Weekly recap of the crypto derivatives markets by BlockScholes.

BTC

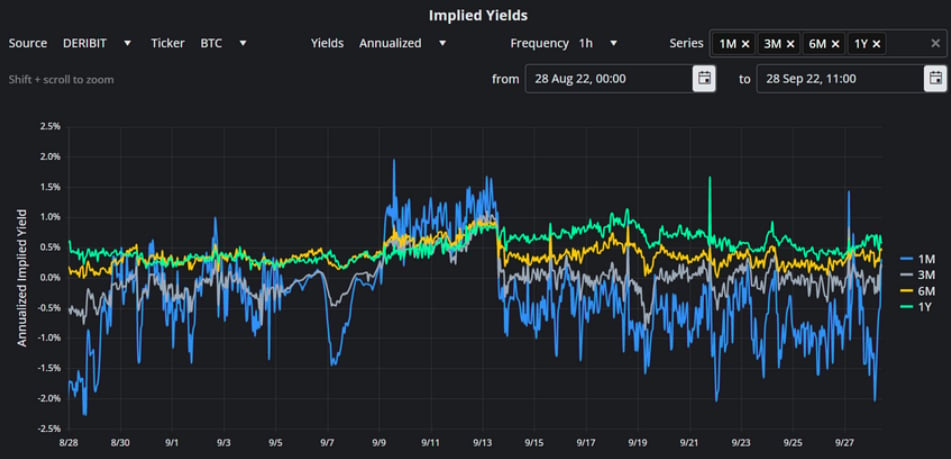

BTC’s annualised implied yields jump to above 0% for all tenors less than 1Y

BTC Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

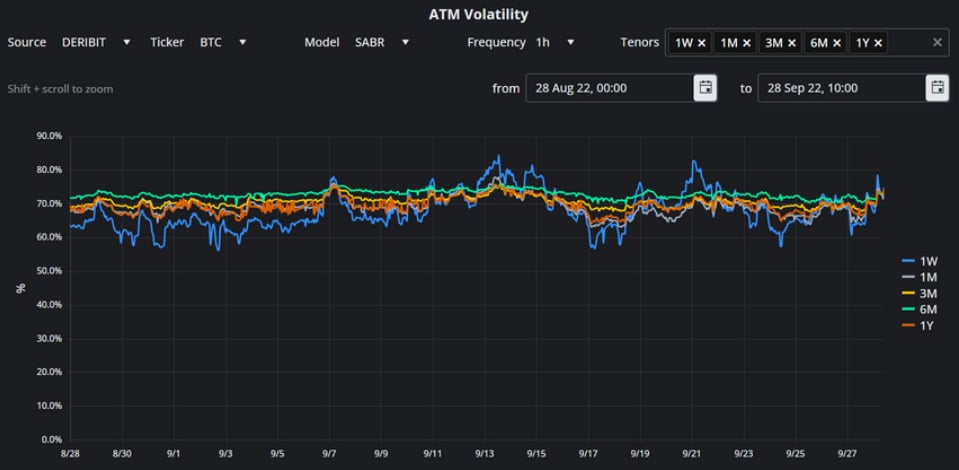

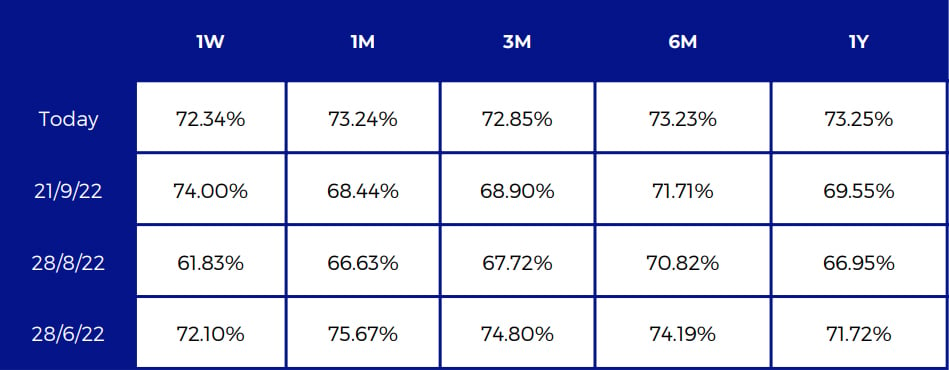

BTC’s ATM implied volatility is rising, with IV between 70% and 75% at all tenors

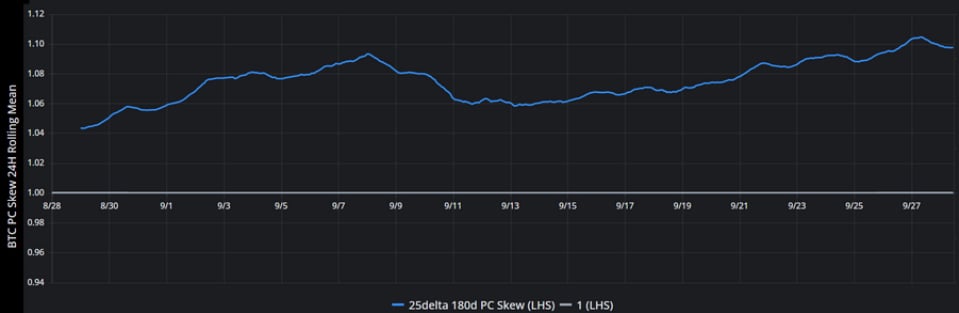

BTC’s 25-delta vol smile continues its skew towards OTM puts

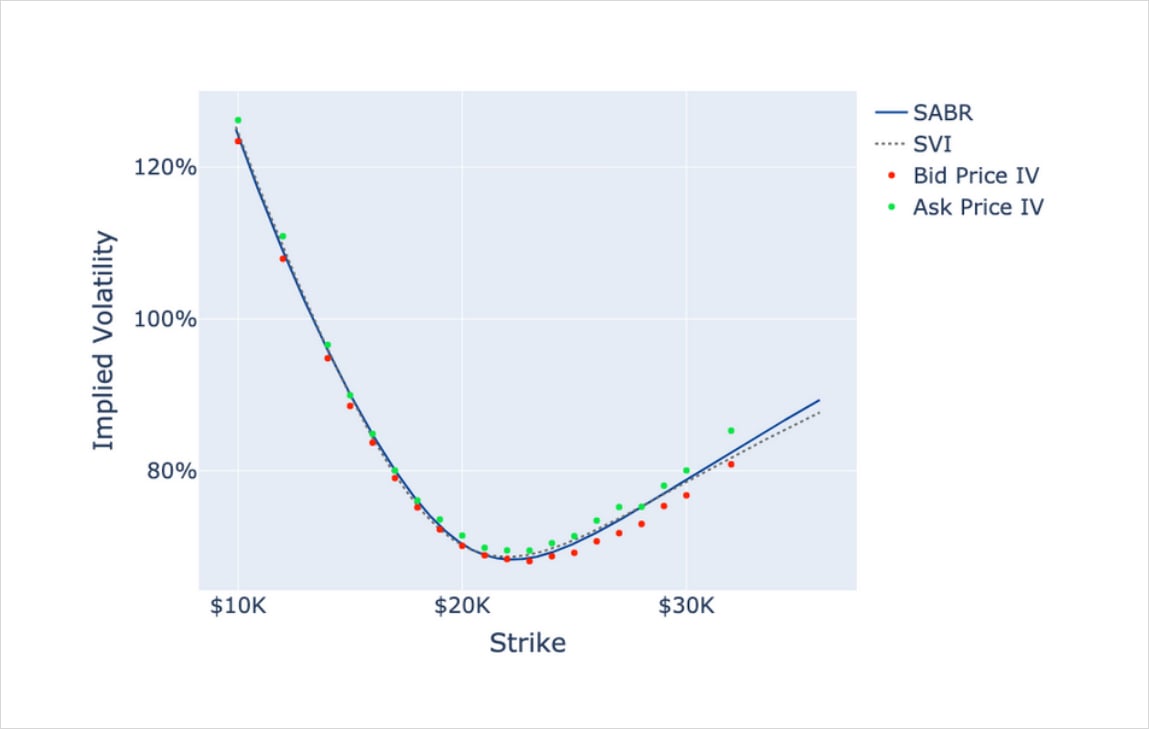

SABR Smile Calibration

Short-dated OTM puts continue to outperform the rest of the smile, with IVs near to 100% at short-dated tenors

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

BTC ATM Implied Volatility Table

All timestamps 10:00 UTC, SVI Smile Calibration

SABR and SVI Smile Calibrations, 28th October Expiry

BTC’s 30d tenor vol smile rises across the strike domain

BTC 1 Month SABR Implied Vol Smile.

ETH

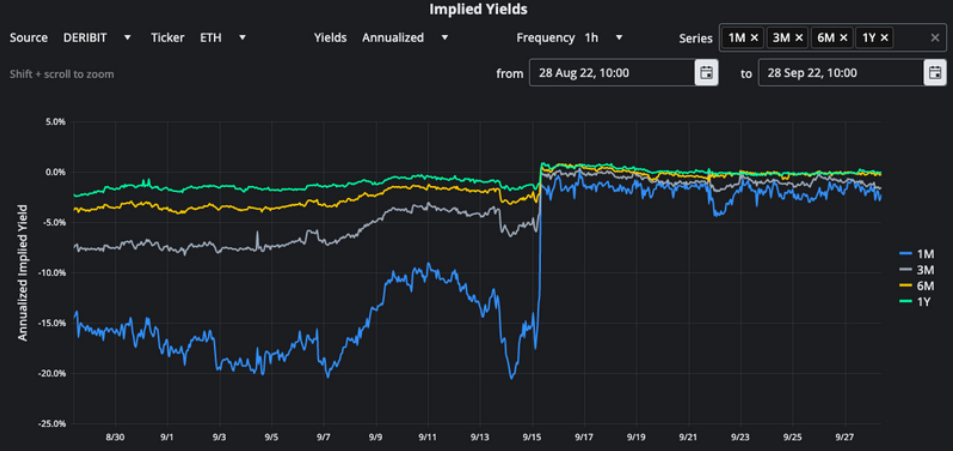

Whilst still negative at all tenors, ETH’s yields continue at their new level post-Merge trade action

ETH Annualised Futures Implied Yields Table

All timestamps 10:00 UTC

ETH’s ATM volatility continues to fall lower, despite a tumbling spot price

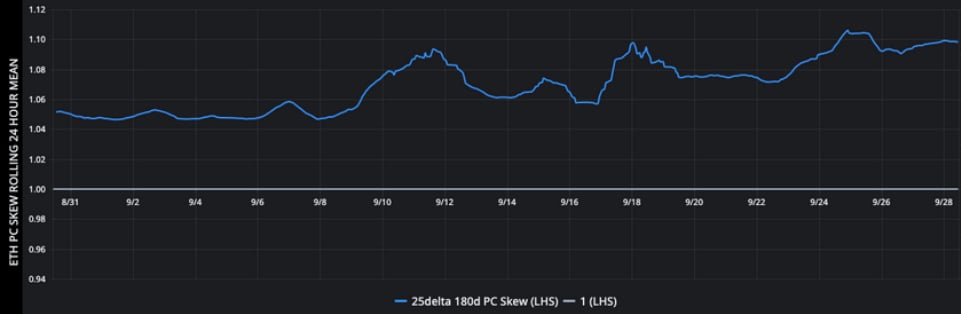

ETH’s 180d volatility smile matches the skew in BTC’s volatility smile

SABR Smile Calibration

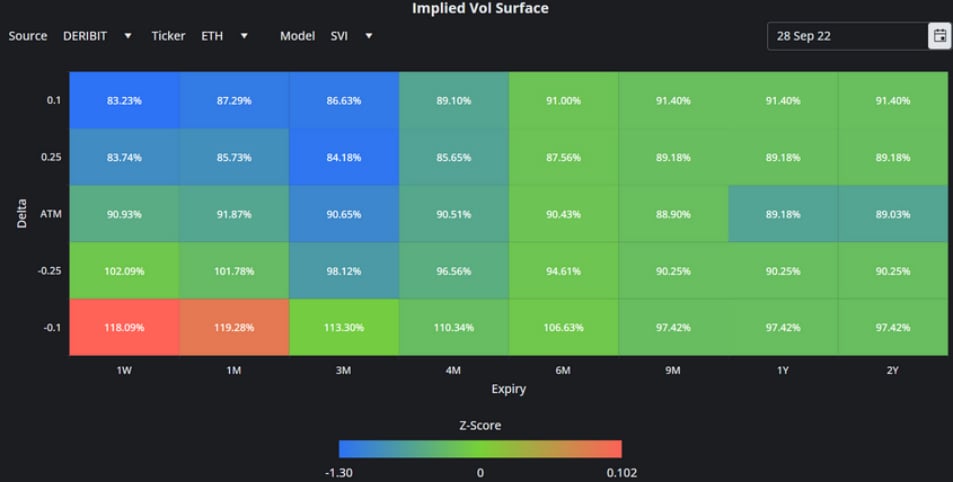

ETH Implied Volatility Surface

Z-Score calculated with respect to the distribution of implied volatility of an option at a given delta and tenor over the previous 30-days of hourly data, timestamp 10:00 UTC

ETH ATM Implied Volatility Table

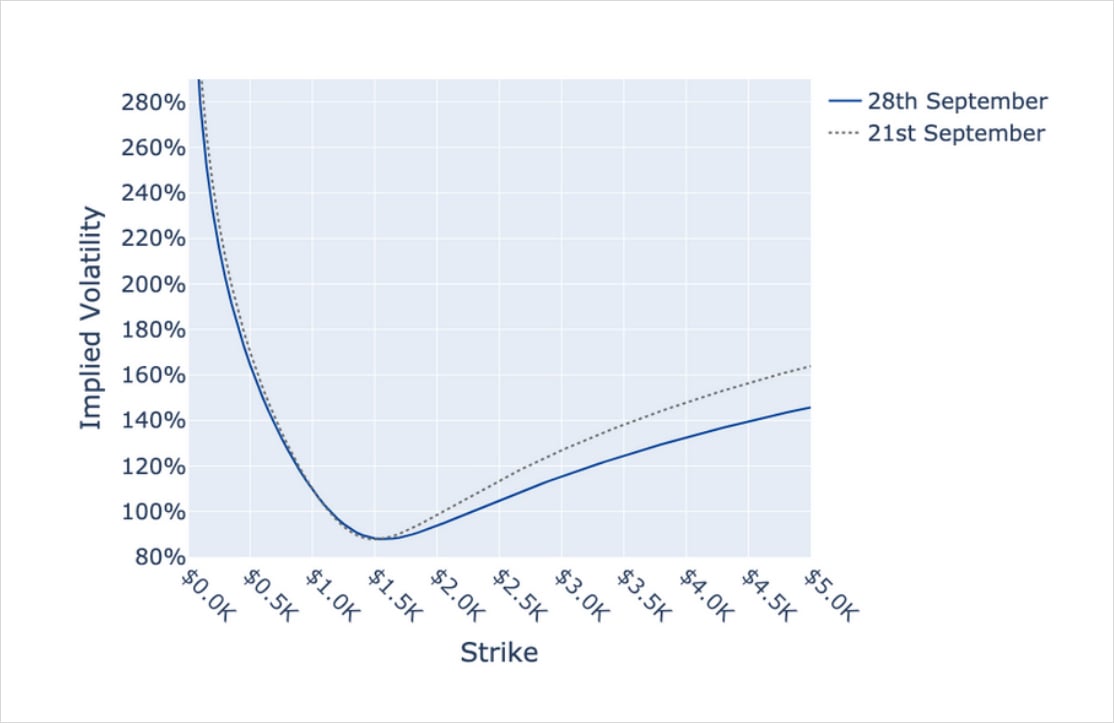

All timestamps 10:00 UTC, SVI Smile Calibration

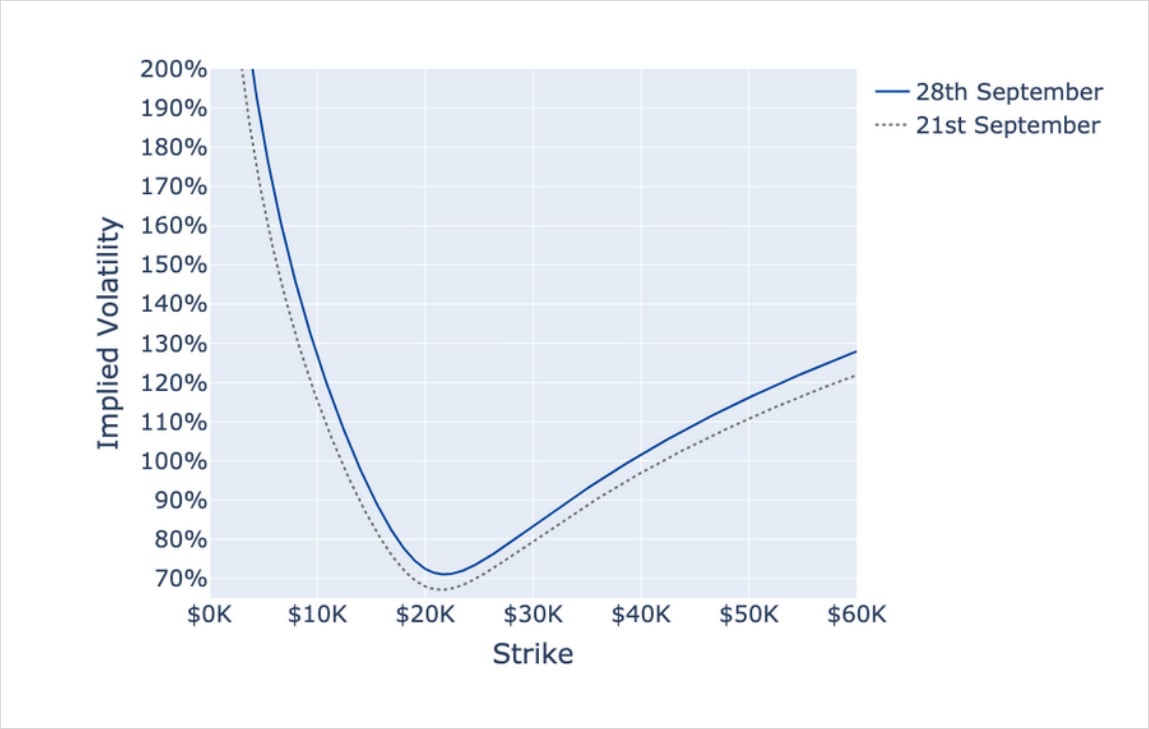

SABR and SVI Smile Calibrations, 28th October Expiry

ETH’s vol smile sees a fall in the implied volatility of OTM calls, whilst OTM puts remain static

ETH 1 Month SABR Implied Vol Smile.

AUTHOR(S)