Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

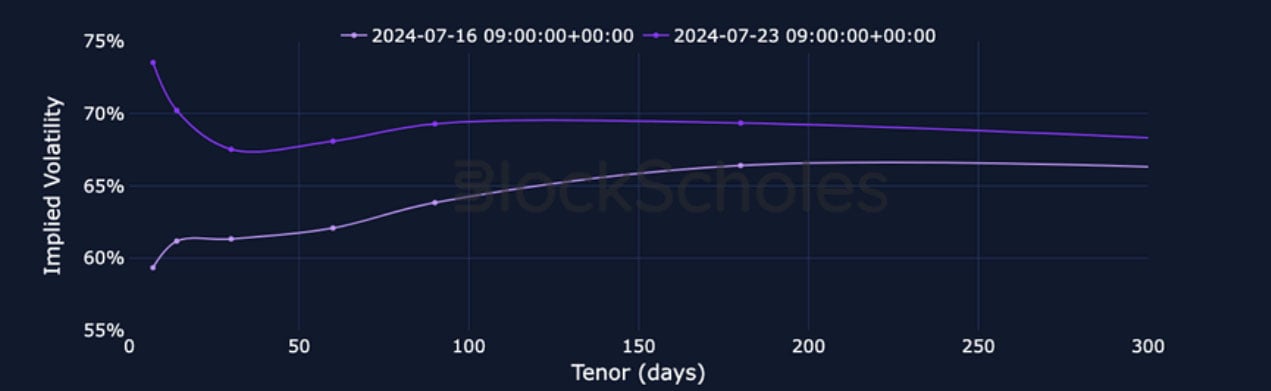

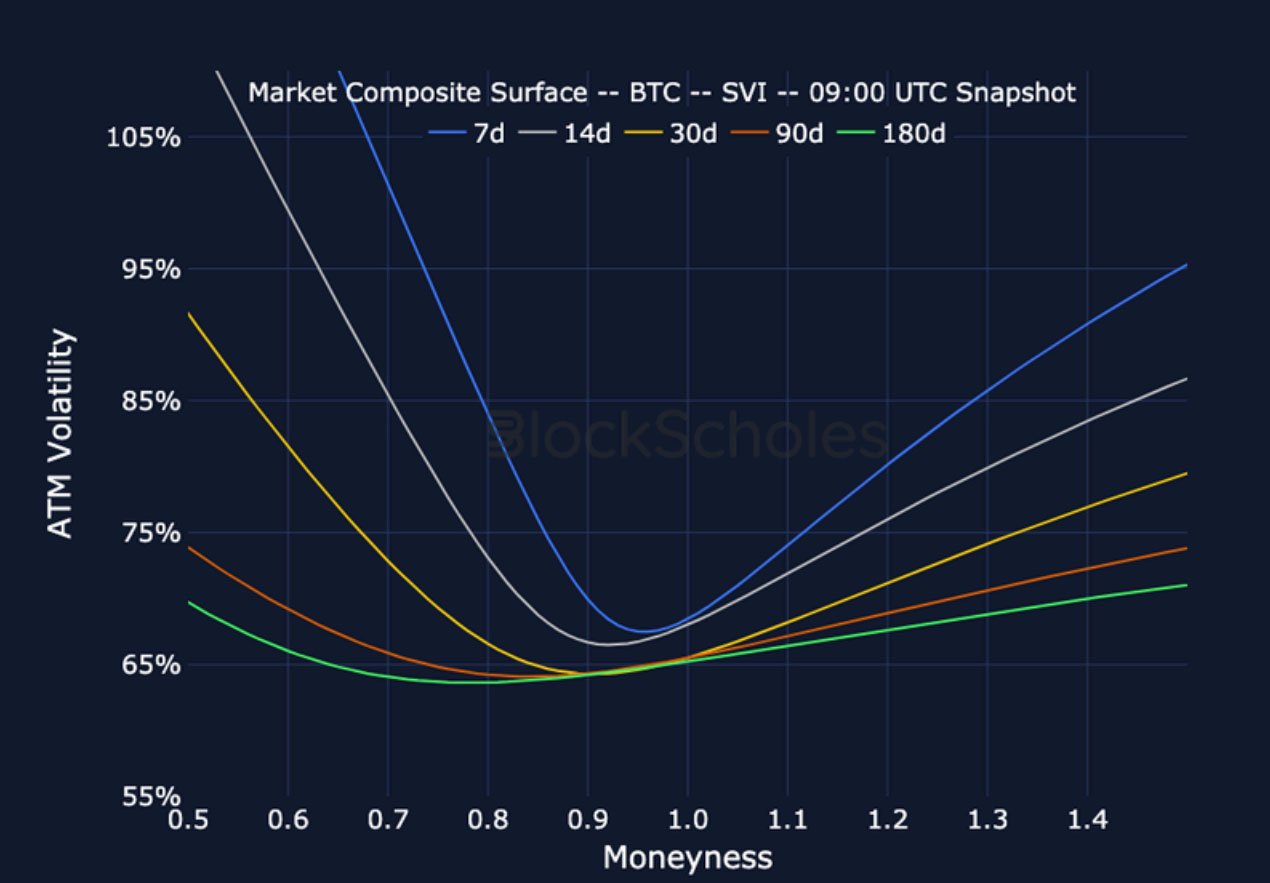

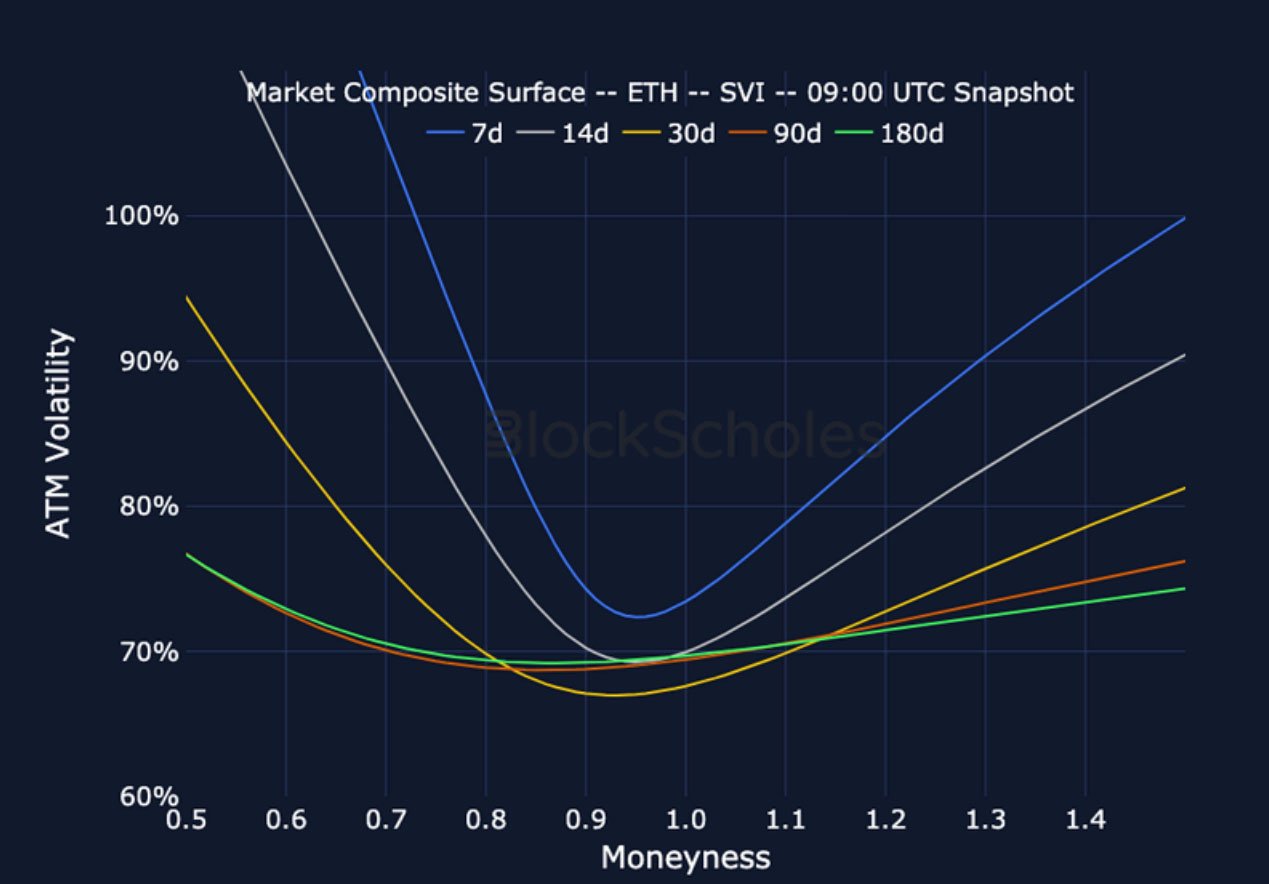

While volatility has generally been on the rise for both BTC and ETH, the term structure of volatility has changed dramatically especially at shorter tenors, now having inverted at the front end and continuing to trade at a premium for ETH options compared to BTC options. Volatility skew suggests that call options are preferred for both digital currencies. A general bullish trend is observed but more strongly for BTC, as reflected in the future implied yield chart and the perp swap funding rate, if not the skew of its volatility surface. Despite the recent approval of an ETH spot ETF, BTC is still holds a stronger bullish sentiment in derivatives space.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

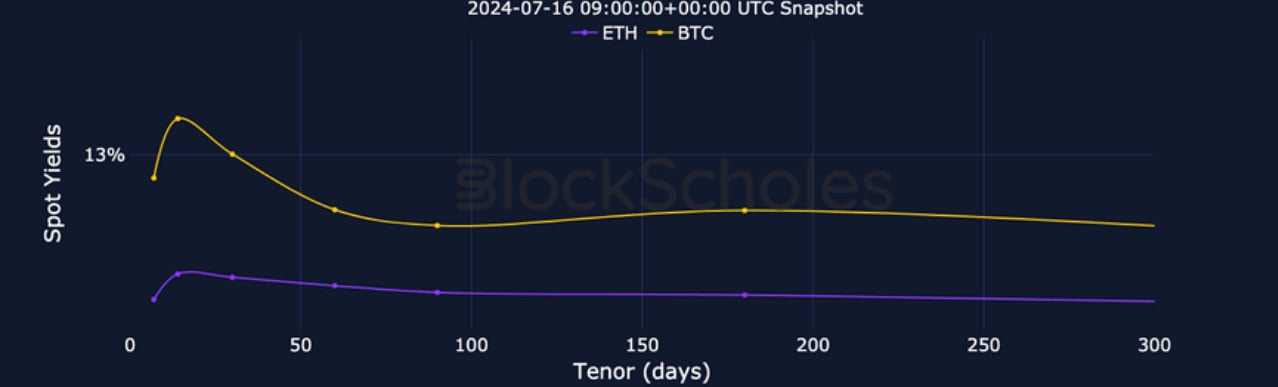

BTC ANNUALISED YIELDS – are at their highest levels in months, inverting at the front end of the term structure as shorter tenors rally higher.

ETH ANNUALISED YIELDS – have not shown the same excitement as BTC’s despite the launch of its spot ETF this week.

Perpetual Swap Funding Rate

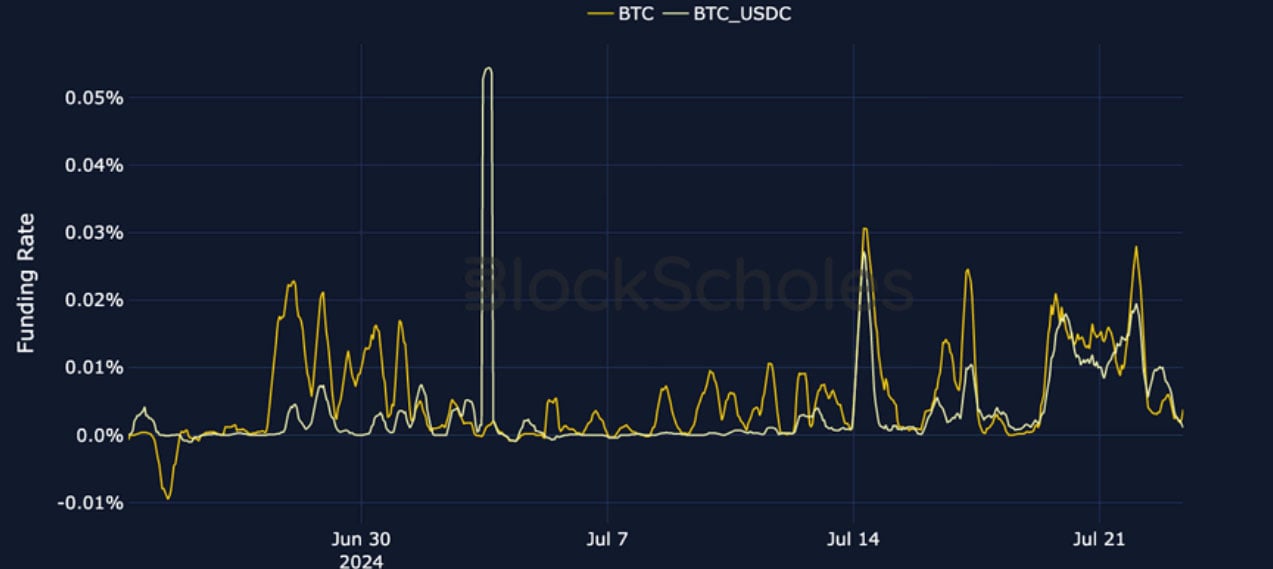

BTC FUNDING RATE – has shown a persistent positive rate over the last month, but appears to have reset somewhat overnight.

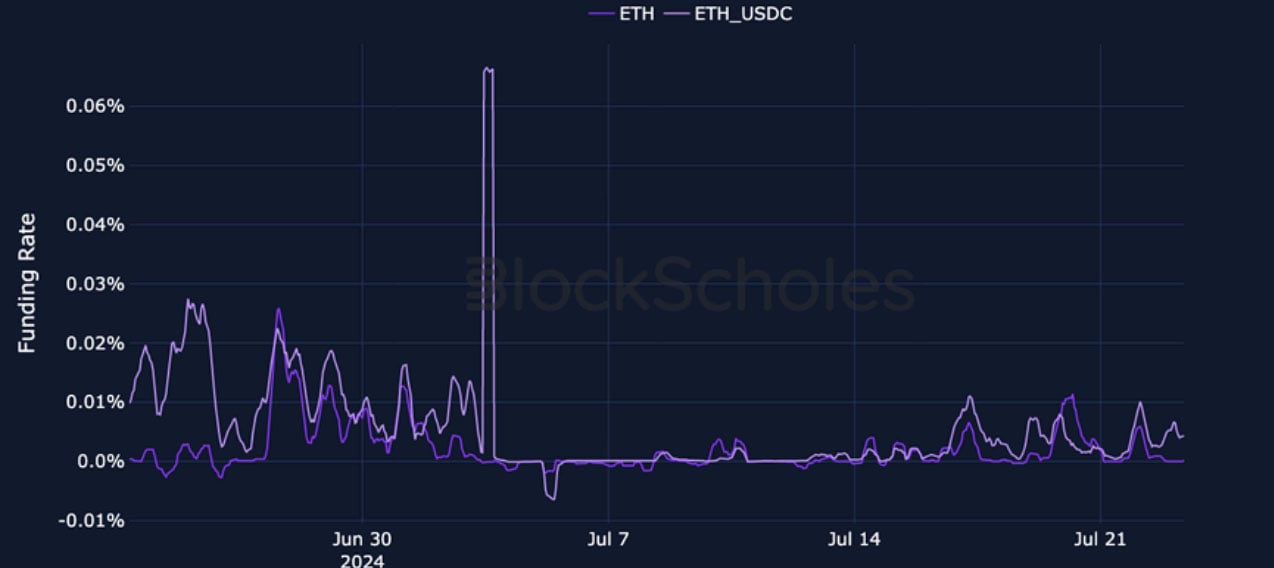

ETH FUNDING RATE – remains consistently positive, but without the same levels reached by BTC as recently as this weekend.

BTC Options

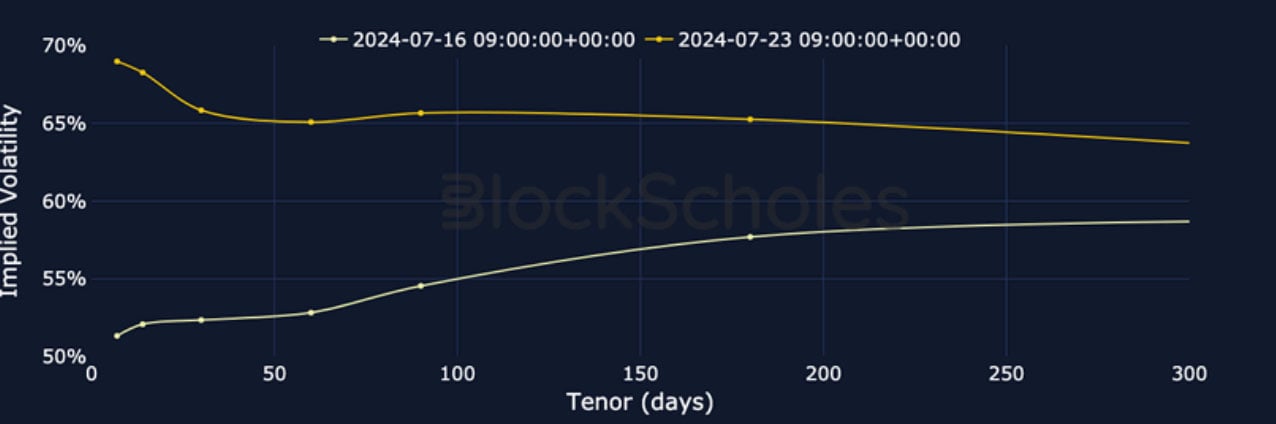

BTC SVI ATM IMPLIED VOLATILITY – volatility levels are back at their highest levels in over a month with a flat term structure.

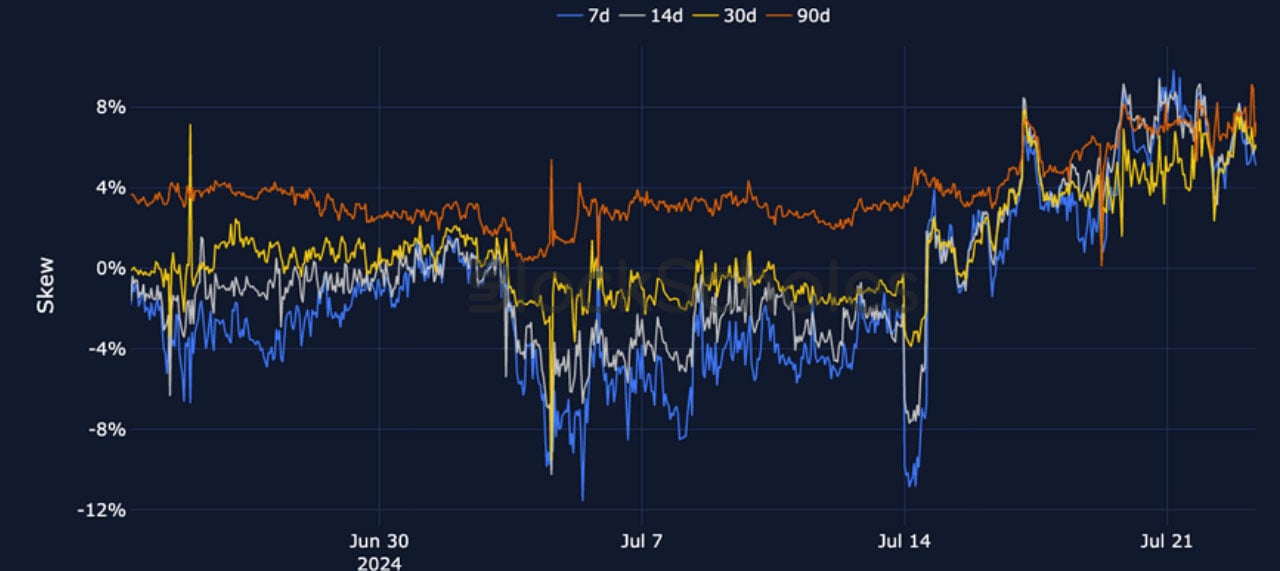

BTC 25-Delta Risk Reversal – demand for vol is expressed in a clear preference for upside exposure as the smile skews strongly towards calls.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – remains at a premium to BTC across the term structure which has nevertheless narrowed at the front end.

ETH 25-Delta Risk Reversal – expresses a similar skew towards OTM calls as BTC across the term structure.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

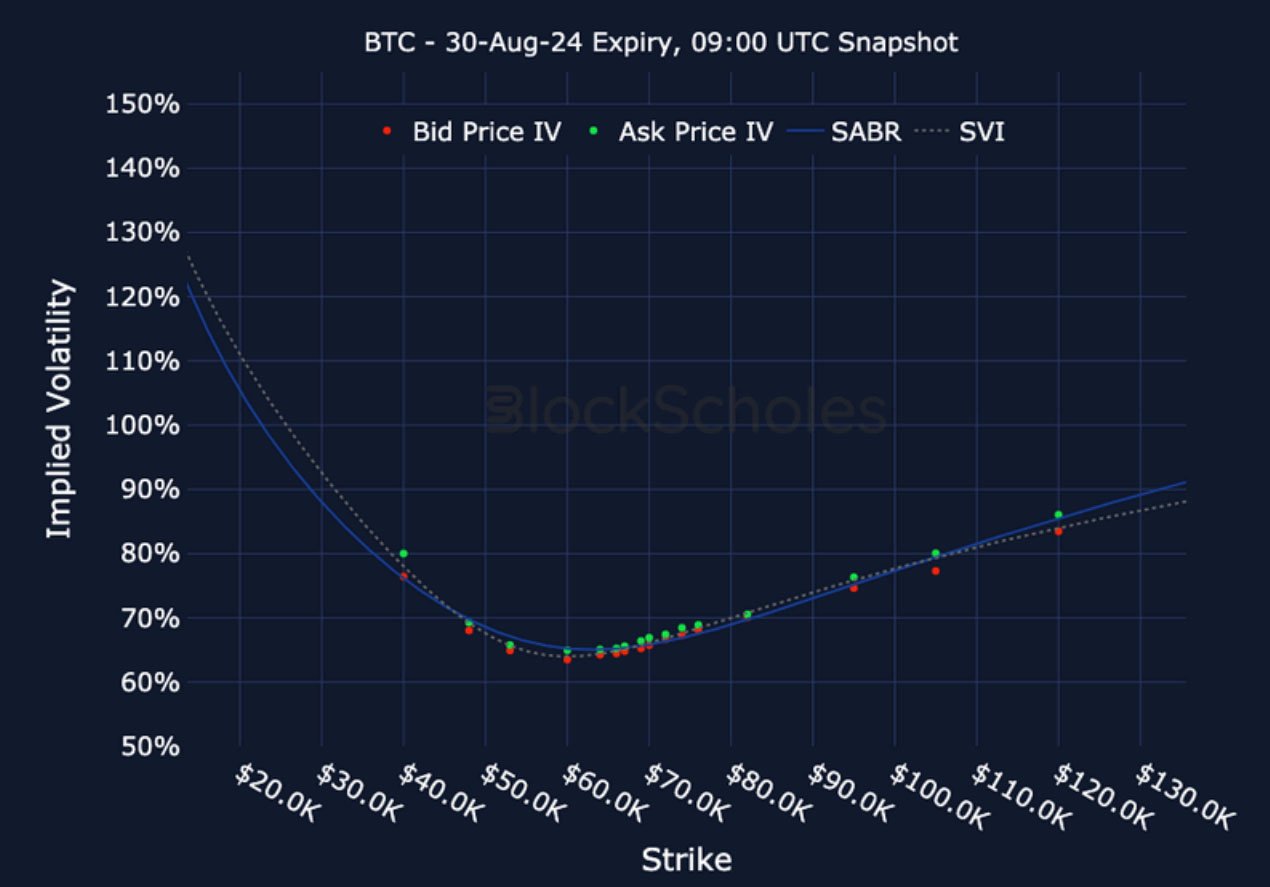

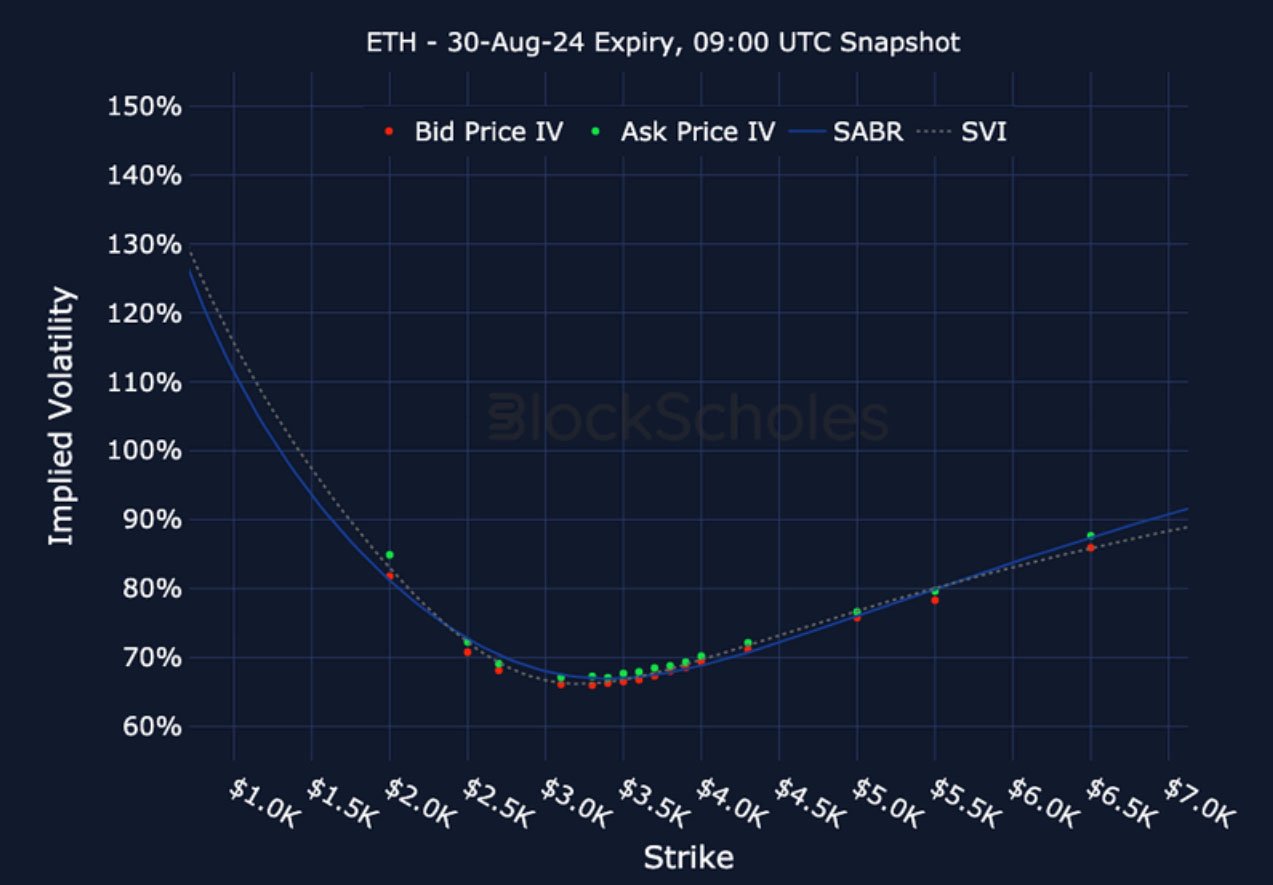

Listed Expiry Volatility Smiles

BTC 30-AUG EXPIRY– 9:00 UTC Snapshot.

ETH 30-AUG EXPIRY– 9:00 UTC Snapshot.

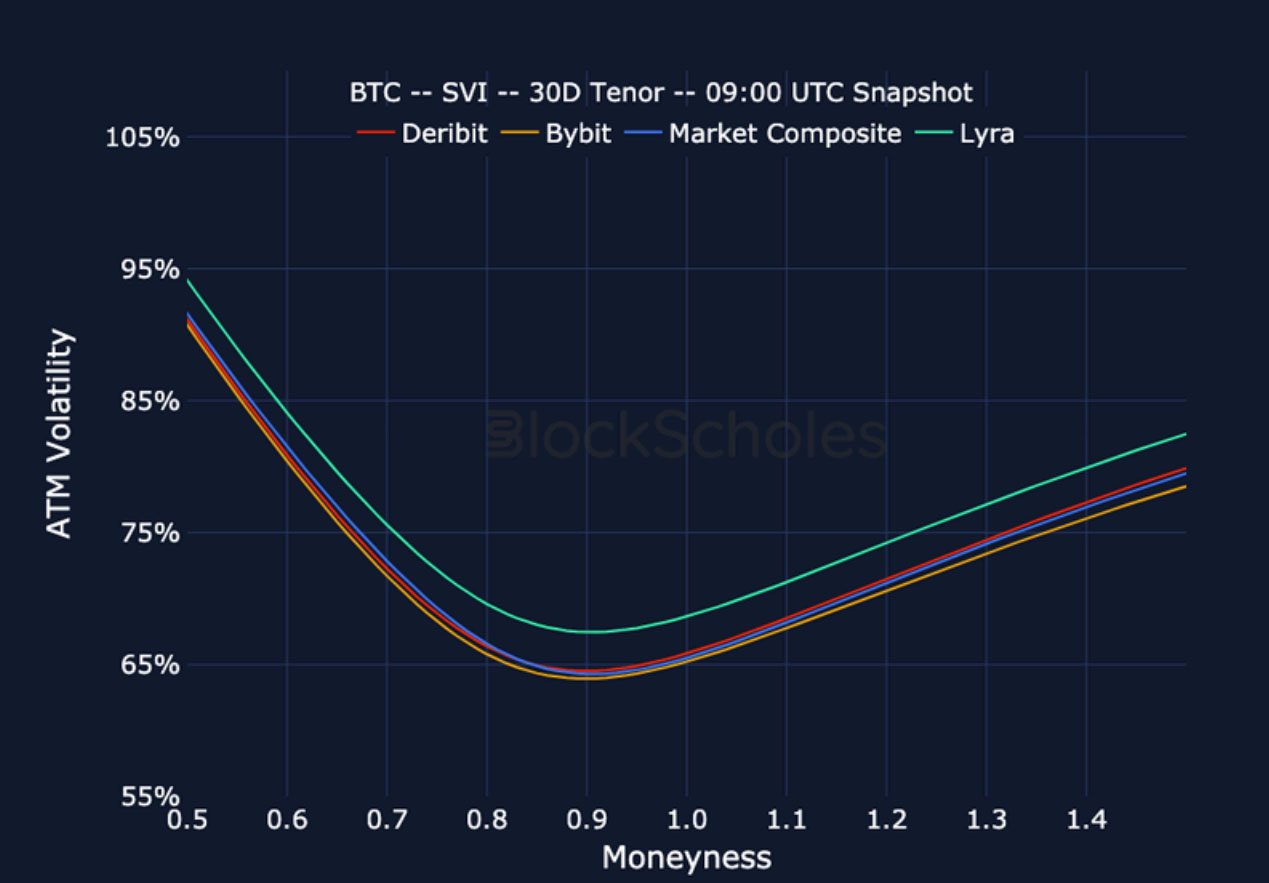

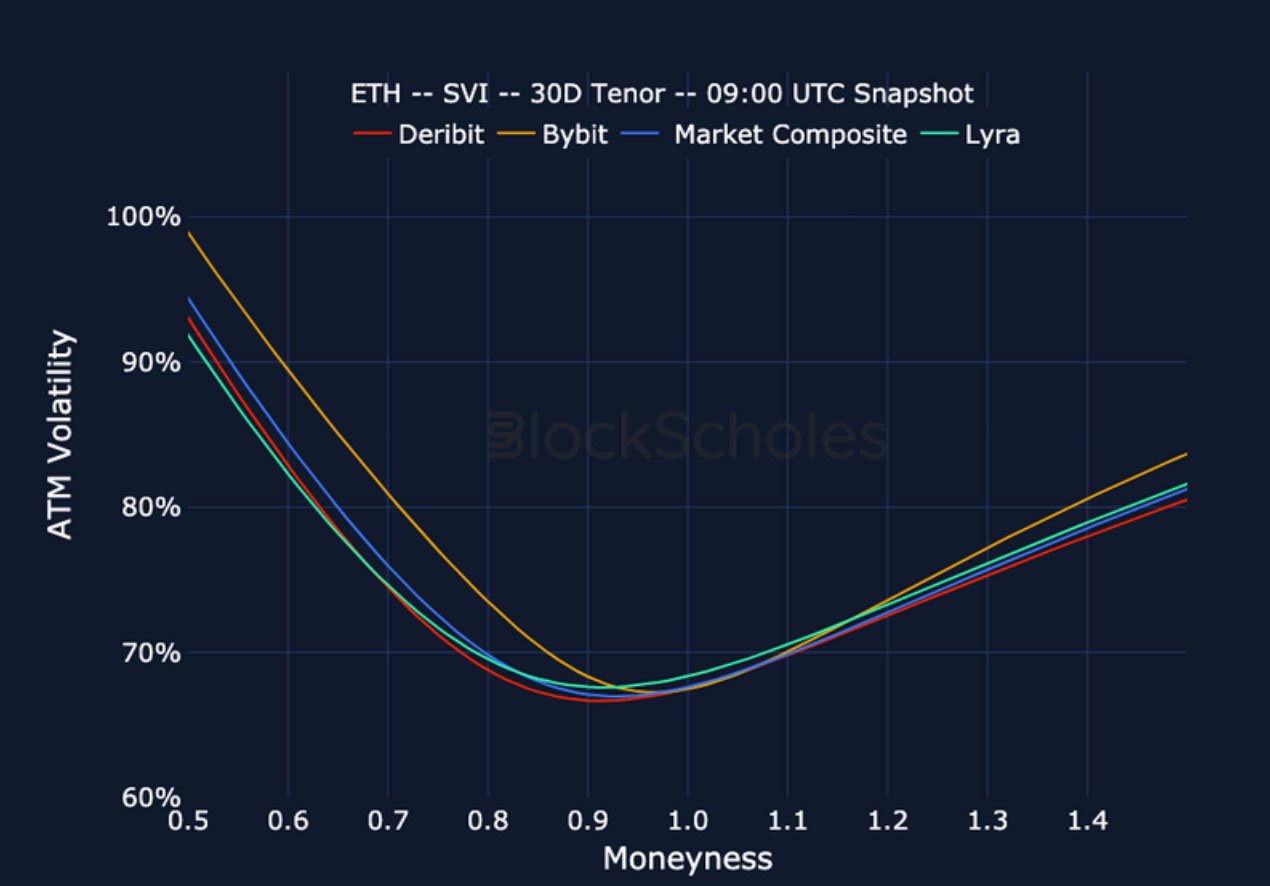

Cross-Exchange Volatility Smiles

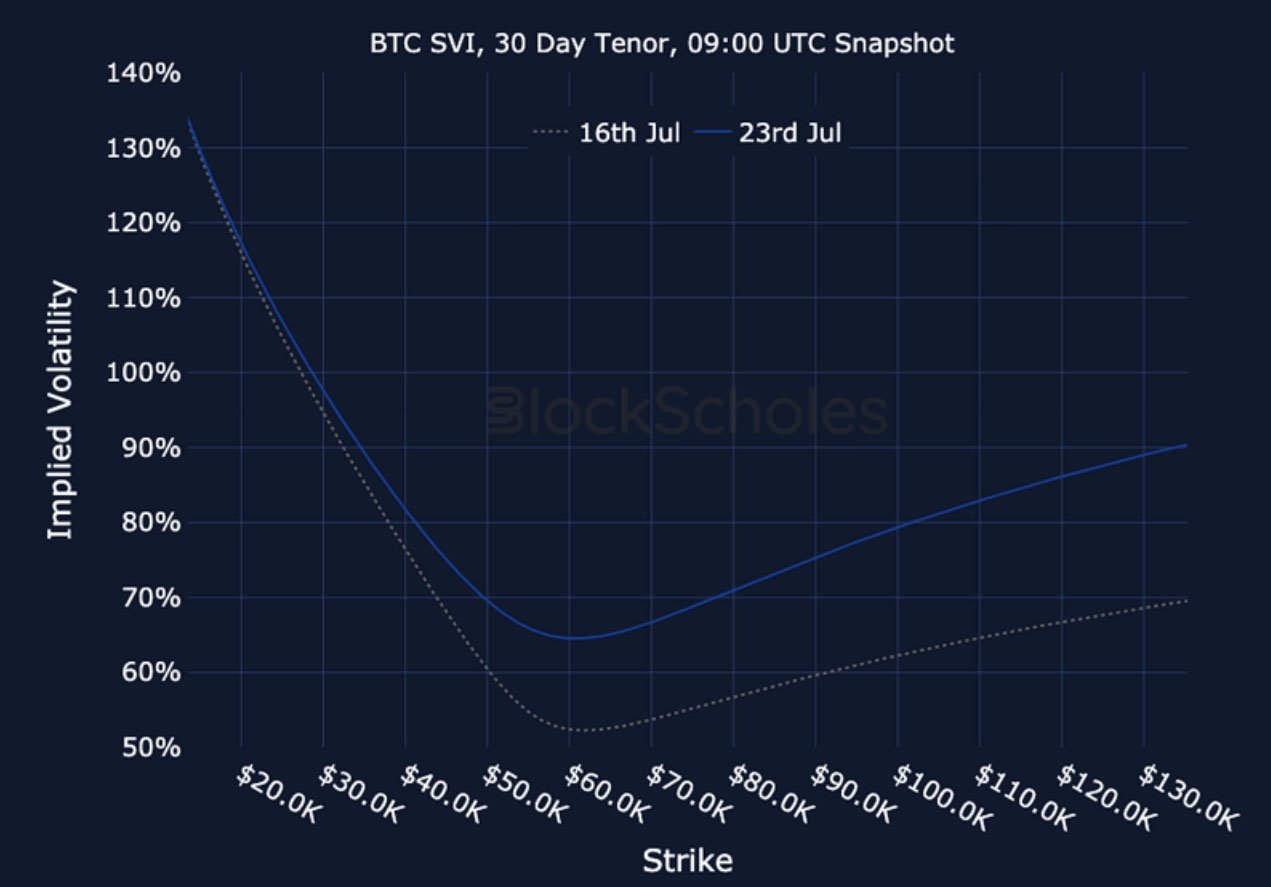

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

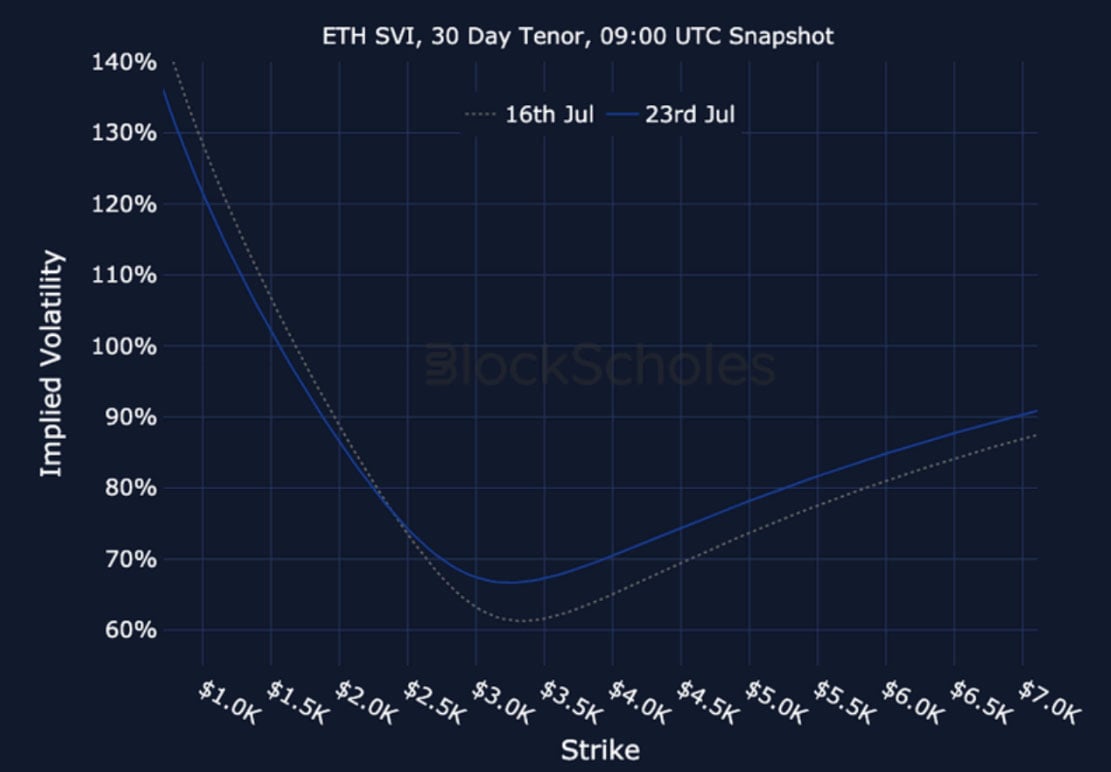

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)