Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The brief spot rally that began late last week was not enough to reverse implied volatility’s drift lower to all-time low levels. The positive sentiment did cause the risk-reversal of both BTC and ETH vol smiles to turn positive before drifting towards OTM puts once more. Whilst we see a similarly short-lived boost to future-implied yields over spot being reversed towards the end of the weekly period, future contracts continue to trade at prices above spot at all tenors.

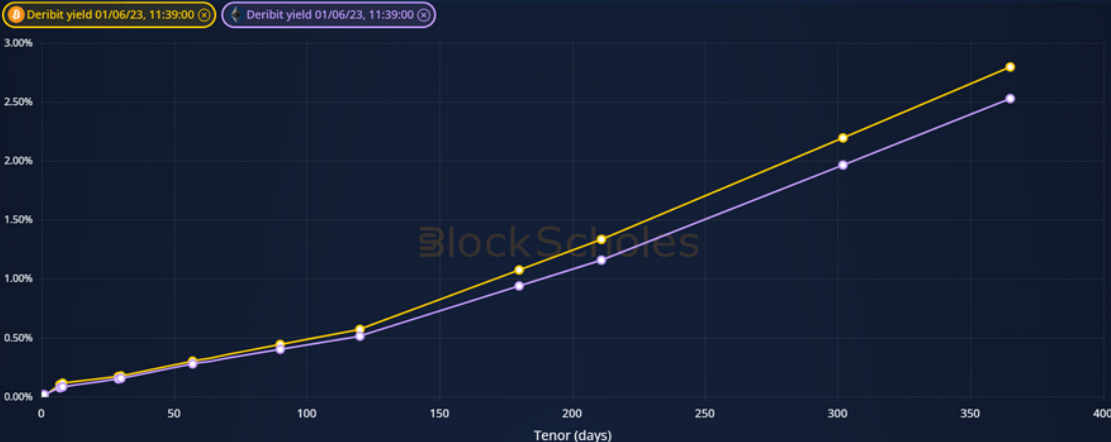

FUTURES IMPLIED YIELD TERM STRUCTURE.

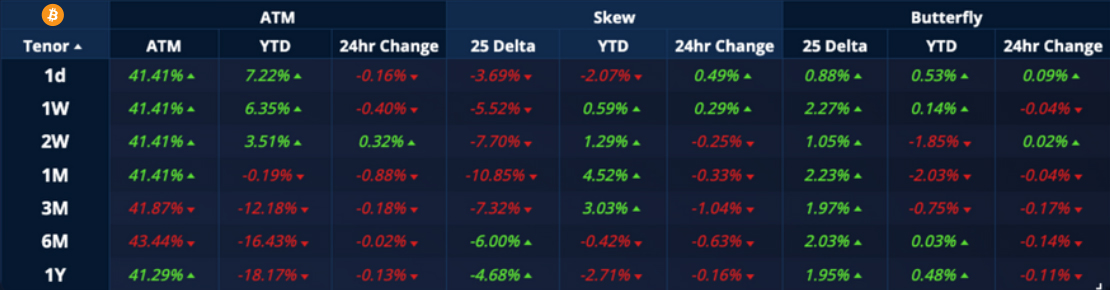

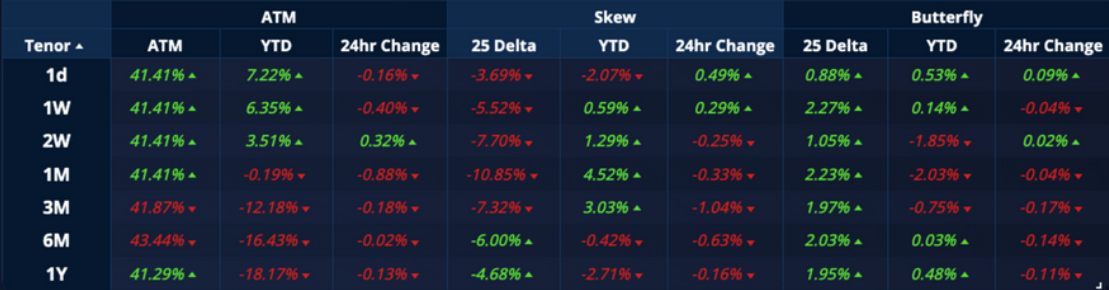

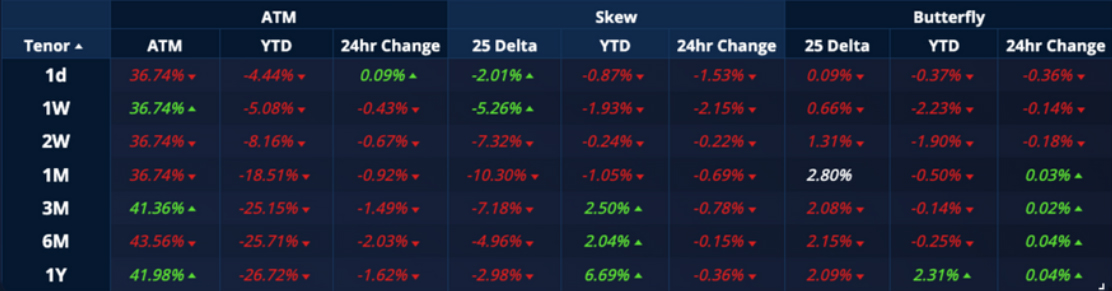

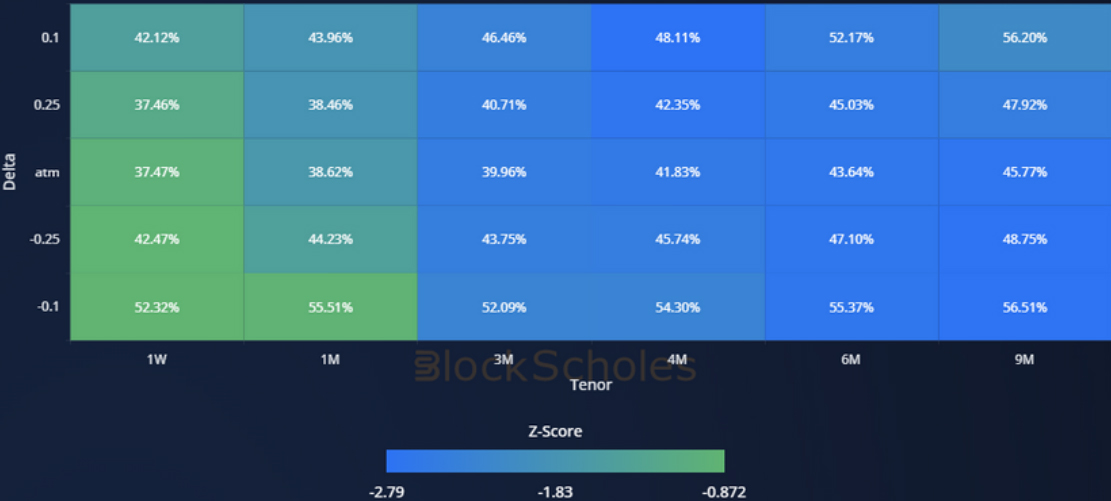

VOLATILITY SURFACE METRICS.

All data in tables are recorded at a 10:00 UTC snapshot unless otherwise stated.

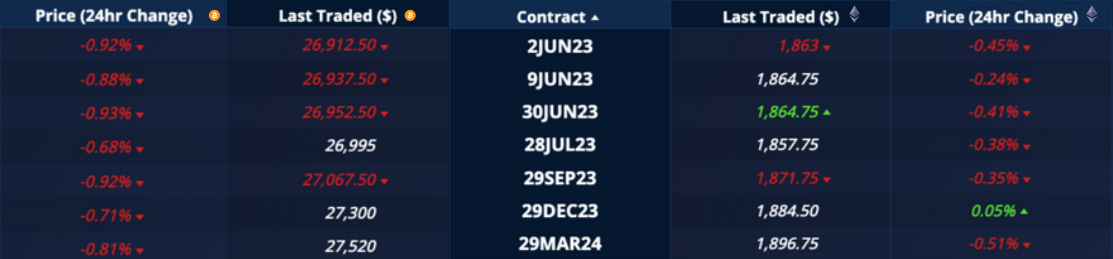

Futures

BTC ANNUALISED YIELDS – a positive spike for short term yields was reversed somewhat as futures at all tenors trade above spot.

ETH ANNUALISED YIELDS – saw a more decisive reversal to its positive spike, and has picked up again towards the end of the weekly period.

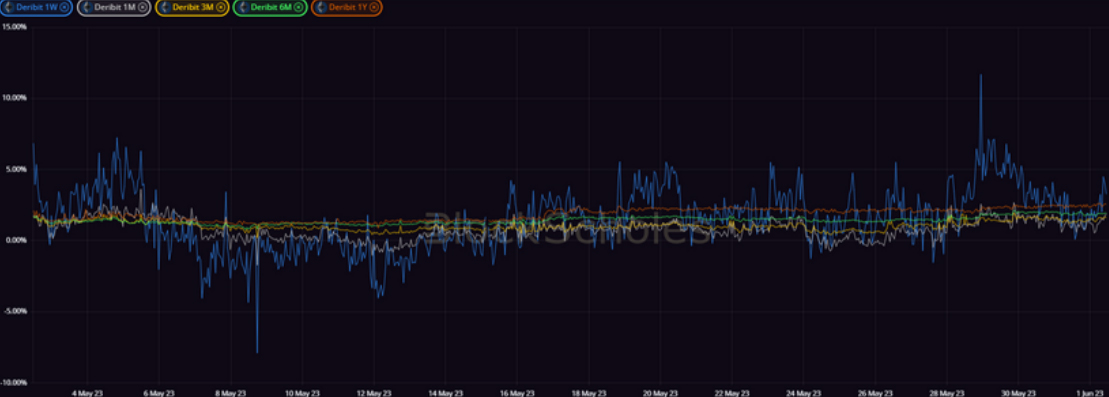

Perpetual Swap Funding Rate

BTC FUNDING RATE – has repeated a strong positive spike as traders look to the perpetual swap contract for leveraged exposure to the spot rally.

ETH FUNDING RATE – saw a similar positive spike that has continued beyond that of BTC’s, picking back up in the last 24 hours.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – fall further downwards, trading in the historically low range between 35% and 50% for all tenors.

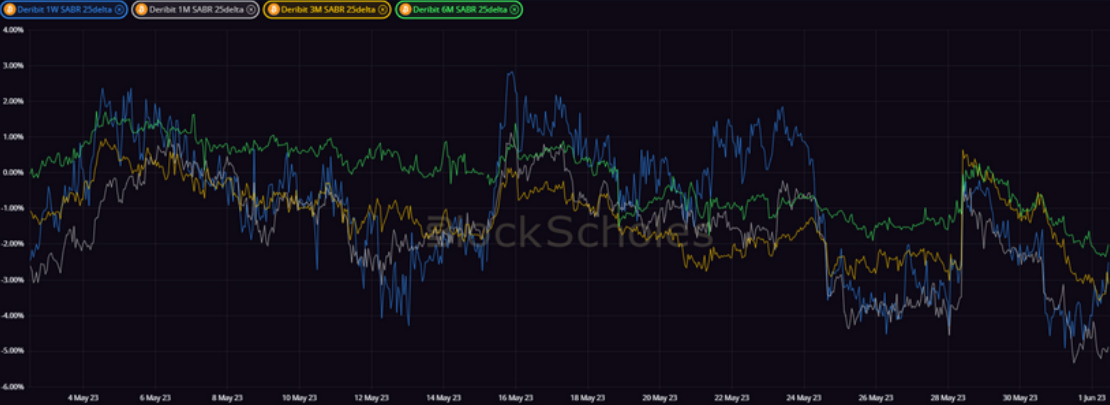

BTC 25-Delta Risk Reversal – have exhibited another downwards trend after the spot rally briefly inspired a return to a more neutral vol smile.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – has drifted below that of BTC options for the second period in the 3Y history of liquid options markets.

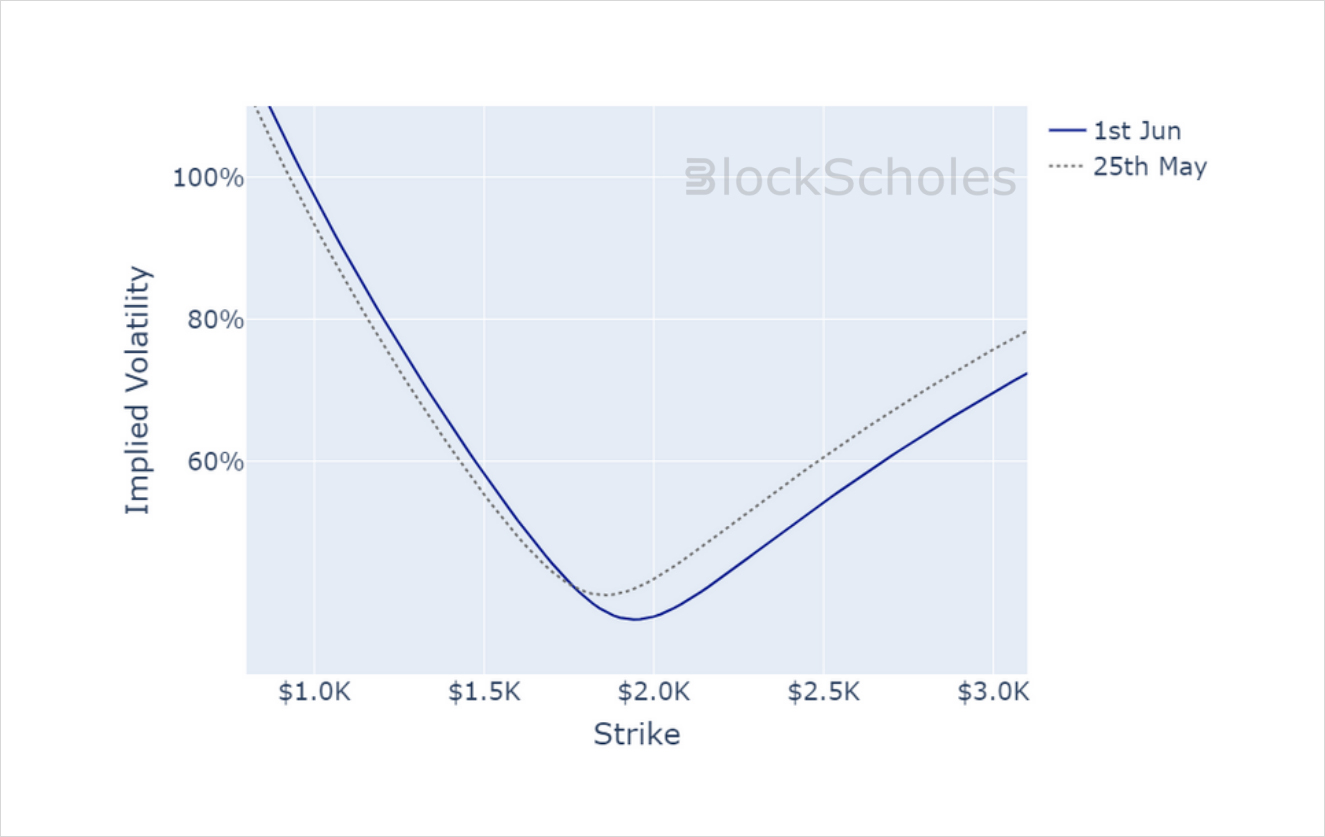

ETH 25-Delta Risk Reversal – echoes BTC’s vol smile over the last 7 days – rising sharply during the spot rally before drifting back towards OTM puts.

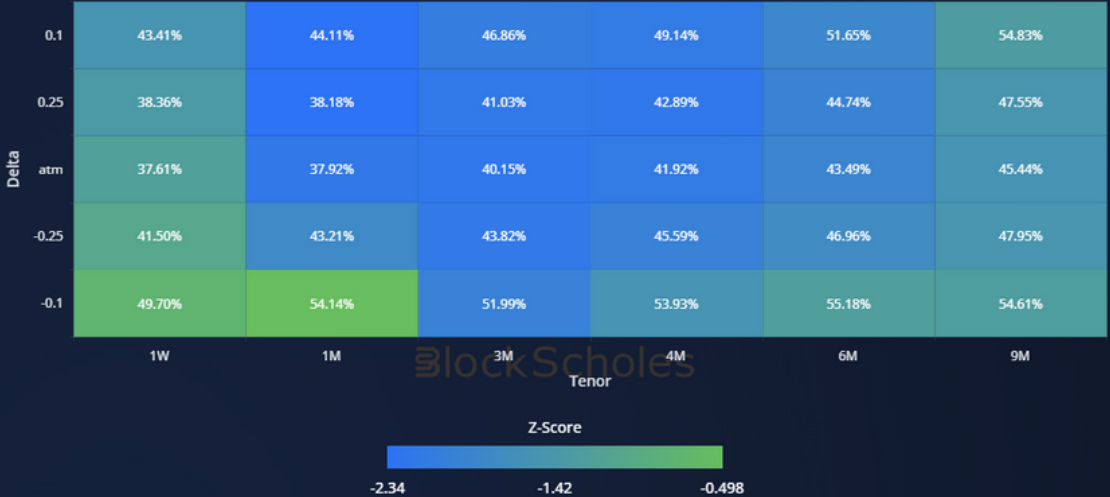

Volatility Surface

BTC IMPLIED VOL SURFACE – shows that the fall in implied volatility is surface wide.

ETH IMPLIED VOL SURFACE – reports a stronger cooling in implied volatility at longer dated tenors, with a moderate fall in short term vol.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration

Volatility Smiles

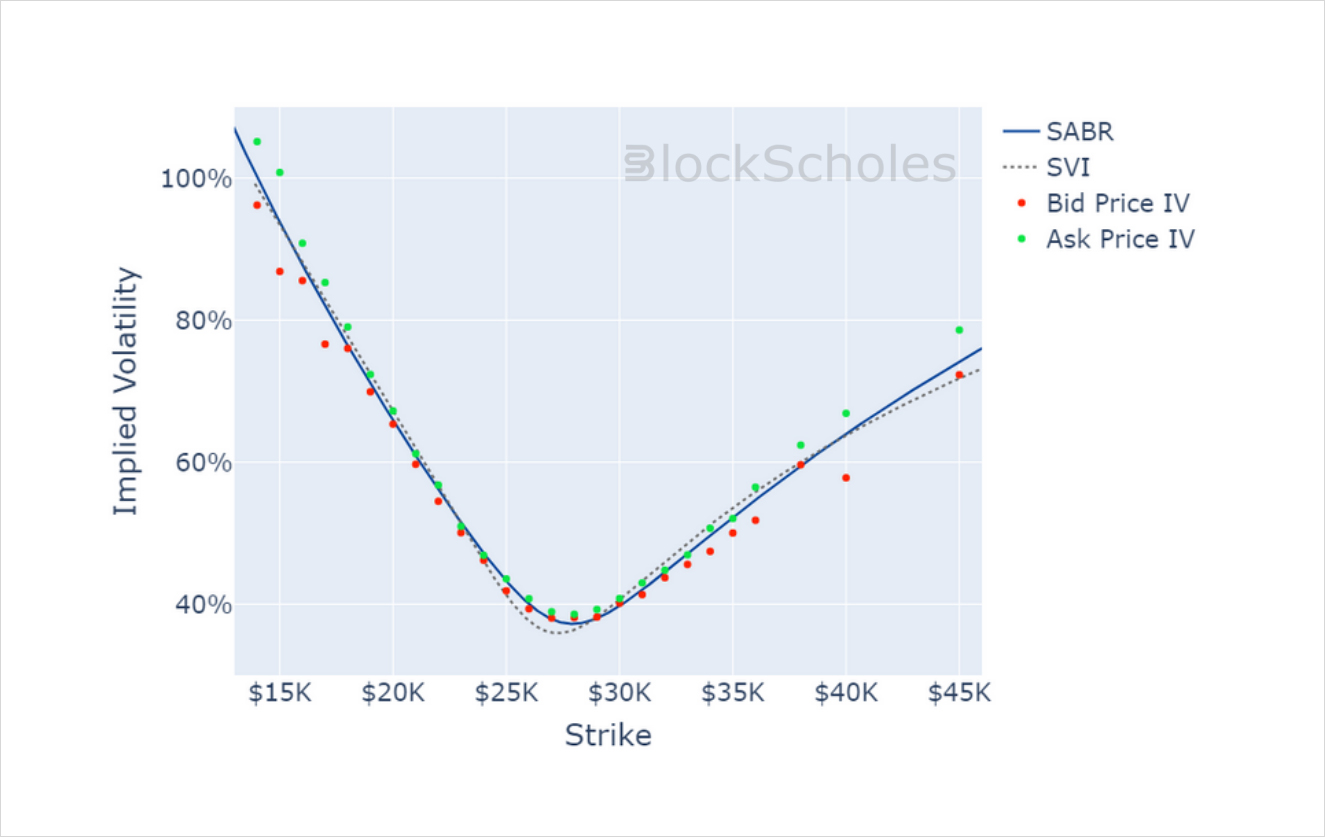

BTC SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

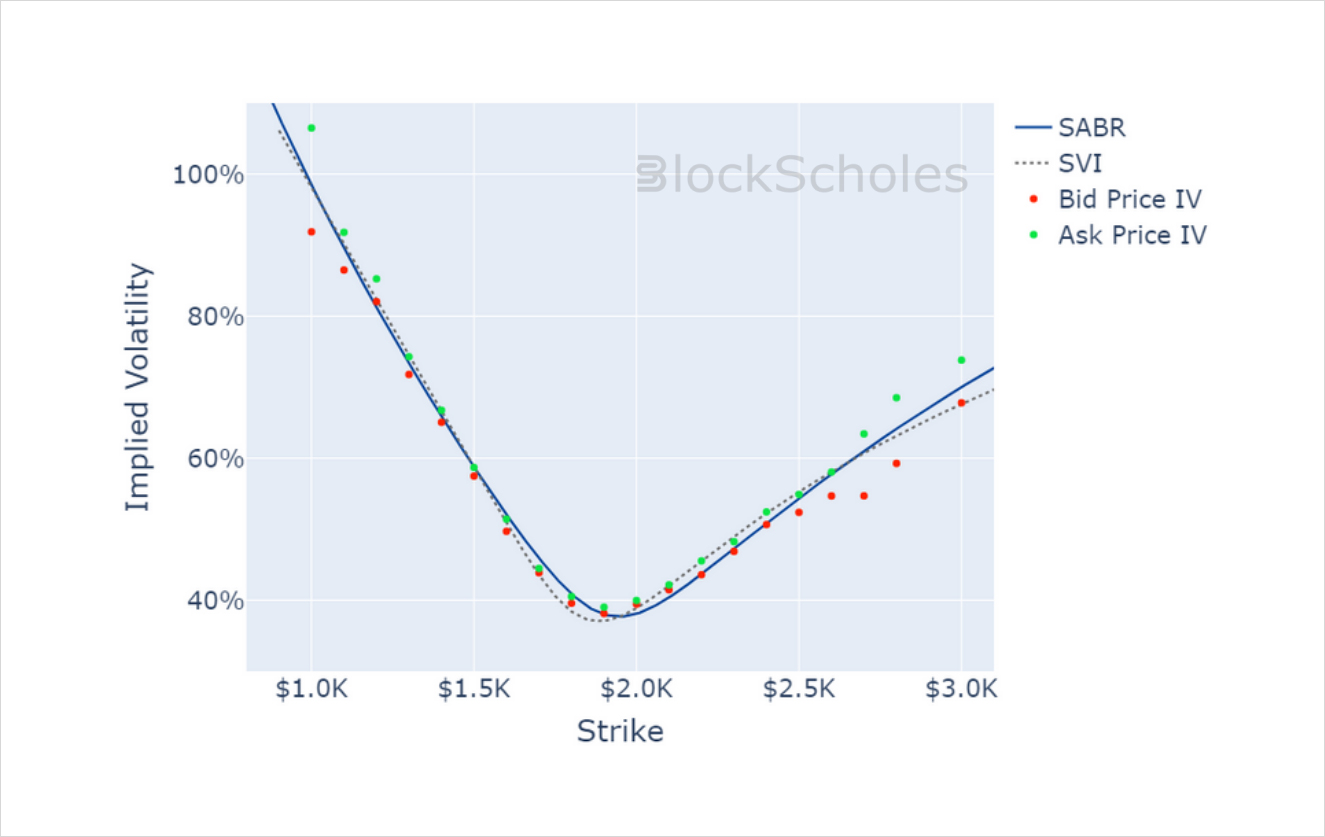

ETH SMILE CALIBRATIONS – 30-Jun-2023 Expiry, 10:00 UTC Snapshot.

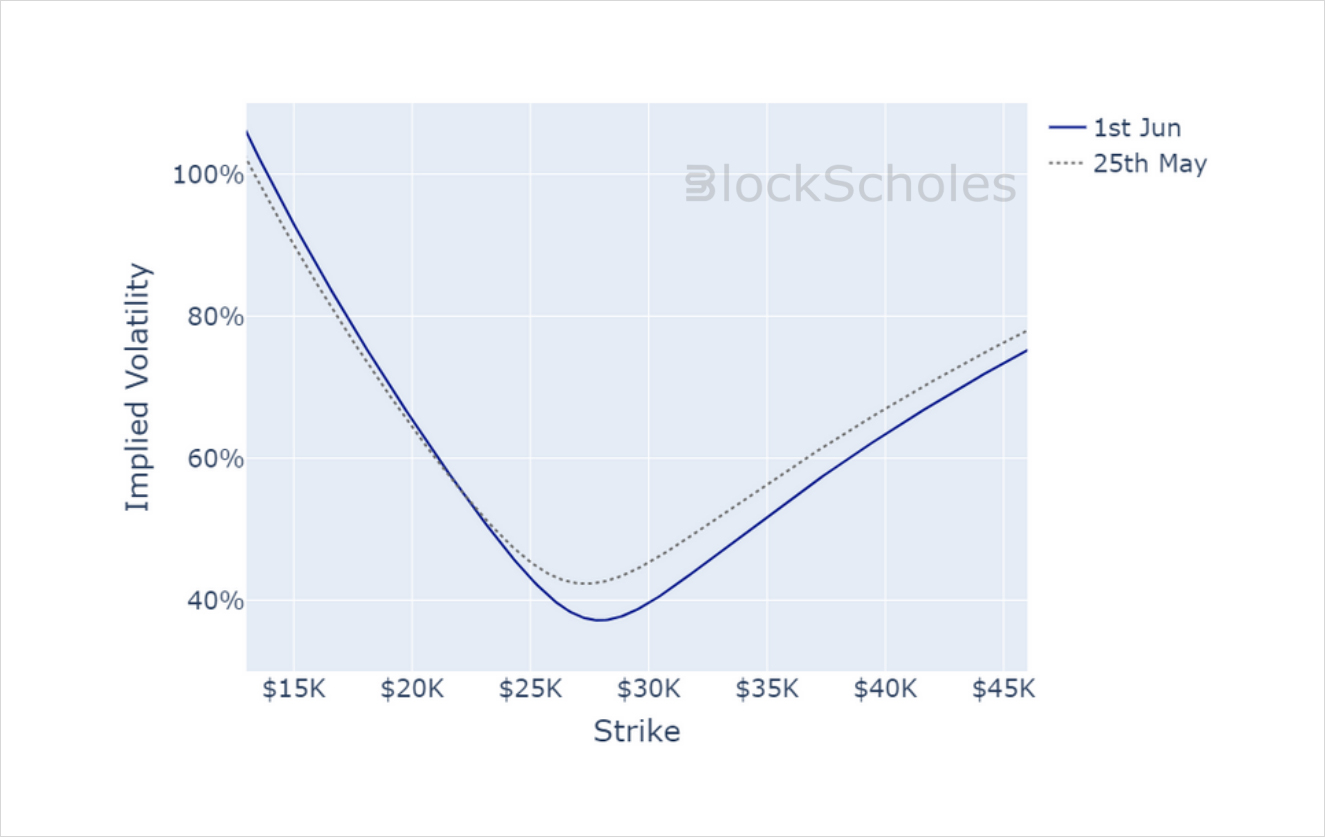

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:00 UTC Snapshot.

AUTHOR(S)