Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

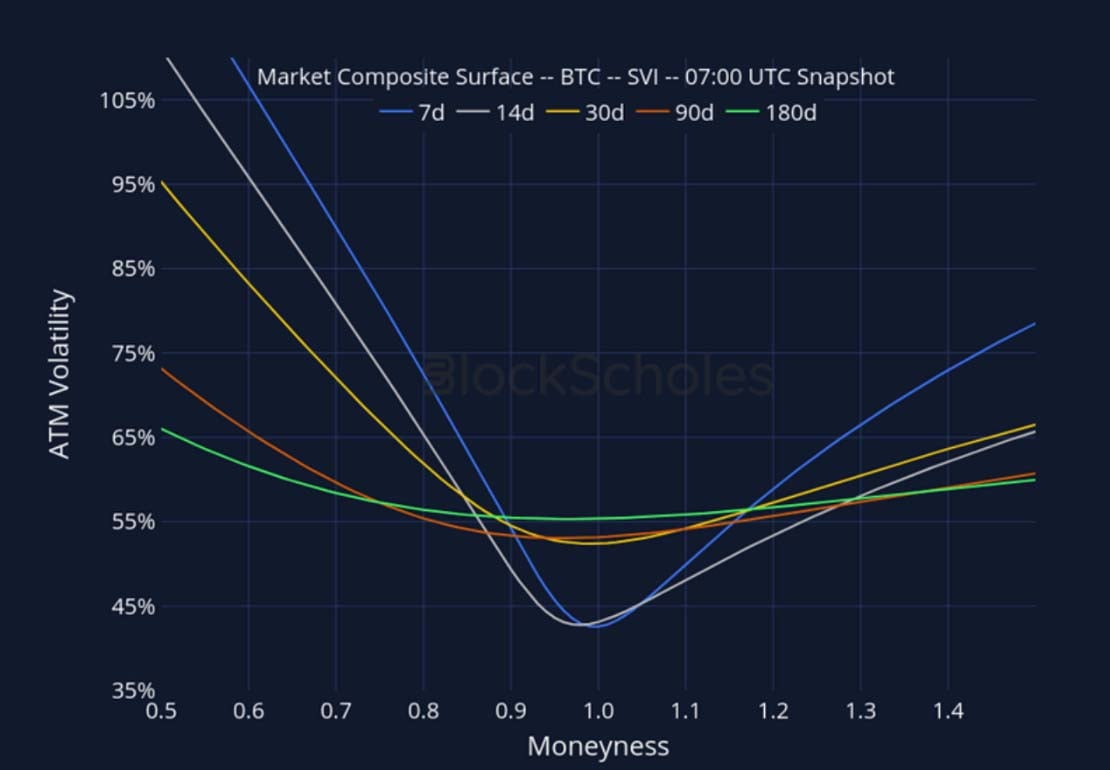

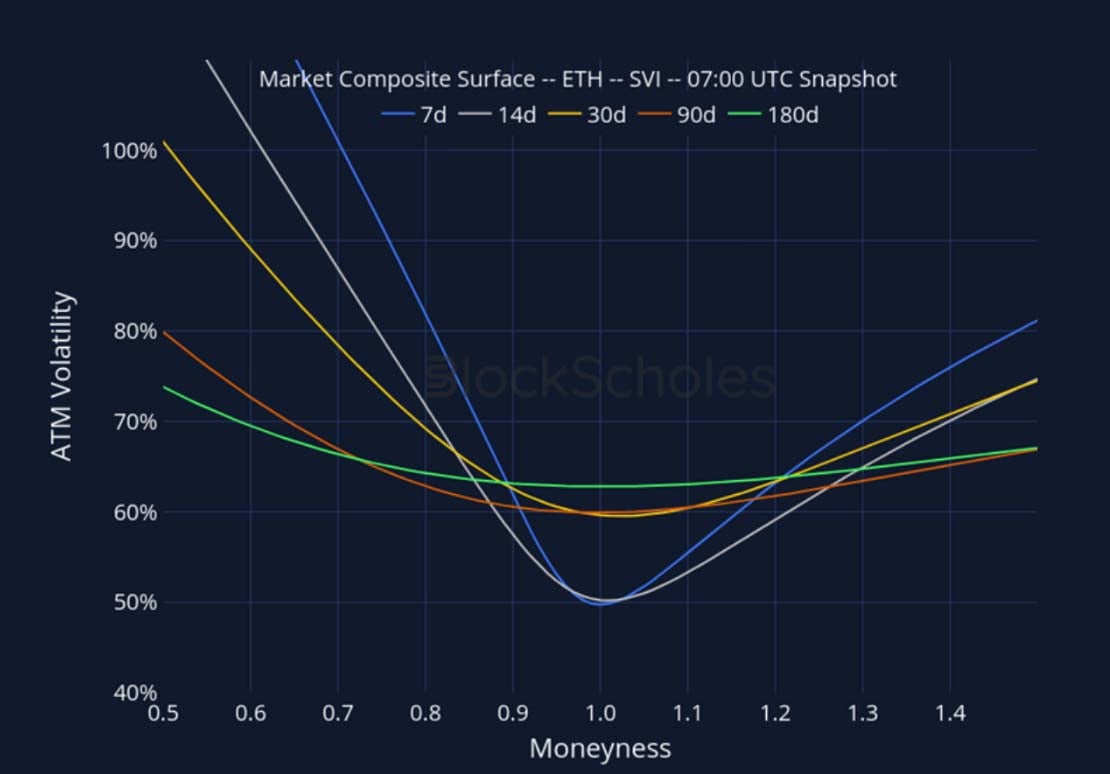

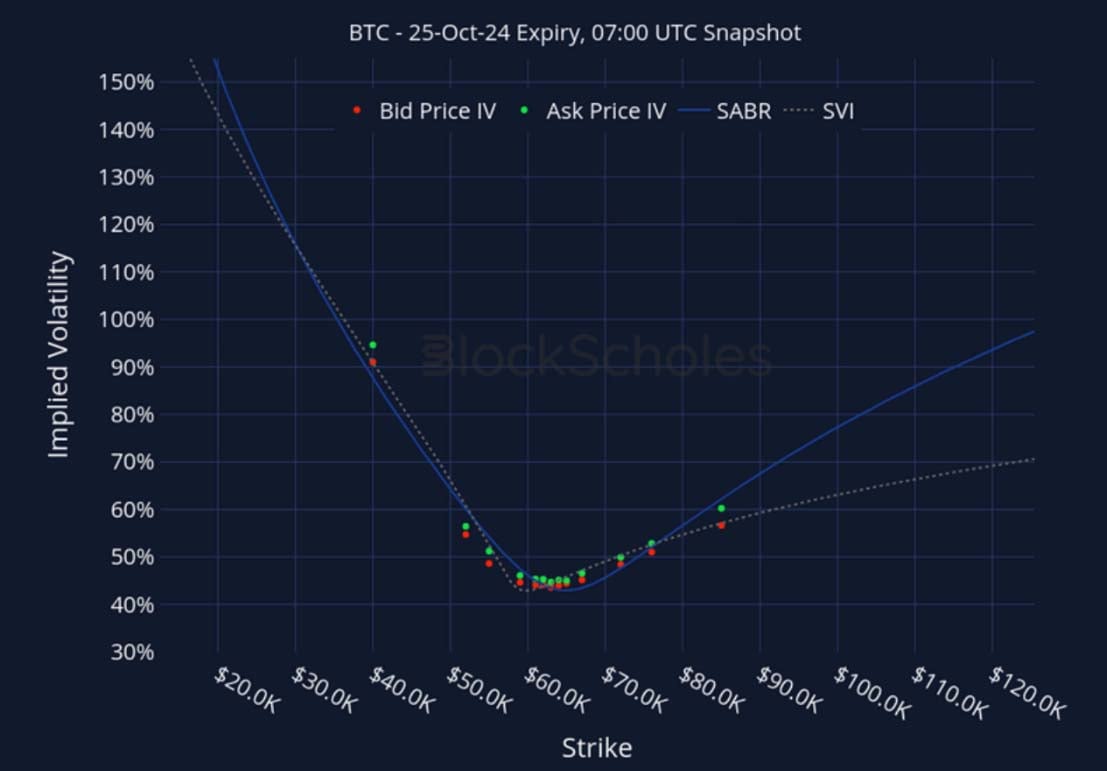

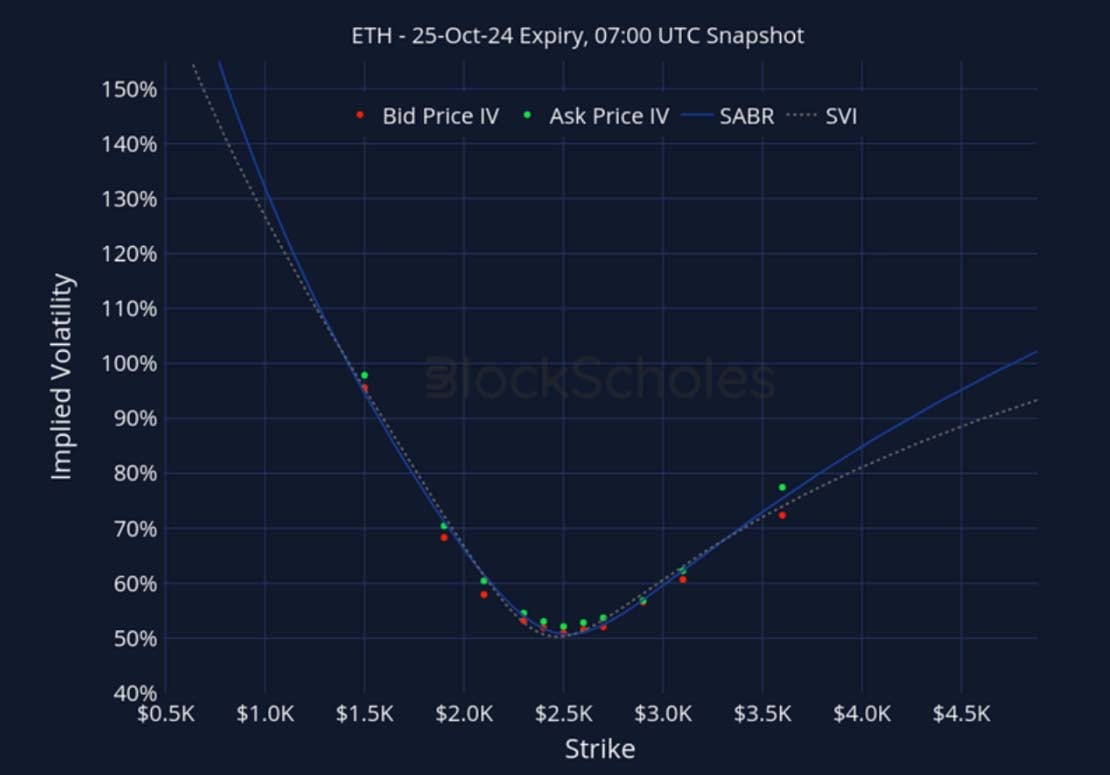

With less than 30 days left until the US Presidential election, the term structure of ATM implied volatility is clearly showing the same dislocation that we have observed for several months. Implied volatility levels for 30-day-tenor options have moved further up, now trading similar levels to longer-dated options. Despite the relative kink, outright volatility levels have dipped in the past week for both majors. Spot price downside volatility in early October has been reflected in derivatives sentiment, with volatility smiles skewing towards puts at pre-election expiries. While levels have since recovered for BTC OTM options, showing a preference overall for OTM calls, ETH volatility smiles still exhibit a premium assigned to puts at short tenors.

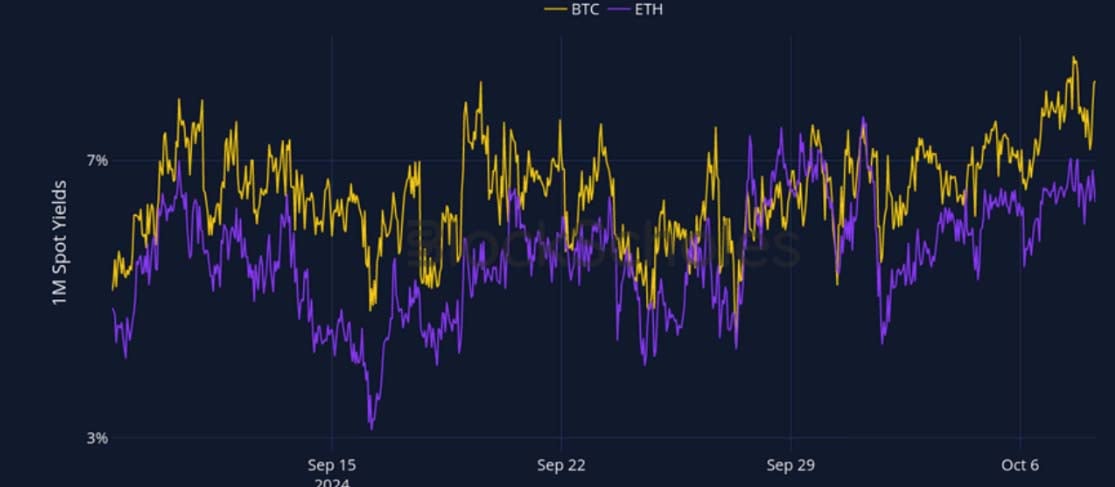

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

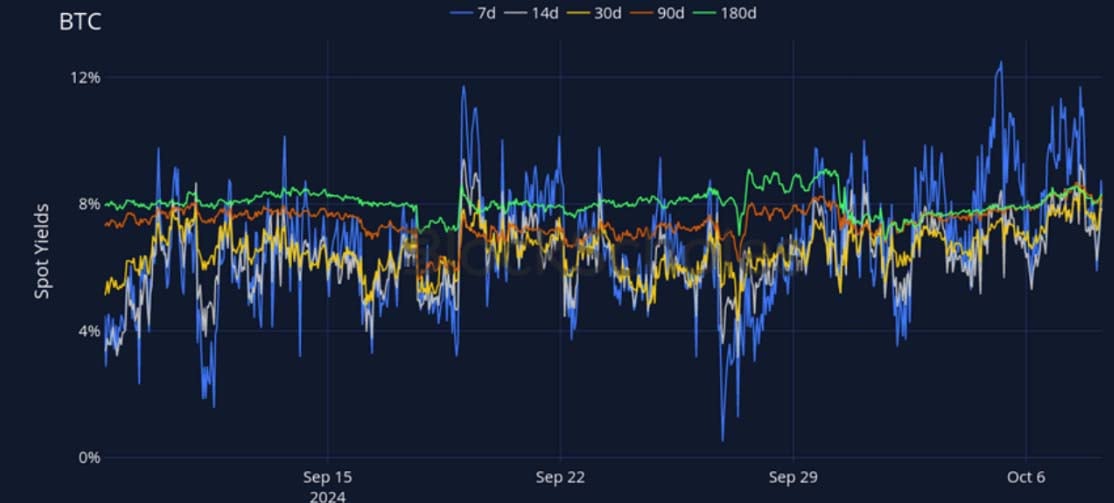

Futures

BTC ANNUALISED YIELDS – 7D futures yields have oscillated significantly, resulting in a flat term structure.

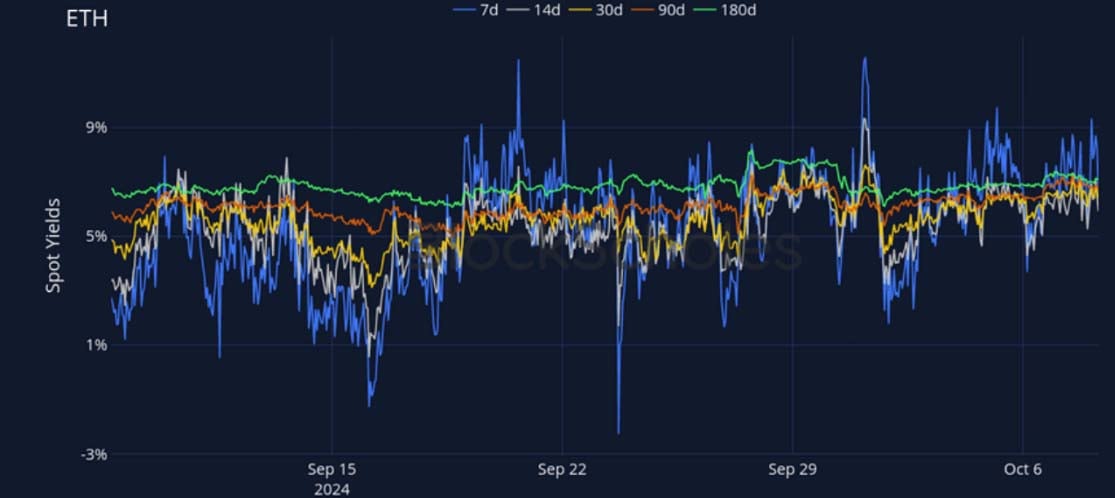

ETH ANNUALISED YIELDS – ETH’s futures yields term structure shows the same flattening as that of BTC but at 1 point lower at all tenors.

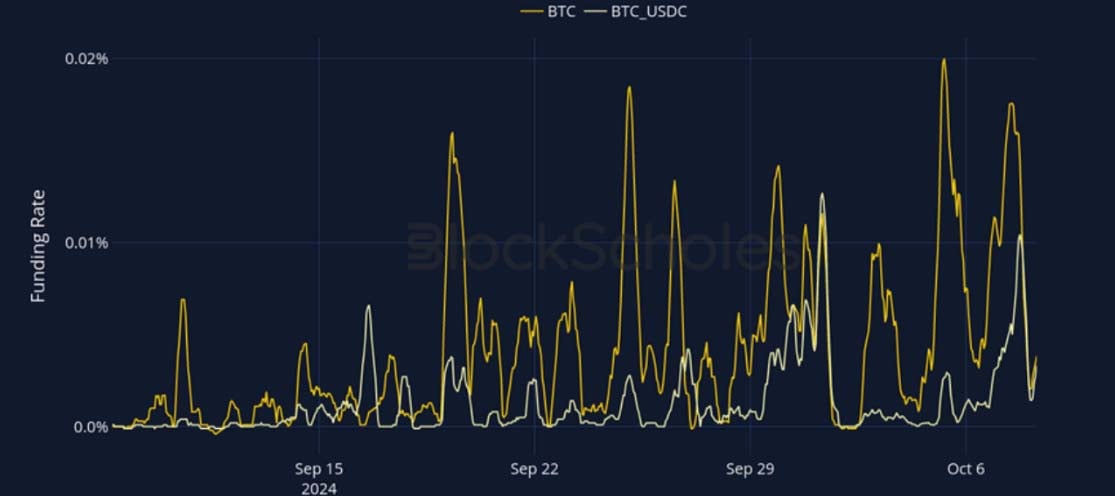

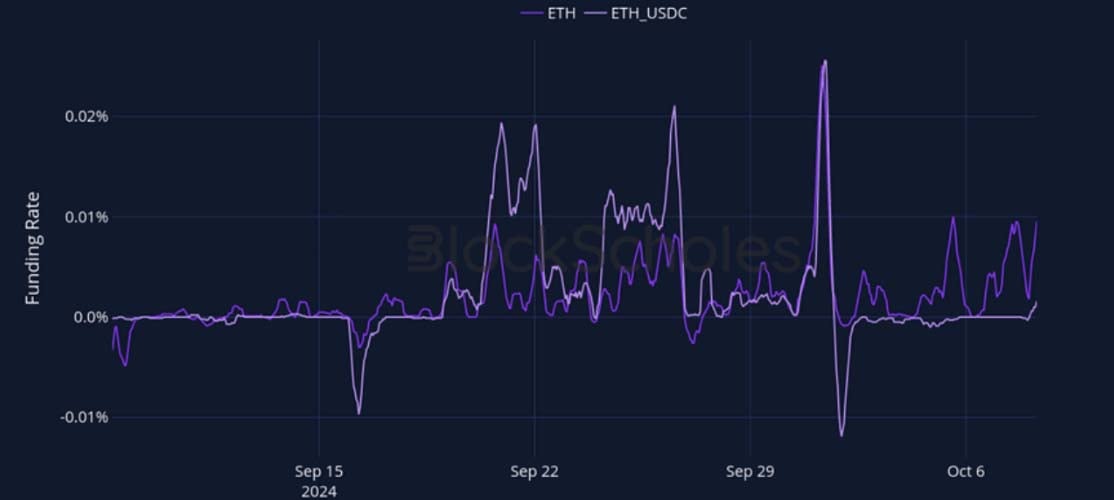

Perpetual Swap Funding Rate

BTC FUNDING RATE – BTC’s perpetual funding rate has registered consistent positive high levels.

ETH FUNDING RATE – ETH’s perpetual swap funding rate has showed positive values, dipping strongly negatively only once in the past week.

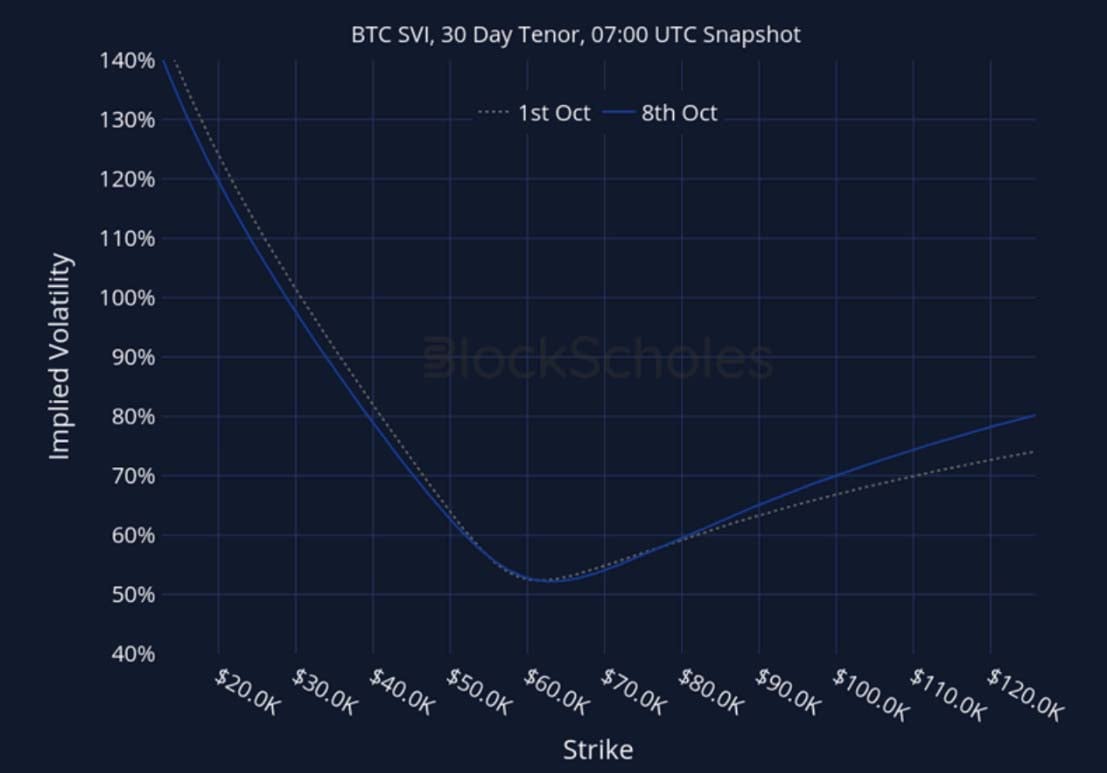

BTC Options

BTC SVI ATM IMPLIED VOLATILITY – Implied volatility levels are slightly lower than last week, but still show a dislocation for the US election on Nov 5, 2024.

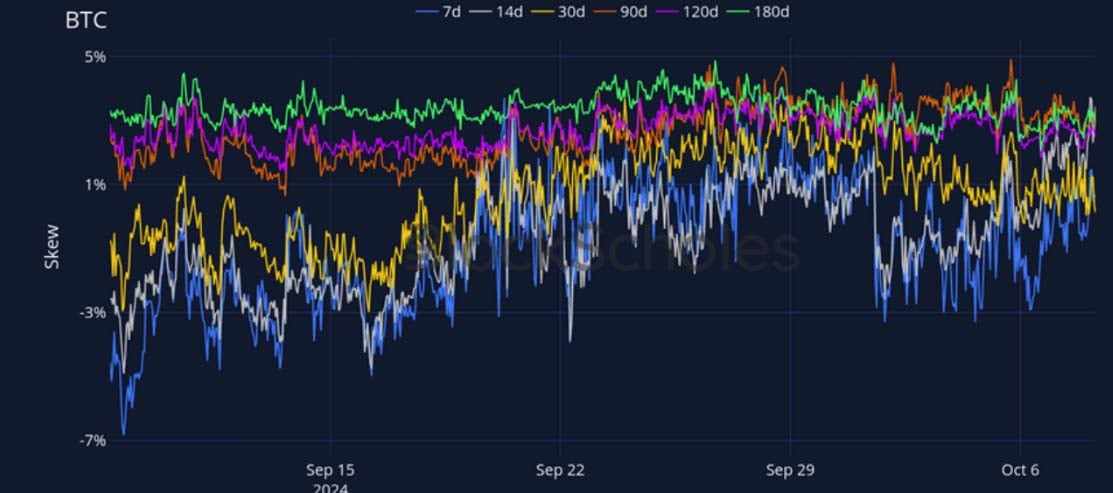

BTC 25-Delta Risk Reversal – Smiles have skewed towards puts for short tenors around the recent short-lived sell-off, before recovering.

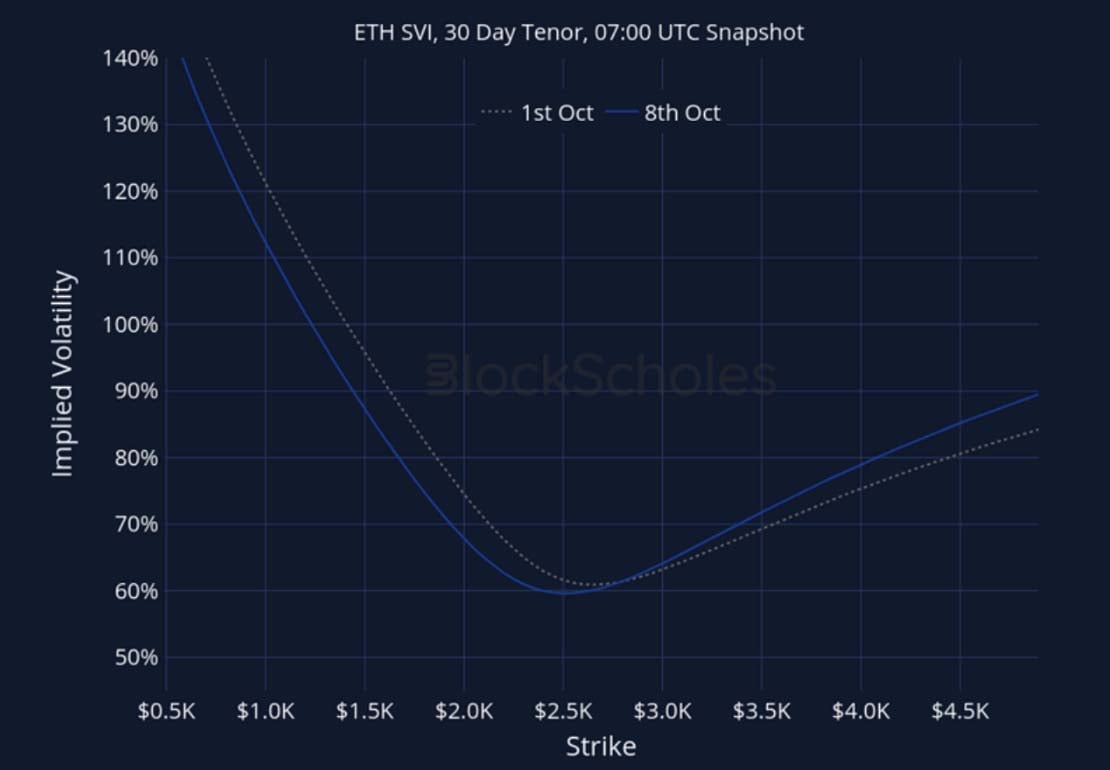

ETH Options

ETH SVI ATM IMPLIED VOLATILITY – Implied volatility has showed a decrease in overall levels.

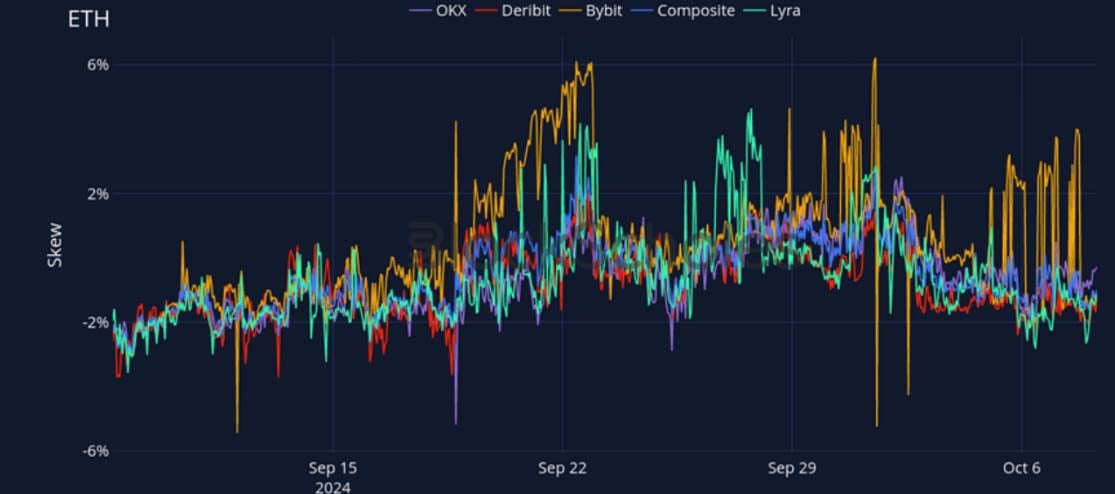

ETH 25-Delta Risk Reversal – ETH’s skews have dropped for short-dated OTM options, but have not recovered as BTC’s have.

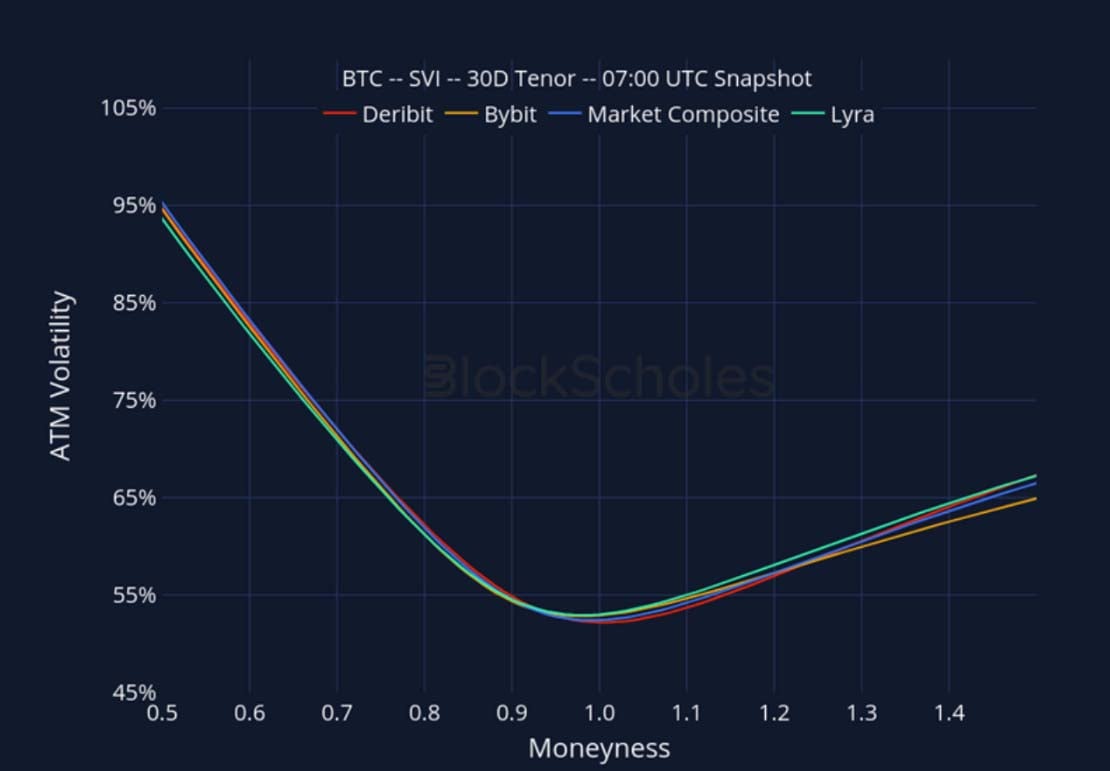

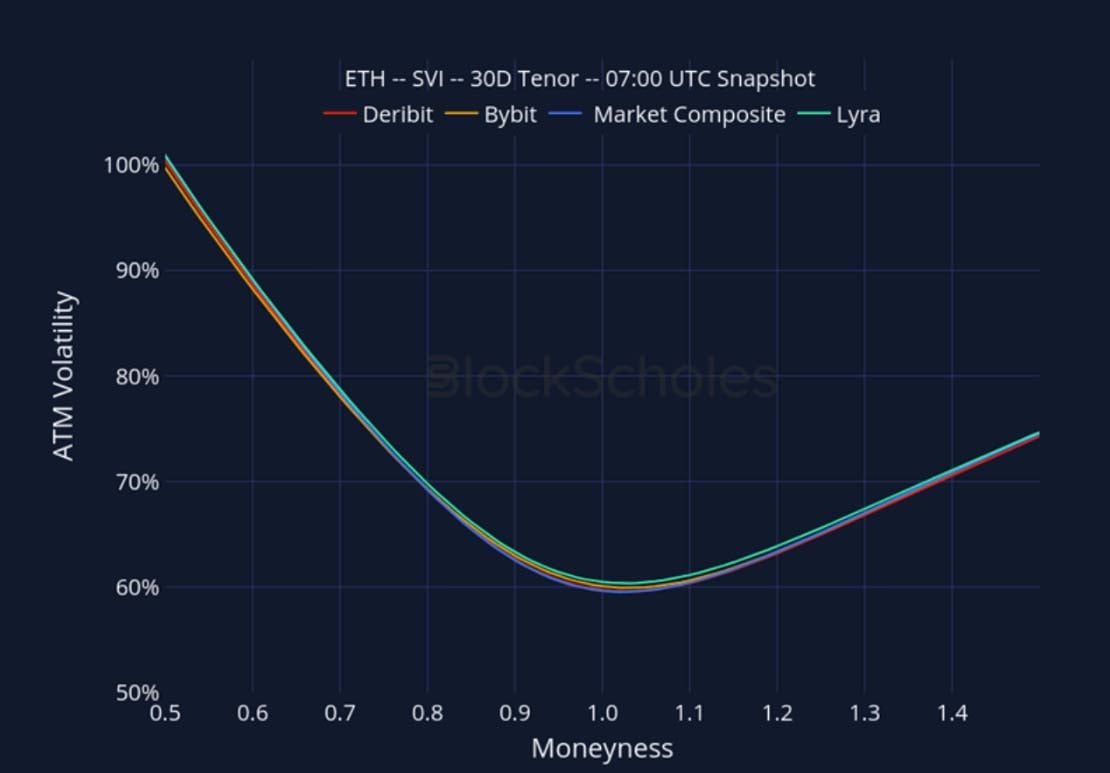

Volatility by Exchange

BTC, 1-MONTH TENOR, SVI CALIBRATION

ETH, 1-MONTH TENOR, SVI CALIBRATION

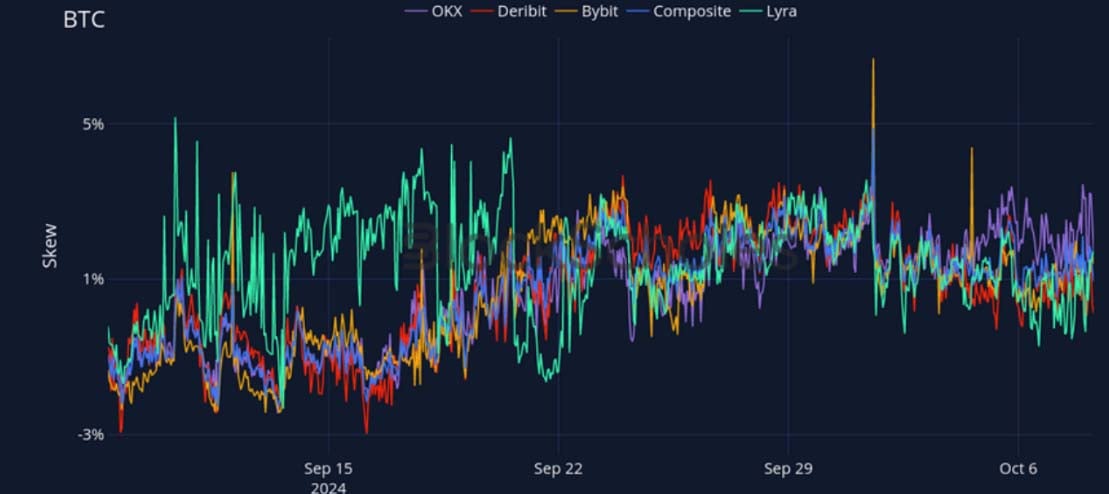

Put-Call Skew by Exchange

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 7:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 7:00 UTC Snapshot.

Listed Expiry Volatility Smiles

BTC 25-OCT EXPIRY – 7:00 UTC Snapshot.

ETH 25-OCT EXPIRY – 7:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 7:00 UTC Snapshot.

ETH SVI, 30D TENOR – 7:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 7:00 UTC Snapshot.

ETH SVI, 30D TENOR – 7:00 UTC Snapshot.

AUTHOR(S)