Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

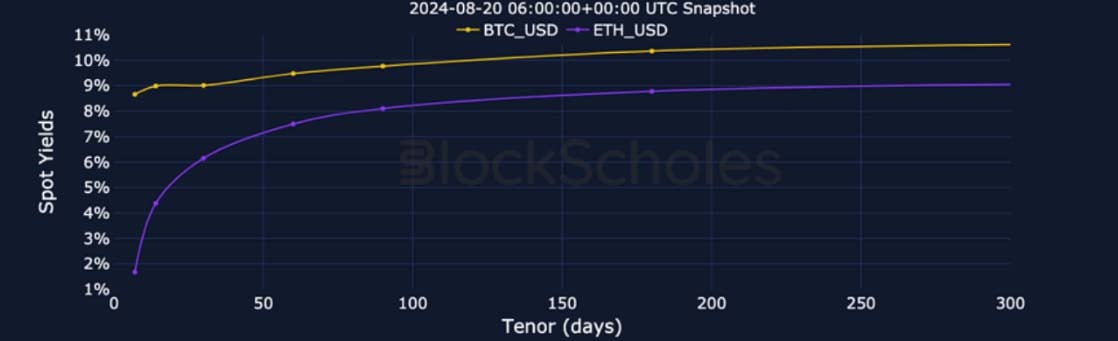

Since recovering from the selloff in the first week of August, spot prices have largely moved sideways. This period of relative calmness has opened up a space for a divergence in sentiment between BTC and ETH, with metrics across derivatives markets indicating a stronger bearishness assigned to the latter in the short term. ETH futures-implied yields trade significantly lower, perpetual swap funding rates have moved intermittently negative, and options on ETH trade with a premium to BTC’s implied volatility across the term structure, with short-tenorr OTM puts afforded an implied volatility premium over OTM calls.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

BTC ANNUALISED YIELDS – BTC’s curve has flattened over the last 24H, but remains in the same 9-11% range.

ETH ANNUALISED YIELDS – ETH yields trade lower than BTC’s for each tenor, with short-dated expiries underperforming the most.

Perpetual Swap Funding Rate

BTC FUNDING RATE – a short period of positive funding rates has returned to neutral, indicating low demand to pay for leveraged long exposure.

ETH FUNDING RATE – has continued to trade intermittently negative over the past two weeks.

BTC Options

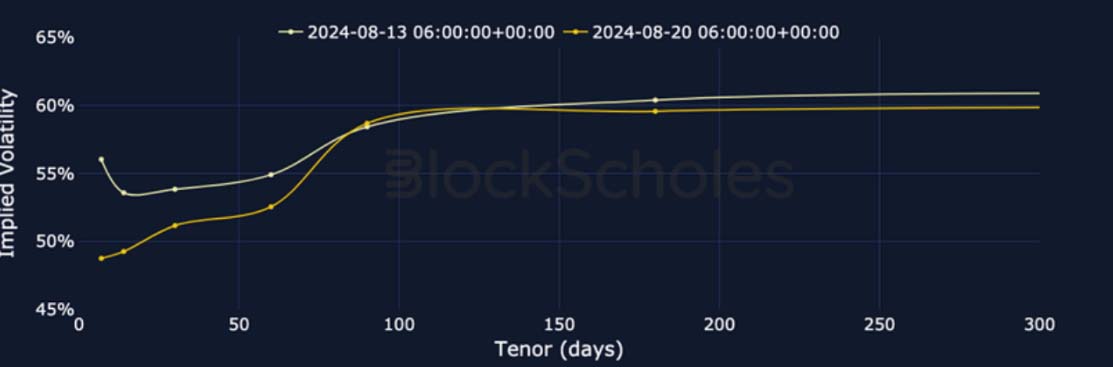

BTC SVI ATM IMPLIED VOLATILITY – short-dated volatility has fallen to around 50%, while longer tenor optionality has remained near to 60%.

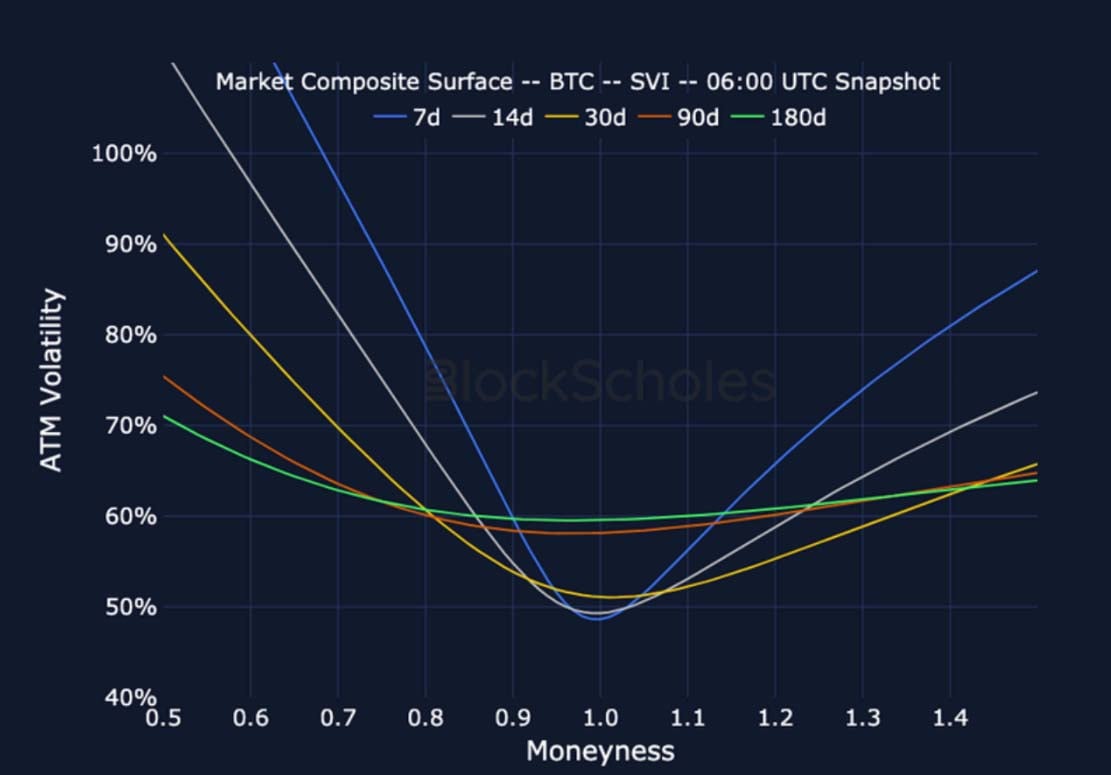

BTC 25-Delta Risk Reversal – we still see a divergence in skew between put- skewed short-tenor smiles and call-skewed longer-tenor smiles.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – shows the same steepening in the term structure as BTC but with a premium of 10 points or greater at all tenors.

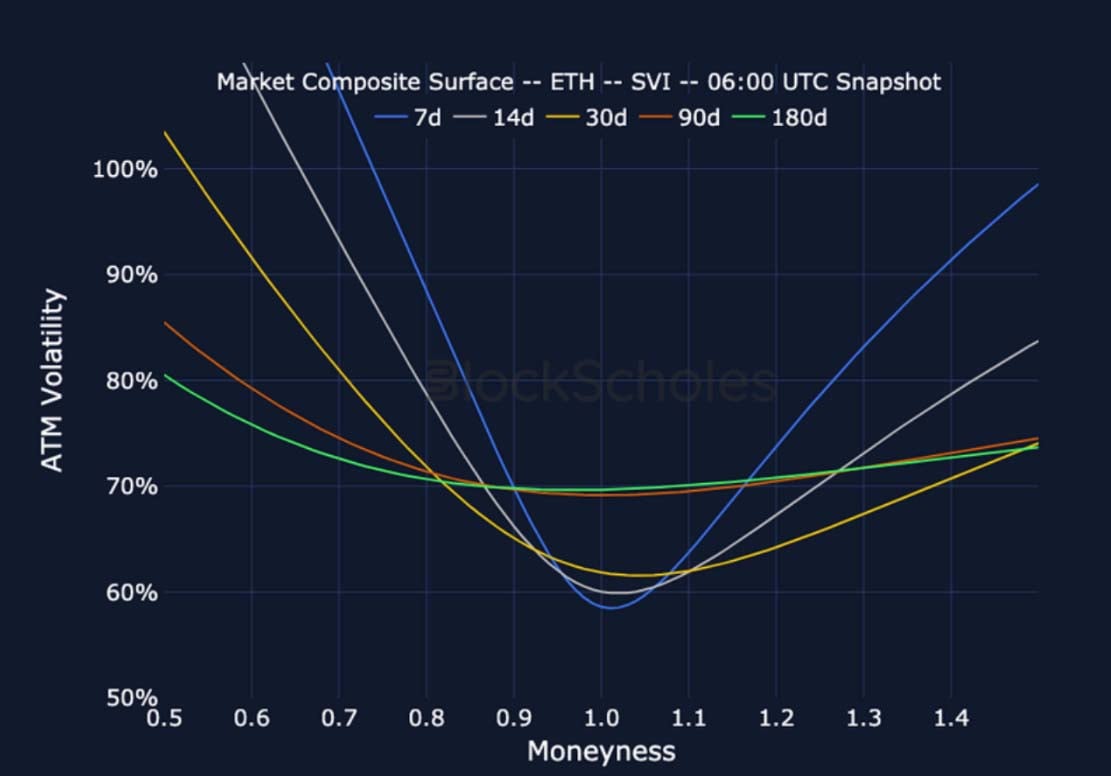

ETH 25-Delta Risk Reversal – ETH short-tenor smiles remain more strongly put-skewed than BTC’s and we see the same skew towards calls at a 90D tenor.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 06:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 06:00 UTC Snapshot.

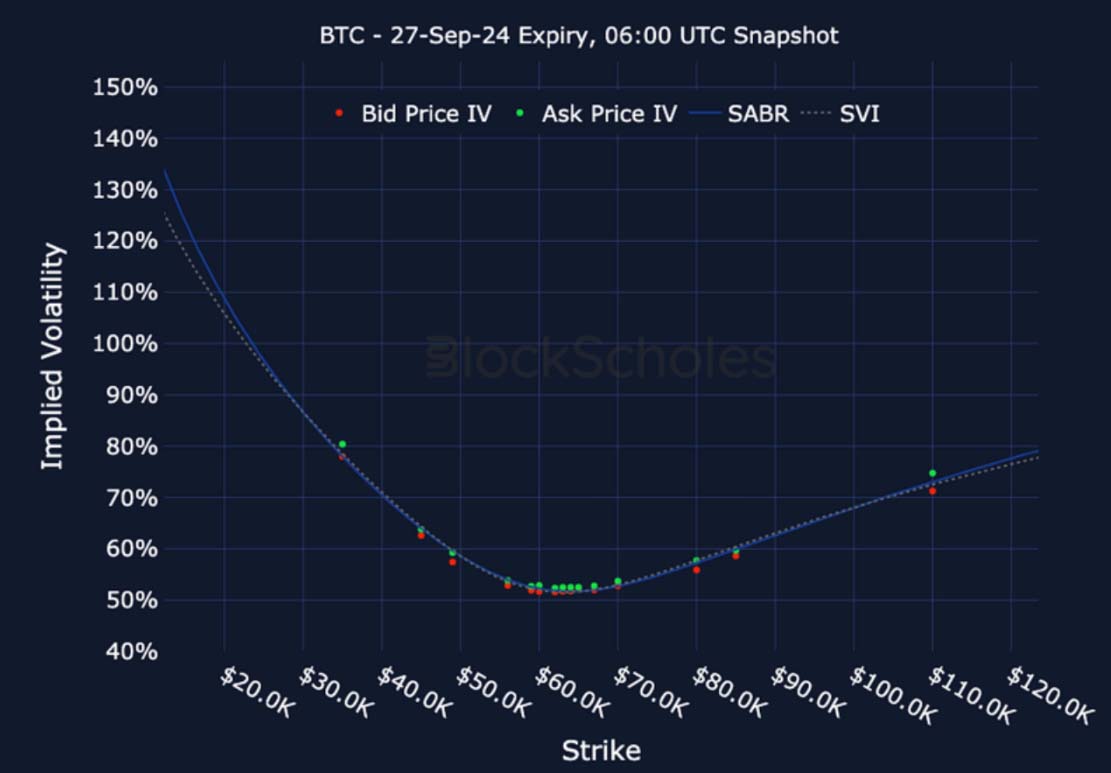

Listed Expiry Volatility Smiles

BTC 27-SEP EXPIRY– 06:00 UTC Snapshot.

ETH 27-SEP EXPIRY – 06:00 UTC Snapshot.

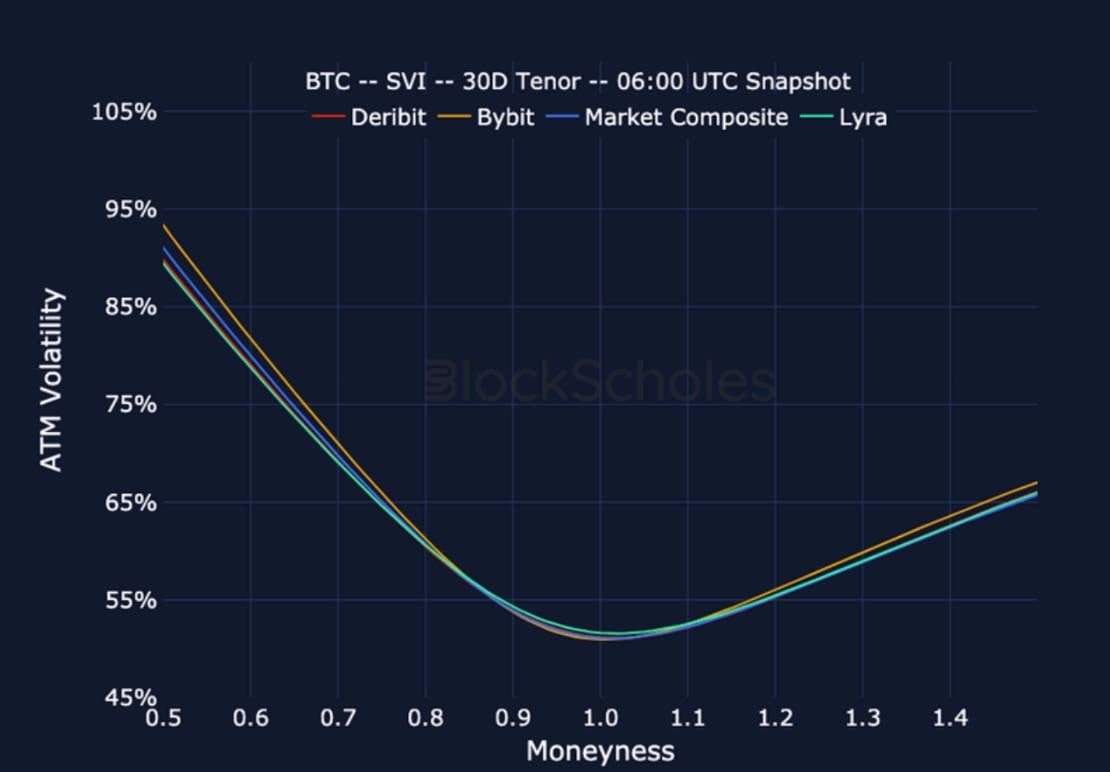

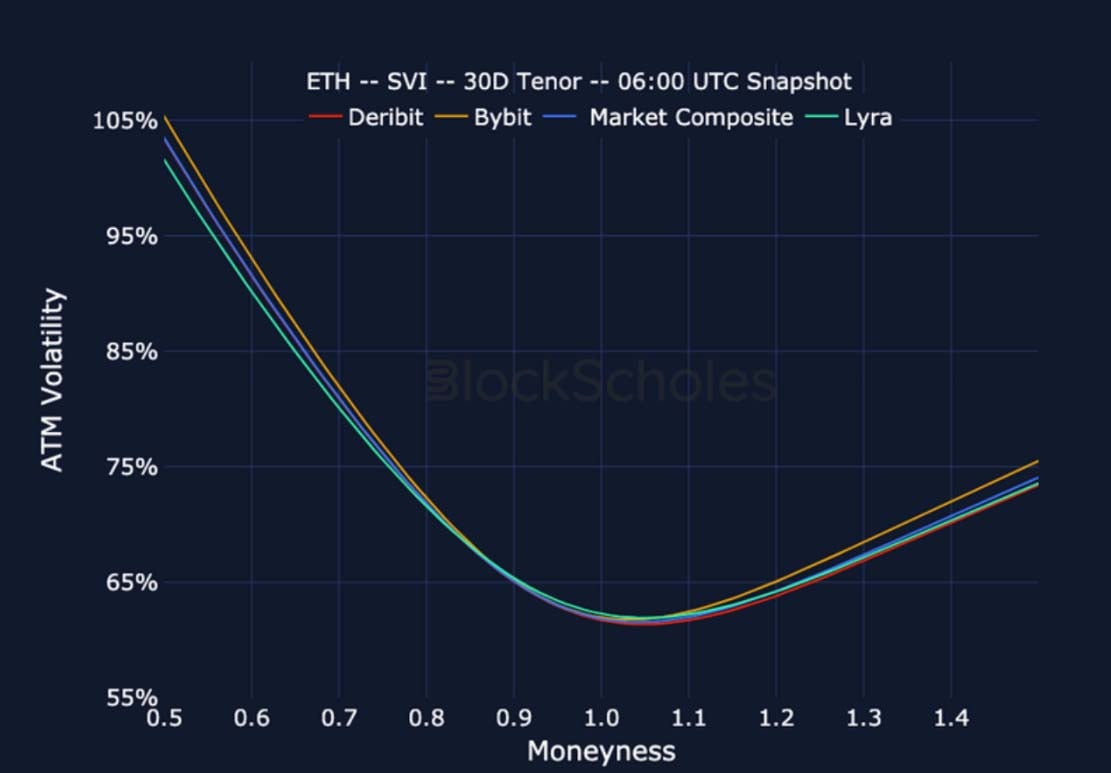

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 06:00 UTC Snapshot.

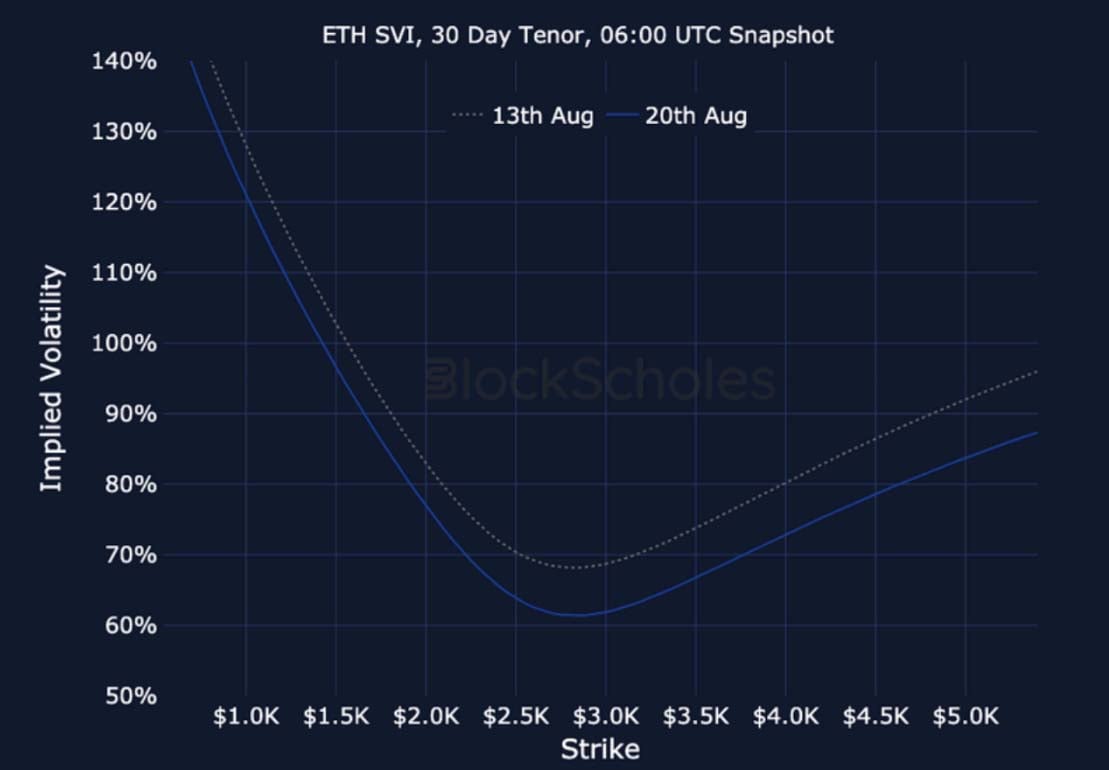

ETH SVI, 30D TENOR – 06:00 UTC Snapshot.

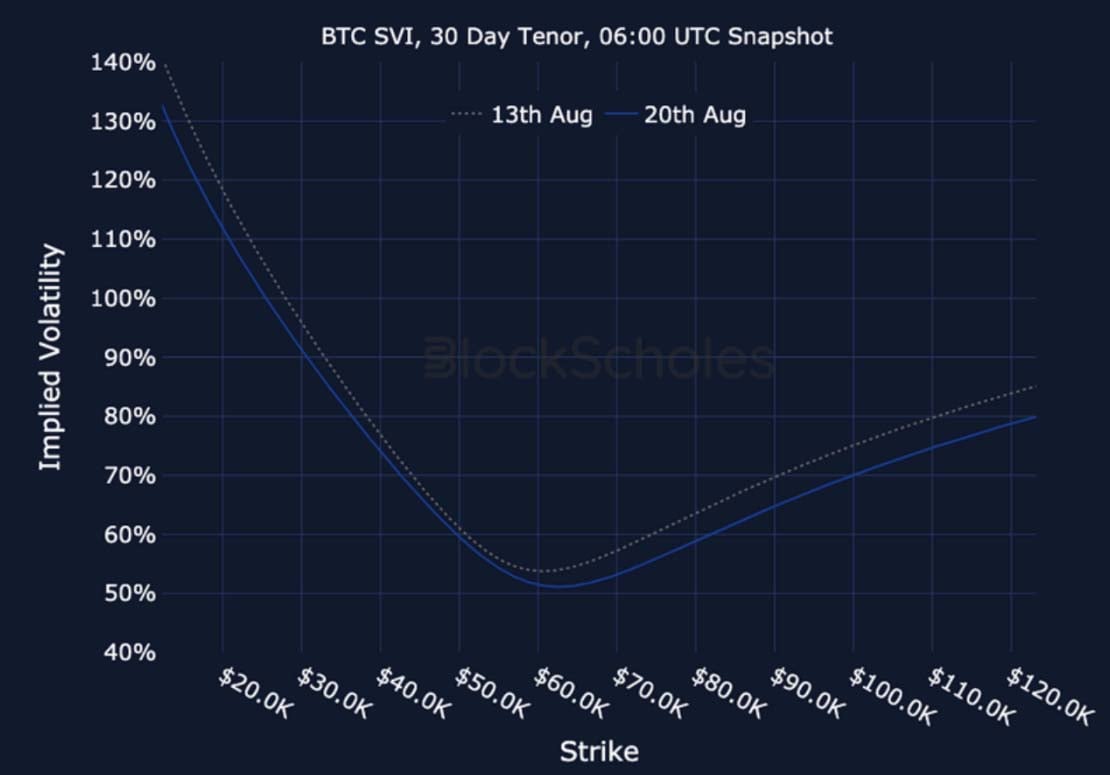

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 06:00 UTC Snapshot.

ETH SVI, 30D TENOR – 06:00 UTC Snapshot.

AUTHOR(S)