Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

The recent downward spot price action had an outsized impact on the ETH derivatives market relative to BTC, with ETHʼs futures implied spot yields reporting a decline, whilst funding rated turned negative in its perpetual swap markets. Despite this, ETH experienced a more outsized skew towards OTM calls than BTC, with the implied volatility of both crypto assets increasing over the last week.

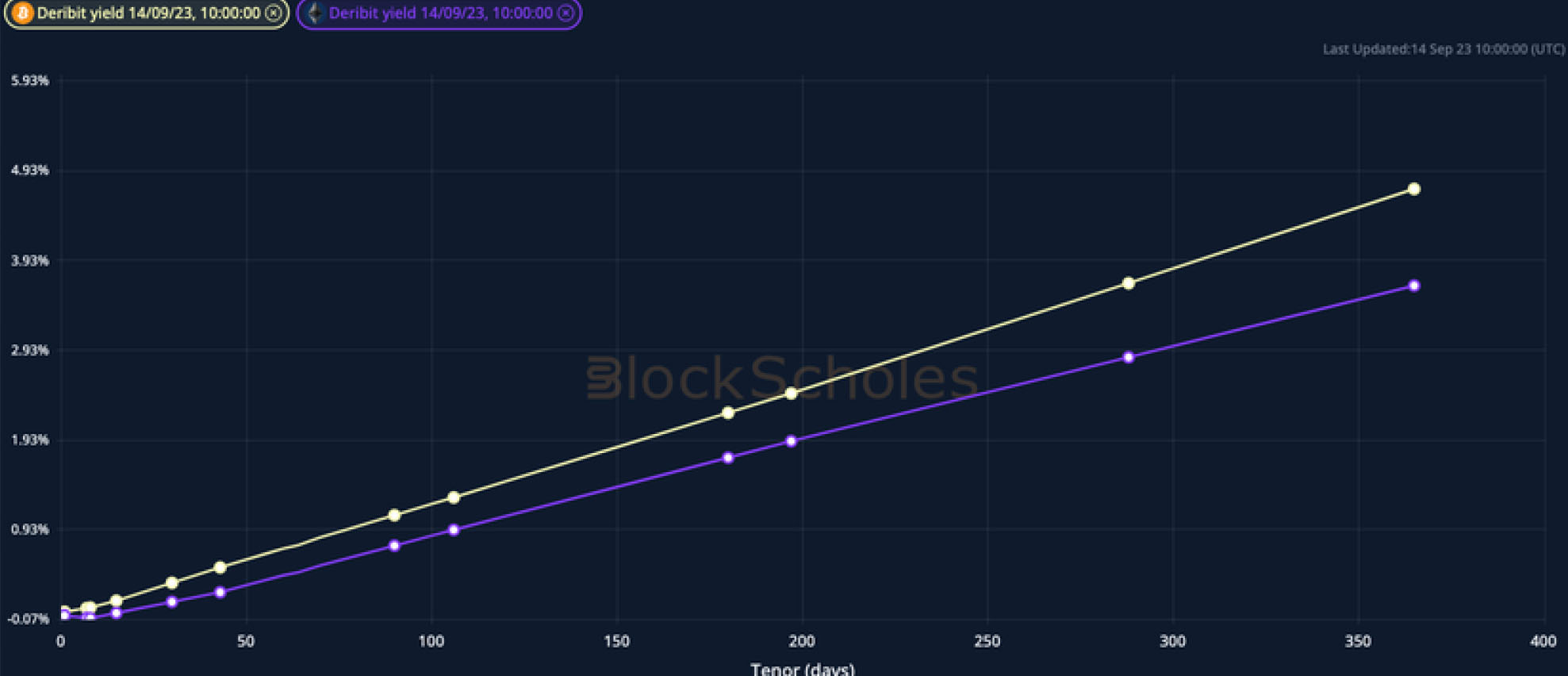

Futures implied yield term structure.

Volatility Surface Metrics.

*All data in tables recorded at a 10:05 UTC snapshot unless otherwise stated.

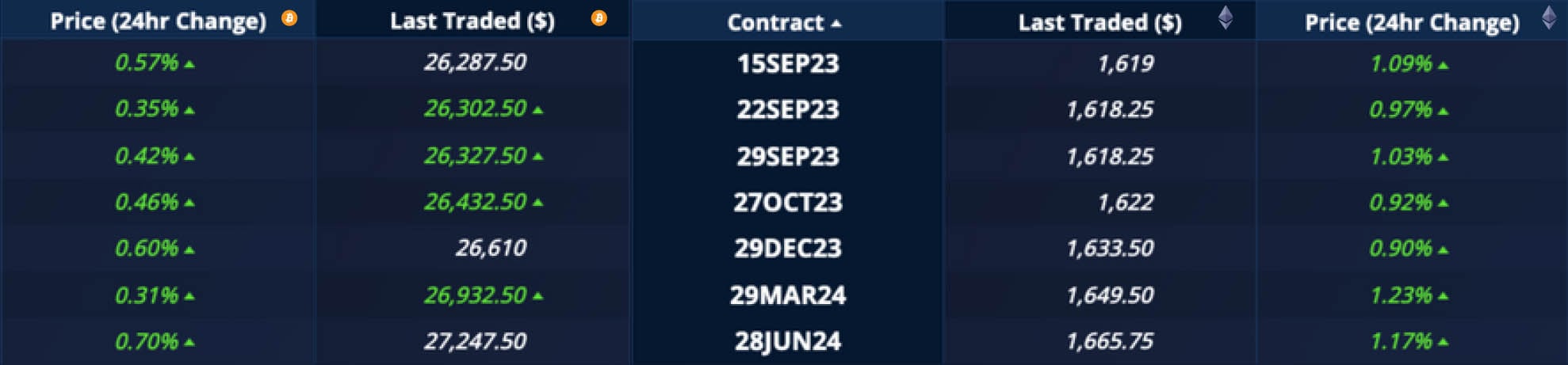

Futures

BTC ANNUALISED YIELDS – continues to trade sideways, remaining relatively agnostic to recent moves in spot price.

ETH ANNUALISED YIELDS – sees a decline that is most pronounced at shorter tenors, following the fall in spot prices on the 11th of September.

Perpetual Swap Funding Rate

BTC FUNDING RATE – has seen a pickup in demand for long exposure in the last 48 hours.

ETH FUNDING RATE – acts in contrast to BTC, seeing more short exposure demand relative to long exposure in the last 48 hours.

BTC Options

BTC SABR ATM IMPLIED VOLATILITY – has been on an uptrend since the 9th of September, which is more pronounced at shorter-dated tenors.

BTC 25-Delta Risk Reversal – has recovered from its decline since the 9th of September now trading at higher level seen last week.

ETH Options

ETH SABR ATM IMPLIED VOLATILITY – mirrors the uptrend seen in BTC, with a less steep term structure.

ETH 25-Delta Risk Reversal – has seen a more pronounced shift in positioning towards OTM calls than BTC across the surface.

Volatility Surface

BTC IMPLIED VOL SURFACE – has seen a pickup in implied volatility that is most pronounced in long-dated upside exposure.

ETH IMPLIED VOL SURFACE – sees the implied volatility of short-dated OTM puts fall, whilst mid-to-long dated OTM calls rose.

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC, SABR smile calibration.

Volatility Smiles

BTC SMILE CALIBRATIONS – 27-Oct-2023 Expiry, 10:05 UTC Snapshot.

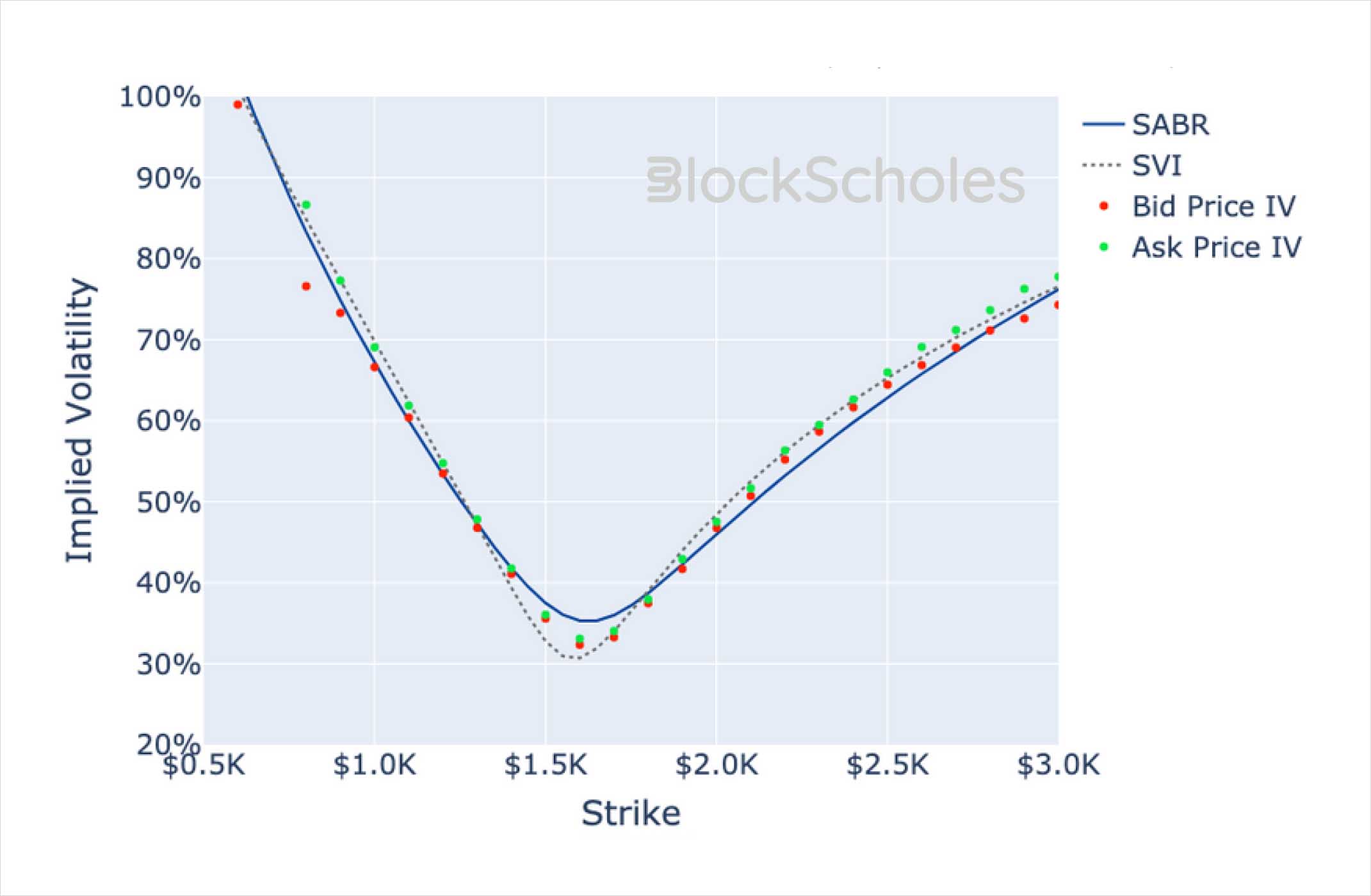

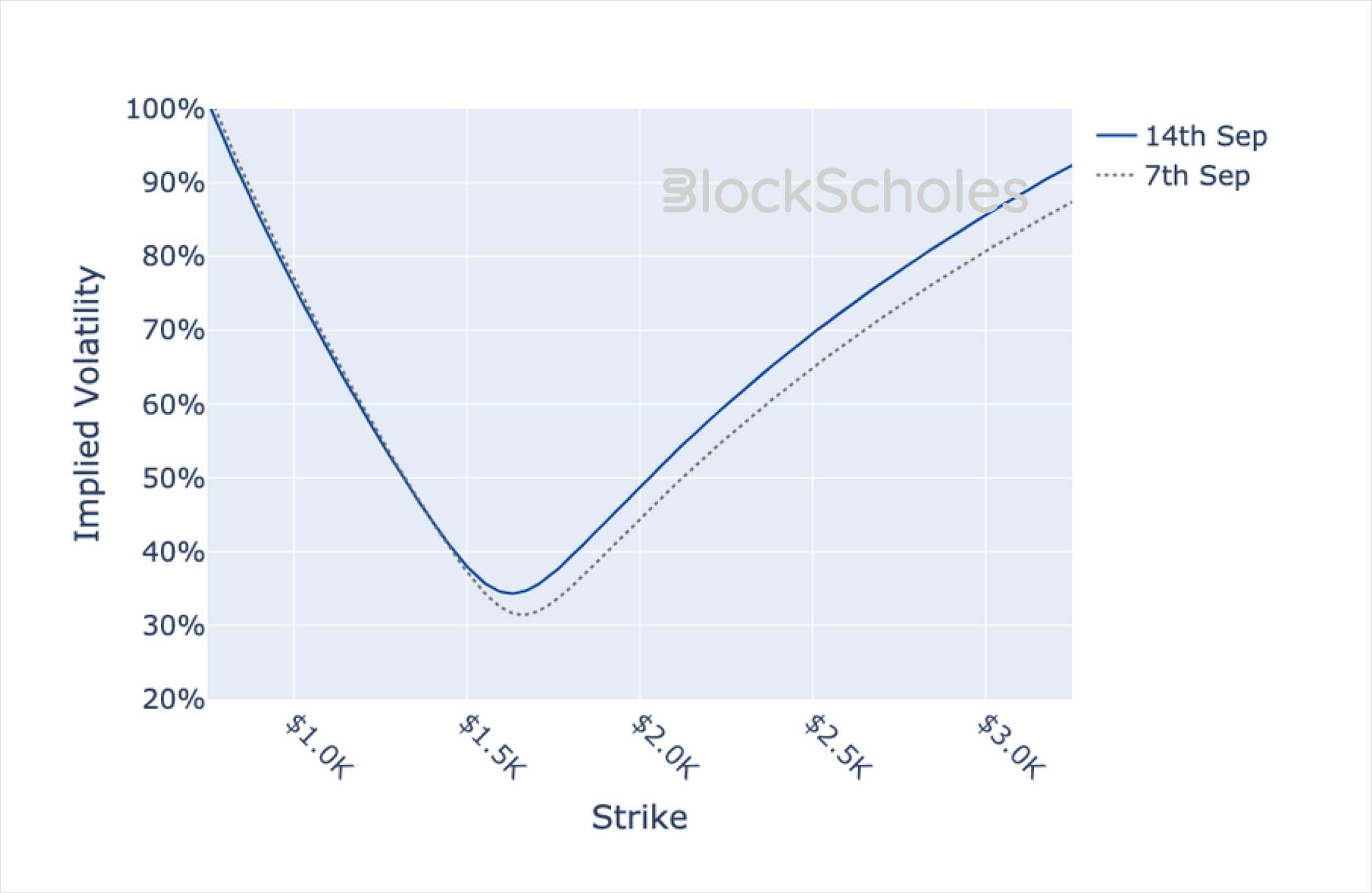

ETH SMILE CALIBRATIONS – 27-Oct-2023 Expiry, 10:05 UTC Snapshot.

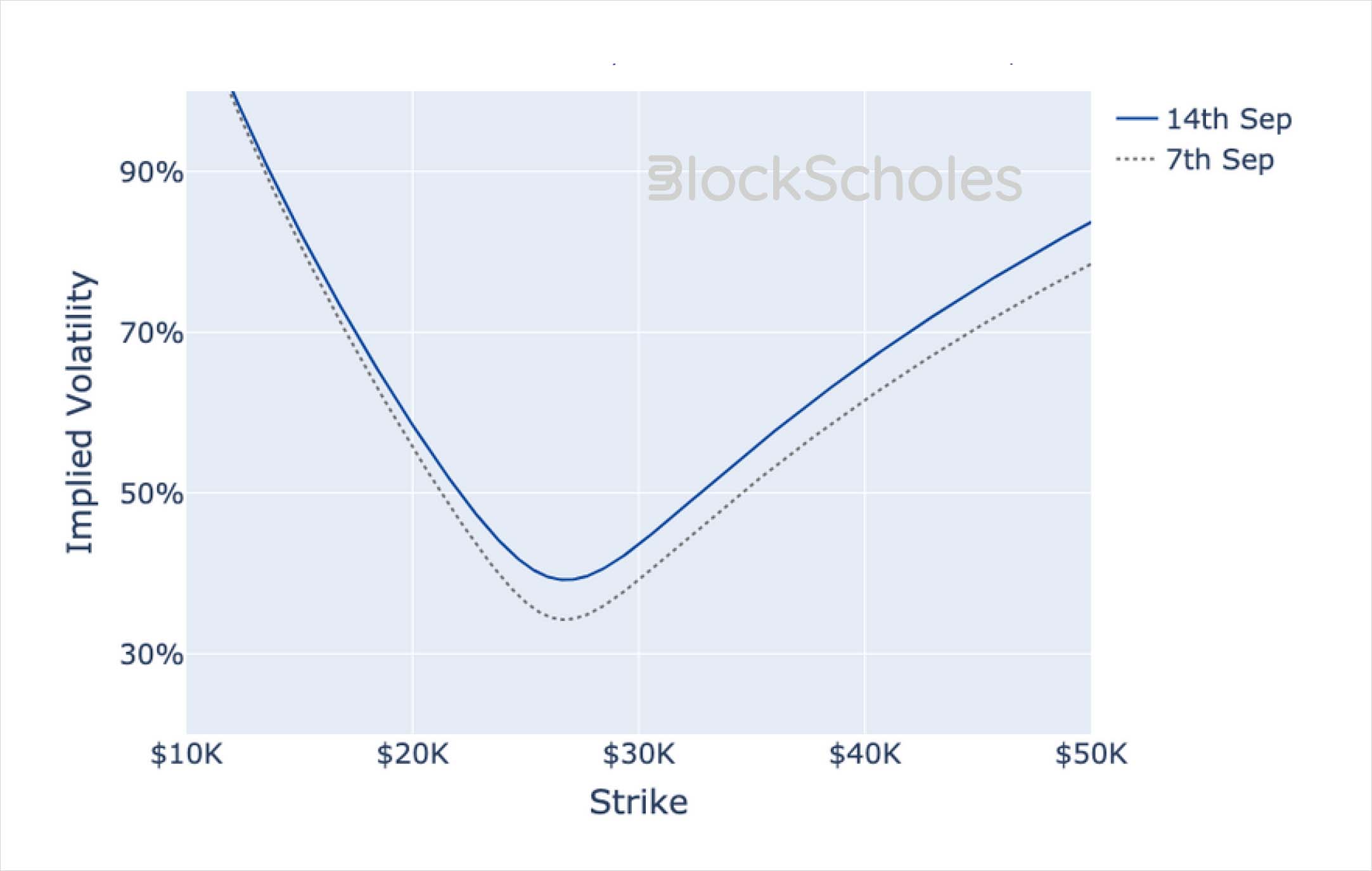

Historical SABR Volatility Smiles

BTC SABR CALIBRATION – 30 Day Tenor, 10:05 UTC Snapshot.

ETH SABR CALIBRATION – 30 Day Tenor, 10:05 UTC Snapshot.

AUTHOR(S)