Weekly recap of the crypto derivatives markets by BlockScholes.

BTC Derivatives Analytics

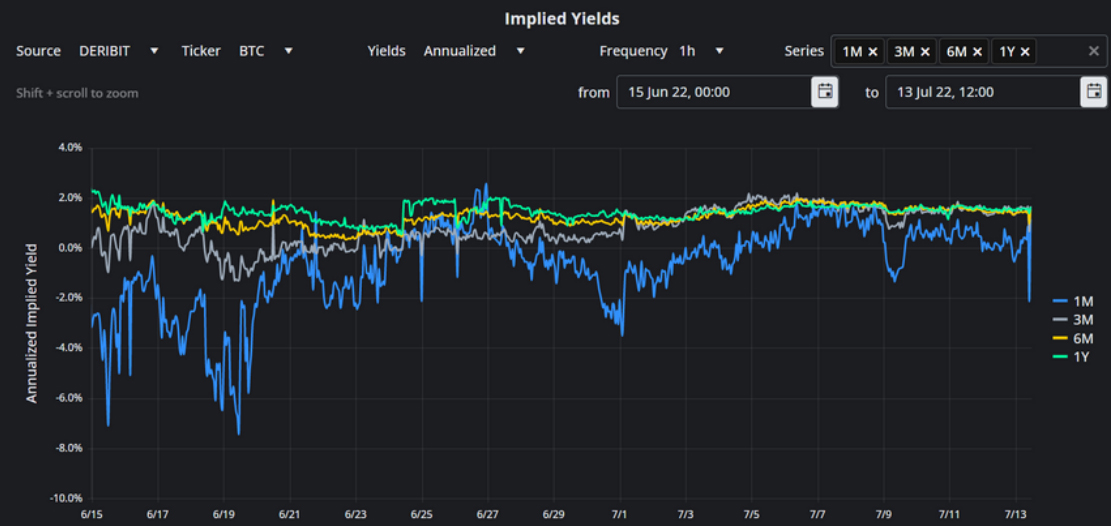

Annualised yields of short tenor futures drop, but yields at higher tenors remain flat

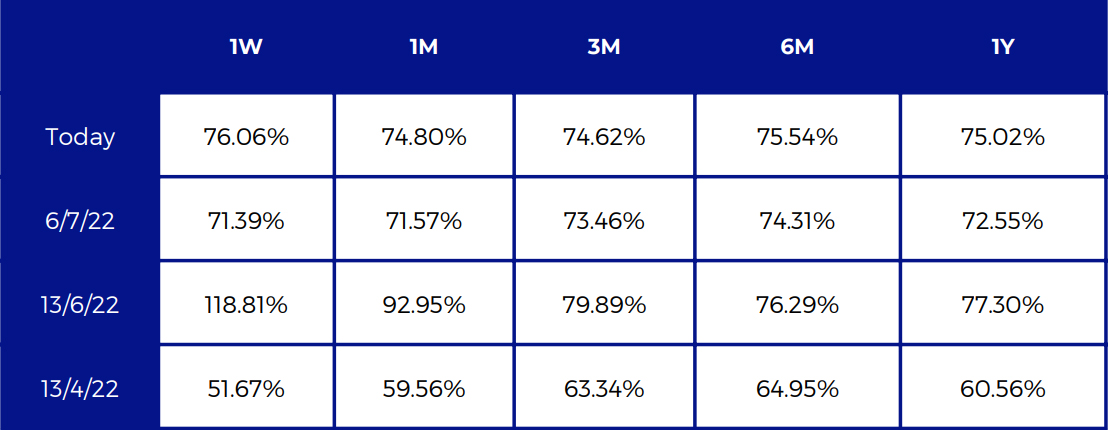

BTC Annualised Futures Implied Yields Table

All timestamps 08:00 UTC

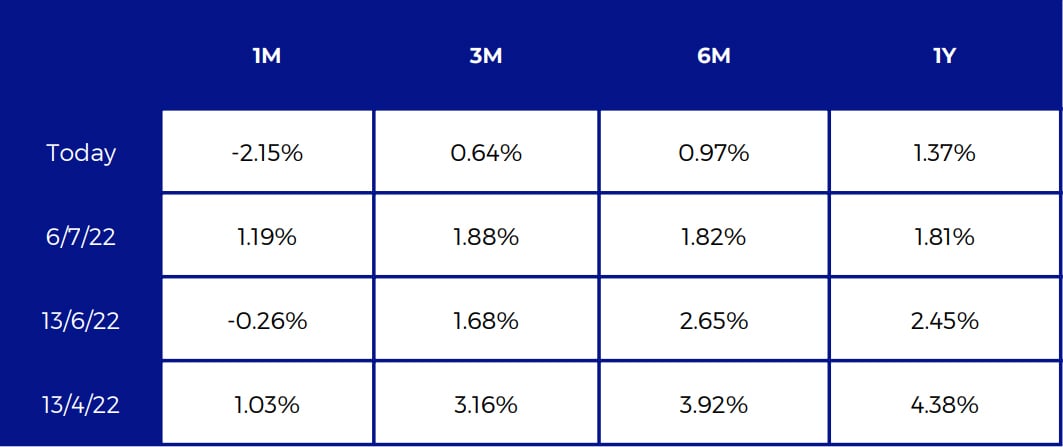

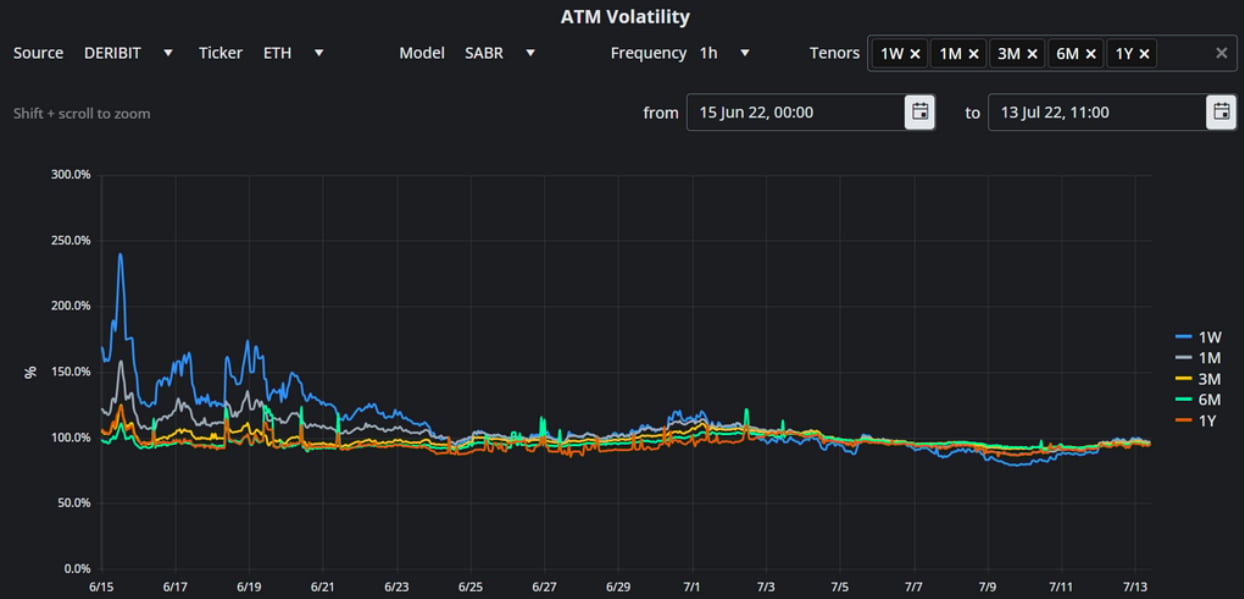

Short-term ATM vol is inverted again as short term tenors rise above the vol of longer dated options

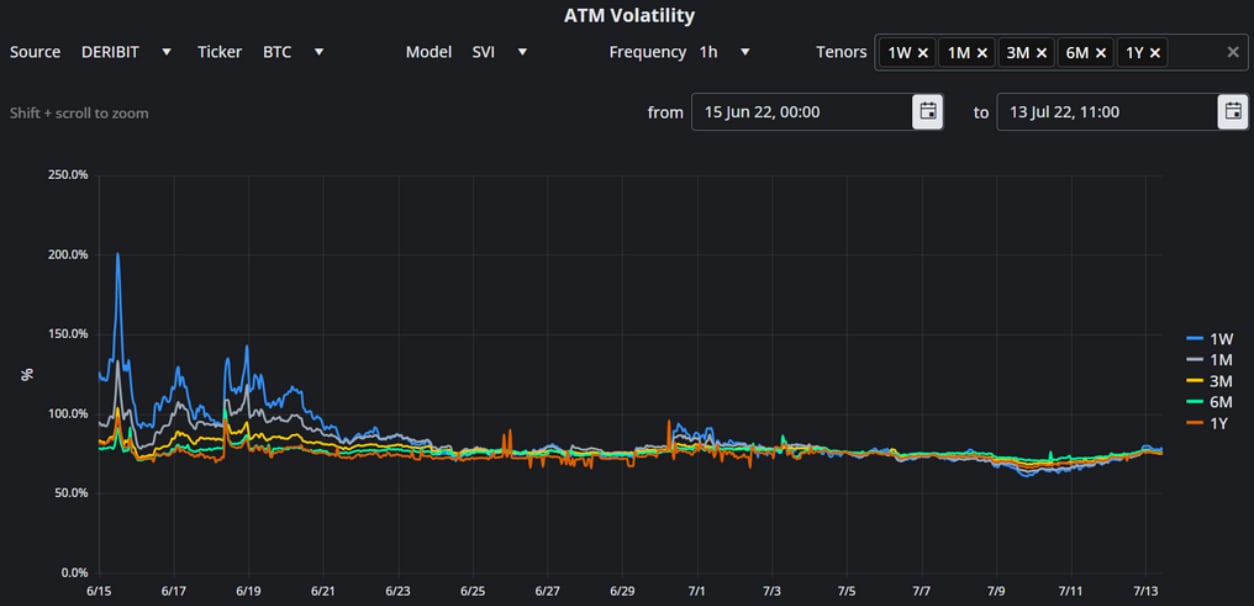

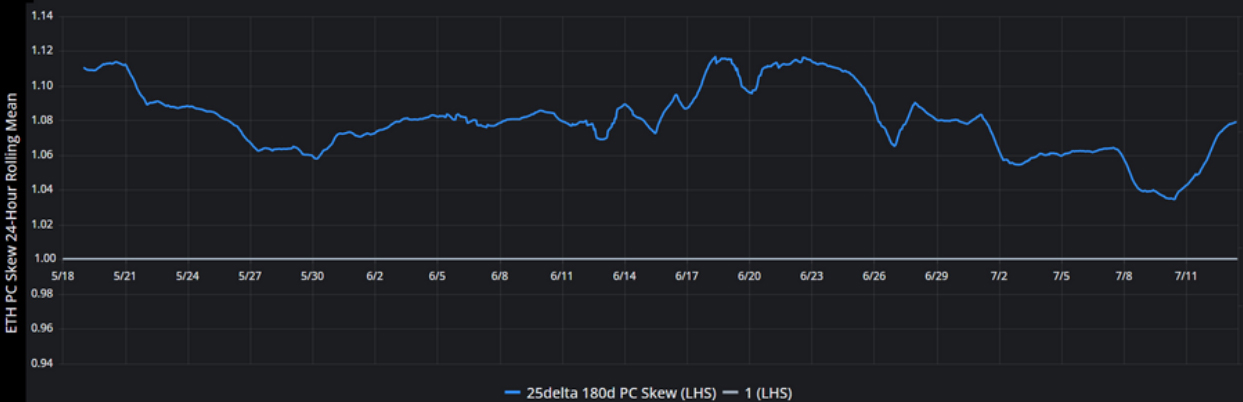

BTC’s 25-delta puts remain at a 10% premium to 25-delta calls

The IV of options near 1M and 3M tenors cools across the delta domain

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 15:00 UTC

BTC ATM Implied Volatility Table

All timestamps 15:00 UTC, SVI Smile Calibration

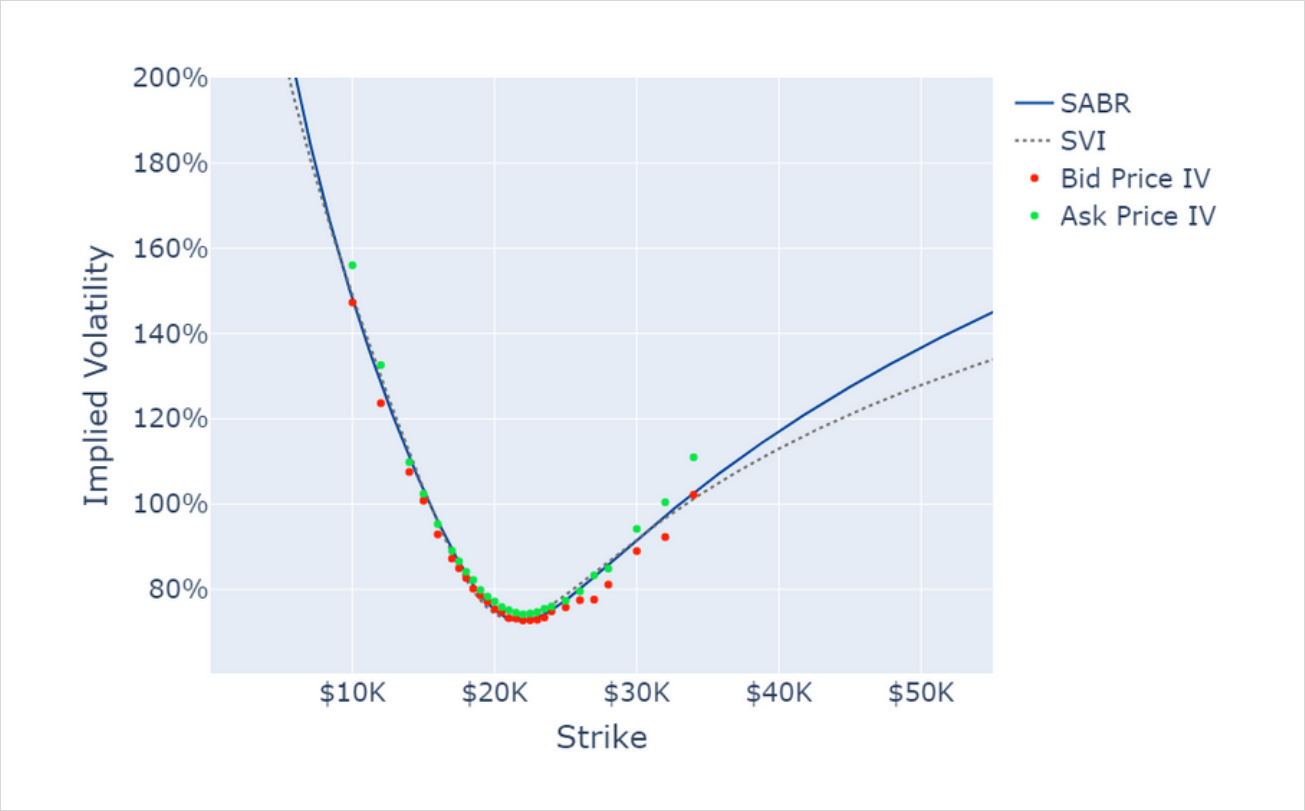

SABR and SVI Smile Calibrations, 29th July Expiry

BTC’s vol smile rises slightly in OTM calls and is stationary in OTM puts, resulting in a lower PC skew

BTC 1 Month SABR Implied Vol Smile.

ETH Derivatives Analytics

ETH’s annualised yields are still performing worse than BTC’s, pushing further below 0 at short tenors

Annualised Futures Implied Yields Table

All timestamps 08:00 UTC

ETH’s ATM term structure remains flat in the mid 90s and, like BTC’s, is inverted once more

ETH’s skew towards puts rises again towards the levels seen in BTC’s vol smile

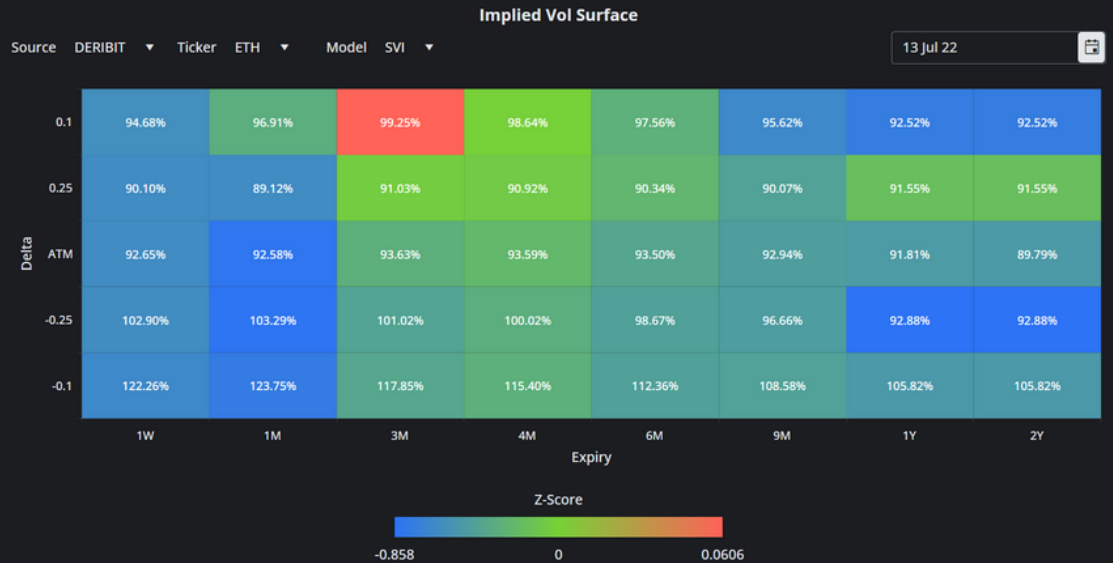

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 15:00 UTC

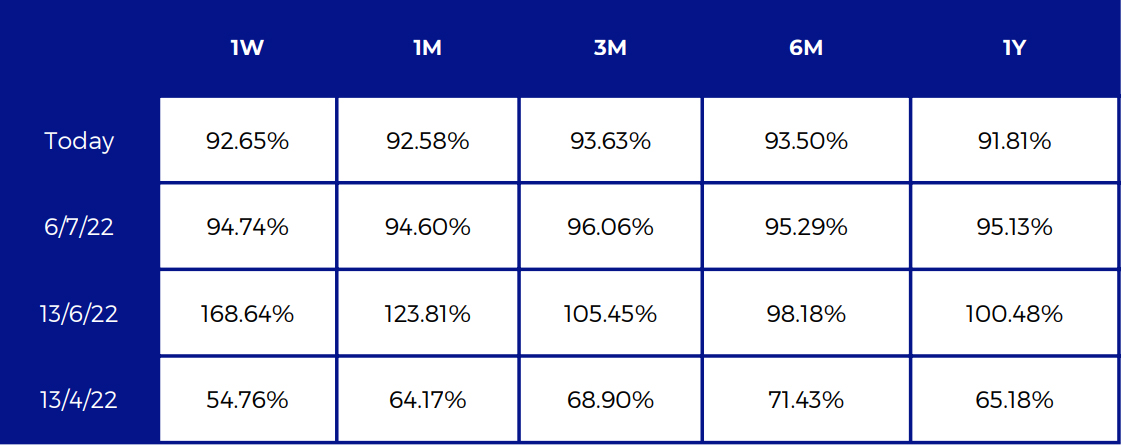

ETH ATM Implied Volatility Table

All timestamps 15:00 UTC, SVI Smile Calibration

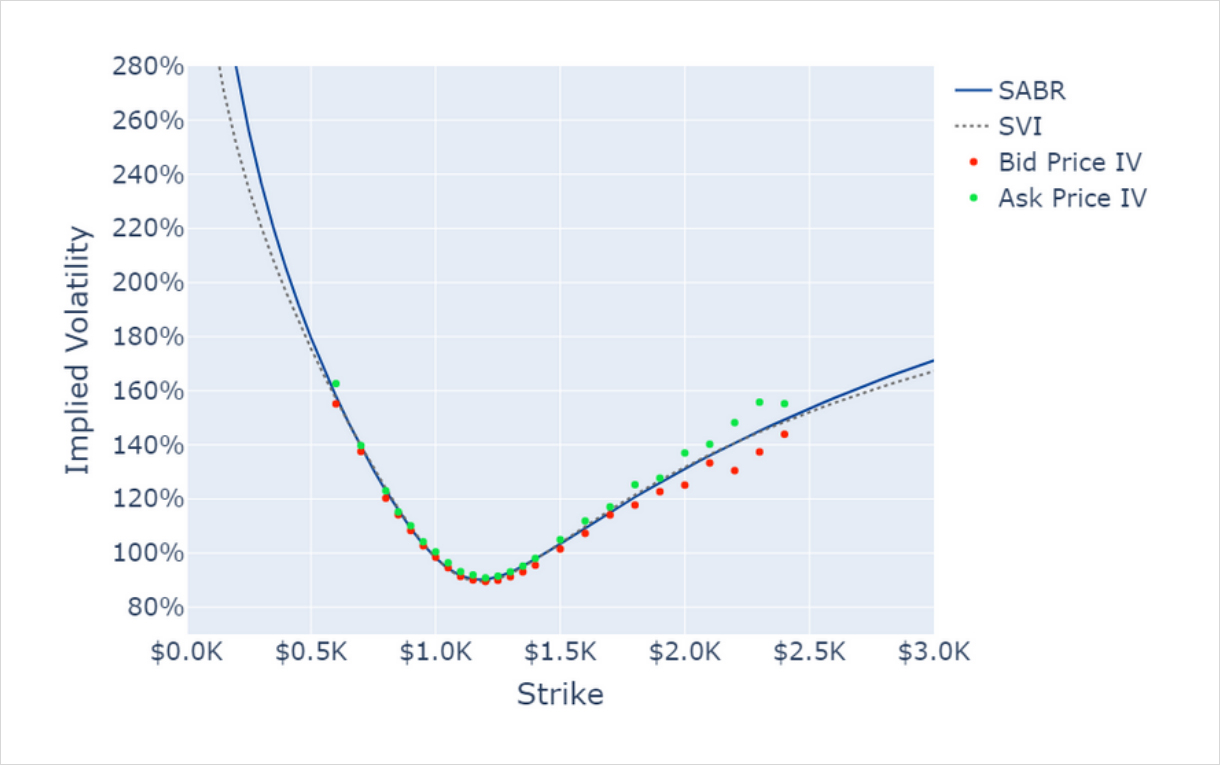

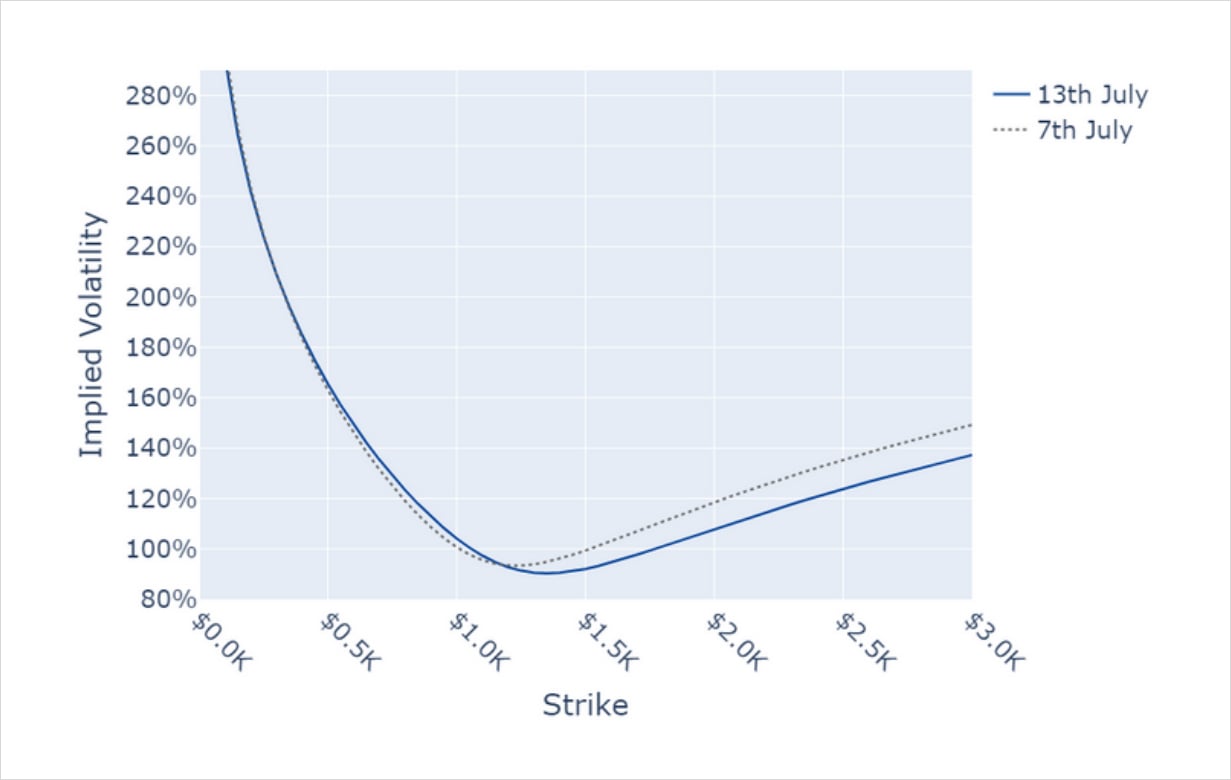

SABR and SVI Smile Calibrations, 29th July Expiry

The implied volatility of OTM calls drops further, corresponding to the increase in PC Skew

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)