Weekly recap of the crypto derivatives markets by BlockScholes.

BTC

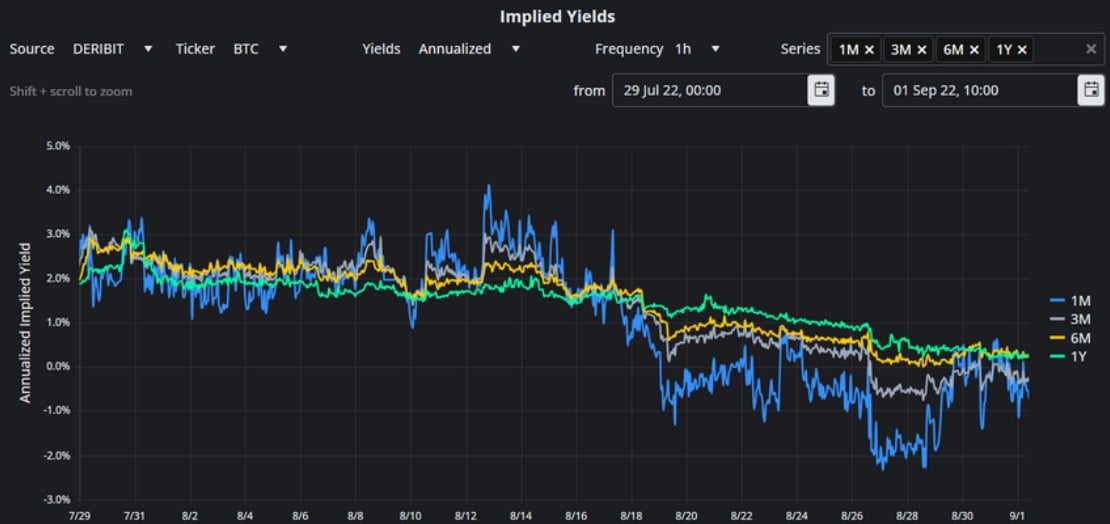

BTC’s Implied yields are near zero for most tenors in light of of the spot price’s return to $20K

BTC Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

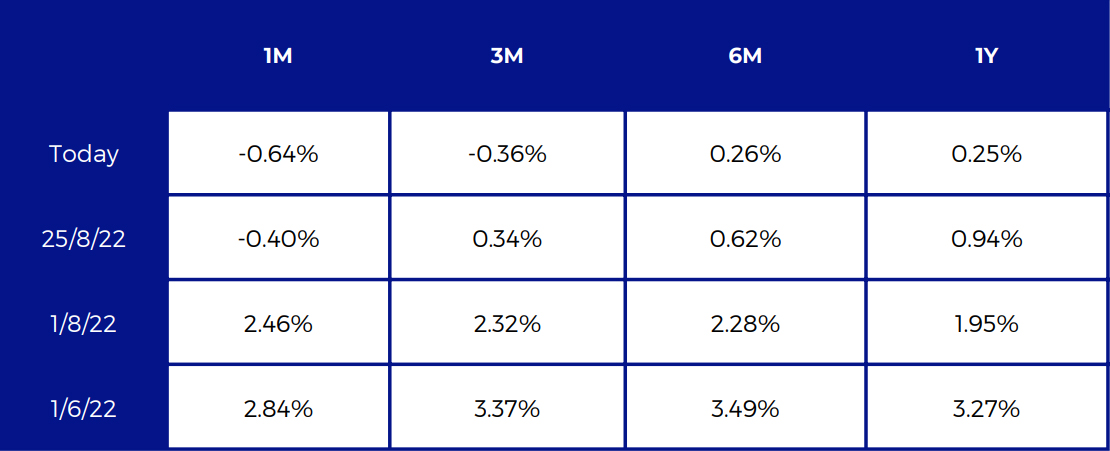

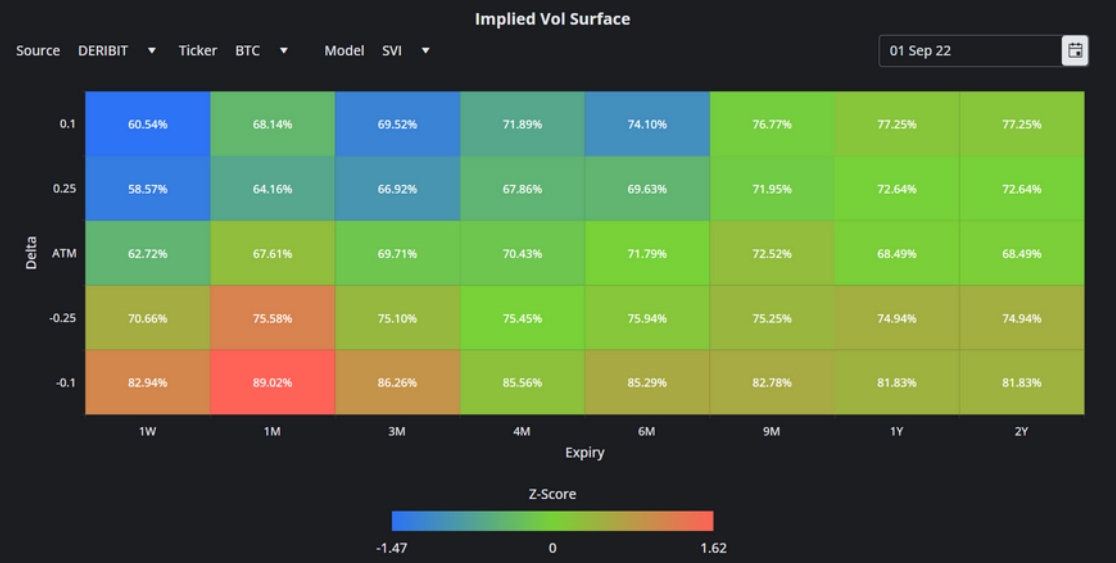

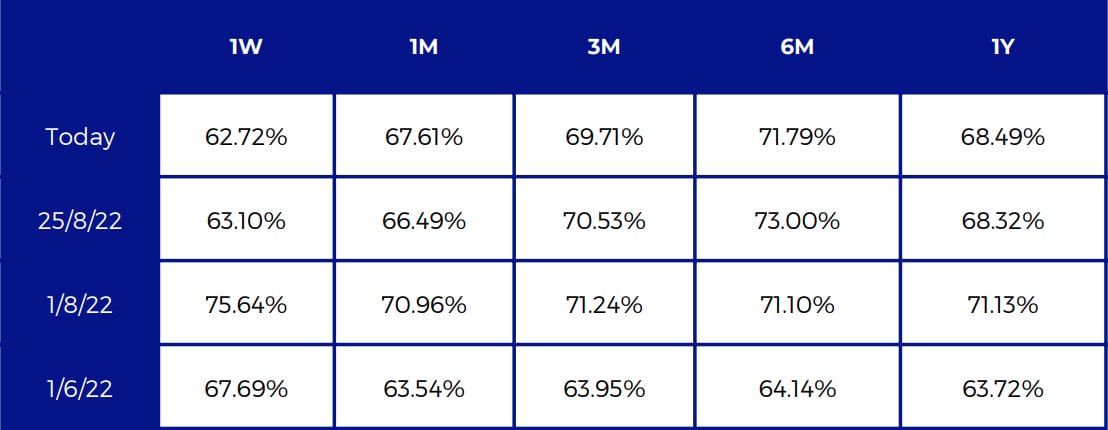

BTC’s ATM implied volatility is still between 60% and 75%, with a normal term structure

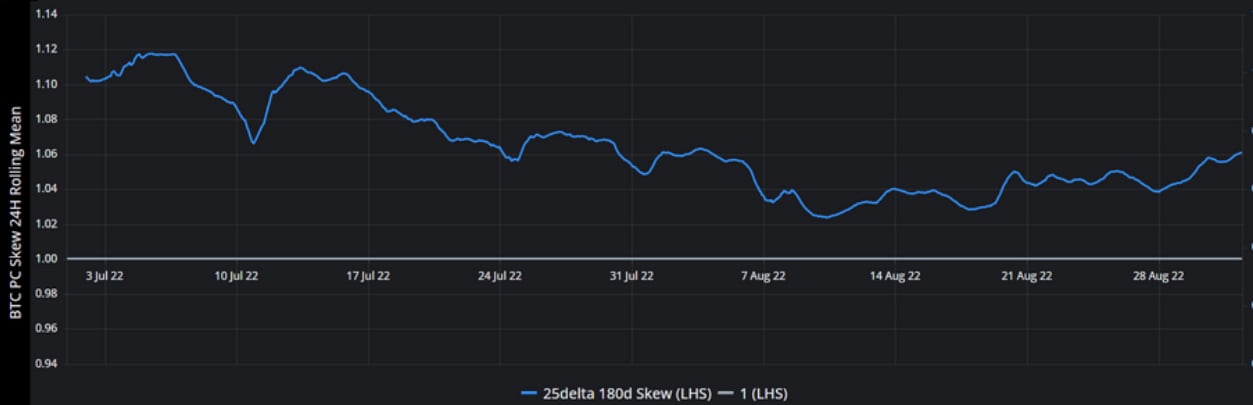

BTC’s 25-delta put-call skew inflects upwards as downside protection becomes more attractive

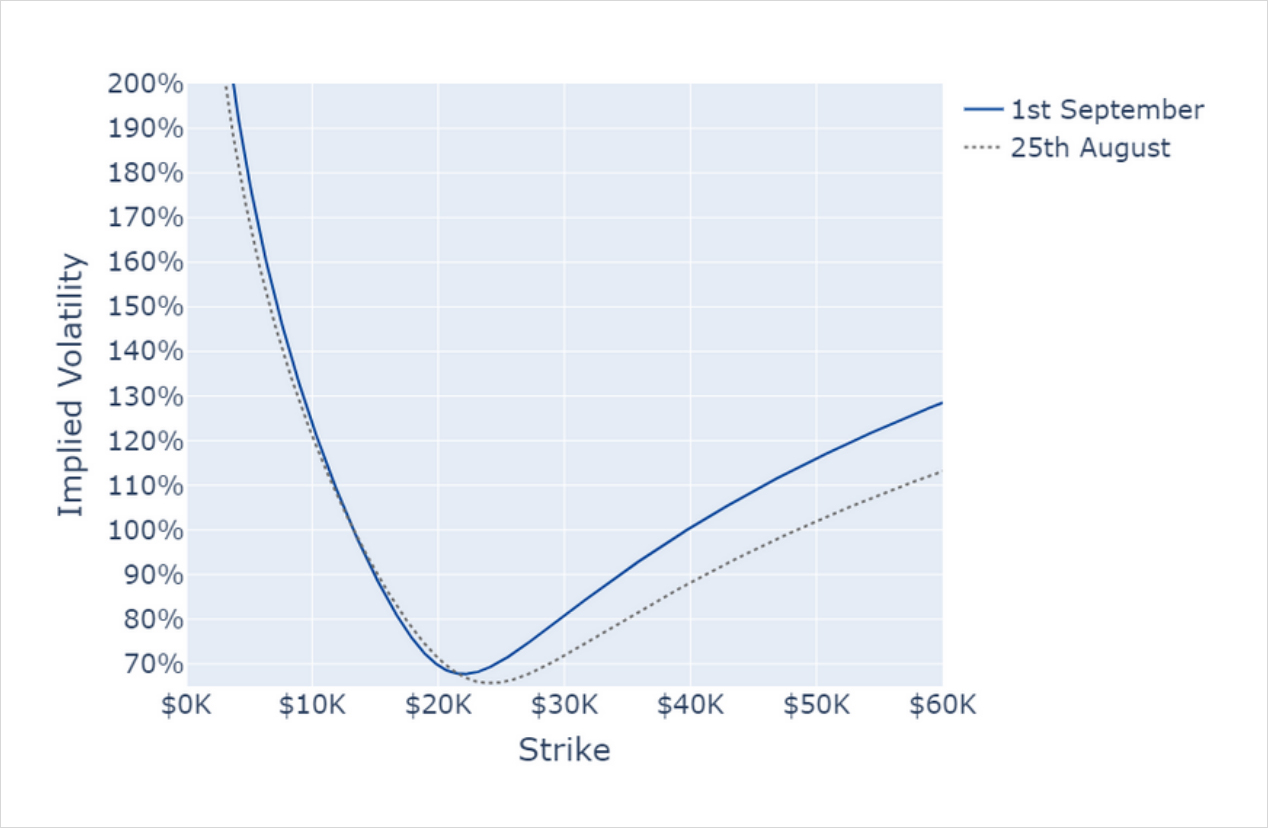

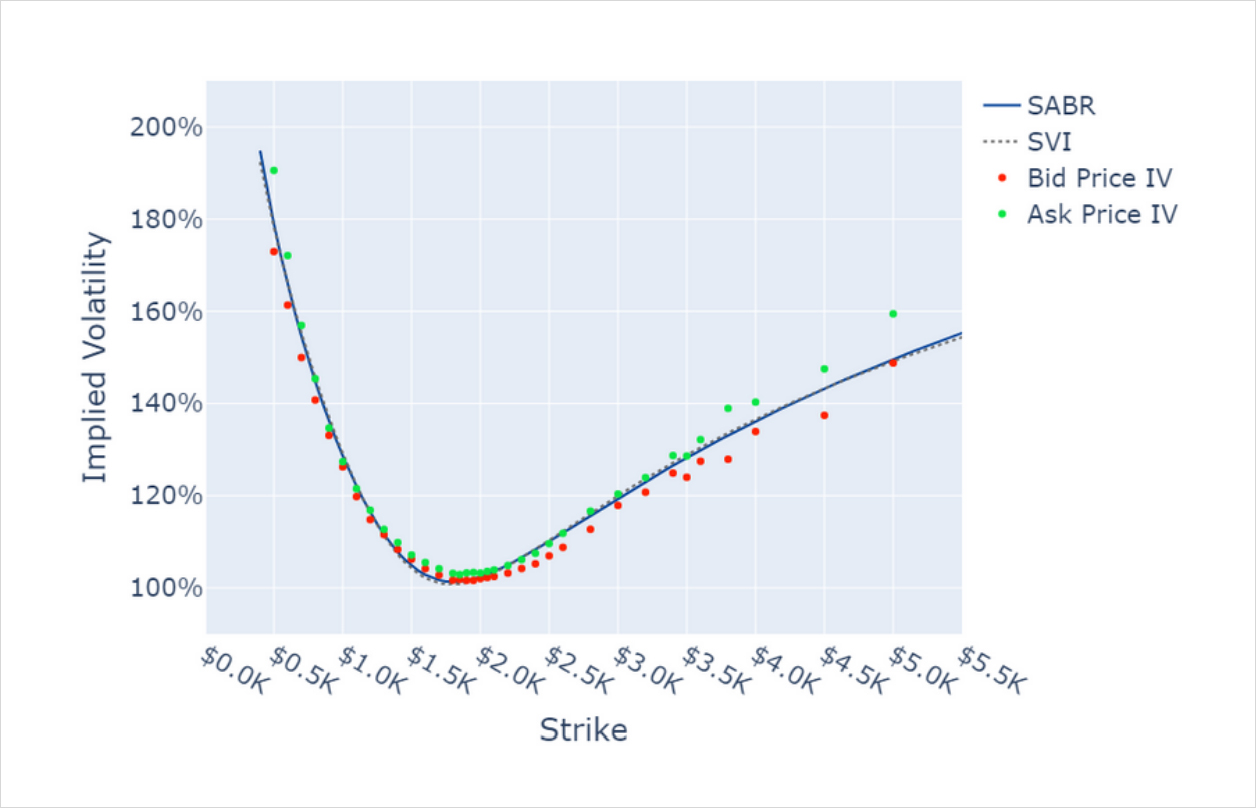

SABR Smile Calibration

The IV of short-dated BTC underperforms the rest of the surface as demand for short-dated puts rises

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 30th September Expiry

The skew of BTC’s 30d smile decreased over the last 7 days due to an increased demand for OTM calls

BTC 1 Month SABR Implied Vol Smile.

ETH

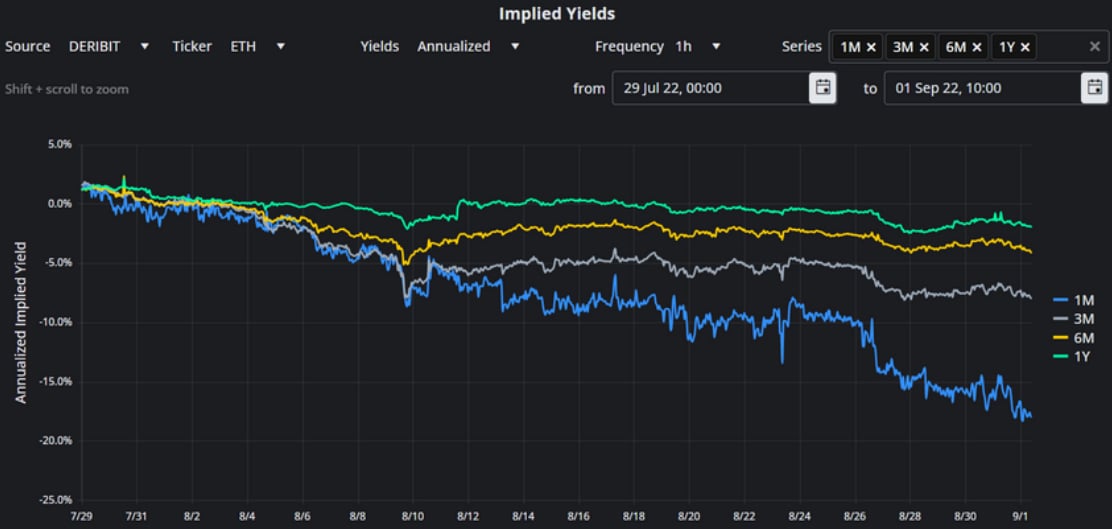

ETH’s annualised yields plunge even further negative as the Merge dominates the narrative

ETH Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

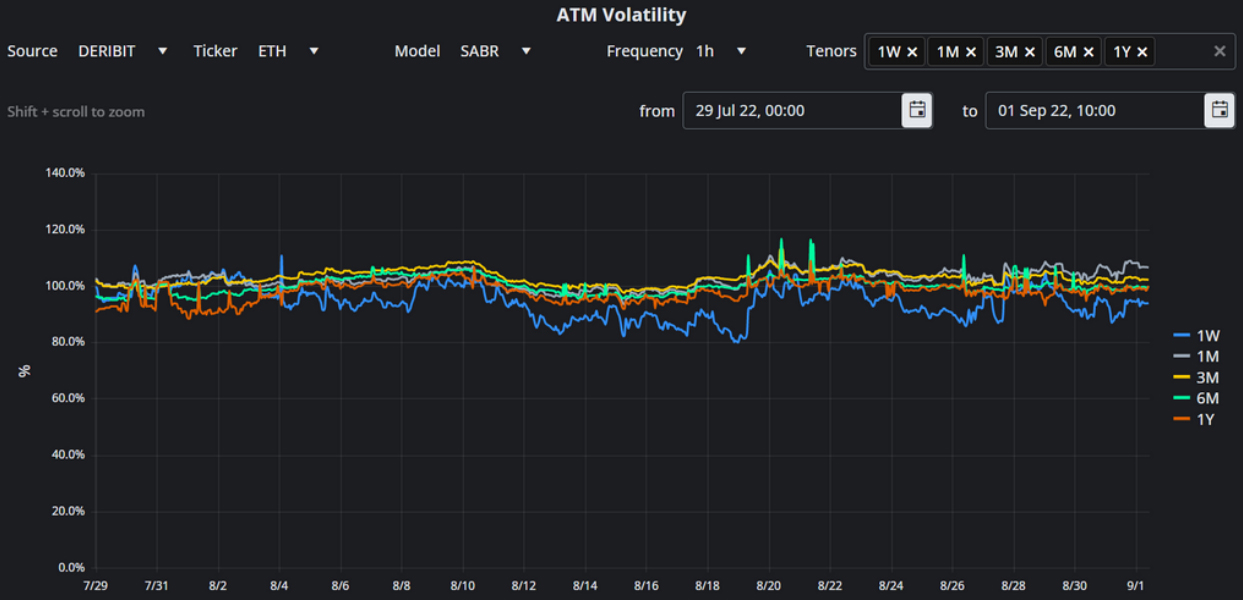

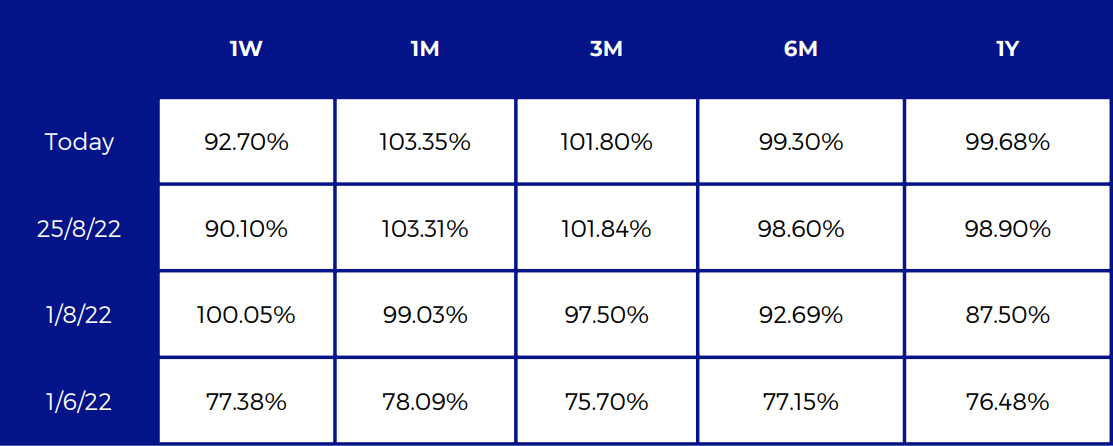

ETH’s 1M tenor options (now 30SEP22 expiry) see the highest ATM vols as traders look to take advantage of the Merge mid-September

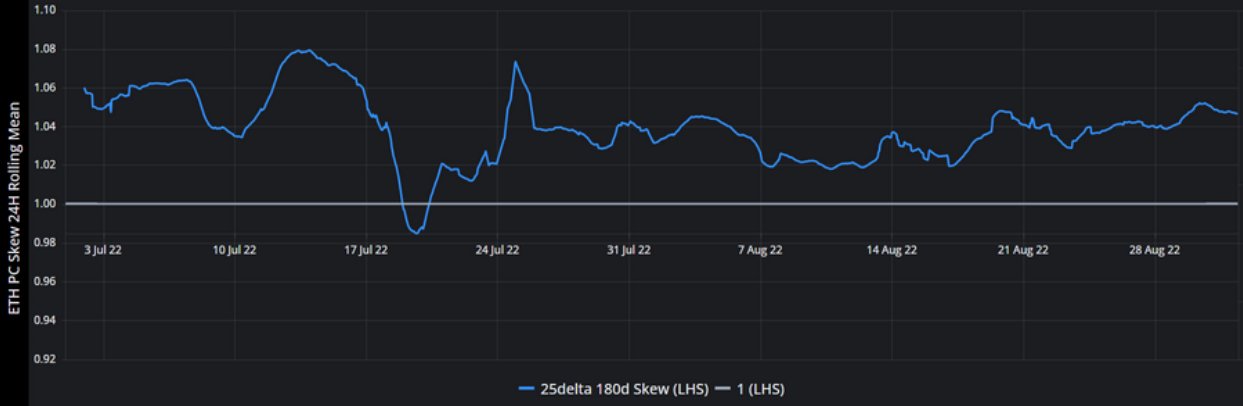

ETH’s 180d volatility smile remains skewed towards puts

SABR Smile Calibration

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

ETH ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

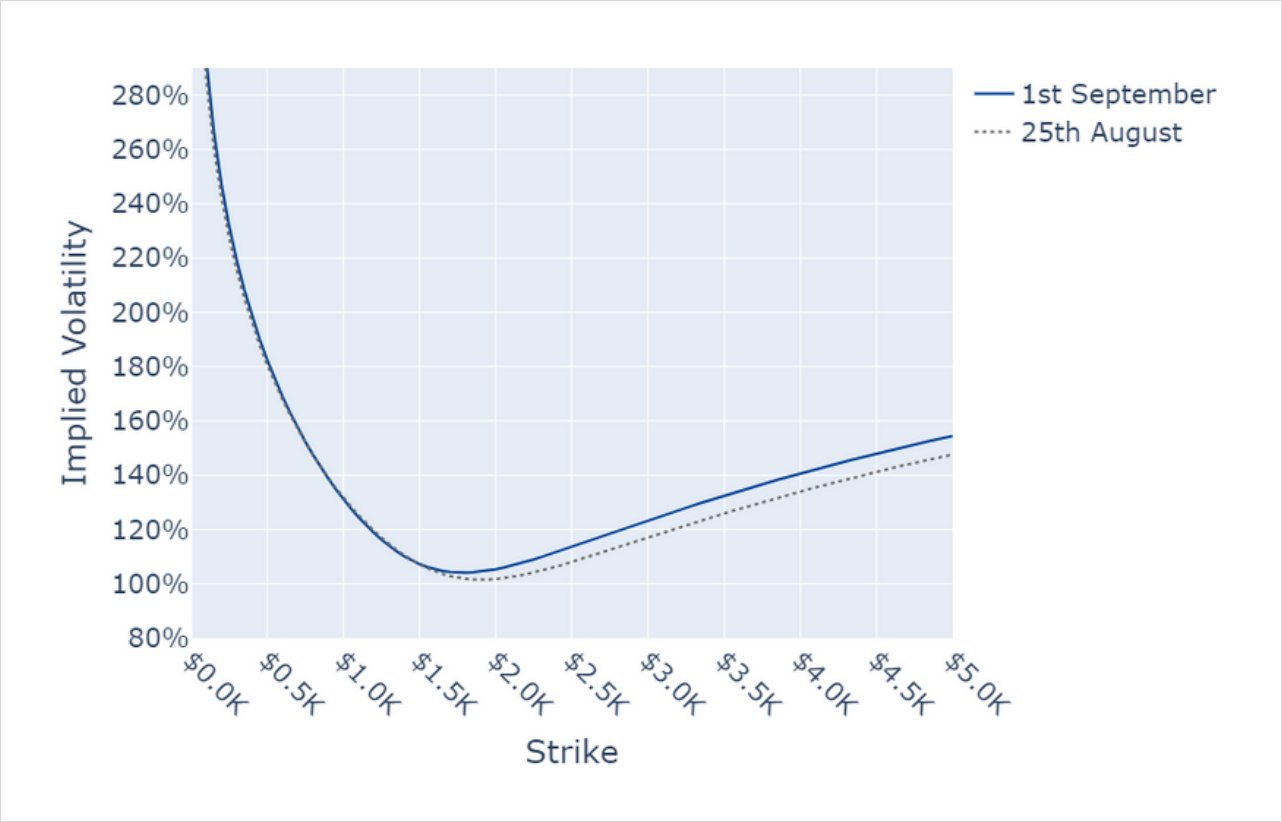

SABR and SVI Smile Calibrations, 30th September Expiry

ETH’s vol smile remains static, with a small rise in the vols of OTM calls

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)