Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

One of the largest global market selloffs since the COVID pandemic took its toll on crypto-spot prices, resulting in double-digit selloffs that were harder felt by ETH and alts than BTC. The selloff saw funding rates spike negative as accumualted long positions were likely liquidated, and the volatility term structure inverted as traders rushed to cover exposure to further downside moves in the short term. However, volatility levels did not spike above their year-to-date highs for either major, and longer-dated volatility smiles remained steadfastly skewed towards OTM calls. This indicates that while this was strong move in the short term, traders are not yet concerned about long-term performance.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

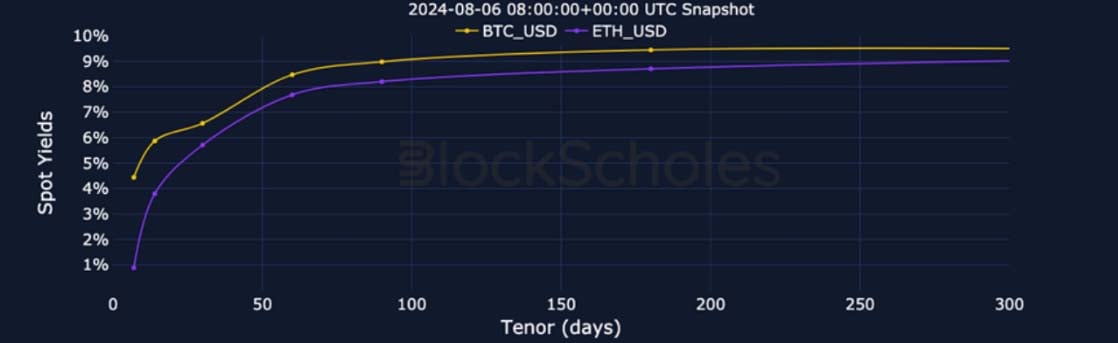

Futures

BTC ANNUALISED YIELDS – yields have fallen from their highest levels in months to barely positive in the recent spot sell off.

ETH ANNUALISED YIELDS – trade slightly lower than BTC’s at all tenors with the same steep shape of the term structure.

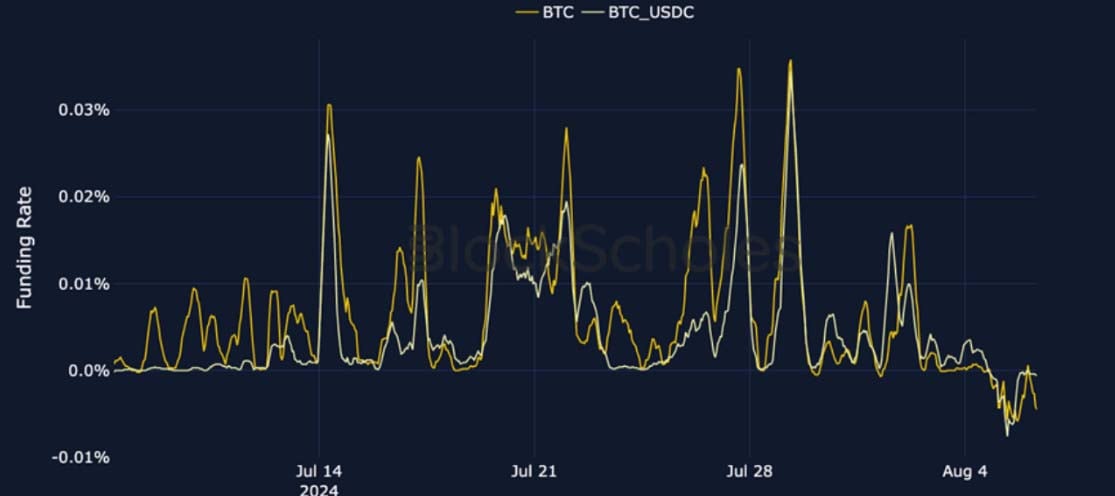

Perpetual Swap Funding Rate

BTC FUNDING RATE – have traded intermittently negative as traders exit long positions and cover short exposure.

ETH FUNDING RATE – spiked far more negative than BTC’s, suggesting a possible liquidation event during the selloff.

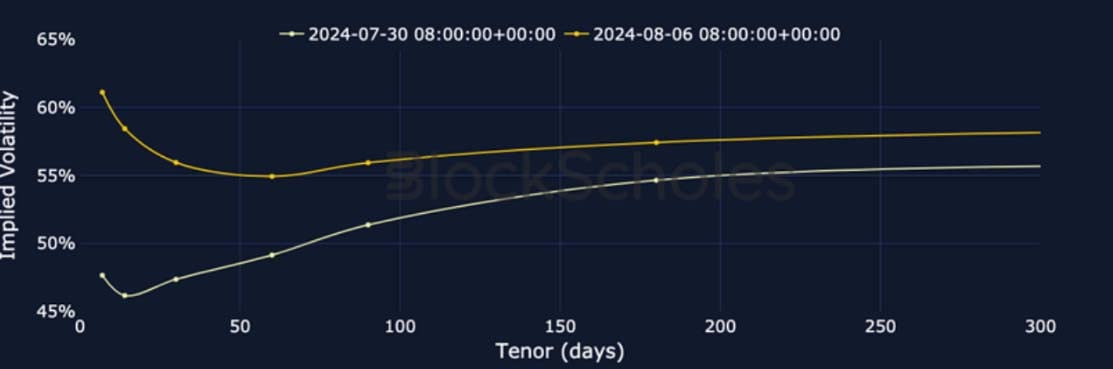

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – volatility levels inverted strongly during the selloff, and have since trailed off.

BTC 25-Delta Risk Reversal – short tenor options skewed strongly towards puts, but longer-tenor smiles remained steadfastly call-skewed.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – shows a similar premium at short tenors to BTC, but trades 10-15 points higher across the term structure.

ETH 25-Delta Risk Reversal – short tenors have not shown the same recovery from their sharp put-skew during the selloff as BTC’s have.

Volatility by Exchange

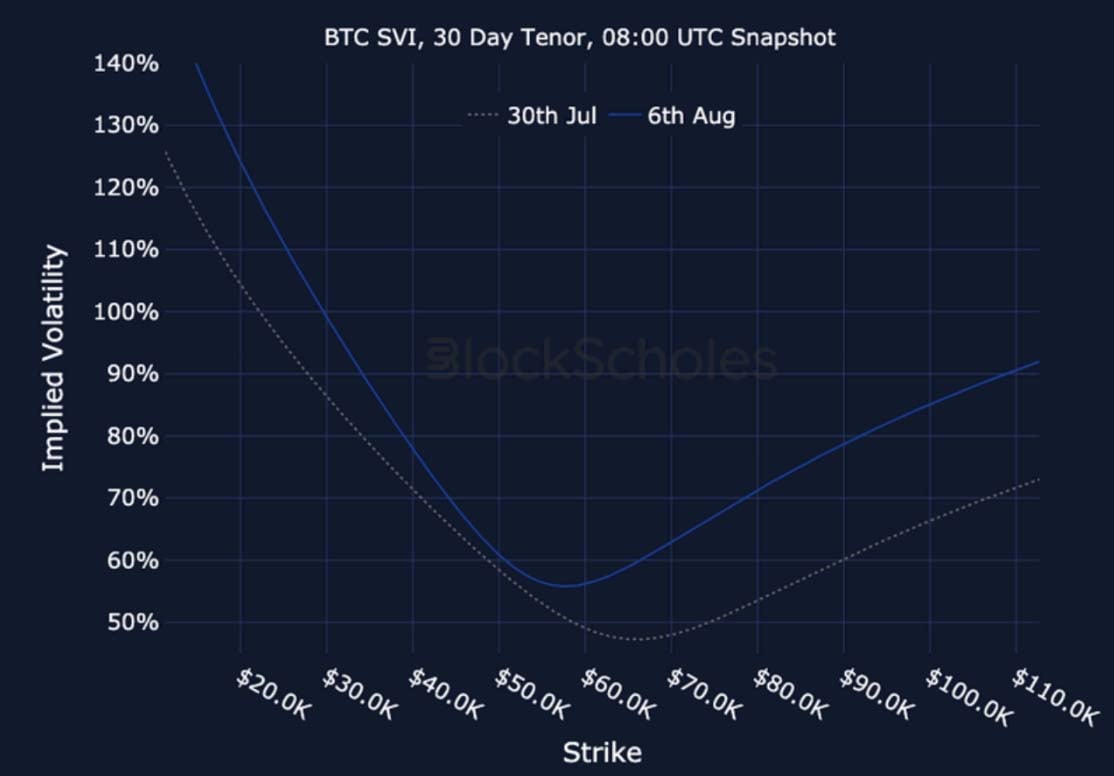

BTC, 1-MONTH TENOR, SVI CALIBRATION

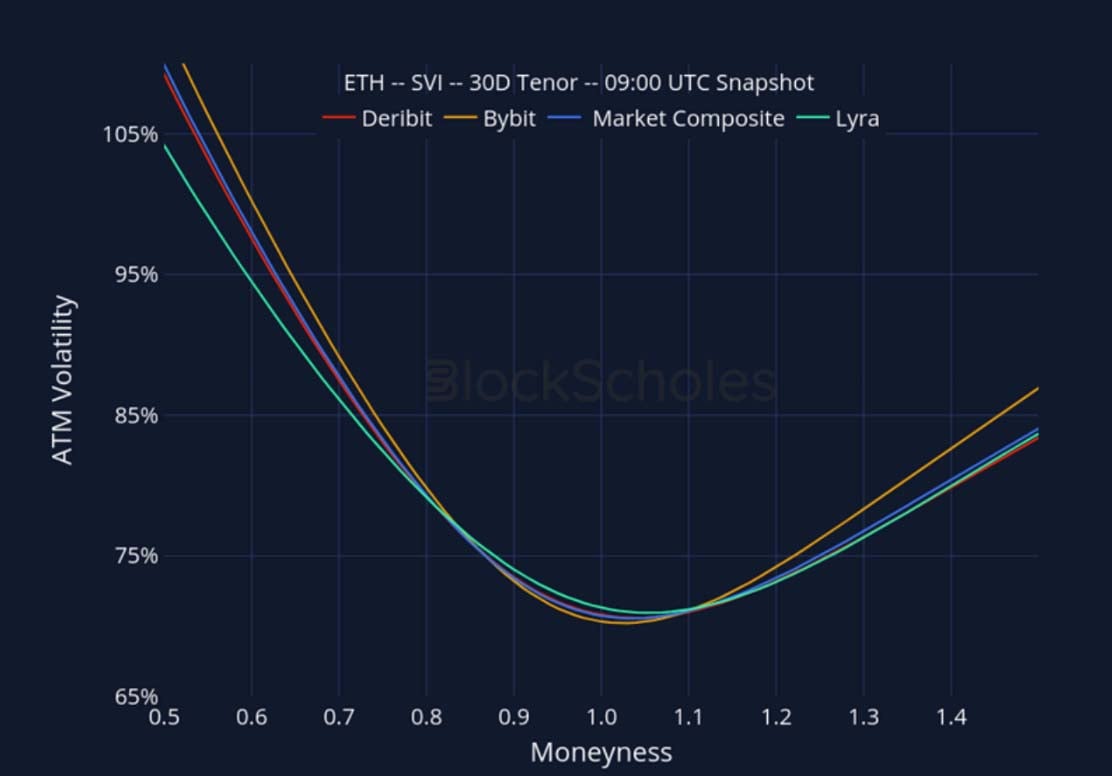

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

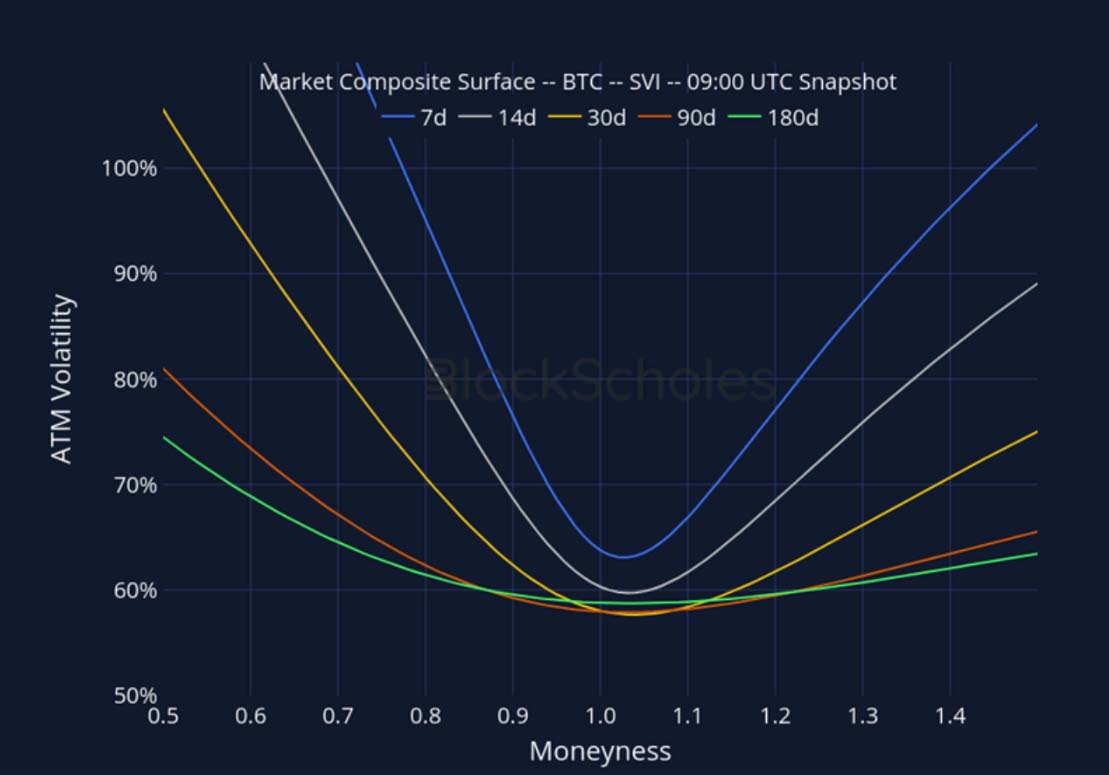

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

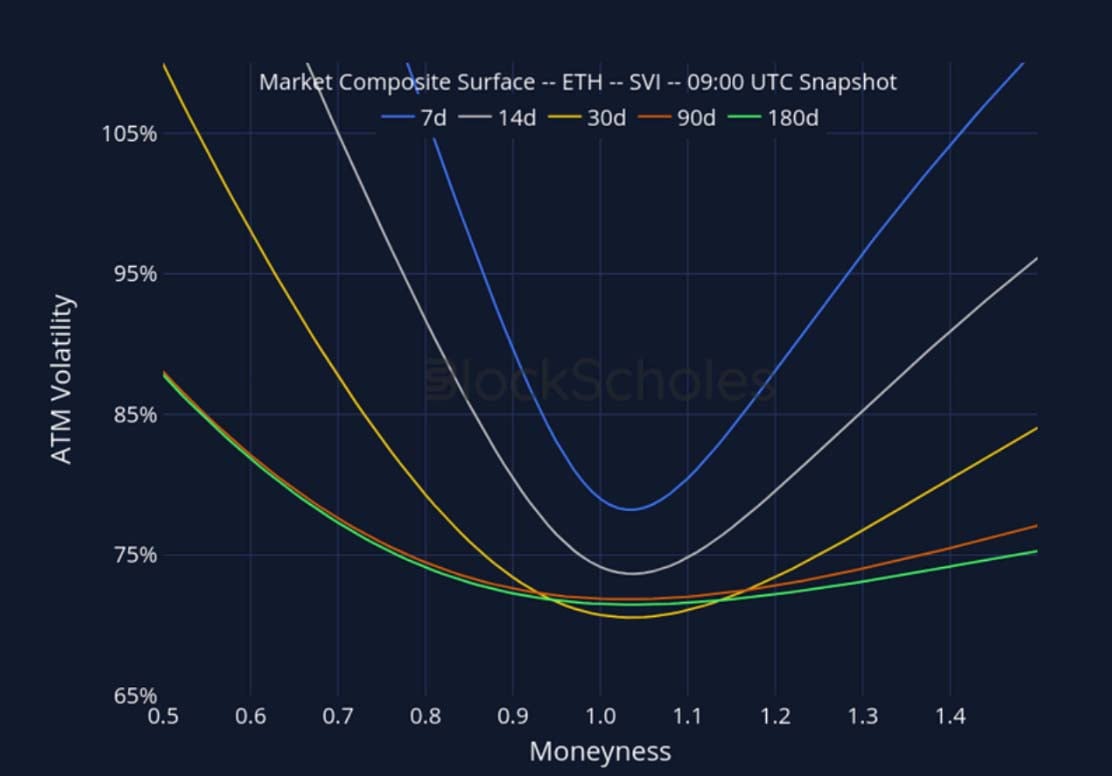

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

Listed Expiry Volatility Smiles

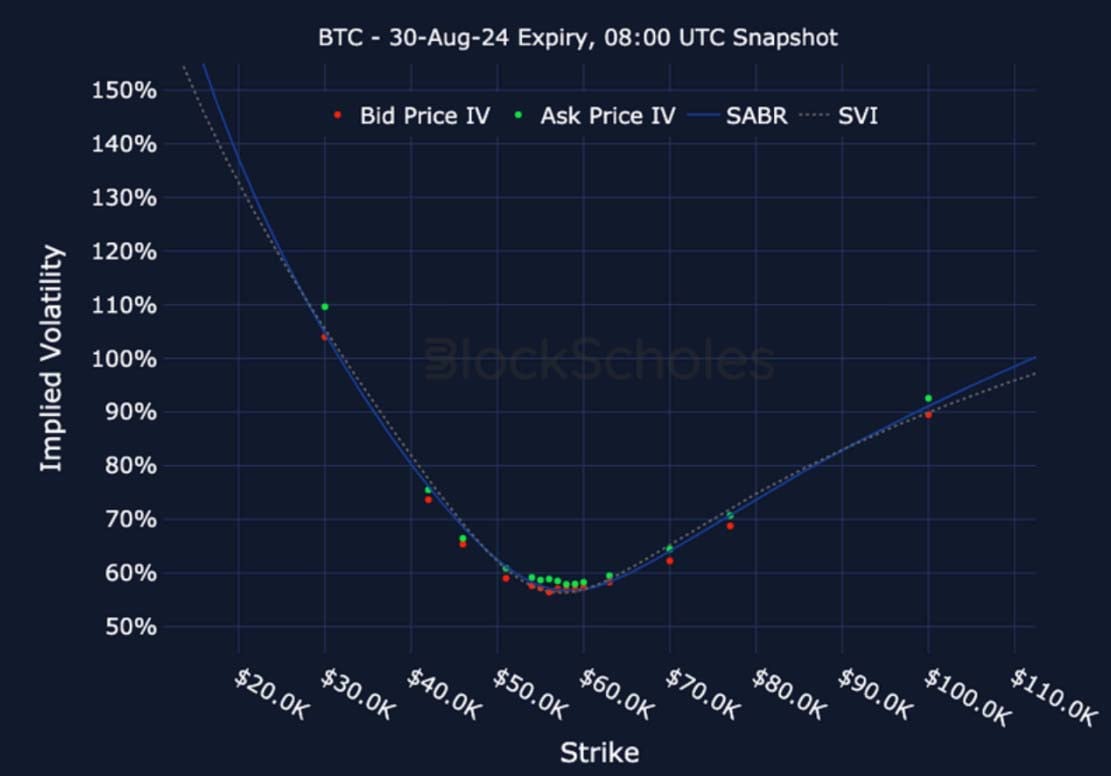

BTC 30-AUG EXPIRY – 9:00 UTC Snapshot.

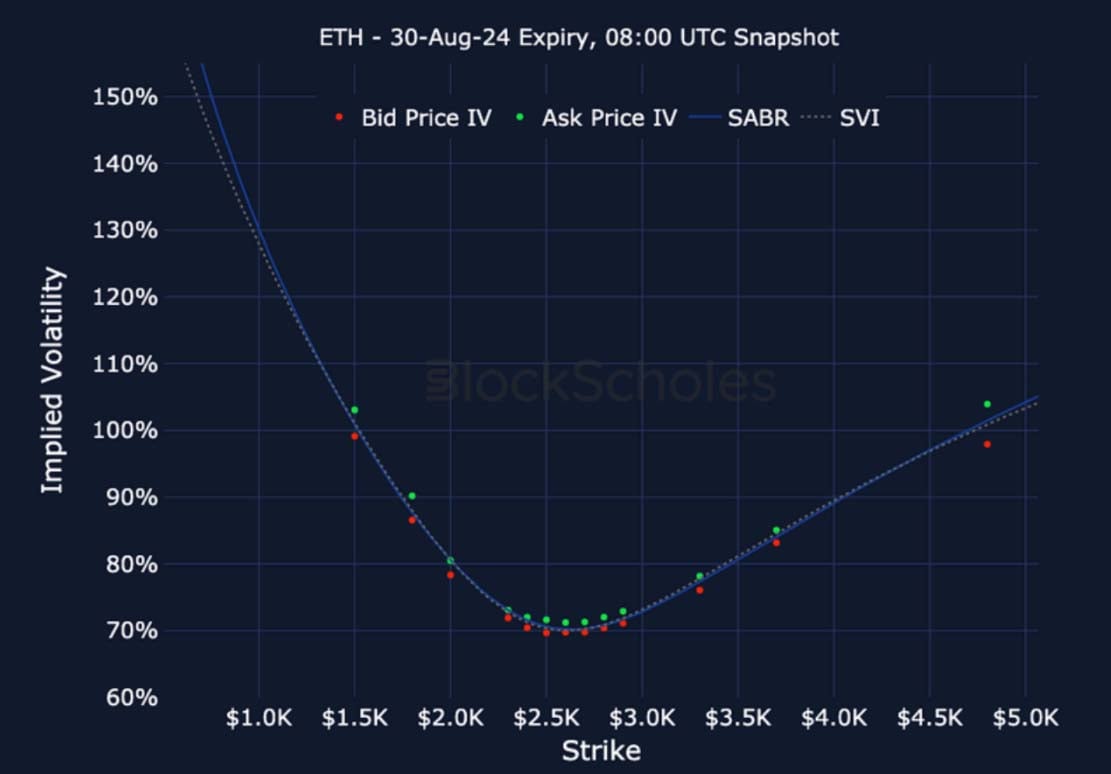

ETH 30-AUG EXPIRY – 9:00 UTC Snapshot..

Cross-Exchange Volatility Smiles

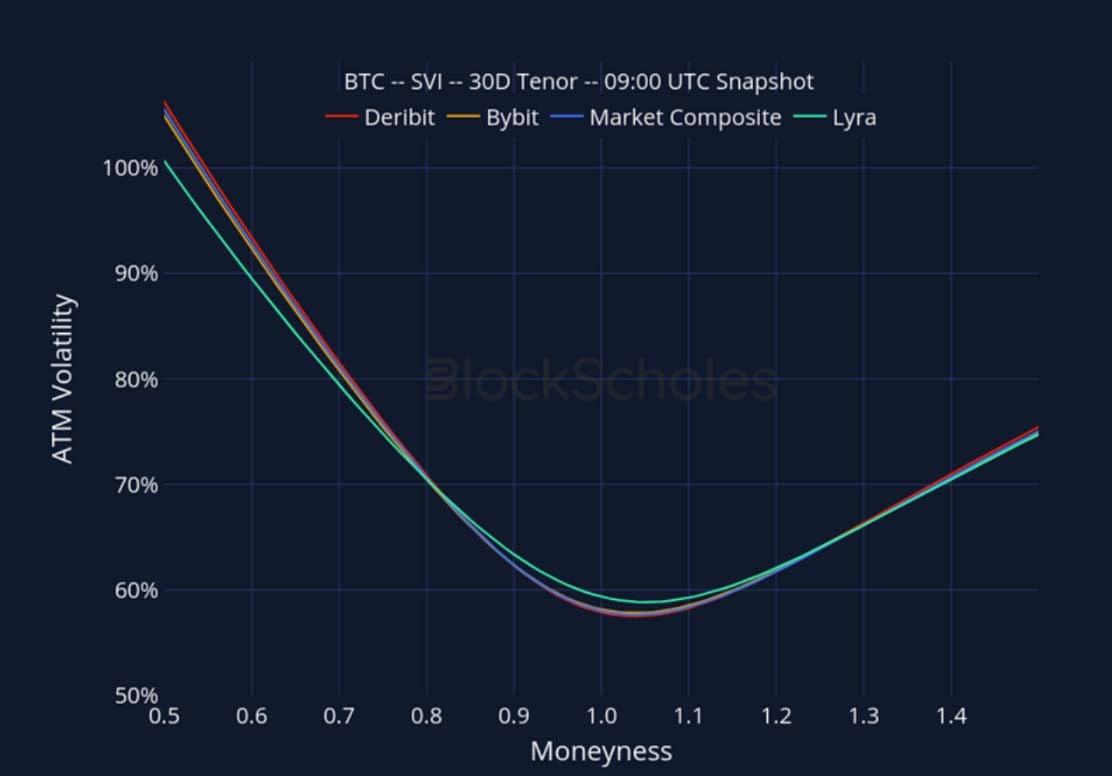

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)