Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

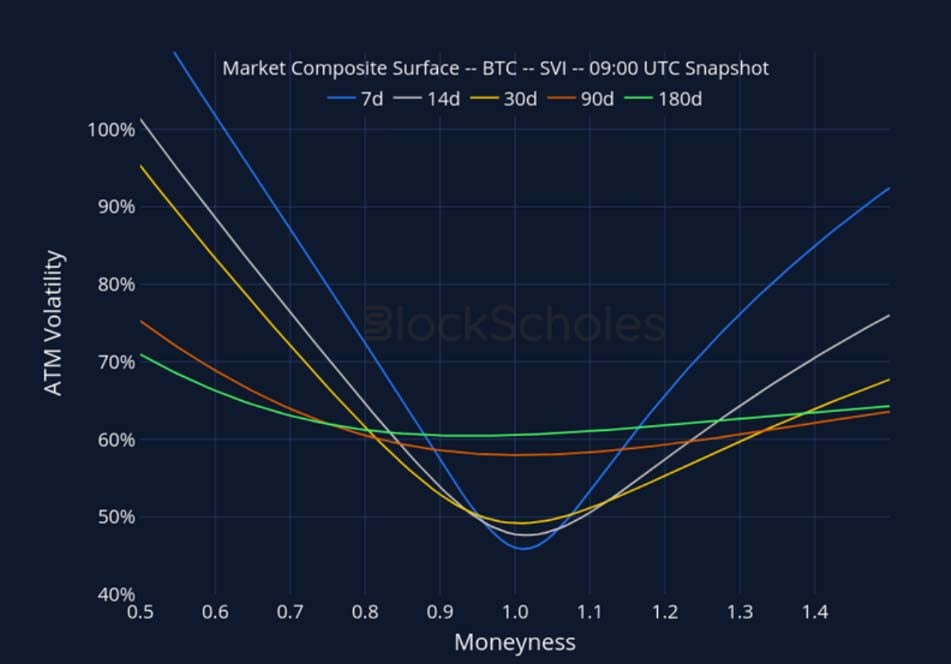

Despite volatility levels having largely fluctuated for short-tenor ATM options, from the term structure we can once again observe that, as the US election approaches, volatility for options expiring after the election date is rising. We can additionally observe that skew for short-tenor options has been evolving positively in the past few days, with skew levels slightly rising similarly to what happened in mid-August, indicating a more neutral outlook despite the recent spot volatility. Concurrently, long-tenor options have consistently been pricing in higher volatility levels across the term structure, showing a stronger preference towards OTM calls.

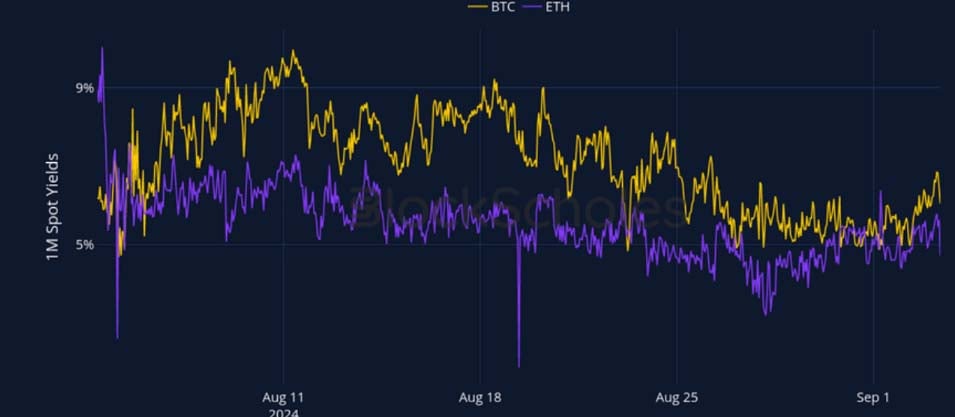

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

BTC ANNUALISED YIELDS – BTC’s spot yields have increased for short tenors reaching 6%, and lowered for long tenors, now trading at 9% above spot.

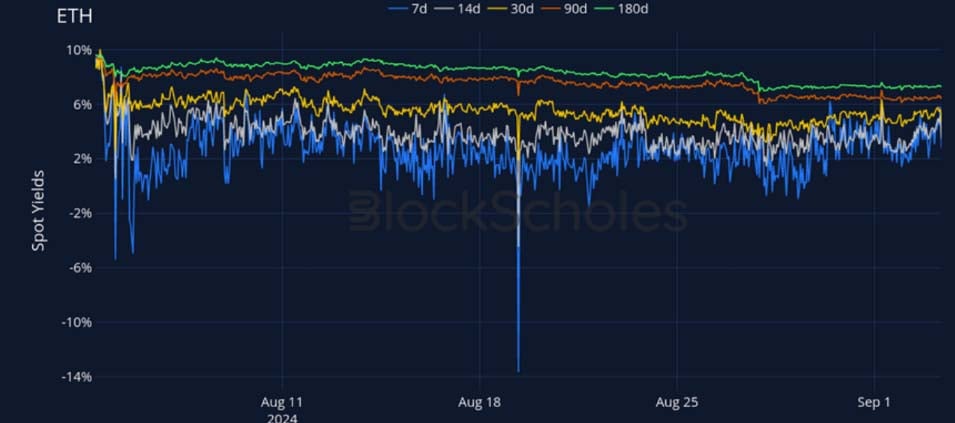

ETH ANNUALISED YIELDS – ETH’s spot yields have overall been on the rise, but not showing the same increase for the short term as BTC.

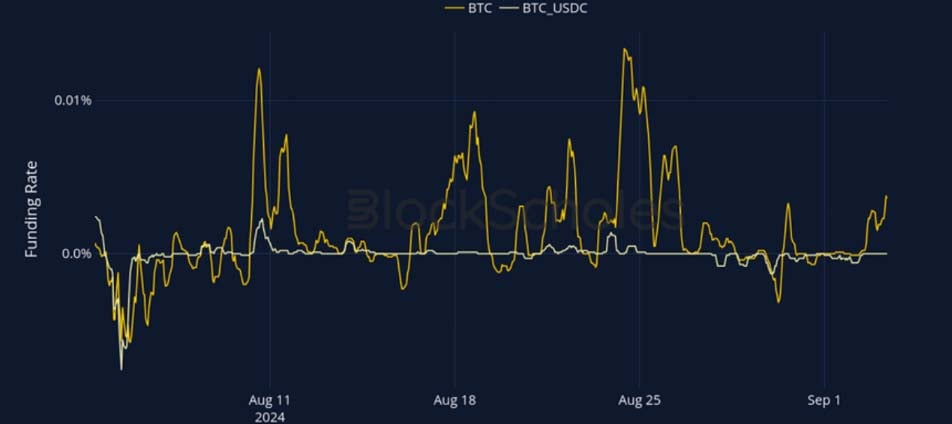

Perpetual Swap Funding Rate

BTC FUNDING RATE – After dropping negative for a short period, BTC perpetual funding rate has returned positive and is slowly recovering.

ETH FUNDING RATE – ETH’s perpetual swap funding rate is showing no sign of recovery and remains neutral.

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – short-dated volatility is oscillating, while volatility levels remain constant for long-tenor options.

BTC 25-Delta Risk Reversal – skew levels have dropped towards puts in the past week for short tenors, but show signs of recovery in the past days.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – shows the same increase in the term structure as BTC for short tenors.

ETH 25-Delta Risk Reversal – ETH’s short-tenor skews have fallen more significantly than BTC’s, and show slower signs of recovery.

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

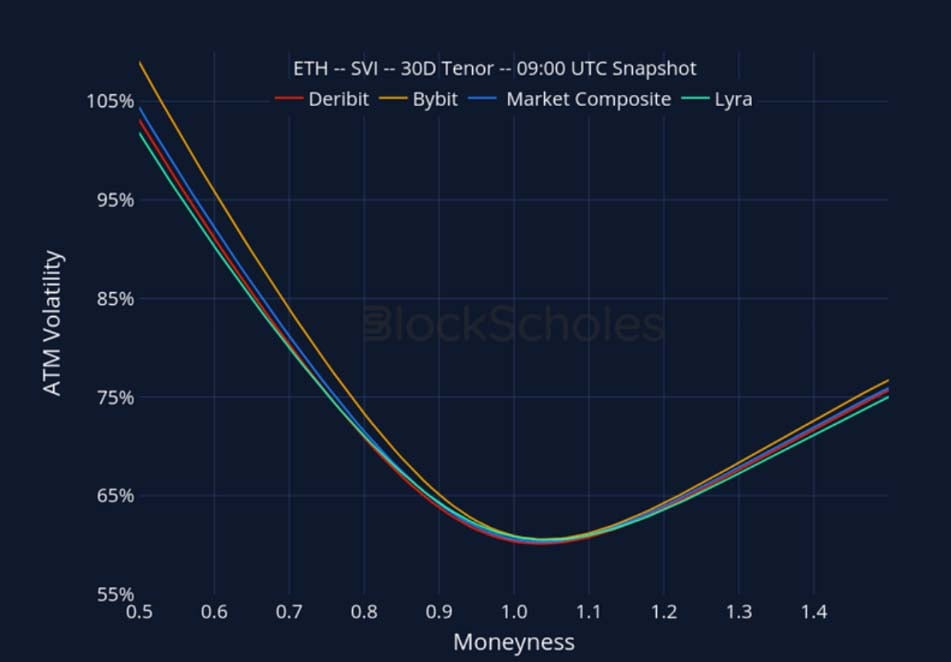

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

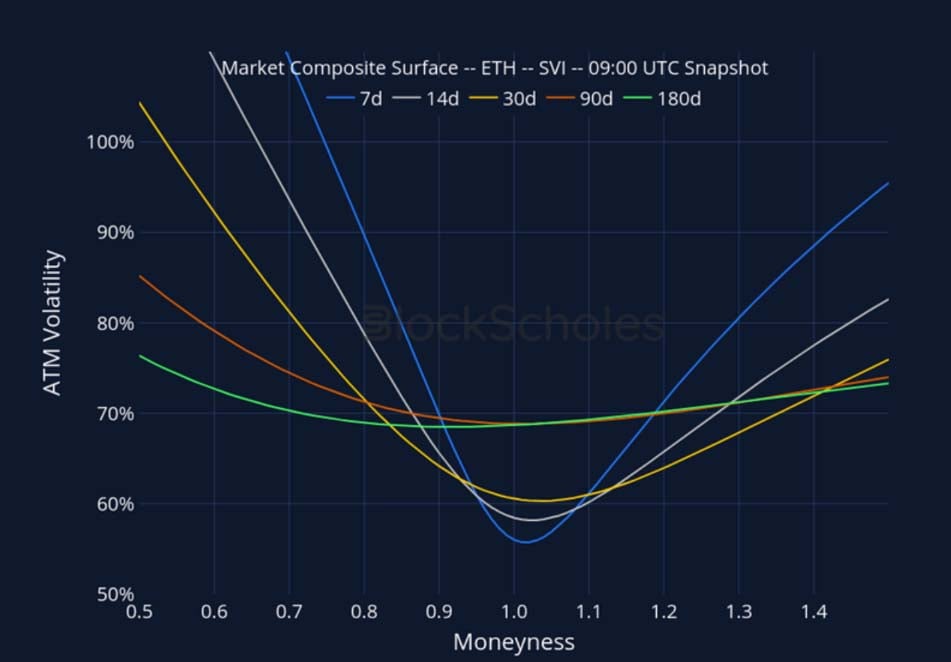

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

Listed Expiry Volatility Smiles

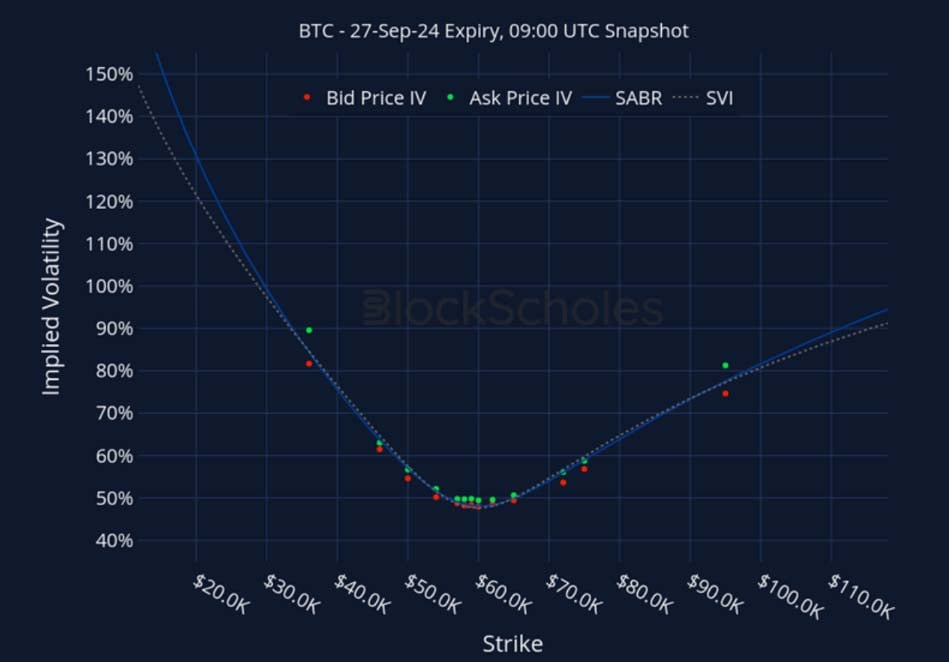

BTC 27-SEP EXPIRY – 9:00 UTC Snapshot.

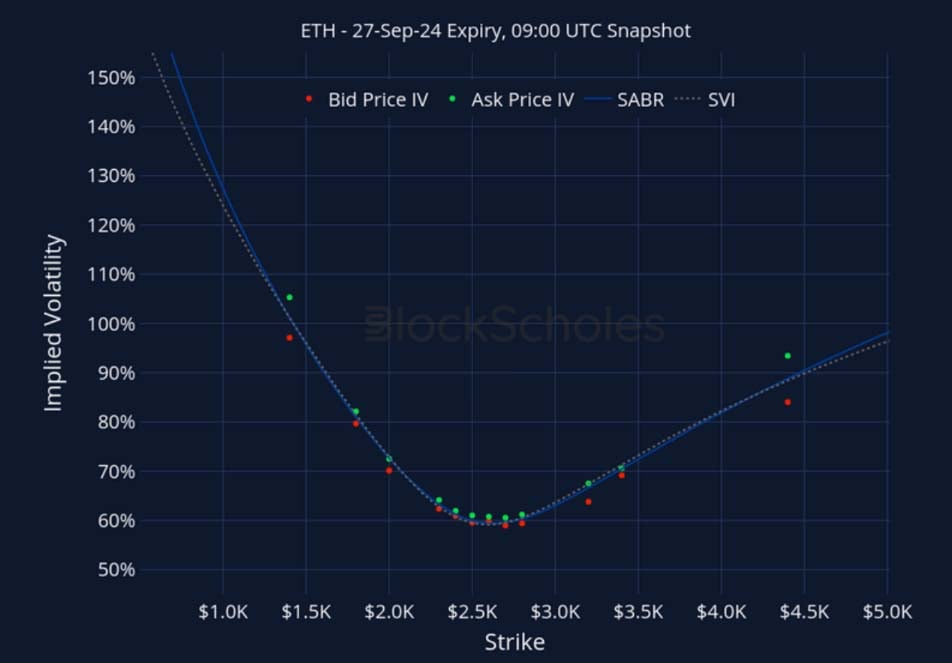

ETH 27-SEP EXPIRY – 9:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

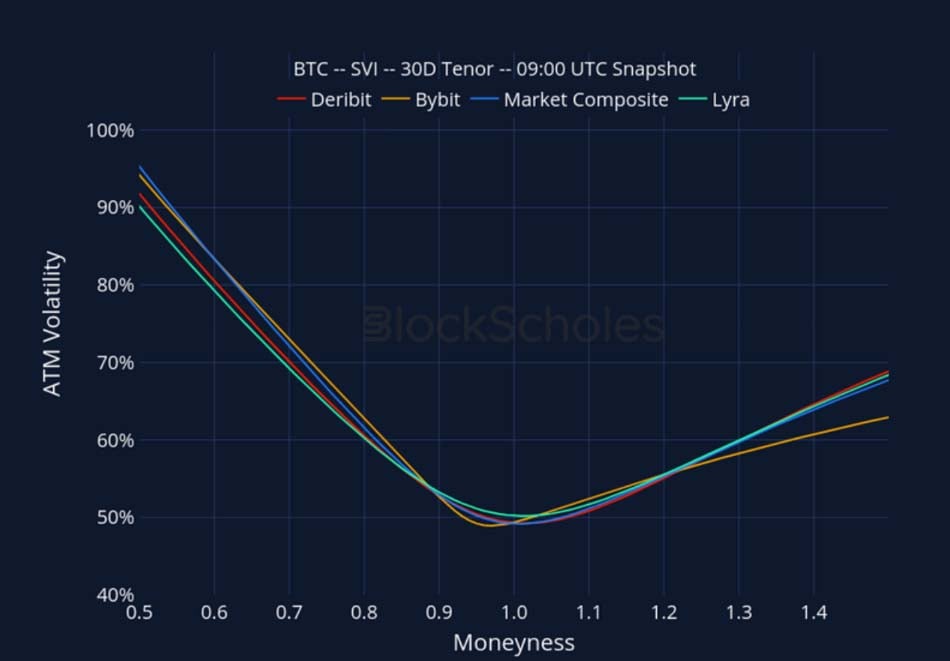

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

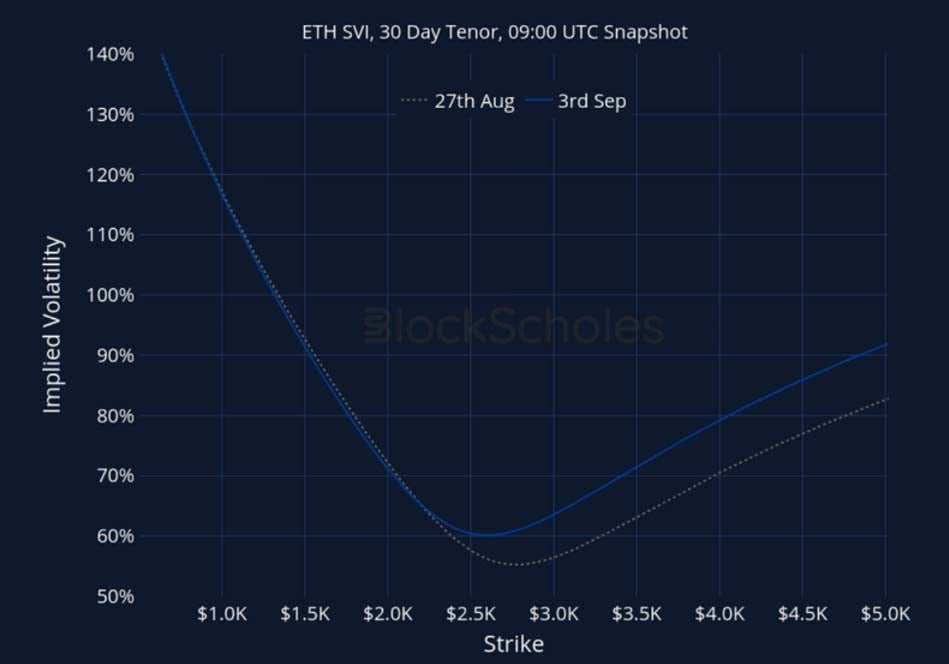

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

AUTHOR(S)