also recovered towards calls over the past week, but has since sold off at the front-end as investors rush to purchase OTM puts for downside protection as spot price reaches range highs of $71K and a $3.7K. Leverage in futures markets has increased, particularly at short-dated tenors which have risen beyond longer-dated tenors, indicating a demand for leveraged long exposure that is stronger for ETH.

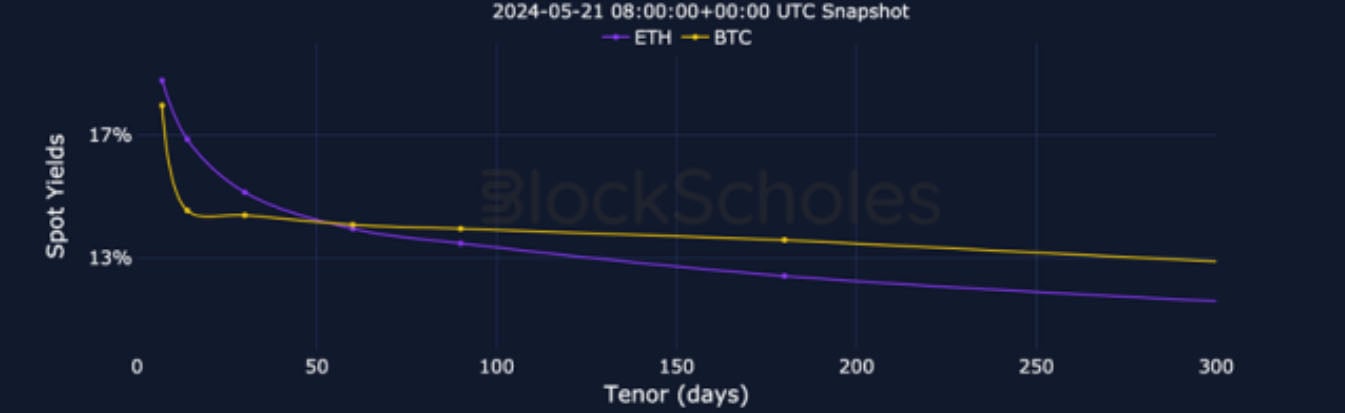

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Futures

BTC ANNUALISED YIELDS – yields at tenors 1M and beyond have increased steadily over the past week as BTC approaches range highs.

ETH ANNUALISED YIELDS – yields at short-dated tenors rose beyond longer-dated tenors following an increase in the probability of an ETH ETF.

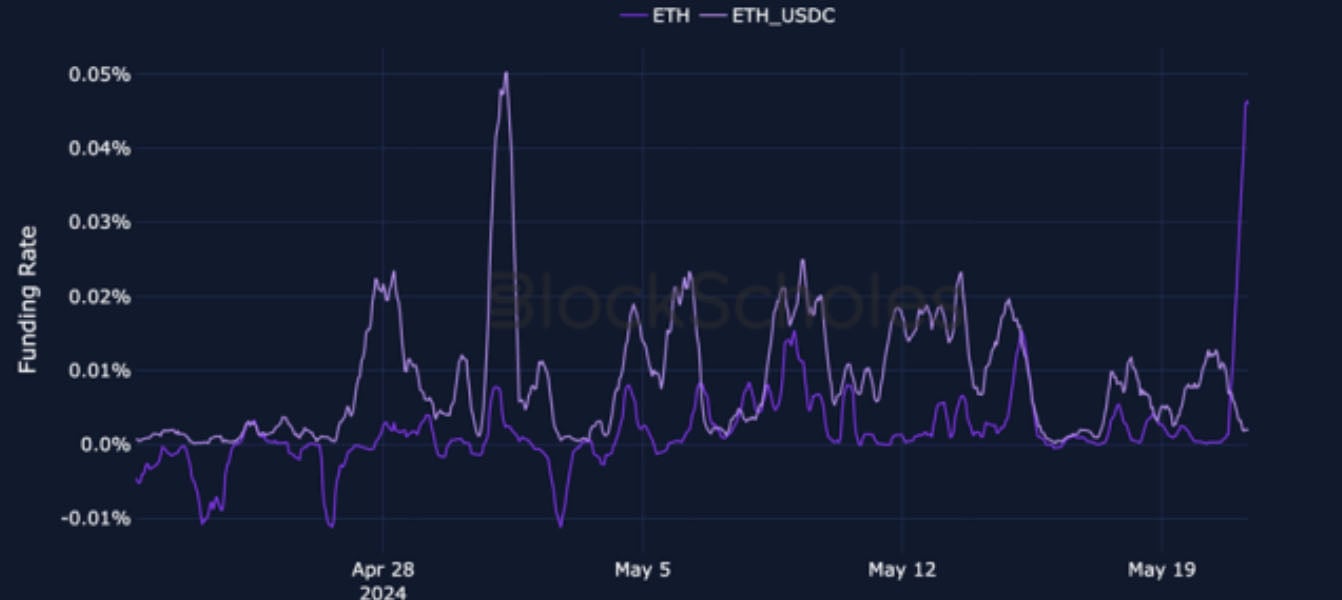

Perpetual Swap Funding Rate

BTC FUNDING RATE – traded positively over the past week with some volatility, indicating increased demand for leveraged long exposure.

ETH FUNDING RATE – recently spiked to levels not seen since April as the probability of an ETH ETF being approved this year was upgraded by analysts.

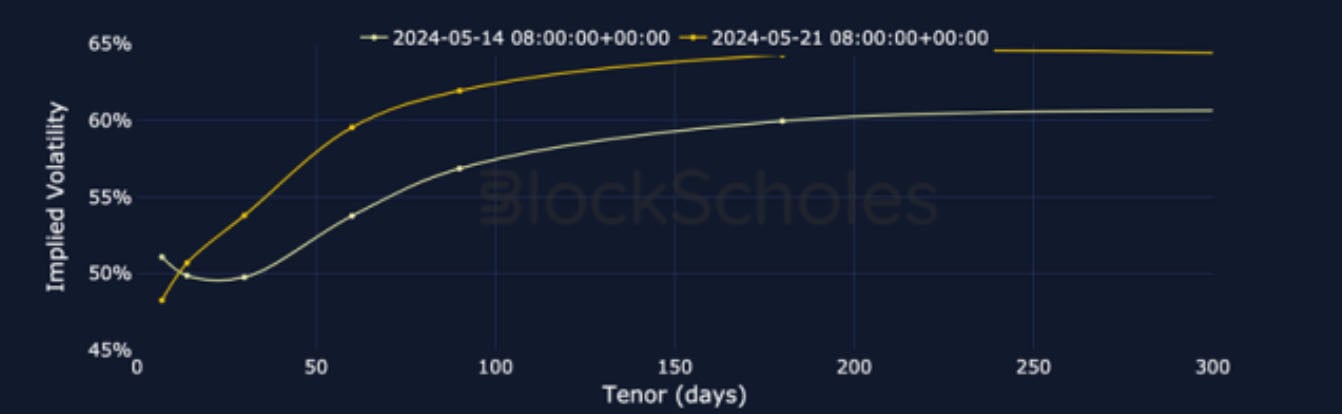

BTC Options

BTC SVI ATM IMPLIED VOLATILITY– vol has increased across the term structure, where the back-end has seen a more steady increase.

BTC 25-Delta Risk Reversal – remains skewed towards calls at tenors 1M and beyond, but has spiked down to more neutral levels at short-dated tenors as implied volatility for OTM puts rises.

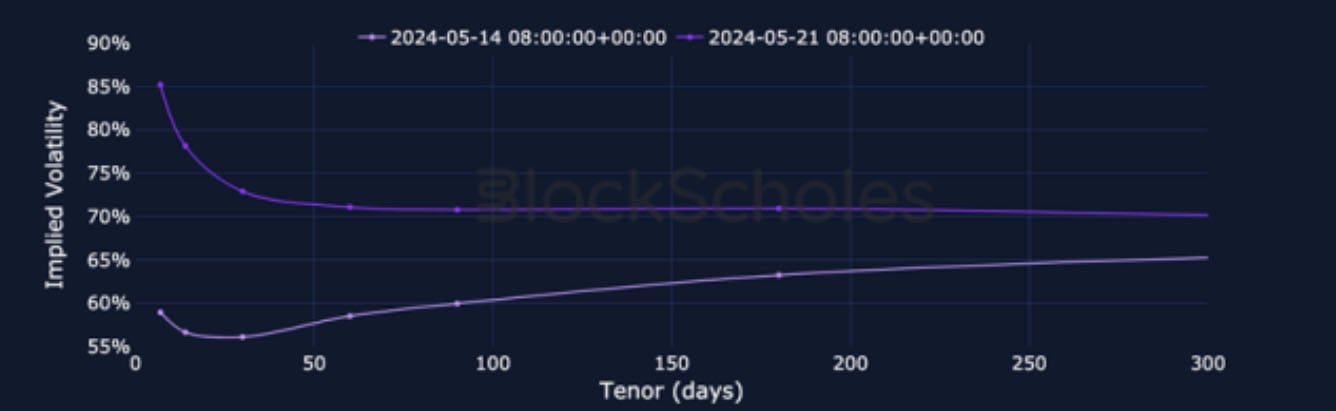

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – gradually risen over the past week, and recently become heavily inverted following a spike in implied vol at the front-end.

ETH 25-Delta Risk Reversal – has spiked down recently due to implied volatility for OTM puts rallying more than OTM calls.

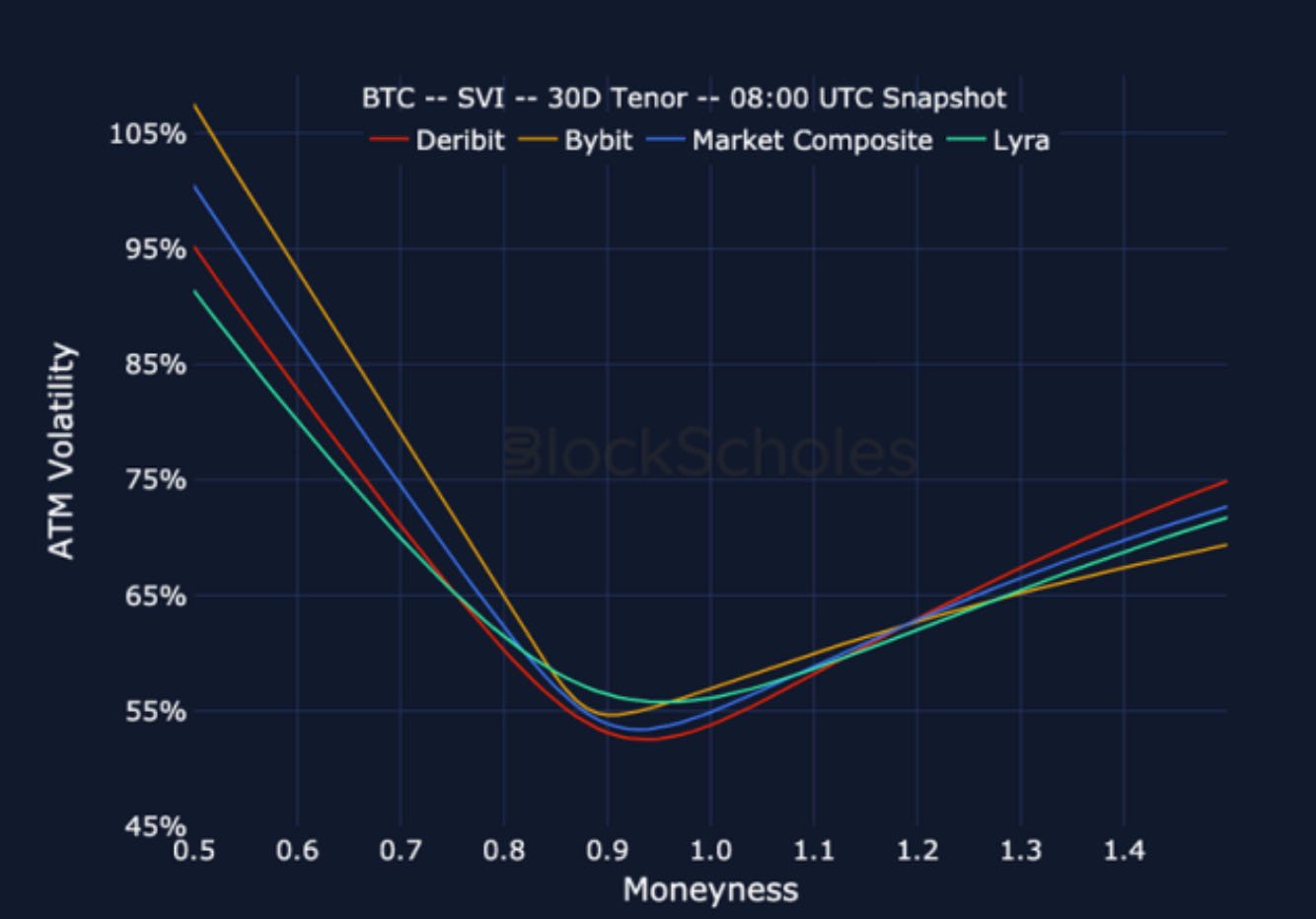

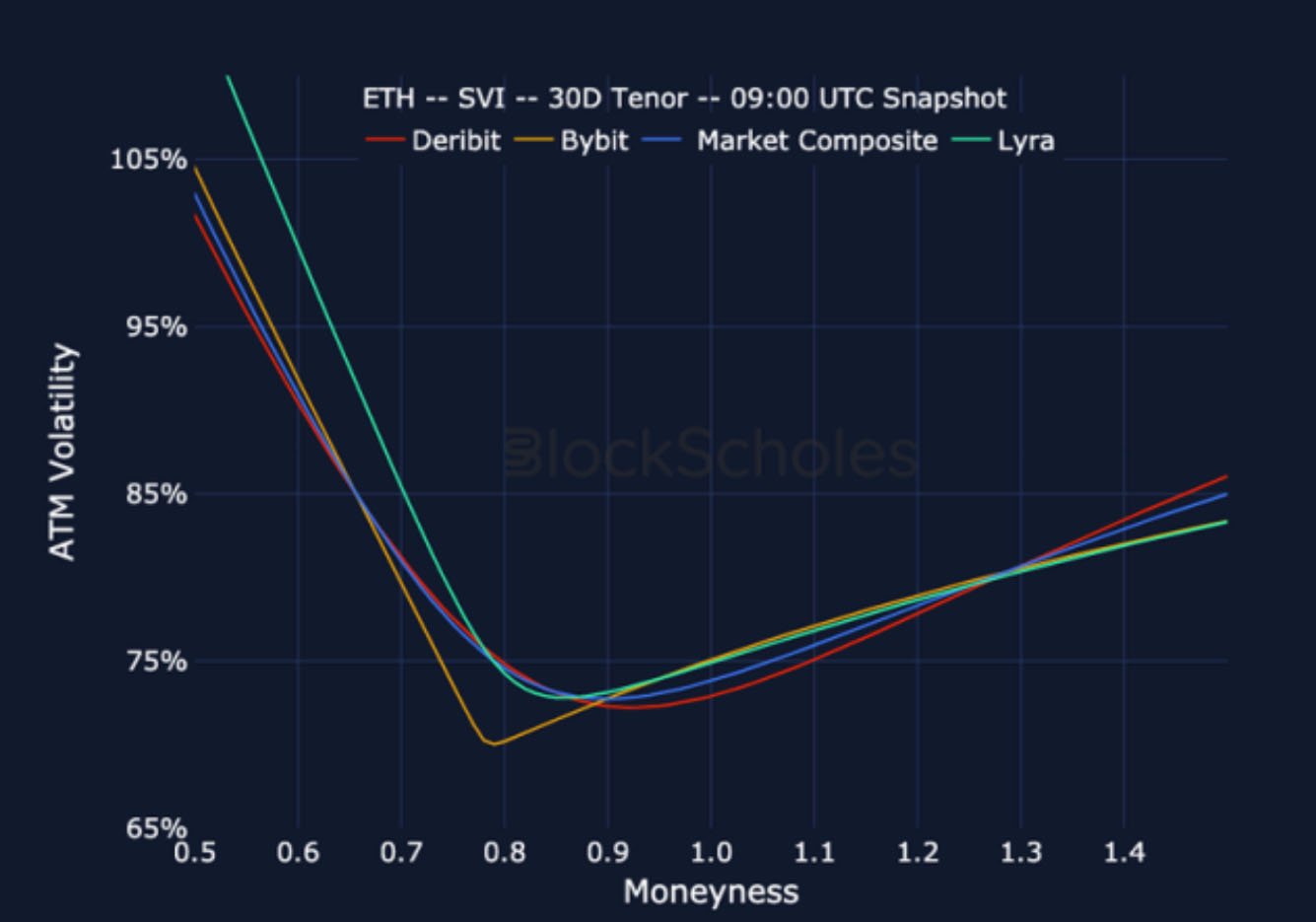

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

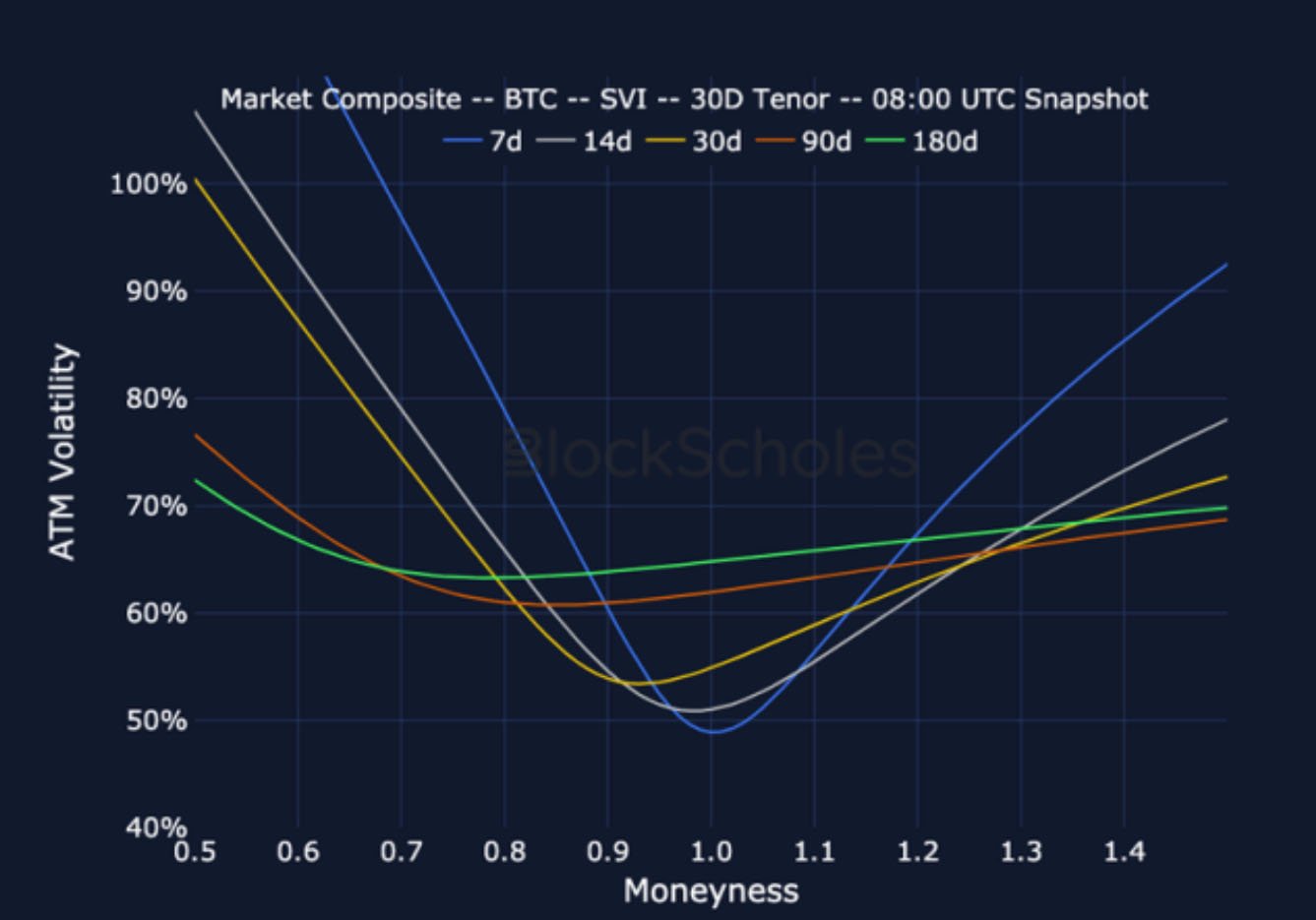

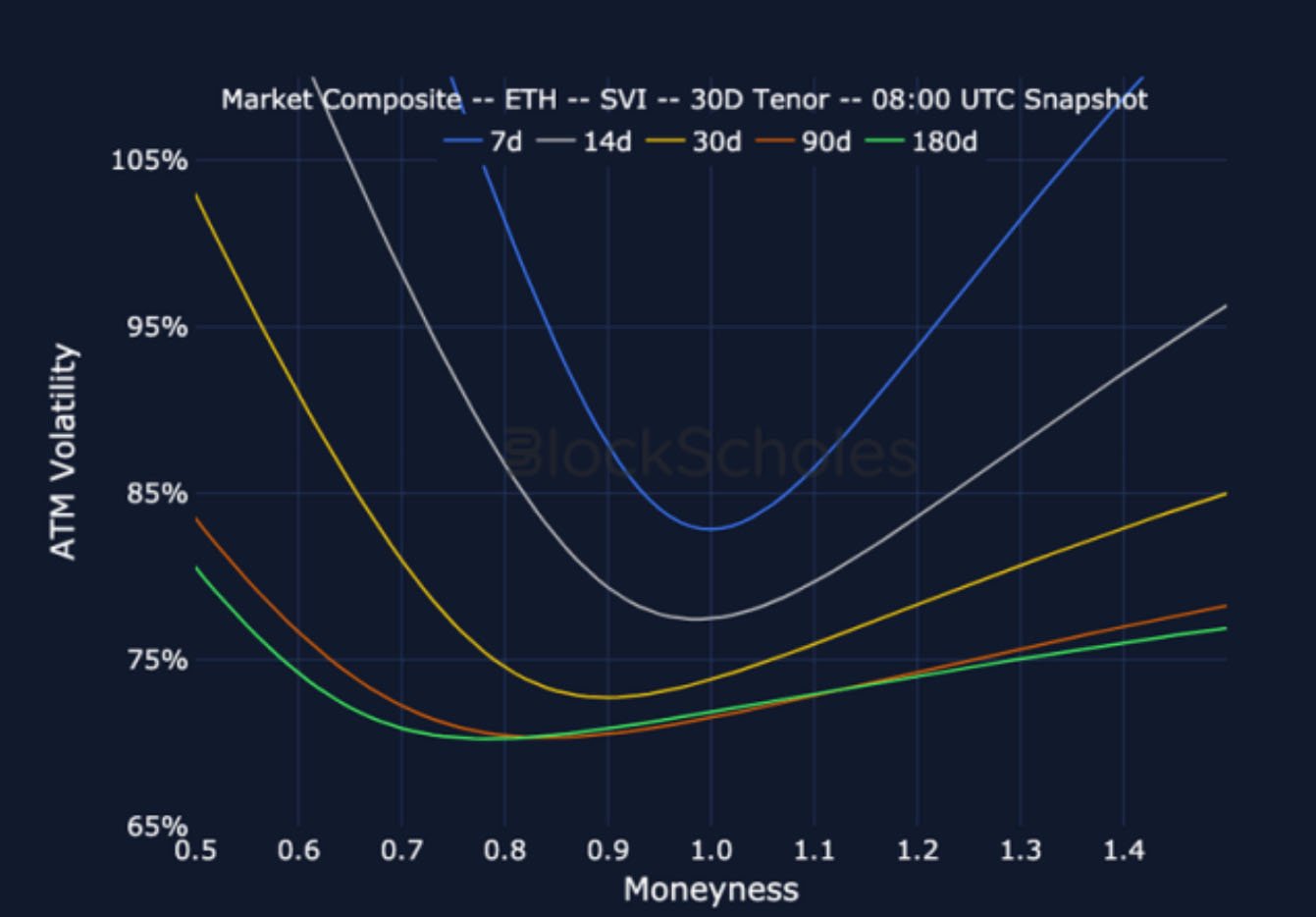

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 8:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 8:00 UTC Snapshot.

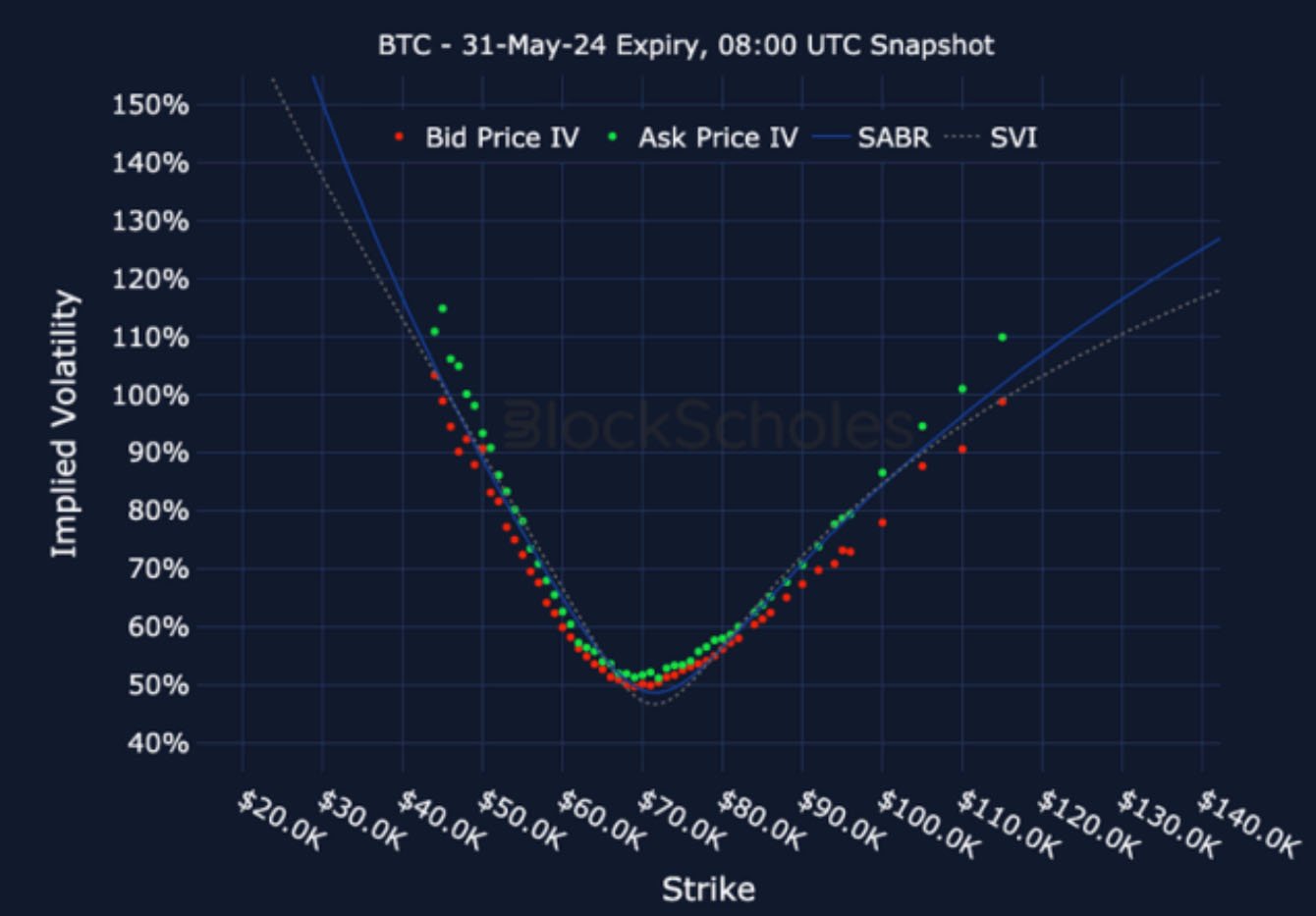

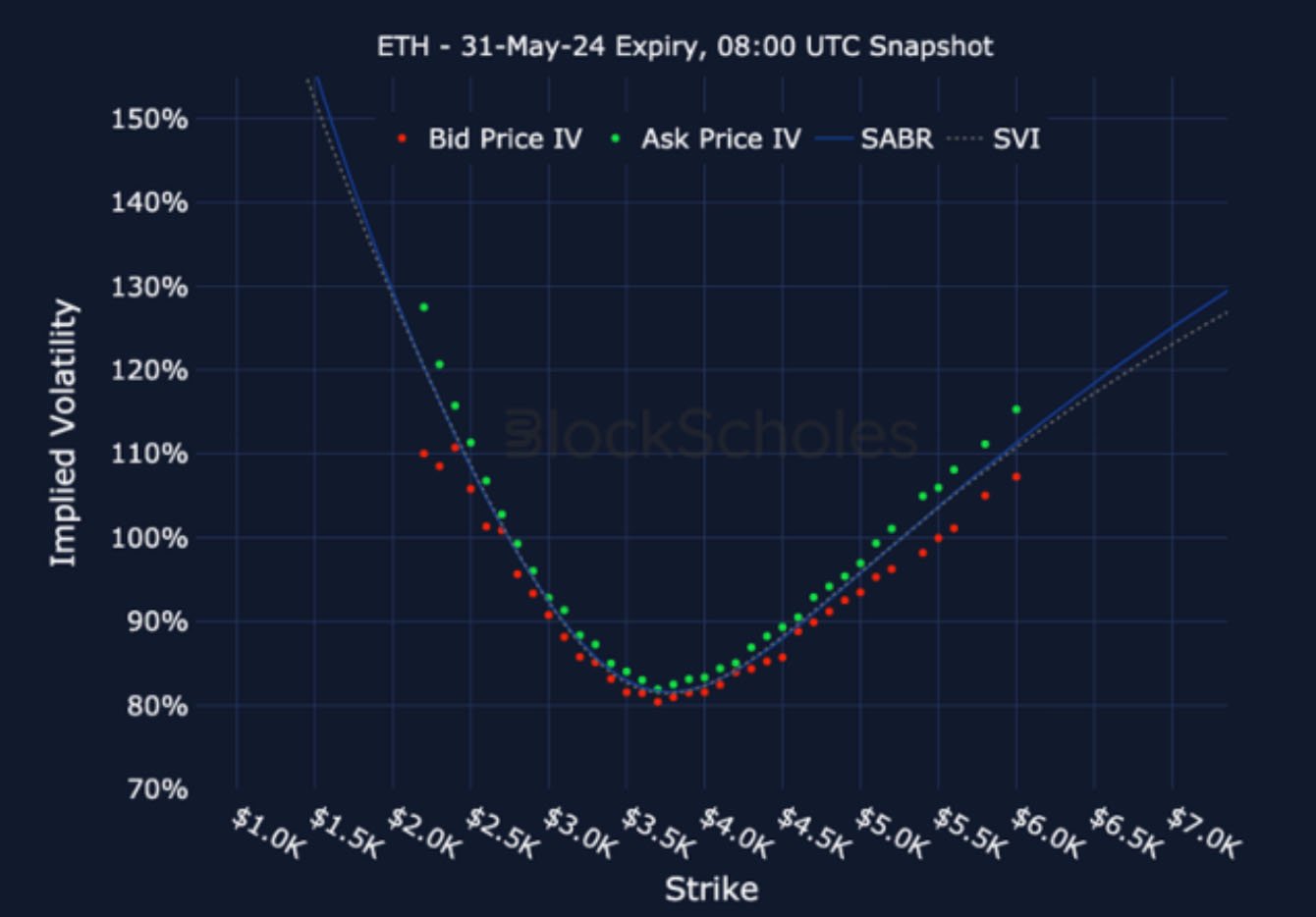

Listed Expiry Volatility Smiles

BTC 31-MAY EXPIRY– 8:00 UTC Snapshot.

ETH 31-MAY EXPIRY – 8:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

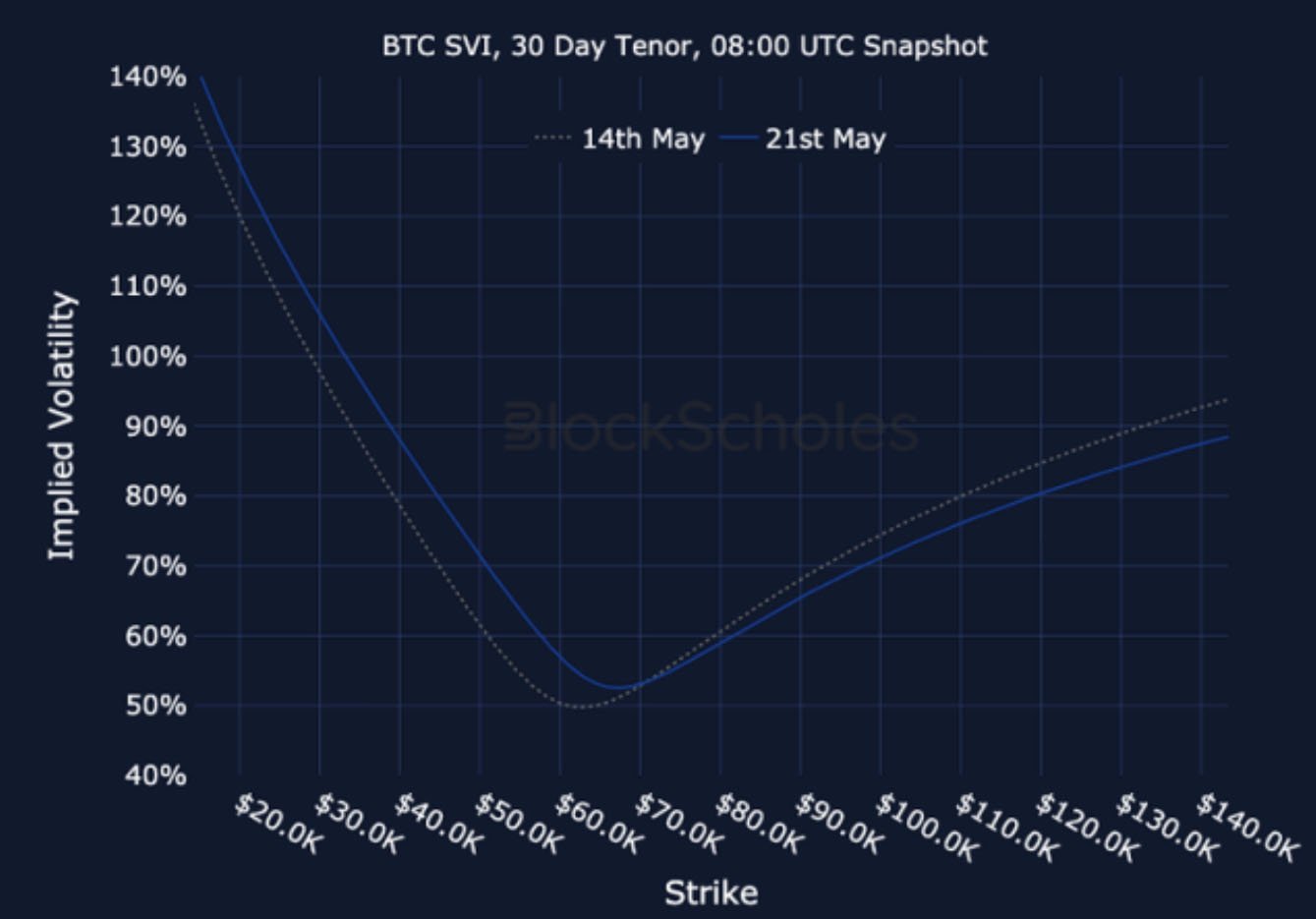

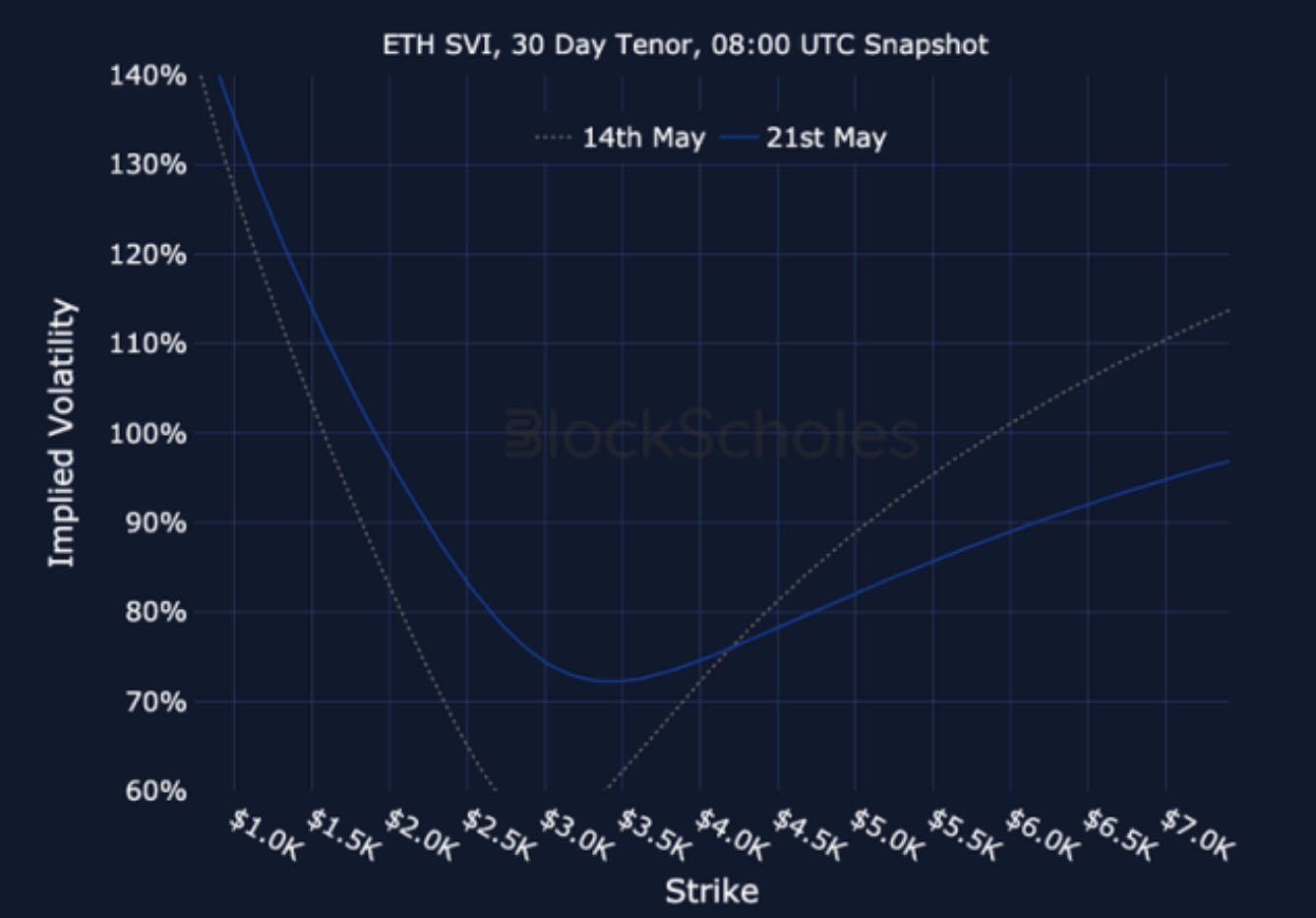

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

AUTHOR(S)