Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

A non-stop week of narratives for crypto-assets has been reflected in a decisive change in sentiment in crypto-asset derivatives markets. BTC markets now express a far stronger preference for OTM calls than do ETH’s, and the former’s future-implied yields hold a slight premium to match the strongly positive funding rate paid by long positions for leveraged positions. However, the resolution of the ETH ETF launch and at the end of last week have seen implied volatility levels fall as traders appear to unwind positions that had built up ahead of these events. The fall has been strongest at the front-end of the term structure, a pattern that we have come to expect following the resolution of known event risks.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

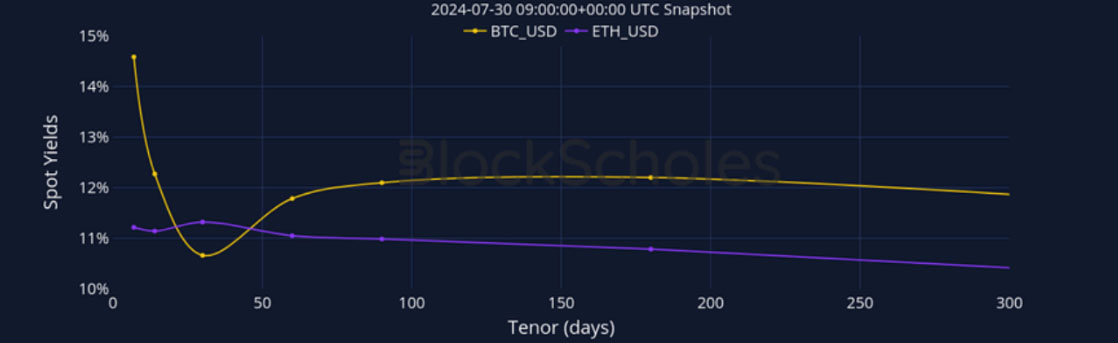

BTC ANNUALISED YIELDS – are at their highest levels in months, inverting at the front end of the term structure as shorter tenors rally higher.

ETH ANNUALISED YIELDS – have shown high levels at the front end of the term in the last week but now levelled in a range slightly below BTC’s.

Perpetual Swap Funding Rate

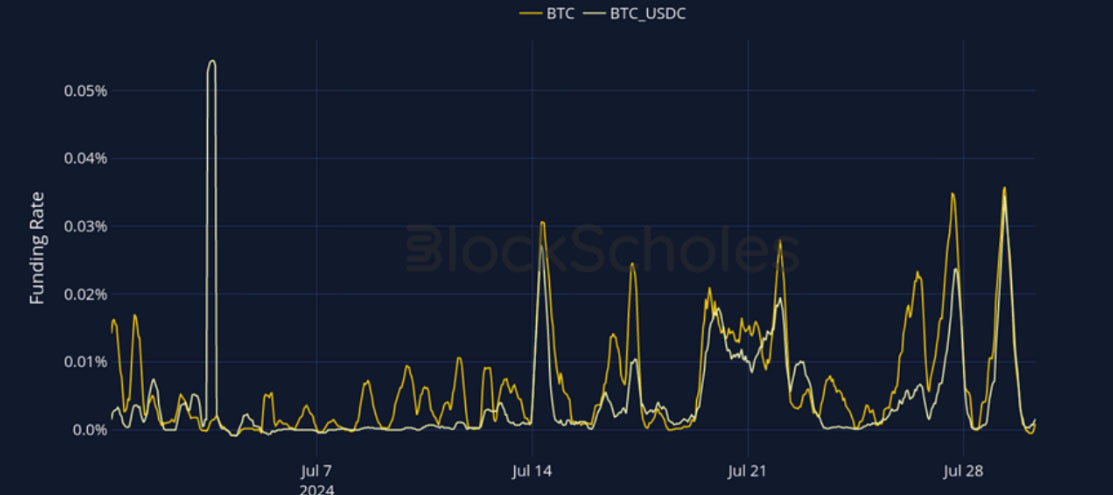

BTC FUNDING RATE – has shown a volatile positive rate over the last week of non-stop spot price action.

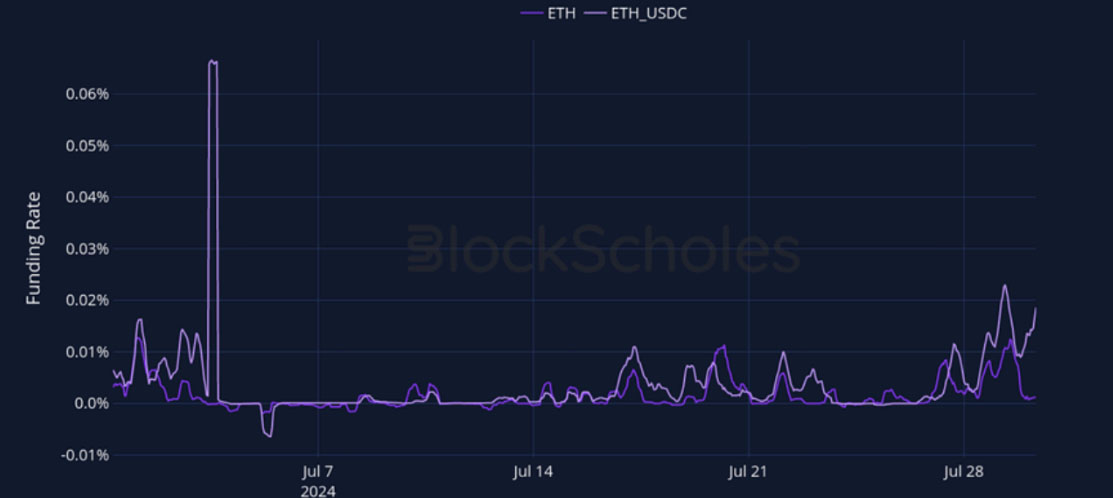

ETH FUNDING RATE – is more consistently positive than BTC’s but also remains below the same levels reached by BTC.

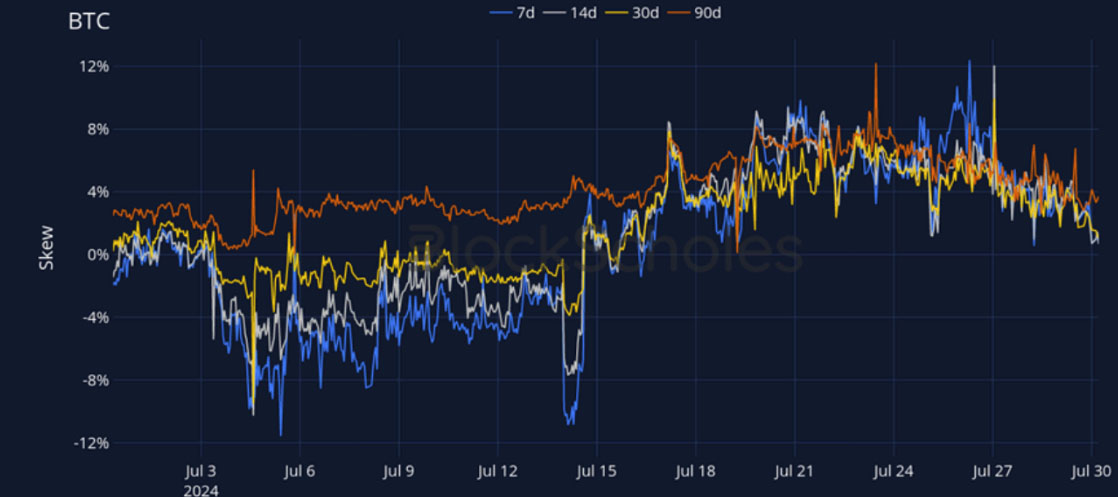

BTC Options

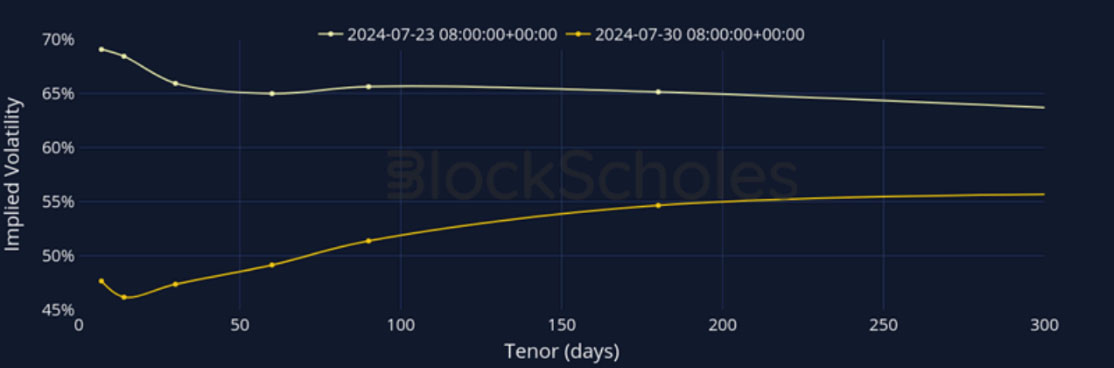

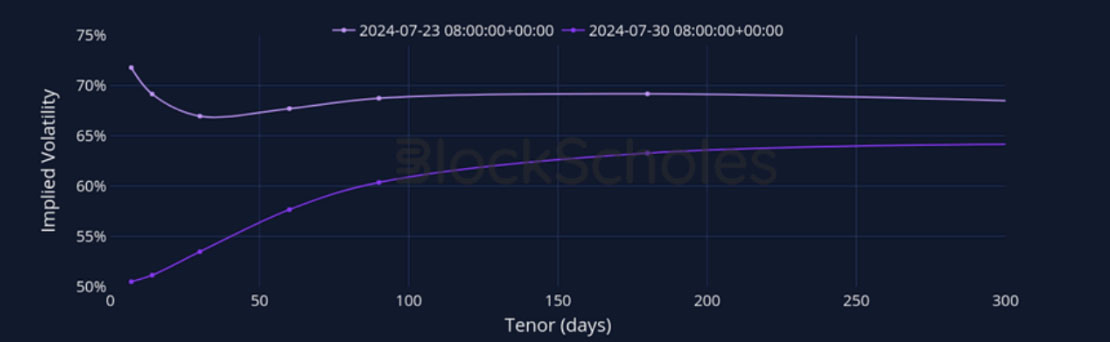

BTC SVI ATM IMPLIED VOLATILITY – volatility levels have been dropping after the ETF release and now show a steepening term structure.

BTC 25-Delta Risk Reversal – the fall in outright vol is matched by a falling excess demand for OTM calls over puts.

ETH Options

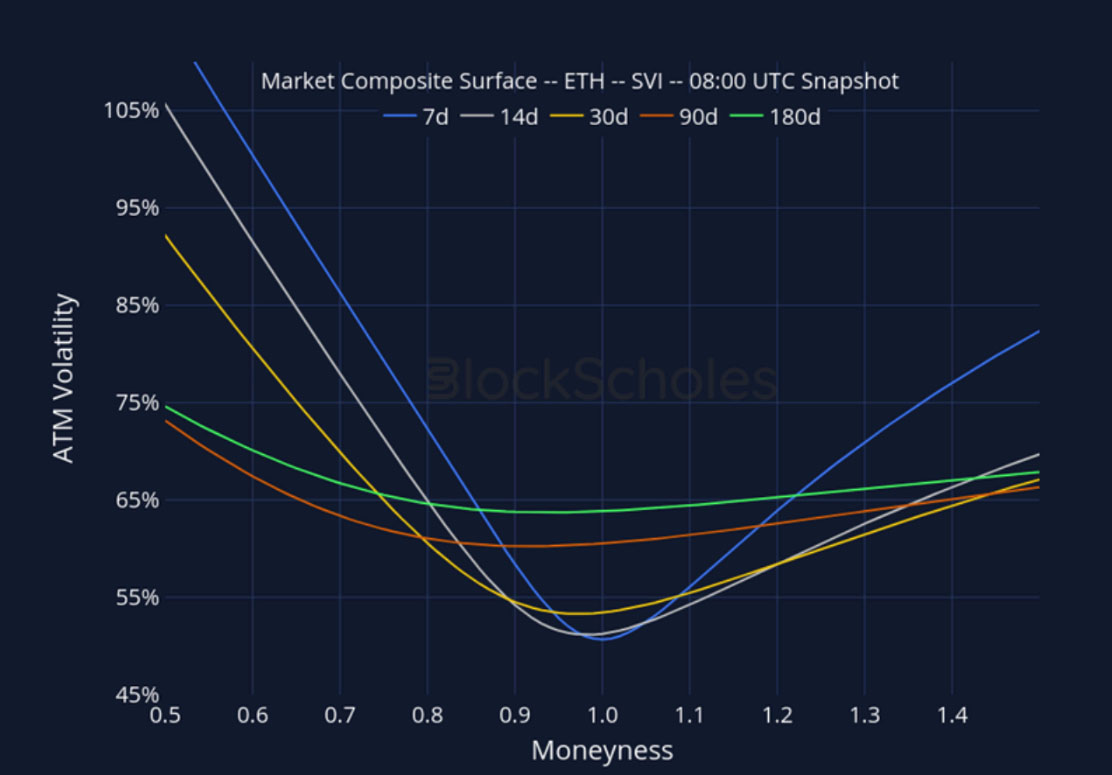

ETH SVI ATM IMPLIED VOLATILITY – remains at a premium to BTC across the term structure despite the drop and increasing steepness.

ETH 25-Delta Risk Reversal – short tenors have exhibited a preference for OTM puts following the release of the ETF.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

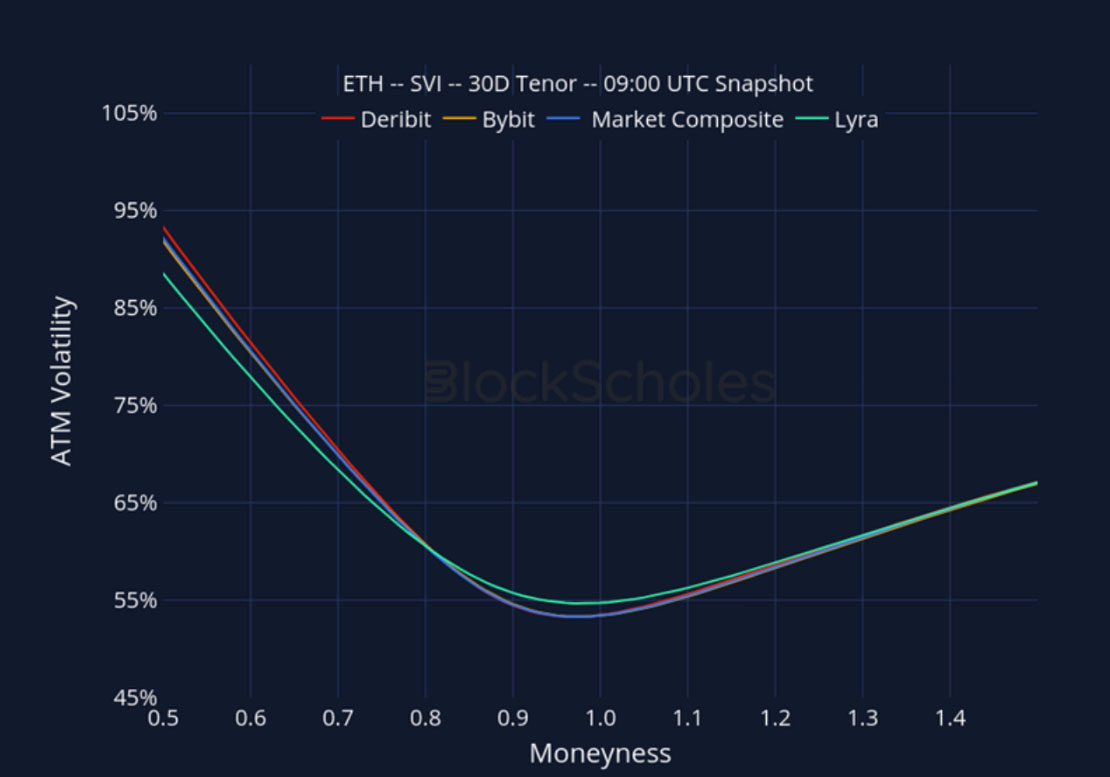

ETH, 1-MONTH TENOR, SVI CALIBRATION

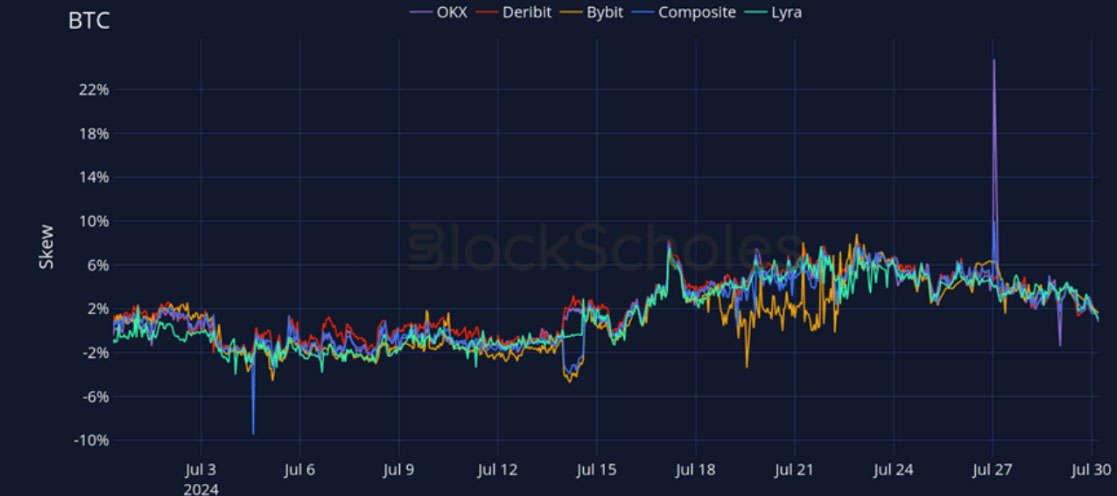

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

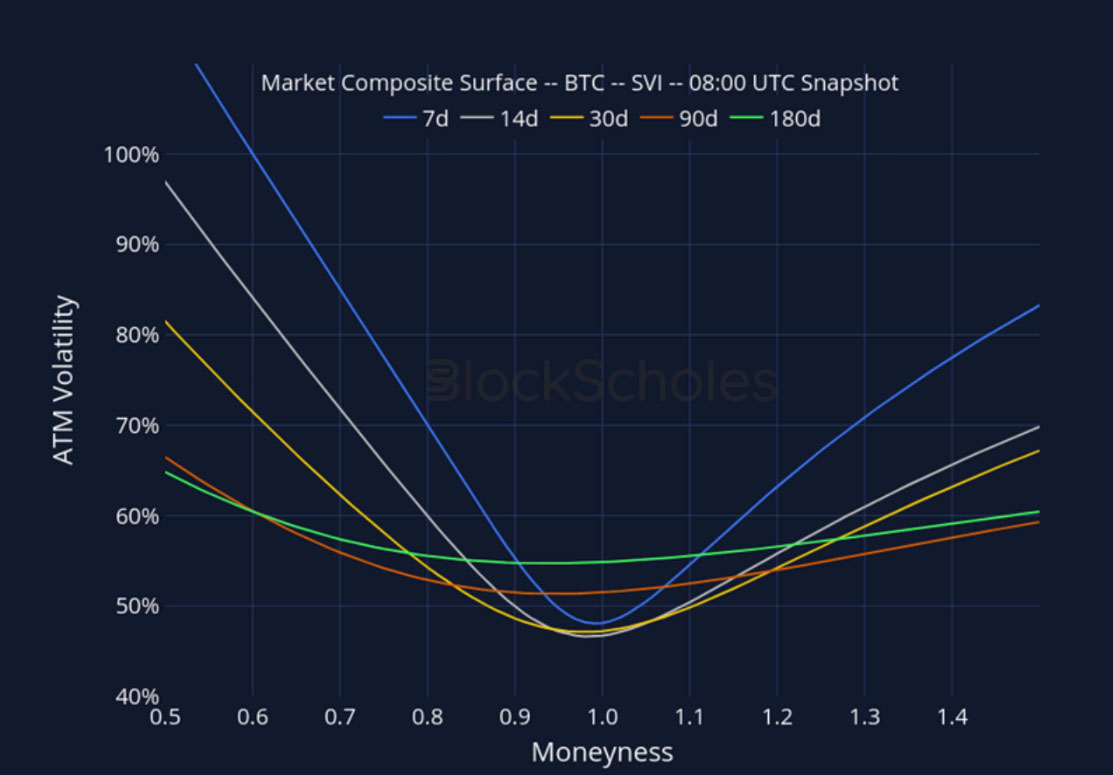

Market Composite Volatility Surface

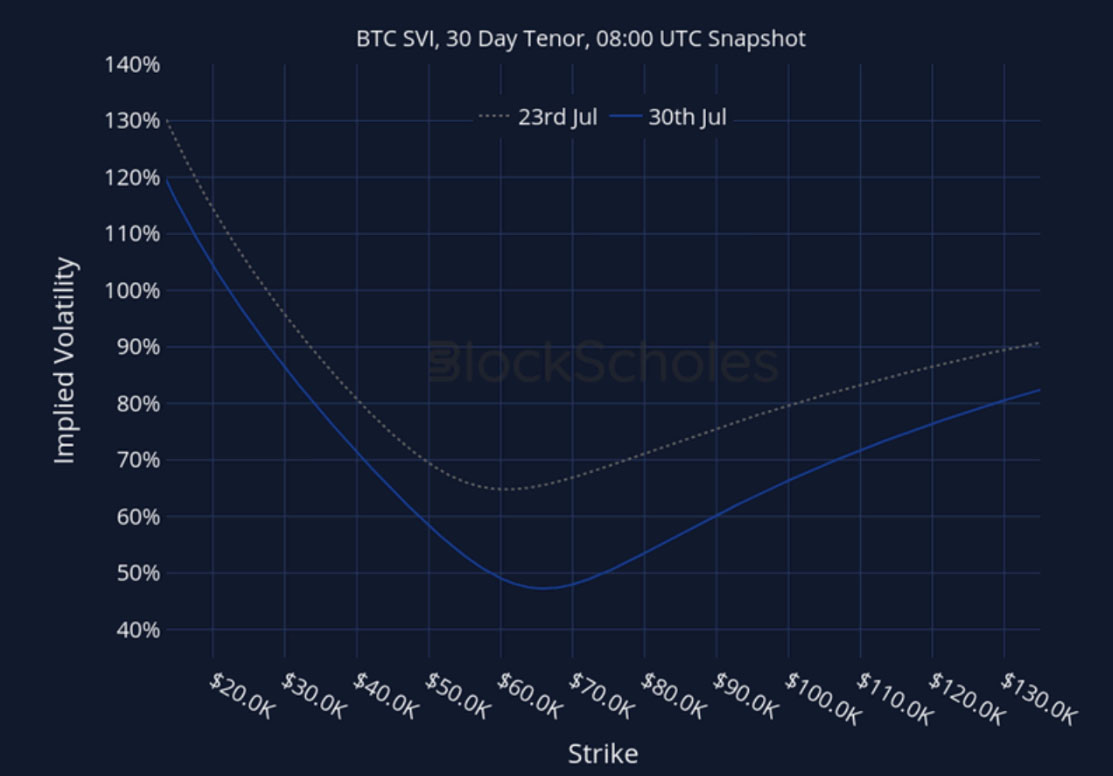

CeFi COMPOSITE – BTC SVI – 8:00 UTC Snapshot.

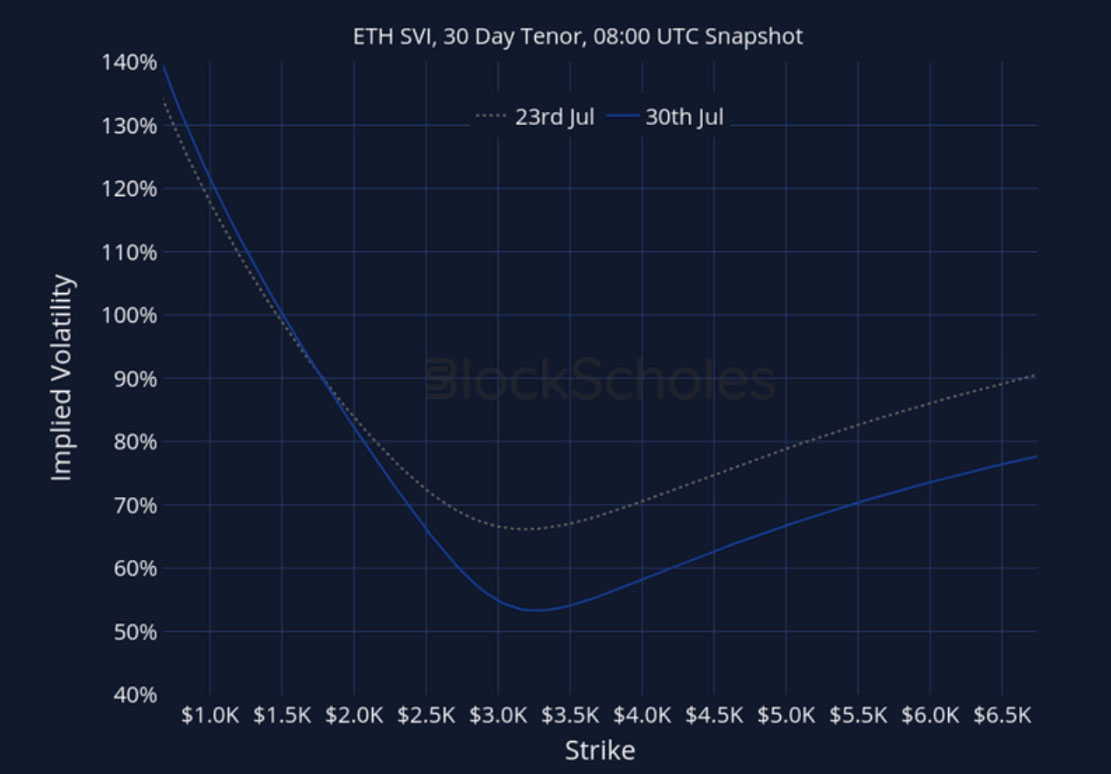

CeFi COMPOSITE – ETH SVI – 8:00 UTC Snapshot.

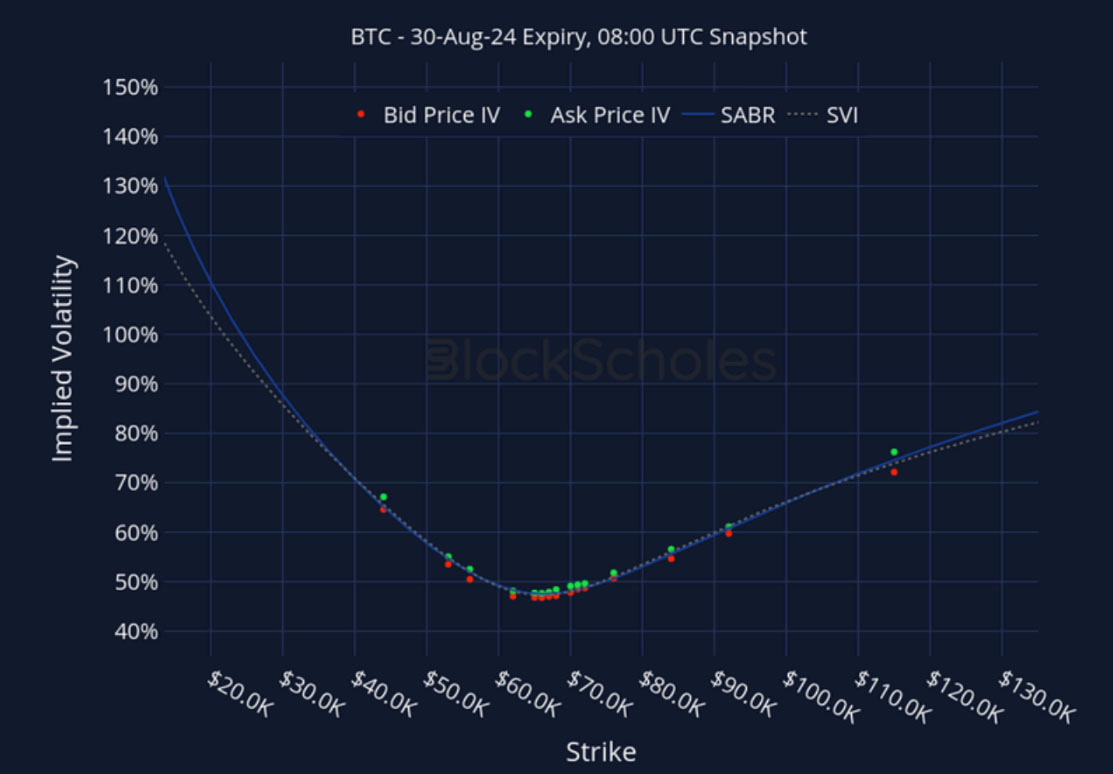

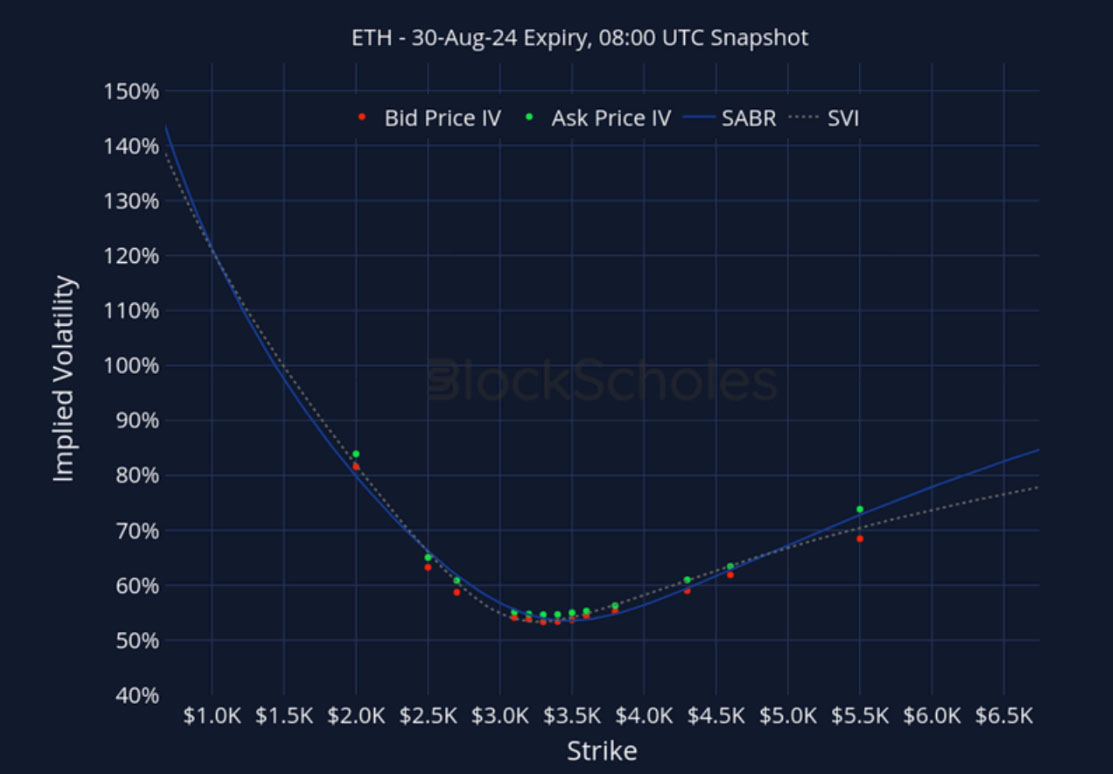

Listed Expiry Volatility Smiles

BTC 30-AUG EXPIRY– 8:00 UTC Snapshot.

ETH 30-AUG EXPIRY– 8:00 UTC Snapshot.

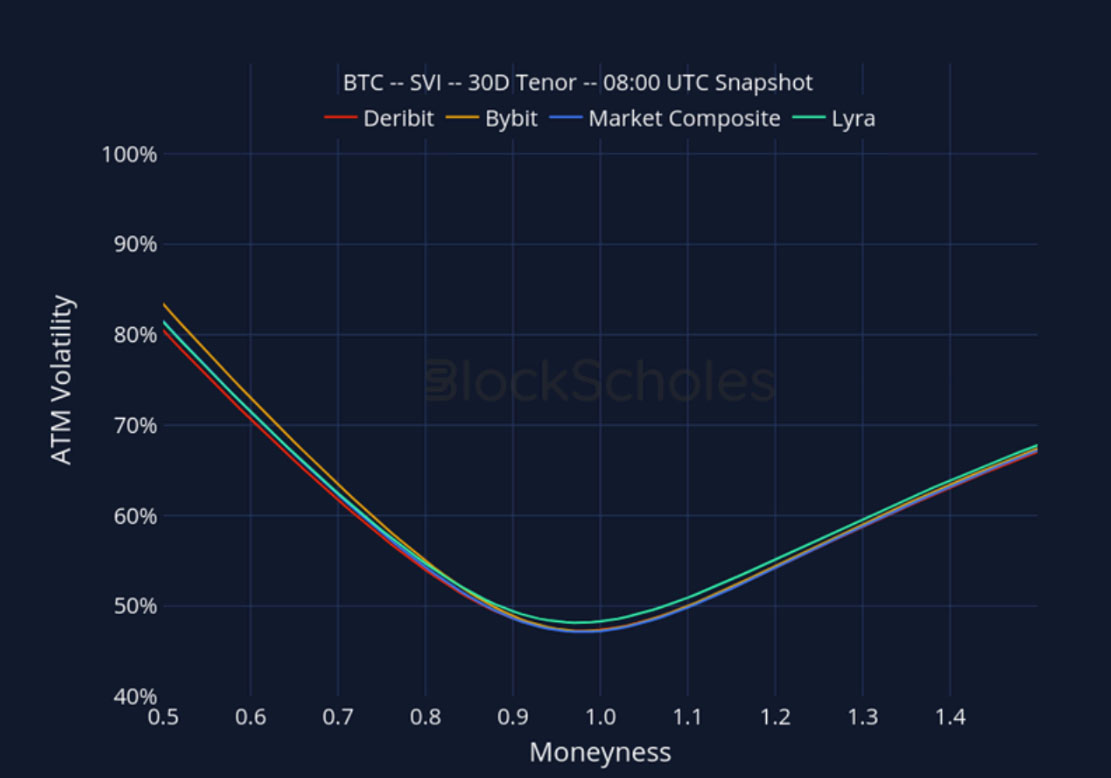

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

AUTHOR(S)