Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

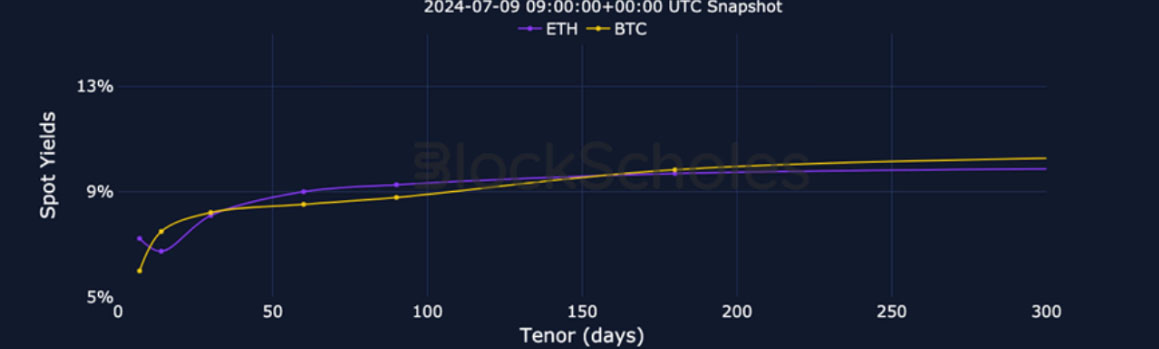

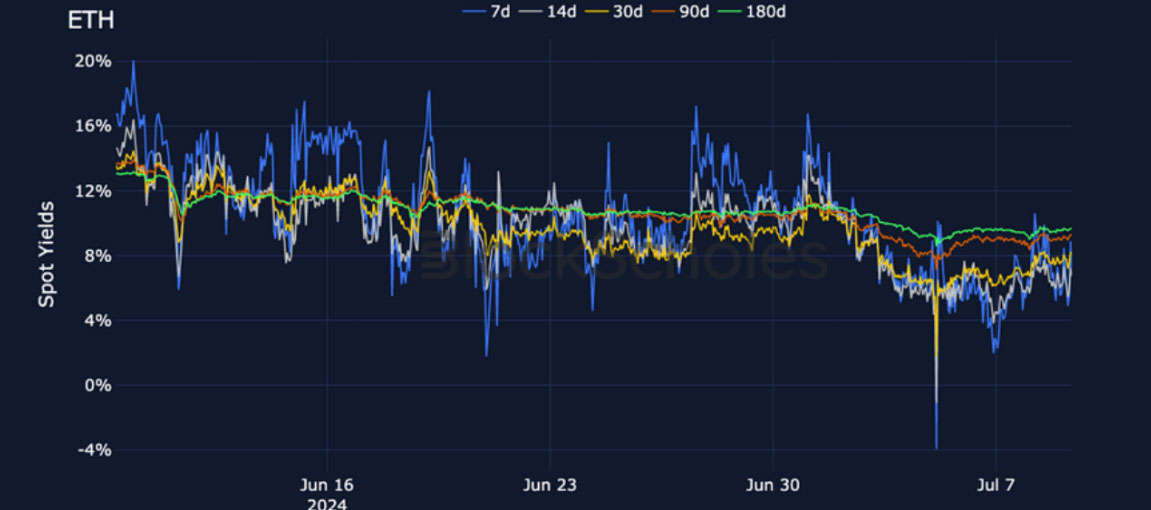

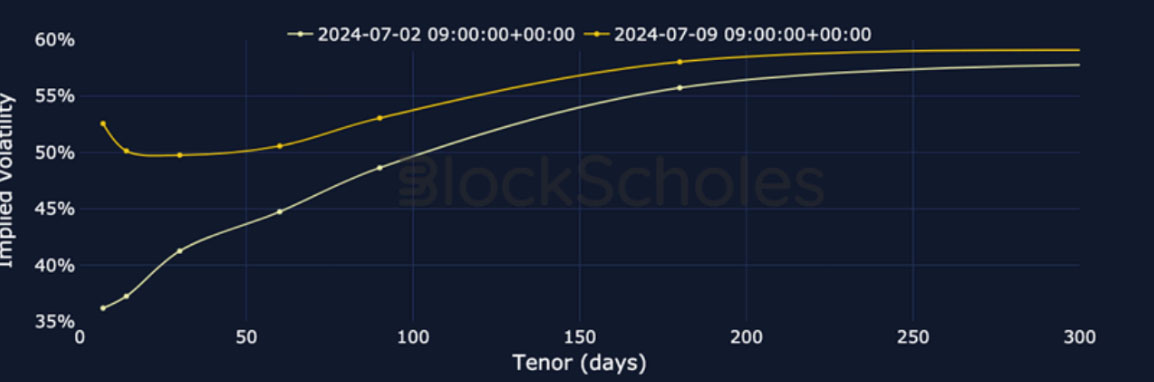

The latest venture of spot prices down to the bottom of their range has seen volatility levels at short tenors spike while traders rush to protect against further downside price action. While funding rates has remained steadily positive and short tenor future-implied yields have recovered some of their lost ground, volatility smiles remain skewed towards OTM puts and short tenor volatility has not fallen back from the levels of longer dated tenors. ETH retains its 10 vol point premium over BTC volatility at equivalent tenors and its term structure trades much flatter, continuing a trend that we have seen several times over the past month of range-bound price action.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

BTC ANNUALISED YIELDS – short tenor yields rally but do not recover the levels that they traded at before the selloff in spot.

ETH ANNUALISED YIELDS – trade at similar levels to BTC across the board having spiked further negative in the selloff.

Perpetual Swap Funding Rate

BTC FUNDING RATE – we see some sporadic greenshoots of excess long demand in BTC but nothing like levels seen as recently as late June.

ETH FUNDING RATE – does not show the same sparks of bullish demand as BTC despite spot following the rally higher.

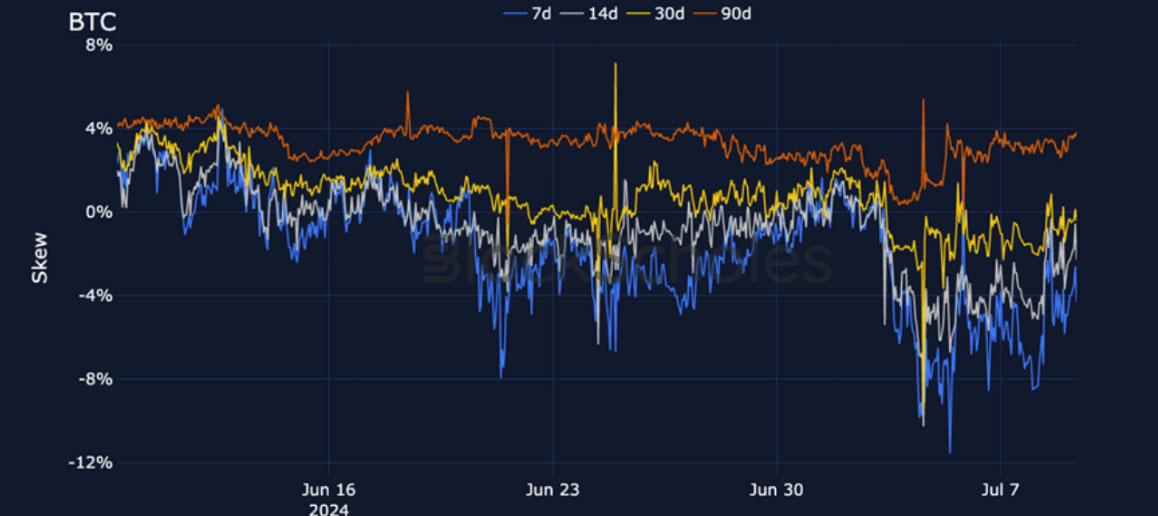

BTC Options

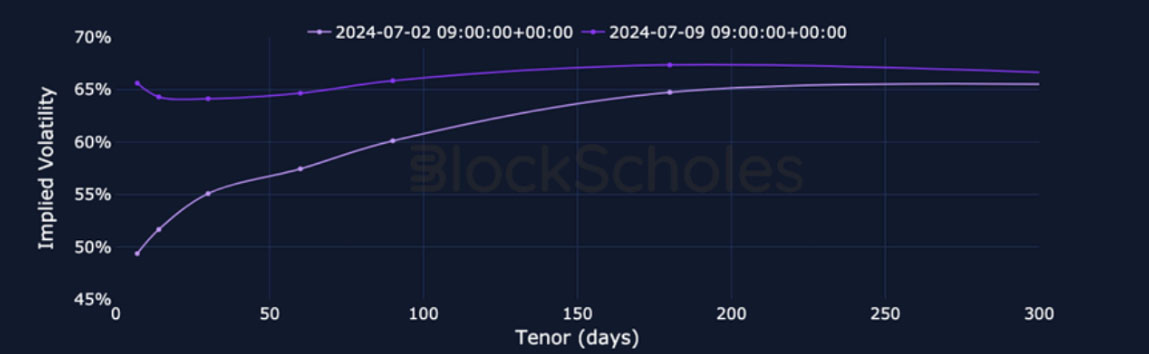

BTC SVI ATM IMPLIED VOLATILITY – short tenor volatility levels have rallied more than 10 points, compressing the term structure.

BTC 25-Delta Risk Reversal – the rally in vol was matched by a strong tilt towards OTM puts, which has persisted in the days since the selloff.

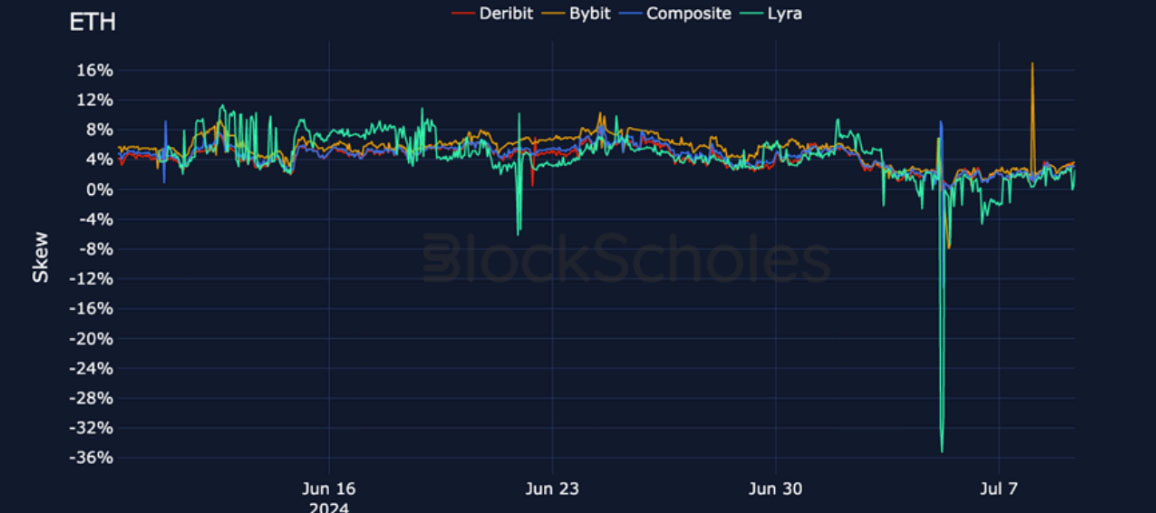

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – ETH’s term structure has flattened even further than BTC’s and retains its premium of 10 vol points.

ETH 25-Delta Risk Reversal – spiked harder and faster than BTC, but matches its neutral-to-bearish positioning across the term structure.

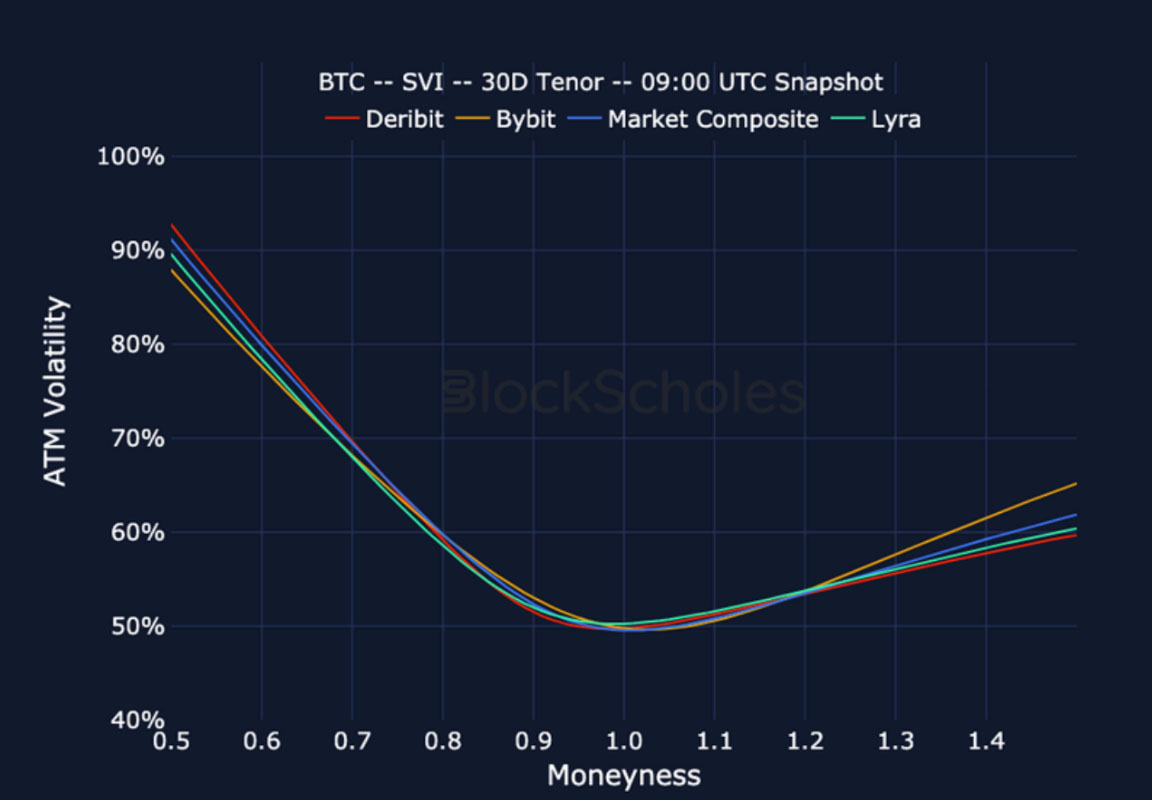

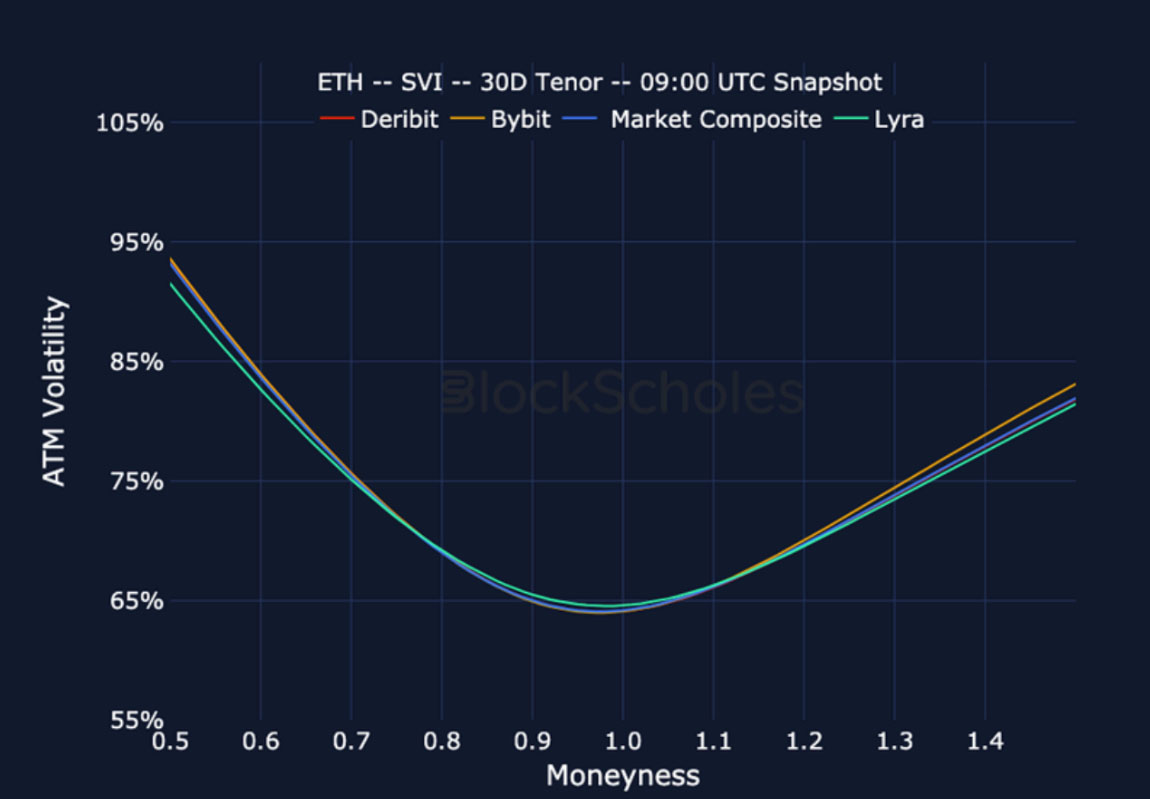

Volatility by Exchange

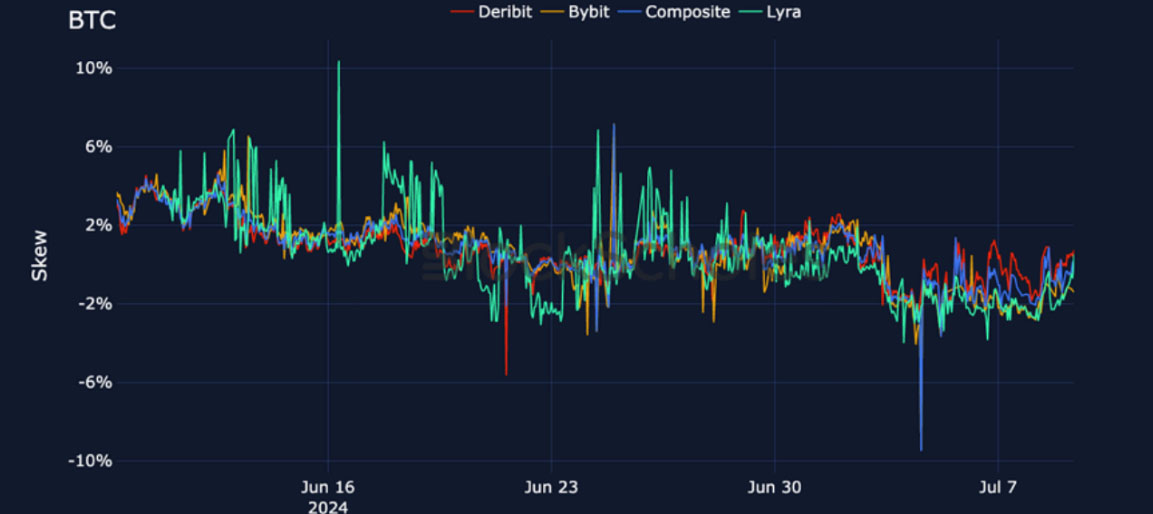

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

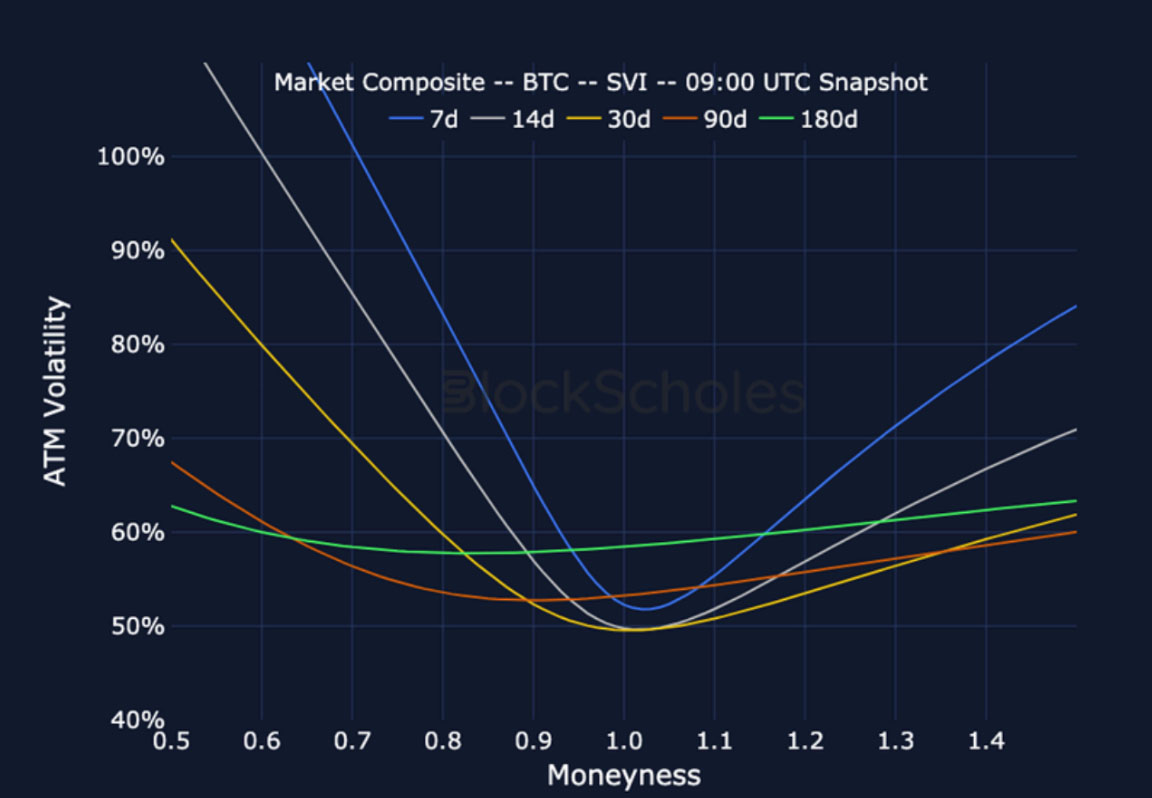

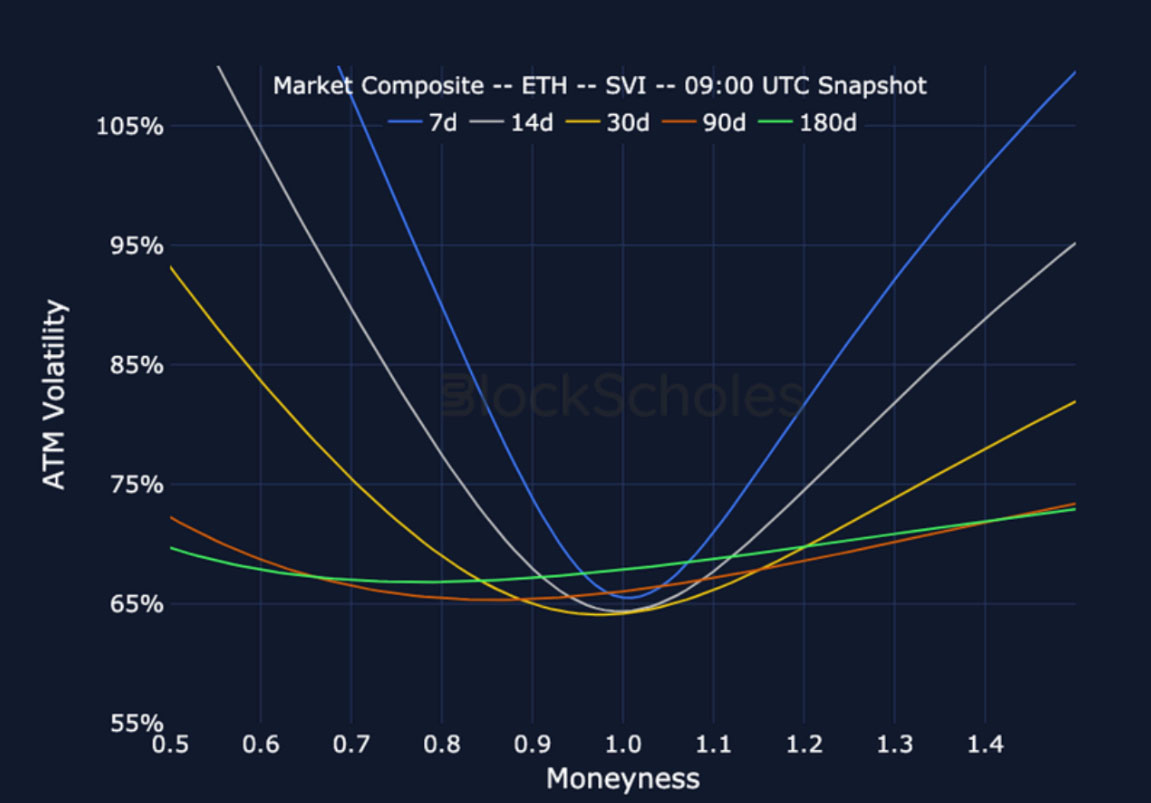

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

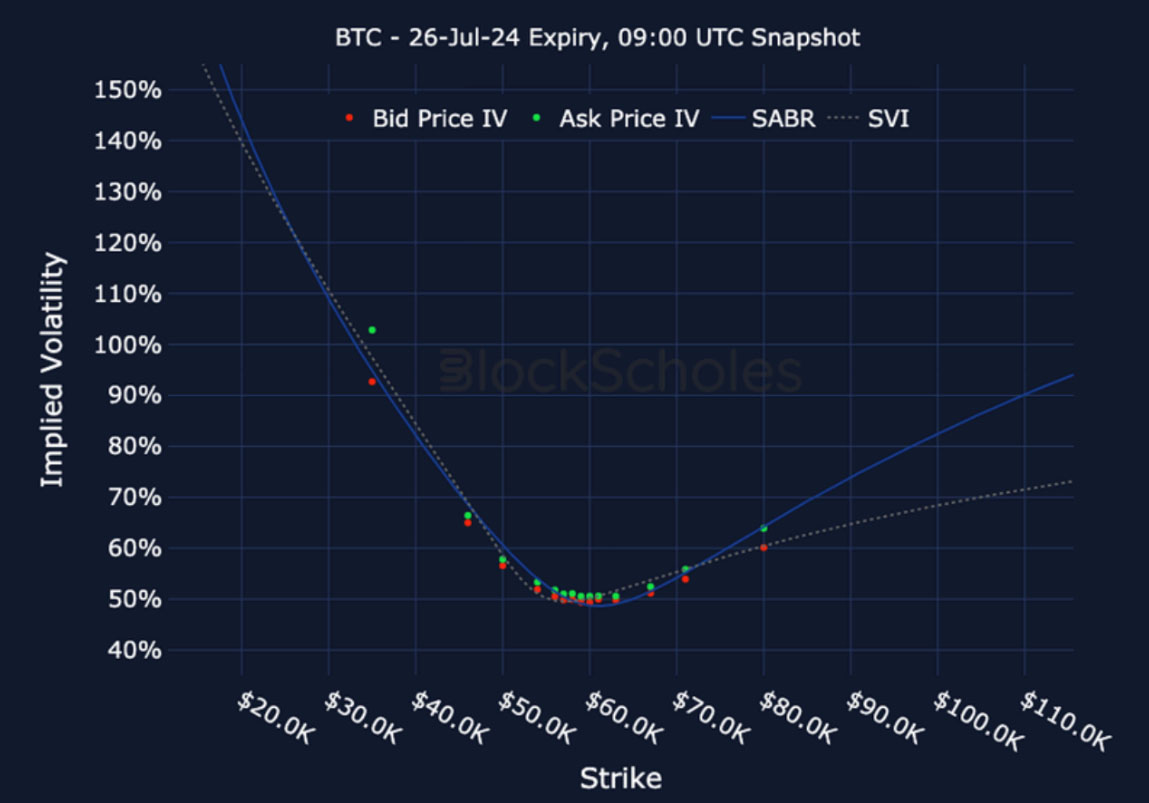

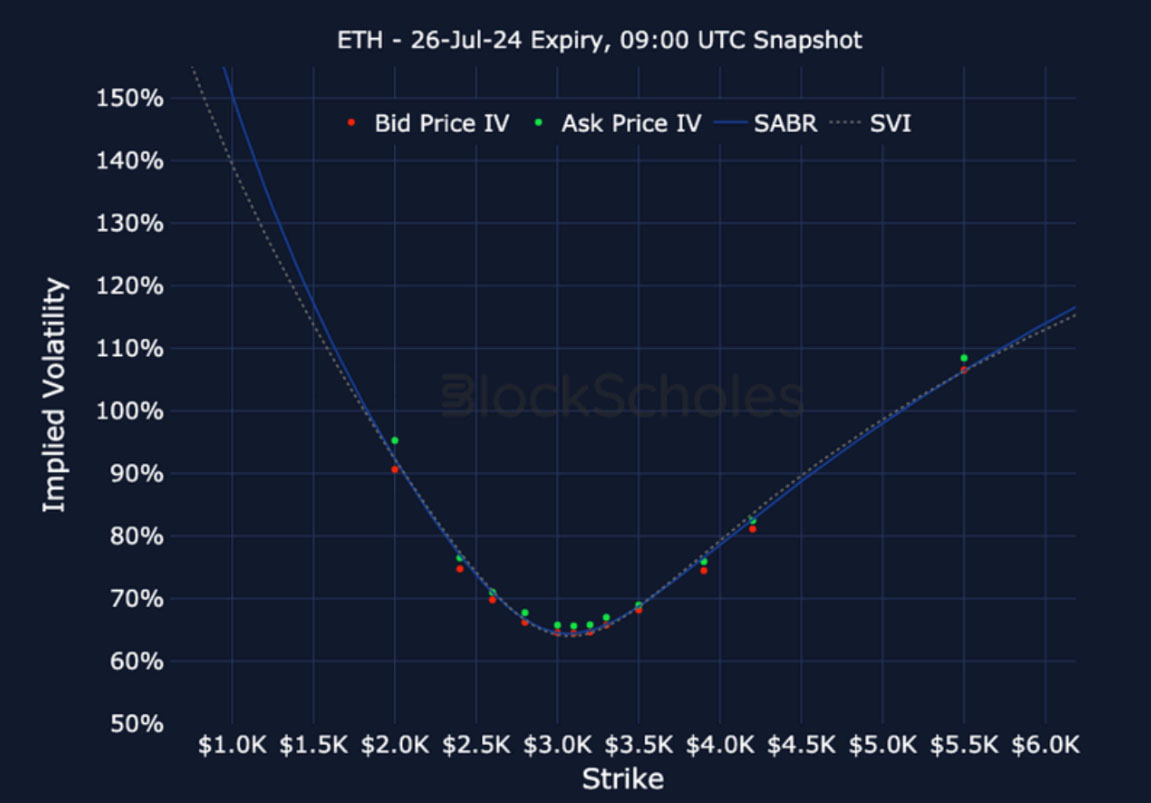

Listed Expiry Volatility Smiles

BTC 26-JUL EXPIRY– 9:00 UTC Snapshot.

ETH 26-JUL EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

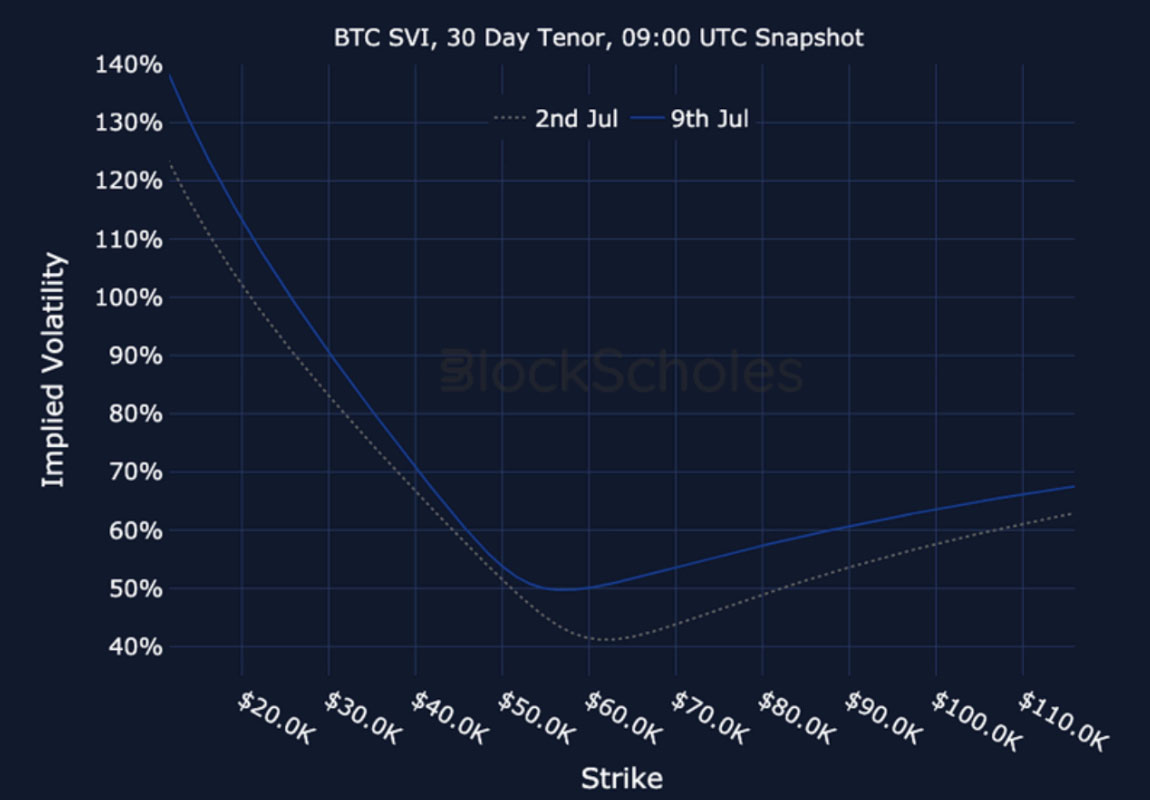

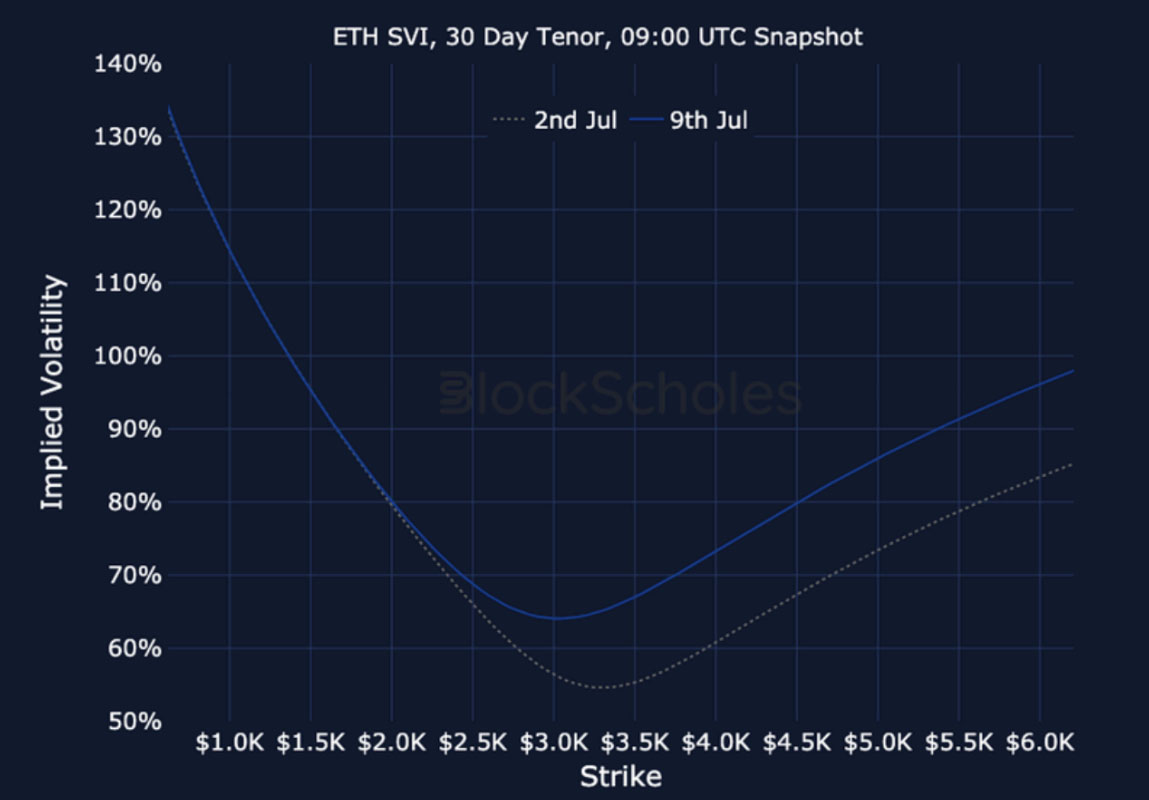

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)