Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

Since breaking to new all-time highs last week on the back of advancements in the regulatory landscape (particularly for crypto stablecoins) BTC has since traded within a range of $111K (the new record high) and $107K. Despite spot price being unable to hold the new high for long, derivatives markets remain optimistic – all three measures of directional sentiment, although less bullish than in the run up to $111K, remain positive. Short-tenor volatility smile skews are tilted towards OTM calls by as much as 5%, funding rates are still positive and the futures yield for the 1-month tenor remains above 7%. ETH derivatives markets carry less of that optimism – perp funding rates are currently sub-zero, and ETH volatility smile skews are less skewed towards call options, though not yet tilted towards puts.

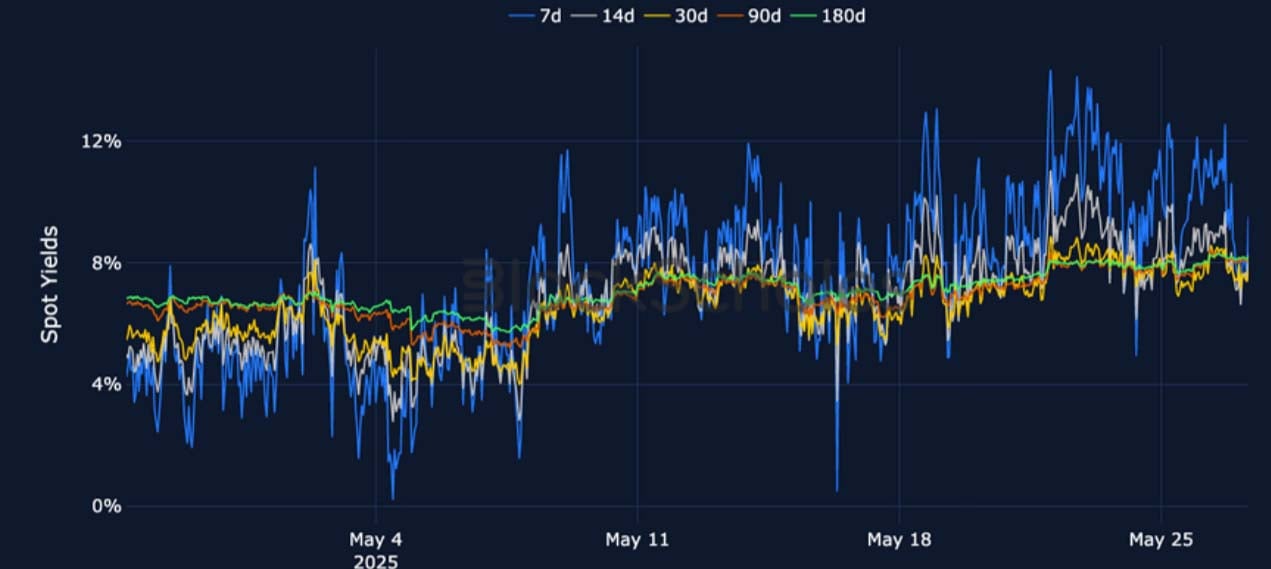

Futures Implied Yields

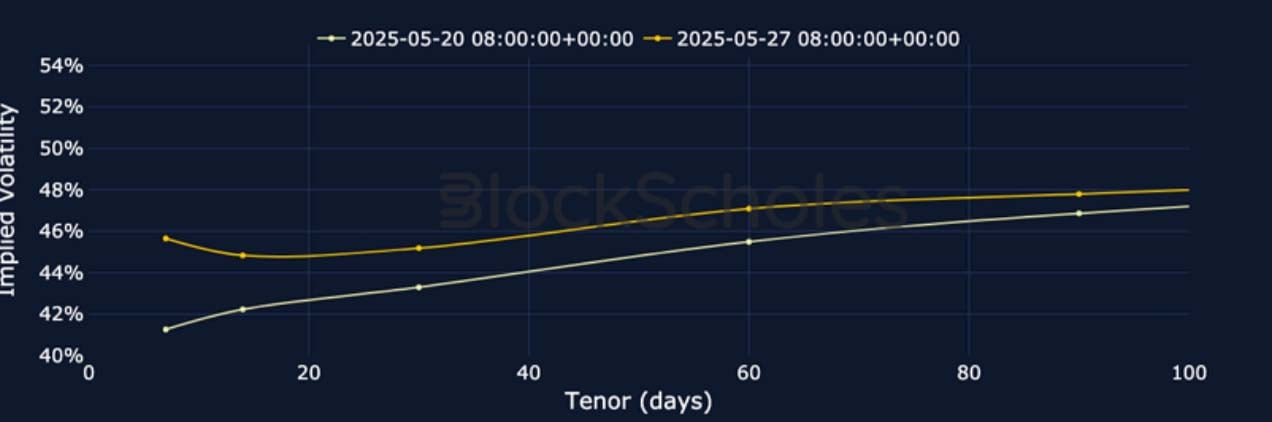

1-Month Tenor ATM Implied Volatility

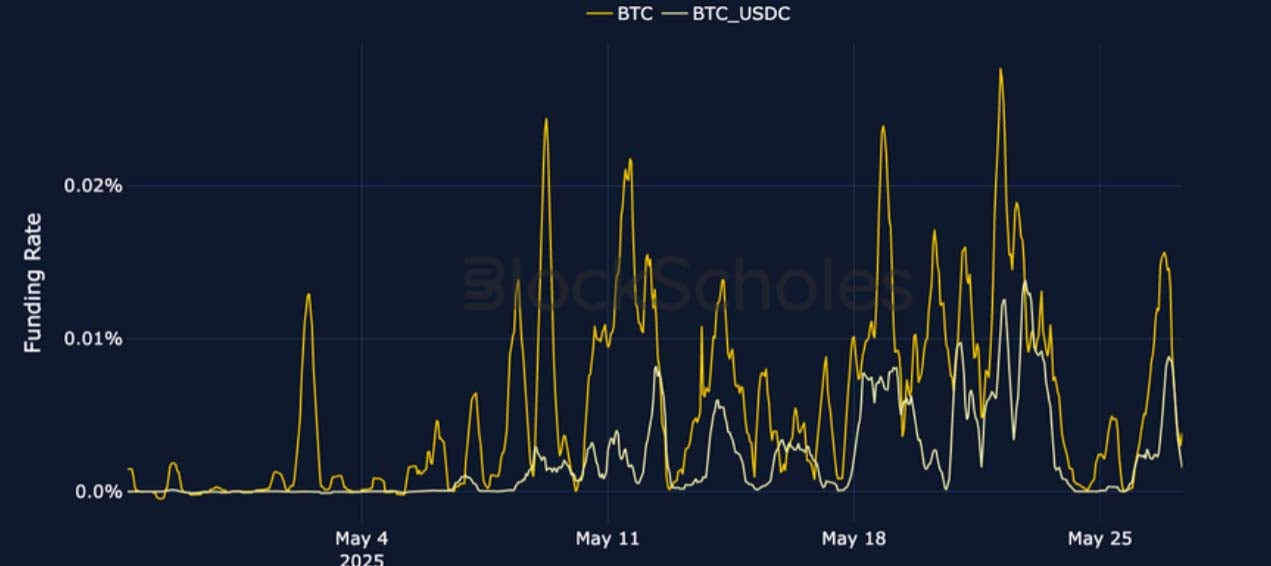

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC funding rates surged to their highest levels so far in May, as BTC reached a new all-time high of $111.7K.

ETH FUNDING RATE – ETH funding rates saw a similar spike as BTC’s ATH dragged up the rest of the market, though rates have now dropped negative.

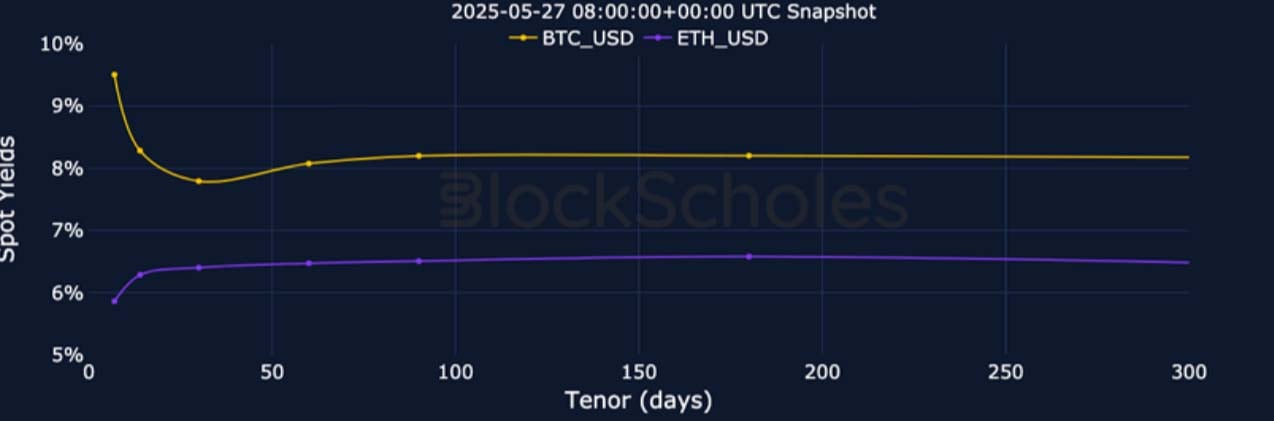

Futures Implied Yields

BTC Futures Implied Yields – BTC’s futures term structure maintains the inversion it has carried for most of May, as spot trades close to recent highs.

ETH Futures Implied Yields – ETH futures yields term structure, on the other hand, has been mostly positively sloped through the month and past week.

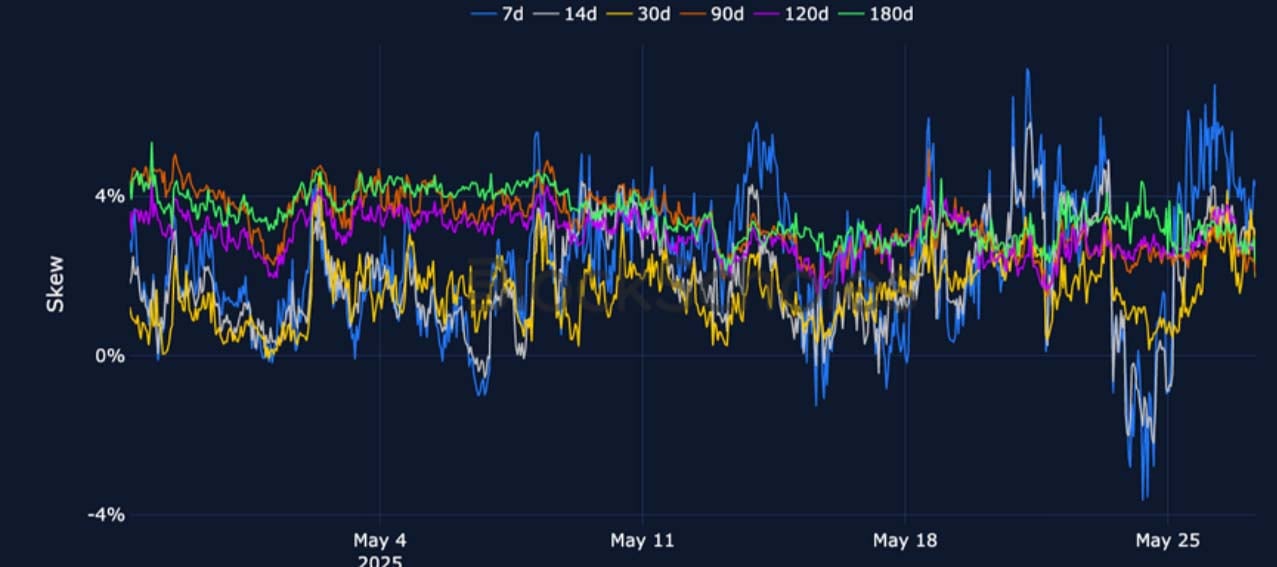

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Short-term vol expectations dropped following the ATH, and rose again on US-EU tariff talks on Sunday May 25.

BTC 25-Delta Risk Reversal – Short-tenor smiles still favour OTM calls, though to a lesser extent than when BTC first broke January’s $109K high.

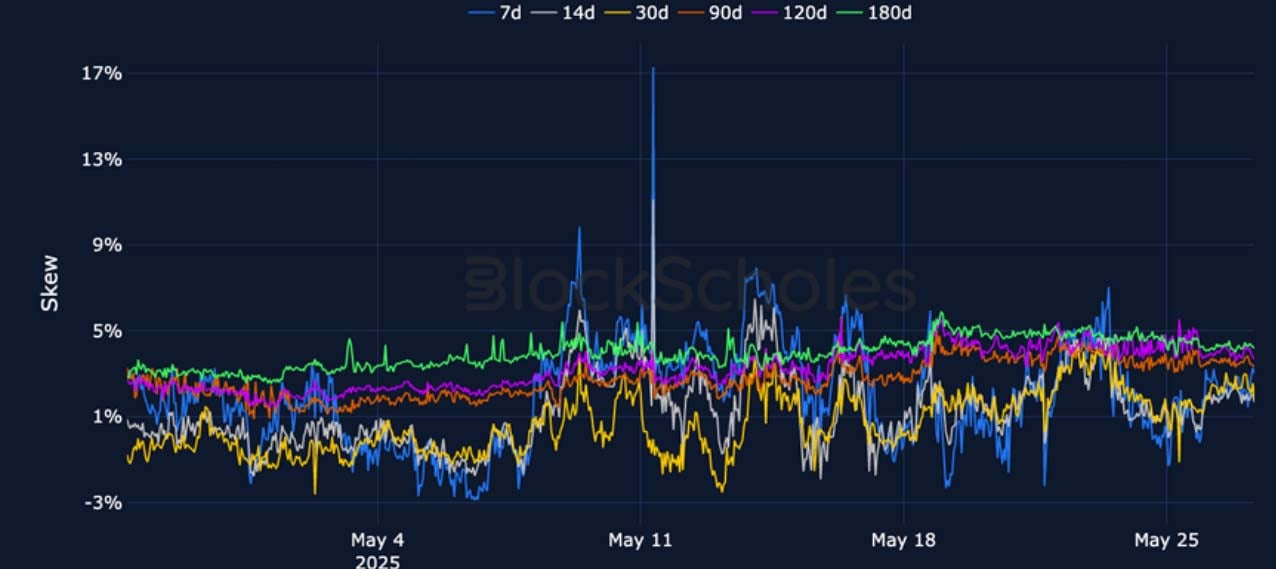

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Short tenor options carry a 4 point vol premium to longer-tenor options, compared to BTC’s steeper slope.

ETH 25-Delta Risk Reversal – ETH’s skew is far below its May high, when spot rallied over 50% in a single-week, but 7-day options skewed towards OTM calls by more than 4%.

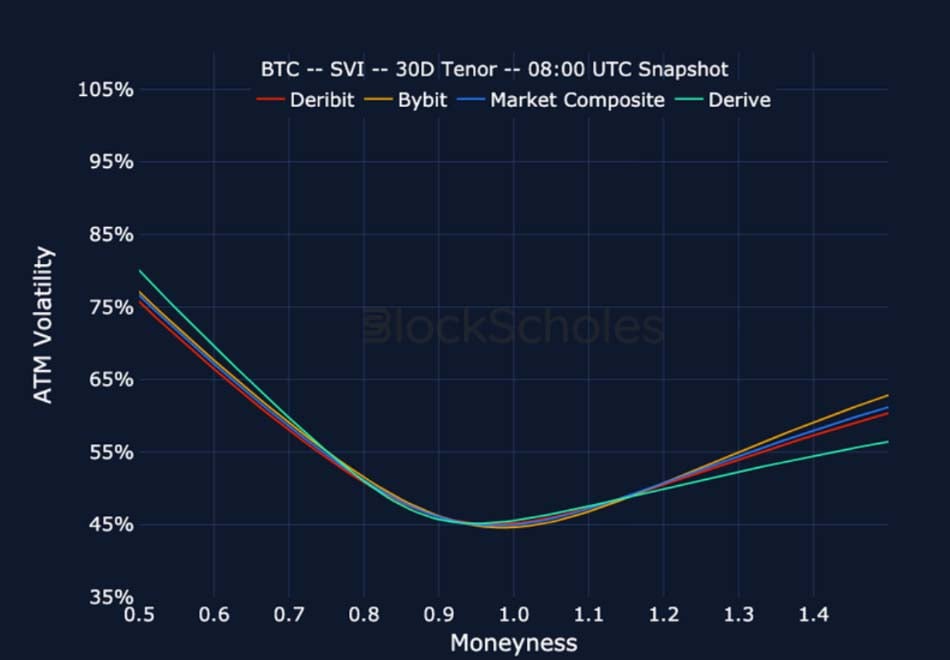

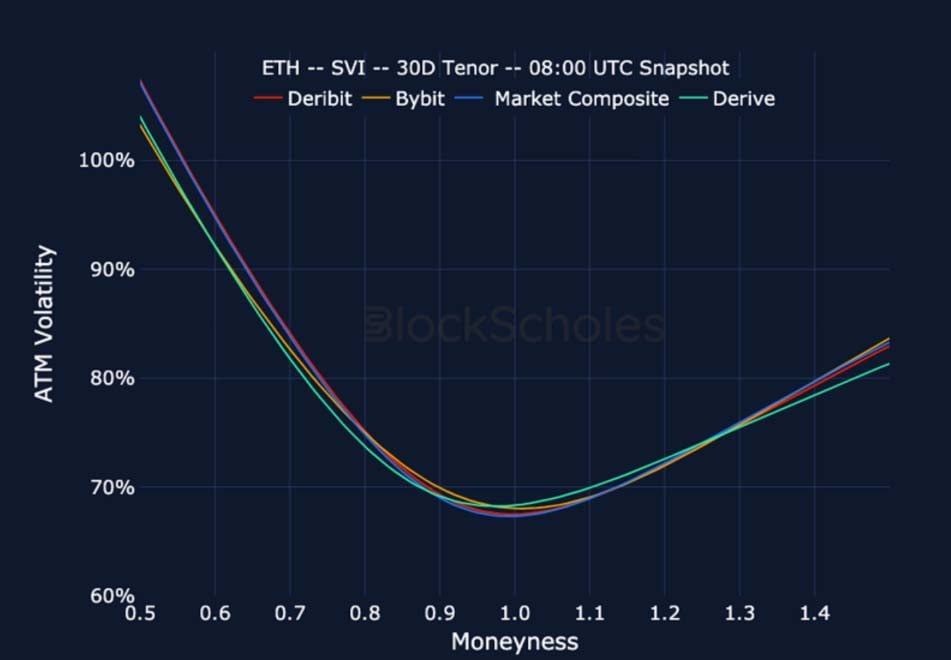

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

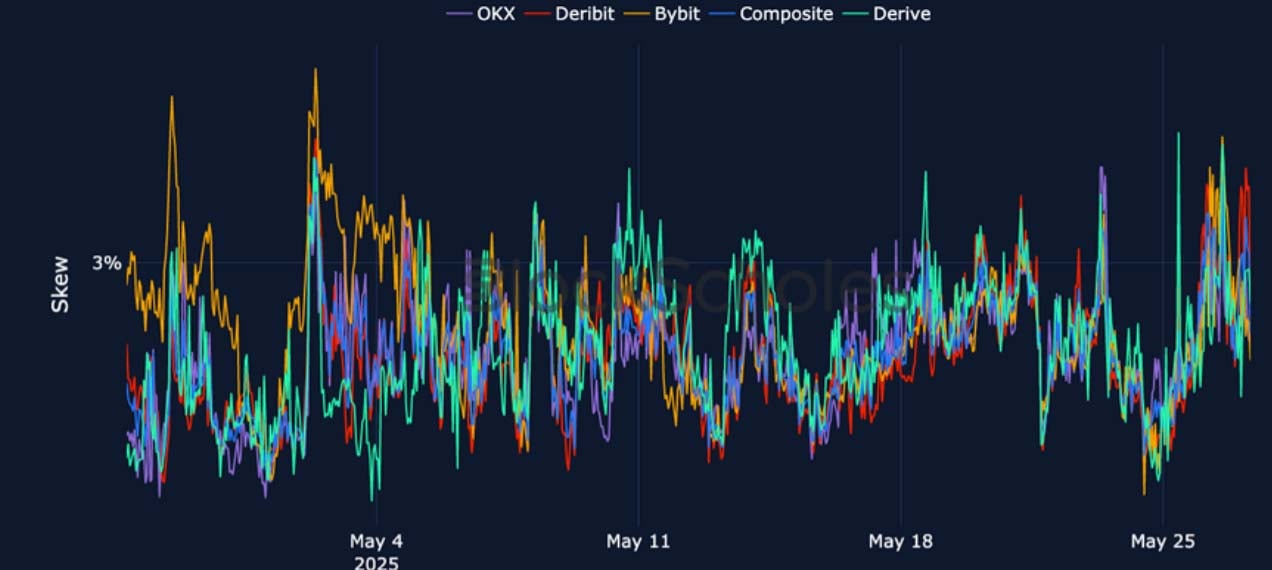

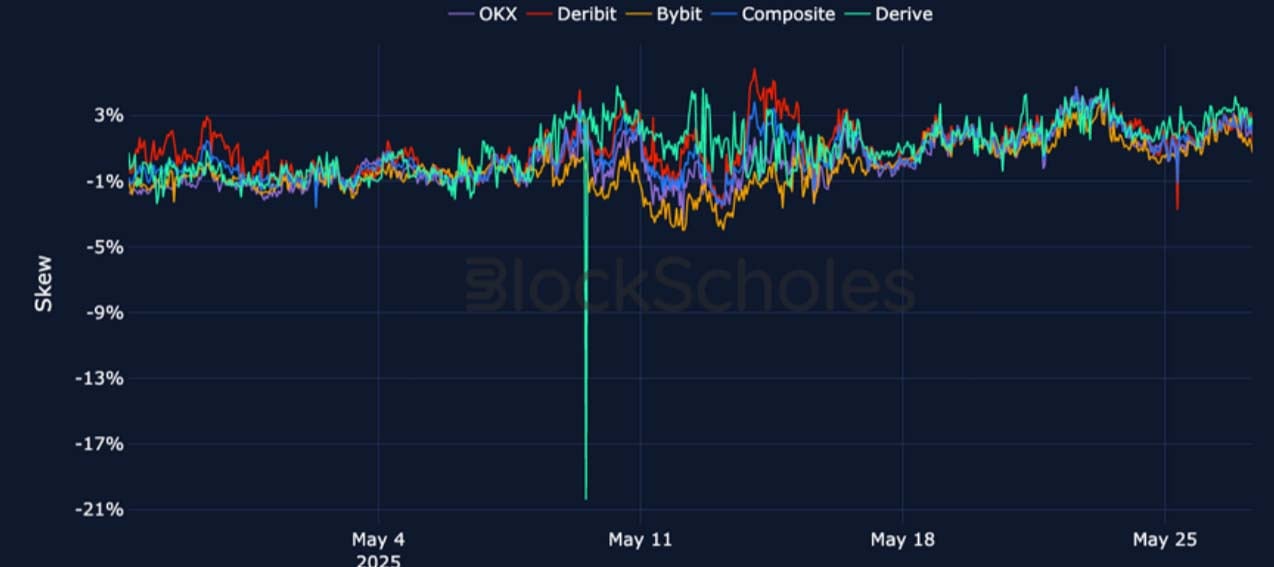

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

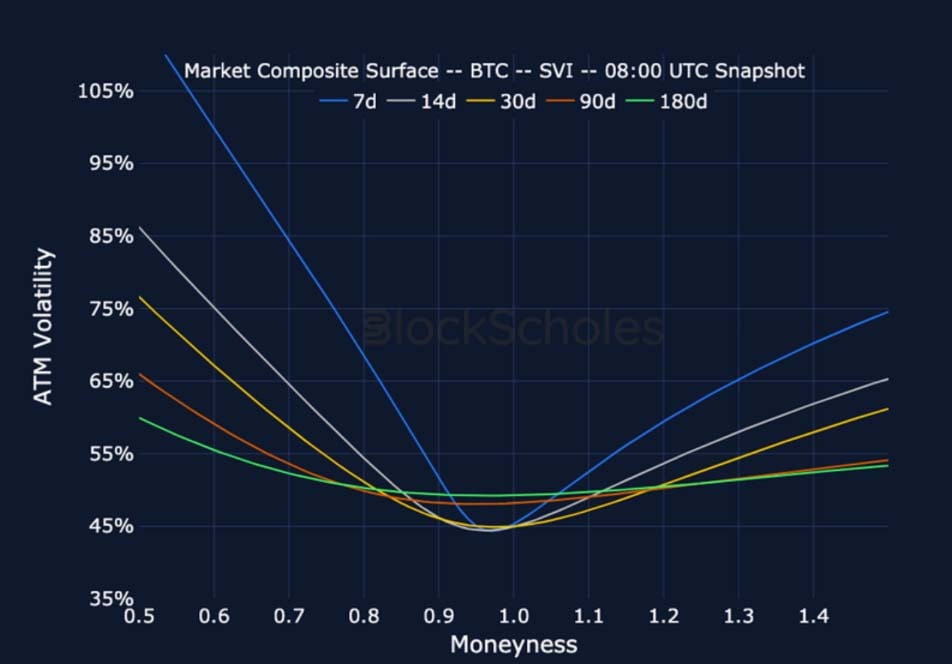

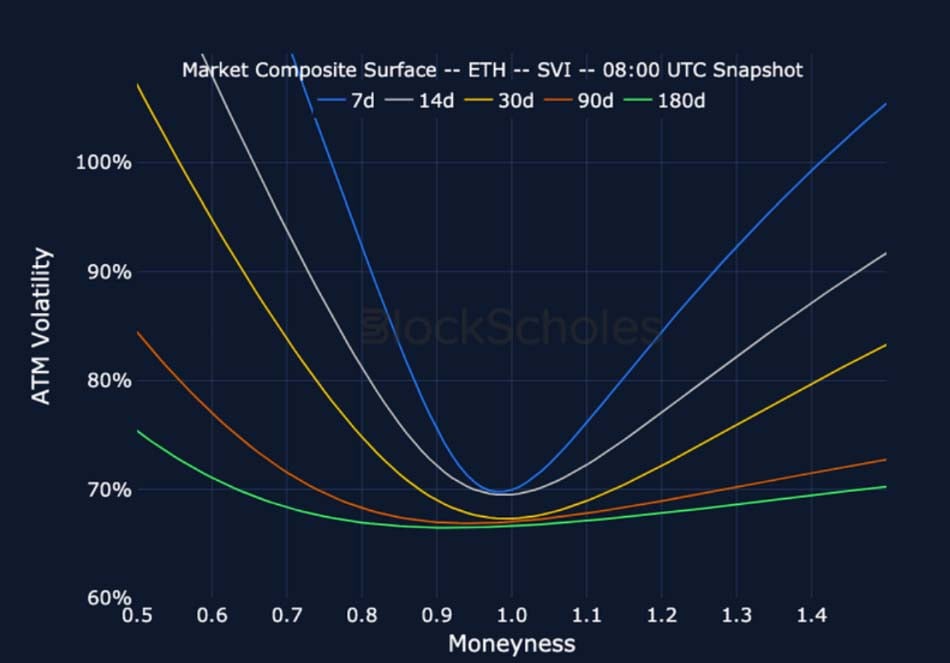

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

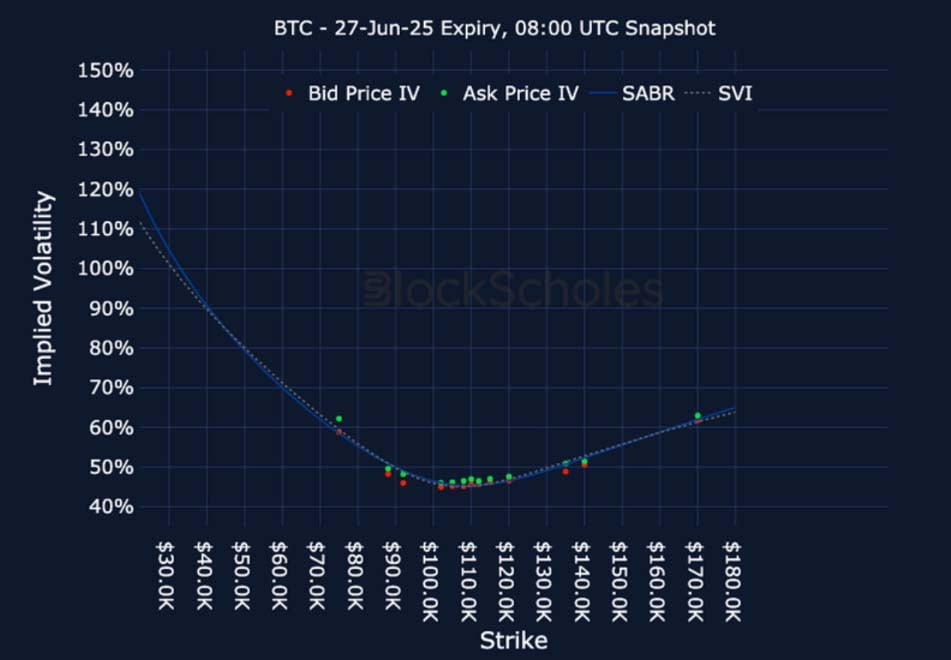

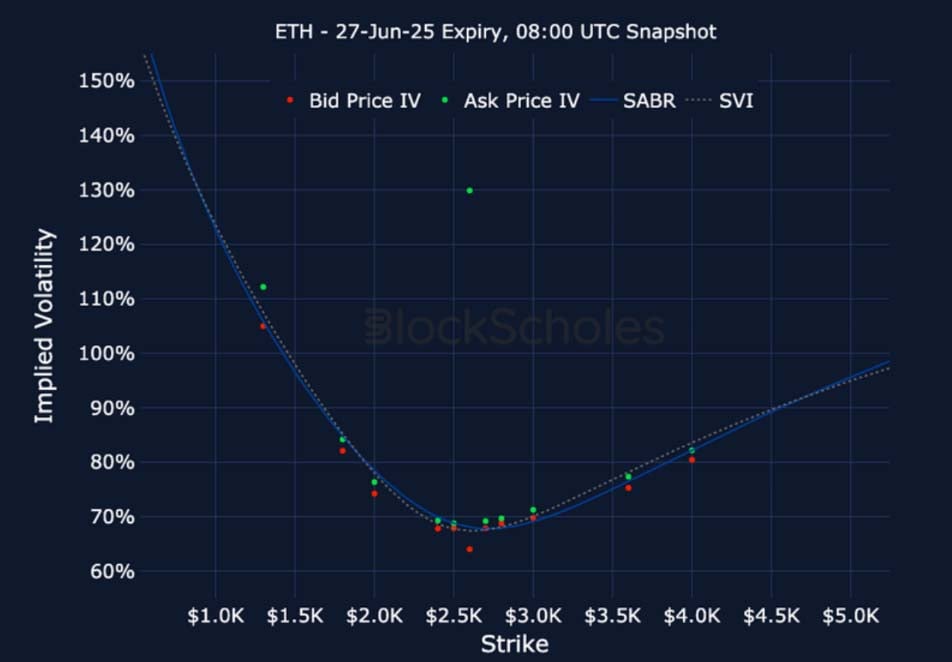

Listed Expiry Volatility Smiles

BTC 27-JUN EXPIRY – 9:00 UTC Snapshot.

ETH 27-JUN EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

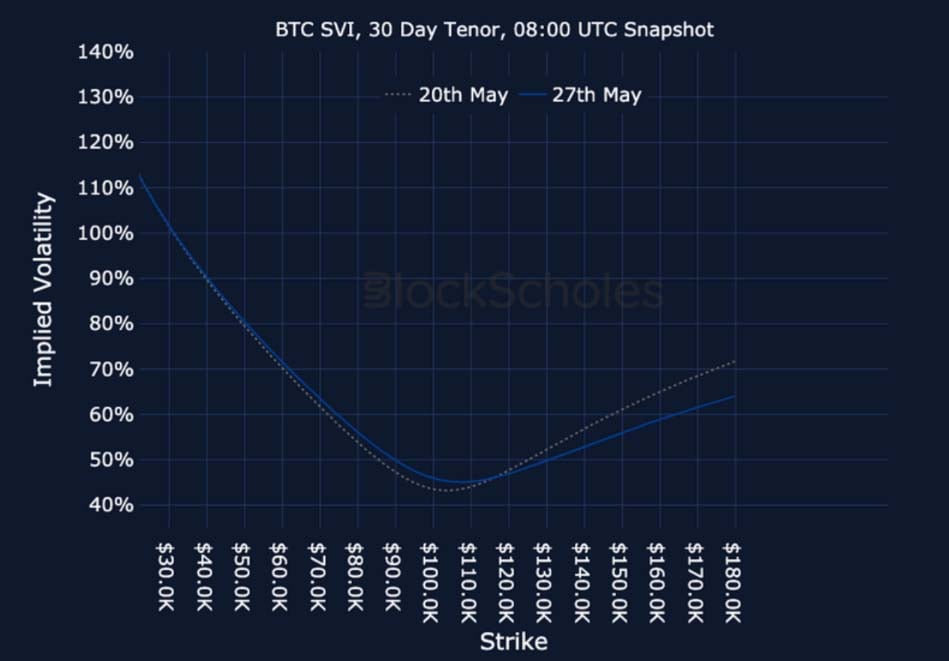

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)