Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

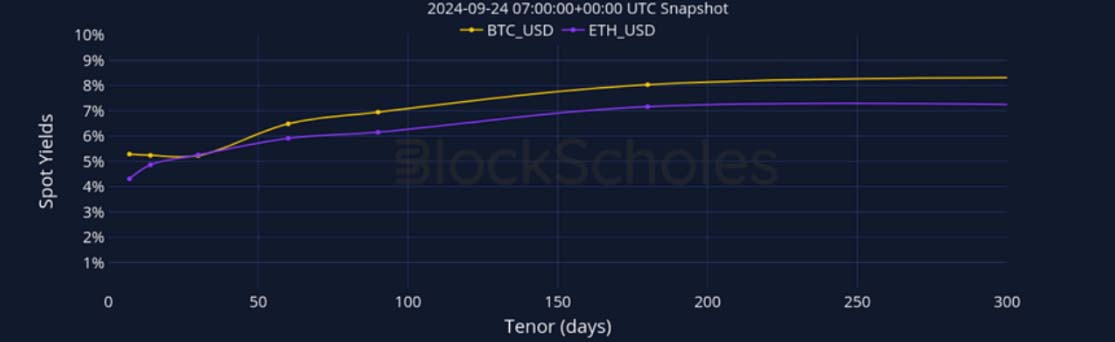

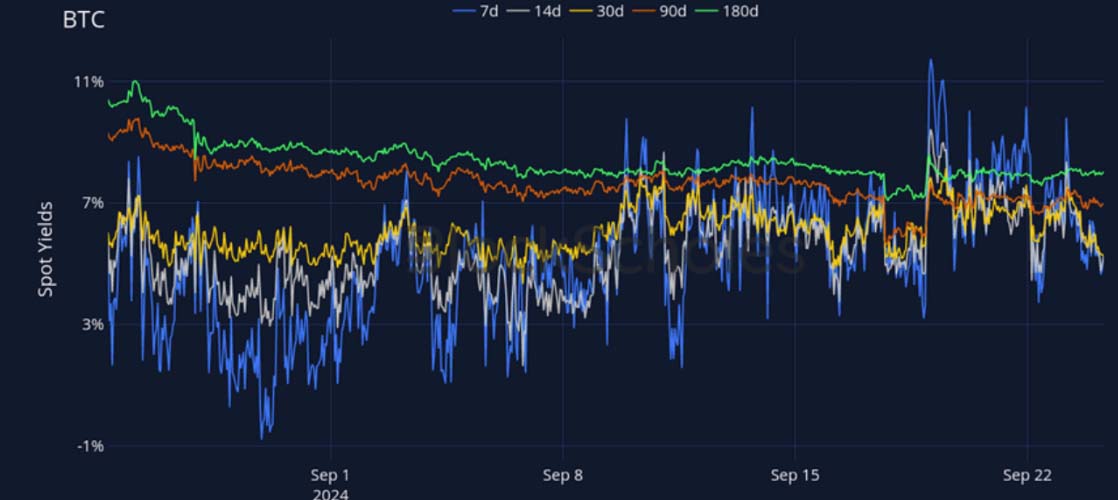

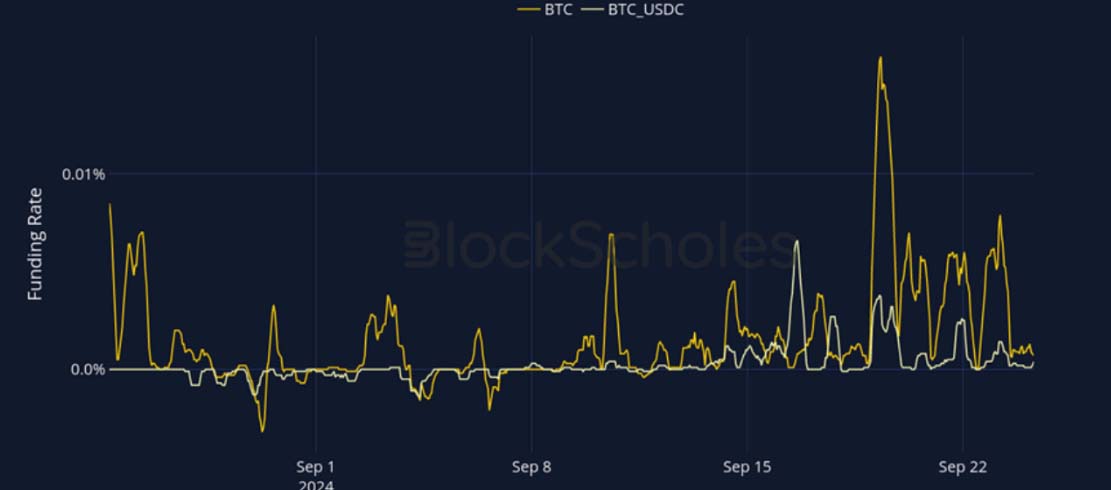

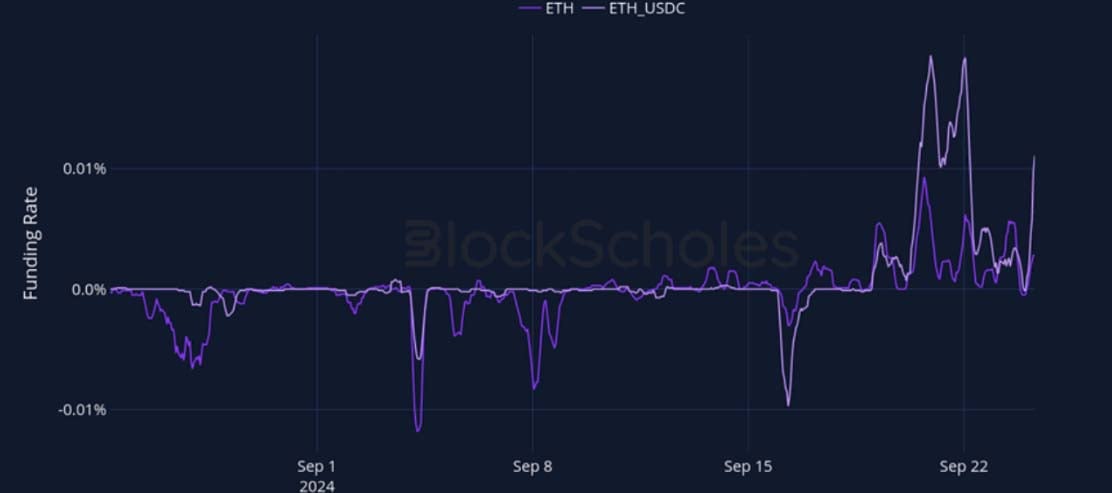

Following the cut in the Fed funds interest rate on September 18, 2024 we have seen an increase in spot prices for both major coins and an overall positive sentiment in the derivatives markets. The futures implied yields term structure was largely inverted over the last week, with yields showing high levels for the short term. However, the curve has now disinverted, having returned to similar levels as of last week. Perp swaps funding rates have fully recovered for both tokens, after a long period of stagnant negative rates. While ATM implied volatility levels have been on a slight decline for both BTC and ETH options, skews have been on the rise across all tenors, indicating a general increase in preference towards calls, adding to the evidence of a growing bullish sentiment in derivatives markets after the interest rate cut.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

BTC ANNUALISED YIELDS – BTC’s futures yields have largely oscillated and now back to similar levels as of last week.

ETH ANNUALISED YIELDS – ETH’s futures yields have evolved in the last week similarly to BTC’s.

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC’s perpetual funding rate has consistently traded positively over the past week.

ETH FUNDING RATE – ETH’s perpetual swap funding rate has recovered, now showing positive levels after a period of negative and neutral funding rate.

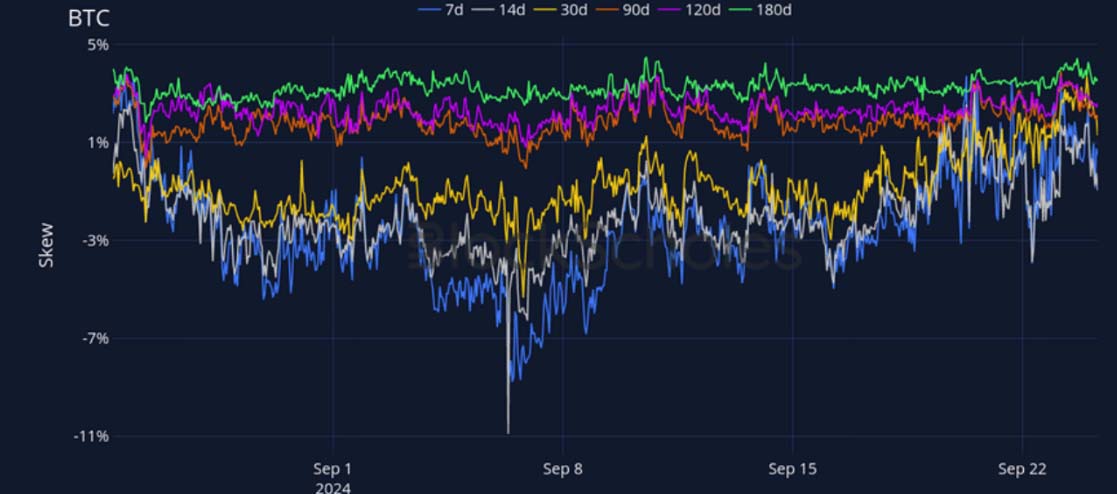

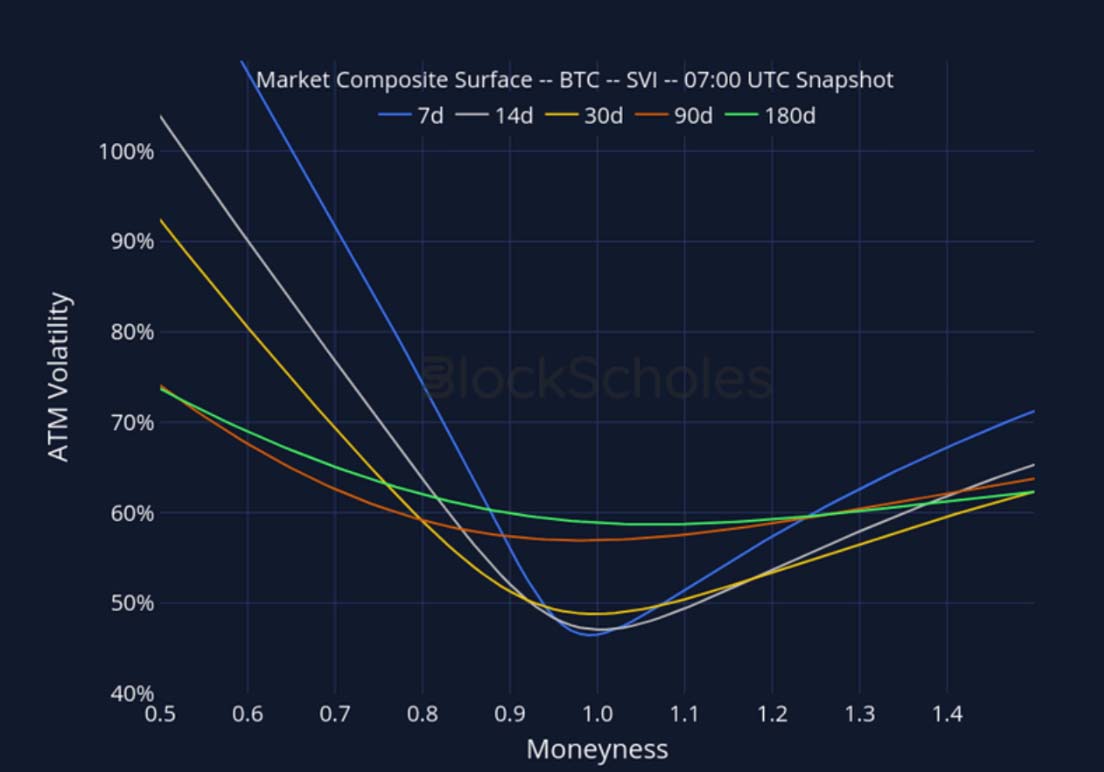

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Implied volatility has overall been on the decline across the term structure.

BTC 25-Delta Risk Reversal – BTC skew has been rising for short-dated options.

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Implied volatility has oscillated similarly to BTC’s and has fallen for short-tenor options.

ETH 25-Delta Risk Reversal – ETH’s skews have increased significantly after the interest rate cut.

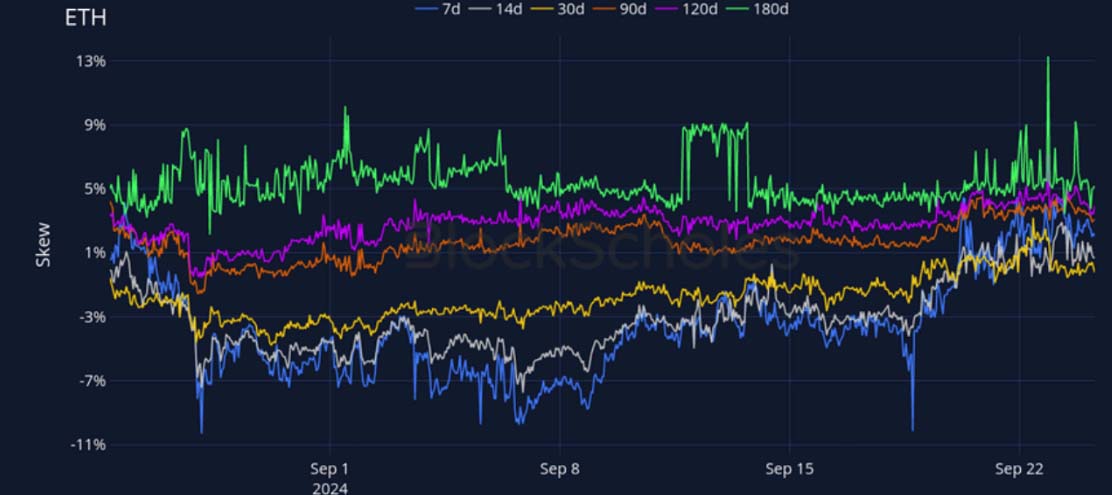

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

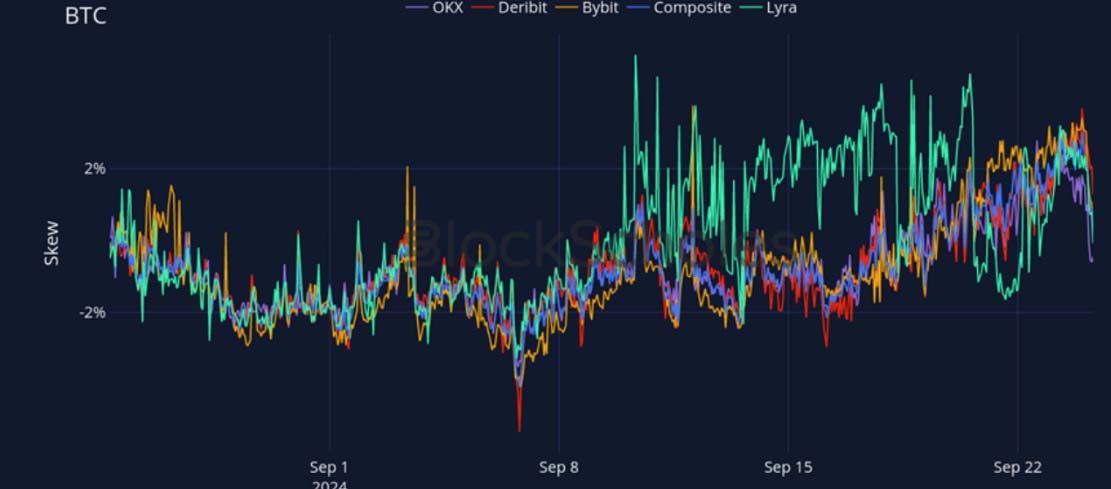

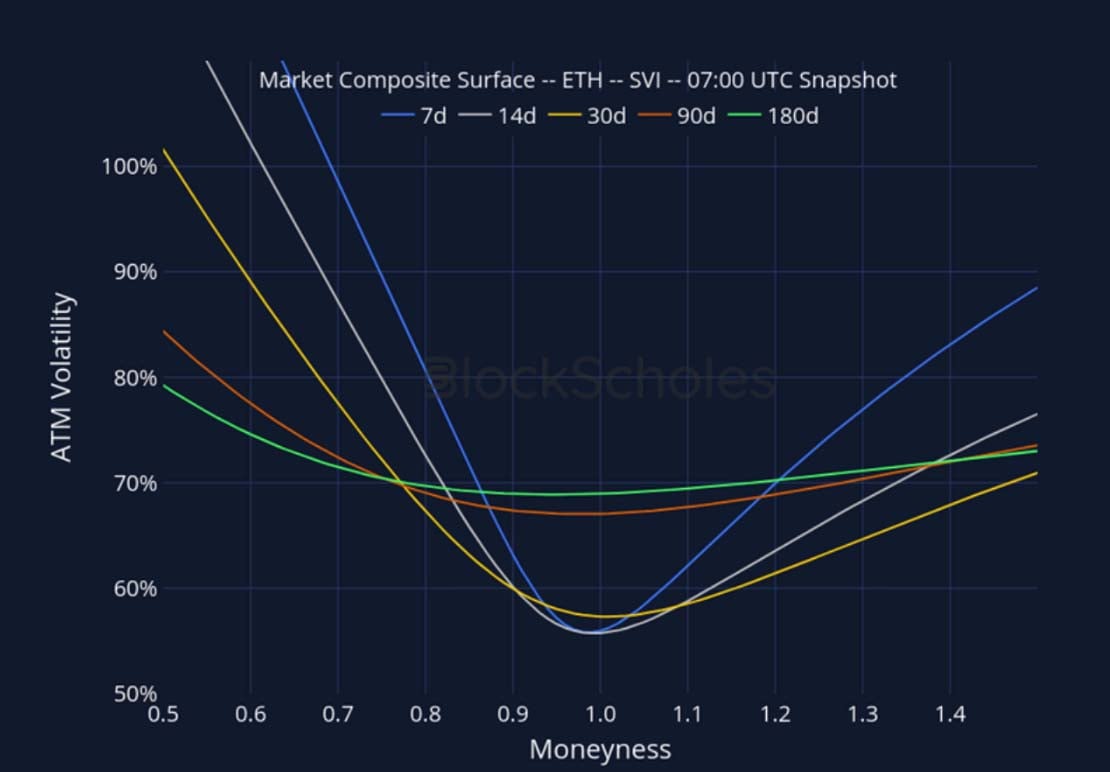

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 7:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 7:00 UTC Snapshot.

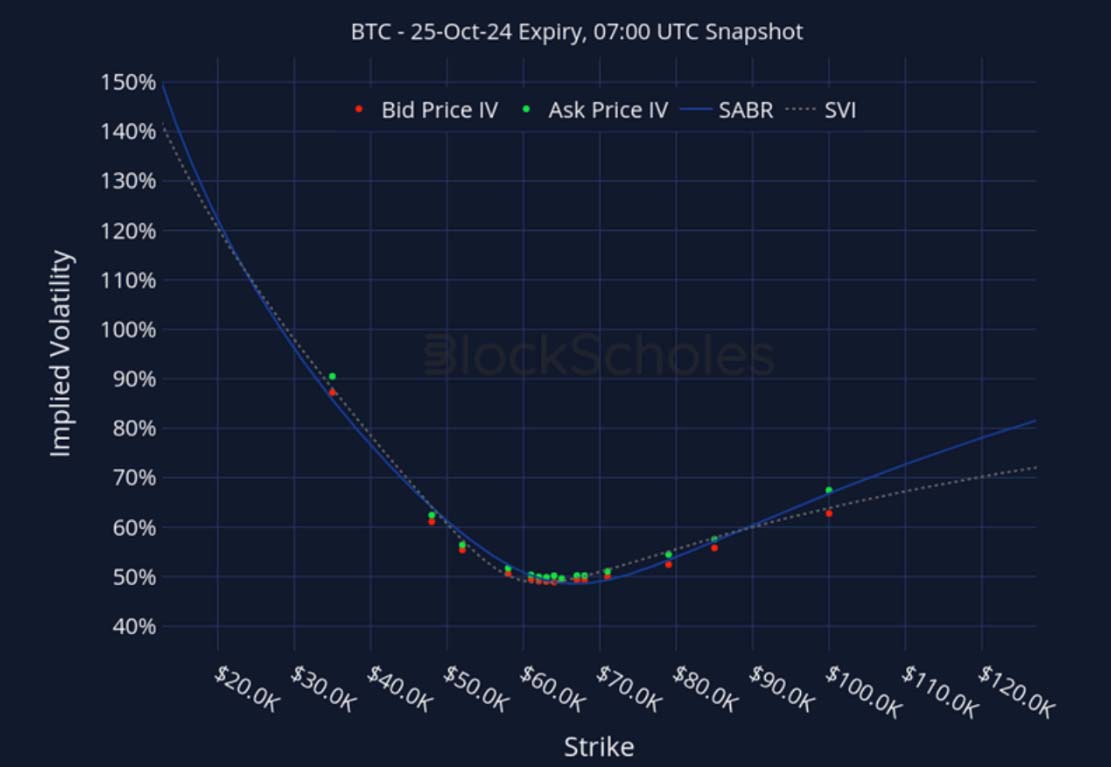

Listed Expiry Volatility Smiles

BTC 25-OCT EXPIRY – 7:00 UTC Snapshot.

ETH 25-OCT EXPIRY – 7:00 UTC Snapshot.

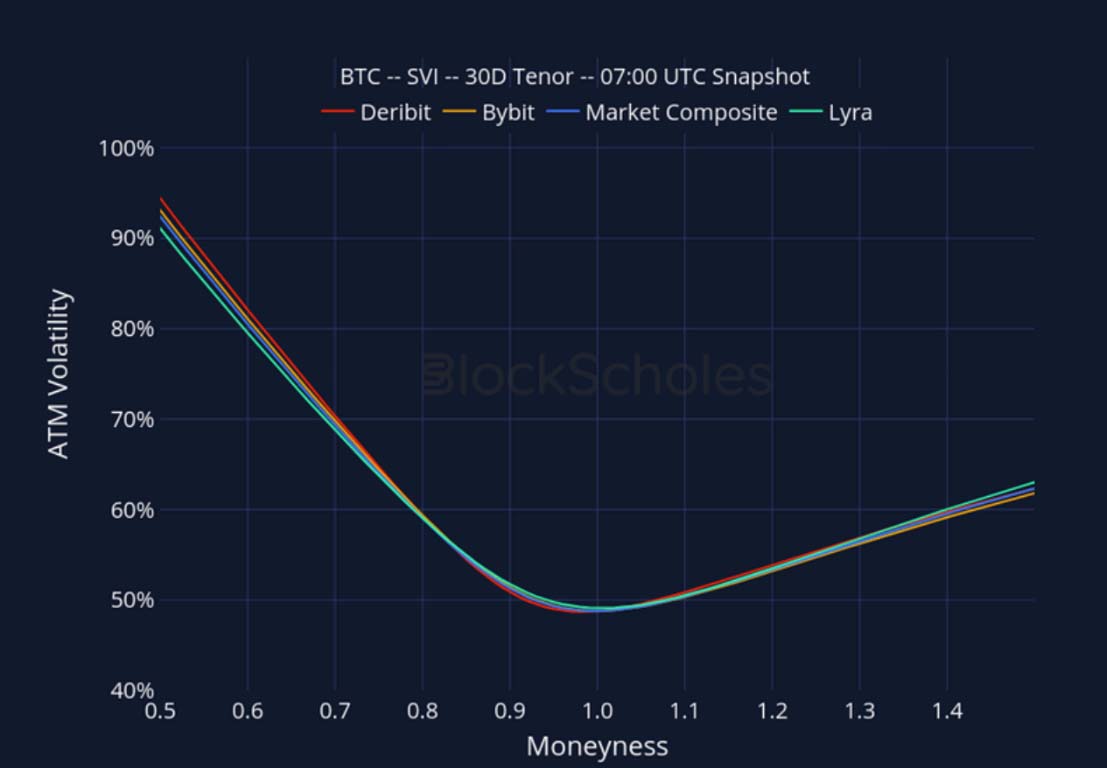

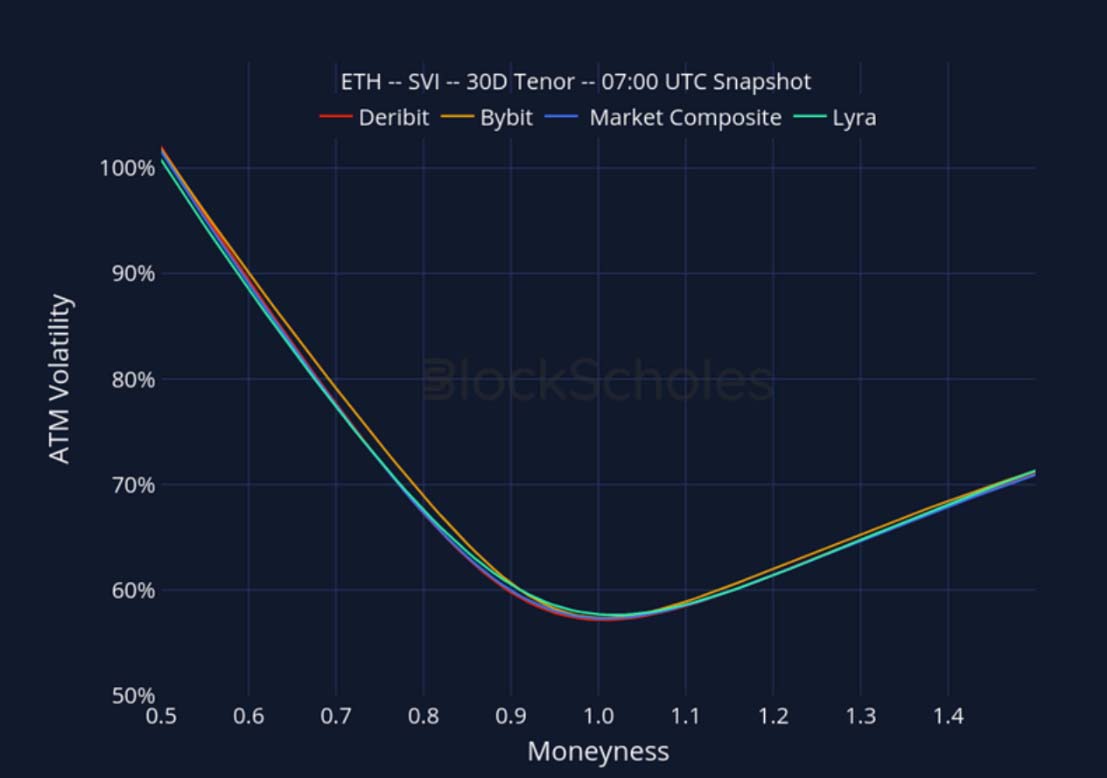

Cross-Exchange Volatility Smiles

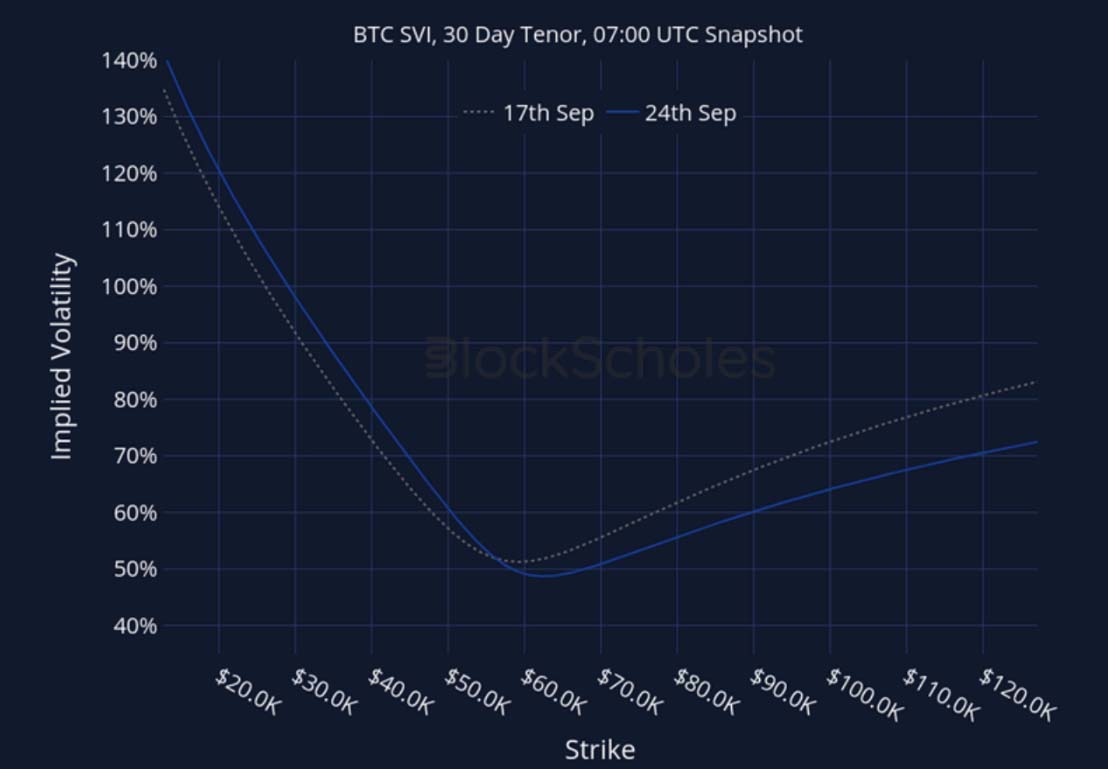

BTC SVI, 30D TENOR – 7:00 UTC Snapshot.

ETH SVI, 30D TENOR – 7:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 7:00 UTC Snapshot.

ETH SVI, 30D TENOR – 7:00 UTC Snapshot.

AUTHOR(S)