Weekly recap of the crypto derivatives markets by BlockScholes.

Key Insights:

We’ve seen evidence of increasingly positive sentiment in the derivatives markets over the last week. The futures implied yields term structure has inverted, with a dramatic rise at the front end that signals increased demand for near-term long exposure. The perp swap funding rate has remained positive for both BTC and ETH, reflecting bullish sentiment as traders are willing to pay to hold long positions. Additionally, volatility smile skews have grown towards calls, reflecting the increasing appetite for upside exposure that we see in futures. At the same time, while pre-election implied volatility has remained subdued, reflecting relatively stable spot price movements, this positive market sentiment suggests expectations for a continued rise in spot prices that we have not seen in some time.

Futures Implied Yield, 1-Month Tenor

ATM Implied Volatility, 1-Month Tenor

Crypto Senti-Meter

BTC Derivatives Sentiment

ETH Derivatives Sentiment

Futures

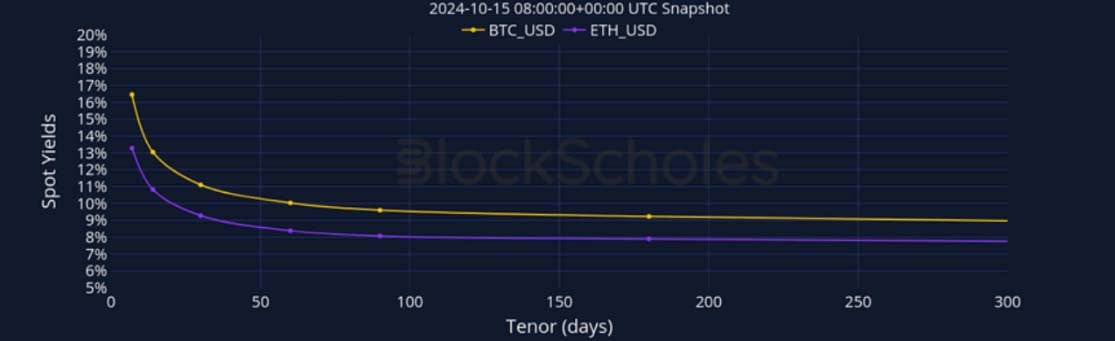

BTC ANNUALISED YIELDS – The term structure has swiftly inverted in the past days, having increased largely at the front end.

ETH ANNUALISED YIELDS – ETH’s futures yields term structure shows the same inversion, but remains at lower levels than BTC’s.

Perpetual Swap Funding Rate

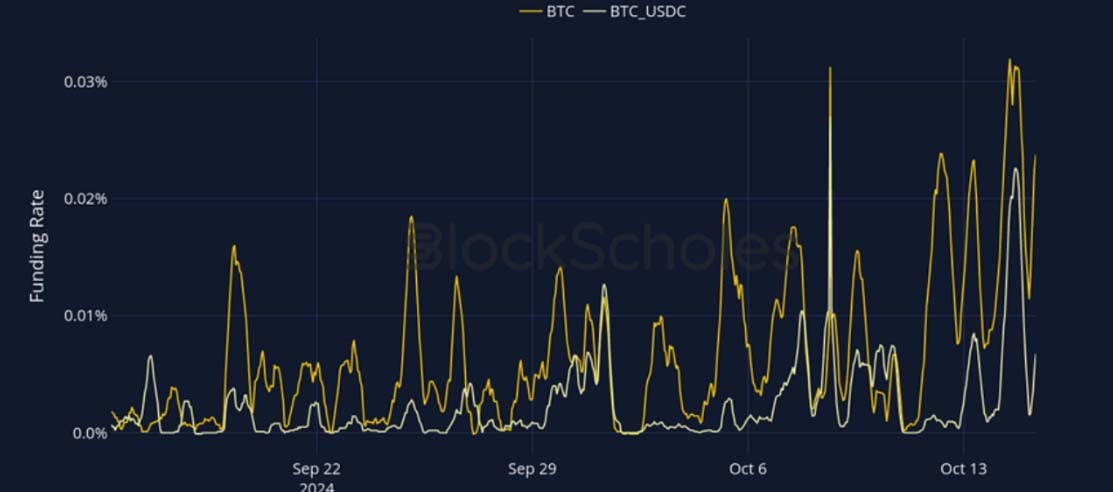

BTC FUNDING RATE – BTC’s perpetual funding rate has maintained high positive levels in the past week.

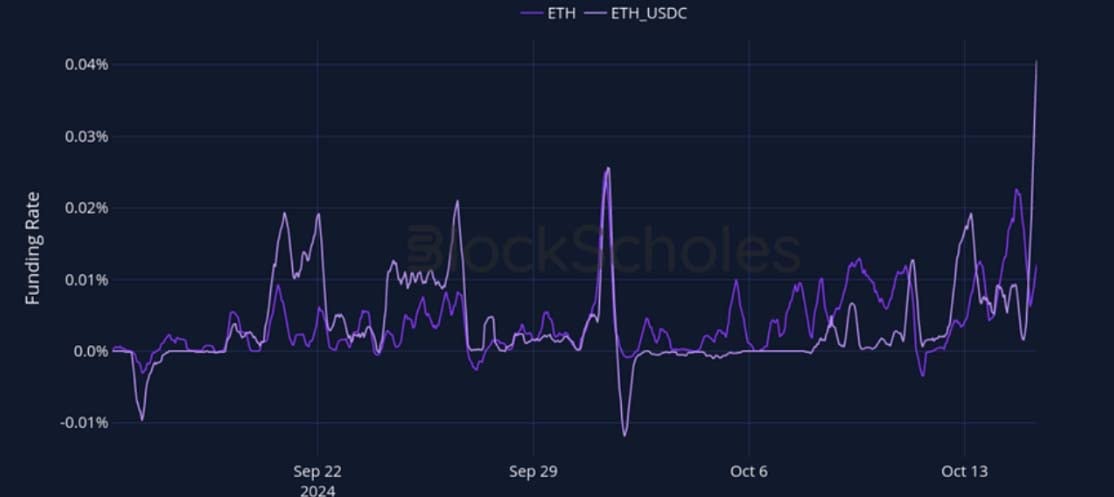

ETH FUNDING RATE – ETH’s perpetual swap funding rate is exhibiting positive sentiment similarly to BTC’s.

BTC Options

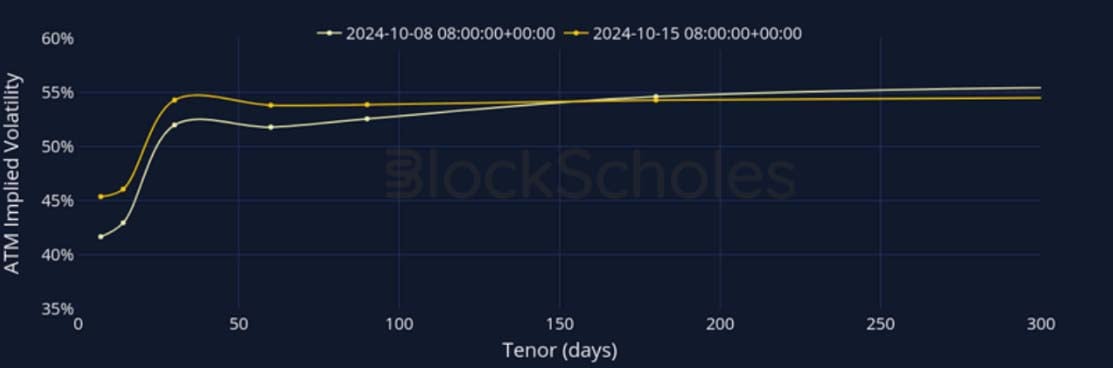

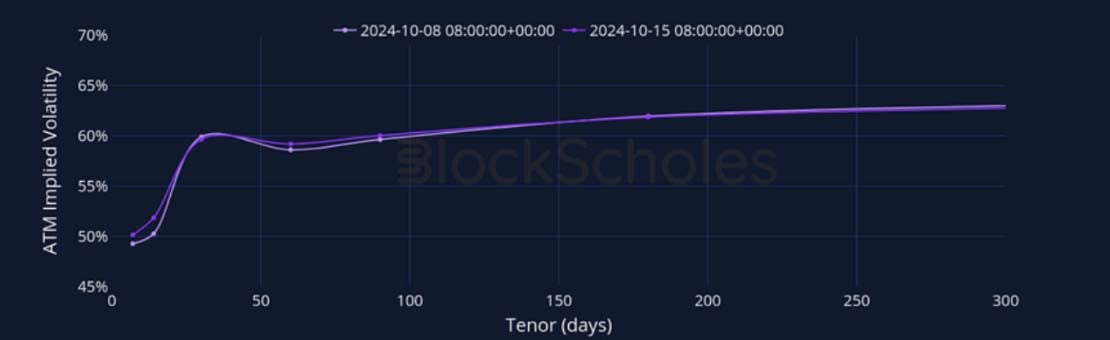

BTC SVI ATM IMPLIED VOLATILITY – Volatility has slightly risen at the front end of the term structure, but it remains flat post-election.

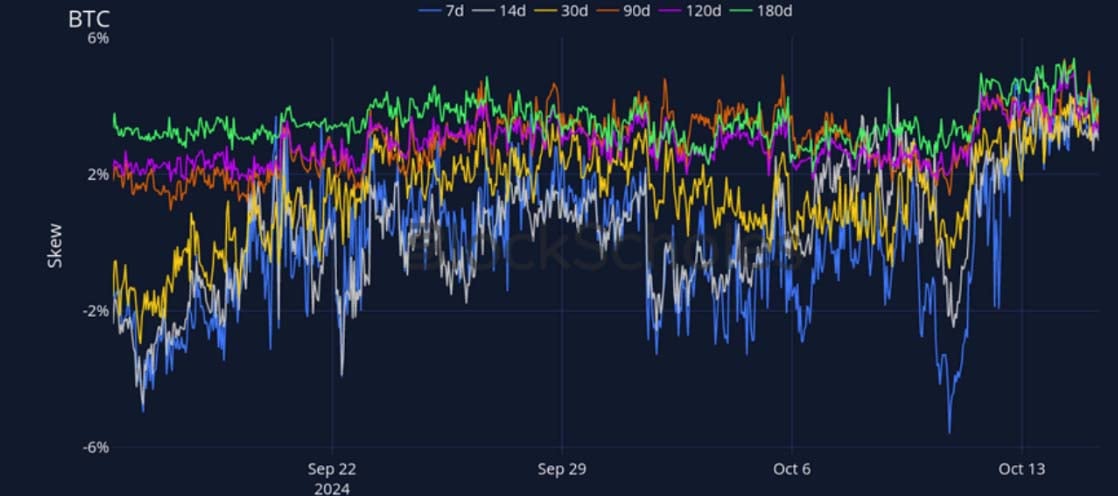

BTC 25-Delta Risk Reversal – Smiles have skewed strongly towards calls in the past week across all tenors.

ETH Options

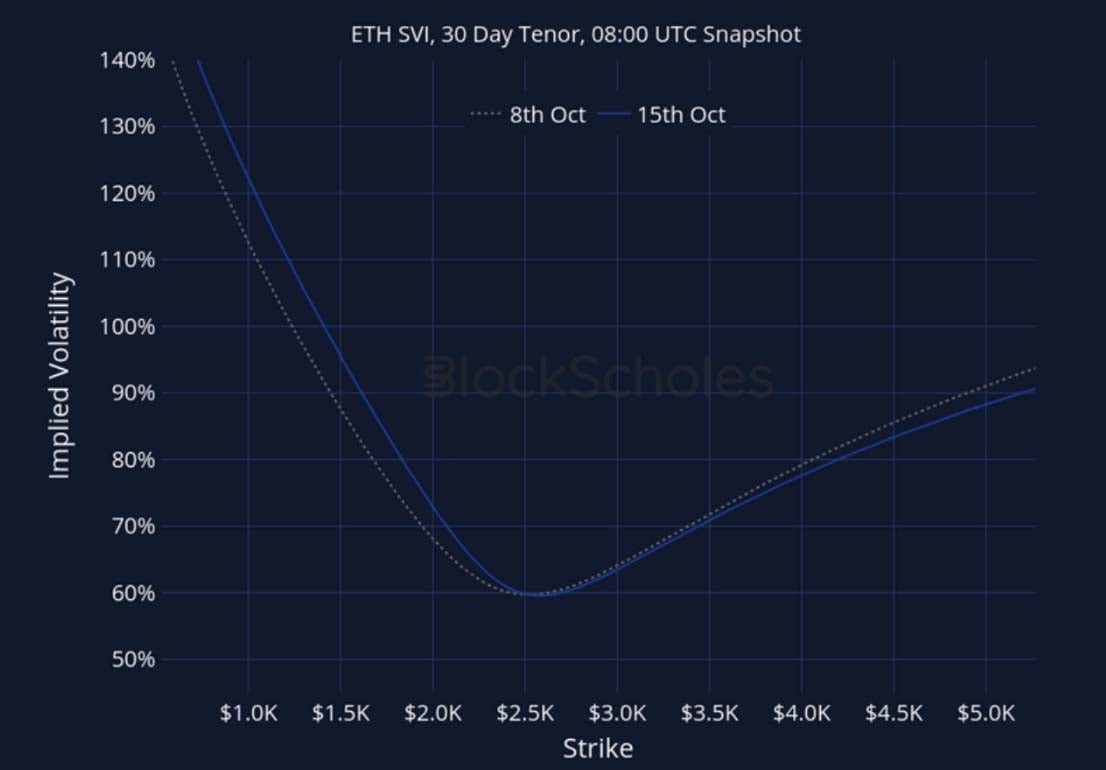

ETH SVI ATM IMPLIED VOLATILITY – Implied volatility levels have moved sideways as a whole, despite fluctuations in volatility for short-tenor options.

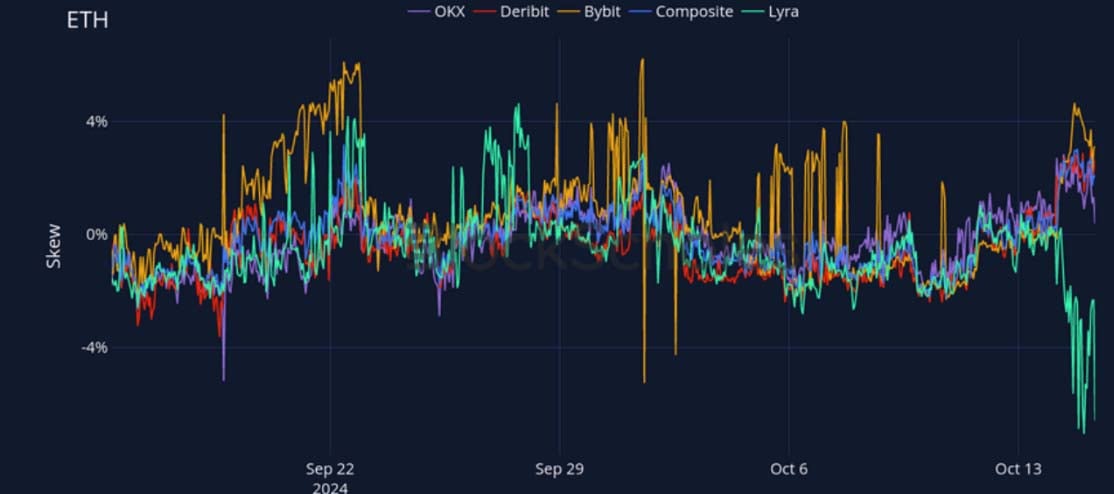

ETH 25-Delta Risk Reversal – ETH’s skews have sharply risen and smiles are exhibiting a strong call-skew across tenors.

Volatility by Exchange

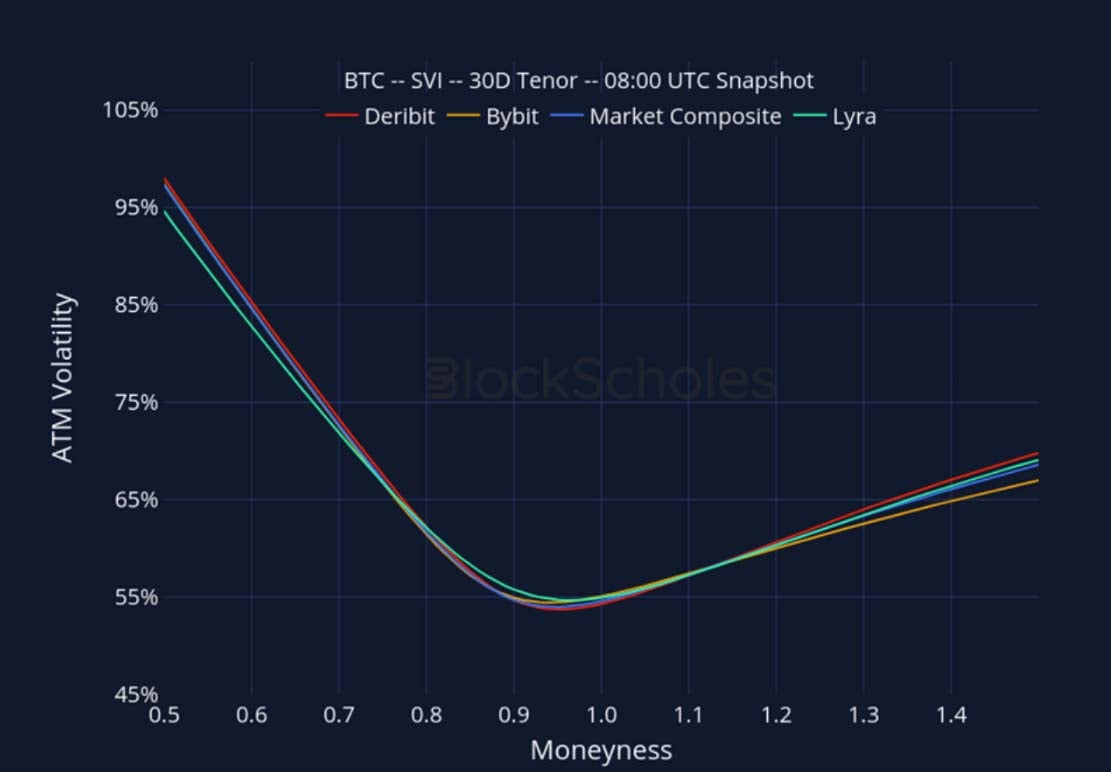

BTC, 1-MONTH TENOR, SVI CALIBRATION

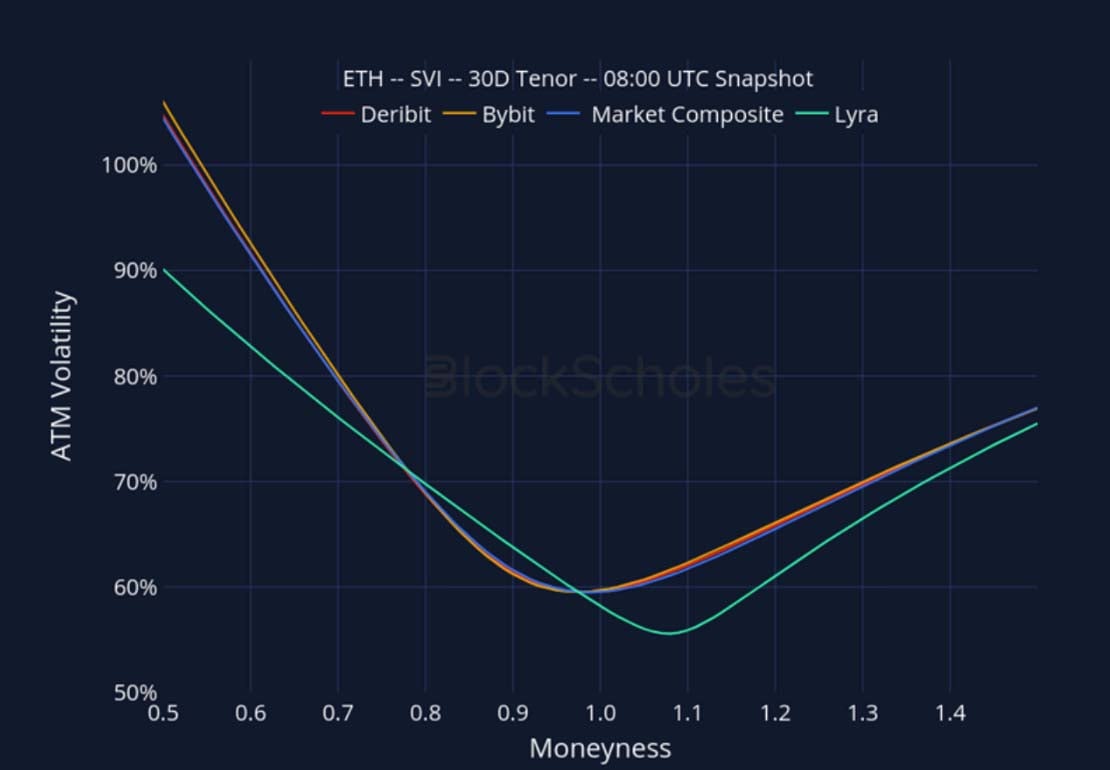

ETH, 1-MONTH TENOR, SVI CALIBRATION

Put-Call Skew by Exchange

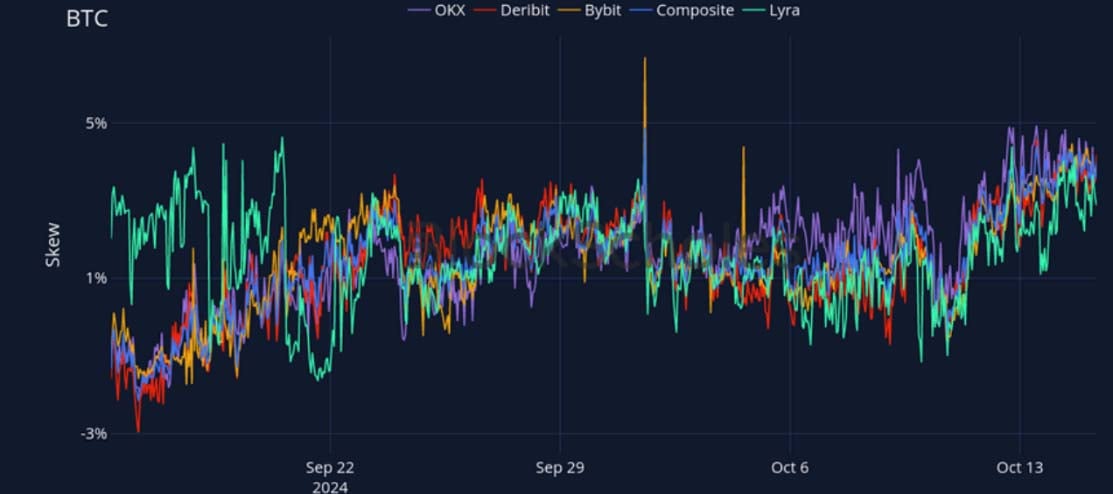

BTC, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

ETH, 1-MONTH TENOR, 25-DELTA, SVI CALIBRATION

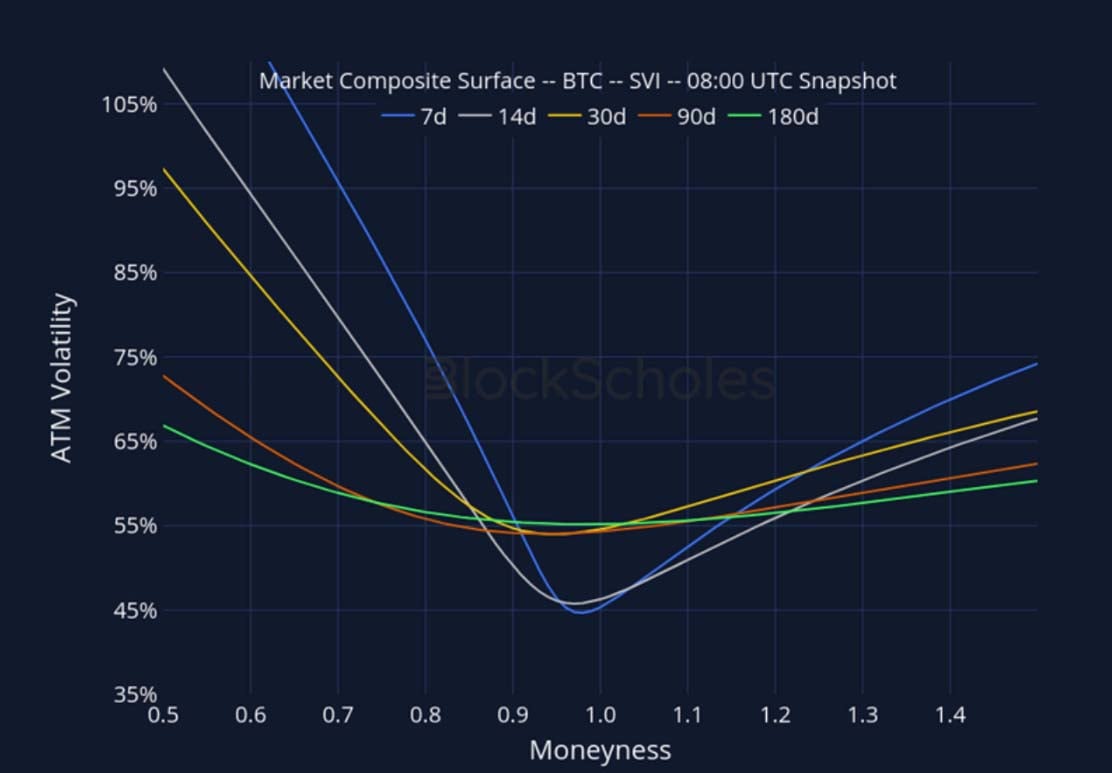

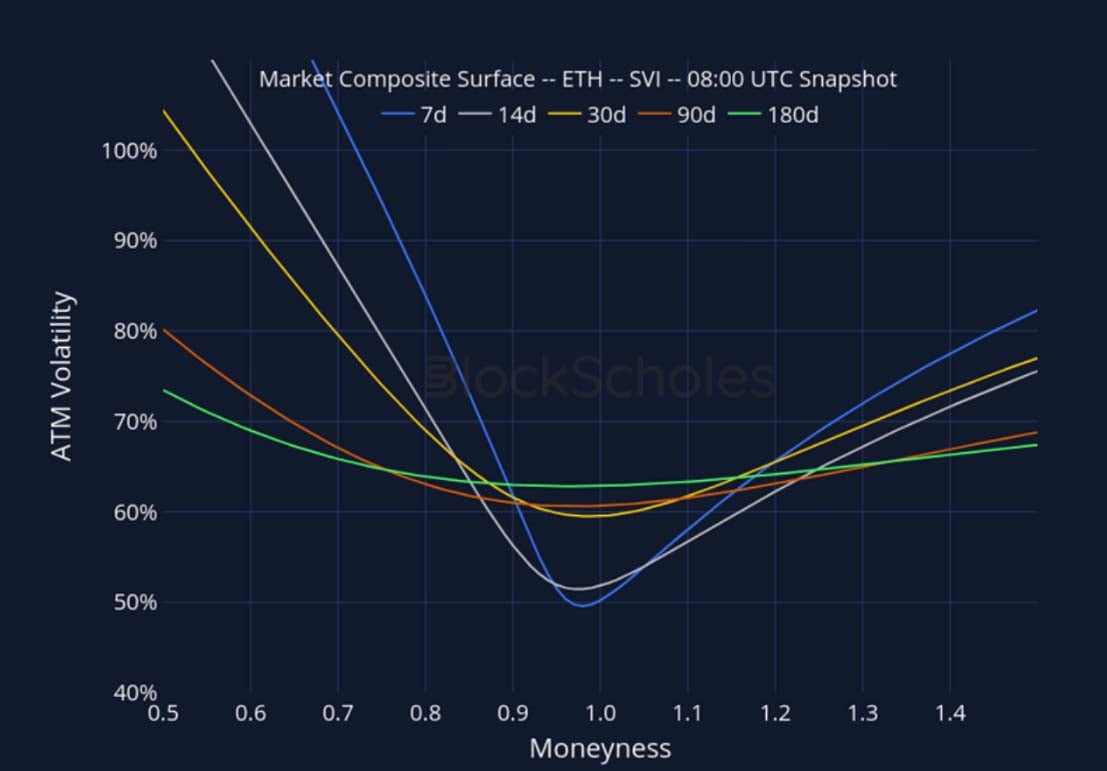

Market Composite Volatility Surface

CeFi COMPOSITE – BTC SVI – 8:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 8:00 UTC Snapshot.

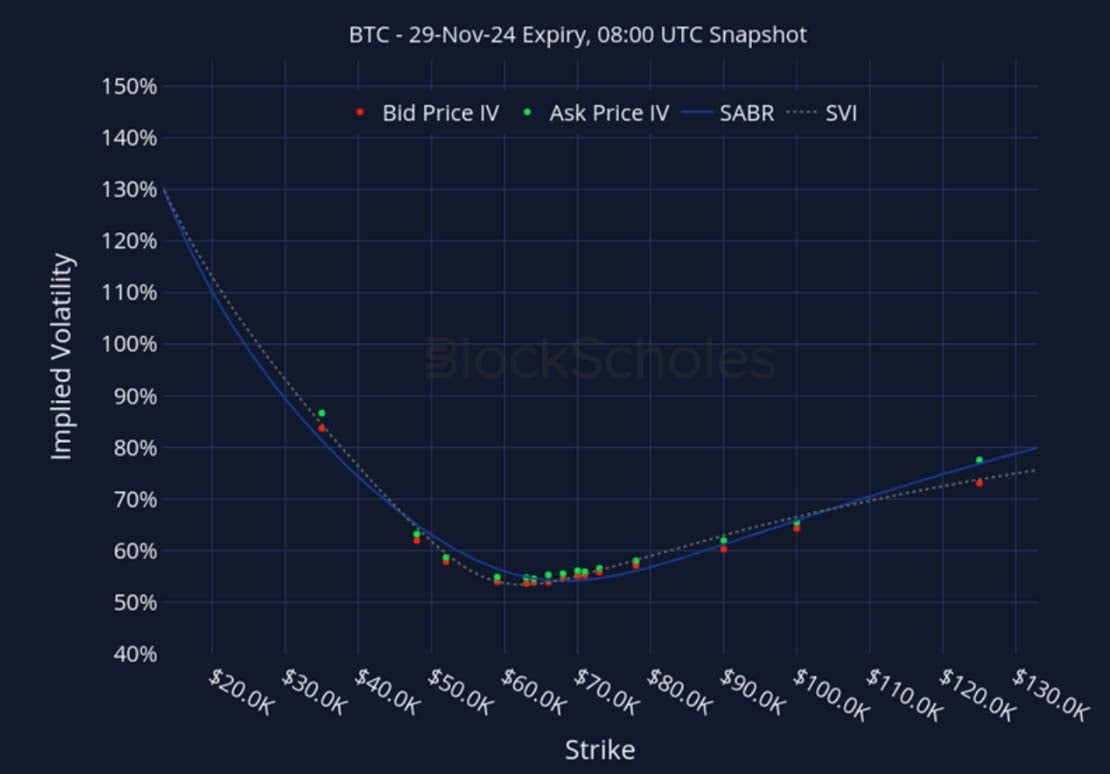

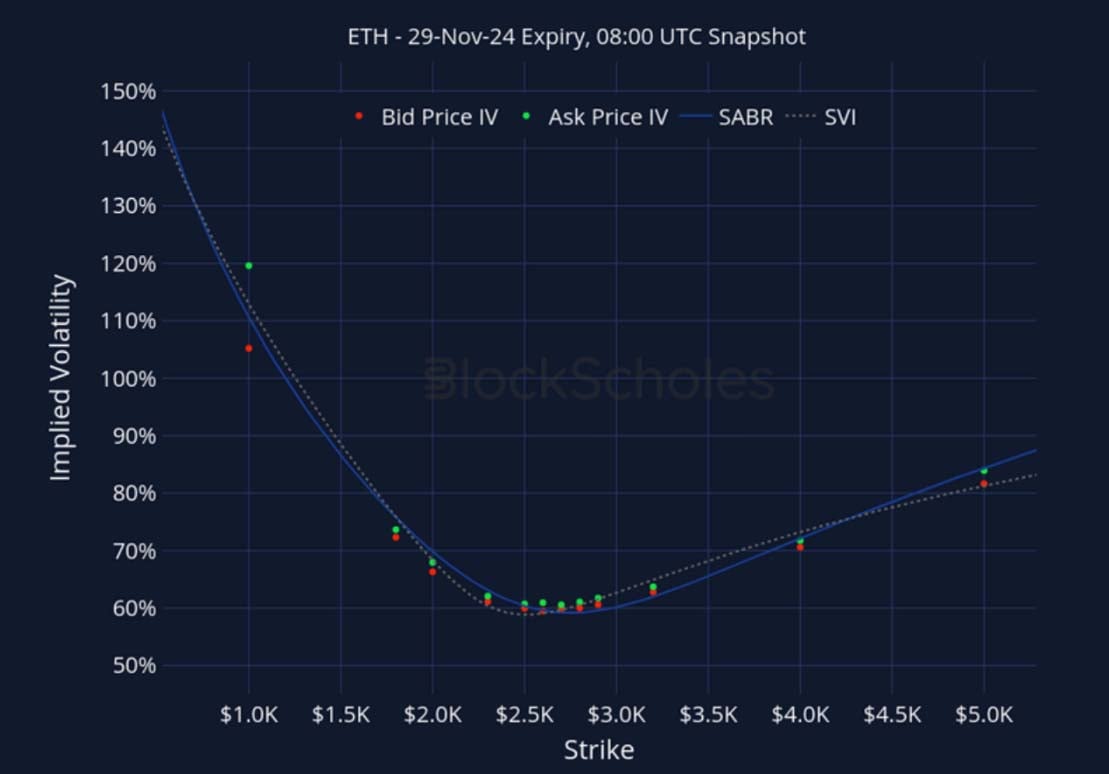

Listed Expiry Volatility Smiles

BTC 29-NOV EXPIRY – 8:00 UTC Snapshot.

ETH 29-NOV EXPIRY – 8:00 UTC Snapshot.

Cross-Exchange Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

Constant Maturity Volatility Smiles

BTC SVI, 30D TENOR – 8:00 UTC Snapshot.

ETH SVI, 30D TENOR – 8:00 UTC Snapshot.

AUTHOR(S)